Fill Out Your Lic Surrender Form

The Lic Surrender form is a crucial document for policyholders of the Life Insurance Corporation of India who wish to surrender their insurance policy. This form serves multiple purposes, ensuring a smooth process for receiving the surrender value of the policy. It requires the policyholder to provide vital information such as the policy number, the insured person's name, and the amount they will receive. The document also includes declarations affirming that no notices of assignment or reassignment have been submitted to any office of the corporation, which helps to clarify ownership. Additionally, the form outlines the breakdown of the surrender value, including any cash bonuses, premiums refundable due to occupational extra, and adjustments for loans or other charges. A witness is required to confirm the identity of the signatories, which adds an essential layer of security and validity to the transaction. Policyholders must be mindful of additional instructions included in the form, especially concerning illiterate individuals who may need to provide thumb marks verified by an authorized official. This comprehensive structure of the Lic Surrender form aims to protect all parties involved and facilitate a clear understanding of the surrender process.

Lic Surrender Example

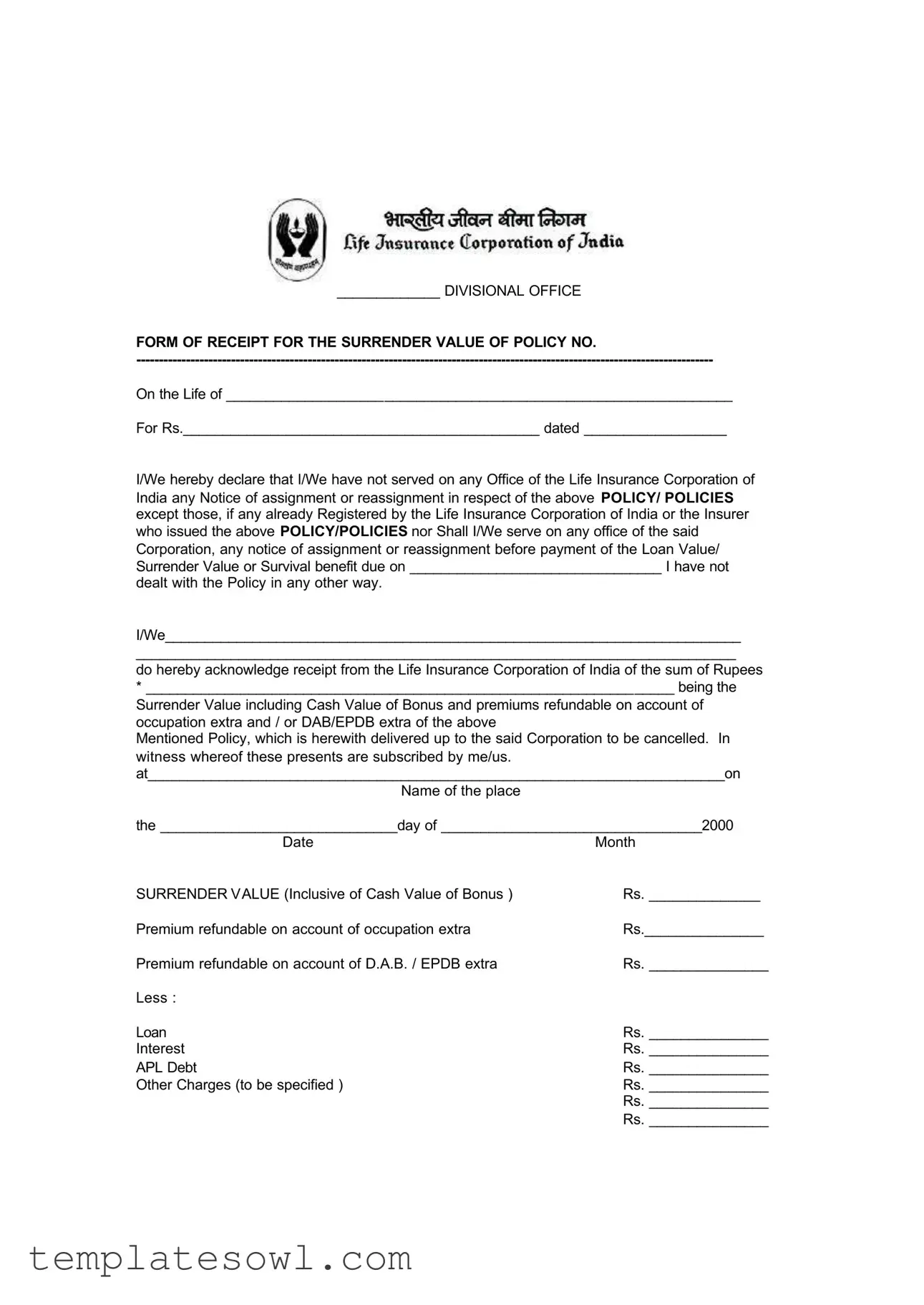

_____________ DIVISIONAL OFFICE

FORM OF RECEIPT FOR THE SURRENDER VALUE OF POLICY NO.

On the Life of ________________________________________________________________

For Rs._____________________________________________ dated __________________

I/We hereby declare that I/We have not served on any Office of the Life Insurance Corporation of India any Notice of assignment or reassignment in respect of the above POLICY/ POLICIES except those, if any already Registered by the Life Insurance Corporation of India or the Insurer who issued the above POLICY/POLICIES nor Shall I/We serve on any office of the said Corporation, any notice of assignment or reassignment before payment of the Loan Value/ Surrender Value or Survival benefit due on ________________________________ I have not

dealt with the Policy in any other way.

I/We_________________________________________________________________________

____________________________________________________________________________

do hereby acknowledge receipt from the Life Insurance Corporation of India of the sum of Rupees

*___________________________________________________________________ being the Surrender Value including Cash Value of Bonus and premiums refundable on account of occupation extra and / or DAB/EPDB extra of the above

Mentioned Policy, which is herewith delivered up to the said Corporation to be cancelled. In

witness whereof these presents are subscribed by me/us.

at_________________________________________________________________________on

Name of the place

the ______________________________day of _________________________________2000

Date |

Month |

SURRENDER VALUE (Inclusive of Cash Value of Bonus ) |

Rs. ______________ |

Premium refundable on account of occupation extra |

Rs._______________ |

Premium refundable on account of D.A.B. / EPDB extra |

Rs. _______________ |

Less : |

|

Loan |

Rs. _______________ |

Interest |

Rs. _______________ |

APL Debt |

Rs. _______________ |

Other Charges (to be specified ) |

Rs. _______________ |

|

Rs. _______________ |

|

Rs. _______________ |

|

|

|

Signature : _____________________________ |

|

One Rupee |

|

||

|

Revenue |

|

|

|

|

Full Name : _____________________________ |

|

Stamp |

|

When |

|

|

|

|

|

|

amount |

|

|

|

|

|

exceeds Rs. |

|

500/- |

|

(of the witness) |

|

|

|

Occupation : ____________________________ |

|

|

|

Address : ____________________________ |

Signature |

In Short in |

English |

______________________________________ |

|

Full |

Vernacular |

______________________________________ |

|

|

|

___________________________________________________________________________ |

|||

* Gross amount of Surrender Value |

* Delete where not applicable |

||

___________________________________________________________________________

Note : Illiterate persons must affix their thumb marks which should be indentified by the attesting Magistrate under the seal of his office, or a Block Development Officer or a Gazetted Officer or a Principal/Headmaster of Local High School or Higher Secondary School run by the Government or an Agent of a Nationalised Bank or Class I Officer of the Corporation or a Development Officer of the Corporation with atleast Five Years' Service provided he/she is fully satisfied about the identify of the person(s) executing the form. Signature in Regional Languages must be attested by respectable

"The contents of this discharge form have been explained to ____________________________

______and he/she/they have/has signed the same/put thumb impression after fully understanding

the same.

SEAL OF OFFICE |

______________________ |

IF ANY |

|

|

Signature of the Witness |

If the Receipt is signed by more than one person and payment is desired to be made to only one of their number, then a letter of Authority as under must be completed and signed by all of them except the authorised person before Magistrate or a Block Development Officer or Gazetted Officer or a Principal/Head Master of Local High School or Higher Secondary School run by the Government or an Agent of a Nationalised Bank or a Class I Officer of the Corporation or a Development Officer of atleast 3 years' standing or confirmed Dev. Officer recruited from Agents who were D.M.'s or B.M.'s Club Members before joining provided he/she is fully satisfied about the identity of the executants. The Letter of Authority will also be required if payment is to be made to any person other than the parties signing the Receipt.

Place__________________

Date __________________

I/We hereby authorise and request Life Insurance Corporation of India to pay the above mentioned amount of Rs. ______________________________________________________

to ________________________________________________________________________

(Name of the authorised person)

Signed by the party or parties

______________________

Signature/s in full

__________________________________________________________________________

Magistrate or a Block Development Officer or a Gazetted Officer etc.

??I hereby certify that the contents of this note of Authority were explained by me in vernacular

to

____________________________________________________________________________

____________________________________________________________________________

and he/she has agreed to payment being made to ____________________________________

They have

______________________________________the party or parties authorised.

Magistrate or a Block Development Officer or a Gazetted Officer etc.

____________________________________________________________________________

??This endorsement is required to be completed and signed by the attesting Magistrate, or a Block Development Officer or a Gazetted Officer etc. when the Note of Authority is completed by an illiterate or Vernacular knowing person.

F.No. 5074/3510 (Rev.)

___________________

Form Characteristics

| Fact Title | Details |

|---|---|

| Purpose | The Lic Surrender form is used to formally surrender a life insurance policy and claim the surrender value from the insurer. |

| Governing Law | The surrender process is regulated by the Insurance Act of 1938 in India. |

| Notice Requirements | The form requires the policyholder to declare that no notice of assignment or reassignment has been served before claiming the surrender value. |

| Surrender Value Components | The surrender value includes cash value of bonuses, premiums refundable, and any applicable deductions like loans and charges. |

| Witness Requirements | Signatures need to be witnessed by an English-knowing person, or a Magistrate, to ensure validity. |

| Illiterate Policyholders | Illiterate individuals must affix their thumbprint, which should be attested by a qualified official. |

| Signature by Multiple Parties | If more than one person signs the form, a Letter of Authority is necessary for payment to be made to only one party. |

| Authority for Payment | The policyholder must authorize the Life Insurance Corporation to disburse the amount to a specified individual. |

| Confidentiality | The entire process is meant to safeguard the identity of the policyholder and their intentions regarding the surrender. |

Guidelines on Utilizing Lic Surrender

To successfully fill out the Lic Surrender form, you will need to provide accurate information regarding the policy, the amount, and any personal details required. After completing the form, you will sign it and may need a witness to confirm your identity, especially if you are unable to write your name. Once the form is duly filled and signed, it will be submitted to the respective office for processing.

- Begin by entering the policy number at the designated space at the top.

- Fill in the name of the individual on whose life the policy was issued.

- Specify the surrender value amount in the designated field.

- Indicate the date of completion next to the surrender value amount.

- Declare that you have not served any notice of assignment or reassignment regarding the policy. Check the box or insert the relevant information as required.

- Record your full name in the specified section.

- Provide the location where you are filling out the form.

- Write the date in the format of day, month, and year.

- Complete the detailed surrender value section with the appropriate amounts. This includes the gross surrender value, any refunds, and deductions such as loans and interest.

- If needed, include your thumbprint if you are unable to write.

- Have a witness, who understands English, sign the document in the appropriate section. They will also need to provide their full name, occupation, and address.

- If the receipt is signed by multiple individuals, complete the Letter of Authority, allowing payment to one person designated in the document.

- Ensure that the Letter of Authority is also witnessed and signed by a valid authority figure as outlined in the form.

What You Should Know About This Form

What is the purpose of the LIC Surrender form?

The LIC Surrender form is used to officially request the surrender of a life insurance policy. By completing this form, policyholders acknowledge that they are relinquishing their policy in exchange for its surrender value. This value consists of the cash value of bonuses accumulated and any refundable premiums. It’s crucial for policyholders to understand the terms before proceeding, as surrendering a policy means they will no longer be covered under its terms.

What should I include when filling out the form?

When completing the form, ensure that you provide complete and accurate information. Include your name, policy number, and details regarding the surrender value. You must also declare whether there are any pending assignments or reassignments associated with the policy. Additionally, signatures and personal information of witnesses may be required, particularly for those who cannot read or write. Keeping all this in mind will help avoid delays in processing your request.

Can I authorize someone else to receive the surrender value on my behalf?

Yes, you can authorize another person to receive your surrender value. You will need to complete a Letter of Authority section in the form, which must be signed by all parties involved before a designated official such as a magistrate or a gazetted officer. Ensure that the authorized person's name is clearly stated in the Letter of Authority to facilitate smooth processing.

What happens if I have an outstanding loan against my policy?

If there is an outstanding loan against your policy, the surrender value will be adjusted accordingly. The outstanding loan amount and any applicable interest will be deducted from the total surrender value. It's important to be aware of this deduction, as it can significantly reduce the final amount you receive.

What do I need to do if I cannot read or write?

If you cannot read or write, you will need to mark your thumbprint on the form. This must then be attested by a qualified witness, such as a gazetted officer or a community leader who can confirm your identity and the understanding of the document’s contents. It’s essential to have this completed accurately to avoid any issues during the submission process.

Common mistakes

Filling out the License Surrender form can be straightforward, but mistakes often occur. One common error is neglecting to include the policy number. This key piece of information is vital for the processing of the surrender value, and without it, the form may be rejected or delayed.

Another mistake people make is failing to provide accurate identification details. It's important to ensure that the name of the policyholder is spelled correctly. Any discrepancies can lead to confusion and unnecessary complications in the surrender process.

Omitting the declaration regarding notices of assignment or reassignment is another frequent issue. The form explicitly requests that you confirm whether any such notices have been served. Inaccuracies here can result in legal setbacks and affect the payout.

Some individuals mistakenly believe that a generic signature is sufficient. Each signatory must sign their name in full. Initials or abbreviated signatures can create problems, particularly if the surrender involves multiple parties.

Improperly calculating the surrender value is an additional common error. Ensure that all amounts, including premiums and outstanding loans, are calculated accurately. A small miscalculation can lead to delays or disputes over the final payout amount.

Another area where errors tend to arise is in the section regarding dismissals of other charges. Be specific when indicating any fees or charges deducted from the surrender value. Failure to properly itemize these can lead to confusion during processing.

A mistake that can result in major delays is not including an attesting witness's signature. If required, always ensure that a proper witness is present to sign the form, as this validates the information submitted.

Individuals sometimes forget to complete the submission date. The date provides a crucial reference point for any transactions and must be filled out accurately to avoid complications.

Finally, one of the most unfortunate errors is neglecting to keep a copy of the completed form. Without documentation, you may face issues if disputes arise later. Keeping copies provides a safeguard against potential problems.

By being aware of these common mistakes, individuals can improve the likelihood of a smooth and efficient surrender process, ensuring they receive their funds without unnecessary delays.

Documents used along the form

When surrendering an insurance policy, several other documents may be necessary to complete the process effectively. Each of these documents serves a specific purpose and helps ensure that all legal and procedural requirements are met. Below are common forms associated with the Lic Surrender form.

- Letter of Authority: This document authorizes a designated individual to receive payment on behalf of the policyholder. It must be signed by all parties involved to ensure that there is clear consent regarding the transaction.

- Claim Form: If there are any claims associated with the policy being surrendered, this form is used to formally notify the insurance company about the claim. It provides necessary details and can facilitate the claims process.

- Identification Verification: This could be a government-issued ID or another form of identification. It is needed to authenticate the identity of the person surrendering the policy to prevent fraud.

- Witness Statement: In certain cases, especially when the policyholder is illiterate or requires assistance, a witness statement may be needed. This document attests that the contents of the surrender were explained and understood by the policyholder.

- Cancellation Confirmation: After the surrender process, this document confirms that the policy has been officially canceled. It serves as proof that both parties have completed their obligations regarding the policy.

Having these documents on hand can streamline the surrender process and help avoid any complications. Ensuring all paperwork is properly filled out and submitted will lead to a smoother experience. Always verify the specific requirements with the insurance company to remain compliant with their procedures.

Similar forms

The Lic Surrender form shares similarities with several other important documents in the realm of finance and insurance. Each serves a purpose focused on official acknowledgment and the transfer of rights or benefits. Here’s a list of 10 documents that are similar to the Lic Surrender form:

- Policy Assignment Form: This document transfers ownership rights of an insurance policy from one individual to another, similar to how the Lic Surrender form acknowledges the surrender of a policy's value.

- Claim Form: A claim form is submitted to request payment for a loss or benefit under an insurance policy. It, like the Lic Surrender form, involves verifying entitlement to funds based on a contract.

- Loan Disbursement Receipt: This document is used when funds are loaned to a policyholder. It records the amount disbursed and may include conditions, similar to the conditions outlined in the Lic Surrender form.

- Cancellation Notice: A cancellation notice terminates an insurance policy. The Lic Surrender form essentially serves to cancel the policy’s current terms in exchange for a surrender value.

- Endorsement Form: This form modifies the terms of an existing insurance policy. Similar to the Lic Surrender form, it is used to acknowledge changes that impact benefits or agreements.

- Authority to Disburse Funds: This document authorizes a third party to receive payments on behalf of an insured individual, paralleling how the Lic Surrender form might authorize a payment to an authorized person.

- Power of Attorney: A power of attorney allows an appointed individual to act on someone else's behalf, particularly when it comes to financial matters, like surrendering an insurance policy.

- Beneficiary Designation Form: This form is used to name a beneficiary for an insurance policy. It is similar in nature to the Lic Surrender form, as both require formal acknowledgment of rights and benefits.

- Refund Request Form: This form requests a refund for overpayments or adjustments. Both documents include the process of confirming entitlement to a monetary value based on existing contracts.

- Withdrawal Request Form: For retirement accounts, a withdrawal request form allows individuals to take funds out. This is akin to surrendering an insurance policy, as both involve receiving cash value.

Dos and Don'ts

When filling out the LIC Surrender form, following certain guidelines can help ensure a smooth process. Here are nine essential do's and don'ts:

- Do: Provide accurate and complete personal information.

- Do: Sign the form in the appropriate sections.

- Do: Keep a copy of the form for your records.

- Do: Consult a professional if you have any doubts regarding details.

- Do: Ensure all required witnesses are present and sign appropriately.

- Don't: Alter any pre-printed information on the form.

- Don't: Forget to mention any loans or other deductions associated with the policy.

- Don't: Submit the form without a witness, if required.

- Don't: Ignore the requirements for identification or witness signatures, especially for illiterate applicants.

Misconceptions

Here is a list of common misconceptions regarding the Lic Surrender form:

- It's only necessary when cashing out. Many believe the form is required exclusively for cashing out policies. In reality, it is also necessary for assigning or transferring ownership of the policy.

- All signatures need to be notarized. While some cases require notarization, this is not universally necessary. It typically depends on the specific circumstances and the individuals involved.

- The form can be filled out any way. This misconception leads to errors. Accurate and complete information must be provided, or the form may be rejected.

- Once submitted, the process is immediate. Some assume the payment will occur instantly. The processing time can vary, and it's essential to allow adequate time for the transaction.

- Only the policyholder can submit the form. In some cases, authorized agents or representatives can submit the surrender form on behalf of the policyholder. Proper authorization is required.

- Signing the form absolves all future obligations. Signing does not automatically end all responsibilities. Any outstanding loans or debts must be settled as part of the surrender process.

- The Surrender Value is final and unchangeable. Some individuals believe the quoted Surrender Value is fixed, but adjustments can occur based on specific terms, such as outstanding loans or penalties.

Key takeaways

When completing and using the Lic Surrender form, keep the following key points in mind:

- Read the Form Carefully: Ensure that you understand all sections before filling it out to avoid mistakes.

- Provide Accurate Information: Fill in your personal details and policy information accurately to ensure smooth processing.

- Declare Previous Assignments: Clearly state if you have previously assigned or reassigned the policy, as this could impact the surrender process.

- Acknowledge Receipt: By signing, you confirm receipt of the surrender value, so make sure all amounts are correct.

- Signature Requirements: The form must be signed in the presence of an authorized witness, ensuring proper identification.

- Authority for Payment: If multiple parties are involved, a letter of authority is essential for directing payment to one individual.

- Thumb Impression for Illiterate Persons: If you cannot read or write, a thumb impression is required and must be verified by a qualified official.

- Keep a Copy: Always retain a copy of the completed form for your records in case of inquiries or follow-ups.

Being thorough and following these guidelines can help ensure that the surrender process goes smoothly and efficiently.

Browse Other Templates

Michigan Lottery Claim Form - A bond may be requested from Retailers as part of the licensing process.

Washington State Labor Laws Breaks - This waiver is specific to California law regarding meal breaks.