Fill Out Your Lifesecure Beneficiary Change Form

Understanding the Lifesecure Beneficiary Change form is essential for ensuring your life insurance policy reflects your current wishes. This form allows you to update or designate new primary and contingent beneficiaries, ensuring that your assets go to your chosen individuals. When filling out the form, you must provide necessary information, including the full legal names, social security numbers, and relationships of each beneficiary to you. You also have the option to designate a trust as a primary beneficiary, which requires additional documentation. It’s crucial that the form is signed and witnessed correctly to avoid delays or complications in processing your request. Should any previously designated beneficiary be a child of the insured who predeceases them, the form allows for the proceeds to be distributed to the deceased’s children. Make sure to be thorough when providing details, as inaccuracies can result in the form being returned and could hold up important benefits. With the Lifesecure Beneficiary Change form, you take an important step in managing your insurance policy and securing your loved ones' future.

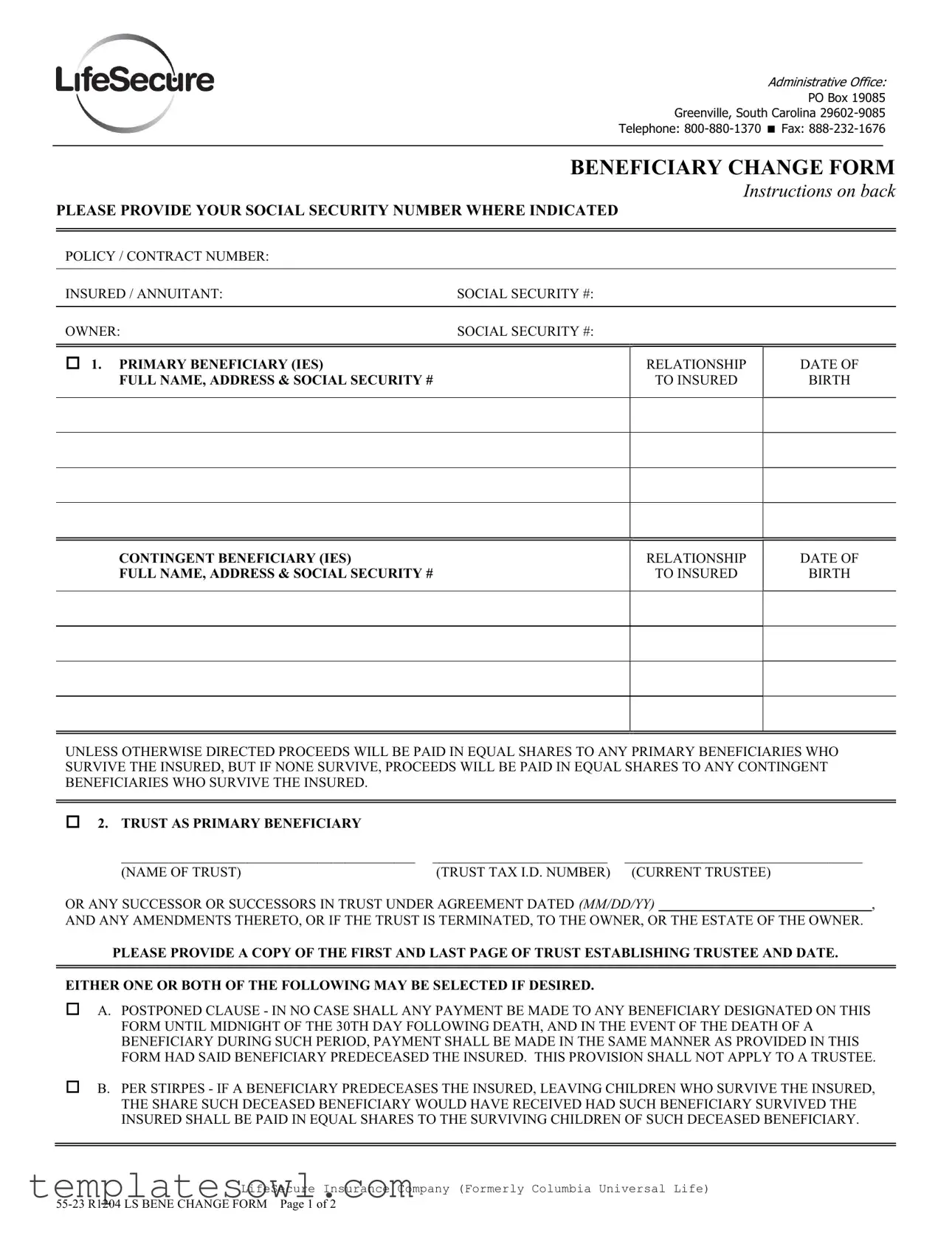

Lifesecure Beneficiary Change Example

Administrative Office:

PO Box 19085

Greenville, South Carolina

Telephone:

BENEFICIARY CHANGE FORM

Instructions on back

PLEASE PROVIDE YOUR SOCIAL SECURITY NUMBER WHERE INDICATED

POLICY / CONTRACT NUMBER:

INSURED / ANNUITANT: |

SOCIAL SECURITY #: |

|

|

|

|

|

|

OWNER: |

SOCIAL SECURITY #: |

|

|

1. PRIMARY BENEFICIARY (IES) |

|

|

|

|

RELATIONSHIP |

DATE OF |

|

FULL NAME, ADDRESS & SOCIAL SECURITY # |

|

TO INSURED |

BIRTH |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

CONTINGENT BENEFICIARY (IES) |

RELATIONSHIP |

DATE OF |

FULL NAME, ADDRESS & SOCIAL SECURITY # |

TO INSURED |

BIRTH |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

UNLESS OTHERWISE DIRECTED PROCEEDS WILL BE PAID IN EQUAL SHARES TO ANY PRIMARY BENEFICIARIES WHO SURVIVE THE INSURED, BUT IF NONE SURVIVE, PROCEEDS WILL BE PAID IN EQUAL SHARES TO ANY CONTINGENT BENEFICIARIES WHO SURVIVE THE INSURED.

2. TRUST AS PRIMARY BENEFICIARY |

|

|

|

__________________________________________ |

_________________________ |

__________________________________ |

|

(NAME OF TRUST) |

(TRUST TAX I.D. NUMBER) |

(CURRENT TRUSTEE) |

|

OR ANY SUCCESSOR OR SUCCESSORS IN TRUST UNDER AGREEMENT DATED (MM/DD/YY) |

, |

||

AND ANY AMENDMENTS THERETO, OR IF THE TRUST IS TERMINATED, TO THE OWNER, OR THE ESTATE OF THE OWNER.

PLEASE PROVIDE A COPY OF THE FIRST AND LAST PAGE OF TRUST ESTABLISHING TRUSTEE AND DATE.

EITHER ONE OR BOTH OF THE FOLLOWING MAY BE SELECTED IF DESIRED.

A. POSTPONED CLAUSE - IN NO CASE SHALL ANY PAYMENT BE MADE TO ANY BENEFICIARY DESIGNATED ON THIS

FORM UNTIL MIDNIGHT OF THE 30TH DAY FOLLOWING DEATH, AND IN THE EVENT OF THE DEATH OF A BENEFICIARY DURING SUCH PERIOD, PAYMENT SHALL BE MADE IN THE SAME MANNER AS PROVIDED IN THIS FORM HAD SAID BENEFICIARY PREDECEASED THE INSURED. THIS PROVISION SHALL NOT APPLY TO A TRUSTEE.

B. PER STIRPES - IF A BENEFICIARY PREDECEASES THE INSURED, LEAVING CHILDREN WHO SURVIVE THE INSURED, THE SHARE SUCH DECEASED BENEFICIARY WOULD HAVE RECEIVED HAD SUCH BENEFICIARY SURVIVED THE INSURED SHALL BE PAID IN EQUAL SHARES TO THE SURVIVING CHILDREN OF SUCH DECEASED BENEFICIARY.

LifeSecure Insurance Company (Formerly Columbia Universal Life)

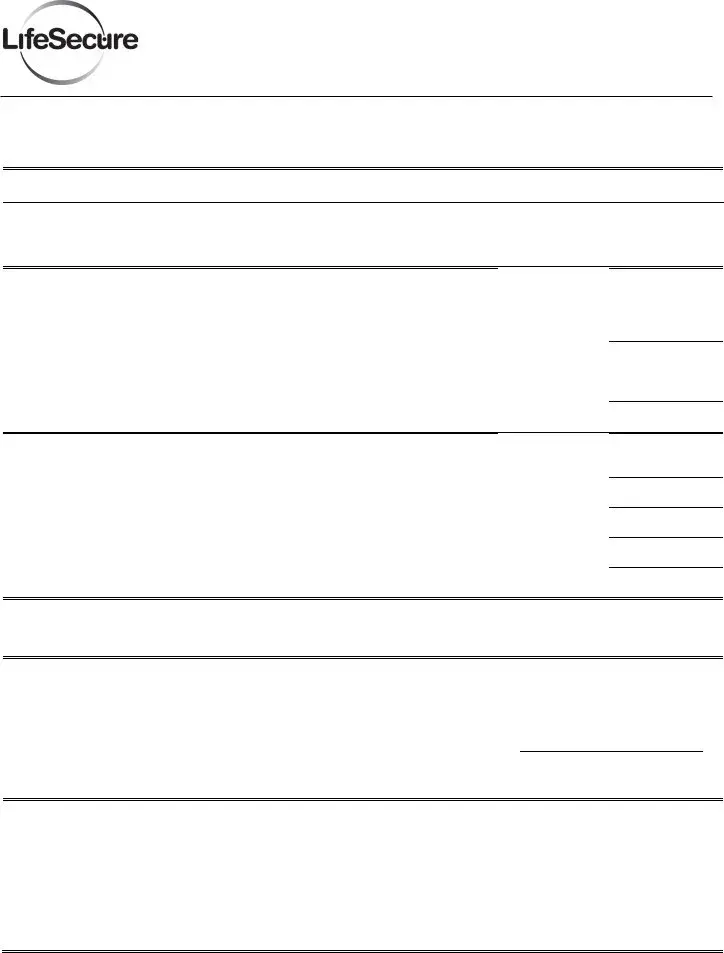

I DIRECT THAT ANY ENDORSEMENT OF THE POLICY REQUESTED BE EFFECTED BY RETURN OF THIS REQUEST WITH THE COMPANY'S ACKNOWLEDGMENT. I AGREE THAT THE COMPANY MAY WAIVE ANY POLICY PROVISION REQUIRING PRESENTATION ON THE POLICY FOR ENDORSEMENT, BUY MAY REQUIRE SUCH PRESENTATION IF DESIRED.

DATED AT |

THIS |

DAY OF |

, 20_____ |

|

|

_______________________________________________ |

|

WITNESS (PLEASE SEE BELOW*) |

|

SIGNATURE OF POLICY/CONTRACT OWNER |

|

|

|

(IF OWNED BY A COMPANY, NEED TWO SIGNATURES |

|

|

|

AND INCLUDE TITLE |

|

THE UNDERSIGNED AGREES TO THE ABOVE REQUESTS AND CHANGES |

|

||

|

|

SIGNATURE OF IRREVOCABLE BENEFICIARY (IF ANY) |

|

SIGNATURE OF ASSIGNEE, INCLUDE TITLE (IF ANY) |

|

||

FOR ADMINISTRATIVE OFFICE USE ONLY

ACKNOWLEDGMENT OF REQUEST FOR CHANGE - PLEASE ATTACH TO POLICY

THE ABOVE COMPANY HAS RECORDED THE CHANGE REQUESTED

DATED AT GREENVILLE, SOUTH CAROLINA |

|

BY |

|

|

|

*BE SURE TO HAVE THE POLICYOWNER'S SIGNATURE WITNESSED BY SOMEONE WHO IS NOT A RELATIVE OR BENEFICIARY

INSTRUCTIONS FOR CHANGING BENEFICIARY

THE FULL LEGAL NAME AND RELATIONSHIP TO THE INSURED OF EACH PRIMARY AND CONTINGENT BENEFICIARY IS TO BE CLEARLY SHOWN. FOR EXAMPLE, MARTHA BROWN SMITH (WIFE) AND NOT MRS. JOHN H. SMITH (WIFE).

IF THE POLICY IS ASSIGNED, THE ASSIGNEE MUST JOIN IN SIGNING THE CHANGE OF BENEFICIARY AGREEMENT. THE CHANGE OF BENEFICIARY AGREEMENT MUST BE DATED, AND YOUR SIGNATURE AND THAT OF THE ASSIGNEE MUST BE WITNESSED BY A RESPONSIBLE ADULT.

ALL SIGNATURES ARE TO BE IN INK. THE CHANGE WILL BE RECORDED BY US AND A COPY WILL BE RETURNED TO THE OWNER. PLEASE DO NOT SEND US YOUR POLICY.

THE POLICYOWNER REVOKES ANY PREVIOUS DESIGNATION OF BENEFICIARY AND METHOD OF SETTLEMENT FOR THE POLICY. RECORDING THE INSTRUMENT THE COMPANY AGREES, THAT THE CHANGE OF BENEFICIARY REQUESTED SHALL BECOME EFFECTIVE UPON RECEIPT AND RECORDING OF THIS PROPERLY COMPLETED FORM BY THE COMPANY, DURING THE LIFETIME OF THE INSURED, AT ITS HOME OFFICE IN AUSTIN, TEXAS; AND SUBJECT TO THE PROVISIONS OF THE POLICY.

WHEN MORE THAN ONE PRIMARY BENEFICIARY IS NAMED, PAYMENT SHALL BE MADE SHARE AND SHARE ALIKE, SURVIVORS AND SURVIVOR. THIS SIMILARLY APPLIES WHEN MULTIPLE CONTINGENT BENEFICIARIES ARE NAMED AND BECOME ENTITLED TO THE PROCEEDS OF THIS POLICY.

IF A CHANGE OF BENEFICIARY IS DESIRED ON MORE THAN ONE POLICY, COMPLETE A SEPARATE FORM FOR EACH POLICY. FOR EACH INSURED COVERED UNDER ONE POLICY, COMPLETE A SEPARATE FORM.

PLACE AN "X" IN ONLY ONE OF THE BOXES NUMBERED 1 OR 2 AND INDICATE THE DESIRED BENEFICIARY IN THE SPACE PROVIDED. IF MORE THAN ONE BOX IS MARKED, THE FORM WILL BE RETURNED FOR CLARIFICATION AND PROCESSING WILL BE DELAYED. GIVE THE FULL NAME (FIRST NAME, MIDDLE INITIAL, AND LAST NAME) AND ADDRESS OF THE DESIRED BENEFICIARY (IES) AND THE RELATIONSHIP, IF ANY, OF EACH TO THE INSURED AND THE DATE OF BIRTH. FOR DESIGNATION NUMBER 2, PROVIDE THE TRUST NAME AND GIVE THE DATE OF THE TRUST AGREEMENT.

IMPORTANT:

PLEASE PROVIDE THE NAME, ADDRESS, SOCIAL SECURITY NUMBER AND THE RELATIONSHIP TO THE INSURED FOR EACH BENEFICIARY, OR IF THE CLASS OF BENEFICIARIES IS NAMED, THE NAME OF EACH CURRENT BENEFICIARY IN THE CLASS.

Page 2 of 2 |

Form Characteristics

| Fact | Description |

|---|---|

| Administrative Office | The LifeSecure Beneficiary Change form is managed by LifeSecure Insurance Company, located at PO Box 19085 Greenville, South Carolina 29602-9085. |

| Contact Information | You can reach the administrative office via telephone at 800-880-1370 or by fax at 888-232-1676 for any inquiries regarding the form. |

| Social Security Requirement | It is important to provide the Social Security Number of both the insured and the policy owner as indicated on the form. |

| Primary and Contingent Beneficiaries | The form allows for the designation of both primary and contingent beneficiaries. In the absence of primary beneficiaries, contingent beneficiaries will receive the proceeds. |

| Property Laws | This form is regulated under the laws of South Carolina, requiring clear identification of beneficiaries and compliance with state-specific rules. |

| Process for Change | The change of beneficiary is effective once the completed form is received and recorded by the company at its home office in Austin, Texas. |

Guidelines on Utilizing Lifesecure Beneficiary Change

Completing the Lifesecure Beneficiary Change form ensures that your wishes regarding your beneficiaries are recorded accurately. Follow these steps carefully to avoid delays. After submitting the form, the insurance company will process your request, and you will receive a confirmation once the changes are made.

- Gather information: Collect the necessary details, including full legal names, social security numbers, addresses, and dates of birth for all beneficiaries.

- Fill in your information: Provide your policy or contract number, and the insured/annuitant’s name and social security number. Also, include the owner's name and social security number.

- Enter primary beneficiaries: In the designated area, list the full names, relationships to the insured, and social security numbers of each primary beneficiary. Include their addresses and dates of birth.

- Enter contingent beneficiaries: If you have contingent beneficiaries, follow the same format as above to include their information. This step is essential in case your primary beneficiaries do not survive.

- Trust beneficiary (if applicable): If designating a trust as a primary beneficiary, provide the name of the trust, trust tax ID number, and current trustee's name. Also, include the date of the trust agreement.

- Select options (if desired): Check any additional options, such as the postponed clause or per stirpes designation, if you wish to include these conditions for your beneficiaries.

- Signature requirements: Sign and date the form. If owned by a company, ensure two signatures and titles are included. Have your signature witnessed by a responsible adult, who is not a relative or beneficiary.

- Do not send your policy: You are not required to submit your policy with this form. Just send the completed beneficiary change form.

Finally, ensure that all details are accurate and clearly stated before submitting the form. This will help to expedite the processing of your request.

What You Should Know About This Form

1. What is the Lifesecure Beneficiary Change form used for?

The Lifesecure Beneficiary Change form is designed to help policyholders update their designated beneficiaries on an insurance policy. This is important to ensure that the intended individuals receive benefits in the event of the policyholder's passing. The form allows the policyholder to provide detailed information about primary and contingent beneficiaries.

2. How do I fill out the Beneficiary Change form?

To fill out the Beneficiary Change form, start by providing your personal details, including your social security number and policy number. Clearly list the full legal names, relationships to the insured, and social security numbers for all primary and contingent beneficiaries. Ensure that all names are complete and accurate to avoid any processing delays. If you are designating a trust as a beneficiary, you will need to provide the trust name and tax identification number, as well as additional documentation.

3. Is it necessary to have the form witnessed?

Yes, it is important to have the policyowner's signature witnessed by someone who is not a relative or a beneficiary. This adds an extra layer of verification to the change request and helps ensure that the form is valid. The witness should sign the form as well.

4. What happens if I designate multiple beneficiaries?

If you name more than one primary or contingent beneficiary, the policy proceeds will generally be divided equally among them. This means that each surviving beneficiary will receive an equal share of the benefits. Make sure to indicate this on the form clearly. If you are unsure about how to divide shares, consider adding a "per stirpes" designation to clarify how the benefits should be handled if a beneficiary predeceases you.

5. How is the change effective?

The change of beneficiaries becomes effective upon the insurance company’s receipt and recording of the properly completed form. This means it’s important to send the form directly to the administrative office for it to take effect. You do not need to send in your insurance policy, just the completed form.

6. What if I want to make changes on more than one policy?

If you need to change beneficiaries for multiple policies, you will need to complete a separate Beneficiary Change form for each policy. Each form must be filled out and submitted individually to ensure that all changes are processed accurately and efficiently.

Common mistakes

Filling out the Lifesecure Beneficiary Change form can be straightforward, but there are common errors that people often make which can cause delays or complications. Awareness of these mistakes can help ensure that your desired changes are processed smoothly.

First, one significant mistake is not providing the full legal name for each beneficiary. It's crucial to list names in their entirety, including first names, middle initials, and last names. For instance, writing "Martha Brown Smith (Wife)" rather than "Mrs. John H. Smith (Wife)" clarifies the identity of the beneficiary. This can prevent confusion and potential legal challenges later on.

Another error involves the relationship to the insured. People sometimes skip this section or provide vague identifiers. Clearly stating the relationship—such as "sibling," "partner," or "child"—is essential. This information helps the company process the claim and understand the dynamics involved.

Many individuals also neglect to specify the date of birth for each beneficiary. This might seem like a minor detail, but it can help verify the identity and avoid any possible disputes regarding age or eligibility related to the benefits.

One common oversight is not giving attention to the trust designation. If naming a trust as a beneficiary, it’s important to include the exact name of the trust, the tax identification number, and the current trustee’s name. Missing any of these details can lead to complications when the time comes to distribute benefits.

Additionally, people sometimes fail to check the box for either the postponed clause or the per stirpes designation. Marking one of these options indicates how payments will be handled under specific circumstances. Without a clear decision, the processing may be stalled as the company seeks clarification.

Signature errors are also frequent. All signatures must be in ink, and if the policy is owned by a company, two signatures are required along with titles. Failure to follow these instructions can result in a rejection of the form.

Lastly, many forget the importance of witnessing their signature. It is mandatory to have the policy owner's signature witnessed by a responsible adult who is neither a relative nor a beneficiary. This step ensures that the form is valid and carries the appropriate legal weight for processing.

By recognizing and avoiding these common mistakes, individuals can help ensure that their changes to the Lifesecure Beneficiary Change form are executed without unnecessary delays or complications. Proper attention to detail will facilitate a smoother process and provide peace of mind.

Documents used along the form

Along with the Lifesecure Beneficiary Change form, various other documents are often utilized to ensure a smooth process for managing policyholder details and beneficiaries. These forms help maintain clear records and facilitate communications between policyholders, insurers, and beneficiaries.

- Life Insurance Policy: This document outlines the terms of the insurance contract, detailing coverage, premiums, and other essential information. It serves as the foundation for any changes made, including beneficiary designations.

- Statement of Insurability: Used to assess an individual's health status and ensure they are eligible for coverage, this form may be required when applying for or updating a policy. It helps insurers evaluate risk based on medical history.

- Trust Documents: These documents establish a legal trust, defining its terms and beneficiaries. If a trust is named as a beneficiary, providing a copy of the trust is essential for verification and proper execution of the policy proceeds upon the insured's passing.

- Power of Attorney (POA): A POA allows someone to manage financial and legal affairs on behalf of another individual. It's critical when a policyholder wishes to grant authority to someone else to make decisions about their insurance coverage and beneficiaries.

- Change of Ownership Form: This form facilitates the transfer of policy ownership, allowing one individual or entity to take control of an insurance policy from another. It's important for instances where the original owner wants to change the policyholder while ensuring that beneficiary provisions remain intact.

Having these documents readily available can simplify the process of managing a life insurance policy. By understanding how they work together, policyholders can better navigate changes and ensure that their wishes are accurately reflected.

Similar forms

The Lifesecure Beneficiary Change form serves a critical purpose in estate planning and insurance management. It’s important to understand similar documents that also facilitate beneficiary designations and changes. Here are four such documents:

- Health Insurance Beneficiary Change Form: This document is used to designate or change the beneficiaries of a health insurance policy. Like the Lifesecure form, it identifies primary and contingent beneficiaries, ensuring clarity on who receives benefits after the policyholder’s passing. Both forms often require the policyholder’s agreement and signature to be effective.

- Retirement Account Beneficiary Designation Form: This form specifies who will inherit funds from a retirement account such as an IRA or 401(k) upon the account owner's death. Just like the Lifesecure form, it allows account owners to name multiple primary and contingent beneficiaries and may feature similar stipulations about how funds are distributed if beneficiaries predecease the account owner.

- Trust Beneficiary Designation: When creating a trust, individuals often fill out a beneficiary designation form to specify which beneficiaries will receive assets held by the trust after the grantor passes away. Similar to the Lifesecure form, it outlines the distribution process and includes provisions for contingent beneficiaries should the primary beneficiaries not survive.

- Will Document: A will outlines how a person's assets will be distributed after their passing, including life insurance policies. Though more comprehensive than the Lifesecure form, both documents name beneficiaries and allow for contingencies, ensuring that a clear directive is given regarding who receives benefits or assets.

Understanding these documents can empower individuals to take control of their estate planning and ensure that their wishes are honored in a clear and organized manner.

Dos and Don'ts

When filling out the LifeSecure Beneficiary Change form, keeping a few important guidelines in mind is essential. Here’s a list of what to do and what to avoid.

- Do provide your social security number where indicated.

- Do clearly write the full legal name and relationship of each beneficiary to the insured.

- Do ensure all signatures are in ink; no pencil or digital signatures are allowed.

- Do fill out one form for each policy if you want to make changes for multiple policies.

- Do place an “X” in only one of the beneficiary boxes to avoid confusion.

- Don't forget to have the policy owner's signature witnessed by someone not related to them.

- Don't send in your original policy with the form; only submit the completed form.

Following these tips will help ensure that your changes are processed smoothly and correctly.

Misconceptions

- Misconception 1: The Lifesecure Beneficiary Change form is only for naming a single primary beneficiary.

- Misconception 2: You do not need to provide a Social Security number for beneficiaries.

- Misconception 3: Beneficiary designations are automatic and do not require any documentation.

- Misconception 4: The form only needs to be signed by the policy owner.

- Misconception 5: You can cross out previous beneficiaries on the form.

- Misconception 6: Beneficiary designations can take effect immediately upon submission.

- Misconception 7: You can submit the form without a witness.

- Misconception 8: It is acceptable to mark multiple boxes for beneficiaries.

- Misconception 9: The form can be submitted online or via email.

- Misconception 10: Providing trust information is optional.

This is incorrect. You can assign multiple primary beneficiaries and contingent beneficiaries on the form.

Actually, it’s required to include the Social Security number for each beneficiary to ensure accurate identification.

This is not true. You must properly complete and submit the Beneficiary Change form for any changes to be effective.

The signatures of both the policy owner and, if applicable, the irrevocable beneficiary or assignee are necessary.

This should be avoided. The form requires that the policyowner revokes any prior designations clearly.

The changes become effective only once the company receives and records the properly completed form.

A witness who is not related to the policy owner or a beneficiary must sign the form to validate the signatures.

You should only check one box for either primary or contingent beneficiaries. Checking multiple boxes will delay processing.

The form must be mailed or faxed to the administrative office as indicated on the document.

If designating a trust as a beneficiary, providing the trust name and tax ID is essential for the submission to be accepted.

Key takeaways

Making changes to your beneficiary designations is an important process. Here are some key takeaways when using the LifeSecure Beneficiary Change form:

- Provide Accurate Information: Ensure you fill in the full legal name, relationship to the insured, and date of birth for each beneficiary.

- Include Social Security Numbers: Your Social Security number is required, and all beneficiaries must provide theirs as well.

- Use Full Names: Avoid abbreviations. For example, write "Martha Brown Smith (Wife)" instead of "Mrs. John H. Smith (Wife)."

- Complete Each Section: Select one primary beneficiary or trust designation only. If you mark more than one, the form will be returned for clarification.

- Witness Signatures: Have your signature witnessed by a responsible adult who is not a relative or beneficiary.

- Attach Trust Documents: If naming a trust as a beneficiary, provide a copy of the first and last page of the trust document.

- Understand Payment Distribution: Without any direction, proceeds will typically be divided equally among the primary beneficiaries who survive the insured.

- No Need to Send Policy: You do not need to return the insurance policy with this form. Simply submit the completed form.

- Processing Time: Changes will take effect once the properly completed form is received and recorded by the company.

These guidelines will help ensure your beneficiary designations are accurate and effective. It’s essential to keep your beneficiary designations updated to reflect any changes in your situation.

Browse Other Templates

College Common Application - This application form must be completed in block print for clarity.

Ga It-511 Tax Booklet - Checking relevant boxes helps clarify the nature of the business activities.