Fill Out Your Letter Of Lien Form

The Letter of Lien form serves as a crucial document in the construction and contracting industry, especially when payment disputes arise. This form notifies parties involved in a residential project of any unpaid work, materials, or equipment provided. It clearly outlines the original contract amount, any changes or additions to that amount, and details all payments that have been received to date. Additionally, the form specifies the amount that's still owed, leaving no ambiguity. The Letter of Lien emphasizes the urgency of addressing the overdue payment, stating that if it remains unpaid for 15 days from the notice date, a lien claim will be filed against the project. By documenting these key elements, the Letter of Lien ensures that everyone involved understands their financial obligations and the potential consequences of non-payment.

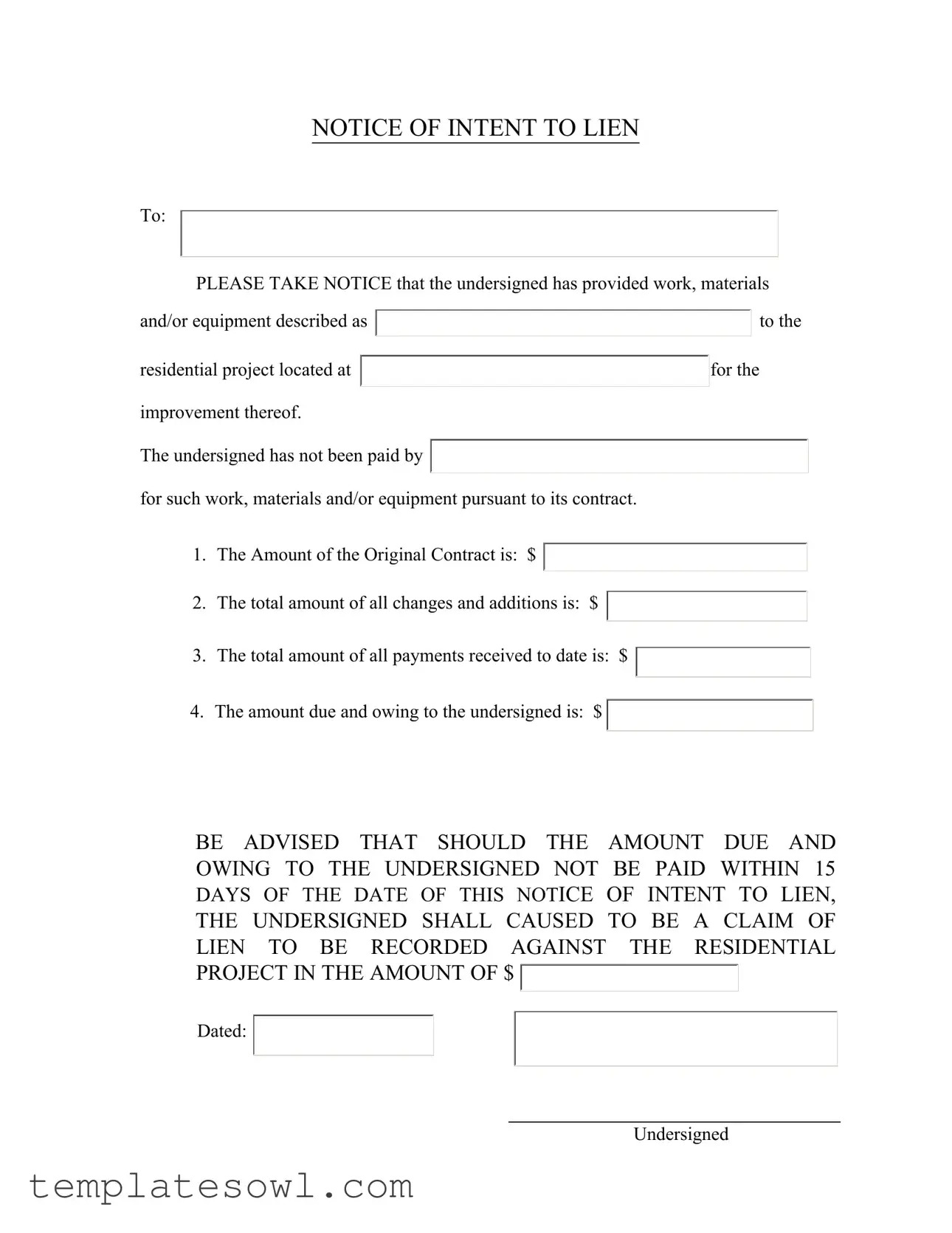

Letter Of Lien Example

NOTICE OF INTENT TO LIEN

To:

PLEASE TAKE NOTICE that the undersigned has provided work, materials

and/or equipment described as |

|

|

|

|

|

|

to the |

|

||

|

|

|

|

|

|

|

|

|

|

|

residential project located at |

|

|

|

|

|

|

for the |

|

||

|

|

|

|

|

|

|

|

|

||

improvement thereof. |

|

|

|

|||||||

|

|

|

|

|

|

|

|

|||

The undersigned has not been paid by |

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|||

for such work, materials and/or equipment pursuant to its contract. |

|

|

|

|||||||

|

|

|

|

|

|

|

|

|||

1. |

The Amount of the Original Contract is: $ |

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

||||

2. |

The total amount of all changes and additions is: $ |

|

|

|

|

|

||||

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|||||

3. |

The total amount of all payments received to date is: $ |

|

|

|

|

|||||

|

|

|

|

|

||||||

|

|

|

|

|||||||

4. The amount due and owing to the undersigned is: $ |

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

BE ADVISED THAT SHOULD THE AMOUNT DUE AND OWING TO THE UNDERSIGNED NOT BE PAID WITHIN 15 DAYS OF THE DATE OF THIS NOTICE OF INTENT TO LIEN, THE UNDERSIGNED SHALL CAUSED TO BE A CLAIM OF LIEN TO BE RECORDED AGAINST THE RESIDENTIAL PROJECT IN THE AMOUNT OF $

Dated:

Undersigned

Form Characteristics

| Fact Name | Details |

|---|---|

| Purpose | A Letter of Lien notifies a party of unpaid work or materials provided for a project. |

| Notice Requirement | This notice is sent before filing a formal claim of lien against a property. |

| Timeline | Recipients must pay the amount due within 15 days to avoid a lien being recorded. |

| Original Contract Amount | The document includes the total amount of the original contract. |

| Changes and Additions | It lists the total amount for any changes or additions to the original contract. |

| Payments Received | A record of total payments received to date is included. |

| Amount Due | The amount due and owing to the undersigned is specified in the document. |

| Governance | This form is subject to state laws regarding lien and notice requirements. |

| State-Specific Forms | Each state may have specific regulations governing lien notices; verify local laws. |

| Recordkeeping | It is important for both parties to keep a copy of this notice for their records. |

Guidelines on Utilizing Letter Of Lien

Completing the Letter of Lien form is an essential step in asserting your rights regarding unpaid work or materials provided for a residential project. After you have filled out the form accurately, it is critical to send it to the appropriate parties, ensuring that you comply with any local regulations regarding lien notices.

- Begin by entering the date at the top of the form.

- In the section labeled "To:", specify the name of the party that owes you payment.

- Clearly state that you have provided work, materials, or equipment for a particular residential project. Include the location of the project.

- Indicate the name of the party with whom you contracted for the work, materials, or equipment.

- Fill in the Amount of the Original Contract in the designated space.

- List the total amount of all changes and additions to the original contract.

- Document the total amount of all payments received to date.

- Calculate and enter the remaining Amount Due and Owing in the appropriate field.

- Clearly state that if payment is not made within 15 days, you will record a Claim of Lien against the residential project.

- At the bottom of the form, sign and print your name as the Undersigned.

What You Should Know About This Form

What is a Letter of Lien?

A Letter of Lien is a formal notice sent to inform a property owner that a contractor or supplier has not been paid for work or materials provided on a specific project. It outlines the amount owed and serves as a warning that a lien may be placed on the property if payment is not made. This document is crucial for contractors to protect their right to payment.

When should I use a Letter of Lien?

You should use a Letter of Lien when you have provided work, materials, or equipment on a project and have not received payment. It serves as a last effort to obtain payment before filing a formal lien against the property. It is often used when payment is overdue by a significant period but is typically sent 15 days before any action is taken to file a lien.

What information is included in a Letter of Lien?

The Letter of Lien includes the following key details: the name of the property owner, a description of the work or materials provided, the original contract amount, any changes or additions to the project costs, payments received to date, and the remaining balance owed. This clarity helps ensure that all parties understand the amounts being discussed.

How long do I have to pay after receiving a Letter of Lien?

You typically have 15 days to pay the amount due after receiving a Letter of Lien. If the payment is not made within that time frame, the contractor has the right to file a lien against the property, which can lead to further legal actions and complications.

Can a Letter of Lien be contested?

What happens if I don’t pay the amount stated in the Letter of Lien?

If you do not pay the amount specified in the Letter of Lien, the contractor may proceed to file a formal lien against your property. This could complicate any future sales or refinancing of the property, as a lien creates a legal claim on it until the debt is settled.

Is a Letter of Lien the same as a lien?

No, a Letter of Lien is not the same as a lien. The letter serves as a notice of intent to file a lien if payment is not received. The actual lien is a legal claim placed on the property after proper filing with the appropriate government authority, which can impact the property owner’s ability to sell or refinance.

How can I avoid receiving a Letter of Lien?

To avoid receiving a Letter of Lien, ensure timely payment for work, materials, or equipment delivered to your project. Maintain open communication with your contractors and keep records of all transactions. If there are any disputes regarding payments, address them promptly to prevent escalation.

Common mistakes

One common mistake people make when filling out the Letter Of Lien form is failing to provide accurate details about the project. The section specifying the location of the residential project must be clear and complete. Without an exact address, there might be confusion about which property the lien pertains to. Always double-check that the project location is correct. Clarity here helps avoid unnecessary disputes.

Another frequent error occurs in the calculations provided. Individuals sometimes miscalculate the amounts, especially when listing the total payments received to date. Discrepancies in these figures can lead to significant legal complications later on. Ensuring that each number is accurate and confirmed will prevent issues that could complicate your lien claim.

Many also neglect to mention the original contract amount or the total of changes and additions. Omitting these amounts not only looks unprofessional, but it can also undermine your position. Always make sure to fill in every section completely and accurately. This information is essential for establishing the validity of your claim.

Lastly, individuals often forget to sign and date the form. A missing signature can render the entire notice void. Ensure that the form is signed by the rightful party and dated appropriately. Proper execution of the form is critical to enforce your lien rights.

Documents used along the form

The Letter of Lien form is an important document used by contractors and suppliers to provide notice of non-payment for services or materials rendered. It serves as a formal warning that a lien may be filed against the property if the owed amount is not settled within a specified timeframe. Alongside this form, there are several other documents that may be required in the process of filing a lien. Here’s a list of some commonly used forms and their brief descriptions.

- Claim of Lien: This document officially asserts a lien on the property. It will be recorded with the county clerk’s office and provides a legal claim to the unpaid amounts due.

- Preliminary Notice: A notice sent at the beginning of a project to inform property owners and general contractors of the intention to file a lien if payment issues arise in the future.

- Lien Waiver: A form that contractors and subcontractors use to waive their right to claim a lien after receiving payment. This protects property owners from future claims related to paid work.

- Affidavit of Non-Payment: This document is used to detail the unpaid amounts and can accompany the lien claim. It serves to reinforce the need for payment.

- Notice of Completion: A notice filed by the property owner or general contractor after the completion of work, which can trigger time limits for filing a lien.

- Certificate of Service: A document proving that relevant parties have been notified of the lien or any related documents, enhancing transparency in the process.

- Bonded Lien Claim: A specific form used when a lien is secured by a surety bond. This claims a right to payment while also protecting property owners from potential losses.

- Statement of Account: A detailed statement listing amounts owed for services or materials provided. This can clarify what is being claimed in the lien.

- Request for Payment: A formal request made to the client to settle outstanding balances before further legal action is taken.

- Motion to Release Lien: This document is filed to request that a previously filed lien be removed, typically after the payment has been made.

Using these documents effectively can streamline the process of securing payments for work completed. Each form plays its own role in protecting the rights of those who provide services while ensuring fairness in business transactions. Understanding these forms can make a significant difference when it comes to property-related finances.

Similar forms

-

Mechanic’s Lien: This document is filed by a contractor, subcontractor, or material supplier who has not been paid for work performed on a property. Like the Letter of Lien, it serves as a formal notice of a claim against the property for unpaid labor or materials, and it can lead to legal action if payment is not made.

-

Notice of Commencement: Used primarily in construction, this document indicates the start of a project and can help streamline the payment process. Similar to the Letter of Lien, it establishes a timeline and provides important information about the parties involved in the project.

-

Contractor’s Affidavit: This affidavit is often used during the closing of a construction project to confirm that all subcontractors and suppliers have been paid. It parallels the Letter of Lien by ensuring that there are no outstanding liens on the property from unpaid contractors.

-

Subrogation Agreement: This legal document enables a lender to assert the rights of a property owner to receive payment from a third party, usually used in cases of insurance claims. It is similar to the Letter of Lien because both establish rights to claim money owed for services provided.

-

Demand for Payment: A less formal document usually prepared by a creditor who has provided goods or services. While it does not have the same legal weight as a Letter of Lien, it serves to express the urgency of payment and signals the possibility of further action if the debt remains unpaid.

-

Personal Guarantee: This document is an agreement where an individual agrees to pay back a loan or debt if the original borrower defaults. Like the Letter of Lien, it provides security to the lender indicating they can claim money owed and reinforces the obligation of payment.

-

Release of Lien: This document is used to formally remove a lien from a property once payment has been made. It is directly related to the Letter of Lien as it signifies the closure of a claim for payment and confirms that the contractor has been compensated.

Dos and Don'ts

When filling out the Letter of Lien form, it's crucial to approach the task with care. Here are some suggestions to guide your efforts:

- Confirm the accuracy of all details: Make sure the names, addresses, and amounts listed in the form are correct.

- Provide clear descriptions: Accurately describe the work, materials, or equipment provided to ensure clarity.

- Review the original contract amount: Double-check that the original contract amount is entered correctly.

- Ensure timely submission: File the notice promptly to meet the required deadline.

- Keep a copy for your records: Always retain a copy of the completed form for your personal records.

Conversely, there are certain pitfalls to avoid:

- Do not miss deadlines: Failing to adhere to the timeline can jeopardize your lien rights.

- Avoid vague language: Using ambiguous terms can lead to misunderstandings or rejection of the notice.

- Do not omit necessary amounts: Leaving out amounts for changes, additions, or payments can create confusion.

- Refrain from incomplete information: Ensure every section is filled out; incomplete forms are often rejected.

- Don't forget to sign the letter: A missing signature invalidates the form.

Misconceptions

Here are 10 misconceptions about the Letter of Lien form:

- A Letter of Lien guarantees payment. A Letter of Lien is a notice of an unpaid debt but does not ensure that payment will be made.

- The Letter of Lien must be filed to be valid. The Letter can serve as a notification without formal filing, though filing is often necessary for enforcement.

- Anyone can file a Letter of Lien. Only those who have provided services or materials related to the property can issue this notice.

- A Letter of Lien must be served in person. It can typically be delivered by mail or through an electronic method permitted by law.

- The Letter of Lien is the final step in the collection process. It serves as a warning but often precedes further legal action.

- The project owner is automatically liable. Liability may depend on the contract terms between the parties involved.

- A Letter of Lien needs to specify an exact payment due date. While it lists amounts, it does not need to set a specific date for payment.

- A Letter of Lien can be ignored without consequence. Ignoring a Letter may lead to a formal legal claim being filed against the property.

- Filing a Letter of Lien is a lengthy process. Preparing one is generally straightforward and can be done quickly.

- Once a Letter of Lien is filed, it cannot be withdrawn. It can be released or withdrawn if the debt is paid or resolved.

Key takeaways

When filling out and using the Letter of Lien form, consider the following key takeaways:

- Complete All Sections: Ensure that you fill in all required fields, including the project details and amounts. Inaccurate or incomplete information may jeopardize your claim.

- Be Timely: The letter serves as a notice of intent. If payment is not received within 15 days, a lien can be recorded. It is important to keep track of the timeline.

- Stay Professional: Maintain a formal tone throughout the letter. Clear, concise language increases the likelihood of a positive response.

- Document Everything: Keep copies of the letter and any related communications. This documentation may be crucial later, especially if further legal action is necessary.

- Understand Your Rights: Familiarize yourself with the laws regarding liens in your state. This knowledge can empower you to navigate potential disputes effectively.

- Consult an Expert: If you are unsure about the process or the implications of filing a lien, consider seeking advice from a legal professional with experience in lien laws.

Browse Other Templates

Bcbs Away From Home Care - Today’s date must be filled in to establish a clear timeline for the membership request.

Metlife Shareholder Services - Electronic transfers will be conducted in Book Entry form unless otherwise specified.