Fill Out Your Letter Of Instruction Form

The Letter of Instruction form serves as an essential tool for individuals seeking to manage their shareowner accounts effectively. This document enables account holders to communicate specific requests or changes related to their investments in a straightforward manner. Key information required on the form includes the account number or Social Security/Tax ID number, the name of the company or stock issue, and the registered owner's names and address. Additionally, if a different mailing address is preferred for the request, an alternate address can be provided. When completing the letter, the registered owner's signature is crucial, particularly if a representative, such as an executor or an individual with power of attorney, is acting on their behalf. This form must be mailed to Shareowner Services at the specified address, ensuring that requests are directed to the right team for processing. Moreover, if there are necessary adjustments, such as changing the names associated with the account, specific procedures must be followed, which are outlined in the accompanying documentation. Individuals signing on behalf of another owner must also provide relevant legal documentation, ensuring that their authority to act is clear and valid. Familiarity with this form and its requirements can streamline account management and help avoid potential delays in processing requests.

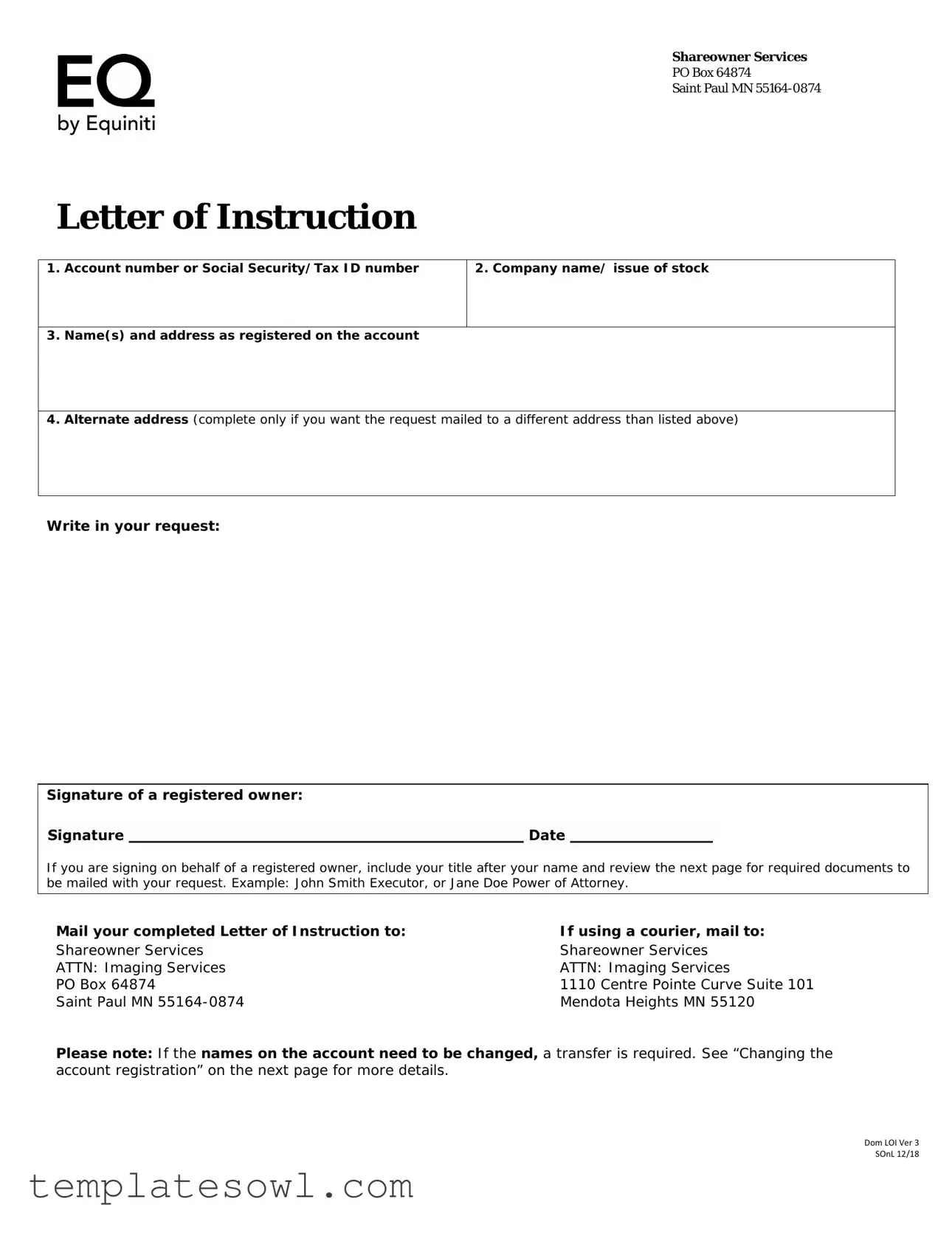

Letter Of Instruction Example

Shareowner Services

PO Box 64874

Saint Paul MN

Letter of Instruction

1. Account number or Social Security/Tax ID number |

2. Company name/ issue of stock |

|

|

3.Name(s) and address as registered on the account

4.Alternate address (complete only if you want the request mailed to a different address than listed above)

Write in your request:

Signature of a registered owner:

If you are signing on behalf of a registered owner, include your title after your name and review the next page for required documents to be mailed with your request. Example: John Smith Executor, or Jane Doe Power of Attorney.

Mail your completed Letter of Instruction to: |

If using a courier, mail to: |

Shareowner Services |

Shareowner Services |

ATTN: Imaging Services |

ATTN: Imaging Services |

PO Box 64874 |

1110 Centre Pointe Curve Suite 101 |

Saint Paul MN |

Mendota Heights MN 55120 |

Please note: If the names on the account need to be changed, a transfer is required. See “Changing the account registration” on the next page for more details.

Dom LOI Ver 3 SOnL 12/18

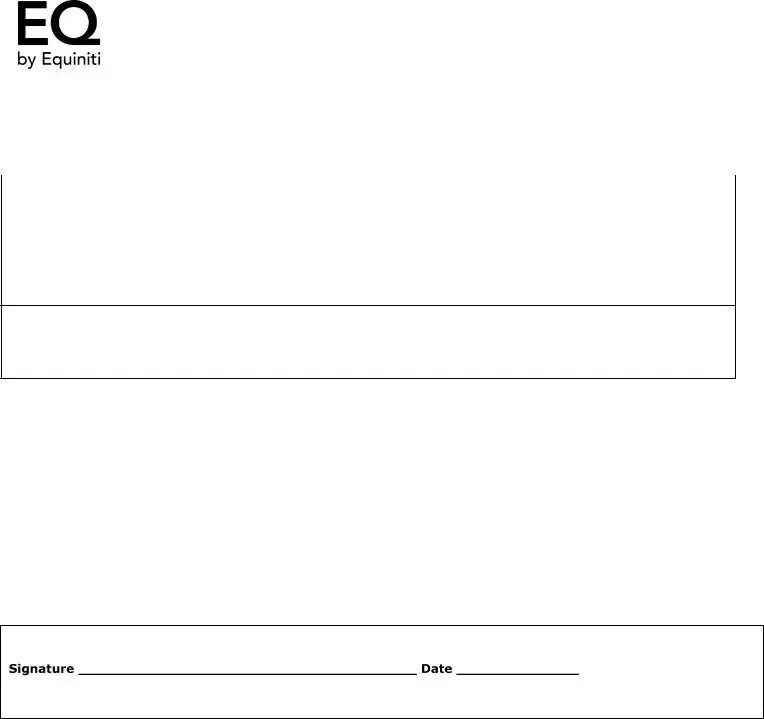

Instructions for individuals signing on behalf of a shareowner

If you are the: |

You need to include: |

|

|

|

|

|

A copy of the court certified document dated within 60 days (within six months if |

|

|

issued in New York or within one year if issued in Connecticut). |

|

Executor or administrator |

|

|

|

If the estate is not being probated, include a small estate affidavit and a photocopy of |

|

|

the death certificate. |

|

|

|

|

|

If your name has changed, please sign the letter as your name appears on the |

|

Your name has changed |

account, and then sign again using your new name. For example: Jane Doe now |

|

|

known as Jane Smith. |

|

|

|

|

Minor who is now over |

Sign the letter and include one of the following: a photocopy of your birth certificate, |

|

the age of majority on a |

||

driver's license, passport, or military ID. |

||

Custodial account |

||

|

||

|

|

|

|

A copy of POA document with the following statement written on the document: "The |

|

Power of attorney (POA) |

Power of Attorney is in full force and effect, is a true and correct copy of the original, |

|

and the maker is still alive." The POA document must state the attorney in fact can act |

||

|

||

|

on behalf of share or security transactions. |

|

|

|

|

|

A photocopy of the court certified Letters of Guardianship/Conservatorship, dated |

|

Guardian or conservator |

within the past 60 days (within six months if issued in New York or within one year if |

|

issued in Connecticut). The Letters must authorize the Guardian/Conservator to act on |

||

|

||

|

behalf of the individual’s assets. |

|

|

|

|

|

Include a Certificate of Fiduciary Authority. You may download this form at |

|

Successor trustee |

shareowneronline.com. Under Download Forms, select “Certificate of Fiduciary |

|

|

Authority.” |

|

|

|

|

|

Chief executive partners, general partners, or managing general partners may sign |

|

Partnership |

the letter listing their title, with no further documents needed. If the partnership has a |

|

|

governing resolution, please follow the requirements for a corporation. |

|

|

|

|

Sole proprietor |

Sole Proprietors may sign the letter listing their title as Sole Proprietor or Sole Owner, |

|

with no further documents needed. |

||

|

||

|

|

|

Corporation |

|

|

|

|

|

Investment club |

|

|

School |

Authorized individuals may sign with their title listed after their name. You will also |

|

|

need to include a copy of the corporate resolution, or governing document listing the |

|

Government agency |

||

authorized individuals who may sign on behalf of the Company or Organization. The |

||

|

||

Religious organization |

resolution/document must be dated within the past 6 months. It must also contain a |

|

|

corporate seal, or have a written statement on it advising there is no seal. The person |

|

|

signing the resolution or document may not be the same person signing this letter. |

|

Financial institution |

||

|

||

acting as custodian or |

|

|

trustee |

|

|

|

|

Changing the account registration

Your name or the names on the account have changed

To change the names on the account, a transfer must be completed. You can download instructions and forms at shareowneronline.com. Under Download Forms, select “Stock Power and Transfer Instructions.”

Form Characteristics

| Fact Name | Fact Details |

|---|---|

| Purpose of the Form | The Letter of Instruction is used to request changes or actions regarding a shareholder's account. |

| Required Information | Individuals must provide their account number or Social Security/Tax ID, the name of the company, and the names and addresses registered on the account. |

| Signature Requirements | The letter must be signed by a registered owner. If someone is signing on behalf of the owner, they must include their title, such as Executor or Power of Attorney. |

| Mailing Instructions | Completed letters should be mailed to Shareowner Services using either a standard or courier service, with specific addresses provided for each method. |

| State-Specific Laws | In New York, court certified documents must be dated within six months; in Connecticut, within one year. These rules may affect executor or guardian submissions. |

| Changing Account Registration | To change names on the account, a transfer is required. Instructions and necessary forms can be downloaded from the Shareowner Services website. |

| Who Can Sign | Authorized individuals, such as executives or partners of corporations and partnerships, may sign the letter. They must include their title and, in some cases, a governing document. |

Guidelines on Utilizing Letter Of Instruction

Filling out the Letter of Instruction form is an important task that helps ensure your request is processed smoothly. After you complete the form, be sure to send it to the provided address. Below are the steps to guide you through filling out the form correctly.

- Write your account number or Social Security/Tax ID number at the top.

- Enter the company name or issue of stock you are referring to.

- Fill in your name(s) and address as they are registered on the account.

- If you want the request sent to a different address, fill in the alternate address section.

- Clearly write your request in the specified area.

- Sign the form as a registered owner. If you are signing on behalf of someone else, include your title after your name. For example, you might write 'John Smith, Executor.'

- Check the next page for required documents that need to be mailed with your request.

- Mail your completed Letter of Instruction to the appropriate address for Shareowner Services.

- If using a courier, send it to the specified address in Mendota Heights, MN.

Make sure to review your form and documents before sending them off to avoid any delays in processing.

What You Should Know About This Form

What is a Letter of Instruction?

A Letter of Instruction is a formal document that provides specific instructions regarding an account, typically a shareowner account. It includes details such as the account number, company name, and the names and addresses of the registered owners. This letter is essential for initiating requests or making changes related to the account.

Who can sign the Letter of Instruction?

The Letter of Instruction can be signed by the registered owner of the account. If someone is signing on behalf of the registered owner, they must include their title as well. For instance, an executor or a power of attorney must indicate their role clearly. This ensures that the request is valid and could be processed accordingly.

How should I submit the Letter of Instruction?

You should mail the completed Letter of Instruction to the designated address provided. If you are using a courier, the address differs slightly and should be directed to the imaging services department. Be sure to double-check the recipient address to ensure timely processing of your request.

What should I do if I need to change the names on the account?

To change the names on the account, a transfer is required. It's not enough to simply submit a Letter of Instruction. You need to follow the processes outlined for changing account registration. You can download the necessary instructions and forms from the relevant website to proceed with the transfer.

What documentation is needed if I'm signing on behalf of someone else?

If you are signing on behalf of a shareowner, specific documents must be included based on your relationship to the owner. For example, if you are an executor, provide a court-certified document. Each situation, such as guardianship or power of attorney, has unique documentation requirements that you must fulfill to ensure the validity of your request.

Is there a deadline for submitting documents along with the Letter of Instruction?

Yes, certain documents must be certified and dated within specific timeframes. For example, documents related to guardianship must be dated within the last 60 days, while some documents from New York may be accepted if issued within the last six months. Failure to comply with these timeframes could delay or invalidate your request.

Common mistakes

When filling out the Letter of Instruction form, individuals often encounter several pitfalls that can delay or complicate the process. One common mistake is failing to include accurate identifying information.

Account numbers or Social Security/Tax ID numbers must be written clearly and correctly. Omitting these details or entering incorrect numbers can result in processing delays. Similarly, the section requiring the company name or stock issue must be filled out with precision; errors here can lead to significant administrative hold-ups.

Another frequent error involves the failure to provide the correct signature. Signatures must be those of registered owners. For those signing on behalf of another, it is essential to include the appropriate title following the name. Neglecting this requirement may lead to the rejection of the form, as it does not reflect the authority to act on behalf of the registered owner.

In addition to signature issues, individuals often skip providing an alternate address when necessary. The form allows for the designation of a different mailing address. Omitting this detail can result in the request being sent to an unwanted location, thereby complicating communication.

Moreover, many individuals do not include required documentation when applicable. For example, if signing as an executor or administrator, a court-certified document is essential. Similarly, guardians or custodians must provide documentation that verifies their authority. Without these documents, the submission may be deemed incomplete.

Another mistake arises from incomplete understanding of the legal requirements for certain signers. Individuals who have changed their names must sign the letter under both old and new names to avoid any confusion. This practice ensures that the request will be processed smoothly by the authorities.

Additionally, people often neglect the necessity of including corporate resolutions or governing documents when signing on behalf of a corporation or partnership. These documents must be included to verify that the individual has the authority to sign. Without them, the request is at risk of being postponed.

Lastly, it is crucial to recognize the specific procedures for changing account registrations. Many individuals wrongly assume that name changes can be handled without following a transfer process. Clarity in these procedures is necessary to prevent future complications. By paying close attention to each of these aspects, individuals can ensure that their Letter of Instruction is complete and correctly executed.

Documents used along the form

When addressing the management of assets and legal affairs, several documents serve essential roles alongside the Letter of Instruction. Each of these forms helps ensure clarity and compliance with operation protocols. Understanding their purposes can help individuals navigate their specific needs.

- Power of Attorney (POA): This document designates an individual to act on someone else's behalf. It is crucial for managing financial or legal matters when the original owner is unable to do so. The POA must specify the authority granted and can be tailored to fit different scenarios.

- Death Certificate: This official document confirms an individual's death. It is often required when transferring or managing assets of the deceased. A certified copy is essential in legal contexts, providing proof for necessary actions related to estate management.

- Letters of Guardianship/Conservatorship: This document authorizes a guardian or conservator to act on behalf of an individual who is unable to manage their affairs. It's vital when someone needs assistance due to age, disability, or incapacity, outlining the extent of the appointed individual’s authority.

- Corporate Resolution: Used by corporations, this document records decisions made by the board or to authorize specific actions. It must be signed and often includes the corporate seal. It's essential for verifying who can act on behalf of the corporation in various transactions.

Being informed about these documents not only helps streamline the process but also provides peace of mind during potentially challenging circumstances. Each form plays a pivotal role in ensuring that legal and financial intentions are appropriately fulfilled.

Similar forms

- Power of Attorney (POA): Similar to a Letter of Instruction, a Power of Attorney allows one individual to act on behalf of another in various transactions. Both documents require the signatures of the involved parties and can grant authority for specific actions regarding financial matters.

- Last Will and Testament: A Last Will and Testament outlines how an individual's assets will be distributed after their death. Like the Letter of Instruction, it provides clear direction and requires the author’s signature, indicating their wishes regarding asset management.

- Trust Agreement: A Trust Agreement establishes a trust to manage and allocate assets. Similar to a Letter of Instruction, it specifies the roles of different parties and instructs them on how to handle assets according to the individual’s desires.

- Affidavit: An affidavit is a written statement confirmed by oath, often used in legal transactions. Like a Letter of Instruction, it must be signed and may require supporting documentation to validate the authority of the person acting on behalf of another individual.

- Certificate of Authority: This document gives an individual or organization the power to act on behalf of another, often in a business context. Similar to a Letter of Instruction, it necessitates the verification of authority and outlines the scope of the power granted.

Dos and Don'ts

When completing the Letter of Instruction form, it’s important to follow certain guidelines to ensure a smooth process. Below is a helpful list of do’s and don'ts:

- Do provide your account number or Social Security/Tax ID number accurately.

- Do include the name of the company or stock issue related to your account.

- Do list your name(s) and address as they are registered on the account.

- Do sign the letter in the same name that appears on your account.

- Don't omit the required documentation if you are signing on behalf of a registered owner.

- Don't forget to check if you need to provide additional paperwork for a name change.

- Don't mail your request to an incorrect address; ensure it's sent to the correct location.

- Don't neglect to include your title or designation when signing on behalf of someone else.

By paying attention to these guidelines, you can facilitate a more efficient processing of your Letter of Instruction.

Misconceptions

There are many misconceptions about the Letter of Instruction form that can lead to confusion. Here are some of the most common myths, along with explanations to help clarify:

- The Letter of Instruction can replace a will. This is not true. The Letter of Instruction is not a legal document like a will. It merely provides guidance on handling your assets.

- You don’t need to provide identification. Incorrect. When submitting a Letter of Instruction, you must include specific identification, such as your Social Security or Tax ID number.

- Anyone can sign the Letter of Instruction. This is misleading. Only registered owners or their authorized representatives can sign. Proper documentation is required if you are acting on someone else's behalf.

- It’s enough to just fill out the form. Actually, there may be additional documents that need to be submitted. Make sure to review all requirements carefully.

- A Letter of Instruction allows for instantaneous changes to account ownership. This is false. If you need to change names on an account, a transfer must be completed, and the proper forms need to be submitted.

- Providing an alternate address is optional. This is not necessarily the case. If you want your request to be sent to a different address, you must complete that section of the form.

- A Letter of Instruction can be submitted without a signature. This is incorrect. A registered owner's signature is mandatory, whether it's an individual or a representative.

- All states have the same requirements for supporting documents. This is misleading. Some states, like New York and Connecticut, have specific requirements regarding the timeliness of documents submitted.

- Once submitted, the Letter of Instruction cannot be revoked. This is not true. You can send a new Letter of Instruction at any time to update or change your previous requests.

- The form can be mailed anywhere, and it will still be processed. This is inaccurate. The completed form must be sent to the specified addresses provided in the instructions to ensure proper handling.

Understanding these points can help prevent unnecessary issues when using a Letter of Instruction. Always double-check the requirements to ensure everything is in order.

Key takeaways

When filling out and using the Letter of Instruction form, it’s important to keep a few key points in mind.

- Account or Tax ID: Always start with your account number or Social Security/Tax ID number. This helps identify your request quickly.

- Correct Company Name: Include the name of the company or stock issue clearly. Accuracy here is essential.

- Registered Names and Addresses: Provide the name(s) and address as they appear on your account. This ensures your request matches official records.

- Alternate Address: If you want the request sent to a different address, fill in the alternate address section.

- Signature Matters: Ensure the Letter is signed by a registered owner. If you're signing for someone else, include your title as well.

- Mailing Instructions: After completion, send your Letter of Instruction to the appropriate address. Double-check that you’re using the correct mailing option.

- Document Requirements: If you’re signing on behalf of a registered owner, be aware of the required documents to include based on your authority.

- Changing Account Information: If you need to change names on the account, realize that a transfer is necessary. Follow the links provided for more information.

Browse Other Templates

Mobile Liquor License - Non-compliance with timelines stated on the form can affect warranty start dates.

Proof of Service Family Law - The FL-300 form is a Request for Order used in family law court proceedings.

Missouri Department of Revenue Drivers License - Careful driving: This instruction is a friendly reminder to practice cautious driving for the safety of everyone.