Fill Out Your Lausd Hi 22 Form

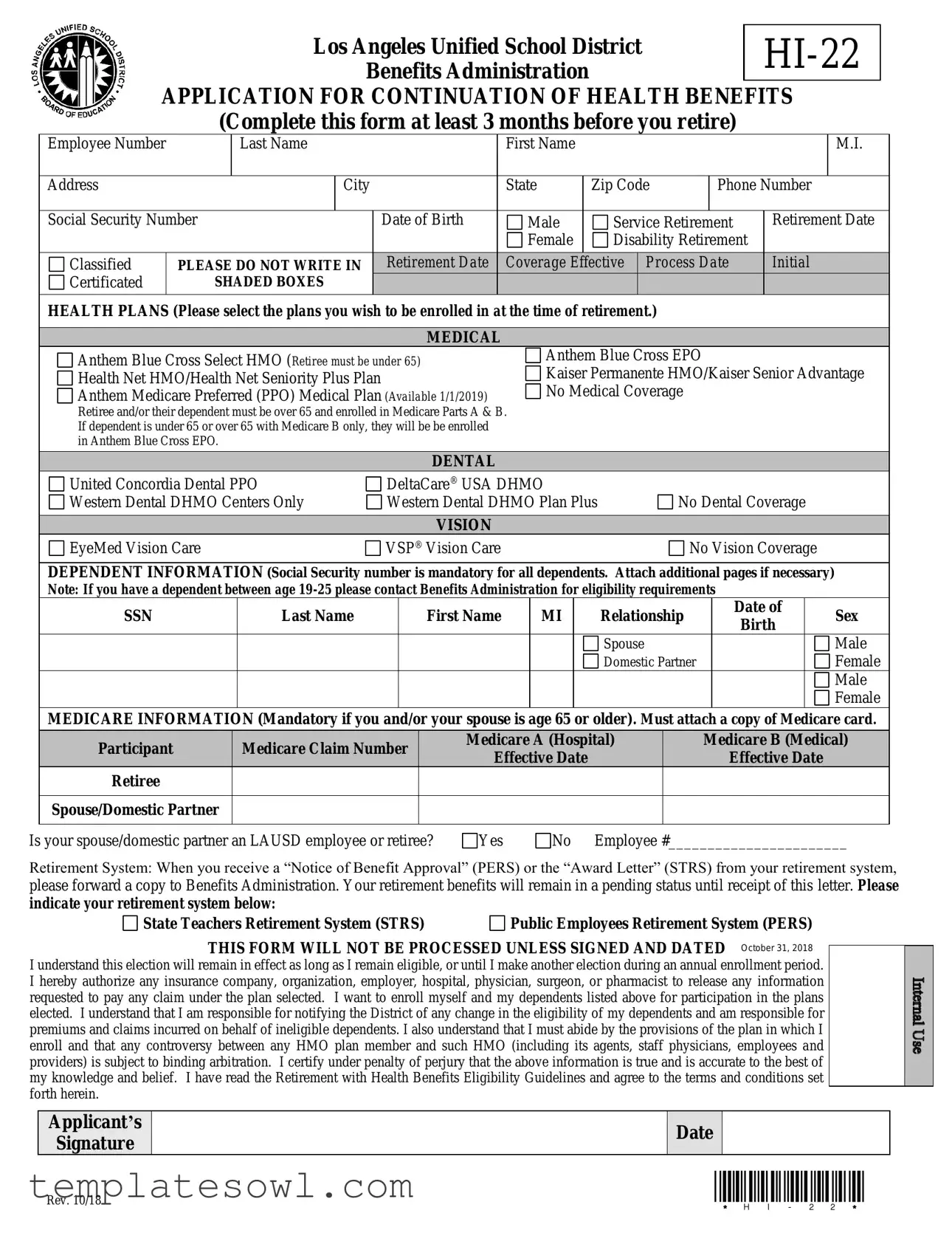

The LAUSD HI 22 form is a crucial document designed for employees of the Los Angeles Unified School District who are nearing retirement and want to continue their health benefits. It should be completed at least three months before your retirement date. This application provides essential information such as your personal details, retirement date, and selection of medical, dental, and vision plans that you wish to enroll in post-retirement. Importantly, the form requires that you indicate your chosen health plan options, which include various medical coverage providers like Anthem Blue Cross and Kaiser Permanente. Additionally, you must supply information about your dependents, including their Social Security numbers, and confirm any Medicare enrollment for those aged 65 or older. To ensure your application is processed, the form must be signed and dated by you, acknowledging your understanding of the retirement health benefit guidelines. It is worth noting that submitting this application accurately and on time can significantly impact your ability to maintain crucial benefits as you transition into retirement.

Lausd Hi 22 Example

Los Angeles Unified School District |

|

|

|

Benefits Administration |

|

APPLICATION FOR CONTINUATION OF HEALTH BENEFITS |

|

(Complete this form at least 3 months before you retire) |

|

Employee Number |

|

Last Name |

|

First Name |

|

|

|

|

M.I. |

|

|

|

|

|

|

|

|

|

|

|

|

Address |

|

|

City |

|

State |

Zip Code |

Phone Number |

|||

|

|

|

|

|

|

|

|

|

||

Social Security Number |

Date of Birth |

Male |

Service Retirement |

Retirement Date |

||||||

|

|

|

|

|

Female |

Disability Retirement |

|

|

||

|

|

|

|

|

|

|

||||

Classified |

PLEASE DO NOT WRITE IN |

Retirement Date |

Coverage Effective |

Process Date |

Initial |

|||||

Certificated |

SHADED BOXES |

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

HEALTH PLANS (Please select the plans you wish to be enrolled in at the time of retirement.)

MEDICAL

Anthem Blue Cross Select HMO (Retiree must be under 65)

Anthem Blue Cross Select HMO (Retiree must be under 65)

Health Net HMO/Health Net Seniority Plus Plan

Health Net HMO/Health Net Seniority Plus Plan

Anthem Medicare Preferred (PPO) Medical Plan (Available 1/1/2019) Retiree and/or their dependent must be over 65 and enrolled in Medicare Parts A & B. If dependent is under 65 or over 65 with Medicare B only, they will be be enrolled in Anthem Blue Cross EPO.

Anthem Medicare Preferred (PPO) Medical Plan (Available 1/1/2019) Retiree and/or their dependent must be over 65 and enrolled in Medicare Parts A & B. If dependent is under 65 or over 65 with Medicare B only, they will be be enrolled in Anthem Blue Cross EPO.

Anthem Blue Cross EPO

Anthem Blue Cross EPO

Kaiser Permanente HMO/Kaiser Senior Advantage

Kaiser Permanente HMO/Kaiser Senior Advantage

No Medical Coverage

No Medical Coverage

DENTAL

United Concordia Dental PPO |

DeltaCare® USA DHMO |

|

Western Dental DHMO Centers Only |

Western Dental DHMO Plan Plus |

No Dental Coverage |

|

|

|

|

VISION |

|

EyeMed Vision Care |

VSP® Vision Care |

No Vision Coverage |

DEPENDENT INFORMATION (Social Security number is mandatory for all dependents. Attach additional pages if necessary) Note: If you have a dependent between age

SSN |

Last Name |

First Name |

MI |

Relationship |

Date of |

Sex |

|

Birth |

|||||||

|

|

|

|

|

|

||

|

|

|

|

Spouse |

|

Male |

|

|

|

|

|

Domestic Partner |

|

Female |

|

|

|

|

|

|

|

Male |

|

|

|

|

|

|

|

Female |

MEDICARE INFORMATION (Mandatory if you and/or your spouse is age 65 or older). Must attach a copy of Medicare card.

|

|

Participant |

|

|

Medicare Claim Number |

|

|

Medicare A (Hospital) |

|

|

Medicare B (Medical) |

|

|

|

|

|

|

|

|

Effective Date |

|

|

Effective Date |

|

|||

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

Retiree |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Spouse/Domestic Partner |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

Is your spouse/domestic partner an LAUSD employee or retiree? |

Yes |

No Employee #_______________________ |

|||||||||||

Retirement System: When you receive a “Notice of Benefit Approval” (PERS) or the “Award Letter” (STRS) from your retirement system, please forward a copy to Benefits Administration. Your retirement benefits will remain in a pending status until receipt of this letter. Please

indicate your retirement system below: |

|

State Teachers Retirement System (STRS) |

Public Employees Retirement System (PERS) |

THIS FORM WILL NOT BE PROCESSED UNLESS SIGNED AND DATED October 31, 2018

I understand this election will remain in effect as long as I remain eligible, or until I make another election during an annual enrollment period. I hereby authorize any insurance company, organization, employer, hospital, physician, surgeon, or pharmacist to release any information requested to pay any claim under the plan selected. I want to enroll myself and my dependents listed above for participation in the plans elected. I understand that I am responsible for notifying the District of any change in the eligibility of my dependents and am responsible for premiums and claims incurred on behalf of ineligible dependents. I also understand that I must abide by the provisions of the plan in which I enroll and that any controversy between any HMO plan member and such HMO (including its agents, staff physicians, employees and providers) is subject to binding arbitration. I certify under penalty of perjury that the above information is true and is accurate to the best of my knowledge and belief. I have read the Retirement with Health Benefits Eligibility Guidelines and agree to the terms and conditions set forth herein.

Applicant’s

Signature

Date

Rev. 10/18 |

If you change your address, you must notify Benefits Administration or you may fail to receive important benefits information. Failure to receive information could result in the loss of your benefits.

Retirement with Health Benefits Eligibility Guidelines

TO RECEIVE COVERAGE AS A RETIRED EMPLOYEE, YOU MUST MEET THE FOLLOWING REQUIREMENTS:

1.Select any available plan you wish to be enrolled in at the time of retirement. If your selection is different than the plan you are currently enrolled in, the effective date will be the first of the following month after your retirement date.

If you are not enrolled in a medical, dental, or vision care plan, you must contact Benefits Administration regarding enrollment procedures before your retirement date.

2.You must resign to retire from District service and be eligible to receive an allowance from your retirement system (CalSTRS or CalPERS) for either age or disability retirement the day after your District resignation.

You are not eligible for retirement health benefits if you separated, resigned without retiring, or were dismissed from District Service.

Your District resignation date and CalSTRS/CalPERS retirement date must be consecutive dates (may include weekend days).

If there is a gap between your District resignation date and your CalSTRS/CalPERS retirement date, you will not be eligible for retirement health benefits.

3.You must receive a monthly retirement payment from your retirement system. If you take deferred retirement (that is, leaving funds on deposit with the retirement system for withdrawal at a later date) or a lump sum distribution, you are not eligible for these retirement benefits.

4.You must meet the following requirements:

a.For employees hired prior to March 11, 1984, five (5) consecutive years of qualifying service immediately prior to retirement shall be required in order to qualify for retiree health benefits for the life of the retiree.

b.For employees hired on or after March 11, 1984, but prior to July 1, 1987, ten (10) consecutive years of qualifying service immediately prior to retirement shall be required in order to qualify for retiree health benefits for the life of the retiree.

c.For employees hired on or after July 1, 1987, but prior to June 1, 1992, fifteen (15) consecutive years of qualifying service immediately prior to retirement shall be required, or ten (10) consecutive years immediately prior to retirement plus an additional ten (10) years which are not consecutive.

d.For employees hired on or after June 1, 1992, years of qualifying service and age must total at least eighty (80) in order to qualify for retiree health benefits. For employees who have a break in service, this must include at least ten (10) consecutive years immediately prior to retirement.

e.For employees hired on or after March 1, 2007 shall be required to have a minimum of fifteen (15) consecutive years of service with the District immediately prior to retirement, in concert with the “Rule of 80” eligibility requirement (section 4.0 (d) above) to receive employee and dependents’ health and welfare benefits (medical dental and vision) upon retirement as provided for in this agreement.

f.For employees hired on or after April 1, 2009, years of qualifying service and age must total at least

g.For School Police (sworn personnel), if you were hired on or after April 1, 2009, the employee’s age plus the number of consecutive qualifying years of service, when added together, must equal 80 and you must have twenty (20) consecutive years of qualifying service immediately prior to retirement.

5.Medicare requirement (Effective January 1, 2010):

If you and/or your dependent reach/are age 65 or older you must enroll and remain enrolled in Medicare Part B. If you do not enroll in

Medicare Part B, you will lose your health benefits until proof of enrollment is submitted.

If you and/or your dependent are eligible for Medicare Part A

If you are not eligible for Medicare Part A

If you are a member of Kaiser, you must enroll in Senior Advantage (Kaiser’s Medicare Advantage Plan) in order to maintain your coverage. If you are a member of Health Net HMO, you must enroll in Seniority Plus (Health Nets Medicare Advantage Plan) in order to maintain your coverage. All retirees in Anthem Medicare Preferred (PPO) Medical plan or Health Net Seniority Plus plan must have Medicare parts A and B.

6.Life Insurance: Conversion plans are available for both the Basic

7.Flexible Spending Account (FSA): Employees who retire before the end of the plan year have 90 days following the termination date of their account to submit claims for reimbursement. All expenses must be incurred during employment. For more details, contact ConnectYourCare at

If you meet the above requirements, you may be eligible for health benefits for yourself and your eligible dependents. Complete and return this form along

with copies of the required documents to:

Los Angeles Unified School District - Benefits Administration

P.O. Box 513307

Los Angeles, CA

Telephone:

eMail: benefits@lausd.net Website: benefits.lausd.net

Form Characteristics

| Fact Title | Detail |

|---|---|

| Form Purpose | This form allows retirees to apply for the continuation of health benefits after retiring from the Los Angeles Unified School District. |

| Submission Deadline | Applicants should complete and submit the HI-22 form at least three months before their retirement date. |

| Employee Information Required | Information such as the employee's number, name, address, and social security number is mandatory on the form. |

| Health Plans Available | Health benefits choices include various medical plans, dental plans, and vision care options. |

| Dependent Information | Social Security numbers are required for all dependents. Additional documentation may be requested. |

| Medicare Requirement | For individuals aged 65 or older, enrollment in Medicare Parts A and B is mandatory to maintain health benefits. |

| Retirement Systems | Retirees must be part of either the CalPERS or CalSTRS systems to qualify for benefits. |

| Health Benefit Eligibility | Eligibility criteria vary based on the date of hire and years of service, ranging from five to twenty-five years. |

| Important Compliance Notes | Failure to follow guidelines (e.g., notifying Benefits Administration of address changes) may lead to loss of benefits. |

Guidelines on Utilizing Lausd Hi 22

Filling out the LAUSD HI-22 form is an important step for securing your health benefits upon retirement. It's essential to do this correctly to ensure you, and possibly your dependents, receive the necessary coverage. Gather the needed information and follow the steps carefully to complete the form successfully.

- Write your Employee Number at the top of the form.

- Fill in your Last Name, First Name, and Middle Initial.

- Provide your Address, City, State, and Zip Code.

- Enter your Phone Number and Social Security Number.

- Fill out your Date of Birth and select your Gender.

- Indicate whether you are applying for Service Retirement or Disability Retirement.

- Specify your expected Retirement Date.

- Select the health plans you wish to enroll in under the HEALTH PLANS section. Choose from Medical, Dental, and Vision options.

- If you have any dependents, complete their information in the DEPENDENT INFORMATION section, including their Social Security Numbers.

- Fill out the MEDICARE INFORMATION section if applicable. Attach a copy of the Medicare card if you or your spouse is 65 or older.

- Indicate whether your spouse or domestic partner is an LAUSD employee or retiree.

- Choose your retirement system (STRS or PERS) and provide the necessary details.

- Sign and date the form at the bottom. Make sure to confirm that the information is accurate.

After finishing the form, send it along with any required documents to the LAUSD Benefits Administration. Remember that missing or incorrect information can delay your application or even affect your benefits eligibility. Stay on top of this process to ensure you have everything ready for your retirement transition.

What You Should Know About This Form

What is the LAUSD HI-22 form?

The LAUSD HI-22 form is an application used by employees of the Los Angeles Unified School District to request the continuation of health benefits upon retirement. It is essential to complete this form to ensure coverage for medical, dental, and vision benefits after retirement.

When should I submit the LAUSD HI-22 form?

It is recommended to submit the LAUSD HI-22 form at least three months before your retirement date. This allows enough time for processing and ensures that your health benefits remain uninterrupted upon retirement.

What information do I need to provide on the LAUSD HI-22 form?

You will need to provide personal information such as your employee number, full name, address, social security number, and date of birth. Additionally, you must specify your desired health plans and provide information regarding any dependents, including their social security numbers and Medicare information if applicable.

What health plans can I select on the LAUSD HI-22 form?

On the LAUSD HI-22 form, you can choose from various medical, dental, and vision plans. Options include Anthem Blue Cross, Health Net, Kaiser Permanente, and others. Ensure that you select your preferred plans, as failure to enroll may lead to a lack of coverage after retirement.

What are the eligibility requirements for retiree health benefits?

To qualify for retiree health benefits, you must meet several conditions. These include being eligible for a monthly retirement payment, having a set number of consecutive years of service with LAUSD, and enrolling in Medicare if you are 65 or older. Specific requirements vary based on when you were hired, so it is crucial to review the guidelines closely.

What happens if I do not enroll in Medicare?

If you and/or your dependent are 65 or older and do not enroll in Medicare Part B, you will lose your health benefits until proof of enrollment is provided to the LAUSD Benefits Administration. Compliance with Medicare requirements is essential for maintaining your health coverage.

Can I change the health plan I chose after retirement?

Once you enroll in a health plan upon retirement, that election remains in effect as long as you are eligible. However, there are annual enrollment periods during which you can make changes to your health plan selections.

Where can I submit the completed LAUSD HI-22 form?

You should mail the completed LAUSD HI-22 form and any required documents to the Los Angeles Unified School District - Benefits Administration at P.O. Box 513307, Los Angeles, CA 90051-1307. For further assistance, you can contact them at 213-241-4262.

Common mistakes

People often overlook critical details when filling out the LAUSD HI-22 form. One common mistake is not signing and dating the form. Without a signature, the application will not be processed, and this could lead to delays in receiving health benefits.

Another frequent error is failing to provide accurate dependent information. All dependents must have their Social Security numbers included. Missing this information can lead to complications in coverage, so it's important to double-check that every detail is complete.

Many applicants misunderstand the Medicare requirements. If you or your spouse are 65 or older, you must attach a copy of your Medicare card. Failing to do this can result in a loss of health benefits, so ensure you have the necessary documentation ready.

Some people mistakenly skip selecting their health plans. The form requires you to choose plans for medical, dental, and vision coverage. If you leave this section blank, your application may be considered incomplete.

It’s also crucial to understand the retirement system requirements. Individuals need to specify whether they are enrolled in CalSTRS or CalPERS on the form. Not providing this information can delay the processing of your application.

Failing to keep the Benefits Administration updated about any address changes is a common oversight. If your address changes after submitting the form, notify them promptly. Missing communications from the Benefits Administration might affect your coverage status.

Some applicants neglect to read the eligibility guidelines closely. Understanding the qualifications for retirement health benefits can clarify what documents and information you need to include. Ignoring this information might lead to an inappropriate submission.

Lastly, another critical mistake is missing the submission deadline. You should complete this form at least three months before your retirement date. Being mindful of deadlines can significantly ease the transition into retirement and ensure you don't miss out on important benefits.

Documents used along the form

The Lausd Hi 22 form is a crucial document for employees of the Los Angeles Unified School District who are preparing for retirement and wish to continue their health benefits. In addition to this form, several other documents are often required to ensure a smooth transition into retirement benefits. Below is a list of documents that may be utilized alongside the Hi 22 form.

- Medicare Card: A valid Medicare card must be submitted if the retiree or their spouse is age 65 or older. This card verifies enrollment in Medicare, which is critical for maintaining health coverage.

- Notice of Benefit Approval: This document from the retirement system, such as PERS or STRS, confirms the approval of retirement benefits. It should be forwarded to Benefits Administration.

- Award Letter: Similar to the Notice of Benefit Approval, the Award Letter provides official recognition of retirement status and benefits from the respective retirement system.

- Life Insurance Conversion Application: Retirees may wish to convert their existing life insurance policies upon retirement. This application allows for the continuation or conversion of coverage offered by the district.

- Flexible Spending Account (FSA) Claims: Any claims for FSA reimbursements must be submitted within 90 days after retirement. This document includes all expenses incurred during employment that need reimbursement.

- Retirement System Documentation: Information about the specific retirement system from which benefits are being drawn is often necessary. This could be a statement or guidance outlining the terms of the retirement plan.

- Dependent Information Form: When enrolling dependents, a form detailing their Social Security numbers and relationship to the retiree must be completed to ensure appropriate coverage.

- Retirement with Health Benefits Eligibility Guidelines: These guidelines outline the specific criteria that retirees must meet to qualify for continued health benefits, clarifying eligibility requirements based on service years and age.

Each of these documents plays an integral role in the retirement process for LAUSD employees. Ensuring all necessary paperwork is properly filled out and submitted can facilitate a smoother transition into post-employment health benefits. Keep these documents organized and accessible to ease the filing process.

Similar forms

- Medicare Application: Similar to the HI-22 form, the Medicare application requires personal details like Social Security number and proof of age. Both documents facilitate the enrollment process for health benefits, ensuring individuals meet the necessary criteria for coverage.

- Health Insurance Enrollment Form: This document, like the HI-22, requires selection of health plans and dependent information. It serves to officially enroll individuals in chosen medical, dental, and vision plans upon retirement or during open enrollment periods.

- Dependent Coverage Application: This form focuses on enrollment details for dependents, requiring similar information to the HI-22. Each document ensures that dependents are covered under the retiree's health benefits.

- Short-term Disability Claim: While primarily for sickness or injury, this claim form, like the HI-22, requires personal information, proof of dependency, and authorization for benefit claims. Both are essential for receiving benefits under a specific plan.

- Long-term Care Insurance Application: This application shares the necessity of personal information and eligibility criteria. It aids in securing health-related services post-retirement, akin to the HI-22's focus on health benefits for retirees.

- Life Insurance Beneficiary Designation: This document is crucial for naming beneficiaries for life insurance policies, similar to how the HI-22 ensures health benefits continuity. Both require personal details and signatures to validate eligibility and claims.

- Retirement Benefit Allocation Form: This allocates retirement benefits and requires similar eligibility criteria to the HI-22. It assists retirees in defining their retirement package upon leaving employment.

- Flexible Spending Account (FSA) Reimbursement Form: This form allows for reimbursement claims post-employment and requires actions similar to those in the HI-22 regarding finalizing benefit claims before losing coverage.

- COBRA Enrollment Form: This document facilitates continued health coverage after employment termination. Both the HI-22 and COBRA form require clear identification of eligible individuals for health benefit continuation.

- Employee Retirement System Enrollment Form: This form, like the HI-22, ensures retirees are enrolled in pension plans while gathering relevant employment history for processing benefits.

Dos and Don'ts

When filling out the LAUSD HI-22 form, taking care to avoid mistakes can make a significant difference in processing. Here’s a helpful list of things to do and not do.

- Do fill out the form at least three months before your retirement date to ensure timely processing.

- Do double-check that all personal information, including Social Security Number and phone number, is accurate and complete.

- Do attach a copy of your Medicare card if you or your spouse is age 65 or older; this is mandatory.

- Do sign and date the form; it will not be processed if you fail to do so.

- Don't leave any required sections blank; any omissions could delay the processing of your application.

- Don't forget to provide Social Security numbers for all dependents, as this information is mandatory.

- Don't submit the form without confirming your enrollment in the retirement system. Ensure all retirement details are accurate to avoid complications.

- Don't forget to notify Benefits Administration of any change in your address after submitting the form, as this may impact your benefits.

Misconceptions

Misconception 1: The HI-22 form is only for employees planning to retire.

In reality, while the HI-22 form is primarily intended for those preparing for retirement, it also serves important functions for dependents and beneficiaries. Completing the form ensures that all parties maintain access to health benefits, regardless of their employment status.

Misconception 2: Submitting the HI-22 form guarantees health benefits after retirement.

Submitting the HI-22 form is just one step in a larger process. To be eligible for health benefits, retirees must meet specific eligibility requirements, such as minimum years of service and proper enrollment in Medicare. Failure to adhere to these criteria can lead to the denial of health benefits.

Misconception 3: The HI-22 form can be submitted at any time before retirement.

It is essential to submit the HI-22 form at least three months before retirement to ensure all necessary arrangements are in place. Late submissions can result in delays or complications in accessing healthcare coverage.

Misconception 4: Once health benefits are selected, they cannot be changed.

Retirees have options during annual enrollment periods to modify their health plan selections. Understanding this freedom can help retirees choose plans better suited to their evolving needs during retirement.

Key takeaways

Understanding the process for filling out the LAUSD HI-22 form is crucial for those approaching retirement. Here are some key takeaways to keep in mind:

- Timeliness is essential: Complete the HI-22 form at least three months before your retirement date to ensure that your health benefits are transitioned smoothly.

- Medicare enrollment: For retirees and their dependents aged 65 or older, enrolling in Medicare Parts A and B is mandatory to maintain eligibility for health benefits.

- Plan selection: You must choose from the available medical, dental, and vision plans. If your selected plan differs from your current one, the new coverage will begin the first of the month following your retirement.

- Require accurate information: Ensure all information is complete and accurate, including social security numbers for dependents. Incomplete applications can delay processing.

- Retirement eligibility: To qualify for health benefits, you must resign from District service and receive a retirement allowance from your retirement system on the day after your resignation.

- Maintain communication: Notify the Benefits Administration of any changes in your or your dependents' eligibility to prevent loss of benefits and ensure you receive important information.

By keeping these points in mind, you can confidently navigate the process of filling out and submitting the LAUSD HI-22 form.

Browse Other Templates

Puppy Health Guarantee Template - Breeder and buyer both play essential roles in ensuring a nurturing environment for the puppy.

Metlife Retirement Benefits - Your feedback regarding the form can lead to improvements in the deposit process.