Fill Out Your Ldr R 1392 Form

The Ldr R 1392 form plays a crucial role for employees of the State of Louisiana by facilitating the exemption from state sales taxes on certain travel-related expenses. Designed to streamline the reimbursement process, this certificate documents that an employee is engaged in official business for a state agency. It ensures that authorized travel expenses, which are directly reimbursable by the state, are recognized as exempt from sales tax. Employees must fill out the form with their details, including their title, agency, and travel dates. Furthermore, the state agency must also endorse it, affirming that these expenses are necessary for conducting agency business. The form outlines specific charges that qualify for the exemption, such as rentals from Enterprise and parking fees at Park N Fly in New Orleans. Importantly, vendors must retain a copy of this certificate to substantiate the exemption, making it integral to both employee reimbursement and tax documentation. However, it is important to note that this form does not apply to local sales tax exemptions.

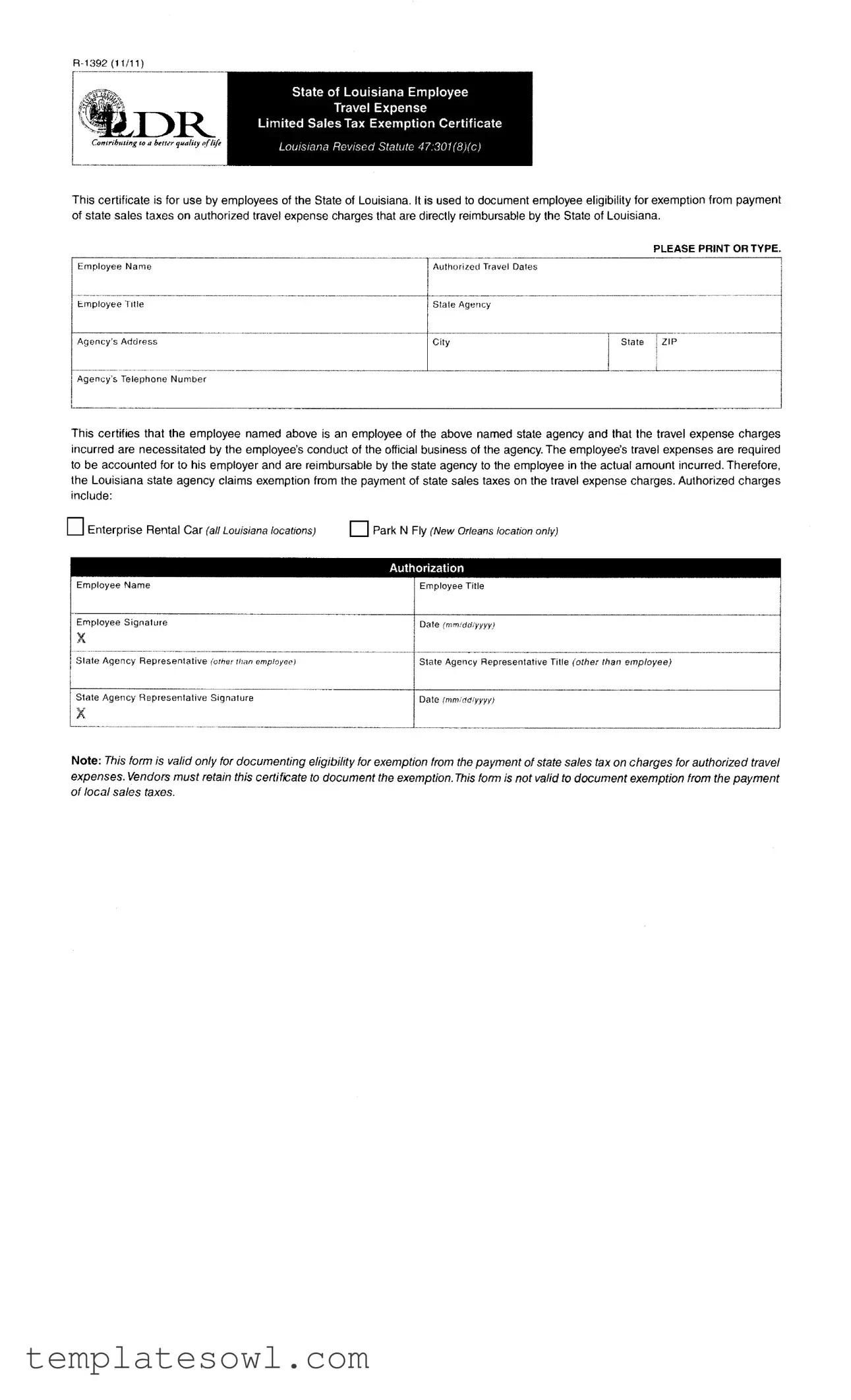

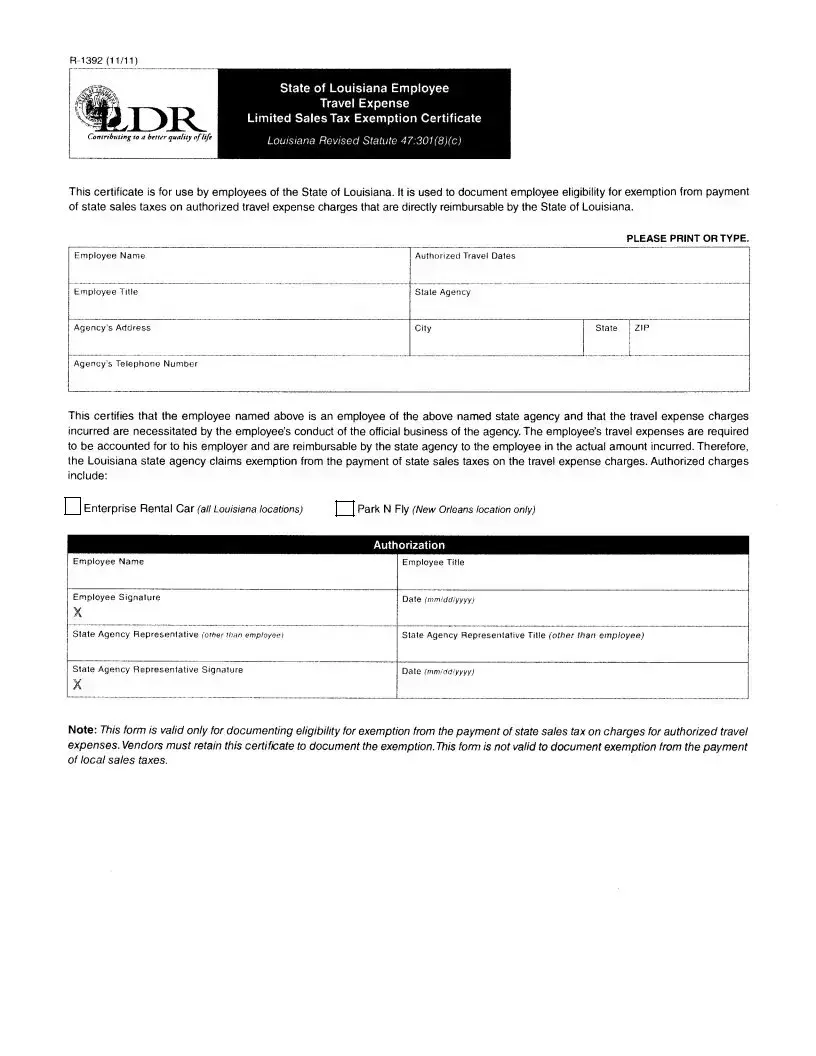

Ldr R 1392 Example

This certificate is for use by employees of the State of Louisiana. It is used to document employee eligibility for exemption from payment of state sales taxes on authorized travel expense charges that are directly reimbursable by the State of Louisiana.

PLEASE PRINT OR TYPE.

I セセセャッケセセMセセセQセ@ |

Authorized Travel Dates |

|

|

|

........................... |

1 L111ployee Tttle |

State Agency |

|

I |

|

|

IAgency"s Address |

City |

I State IZIP |

|

||

l Agency"s Telephone Number |

|

|

I

This certifies that the employee named above is an employee of the above named state agency and that the travel expense charges incurred are necessitated by the employee's conduct of the official business of the agency. The employee's travel expenses are required to be accounted for to his employer and are reimbursable by the state agency to the employee in the actual amount incurred. Therefore, the Louisiana state agency claims exemption from the payment of state sales taxes on the travel expense charges. Authorized charges include:

0 |

Enterprise Rental Car (all Louisiana locations)

D

Park N Fly (New Orleans location only)

|

AUTHORIZATION |

Employee Name |

Employee Title |

Employee Signature |

Date (mmitidiyyyy) |

|

X

State Agency Representative Title (other than employee)

NOTE: This form is valid only for documenting eligibility for exemption from the payment of state sales tax on charges for authorized travel expenses. Vendors must retain this certificate to document the exemption. This form is not valid to document exemption from the payment of local sales taxes.

Form Characteristics

| Fact Name | Details |

|---|---|

| Purpose | This certificate is used by employees of the State of Louisiana to document eligibility for exemption from state sales taxes on reimbursable travel expenses. |

| Authorized Uses | It covers charges for authorized travel expenses, including Enterprise Rental Car (all Louisiana locations) and Park N Fly (New Orleans location only). |

| Eligibility | Only State of Louisiana employees can utilize this form for authorized travel related to official business. |

| Governing Law | The form is governed by Louisiana state tax laws concerning sales tax exemptions. |

| Exemption Limitations | This form is valid only for state sales tax exemptions and does not apply to local sales tax exemptions. |

| Issuer Requirements | Vendors must retain this certificate as documentation for any exemption claimed under this form. |

| Signature Requirement | Both the employee and a state agency representative must sign the form for it to be valid. |

Guidelines on Utilizing Ldr R 1392

Once you have gathered the necessary information, follow these steps to complete the Ldr R 1392 form accurately. Be sure to provide clear and legible details as this form is essential for documenting exemptions from state sales tax related to approved travel expenses.

- Print or type your information to ensure clarity.

- In the first section, enter the Authorized Travel Dates.

- Fill in the Employee Name and Employee Title.

- Write the name of the State Agency.

- Provide the Agency's Address including the city, state, and ZIP code.

- Enter the Agency's Telephone Number.

- Verify that the certification statement regarding the employee's business conduct is filled in correctly.

- Check the boxes for Authorized charges:

- Enterprise Rental Car (all Louisiana locations)

- Park N Fly (New Orleans location only)

- Have the Employee Signature and Date filled out.

- Lastly, ensure a State Agency Representative signs and includes their title (other than employee).

What You Should Know About This Form

What is the Ldr R 1392 form?

The Ldr R 1392 form is a certificate used by employees of the State of Louisiana. Its primary purpose is to document an employee's eligibility for exemption from state sales taxes on travel expenses that are reimbursed by the state. This form needs to be completed with the necessary information and retained by vendors to validate the tax exemption.

Who should use the Ldr R 1392 form?

This form is intended for state employees who incur travel expenses while conducting official business for their agency. It ensures that these employees can avoid paying state sales tax on eligible travel-related charges.

What types of travel expenses are covered by this form?

The Ldr R 1392 form can be used for specific authorized charges such as rental car expenses from Enterprise at all locations in Louisiana and parking fees at the Park N Fly in New Orleans. It is essential for employees to check that their expenses fall within the list of authorized charges.

How does an employee obtain and fill out the Ldr R 1392 form?

What happens to the form after it is completed?

After completing the Ldr R 1392 form, the employee typically submits it to the vendor along with their travel expense. Vendors are required to keep this form on file to document the sales tax exemption. This retention helps ensure compliance with Louisiana's tax regulations.

Can this form be used for local sales tax exemptions?

No, the Ldr R 1392 form is solely valid for exemption from state sales tax on authorized travel expenses. It does not cover exemptions from local sales taxes, which may have different requirements and procedures.

Is there a deadline for submitting the Ldr R 1392 form?

While the form itself does not specify a submission timeline, it is advisable to provide the completed form alongside travel expenses as soon as possible. This timely submission helps in securing the tax exemption for the applicable travel charges.

What information must be included on the Ldr R 1392 form?

Essential information required on the Ldr R 1392 form includes the employee's name, title, the agency's name and address, authorized travel dates, and the signature of both the employee and an agency representative. Each part of the form must be filled out accurately to ensure proper validation.

What are the consequences of not retaining the Ldr R 1392 form?

If vendors fail to retain the Ldr R 1392 form, they may not be able to substantiate the claim for sales tax exemption during audits. This could potentially lead to the payment of owed sales taxes, which the state agency originally sought to avoid through the use of this form.

Can the Ldr R 1392 form be modified?

Modification of the Ldr R 1392 form is not recommended. The form should be filled out as is to ensure compliance with the tax exemption process. Any alterations might result in invalidation of the form and the exemption it provides.

Common mistakes

Filling out the Ldr R 1392 form can seem straightforward, but many people fall into common traps that can lead to issues later on. One significant mistake is not printing or typing the information clearly. When forms are difficult to read, it can lead to misunderstandings or even rejection of the form. Always ensure clarity to avoid delays in processing.

Another frequently overlooked aspect is failing to include all necessary details. Each section of the form has specific requirements. For instance, omitting the authorized travel dates or the state agency’s telephone number can create confusion. Take the time to fill in every required field thoroughly.

In some cases, individuals incorrectly assume that providing their personal information is sufficient without confirming their current employment status. The form necessitates that the person named as the employee truly is a member of the state agency. Confirming employment status helps to uphold the integrity of the exemption.

People often forget to sign the form. Signatures confirm that the information provided is accurate and that the travels were indeed undertaken for official state business. Without a signature, the form may not be considered valid.

Improper date formatting is another mistake that can lead to complications. The form specifies the date format, and failing to adhere to it creates challenges for processing. Use the designated format carefully to avoid unnecessary confusion.

It’s also common for individuals to neglect the process of keeping a copy of the completed form for their records. This can come back to bite you if questions arise regarding the travel expenses. Always retain a copy to streamline any future inquiries.

Lastly, misunderstanding the purpose of the form can lead to misuse. This form is exclusive for state sales tax exemption on specific travel-related charges. Using it for local sales tax exemption instead compromises its validity. Understanding the limitations of the form ensures its correct use and helps avoid potential penalties.

Documents used along the form

The Ldr R 1392 form is an essential document for employees of the State of Louisiana, allowing them to claim an exemption from state sales tax on specific travel-related expenses. Alongside this form, several other documents may be required to ensure proper documentation and reimbursement processes. Below is a list of forms that are frequently used in conjunction with the Ldr R 1392.

- Travel Authorization Form: This document serves as an official approval for an employee to undertake travel for work purposes. It outlines the travel details, including destinations, duration, and estimated costs.

- Travel Expense Report: After the completion of travel, this report itemizes all the expenses incurred by the employee. It must be accompanied by receipts and is submitted for reimbursement from the state agency.

- Vendor Payment Request: This form is used to request payment to a vendor for authorized travel-related expenses. It may accompany invoices to specify the services rendered and the associated costs.

- Mileage Reimbursement Form: When employees use personal vehicles for state business, this form documents the miles driven and allows for the reimbursement of travel at the established mileage rate.

- Invoice from Travel Vendors: Vendors, such as hotels or car rental services, provide invoices as evidence of charges incurred during the travel. These documents validate the expenses claimed by the employee.

- State Agency Policy Manual: This manual outlines the policies regarding travel, reimbursements, and acceptable expenditures. Employees should reference it to ensure compliance with state regulations.

- Proof of Travel Completion: Documents such as boarding passes or hotel check-in receipts serve as proof that the employee completed the travel for which expenses are claimed.

- Direct Deposit Form: This form facilitates the direct deposit of reimbursements into the employee's bank account, enabling a faster reimbursement process.

Understanding the various forms used alongside the Ldr R 1392 is vital for compliance and efficient processing of travel reimbursements. Ensuring that each document is accurately completed and submitted will help facilitate appropriate processing by the State of Louisiana’s agencies.

Similar forms

The Ldr R 1392 form serves a specific purpose regarding travel expense reimbursement and sales tax exemption for employees of the State of Louisiana. Several other documents share similar functions, either in terms of travel expenses or tax exemptions. Here are five notable examples:

- W-9 Form: This form is used to request taxpayer identification information from individuals and businesses. Like the Ldr R 1392, it ensures that the appropriate tax information is collected for reimbursement purposes, particularly when an employee or contractor provides services to a state agency.

- Form 1040-ES: This is used by individuals to estimate their quarterly tax payments. Similar to the Ldr R 1392, it involves tax considerations but pertains to individual estimates rather than tax exemptions for travel expenses specifically.

- Travel Expense Report: Employees use this document to itemize and request reimbursement for travel-related expenses incurred during official duties. Much like the Ldr R 1392, it ensures proper accountability and reimbursement for costs associated with travel for work.

- Sales Tax Exemption Certificate: This form allows qualifying purchases to be made without paying sales tax. Both this document and the Ldr R 1392 are designed to substantiate claims for tax exemption, although the former often applies to goods rather than travel expenses.

- Reimbursement Request Form: This document enables employees to formally request payment for out-of-pocket expenses, similar to the purpose of the Ldr R 1392 in the context of travel-related costs directly associated with state duties.

Dos and Don'ts

When filling out the Ldr R 1392 form, follow these dos and don’ts to ensure accuracy and compliance.

- Do print or type clearly to avoid any misunderstandings.

- Do ensure that the authorized travel dates are accurately indicated.

- Do provide the employee's title and the agency's contact information.

- Do include the actual amount incurred for travel expenses.

- Do sign and date the form where required.

- Don’t leave any sections of the form blank; all fields must be completed.

- Don’t forget to verify that the agency representative’s signature is included.

- Don’t misrepresent the nature of the travel expenses; they must be directly related to official business.

- Don’t use the form for local sales tax exemptions; it is valid only for state sales tax.

- Don’t submit the form without ensuring all information is correct and matches the agency’s records.

Misconceptions

Misconceptions surrounding the Ldr R 1392 form can lead to confusion. Here are nine common misunderstandings:

- It is for anyone traveling, not just state employees. The Ldr R 1392 form is specifically for employees of the State of Louisiana. It cannot be used by private individuals or employees of non-state organizations.

- All travel expenses qualify for tax exemption. Only authorized travel expenses that are reimbursable by the State of Louisiana are eligible. Unauthorized charges will not qualify.

- Local sales taxes are included in the exemption. This form only documents eligibility for exemption from state sales taxes. Local taxes must still be paid.

- Any employee can fill out the form. The form must be filled out by an employee of a state agency and must be signed by a representative of that agency.

- It can be used for personal travel. This form is strictly for official state business travel. Personal trips do not qualify.

- Vendors must accept the form unconditionally. Vendors are required to retain the certificate, but acceptance is at their discretion based on proper documentation and eligibility.

- It is valid indefinitely. The Ldr R 1392 form is valid only for the particular travel dates specified. Each trip will require a new form.

- Electronic signatures are not permitted. While printed signatures are preferred, electronic signatures may be accepted. However, check specific vendor policies.

- Filling out the form guarantees tax exemption. Proper completion of the form does not guarantee tax exemption. All conditions of reimbursement and eligibility must be met.

Key takeaways

When filling out the Ldr R 1392 form, keep these key takeaways in mind:

- Purpose of the Form: This certificate is specifically designed for employees of the State of Louisiana. It is used to document eligibility for exemption from paying state sales taxes on authorized travel expenses reimbursable by the agency.

- Accurate Information is Crucial: As the form requires detailed information, be sure to print or type clearly. Include your authorized travel dates, employee title, agency contact information, and any other necessary details to avoid confusion.

- Authorization is Required: The form must be signed by both the employee and a state agency representative. This provides the necessary authorization for the sales tax exemption on travel expenses incurred while conducting official business.

- Validity Limitations: Remember that the Ldr R 1392 form is only valid for state sales tax exemptions related to travel expenses. It does not provide exemption from local sales taxes, and vendors must keep this certificate to validate the tax exemption.

Browse Other Templates

Texas Resale Certificate Online - The 01-339 functions not only as a tax document but also as a commitment to responsible business practices.

Form H1836-a - Documentation of any additional recommendations or restrictions can provide further clarity on the patient’s condition.

Authentication Form Global Affairs Canada - Follow up on submission status if confirmation is not received in a timely manner.