Fill Out Your Libc 500 Form

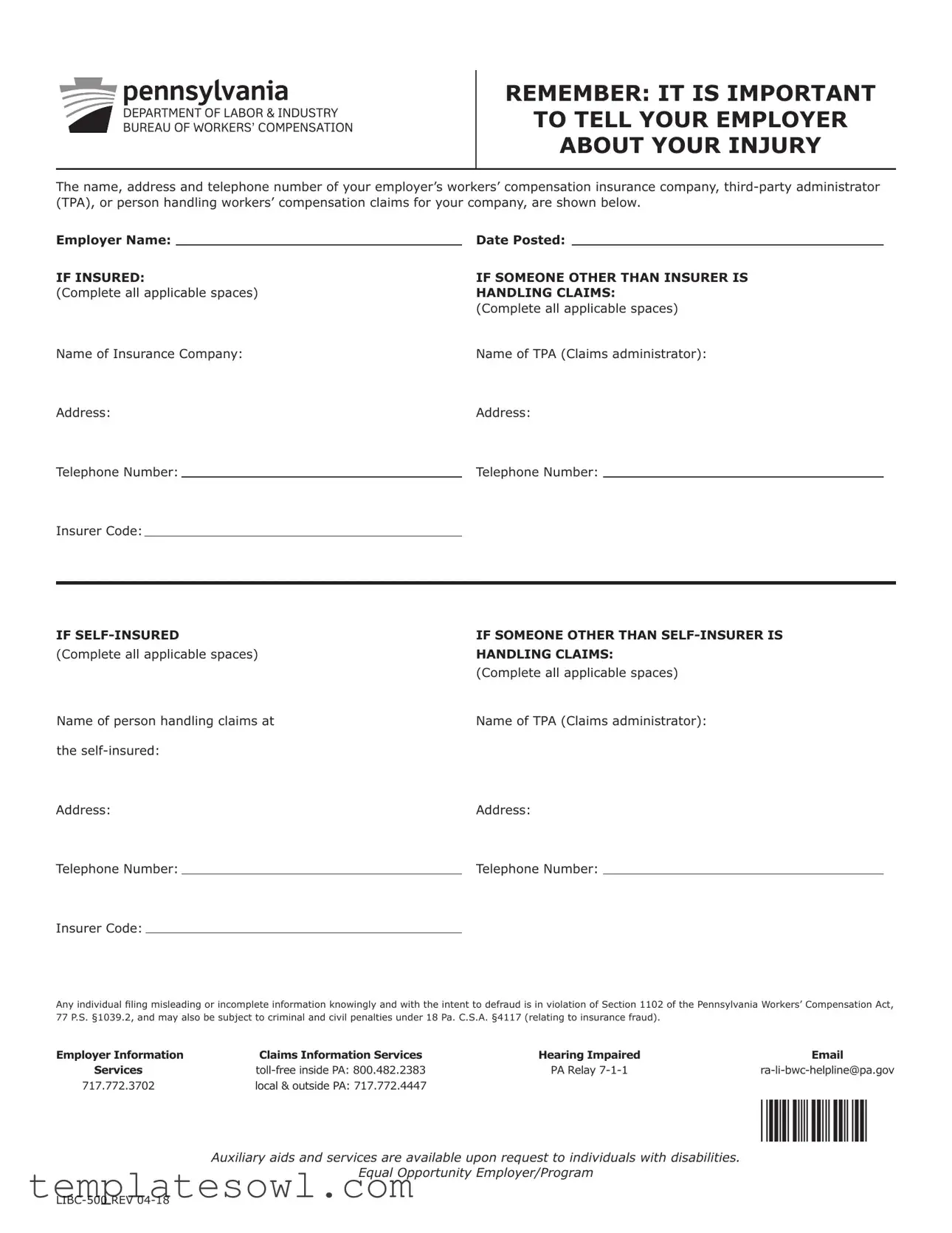

The LIBC 500 form serves as a crucial document in the workers' compensation process in Pennsylvania, reflecting the commitment of the Department of Labor and Industry to ensure clarity and efficiency in handling claims related to workplace injuries. This form contains essential information that employees must provide about their employer’s workers' compensation insurance arrangements. It prompts the injured worker to disclose the name and contact details of the insurance company, any third-party administrators involved, and the person responsible for managing claims at the workplace. Particularly noteworthy is the emphasis on reporting the injury promptly to the employer, highlighting the collaborative nature of the claims process. Additionally, the form includes important legal warnings about the consequences of providing false or incomplete information, underscoring the seriousness of compliance. Access to essential contact information for claim handling and support services, including resources for the hearing-impaired, is also integrated, ensuring that no one faces barriers when seeking assistance. By understanding the components and importance of the LIBC 500, employees can navigate the workers' compensation system more effectively and responsibly.

Libc 500 Example

DEPARTMENT OF LABOR & INDUSTRY BUREAU OF WORKERS’ COMPENSATION

REMEMBER: IT IS IMPORTANT

TO TELL YOUR EMPLOYER

ABOUT YOUR INJURY

The name, address and telephone number of your employer’s workers’ compensation insurance company,

Employer Name: |

|

Date Posted: |

|

|

|||

IF INSURED: |

IF SOMEONE OTHER THAN INSURER IS |

|

|||||

(Complete all applicable spaces) |

HANDLING CLAIMS: |

|

|||||

|

|

|

|

(Complete all applicable spaces) |

|

||

Name of Insurance Company: |

Name of TPA (Claims administrator): |

|

|||||

Address: |

Address: |

|

|||||

Telephone Number: |

|

Telephone Number: |

|

|

|||

Insurer Code: |

|

|

|

|

|||

|

|

|

|

|

|

|

|

IF |

IF SOMEONE OTHER THAN |

|||

(Complete all applicable spaces) |

HANDLING CLAIMS: |

|||

|

|

|

(Complete all applicable spaces) |

|

Name of person handling claims at |

Name of TPA (Claims administrator): |

|||

the |

|

|

||

Address: |

Address: |

|||

Telephone Number: |

|

Telephone Number: |

|

|

Insurer Code: |

|

|

|

|

Any individual filing misleading or incomplete information knowingly and with the intent to defraud is in violation of Section 1102 of the Pennsylvania Workers’ Compensation Act, 77 P.S. §1039.2, and may also be subject to criminal and civil penalties under 18 Pa. C.S.A. §4117 (relating to insurance fraud).

Employer Information |

Claims Information Services |

Hearing Impaired |

|

Services |

PA Relay |

||

717.772.3702 |

local & outside PA: 717.772.4447 |

|

|

|

|

|

*500* |

Auxiliary aids and services are available upon request to individuals with disabilities.

Equal Opportunity Employer/Program

Form Characteristics

| Fact Name | Details |

|---|---|

| Purpose | The LIBC 500 form is used to notify an employer and their workers' compensation insurance provider about an employee's injury in Pennsylvania. |

| Governing Law | This form is governed by the Pennsylvania Workers' Compensation Act, specifically Section 1102 and 77 P.S. §1039.2. |

| Insurer Information | The form requires details about the employer's insurance company or third-party administrator handling the claims. |

| Self-Insurance | If the employer is self-insured, the form must contain information about the individual handling claims at the self-insured entity. |

| Contact Information | The LIBC 500 includes fields for contact details, such as addresses and telephone numbers, to reach the claims administrator. |

| Fraud Penalties | Intentionally providing misleading or incomplete information can lead to criminal and civil penalties under Pennsylvania law. |

| Accessibility Services | Auxiliary aids and services are available for individuals with disabilities who may need assistance with the process. |

| Contact for Hearing Impaired | The form provides a toll-free number and PA Relay services for individuals who are hearing impaired, ensuring broad access to information. |

Guidelines on Utilizing Libc 500

Completing the Libc 500 form requires attention to detail and some fundamental organizational information related to your employer's workers' compensation coverage. It serves as a necessary step in filing for a workers' compensation claim, ensuring that all relevant parties are informed about the incident and that the correct insurance provider is contacted. Below are the steps to accurately fill out the form.

- Gather your employer's contact details, including the name, address, and telephone number of their workers' compensation insurance company or third-party administrator.

- Locate the section labeled "Employer Name" and fill in the name of your employer.

- In the "Date Posted" field, enter the current date.

- If the employer is insured, complete the "IF INSURED" section with the name of the Insurance Company, including their address, telephone number, and the insurer code.

- If applicable, fill out the "IF SOMEONE OTHER THAN INSURER IS HANDLING CLAIMS" section. Provide the name of the TPA or claims administrator, along with their address and telephone number.

- If your employer is self-insured, fill out the "IF SELF-INSURED" section with the name of the individual handling claims.

- Enter the address and telephone number of the claims handler in the self-insured section.

- Include the insurer code for the self-insured employer if required.

Once you have filled out the form, ensure that all information is clear and accurate, as submitting misleading information could lead to legal consequences. After verifying all details, it is ready to be submitted to the appropriate parties involved in your workers' compensation claim.

What You Should Know About This Form

What is the LIBC 500 form?

The LIBC 500 form is a document used in Pennsylvania for reporting workers' compensation claims. Employers and employees fill out this form to provide necessary information regarding workplace injuries. It ensures that the claims are processed efficiently by listing the details of the employer, insurance company, and claims administrator.

Why is it important to submit the LIBC 500 form?

Submitting the LIBC 500 form is crucial because it initiates the workers’ compensation claim process. It informs the employer and the insurance company about the injury and helps in managing the claim accurately. Timely submission can facilitate quicker access to benefits and medical care for the injured worker.

Who is responsible for filling out the LIBC 500 form?

Both the injured employee and the employer have responsibilities when it comes to the LIBC 500 form. The employee must report the injury to their employer and potentially provide details for the form. Employers are responsible for ensuring the form is completed accurately and submitted to the appropriate parties.

What information is required on the LIBC 500 form?

The LIBC 500 form requires details such as the name and address of the employer, insurance company, and third-party administrator handling claims. Additional contact information, such as phone numbers, is also necessary. These pieces of information help ensure that the claim is directed to the right organizations.

What should I do if I notice an error on the LIBC 500 form after submission?

If you discover an error on the LIBC 500 form after submission, it is important to address it promptly. Contact your employer or the claims administrator as soon as possible to discuss the necessary corrections. Timeliness is key, as delays may affect the processing of your claim.

What can happen if false information is provided on the LIBC 500 form?

Providing false information on the LIBC 500 form can lead to serious consequences. It is considered a violation of the Pennsylvania Workers' Compensation Act. Individuals may face civil and criminal penalties for insurance fraud, which can include fines or other legal actions.

Is there assistance available for completing the LIBC 500 form?

Yes, assistance is available for individuals needing help with the LIBC 500 form. Employers can provide guidance, or individuals can contact the Pennsylvania Bureau of Workers’ Compensation helpline for support. Auxiliary aids and services are also available for those with disabilities upon request.

How can I contact the Bureau of Workers’ Compensation for further inquiries?

You can reach the Pennsylvania Bureau of Workers’ Compensation through various methods. For toll-free calls within Pennsylvania, dial 800-482-2383. Local calls or inquiries outside of Pennsylvania can be directed to 717-772-4447. Email communication is also available at ra-li-bwc-helpline@pa.gov.

What is the purpose of the "Employer's Information" section on the LIBC 500 form?

The "Employer’s Information" section serves to identify the employer and provide specific details about the workers' compensation insurance. This information is crucial as it guides the claim to the appropriate insurer or claims administrator, facilitating a smoother claims process.

Common mistakes

Filling out the LIBC 500 form can be straightforward, but mistakes often occur. One common error is providing incomplete information. For instance, missing details about your employer’s workers’ compensation insurance can lead to delays in getting your claim processed. Make sure to include the full name, address, and telephone number of the insurance company responsible for your claim. This is crucial for ensuring your claim is handled efficiently.

Another frequent mistake is neglecting to notify your employer about your injury promptly. It's essential to communicate your injury as soon as possible. If you fail to report it, your employer may not provide the necessary documentation or support your claim, complicating the process further. Remember that your employer needs to be aware of your injury to facilitate the claims process.

Additionally, many individuals overlook the importance of accuracy in the information they provide. Small errors, such as typos in numbers or miswritten names, can lead to significant issues later on. Double-check all entries before submitting the form. Ensuring that every detail is correct can save you time and trouble in the long run.

Finally, some people may not fully understand the consequences of providing misleading information. Intentionally entering false information on the LIBC 500 form is against the law. This could lead to serious penalties, including criminal charges. It's vital to be honest and transparent, as the repercussions of fraud can be severe. Keep in mind that the aim of this form is to protect you and facilitate your claim, so approach it with care.

Documents used along the form

The LIBC 500 form is essential for reporting a work-related injury to Pennsylvania's Bureau of Workers' Compensation. While submitting this form is an important step, several other documents often accompany it to ensure proper processing of the claim. Below is a list of common forms and documents that may be required alongside the LIBC 500.

- LIBC 751: This form documents an individual's serious injury claim. It provides details about the nature and extent of the injury, allowing the claims administrator to assess eligibility for benefits.

- LIBC 755: Known as the “Employee’s Claim Petition,” this document is used to formally initiate a claim for workers' compensation benefits when an employer disputes the claim.

- LIBC 764: This is the “Medical Report,” which must be completed by a healthcare provider. It details the treatment received and gives insight into the employee's medical status post-injury.

- LIBC 763: This form serves as a “Notice of Temporary Compensation.” It is used when an employer begins making temporary compensation payments without formally accepting liability for the claim.

- LIBC 821: The “Application for Fee Review” allows providers to appeal or review fees for medical treatment related to workers' compensation claims.

- LIBC 305: This form is for the “Notice of Compensation Payable,” indicating that a claim has been accepted and benefits are being paid.

- LIBC 2001: Titled “Third Party Liability,” this document addresses potential recovery from third parties who may share responsibility for the injury.

- LIBC 522: The “Supplemental Agreement,” used when an agreement is made regarding benefit amounts or the nature of the benefits provided post-injury.

- LIBC 908: The “Work Status Report” is created by the employer to provide details on the employee's ability to work and potential accommodations.

- LIBC 817: This is the “Final Receipt,” which indicates that the employee has received the final payment of compensation and confirms closure of the claim process.

Understanding these accompanying documents is crucial for employees navigating the workers’ compensation system. Proper documentation helps ensure that claims are processed efficiently and effectively.

Similar forms

- Workers’ Compensation Claim Form: Like the LIBC 500, this form is essential for employees to initiate a claim for workplace injuries. Both forms gather key details about the employee and the circumstances surrounding the injury, including information about the employer's insurance.

- First Report of Injury: This document serves a similar purpose in reporting the injury to the employer and the insurance company. It details the initial incident and includes the date, time, and specifics of the incident, much like the LIBC 500.

- Employer’s Report of Injury: Just as the LIBC 500 allows the employee to report injuries, this form is filled out by the employer. It outlines the company's perspective and any actions taken following the injury.

- Application for Benefits: Employees submit this form to seek various benefits after an injury at work. It parallels the LIBC 500 in that it requires thorough information about the employee and the incident to process claims efficiently.

- Medical Release Form: This document permits healthcare providers to share medical information with the workers’ compensation insurance company. Similar to the LIBC 500, it aims to facilitate communication and transparency in the claims process.

- Return-to-Work Form: Designed for employees returning to work after an injury, this form is significant in the claims process. It typically follows the guidelines set in the LIBC 500 regarding employer notification and insurance communication.

- Final Report of Compensation Received: This document outlines the compensation an employee has received over time. It is similar to the LIBC 500 by tracking payments and ensuring that accurate financial records align with reported injuries.

Dos and Don'ts

When filling out the LIBC 500 form, careful attention to detail can make a significant difference in the success of your claim. Here’s a guide with important do's and don'ts:

- Do provide accurate and complete information on all sections of the form. Each detail matters.

- Do double-check the employer's information, including the name, address, and telephone number, for accuracy before submitting.

- Do keep a copy of the completed form for your records. It's essential for tracking your submission.

- Do sign and date the form. Your signature is a confirmation that the information is correct to the best of your knowledge.

- Don’t misrepresent any facts about your injury or your employment. This could lead to penalties.

- Don’t leave any sections blank unless instructed otherwise. Incomplete forms can delay the processing of your claim.

By following these guidelines, you can avoid common pitfalls and help ensure that your claim is processed smoothly and efficiently.

Misconceptions

Here are nine misconceptions about the LIBC 500 form, along with clear explanations to help you understand its purpose and requirements.

- The LIBC 500 form is only for employees who are injured on the job. While primarily used by injured employees, the form is essential for any worker needing to file a claim or make their employer aware of an injury, regardless of the situation.

- Your employer will automatically report your injury. It is crucial for you to inform your employer about your injury. Failing to do so could delay the claims process.

- The LIBC 500 form is not legally binding. Providing false or misleading information on the form can lead to serious legal consequences, including criminal penalties. Honesty is key.

- You can fill out the LIBC 500 form without any help. While many can complete it independently, seeking assistance can ensure accuracy and completeness, preventing potential issues down the road.

- Filing the form guarantees your claim will be accepted. Submitting the LIBC 500 form starts the claims process, but approval depends on the specifics of each case and the evaluation by the insurance company.

- All employers have the same requirements regarding the LIBC 500 form. Different employers may have unique procedures. Checking with your employer's claims administrator for any specific instructions is wise.

- Once the LIBC 500 form is submitted, you have no further responsibilities. You may need to provide additional information or attend hearings as requested throughout the claims process.

- If you're self-employed, you don't need to worry about the LIBC 500 form. Self-employed individuals still need to complete the form to document any work-related injuries, even if they do not have traditional employer-employee relationships.

- The form is only available in English. Various resources are available to assist non-English speakers in completing the LIBC 500 form. Reach out to local workers' compensation offices for support.

Key takeaways

Filling out the Libc 500 form accurately is crucial for ensuring your workers’ compensation claim proceeds smoothly. Here are some key points to keep in mind:

- Always inform your employer about the injury as soon as possible. This step is essential for your claim to be processed.

- Make sure to fill in all relevant details regarding your employer’s workers’ compensation insurance. This includes the name, address, and contact number of the insurance company or third-party administrator handling claims.

- Verify your entries carefully. Providing false or incomplete information can lead to serious consequences, including penalties under the Pennsylvania Workers’ Compensation Act.

- If you require assistance, remember that services for individuals with disabilities are available. You can reach out to the appropriate helplines for support.

Browse Other Templates

Diabetes Log Book - Provide personal details to get started, like your name and contact information.

Career Counseling Form - What is your preferred method of communication during counseling?

Unemployment for Cut Hours - Claimants are informed that their responses are subject to verification and could lead to penalties for falsehoods.