Fill Out Your Letter To Purchase Land Form

When considering the purchase of land, a Letter to Purchase Land serves as a crucial initial step in formalizing the intentions of both the buyer and the seller. This document outlines an offer to buy real property and sets the stage for further negotiations. Generally, it includes key information such as the names of the parties involved, the description of the property, and the proposed purchase price. The letter specifies a timeline for negotiations, known as the Contract Negotiation Period, during which both parties agree to work towards a definitive Purchase Agreement. An essential component of this letter is the feasibility period, allowing the buyer to conduct due diligence on the property, ensuring that any development potential or issues are properly assessed. Furthermore, the letter details the required deposits, making clear the financial commitments expected from the buyer. It also addresses conditions that must be satisfied for the sale to proceed, such as securing clear title and the absence of any detrimental encumbrances. Overall, the Letter to Purchase Land not only guides the transaction process but also protects the interests of both parties as they move towards a formal agreement.

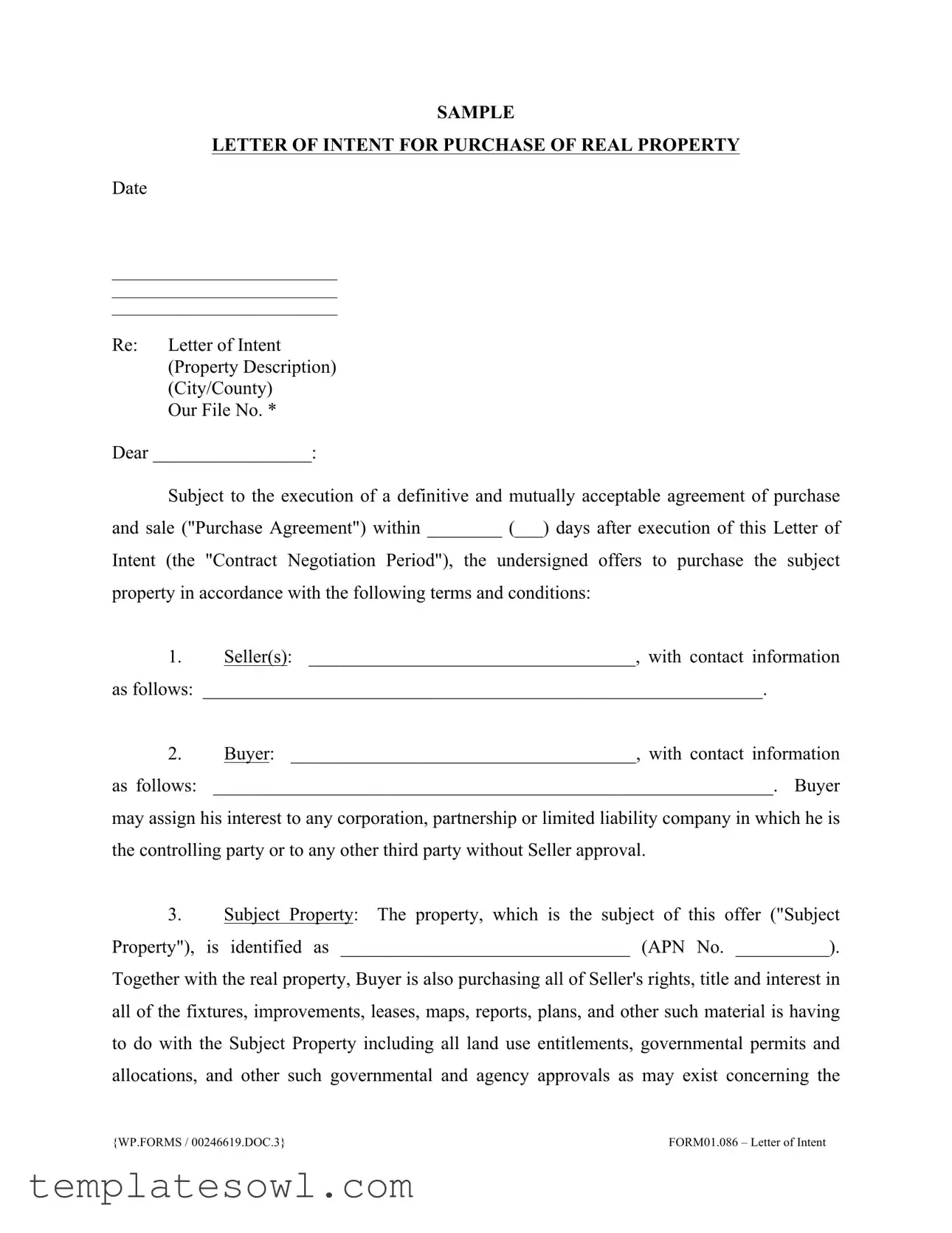

Letter To Purchase Land Example

SAMPLE

LETTER OF INTENT FOR PURCHASE OF REAL PROPERTY

Date

_____________________________

_____________________________

_____________________________

Re: Letter of Intent (Property Description) (City/County)

Our File No. *

Dear _________________:

Subject to the execution of a definitive and mutually acceptable agreement of purchase and sale ("Purchase Agreement") within ________ (___) days after execution of this Letter of

Intent (the "Contract Negotiation Period"), the undersigned offers to purchase the subject property in accordance with the following terms and conditions:

1.Seller(s): ___________________________________, with contact information

as follows: ____________________________________________________________.

2.Buyer: _____________________________________, with contact information

as follows: ____________________________________________________________. Buyer may assign his interest to any corporation, partnership or limited liability company in which he is the controlling party or to any other third party without Seller approval.

3.Subject Property: The property, which is the subject of this offer ("Subject Property"), is identified as _______________________________ (APN No. __________). Together with the real property, Buyer is also purchasing all of Seller's rights, title and interest in all of the fixtures, improvements, leases, maps, reports, plans, and other such material is having to do with the Subject Property including all land use entitlements, governmental permits and allocations, and other such governmental and agency approvals as may exist concerning the

{WP.FORMS / 00246619.DOC.3} |

FORM01.086 – Letter of Intent |

_____________________

_____________________

Page 2

property. In addition, this offer to purchase includes the following specific items: ___________

____________________________________________.

4.Purchase Price: ___________________ ($________).

5.Terms of Purchase: ________________________________________________

___________________________________________________.

6.Opening of Escrow: Escrow ("the Purchase Escrow") shall be opened at

______________ Title Company within three (3) business days from execution of this Letter of Intent. The Purchase Agreement and Mutual Escrow Instructions shall be mutually prepared and executed by Buyer and Seller within ________ (___) days of execution by both parties of this Letter of Intent to purchase (the "Contract Negotiation Period").

7.Deposit Toward Purchase Price:

A.Initial Deposit: Concurrently with the opening of escrow, Buyer shall place therein the sum of ___________________________ Dollars ($____________) as a refundable deposit toward and applicable to the Purchase Price ("the Initial Deposit"). Escrow Holder shall deposit such sum in an

B.Second Deposit: An additional

__________________________ Dollars ($____________) shall be applicable to the Purchase Price and upon approval of the feasibility shall be released to Seller, inclusive of the Initial Deposit.

8.Feasibility Period: Buyer shall have until ________________ to perform all feasibility and due diligence for subject property. Seller shall fully cooperate with Buyer in

_____________________

_____________________

Page 3

providing any and all information available regarding the development potential of the property. Buyer may terminate this Letter of Intent and/or the Purchase Agreement at any time prior to the end of the Feasibility Period for any reason or no reason at all upon written notification to Seller and Escrow Holder of the termination. Upon notice of termination, Escrow Holder shall be instructed to immediately release the Initial Deposit made by Buyer and return to Buyer within five (5) business days of termination.

9.Buyer's Condition Precedent to Closing: Following the expiration of the Feasibility Period, Buyer's obligation to close escrow shall be subject only to the following conditions:

A.Title Company shall be in position to issue a policy of title insurance to Buyer in the full amount of the Purchase Price showing good and marketable title vested in Buyer subject only to such exceptions to title as have been approved by Buyer during the Feasibility Period.

B.The

C.Seller to provide Buyer title to property free and clear of liens except for

10.Close of Escrow: Close of escrow to be on _______________________.

_____________________

_____________________

Page 4

11.Other Provisions:

A.The Purchase Agreement may contain other provisions such as, but not limited to, a liquidated damages clause, attorney's fees, notices, mutual indemnifications, broker's commission, and the like.

B.Any and all documentation provided by Seller to Buyer shall be returned to Seller upon cancellation of this transaction.

12.Expiration of Offer: This Letter of Intent shall constitute an open offer until

____________, at which time it shall be automatically terminated if not executed by Seller.

If the above outline of terms and conditions are acceptable, please indicate by signing below. All parties to these transactions intend that this proposal be superseded by a the Purchase Agreement. In the meantime, all parties agree to proceed in accordance with terms and conditions outlined in this Letter of Intent. Seller understands the purpose of this Letter of Intent is to allow further investigation by both parties into the feasibility of entering into a formal agreement. This Letter of Intent is only binding on the parties during the Contract Negotiation period. If the Purchase Agreement is not mutually executed within the Contract Negotiation Period for any reason whatsoever or no reason at all, this Letter of Intent shall expire and no party shall have any further rights or duties hereunder. Seller shall not solicit other offers during the Contract Negotiation Period.

BUYER:

________________________________ |

Dated: _________________ |

SELLER:

________________________________ |

Dated: _________________ |

_____________________

_____________________

Page 5

Form Characteristics

| Fact Name | Description |

|---|---|

| Purpose of Letter | This form serves as a preliminary agreement, outlining a buyer's intention to purchase property, prior to a more formal Purchase Agreement. |

| Contract Negotiation Period | After the letter is signed, a specified number of days is allotted for both parties to negotiate and execute a definitive Purchase Agreement. |

| Feasibility Period | The buyer is given a set timeframe to conduct due diligence on the property, allowing them to evaluate its potential before finalizing the purchase. |

| Seller Obligations | During the Contract Negotiation Period, the seller must refrain from soliciting other buyers, ensuring exclusivity to the interested buyer. |

| State-Specific Laws | Each state may have its own regulations regarding real estate transactions. In California, for example, the governing laws include California Civil Code Section 1624 regarding the statute of frauds. |

Guidelines on Utilizing Letter To Purchase Land

Once you have the Letter To Purchase Land form in hand, it's essential to fill it out accurately to ensure a smooth transaction. After completing the form, both parties must review it before proceeding to a more formal agreement. Follow these steps to fill out the form correctly.

- Date: Write the current date at the top of the form.

- Recipient Name: Fill in the name of the seller in the designated space.

- Subject Property Description: Provide a detailed description of the property, including the city or county and the APN (Assessor's Parcel Number).

- Seller(s): Input the name(s) of the seller(s) along with their contact information.

- Buyer: Enter your name (the buyer) along with your contact details.

- Property Identification: Clearly define the subject property by providing pertinent details and any specific items included in the sale.

- Purchase Price: State the purchase price in both words and figures.

- Terms of Purchase: Outline the terms related to the purchase in the provided space.

- Escrow Information: Identify the title company where escrow will be opened and the timeline for doing so.

- Deposit Details: Specify the amounts for the initial and second deposits and any related information about interest accruing.

- Feasibility Period: Indicate the date by which the buyer must perform due diligence on the property.

- Conditions Precedent to Closing: List conditions that need to be met before closing, such as title insurance and lien clearances.

- Close of Escrow Date: Fill in the date for when escrow is expected to close.

- Other Provisions: Mention any additional terms that may be included in the final Purchase Agreement.

- Expiration of Offer: State the expiration date of the offer, after which it will become void if not signed.

- Signatures: Finally, both the buyer and seller should sign and date the document at the end.

What You Should Know About This Form

What is the purpose of a Letter to Purchase Land?

The Letter to Purchase Land serves as a preliminary agreement between a buyer and a seller. It outlines the buyer’s intention to purchase a specific piece of property, detailing key terms such as the purchase price, deposit amounts, and timelines for negotiations. This letter acts as a framework for the eventual purchase agreement, allowing both parties to commence due diligence and negotiations with a clear understanding of the primary conditions.

How long is the Contract Negotiation Period?

The Contract Negotiation Period is the timeframe specified in the Letter during which the buyer and seller negotiate the definitive purchase agreement. The duration can vary based on agreements between the parties; however, it is essential to clearly indicate this timeline in the letter. Upon expiration, if no agreement has been executed, the Letter of Intent becomes void.

Can a buyer assign their interest in the property?

Yes, the buyer has the right to assign their interest in the property to another entity without needing the seller's approval. This could include partnerships or limited liability companies, provided the buyer maintains control over that entity. This provision allows for flexibility in the transaction, enabling buyers to adapt their purchasing strategies as necessary.

What is included in the Initial Deposit?

The Initial Deposit is the sum of money the buyer places in escrow concurrent with opening the escrow account. This deposit is refundable and contributes towards the overall purchase price of the property. It also serves to demonstrate the buyer's serious intent to proceed with the purchase.

What happens during the feasibility period?

The feasibility period grants the buyer time to conduct thorough due diligence on the property. During this period, the buyer can assess aspects such as zoning laws, environmental concerns, and development potential. If any issues arise, the buyer retains the right to terminate the letter of intent and reclaim their initial deposit without penalty, simplifying the decision-making process.

Are there any contingencies for closing the escrow?

Yes, closing the escrow is subject to certain conditions, including the ability of the title company to issue a suitable title insurance policy, the absence of development restrictions on the property, and the seller's provision of a clear title, free of liens. These contingencies protect the buyer’s interests and help ensure a smooth transaction.

How long is the offer valid?

The offer outlined in the Letter becomes an open offer until the specified expiration date noted within the letter. If the seller has not executed the letter by that date, the offer automatically terminates, allowing the seller to seek other buyers. This clause ensures that both parties remain committed to the timeline established during negotiations.

What should happen if the transaction is canceled?

In the event that the transaction is canceled, all documentation provided by the seller to the buyer is to be returned. This ensures that both parties handle sensitive information appropriately and signifies the end of the engagement regarding the specific property at hand.

What are the potential other provisions in the Purchase Agreement?

The Purchase Agreement may contain additional provisions beyond those discussed in the Letter to Purchase Land. These could include clauses related to liquidated damages, attorney's fees, mutual indemnification, and documentation processes. It’s crucial for both parties to carefully review these provisions to understand their obligations and rights fully.

Why is this letter not considered a binding agreement?

The Letter of Intent is only binding during the specified Contract Negotiation Period. If a formal Purchase Agreement is not executed within that timeframe, the Letter automatically becomes void. This structure provides both parties with the freedom to explore and negotiate without the pressure of a legally binding contract until a definitive agreement is reached.

Common mistakes

When filling out the Letter To Purchase Land form, many individuals make mistakes that can complicate their purchasing process. Becoming aware of these common errors can help ensure a smoother transaction.

First, ensuring all necessary contact information is included is critical. Many forget to provide complete details about both the buyer and seller. This can lead to unnecessary delays in communication. Always double-check that you’ve included accurate phone numbers and email addresses for both parties.

Another common mistake is related to the Subject Property description. It’s easy to overlook the importance of this detail, yet an incomplete or inaccurate property description could create confusion. Take your time and accurately list the property’s address and other identifying information, such as the APN (Assessor's Parcel Number).

In addition, some individuals fail to establish clear terms of purchase. This includes determining the Purchase Price and any deposits. Be explicit about how much you are offering and any conditions surrounding deposits. Ambiguity in these areas can lead to misunderstandings later on, so clarity is key.

Furthermore, many people neglect the Feasibility Period. This part of the form allows the buyer to conduct due diligence and assess the land's potential. Not specifying this timeframe can lead to rushed decisions or add stress, especially if you need more time to evaluate the property properly. Make sure to outline the feasibility period clearly.

Another frequent mistake involves forgetting to sign the document. Although this may seem simple, many individuals overlook this vital step. Without signatures and dates from both the buyer and seller, the Letter of Intent is incomplete and may not hold any weight in negotiations. It’s a small detail that can have big consequences.

Finally, failing to specify the expiration of the offer can result in confusion down the road. If the time frame for acceptance is not clearly stated, both parties may have different expectations. Make sure to include a specific date by which the offer must be accepted to avoid potential issues.

By paying attention to these common pitfalls, you can navigate the process of purchasing land with greater ease. Each detail matters, and taking the time to ensure they are correctly addressed will ultimately serve to protect your interests.

Documents used along the form

When pursuing the purchase of land, various forms and documents accompany the Letter To Purchase Land. These documents are essential for ensuring a smooth transaction, outlining responsibilities, and protecting the interests of both buyers and sellers. Each document serves a specific purpose in the acquisition process.

- Purchase Agreement: This is a formal contract that details the terms and conditions agreed upon by the buyer and seller. It outlines the purchase price, closing costs, and any contingencies or obligations of both parties.

- Disclosure Statement: Sellers are often required to provide a disclosure statement revealing any known defects or issues with the property. This protects buyers by ensuring they have all the necessary information before making a purchase.

- Title Commitment: This document is issued by a title company and confirms the property's ownership and any existing liens or claims against the title. It is crucial for verifying that the seller has the right to sell the property.

- Escrow Instructions: Escrow instructions outline the agreements between the buyer, seller, and escrow agent. They detail how funds and documents will be handled during the closing process.

- Closing Disclosure: This document provides a final accounting of all costs associated with the purchase. It breaks down the buyer's and seller's closing costs and outlines the amounts needed at closing.

- Property Survey: A survey outlines the boundaries and dimensions of the land being purchased. It is essential for resolving any property disputes and confirming that the property adheres to local zoning regulations.

Understanding these documents and their roles in the transaction can alleviate stress and uncertainty during the buying process. It's advisable to consult with professionals to navigate these important steps effectively.

Similar forms

- Purchase Agreement: This document outlines the specific terms and conditions for the sale of real property. Like the Letter To Purchase Land, it establishes the purchase price, conditions for closing, and responsibilities of both parties.

- Letter of Intent for Lease: Similar to a Letter To Purchase Land, this document expresses a preliminary commitment to lease an asset. It sets forth key terms such as rental amounts and terms while awaiting a formal lease agreement.

- Real Estate Purchase Contract: This contract formalizes the terms of the sale, detailing the property description, purchase price, and conditions for closing. It serves a similar purpose as the Letter To Purchase Land but has a more definitive legal binding.

- Escrow Instructions: These instructions guide the escrow process and detail the responsibilities of the escrow holder. Like the Letter To Purchase Land, it is an essential part of the transaction process and sets timelines for actions.

- Due Diligence Checklist: This checklist aids the buyer in conducting necessary investigations before buying property. It functions similarly to the feasibility period outlined in the Letter To Purchase Land, ensuring all aspects of the property are examined.

- Option to Purchase Agreement: This agreement gives a potential buyer the right to purchase property at a predetermined price within a specified timeframe. It is similar to the Letter To Purchase Land in that both documents outline the intent to purchase.

- Broker Agreement: This contract involves a broker’s services in facilitating a real estate transaction. Like the Letter To Purchase Land, it outlines roles and expectations concerning buyers and sellers during the purchasing process.

- Property Disclosure Statement: This document informs buyers of any known issues with the property before purchase. It parallels the Letter To Purchase Land by promoting transparency and informed decision-making.

- Financing Agreement: This outlines the terms of financing for a property purchase. It is essential for buyers seeking loans and works in conjunction with the Letter To Purchase Land to clarify payment parameters.

Dos and Don'ts

When filling out the Letter To Purchase Land form, there are certain practices you should follow to ensure clarity and legality. At the same time, you should avoid common pitfalls that could complicate the process.

- Do double-check all information for accuracy before submitting the form.

- Do clearly outline the terms of your offer, including the purchase price and any specific contingencies.

- Do provide complete contact information for both the buyer and seller.

- Do sign and date the document to validate your intent.

- Don't leave any crucial sections blank, as this may lead to miscommunication.

- Don't rush through the process; take your time to understand each section of the form.

- Don't verbally agree to changes; ensure any alterations are documented in writing.

Misconceptions

- Misconception 1: The Letter to Purchase Land is a binding contract.

- Misconception 2: It guarantees the purchase of a property.

- Misconception 3: The buyer’s deposit is non-refundable.

- Misconception 4: Seller cannot accept other offers during the negotiation period.

- Misconception 5: The letter includes all property details.

- Misconception 6: The buyer has an unlimited time for due diligence.

- Misconception 7: All verbal agreements supersede the letter’s terms.

- Misconception 8: Legal representation is not necessary for this process.

Many people mistakenly believe that this letter is a legally binding agreement. In reality, it primarily serves as an intention to negotiate a purchase agreement, outlining preliminary terms.

This letter does not guarantee that the sale will happen. It outlines the buyer's interest, but the actual purchase is dependent on later negotiations and the execution of a formal purchase agreement.

Buyers often believe that any deposit made is non-refundable. However, the initial deposit can typically be returned if the buyer decides not to move forward during the feasibility period.

While the letter may suggest exclusivity during negotiations, it is essential to read any terms carefully, as sellers might still be able to consider other offers until a formal agreement is signed.

Some assume that the letter provides a complete overview of the property. In fact, this document typically requires additional details that will need to be supplied later in a formal agreement.

Buyers often think they can take as much time as they want for feasibility studies. However, there is usually a specified feasibility period outlined within the letter, after which the option to withdraw may no longer be valid.

It’s a common belief that verbal discussions can overwrite the written terms. However, any changes or agreements must be documented formally in writing to be enforceable.

Some individuals may think they can navigate this process without a lawyer. Engaging a legal professional can provide valuable guidance and help ensure that terms are clear and in their best interest.

Key takeaways

Key Takeaways for Filling Out and Using the Letter to Purchase Land Form

- The form serves as a preliminary agreement detailing terms before the formal Purchase Agreement.

- Make sure to clearly identify both the seller and buyer, including all necessary contact information.

- Accurately describe the property with its specific details, including any fixtures or entitlements involved in the transaction.

- Establish a Purchase Price and specify any deposits required to show commitment from the buyer.

- Define the feasibility period, allowing time for the buyer to assess the property's potential before committing to the purchase.

- Note that the Letter of Intent is not binding beyond the Contract Negotiation Period unless a Purchase Agreement is executed.

Browse Other Templates

Sample Letter to Disclaim Inherited Ira - Keep a copy of the completed form for your records after submission.

Adidas Employee - Your shopping experience is enhanced with exclusive benefits.