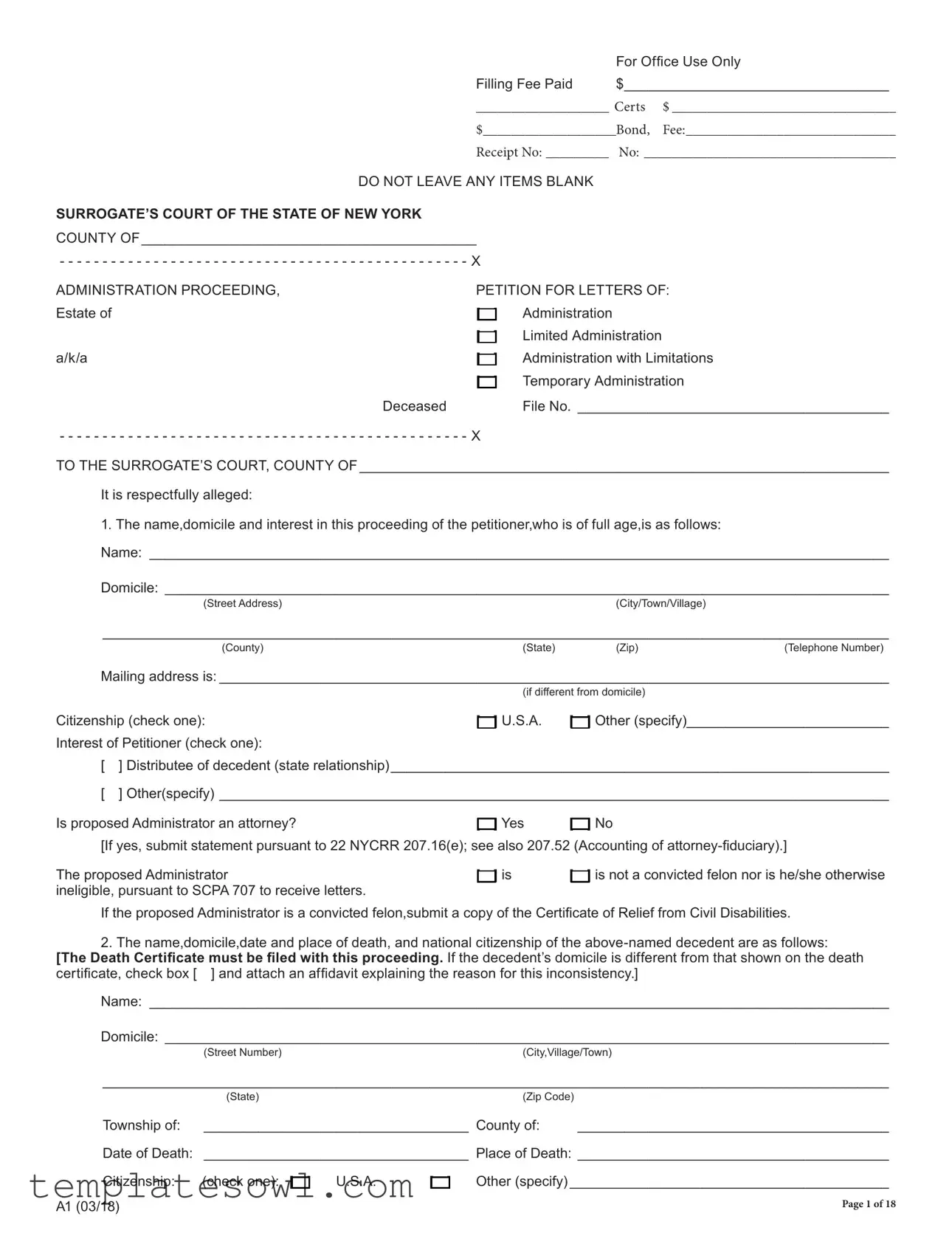

Fill Out Your Letters Administration Form

The Letters Administration form serves as a crucial document in the administration of an estate when a decedent passes away without a will. This form initiates the legal process by allowing individuals, typically relatives or close associates of the deceased, to petition the Surrogate's Court for the authority to manage the decedent's estate. The completion of this form is thorough, requiring detailed information about both the petitioner and the decedent, such as names, addresses, and interests. Important sections of the form include the identification of the proposed administrator, their relationship to the decedent, and affirmations regarding eligibility. Furthermore, the form requests essential information about the decedent's assets, debts, and any surviving relatives who may inherit. Attention to detail is paramount; applicants must ensure that no item remains blank, as omissions can delay the process. This document not only establishes the authority of the appointed administrator but also outlines their responsibilities regarding the estate's management, aiming to ensure that the wishes of the deceased are respected while adhering to state laws.

Letters Administration Example

|

|

|

|

For Office Use Only |

|

Filling Fee Paid |

$__________________________________ |

||

|

___________________ Certs $ ________________________________ |

|||

|

$___________________Bond, Fee:______________________________ |

|||

|

Receipt No: _________ |

No: ____________________________________ |

||

|

DO NOT LEAVE ANY ITEMS BLANK |

|

||

SURROGATE’S COURT OF THE STATE OF NEW YORK |

|

|

|

|

COUNTY OF ___________________________________________ |

|

|

|

|

- - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - |

- - - - - - - - - - - - - X |

|

|

|

ADMINISTRATION PROCEEDING, |

PETITION FOR LETTERS OF: |

|||

Estate of |

[ |

] |

Administration |

|

|

[ |

] |

Limited Administration |

|

a/k/a |

[ |

] |

Administration with Limitations |

|

|

[ |

] |

Temporary Administration |

|

|

Deceased |

|

File No. ________________________________________ |

|

- - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - X

TO THE SURROGATE’S COURT, COUNTY OF ____________________________________________________________________

It is respectfully alleged:

1. The name,domicile and interest in this proceeding of the petitioner,who is of full age,is as follows:

Name: _______________________________________________________________________________________________

Domicile: _____________________________________________________________________________________________

(Street Address)(City/Town/Village)

_____________________________________________________________________________________________________

|

(County) |

|

(State) |

|

(Zip) |

(Telephone Number) |

Mailing address is: ______________________________________________________________________________________ |

||||||

|

|

|

(if different from domicile) |

|

||

Citizenship (check one): |

[ |

] U.S.A. |

[ |

] Other (specify)__________________________ |

||

Interest of Petitioner (check one): |

|

|

|

|

|

|

[ |

] Distributee of decedent (state relationship)________________________________________________________________ |

|||||

[ |

] Other(specify) ______________________________________________________________________________________ |

|||||

Is proposed Administrator an attorney? |

[ |

] Yes |

[ |

] No |

|

|

[If yes, submit statement pursuant to 22 NYCRR 207.16(e); see also 207.52 (Accounting of |

||||||

The proposed Administrator |

[ |

] is |

[ |

] is not a convicted felon nor is he/she otherwise |

||

ineligible, pursuant to SCPA 707 to receive letters. |

|

|

|

|

|

|

If the proposed Administrator is a convicted felon,submit a copy of the Certificate of Relief from Civil Disabilities.

2.The name,domicile,date and place of death, and national citizenship of the

certificate, check box [ |

] and attach an affidavit explaining the reason for this inconsistency.] |

||||||

Name: _______________________________________________________________________________________________ |

|||||||

Domicile: _____________________________________________________________________________________________ |

|||||||

|

(Street Number) |

|

|

|

|

(City,Village/Town) |

|

_____________________________________________________________________________________________________ |

|||||||

|

(State) |

|

|

|

|

(Zip Code) |

|

Township of: |

__________________________________ County of: |

________________________________________ |

|||||

Date of Death: |

__________________________________ Place of Death: ________________________________________ |

||||||

Citizenship: |

(check one): [ ] |

U.S.A. |

[ ] |

Other (specify) _________________________________________ |

|||

A1 (03/18) |

|

|

|

|

|

|

Page 1 of 18 |

|

|

|

|

|

|

|

|

[Note: For Items 3a through c: Do not include any assets that are jointly held, held in trust for another, or have a named beneficiary.]

3.(a) The estimated gross value of the decedent’s personal property passing by intestacy is less than

$____________________________________________________

(b) The estimated gross value of the decedent’s real property, in this state, which is [ ] improved, [ ] unimproved, passing by intestacy is less than

$_____________________________________________________

A brief description of each parcel is as follows:

___________________________________________________________________________________________________________

(c) The estimated gross rent for a period of eighteen (18) months is the sum of $ ____________________________________

(d) In addition to the value of the personal property stated in paragraph (3) the following right of action existed on behalf of the decedent and survived his/her death, or is granted to the administrator of the decedent by special provision of law,and it is impractical to give a bond sufficient to cover the probable amount to be recovered the rein: [Write“NONE or state briefly the cause of action and the person against whom it exists, including names and carrier].

___________________________________________________________________________________________________________

___________________________________________________________________________________________________________

___________________________________________________________________________________________________________

(e) If decedent is survived by a spouse and a parent, or parents but no issue,and there is a claim for wrongful death, check here [ ] and furnish names(s) and address(es) of parent(s) in Paragraph 7. See

4.A diligent search and inquiry, including a search of any safe deposit box,has been made for a will of the decedent and none has been found. Petitioner(s)(has)(have) been unable to obtain any information concerning any will of the decedent and therefore allege(s),upon information and belief,that the decedent died without leaving any last will.

5.A search of the records of this Court shows that no application has ever been made for letters of administration upon the estate of the decedent or for the probate of a will of the decedent, and your petitioner is informed and verily believes that no such application ever has been made to the Surrogate’s Court of any other county of this state.

6.The decedent left surviving the following who would inherit his/her estate pursuant to

a.[ ] Spouse(husband/wife).

] Spouse(husband/wife).

b.[ ] Child or children or descendants of predeceased child or children. [Must include marital, nonmarital

] Child or children or descendants of predeceased child or children. [Must include marital, nonmarital

and adopted].

c.[ ] Any issue of the decedent adopted by persons related to the decedent (DRLSection117).

] Any issue of the decedent adopted by persons related to the decedent (DRLSection117).

d.[ ] Mother/Father.

] Mother/Father.

e.[ ] Sisters or brothers, either of whole or half blood, and issue of predeceased sisters or brothers.

] Sisters or brothers, either of whole or half blood, and issue of predeceased sisters or brothers.

f.[ ] Grandmother/Grandfather.

] Grandmother/Grandfather.

g.[ ] Aunts or uncles, and children of predeceased aunts and uncles (first cousins).

] Aunts or uncles, and children of predeceased aunts and uncles (first cousins).

h.[ ] First cousins once removed (children of first cousins).

] First cousins once removed (children of first cousins).

[Information is required only as to those classes of surviving relatives who would take the property of decedent pursuant to

Page 2 of 18

7.The decedent left surviving the following distributees, or other necessary parties, whose names, degrees of relationship, domiciles, post office address and citizenship are as follows:

[Note: Show clearly how each person is related to decedent. If relationship is through an ancestor who is deceased, give name,date of death, and relationship of the ancestor to the decedent. Use rider sheet if space in paragraph (7) is not sufficient. See Uniform Rules 207.16(b).

If any person listed in paragraph(7)is a

7a. The following are of full age and under no disability:[If

Name |

Relationship |

Domicile and Mailing Address |

Citizenship Mailing Address |

___________________________ |

________________________ |

_________________________ |

________________________ |

___________________________ |

________________________ |

_________________________ |

________________________ |

___________________________ |

________________________ |

_________________________ |

________________________ |

___________________________ |

________________________ |

_________________________ |

________________________ |

___________________________ |

________________________ |

_________________________ |

________________________ |

___________________________ |

________________________ |

_________________________ |

________________________ |

___________________________ |

________________________ |

_________________________ |

________________________ |

___________________________ |

________________________ |

_________________________ |

________________________ |

7b. The following are infants and/or persons under disability: [Attach applicable Schedule A, B, C, and/or D] |

|||

Name |

Relationship |

Domicile and Mailing Address |

Citizenship Mailing Address |

___________________________ |

________________________ |

_________________________ |

________________________ |

___________________________ |

________________________ |

_________________________ |

________________________ |

___________________________ |

________________________ |

_________________________ |

________________________ |

___________________________ |

________________________ |

_________________________ |

________________________ |

___________________________ |

________________________ |

_________________________ |

________________________ |

___________________________ |

________________________ |

_________________________ |

________________________ |

___________________________ |

________________________ |

_________________________ |

________________________ |

___________________________ |

________________________ |

_________________________ |

________________________ |

8 There are no outstanding debts or funeral expenses, except: [Write “NONE” or state same]

___________________________________________________________________________________________________________

___________________________________________________________________________________________________________

___________________________________________________________________________________________________________

___________________________________________________________________________________________________________

___________________________________________________________________________________________________________

___________________________________________________________________________________________________________

___________________________________________________________________________________________________________

___________________________________________________________________________________________________________

___________________________________________________________________________________________________________

Page 3 of 18

9.There are no other persons interested in this proceeding other than those here in before mentioned. WHEREFORE, your petitioner respectfully prays that: [Check and complete all relief requested]

|

|

|

|

( |

) a. process issue to all necessary parties to show cause why letters should not be issued as requested; |

||

|

|

|

|

( |

) b. an order be granted dispensing with service of process upon those persons named in Paragraph(7) who have a right to |

||

|

|

|

letters prior or equal to that of the person nominated, and who are |

|

|

|

are unknown and cannot be ascertained; |

|

|

|

|

( |

) c. a decree award Letters of: |

||

|

|

[ |

] Administration to_________________________________________________________________________________ |

|

[ |

] Limited Administration to __________________________________________________________________________ |

|

|

[ |

] Administration with Limitation to_____________________________________________________________________ |

|

|

[ |

] Temporary Administration to _______________________________________________________________________ |

|

or to such other person or persons having a prior right as may be entitled thereto, and; |

|||

|

|

|

|

( |

) d. That the authority of the representative under the forgoing Letters be limited with respect to the prosecution or |

||

|

|

|

enforcement of a cause of action on behalf of the estate,as follows: the administrator(s) may not enforce a judgment or |

|

|

|

receive any funds without further order of the Surrogate. |

|

|

|

|

( |

) e. That the authority of the representative under the foregoing Letters be limited as follows: |

||

|

|

|

|

_____________________________________________________________________________________________________

_____________________________________________________________________________________________________

_____________________________________________________________________________________________________

_____________________________________________________________________________________________________

_____________________________________________________________________________________________________

_____________________________________________________________________________________________________

( ) f. [State any other relief requested.] _____________________________________________________________________

___________________________________________________________________________________________________________

Dated: ________________________________________________ |

|

1. ____________________________________________________ |

2. _______________________________________________ |

(Signature of Petitioner) |

(Signature of Petitioner) |

______________________________________________________ |

_________________________________________________ |

(Print Name) |

(Print Name) |

Page 4 of 18

STATE OF NEW YORK |

) |

|

) ss: |

COUNTY OF |

) |

COMBINED VERIFICATION, OATH AND DESIGNATION

[For use when petitioner is to be appointed administrator]

I, the undersigned the petitioner named in the foregoing petition, being duly sworn, say:

1.VERIFICATION: I have read the foregoing petition subscribed by me and know the contents thereof, and the same is true of my own knowledge, except as to the matters there in stated to be alleged upon information and belief,and as to those matters I believe it to be true.

2.OATH OF ADMINISTRATOR as indicated above: I am over eighteen (18) years of age and a citizen of the United States; and I will well,faithfully and honestly discharge the duties of Administrator of the goods, chattels and credits of said decedent according to law. I am not ineligible, pursuant to SCPA707,to receive letters and will duly account for all moneys and other property that will come into my hands.

3.DESIGNATION OF CLERK FOR SERVICE OF PROCESS: I do hereby designate the Clerk of the Surrogate’s Court of

________________ County, and his/her successor in office, as a person on whom service of any process, issuing from such Surrogate’s Court may be made in like manner and with like effect as if it were served personally upon me, whenever I cannot be found and served within the State of New York after due diligence used.

My domicile is:_______________________________________________________________________________________________

(Street/Number)(City,Village/Town)(State)(Zip)

___________________________________________________

Signature of Petitioner

On the _______________________ day of ________________________,20 _______________________, before me personally came

___________________________________________________________________________________________________________

to me known to be the person described in and who executed the foregoing instrument. Such person duly swore to such instrument before me and duly acknowledged that he/she executed the same.

______________________________________________________

Notary Public

Commission Expires:

(Affix Notary Stamp or Seal)

Signature of Attorney: ___________________________________ |

|

Print Name: ____________________________________________ |

|

Firm Name: ____________________________________________ |

Tel.No.: __________________________________________ |

Address of Attorney: __________________________________________________________________________________________

Page 5 of 18

SURROGATE’S COURT OF THE STATE OF NEW YORK |

|

COUNTY OF |

|

- - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - |

X |

PROCEEDING FOR |

SCHEDULE A |

Estate of |

NONMARITAL PERSONS |

|

(PERSONS BORN OUT OF WEDLOCK) |

a/k/a |

|

Deceased. |

File# _______________________________________________ |

- - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - X

[NOTE: Nonmarital children (or their issue) who would be distributees if they (or their ancestors) were born in wedlock will not be regarded as distributees unless satisfactory proof is submitted establishing paternity]. See EPTL

Name of alleged distributee: _______________________________ |

|

|

Date of birth: ___________________________________________ |

Relationship to decedent: ____________________________ |

|

Name of father: |

________________________________________ |

|

Name of mother: |

_______________________________________ |

|

Does the birth certificate contain the father’s name? |

Yes [ |

] |

No [ |

] |

If yes, attach copy of birth certificate. |

|

|

|

|

Has an order of filiation establishing paternity been entered? |

Yes [ |

] |

No [ |

] |

If yes, attach copy of order. |

|

|

|

|

Did the nonmarital person live with his or her father? |

Yes [ |

] |

No [ |

] |

If yes, give dates and places of residence: ___________________________________________________________________

___________________________________________________________________________________________________________

___________________________________________________________________________________________________________

___________________________________________________________________________________________________________

Page 6 of 18

SURROGATE’S COURT OF THE STATE OF NEW YORK COUNTY OF

- - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - |

X |

PROCEEDING FOR |

SCHEDULE B |

Estate of |

ISSUE OF THE DECEDENT |

|

WHO WERE THE SUBJECT |

a/k/a |

OF AN ADOPTION |

Deceased. |

File # _______________________________________________ |

- - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - |

X |

Name of child: _________________________________________________________________________________________

Relationship to decedent prior to adoption: __________________________________________________________________

Date of adoption: _______________________________________________________________________________________

Was this a  ]

]

If yes,name of adoptive father or mother: ____________________________________________________________________

If not a

|

|

|

[ |

] grandparent(s) |

|

|

|

|

[ |

] brother or sister |

|

|

|

|

[ |

] aunt or uncle |

|

|

|

|

[ |

] first cousin |

|

|

|

|

[ |

] nephew or niece |

|

|

|

|

Name of the adoptive parent: ___________________________________________________________________________________

Page 7 of 18

SURROGATE’S COURT OF THE STATE OF NEW YORK |

|

COUNTY OF |

|

- - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - |

X |

PROCEEDING FOR |

SCHEDULE C |

Estate of |

INFANTS |

a/k/a |

|

Deceased. |

File # _______________________________________________ |

- - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - |

X |

[NOTE: Please furnish all of the information requested, otherwise the petition may be rejected.]

Name: _______________________________________________________________________________________________

Date of birth: __________________________________________________________________________________________

_____________________________________________________________________________________________________

Relationship to the decedent: _____________________________________________________________________________

With whom does the infant reside? _________________________________________________________________________

Name of mother: _______________________________________________________________________________________

Is she alive? ___________________________________________________________________________________________

Name of Father:________________________________________________________________________________________

Is he alive?____________________________________________________________________________________________

Does infant have a |

Yes [ ] |

No [ ] |

If yes, name and address of guardian: _____________________________________________________________________

Name: _______________________________________________________________________________________________

Date of birth: __________________________________________________________________________________________

Relationship to the decedent: _____________________________________________________________________________

With whom does the infant reside? _________________________________________________________________________

Name of mother: _______________________________________________________________________________________

Is she alive? ___________________________________________________________________________________________

Name of Father:________________________________________________________________________________________

Is he alive?____________________________________________________________________________________________

Does infant have a |

Yes [ ] |

No [ ] |

If yes,name and address of guardian: _____________________________________________________________________

Page 8 of 18

SURROGATE’S COURT OF THE STATE OF NEW YORK COUNTY OF

- - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - |

X |

PROCEEDING FOR |

SCHEDULE D |

Estate of |

PERSONS UNDER DISABILITY |

|

OTHER THAN INFANTS |

a/k/a |

|

Deceased. |

File # _______________________________________________ |

- - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - X

[use additional sheets if more than one]

1.Name: ____________________________________ Relationship: _________________________________________________

Residence: _________________________________________________________________________________________________

With whom does this person reside? _____________________________________________________________________________

If this person is in prison, name of prison: _________________________________________________________________________

Does this person have a |

Yes[ |

|

|

|

] |

No[ |

] |

If yes,give name,title and address: _________________________________________________________________________

_____________________________________________________________________________________________________

If no,describe nature of disability: __________________________________________________________________________

_____________________________________________________________________________________________________

If no,give name and address of relative or friend interested in his or her welfare: _____________________________________

_____________________________________________________________________________________________________

2.Where abouts unknown/Unknowns [persons whose addresses or names are unknown to petitioner;if known,give name and relationship to decedent]

___________________________________________________________________________________________________________

___________________________________________________________________________________________________________

___________________________________________________________________________________________________________

___________________________________________________________________________________________________________

___________________________________________________________________________________________________________

___________________________________________________________________________________________________________

___________________________________________________________________________________________________________

___________________________________________________________________________________________________________

___________________________________________________________________________________________________________

___________________________________________________________________________________________________________

Page 9 of 18

ADMINISTRATION CITATION |

File No. __________________________________________ |

|

SURROGATE’S COURT |

|

CITATION |

|

THE PEOPLE OF THE STATE OF NEW YORK, |

|

By the Grace of God Free and Independent, |

TO

A petition having been duly filed by _________________________________________________________ , who is domiciled at

___________________________________________________________________________________________________________

YOU ARE HERE BY CITED TO SHOW CAUSE before the Surrogate’s Court,_______________________________________

County, at __________________ |

, New York, on ______________________ ,20 ____ at _________ o’clock in |

the ________________________ |

noon of that day, why a decree should not be made in the estate of ________________________ |

___________________________________________________________________________________________________________

lately domiciled at ____________________________________________________________________________________________

in the County of _________________________________________ ,New York, granting Letters of Administration upon the estate of

the decedent to _________________________________________ or to such other person as may be entitled there to.

(State any further relief requested)

|

_________________________________________________ |

|

HON. |

Dated, Attested and Sealed, __________________ , 20________ |

Surrogate |

(Seal) |

|

|

_________________________________________________ |

|

Chief Clerk |

Name of |

|

Attorney for Petitioner ____________________________________ |

Tel.No. ___________________________________________ |

Address of Attorney___________________________________________________________________________________________

Note: This citation is served upon you as required by law. You are not required to appear. If you fail to appear it will be assumed you do not object to the relief requested. You have a right to have an

Page 10 of 18

Form Characteristics

| Fact Name | Description |

|---|---|

| Filing Requirements | The Letters Administration form must be completely filled out without any blank items to ensure the petition is valid. This requirement emphasizes thoroughness in the application process. |

| Associated Fees | There are specific fees associated with filing the form, including a filling fee and possibly bond fees. These amounts must be noted in the designated sections. |

| Governing Law | This form is governed by the Surrogate's Court Procedure Act (SCPA) of the State of New York, specifically concerning the administration of estates. |

| Verification Requirement | The applicant must provide a verification statement. This statement confirms that the information in the petition is true to the best knowledge of the signer, adding an essential layer of accountability. |

Guidelines on Utilizing Letters Administration

Filling out the Letters Administration form requires careful attention to detail. This process sets the stage for the administration of a deceased person's estate, ensuring that all necessary information is submitted correctly. Follow these steps for a complete and accurate application.

- Obtain the Letters Administration form from the Surrogate's Court website or office.

- In the "For Office Use Only" section, leave it blank as it will be filled out by the court staff.

- Enter the full name of the deceased in the "Estate of" section.

- Select the type of administration you are applying for: Administration, Limited Administration, Administration with Limitations, or Temporary Administration.

- Fill in the file number if one has been assigned.

- Provide your full name, domicile (address), and contact information in the petitioner section.

- Check your citizenship status and indicate your interest in the proceeding by selecting the appropriate box.

- If applicable, indicate if the proposed administrator is an attorney and if they have any criminal convictions.

- Complete the section for the deceased’s information, including name, domicile, date and place of death, and citizenship.

- Estimate the gross value of the decedent's personal and real property passing by intestacy in the appropriate sections.

- Describe any rights of action that existed on behalf of the decedent, if any.

- List the names and relationships of the surviving relatives who would inherit the estate.

- Identify any outstanding debts or funeral expenses, or write "NONE" if there are none.

- Assert that there are no other interested persons in the proceeding aside from those mentioned.

- Indicate the relief requested by checking the appropriate boxes and filling out the necessary details.

- Sign and date the petition, including all required signatures of co-petitioners, if applicable.

- Complete the verification, oath and designation section, signing it under oath.

- Have your signature notarized by a qualified notary public.

- Attach any required documents, such as the death certificate and any affidavits if applicable.

What You Should Know About This Form

1. What is the purpose of the Letters Administration form?

The Letters Administration form is used to initiate the process of obtaining letters of administration for a deceased person’s estate. This form allows a petitioner to request the authority to manage and administer the estate of the deceased when no will exists. It establishes who the administrator will be and outlines their responsibilities in handling the estate’s assets and liabilities.

2. Who can file the Letters Administration form?

Any person who has a legitimate interest in the estate can file the form. This typically includes family members such as spouses, children, or siblings. The petitioner must be of full age and meet certain legal criteria, such as not being a convicted felon. If an attorney is applying to serve as administrator, specific qualifications apply.

3. What information is required on the Letters Administration form?

The form requires detailed information about the petitioner, including name, address, and relationship to the deceased. It also demands details about the deceased, such as their domicile, date of death, and citizenship. Additionally, the estimated value of the deceased's property must be disclosed, and the petitioner must declare whether a will was located. Information about surviving heirs is also necessary to determine who will inherit the estate.

4. Are there any fees associated with filing the Letters Administration form?

Yes, there are filing fees associated with this form. Applicants must pay a filing fee at the time of submission. The form allows for the input of the exact amount paid, as well as any additional costs related to certifications or bonds that may be required during the administration process.

5. What happens if no will is found?

If no will can be located, the petitioner must conduct a diligent search for any possible documents. The form requires the petitioner to assert that no will has been found and to explain the search efforts. If satisfied that no will exists, the court will treat the estate as an intestate estate, which means it will be distributed according to state law.

6. Can the form be completed by someone without legal experience?

While it is possible for an individual without legal experience to complete the form, it is highly recommended to seek legal assistance. This is important to ensure accuracy and compliance with court requirements. Mistakes or omissions could lead to delays or complications in the administration process.

7. How long does it take to process the Letters Administration form?

The processing time for the Letters Administration form can vary. After submission, it usually takes a few weeks for the court to review the application and issue the letters. However, this timeline can be affected by court schedules and the completeness of the application submitted.

8. What should a petitioner do if someone contests their application?

If there are challenges to the application, such as disputes from other potential heirs, the petitioner may need to prepare for a hearing. This situation often requires legal representation to navigate potential conflicts. Documentation supporting the petitioner’s claim to administer the estate may be necessary to present in court.

9. What are the responsibilities of a successful petitioner after obtaining letters of administration?

Once a petitioner successfully obtains letters of administration, they assume the responsibility of managing the deceased's estate. This includes identifying and securing assets, paying debts and taxes, and distributing the remaining assets to heirs in accordance with state laws. The administrator must keep accurate records and may need to account for their management of the estate to the court and interested parties.

Common mistakes

Filling out the Letters Administration form is a crucial step in the administration of a deceased person's estate. However, individuals often make mistakes that can delay the process or lead to complications. Understanding these common errors can help ensure a smoother experience.

One significant mistake is leaving items blank. Every section of the form must be completed, as the instructions clearly state. Omitting information can cause the court to reject the application, which prolongs the administration process.

Another frequent error involves failing to provide accurate details about the decedent. It is essential to ensure that the name, date of death, and domicile are correct. If the decedent’s domicile differs from that listed on the death certificate, the instructions mandate an affidavit explaining this discrepancy.

Individuals also often neglect to address the question of relationships accurately. In Section 6 of the form, it asks for details about relatives who may inherit. If someone misidentifies a relationship or fails to list all heirs, it can lead to challenges or disputes later on.

In Section 7, applicants typically list interested parties. However, failing to include necessary parties can be problematic. If all relevant individuals are not named, or if someone is misclassified, it can invalidate the application or cause delays in obtaining the letters.

Applicants sometimes overlook the importance of additional documentation. The form requires the submission of the death certificate and, if applicable, other supporting documents. Without these items, the application may be deemed incomplete.

Furthermore, individuals often fail to check boxes related to claims or debts of the decedent. If there are outstanding debts or potential claims, these must be disclosed; otherwise, the court may impose additional requirements upon discovery.

Lastly, a common mistake arises when individuals assume that legal representation is unnecessary. While it is possible to file without an attorney, having legal guidance can prevent many of these mistakes. Complexities in estate law can make the process daunting, and professional help may streamline the experience significantly.

Documents used along the form

When navigating the process of obtaining Letters of Administration, several additional forms and documents may be needed to support your petition. These documents provide essential information and facilitate various legal requirements. Understanding each can help prepare you for what to expect during the administration process.

- Death Certificate: This document verifies the date and cause of death of the deceased. It is essential for confirming eligibility for Letters of Administration and must typically be submitted alongside your petition.

- Affidavit of Heirship: If the decedent did not leave a will, this form can help clarify the legal heirs of the estate. It provides details about the relationship between the heirs and the deceased, ensuring the correct individuals inherit the estate.

- Bond Form: In some cases, a bond is required to protect the assets of the estate from mismanagement. This form outlines the amount of the bond and the obligations of the administrator to manage the estate responsibly.

- Notice of Petition: This document informs interested parties about the petition for Letters of Administration. It sets a timeframe for those who may want to contest the petition or participate in the proceedings.

- Inventory of Assets: After gaining approval for administration, the administrator must list the assets of the estate. This inventory aids in determining the value of the estate and facilitates proper distribution to the heirs.

Gathering these documents ahead of time can streamline the administration process and help ensure all necessary information is readily available. Being organized will make it easier to address any potential concerns that could arise as you navigate this legal journey.

Similar forms

The Letters Administration form serves a vital function in the legal process of settling an estate. Several documents are similar in purpose and structure. Each of these documents may be used in estate-related proceedings, often addressing issues of administration, guardianship, or appointment. Here’s a list of nine documents that are analogous to the Letters Administration form:

- Last Will and Testament: This document outlines how a person wishes to distribute their assets after death. Like the Letters Administration form, it addresses the decedent's affairs but focuses on the individual's wishes rather than state law.

- Petition for Probate: Used when a will is present, this document requests the court to recognize the will as valid. Both forms initiate legal proceedings for managing a decedent’s estate.

- Letters Testamentary: Issued by the court, this document grants an executor authority over the estate. Just as the Letters Administration form provides authority, Letters Testamentary do so based on a recognized will.

- Guardianship Petition: This is filed to appoint a guardian for minors or incapacitated adults. Similar to the Letters Administration form, it establishes the authority of one party over another’s affairs.

- Estate Inventory Form: This document lists all assets of the deceased. While the Letters Administration form identifies heirs, the inventory form details what is to be administered.

- Affidavit of Heirship: This document declares the heirs of a deceased individual without a will. It serves a similar purpose in proving relationships as the identification of distributees in the Letters Administration form.

- Petition for Appointment of Administrator: When no will exists, this form requests the court to appoint someone to manage the estate. It parallels the Letters Administration form in intent and procedural function.

- Notice of Probate: This document informs interested parties that a will has been probated. While it does not grant authority, it serves to officially announce proceedings similar to the Letters Administration form.

- Decree of Distribution: This document finalizes the distribution of an estate's assets. Whereas the Letters Administration form initiates the process, the decree finalizes it.

Each of these documents shares aspects of legal structure and purpose while addressing specific outcomes in the estate management process.

Dos and Don'ts

When completing the Letters Administration form, there are important guidelines to follow. Adhering to these can help ensure the process goes smoothly, while mistakes can lead to delays or complications. Below are five things to keep in mind:

- Do ensure every section is completed. Leaving items blank can cause unnecessary delays. Each question requires a response or a clear indication that it is not applicable.

- Don't provide inaccurate information. Misrepresentation can lead to legal issues. Careful attention should be given to the accuracy of all details provided.

- Do double-check that all required documents are attached. For instance, ensure the Death Certificate is included and any affidavits are properly filled out if relevant.

- Don't forget to sign and date the form. An unsigned form will not be processed. Ensure that the signature matches the name printed clearly on the form.

- Do seek assistance if needed. If you are uncertain about how to fill out any part of the form, consult a legal professional for guidance.

Following these guidelines will help mitigate any potential issues during the administration process and provide peace of mind during this challenging time.

Misconceptions

Misconceptions about the Letters Administration form can lead to confusion and potentially slow down the administrative process of an estate. Below are common misunderstandings and clarifications to help navigate this important document:

- It's just a standard form that anyone can fill out. Many believe this, but the Letters Administration form contains specific legal requirements and must be completed accurately to be accepted by the court.

- Only attorneys can file the Letters Administration form. While having an attorney is beneficial, individuals who have a legitimate interest in the estate can also file the form. However, they should be aware of the legal responsibilities involved.

- The form is only required when there is a will. This is not true. The Letters Administration form is necessary for both testate (with a will) and intestate (without a will) estate proceedings.

- It's not essential to provide information about surviving family members. Incorrectly assuming this can be detrimental. The form requires detailed information about all potential heirs to ensure proper distribution of the estate.

- Once submitted, the process is quick and straightforward. Many think the process will be immediate, but administrative proceedings can take time, especially if issues arise or additional documentation is needed.

- You don't need to disclose any estate debts. On the contrary, the form requires a full disclosure of debts or funeral expenses, as this information is crucial for settling the estate accurately.

- All information must be known at the time of filing. While it is important to provide as much information as possible, applicants can state “unknown” where applicable and provide details later if necessary.

- Serving notice to all interested parties isn't necessary if they are not in close proximity. This is a misunderstanding; the law requires that all interested parties be notified regardless of their location, ensuring their rights to the estate are protected.

Understanding these misconceptions can better prepare you for completing the Letters Administration form accurately and efficiently, ensuring a smoother process as you manage the responsibilities of estate administration.

Key takeaways

Here are key takeaways on filling out and using the Letters Administration form:

- Do not leave any items blank. Every section must be filled out completely to avoid delays.

- Be aware of the filing fee. This should be clearly noted and paid as part of the submission process.

- Submit the Death Certificate along with your application. This is mandatory and helps validate the request.

- Provide accurate contact information. Ensure that both domicile and mailing addresses are current and correct.

- Indicate your relationship to the decedent. This helps clarify your interest in the proceedings.

- Search for a will thoroughly before declaring the decedent died intestate. A diligent search is required.

- For each potential heir, provide their relationship to the decedent clearly. Include full names and addresses.

- Review your application for consistency. If the decedent's domicile differs from the death certificate, additional explanation is needed.

Browse Other Templates

New Jersey Association of Realtors Standard Form of Residential Lease - Quiet enjoyment guarantees tenants a peaceful living environment while adhering to lease terms.

Virginia S Corporation - Details regarding authorized shares must include designations, preferences, rights, and limitations for each class if applicable.

33hkr - Choose a method for receiving the temporary password: email or SMS.