Fill Out Your Legalshield Will Questionnaire Form

Creating a will is an essential step in planning for the future, and the LegalShield Will Questionnaire form serves as a valuable tool in this process. This comprehensive document helps individuals and couples gather crucial information about their estate, including the full scope of the assets they own, such as real estate, bank accounts, and personal property. As you complete the form, you will specify how you wish to divide your estate among beneficiaries, decide on guardianship for any minor children, and appoint an executor to manage your estate after you pass away. To ensure each person's unique needs are met, both partners need to fill out separate questionnaires, detailing their wishes and circumstances. Information will be gathered regarding any prenuptial agreements, existing trusts, and the financial status of your assets and debts. Completing this questionnaire with accurate and thorough details will greatly assist the law firm in drafting a will that precisely reflects your desires. Furthermore, it is important to note that all personal information remains confidential, providing peace of mind as you navigate this process.

Legalshield Will Questionnaire Example

Your Will Questionnaire

p 1 of 6 • Will Questionnaire

Please print

estate

Everything that you own at your passing after payment of debts and taxes. You will make decisions regarding the percentage share of your estate that you wish to give to your beneficiaries. And if you wish, you may leave specific items of property (car, investments, heirlooms, etc.) or sums of money to your beneficiaries.

will

A document which provides who is to receive your property, who will administer your estate, who will serve as guardian of your children, if applicable, and other provisions.

peace of mind

The wonderful feeling you get as a LegalShield member after having your Will prepared by a qualified law firm at a reasonable price.

For Your

Information

MEMBER AND SPOUSE FILLING OUT A SEPARATE FORM

In order to meet each person’s unique needs, you must each fill out a Will Questionnaire.

Get Started!

1 |

2 |

3 |

4 |

5 |

6 |

What You’ll Need to Complete This Questionnaire:

•Copy of your Prenuptial Agreement (if applicable).

•Names and birth dates of your children and grandchildren (if applicable).

•The name and contact information of the person you’ve chosen to be guardian of your child(ren), the trustee(s) of their estate, and your personal representative/executor.

•To best serve you in completing your Will for estate tax purposes, you’ll be asked to provide the approximate dollar amount of such items as: your home, other real estate, bank accounts, vehicles, retirement plans, life insurance policies, and debts such as mortgages, loans, medical or others over $5,000.

Helpful Information before You Get Started!

•This Will Questionnaire is NOT your Will. It will help your Provider Law Firm prepare your Will. All questions applicable to you MUST be completed in their entirety in order to have your Will prepared.

•If you need more space to answer a question, attach a separate sheet and indicate the question number to which it pertains.

•If you have questions while filling out this form, don’t hesitate to call your Provider Law Firm at the number on your membership card.

•If you need the number to your firm, call Member Services at

1)Full name (first, middle, last):

All other names by which you have been known:

Membership Number:

Age: |

|

|

|

|

Date of Birth (DOB): |

|

|

|

|

|

|

Sex: |

Male Female |

|||||

Are you a US citizen?* |

Y |

N If no, country of citizenship: |

|

|

|

|

||||||||||||

2) Current residence |

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

Street address: |

|

|

|

|

|

City: |

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

County or Parish: |

|

|

|

|

|

|

ST: |

|

|

ZIP: |

|

|||||||

Home Phone: |

|

|

|

|

_Work Phone: |

|

|

|

||||||||||

3) If you are married, your spouse’s full name (first, middle, last, maiden):

DOB: |

|

|

Date of marriage: |

|

|

Place of marriage: |

|

|

|

|

|

|

|

|

|

||

Are you currently living with your present spouse? |

Y |

N |

|||

4)Do you and your spouse have a Prenuptial Agreement which identifies and disposes

of separate spousal property? |

Y |

N |

N/A |

If yes, attach copy with any filing data.

*

5)If either you or your spouse has been divorced, please answer the following. If not applicable, please go to question #6.

Date of marriage:

Date of divorce judgment: Court rendering judgment:

Date of spouse’s death (if applicable):

6)Have you or your spouse created any trusts or made gifts through trusts to others? If yes, describe and include a copy. If not applicable, go to question #7.

7)Do you or your spouse expect any inheritance? If yes, state from whom and how much. If not applicable, please go to question #8.

8)If you have children, including adopted children, state the following for each child. If you do not have children, please go to question #15.

Will Questionnaire • p 2 of 6

For Your

Information

A great deal of personal information is requested in your Will Questionnaire. Without all of the information requested, your Provider Law Firm can’t ensure your wishes will occur or that the most comprehensive estate planning options have been advised. All information you provide them will remain strictly confidential.

Full Name

1

2

3

4

Son/Daughter

Date of Birth

Child of Current Marriage? (Y/N)

9) a. Deceased biological or legally adopted children if applicable.

Full Name |

Son/Daughter |

Date of Death |

|

|

|

b. Deceased child’s living children if applicable:

Full Name |

Son/Daughter |

Date of Birth |

Parent’s Name |

|

|

|

|

10) If you have stepchildren, do you want them treated the same as your natural born

or legally adopted children in your Will?  Y

Y  N

N  N/A If yes, state the following for each:

N/A If yes, state the following for each:

Full Name |

Male/Female |

Date of Birth |

Parent’s Name |

|

|

|

|

11)If you have grandchildren, state the following for each. If not, go to question #12.

Full Name |

Parent’s Name |

Grandson / |

DOB |

Living? |

Granddaughter |

(Y/N) |

1

2

3

Dear LegalShield,

I’m writing to thank you for your firm’s excellent preparation of my Last Will and Testament. [My lawyer] has been very professional, knowledgeable, and responsive to my calls and questions. Due to his excellent service, I am pleased to continue using LegalShield and to recommend it to friends, family, and business associates.

Sincerely,

Florida Member

p 3 of 6 • Will Questionnaire

guardian

A person lawfully invested with the power, and charged with the duty, of taking care of the person who is incapable of doing so because of age or other incapacity. Certain states do not allow anyone other than a biological parent to be appointed as guardian of minor children in the event of one parent’s death. Please call your Provider Law Firm for instructions for your state.

NOTE: Louisiana residents, although the provision in a Will providing for a guardian of minor children is not binding in your state, it is highly persuasive in a proceeding for the appointment of a guardian and should be included in the Will of any person with minor children.

trustee

A person appointed to manage the financial affairs of the one who is legally incapable of doing so because of age or other incapacity.

joint tenants with right of survivorship

A single property owned by two or more persons, under one title, with equal rights to the property.

At the death of one joint tenant, the property transfers to the surviving tenant.

Halfway Point

12) Are any of your children or other beneficiaries mentally or physically disabled or

have special needs? |

Y |

N |

If so, note any special provisions:

If so, are they presently receiving, or do you anticipate that they may apply for, SSI

benefits in the future? |

Y |

N |

Note: If you leave a bequest, not left to a qualified trust, the recipient might be disqualified from SSI benefits.

13)If your children are under age eighteen (18), state the following for the person you wish to act as their guardian (custodian) in the event of your death or in case of the joint death of you and your spouse (if married). You should obtain the consent of that person(s) before executing your will.

If you do not have any minor children, please go to question #15. Name(s):

Address:

Relationship:

If at the time of your death the person(s) named above is/are unwilling to serve as guardian (custodian), please list an alternate:

Name(s):

Address:

Relationship:

14)Do you want the appointed guardian also to be the trustee (conservator) of any

assets inherited by the minor children? |

Y |

N |

At what age would you like your children to take control from the trustee of any

inherited assets? (Must be at least 18 years old.) |

|

years old |

|

If no, please list the person or entity you wish to act as their financial custodian. You should obtain the consent of that person or entity before executing your Will.

Name:

Address:

Relationship:

Please list an alternate in case this person is unwilling or unable to serve:

Name(s):

Address:

Relationship:

1 2 3 4

5  6

6

15) Indicate how you want your assets to pass when you die.

Please check the ONE option you prefer:

OPTION A

I want my assets to pass to my spouse and children as follows:

•To my spouse, if surviving.

•If my spouse predeceases me, my assets will be divided in equal shares to my children.

•If any of my children predecease me, that child’s share shall be distributed to his or her children in equal shares.

•In the event my spouse and all of my children and descendents fail to survive me, I want my assets to be distributed as follows:

OPTION B

I am unmarried with children and want my assets to pass as follows:

•In equal shares to my children.

•If one or more of my children predeceases me, that child’s share in my estate is distributed to his or her children in equal shares.

•In the event all my children and descendents fail to survive me, I want my assets to be distributed as follows:

OPTION C

None of the above. I want my assets to pass as follows:

Will Questionnaire • p 4 of 6

For Your

Information

If you own property jointly with another person as “joint tenants with right

of survivorship,” your interest in that property will pass to the survivor upon your death. It will not pass according to the terms of your Will. If you own property jointly with another person without right of survivorship, your interest in that property will pass according to the provisions in your Will.

NOTE: Idaho and Louisiana residents, contact your Provider Law Firm for information particular to your state.

BENEFICIARY DESIGNATIONS

You should know that decisions you have already made regarding title to property will determine distribution of that property in the future. Will provisions cannot alter those decisions. A beneficiary designation is a binding contractual obligation and a Will provision will not alter that designation.

Beneficiary designations in life insurance policies, retirement plans, annuities, bank accounts with a named “Due on Death” (DOD) beneficiary, etc., will determine who receives those moneys upon your death, not your Will.

MORTGAGED PROPERTY

•If you leave to a named beneficiary real/immovable property which is mortgaged, that property will generally pass under your Will to the beneficiary subject to the debt secured by the mortgage.

•If you wish to leave the property free and clear of the mortgage debt, you must include a provision in your Will directing the debt to be paid from the other assets of your estate, provided sufficient assets are available.

NOTE: Louisiana residents, contact your Provider Law Firm for information particular to your state.

p 5 of 6 • Will Questionnaire

health care power of attorney

A legal document appointing a person the authority to make health care decisions on another person’s behalf.

physicians directive

(also living will)

A legal document containing instructions for physicians regarding your

executor

(also personal representative)

The person appointed in a Will by the testator (person making the Will) to carry out the terms of the Will.

fiduciary bond

A type of surety bond required by the court to be filed by executors, guardians, etc., to ensure proper performance of their duties as an executor. Typically waived, especially when a spouse or family member is appointed executor.

For Your

Information

FUNERAL ARRANGEMENTS

Rather than including your funeral wishes in your Will, which often isn’t read until after your funeral, it’s best to make your wishes known to loved ones in writing prior to your death.

Almost Done!

1 2 3 4 5  6

6

16)Do you wish to disinherit any children or grandchildren? If so list their names here. If not applicable, please go to question #17.

NOTE: In certain states it is not possible to completely disinherit a spouse or minor child. Please contact your Provider Law Firm for more information.

17)Execution of a Will is the best way to determine how your property will be distributed. However, it cannot address important issues regarding health care decisions. Your Provider Law Firm will prepare a Health Care Power of Attorney and Physician’s Directive* at no additional charge if prepared with your Will.

* In Alabama, an Advance Directive for Health Care

Who would you like to serve as your representative responsible for making sure your health care wishes are carried out?

Full name: Address: Phone number:

Please list an alternate in case this person is unwilling or unable to serve: Full name:

Address: Phone number:

Please indicate your wishes by checking one box below:

I want this person to be able to act on my behalf immediately.

I want this person to be able to act on my behalf only upon certification by a doctor that I am no longer able to make decisions and act for myself.

18) If married and your spouse is still alive, do you want your spouse to serve as your

personal representative/executor*? |

Y |

N |

* Louisiana & Missouri residents, see back cover.

Please list an alternate below. If not married or you wish to appoint someone other than your spouse, please indicate below.

NOTE: If you wish to name a

Full name:

Address:

Please list an alternate in case this person is unwilling or unable to serve: Full name:

Address:

Do you wish to waive the fiduciary bond requirement? |

Y |

N |

19)Many people make special provisions for family heirlooms, jewelry, or other items of special value to be distributed to friends or relatives. If you have such property and would like to leave it to a specific person, please complete the following.

NOTE: In question #15 you indicated how you would like your assets to pass. Please fill out question #19 ONLY if you desire items with specific or sentimental value be left to a specific person. (Include a separate sheet of paper if necessary.)

Item |

Special Identifying Features |

Recipient |

|

|

|

|

|

|

|

|

|

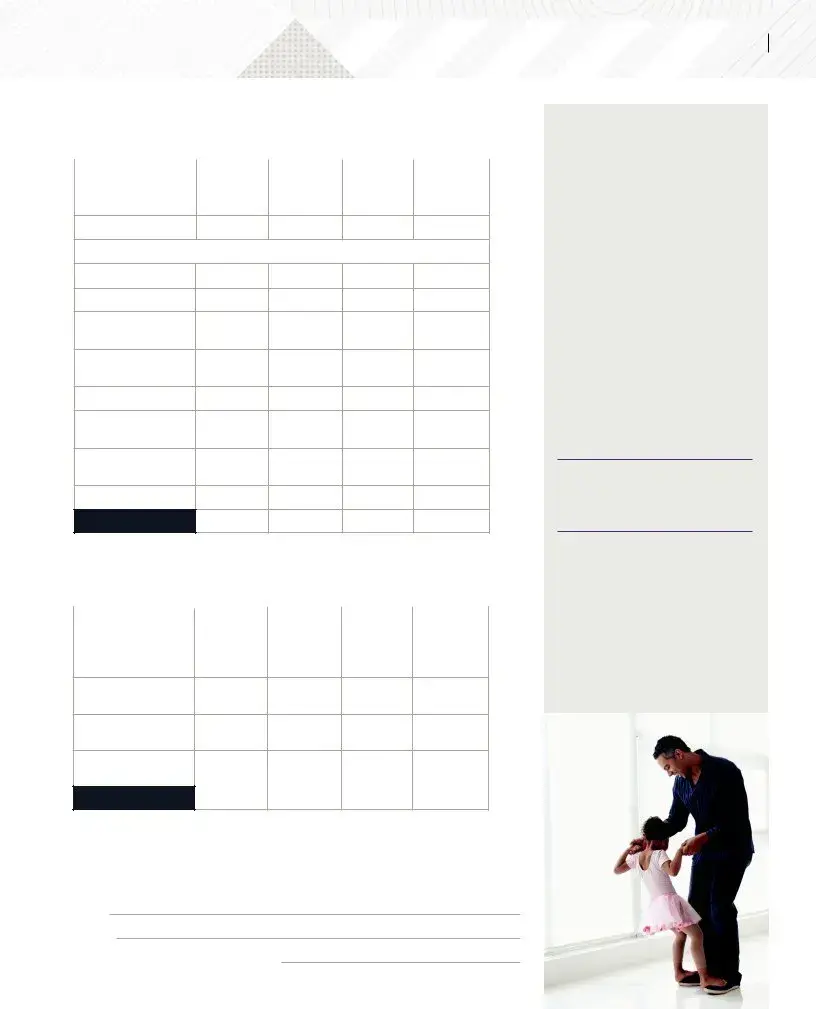

20)List the estimated value of your assets as of today’s date. Include the dollar amount in the appropriate column(s).

|

|

|

V A L U E |

|

|

A S S E T S |

Individual |

Spouse’s |

Joint/Community |

Joint Assets/ |

|

Separate |

|||||

Assets |

Assets |

||||

|

Assets |

||||

|

|

|

|

||

|

|

|

|

|

a.Home

b.Other real estate*

c.Checking, savings, or credit union accounts & certificates 1.

2.

d.Automobiles & Other Vehicles

e.Stocks, Mutual funds & other investments

f.Interest in a business

g.Qualified retirement plans (e.g. 401k plan)

h.Life Insurance Policies

i.Miscellaneous

T O T A L S

*Indicate whether in state or out of state.

21)List your estimated debt in each category as applicable. Include the dollar amount in the appropriate column(s).

D E B T S |

Individual |

Spouse’s |

Joint/Community |

Joint Debts/ |

|

Separate |

|||||

Debts |

Debts |

||||

|

Debts |

||||

|

|

|

|

||

|

|

|

|

|

a.Mortgages on home, car, etc.

b.Signature Loan at Bank

c.Medical or other expenses

d.Other debts over $5,000

T O T A L S

Confirmation of Information and Instructions:

I confirm the information provided by me in this form is complete and accurate and that the instructions I have provided reflect my wishes.

Signature:

Print name:

Date: |

|

Phone number: |

|

IN CASE OF QUESTIONS

Will Questionnaire • p 6 of 6

For Your

Information

FEDERAL ESTATE TAXES

Your taxable estate may include all life insurance on your life and all joint tenancy property. Tax laws are constantly changing. If your taxable estate is larger than $1,000,000 you should consult with your Provider Law Firm regarding advanced tax planning tools available at a discounted rate.

STATE INHERITANCE TAXES

Your estate could be subject to state inheritance tax even if it isn’t subject to federal taxation. Please ask your Provider Law Firm for further clarification.

probate

The judicial determination of the validity of a Will.

PROBATE

Many people think that if their loved one had a Will prepared, they will be able to avoid the probate process. This is not necessarily the case. Please ask your Provider Law Firm for details about your state.

You have now completed your Will Questionnaire! Please see instructions on the next page for final steps on how to get your Will prepared.

Your LegalShield Plan Will Questionnaire

TO HAVE YOUR WILL PREPARED:

1 |

After completing the Will Questionnaire, mail it to your Provider Law Firm. |

|

|

|

If you need to include additional information to this questionnaire, please include |

|

a separate sheet of paper. Your membership guide contains a preaddressed |

|

envelope for mailing your questionnaire to your Provider Law Firm. If you need your |

|

Provider Law Firm’s address, please call their number which you can find in your |

|

electronic membership kit, via the LegalShield mobile app, or by calling Member |

|

Services |

|

you send in. |

|

They will prepare your Last Will & Testament based on the confidential information |

|

you provide in your Will Questionnaire. If they need additional information from you |

|

while completing your Will, they’ll call you. |

2

3

Your Provider Law Firm should mail you your completed Will within ten (10) business days of when they receive your completed Will Questionnaire.

You’ll also receive instructions from your Provider Law Firm on how to have your Will finalized.

Safeguard your Will and make a copy for your executor.

Store your Will in a safe place with other important legal documents. Please remember that

*Louisiana & Missouri Residents: Under law, the Personal Representative serves with Court supervision. Certain actions can be taken by your Personal Representative only after obtaining Court approval, including the sale or transfer of any real estate which is part of your estate. However, you can waive certain Court supervision by electing “Independent Administration” of your estate. By electing “Independent Administration” the expenses associated with probate administration may be lessened. However, because there is less Court supervision, there is a greater chance of dishonesty by the Personal Representative and they must secure the service of an attorney on legal questions arising in connection with the administration of the estate.

Do you wish to elect “Independent Administration” for your estate? |

Y |

N |

Contracts issued by:

In FL: LS, Inc.

In VA: Legal Service Plans of Virginia, Inc.

Toll Free: 800.654.7757

willquest 8.17 51770 © 2017 LegalShield

Form Characteristics

| Fact Name | Detail |

|---|---|

| Purpose of the Questionnaire | The Will Questionnaire serves as a tool to gather essential information required for the preparation of a valid Will by a qualified law firm, helping to ensure that all personal wishes are accurately documented. |

| Confidentiality Assurance | All the information provided in the Will Questionnaire is treated as strictly confidential. This means you can share personal details without fear of unauthorized disclosure. |

| Separate Forms for Couples | If both spouses are preparing Wills, each must complete a separate Will Questionnaire. This allows for tailored estate planning that meets individual needs. |

| State-Specific Considerations | Different states have distinct laws governing Wills. For instance, Louisiana law emphasizes that provisions for guardianship in Wills are persuasive but not binding. Residents should consult their Provider Law Firm for state-specific guidance. |

| Preparation Requirement | It's important to understand that the Will Questionnaire itself is not a Will. Completing all applicable questions is crucial to ensure accurate estate planning and documentation. |

Guidelines on Utilizing Legalshield Will Questionnaire

Completing the LegalShield Will Questionnaire is a crucial step in ensuring that your estate is managed according to your wishes. Follow these steps carefully to fill out the form accurately and thoroughly.

- Full Name: Enter your full name (first, middle, last) and any other names you have been known by.

- Membership Number: Provide your membership number.

- Age and Date of Birth: Fill in your age and date of birth.

- Sex: Indicate whether you are Male or Female.

- Citizenship: State whether you are a US citizen (Yes or No). If No, specify your country of citizenship.

- Current Residence: Fill in your street address, city, county or parish, state (abbreviation), and ZIP code.

- Home and Work Phone: Provide your home and work phone numbers.

- Spouse Information: If married, enter your spouse’s full name, date of birth, date and place of marriage, and indicate if you are currently living together.

- Prenuptial Agreement: Indicate if you have a prenuptial agreement (Yes, No, or N/A) and attach a copy if applicable.

- Divorce Information: If you or your spouse has been divorced, provide the relevant dates and court information. If not applicable, proceed to the next question.

- Trusts: Indicate if you or your spouse have created any trusts or made gifts through trusts. If Yes, provide details and include a copy.

- Inheritance: State if you or your spouse expect any inheritance. Include details if applicable.

- Children: For each child, provide full names, dates of birth, and if they are from your current marriage.

- Stepchildren: State if you have stepchildren and if you want them treated the same as your biological children (Yes, No, or N/A).

- Grandchildren: Provide details for each grandchild, including names, parent names, dates of birth, and if they are living.

- Special Needs: Indicate if any of your beneficiaries have special needs and note any provisions necessary.

- Guardian Information: Provide the name, address, and relationship of your chosen guardian for minor children. If applicable, list an alternate guardian.

- Trustee Decision: Decide if you want the appointed guardian to also serve as the trustee of any inherited assets.

- Asset Distribution: Clearly state how you want your assets distributed after your passing by selecting from the given options (A, B, or C).

- Review: Ensure all applicable questions are completed. Attach separate sheets if more space is needed, clearly indicating the question number.

- Contact Information: If you have any questions while filling out the form, don’t hesitate to contact your Provider Law Firm or Member Services for assistance.

With these completed steps, your Will Questionnaire will be ready for submission to your Provider Law Firm, facilitating the preparation of your Will. Take the time to ensure accuracy, as this information will play an important role in your estate planning process.

What You Should Know About This Form

1. What is the purpose of the LegalShield Will Questionnaire?

The LegalShield Will Questionnaire is designed to gather detailed information about your assets, family, and wishes regarding the distribution of your estate after your death. This information is essential for your Provider Law Firm to prepare a Will that reflects your specific desires and circumstances. The completed questionnaire aids in ensuring your wishes are documented legally and properly.

2. Who needs to fill out the Will Questionnaire?

Both the member and their spouse must fill out separate Will Questionnaires. This allows each individual's unique needs and circumstances to be addressed in the estate planning process. By providing comprehensive details, it facilitates a more accurate and tailored legal document.

3. What information do I need to complete the Will Questionnaire?

You will need various personal details, including names and birth dates of your children, the names of any guardians you wish to appoint, and an inventory of your assets, such as real estate and bank accounts. Additionally, if applicable, you will need to provide details regarding prenuptial agreements, trusts you have created, and any anticipated inheritances.

4. Is the Will Questionnaire the same as my will?

No, the Will Questionnaire is not your Will. It is a preparatory document that helps your Provider Law Firm draft your Will. It is crucial to complete all applicable questions to ensure that the Will produced aligns with your wishes and effectively addresses your estate planning needs.

5. What if I need more space to answer a question?

If you require additional space for your answers, you can attach a separate sheet of paper. Make sure to indicate the corresponding question number for reference. This helps ensure clarity and organization in the information provided.

6. How confidential is the information I provide in the Will Questionnaire?

The information you provide is strictly confidential. Your Provider Law Firm is committed to maintaining the privacy of your personal data. This confidentiality is essential for building trust and ensuring that your estate planning is handled with the utmost care.

7. Can I ask questions while I fill out the Will Questionnaire?

Yes, you can reach out to your Provider Law Firm with any questions you may have while completing the questionnaire. Their contact information is provided on your membership card. They are available to assist you in ensuring that your form is completed accurately and thoroughly.

8. What happens to my assets if I have joint ownership?

Assets owned jointly with rights of survivorship will not pass according to your Will. Instead, they will transfer directly to the surviving owner upon your death. On the other hand, assets owned jointly without such rights will pass according to the provisions you outline in your Will.

9. Are there special considerations for beneficiaries with disabilities?

If you have beneficiaries who are mentally or physically disabled or who have special needs, you should note any special provisions in the questionnaire. Such considerations are essential, especially if they may apply for SSI benefits in the future, as certain inheritances could affect their eligibility.

10. What should I do if I have specific wishes for my assets distribution?

The Will Questionnaire provides options for how you want your assets to pass upon your death. You should carefully consider your preferences and select the appropriate options. You can indicate specific wishes for family members or others, ensuring your estate is distributed as you intend.

Common mistakes

Filling out the LegalShield Will Questionnaire can feel overwhelming. A common mistake people make is leaving questions incomplete. Each section is important. If you skip questions or provide partial answers, your law firm may not be able to prepare your Will accurately. Make sure to read each question carefully and provide all requested information.

Another frequent error is not including specific details about your assets. Whether it's your home, cars, or bank accounts, being as precise as possible helps in planning your estate. Approximate values are also needed for various items. Forgetting to list valuable items or providing vague descriptions can lead to complications later.

Some people mistakenly believe that they can combine information with their spouse on a single form. However, each member of a couple should fill out their own Questionnaire. This process ensures that everyone's wishes are accurately documented and addressed according to their individual needs.

It's also important to understand that this form is not your actual Will. Many fail to realize this distinction. The Questionnaire serves as a tool to create the Will, so treat it with the same seriousness as the final document. This understanding will help you focus on providing all the necessary information.

Another common mistake is not seeking help when needed. If you find a question confusing, don’t hesitate to contact your Provider Law Firm. They are there to guide you. Ignoring your uncertainties could lead to errors that complicate your estate planning.

Some individuals overlook the necessity of preparing necessary documents ahead of time, like prenuptial agreements or information about prior marriages. These documents can play a crucial role in how your estate is handled and should be attached as stated in the Questionnaire.

Lastly, a surprising number of people fail to consult their family or intended guardians before completing the form. Having open discussions with those who will be involved can save heartache later. Confirming that your chosen guardians and trustees agree to their roles ensures that your wishes will be met.

Documents used along the form

When preparing your estate plan alongside the LegalShield Will Questionnaire form, you may encounter other important documents. Each of these forms plays a crucial role in ensuring that your wishes are clearly laid out and legally binding. Below is a list of documents often used in conjunction with the Will Questionnaire, providing a brief overview of their purpose and significance.

- Last Will and Testament: This is the official document that outlines how your assets will be distributed upon your passing, who will serve as guardian for your minor children, and who will act as your executor.

- Living Will: A living will specifies your wishes regarding medical treatment in situations where you may be unable to communicate your decisions, particularly concerning end-of-life care.

- Durable Power of Attorney: This document designates someone to manage your financial affairs if you become incapacitated, ensuring your bills and assets are handled appropriately.

- Health Care Proxy: A health care proxy allows you to appoint someone to make medical decisions on your behalf if you are unable to do so, particularly in emergencies.

- Trust Documents: If you create a trust, these documents outline how assets are managed and distributed. They can help avoid probate and provide for minor children or beneficiaries with special needs.

- Beneficiary Designation Forms: These forms are used for accounts like life insurance policies or retirement plans to specify who will receive these assets upon your death, which supersedes instructions in your will.

- Prenuptial Agreement: If applicable, this legal contract outlines the division of assets between spouses in the case of divorce or death, providing guidance on how specific assets are treated.

- Financial Statements: Keeping updated statements of your assets and liabilities helps in accurately assessing your estate's size and making informed decisions during the planning process.

- List of Personal Assets: Compiling a thorough inventory of your belongings, especially valuable items, ensures clarity in asset distribution among beneficiaries.

- Letter of Instruction: This document provides guidance for your family and executor regarding your wishes for personal items, funeral arrangements, and other details that may not be covered in your will.

Completing these documents alongside the LegalShield Will Questionnaire can streamline the estate planning process, ensuring that all your preferences are adequately recorded and legally enforceable. Careful consideration of each form can provide clarity and peace of mind for you and your loved ones.

Similar forms

The LegalShield Will Questionnaire form serves as an essential tool for gathering important information for estate planning. Various documents share similarities with it, each designed to help individuals clarify their wishes regarding their assets, beneficiaries, and other important aspects of their estate. Below is a list of seven documents that resemble the LegalShield Will Questionnaire:

- Last Will and Testament: Like the Will Questionnaire, a Last Will and Testament provides instructions on how a person's assets should be distributed upon their passing. Both emphasize the importance of specifying beneficiaries and personal representatives.

- Living Trust: A Living Trust, similar to the Will Questionnaire, is a legal document that allows someone to designate how their assets will be managed and distributed during their lifetime and after death. Both documents help ensure that individual wishes are honored.

- Power of Attorney: A Power of Attorney form, much like the Will Questionnaire, establishes who will make financial or medical decisions on behalf of an individual if they become incapacitated. Both documents require careful consideration of the appointed individuals.

- Healthcare Proxy: Similar to the Will Questionnaire, a Healthcare Proxy designates someone to make medical decisions on your behalf if you are unable to do so. Both documents aim to ensure that your health-related preferences are respected.

- Beneficiary Designation Forms: Just as the Will Questionnaire captures information about beneficiaries for estate distribution, Beneficiary Designation Forms specify who will receive assets from accounts such as life insurance policies and retirement plans, effectively bypassing a will’s distribution instructions.

- Prenuptial Agreement: A Prenuptial Agreement, like the Will Questionnaire, addresses asset management and distribution in the event of a divorce or death. Both documents reflect specific decisions made regarding how assets are shared or transferred.

- Trustee Letter: The Trustee Letter is similar as it communicates the intentions of the person who is setting up a trust, including who the beneficiaries are and how the assets should be managed. Like the Will Questionnaire, it is essential to clarify the future management of assets.

These documents collectively assist individuals in establishing a comprehensive estate plan, providing clarity and direction for both themselves and their loved ones.

Dos and Don'ts

Completing the LegalShield Will Questionnaire is an important step in ensuring your estate is managed according to your wishes. Here are ten recommendations to guide you through the process:

- Read the Instructions: Before starting, thoroughly read any instructions provided.

- Be Accurate: Fill out all responses truthfully and carefully. Accurate information ensures your will reflects your true intentions.

- Gather Required Documents: Prepare necessary documents, such as prenuptial agreements and beneficiary information, in advance.

- Include All Beneficiaries: List every person or entity you wish to benefit from your estate to avoid confusion later.

- Ensure Clarity: If a question is unclear, don’t hesitate to seek clarification from your Provider Law Firm.

Conversely, there are several pitfalls to avoid:

- Do Not Rush: Take your time to complete the questionnaire. Rushed answers may lead to mistakes.

- Avoid Leaving Questions Blank: Ensure that every applicable question is answered fully. Incomplete forms can delay the preparation of your will.

- Don't Forget to Update: If your situation changes (e.g., divorce, new children), update your questionnaire and will accordingly.

- Refrain from Ambiguity: Love and wish lists are great, but avoid vague language when describing your wishes for asset distribution.

Misconceptions

Misconceptions about the LegalShield Will Questionnaire form can lead to confusion regarding estate planning. Here are five common misconceptions explained:

- It is a binding legal document. Many believe the Will Questionnaire is a legal will. In reality, it is just a tool to help prepare your actual will. It does not have legal standing until finalized by a qualified law firm.

- Only one form is needed for couples. Some think that a couple can fill out a single form for both partners. Each member must complete separate questionnaires to address their unique circumstances.

- All questions must be left blank if not applicable. Users often misunderstand that they only need to complete applicable sections of the questionnaire. However, leaving key questions unanswered may prevent effective estate planning.

- Confidentiality is not guaranteed. There is a perception that personal information may not be secure. However, all details submitted in the questionnaire remain strictly confidential and are protected by privacy policies.

- Only the estate's value is important. Some individuals think that reporting just the estate's total worth is sufficient. Accurate details about specific items, debts, and assets are necessary to ensure comprehensive planning.

Understanding these misconceptions can enhance the effectiveness of the estate planning process.

Key takeaways

When filling out and utilizing the LegalShield Will Questionnaire form, several key points must be considered to ensure a smooth and effective process.

- Personal Information is Crucial: Complete all sections of the form, including names, dates of birth, and marital status. Incomplete information may hinder the preparation of your will.

- Children and Beneficiaries: List names and relationships for all children, grandchildren, and any other beneficiaries. This information is vital for determining how your estate will be divided.

- Guardianship Provisions: Specify who will act as the guardian for your minor children. This choice must be made carefully and should include a primary and an alternate guardian.

- Asset Details Required: Provide approximate values for all relevant assets, including real estate, bank accounts, and life insurance. This information is necessary for effective estate planning and tax purposes.

- Consultation is Encouraged: If you encounter questions during the process, reaching out to your Provider Law Firm is highly recommended. They can provide guidance to ensure accuracy in your responses.

By keeping these points in mind, individuals will be better prepared to complete the Will Questionnaire accurately, ultimately leading to a well-structured and enforceable will.

Browse Other Templates

Where to Get Official Transcripts - The form requires students to confirm that all outstanding balances are paid before transcripts can be released.

Permanent Resident Card Replacement Application,Green Card Renewal Application,Lost Permanent Resident Card Form,Form for Permanent Resident Card Update,Application for Permanent Resident Card Reissue,Replacement Request for Green Card,USCIS Applicat - The preparer’s details need to be entered if someone else fills out the form.