Fill Out Your Lines 20A 20B Form

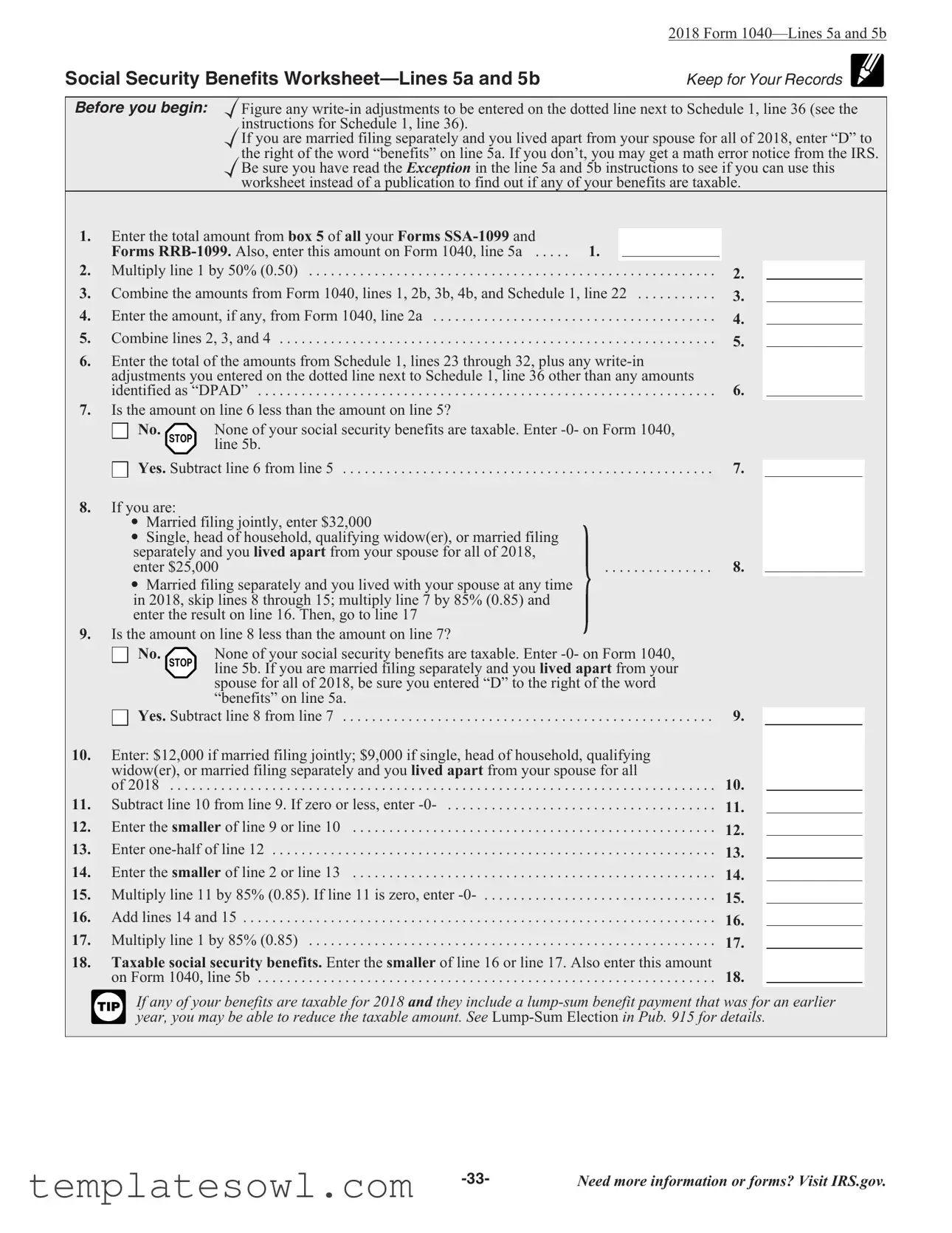

The Lines 20A and 20B form, specifically the Social Security Benefits Worksheet related to Form 1040, provides essential guidance for taxpayers regarding the taxation of Social Security benefits. This worksheet assists individuals in determining whether their Social Security benefits are taxable based on their total income. To use the form effectively, taxpayers must first report their Social Security benefits as received on the appropriate lines of the 1040 form, specifically lines 5a and 5b. The worksheet contains a structured process that involves calculating the total benefits from Social Security and Railroad Retirement Board forms, followed by a series of arithmetic operations to ascertain the portion that might be subject to taxation. Key variables for consideration include filing status and Additional Income, which trigger differing thresholds that can affect tax obligations. For single filers or qualifying widows/widowers, the threshold is set at $25,000 while for married couples filing jointly, the amount is $32,000. Those who claim marriage but lived apart for the entire year must indicate this circumstance to avoid critical errors. Completing this worksheet demands careful attention to detail, as incorrect entries may lead to notices from the IRS or other complications in the tax filing process. Furthermore, considerations such as lump-sum payments from previous years can add layers of complexity, inviting taxpayers to review specific publications for accurate reporting. Thus, Lines 20A and 20B not only facilitate compliance with tax regulations but also provide clarity around a potentially significant aspect of many taxpayers’ incomes.

Lines 20A 20B Example

Social Security Benefits

2018 Form

Keep for Your Records

Before you begin: Figure any

If you are married filing separately and you lived apart from your spouse for all of 2018, enter “D” to the right of the word “benefits” on line 5a. If you don’t, you may get a math error notice from the IRS. Be sure you have read the Exception in the line 5a and 5b instructions to see if you can use this worksheet instead of a publication to find out if any of your benefits are taxable.

1.Enter the total amount from box 5 of all your Forms

2. |

Forms |

|

||||

Multiply line 1 by 50% (0.50) |

||||||

3. |

Combine the amounts from Form 1040, lines 1, 2b, 3b, 4b, and Schedule 1, line 22 |

|||||

4. |

Enter the amount, if any, from Form 1040, line 2a |

|||||

5. |

Combine lines 2, 3, and 4 |

|||||

6. |

Enter the total of the amounts from Schedule 1, lines 23 through 32, plus any |

|||||

|

adjustments you entered on the dotted line next to Schedule 1, line 36 other than any amounts |

|||||

7. |

identified as “DPAD” |

|||||

Is the amount on line 6 less than the amount on line 5? |

||||||

|

|

|

No. |

None of your social security benefits are taxable. Enter |

||

|

|

|

||||

|

|

|

|

STOP |

line 5b. |

|

|

|

|

|

|||

|

|

|

|

|

||

8. |

|

|

Yes. Subtract line 6 from line 5 |

|||

|

|

|||||

If you are: |

|

|

||||

|

|

|

• |

Married filing jointly, enter $32,000 |

||

|

|

|

• |

Single, head of household, qualifying widow(er), or married filing |

||

|

|

|

separately and you lived apart from your spouse for all of 2018, |

|||

|

|

|

enter $25,000 |

|||

|

|

|

• |

Married filing separately and you lived with your spouse at any time |

||

|

|

|

in 2018, skip lines 8 through 15; multiply line 7 by 85% (0.85) and |

|||

9. |

|

|

enter the result on line 16. Then, go to line 17 |

|||

Is the amount on line 8 less than the amount on line 7? |

||||||

|

|

|

No. |

None of your social security benefits are taxable. Enter |

||

|

|

|

||||

|

|

|

|

STOP |

line 5b. If you are married filing separately and you lived apart from your |

|

|

|

|

|

|||

spouse for all of 2018, be sure you entered “D” to the right of the word “benefits” on line 5a.

Yes. Subtract line 8 from line 7 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

2.

3.

4.

5.

6.

7.

8.

9.

10.Enter: $12,000 if married filing jointly; $9,000 if single, head of household, qualifying

|

widow(er), or married filing separately and you lived apart from your spouse for all |

10. |

11. |

of 2018 |

|

Subtract line 10 from line 9. If zero or less, enter |

11. |

|

12. |

Enter the smaller of line 9 or line 10 |

12. |

13. |

Enter |

13. |

14. |

Enter the smaller of line 2 or line 13 |

14. |

15. |

Multiply line 11 by 85% (0.85). If line 11 is zero, enter |

15. |

16. |

Add lines 14 and 15 |

16. |

17. |

Multiply line 1 by 85% (0.85) |

17. |

18.Taxable social security benefits. Enter the smaller of line 16 or line 17. Also enter this amount

on Form 1040, line 5b . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 18.

TIP |

If any of your benefits are taxable for 2018 and they include a |

|

year, you may be able to reduce the taxable amount. See |

|

|

Need more information or forms? Visit IRS.gov. |

Form Characteristics

| Fact Name | Description |

|---|---|

| Purpose of the Form | The Lines 20A and 20B form is a worksheet designed to help individuals determine the taxable portion of their Social Security benefits for the tax year 2018. |

| Who Should Use It | This form is primarily used by taxpayers who received Social Security benefits and need to establish whether any of those benefits are taxable based on their overall income. |

| Key Instructions | Taxpayers must combine various income sources and follow specific instructions based on their filing status to calculate any taxable benefits accurately. |

| Governing Law | This form is governed by federal tax law, specifically relevant sections of the Internal Revenue Code that pertain to taxation of Social Security benefits. |

Guidelines on Utilizing Lines 20A 20B

Completing the Lines 20A and 20B form requires careful attention to detail. Follow the steps below to ensure accurate reporting of your social security benefits on your tax return.

- Gather your Forms SSA-1099 and RRB-1099, and locate the total amount from box 5 on these forms.

- Transfer this amount to line 1 of the Lines 20A and 20B form. Make sure to also enter this amount on Form 1040, line 5a.

- Multiply the amount from line 1 by 50% (0.50) and enter the result on line 2.

- Sum the amounts from Form 1040, lines 1, 2b, 3b, 4b, and Schedule 1, line 22, and enter this total on line 3.

- If there’s an amount on Form 1040, line 2a, enter it on line 4.

- Add the amounts from lines 2, 3, and 4 and write the sum on line 5.

- Total the amounts from Schedule 1, lines 23 through 32, plus any write-in adjustments next to Schedule 1, line 36 (excluding amounts labeled “DPAD”), and put this total on line 6.

- Compare the amounts on line 6 and line 5. If line 6 is less than line 5, skip to line 18. Otherwise, proceed to line 9.

- Subtract line 6 from line 5 and enter the result on line 7.

- Refer to your filing status. Input the appropriate threshold amount on line 10: $32,000 if married filing jointly; $25,000 if single or qualifying widow(er); or $9,000 if married filing separately and lived apart from your spouse for all of 2018.

- Subtract line 10 from line 9. If the result is zero or less, enter -0- on line 11.

- Write the smaller amount between line 9 and line 10 on line 12.

- Calculate and enter one-half of the amount from line 12 on line 13.

- Record the lesser amount between line 2 and line 13 on line 14.

- Multiply line 11 by 85% (0.85) and enter the result on line 15. If line 11 was zero, write -0-.

- Add lines 14 and 15 and place the total on line 16.

- Multiply the amount from line 1 by 85% (0.85) and enter that value on line 17.

- On line 18, write the smaller amount between line 16 and line 17. Also, make sure to enter this figure on Form 1040, line 5b.

After completing these steps, you will have accurately reported your taxable social security benefits. If any of your benefits include a lump-sum payment from a previous year, consider looking into the Lump-Sum Election for potentially favorable tax treatment.

What You Should Know About This Form

What is the purpose of the Lines 20A and 20B form?

The Lines 20A and 20B form is a Social Security Benefits Worksheet for completing your 2018 Form 1040. It helps determine whether any of your Social Security benefits are taxable. This worksheet guides you step-by-step through the calculations needed to report your benefits correctly on your tax return.

Who needs to use this form?

If you received Social Security benefits and are filing your federal tax return for 2018, you may need this worksheet. It's especially necessary if you are unsure if your benefits are taxable, based on your combined income and filing status.

What information do I need to complete the worksheet?

Before starting, gather all relevant documents. You’ll need Form SSA-1099 or RRB-1099, which details the total amount of Social Security benefits received. Additionally, have your Form 1040 and any other income forms handy to determine your total income and deductions required for calculations.

What does it mean if my Social Security benefits are taxable?

Taxable Social Security benefits mean that a portion of your benefits will be included in your gross income and thus subject to federal income tax. The amount that is taxable depends on your total income and filing status, as outlined in the calculations on the worksheet.

How do I know if any of my benefits are taxable?

You will follow a series of calculations on the worksheet. If your total income combined with half of your Social Security benefits exceeds certain thresholds—like $32,000 for married couples filing jointly or $25,000 for single filers—some or all of your benefits may be taxable.

What if I lived apart from my spouse for all of 2018?

If you and your spouse lived apart for the entire year and you are married filing separately, be sure to enter "D" next to the word "benefits" on line 5a. This alerts the IRS that you qualify for different treatment regarding your benefits, which can affect whether they are taxable.

What should I do if I received a lump-sum payment of benefits?

If any of your benefits were received in a lump-sum payment for an earlier year, you might be able to reduce the taxable amount. Refer to the Lump-Sum Election guidelines in IRS Publication 915 for instructions on how to handle this situation properly.

What if my calculations indicate none of my Social Security benefits are taxable?

If your calculations show that none of your benefits are taxable, you should enter -0- on Form 1040, line 5b. That's the end of the process for your Social Security benefits—no tax is owed on those amounts.

What do I do if I have further questions or need more forms?

If you need additional information or forms, visit the IRS website at IRS.gov. They provide comprehensive resources and guidance to help you navigate your tax questions and concerns. You can also find the forms you may need for your filings.

Common mistakes

Filling out the Lines 20A 20B form can be a daunting task. Many people make simple but important mistakes that could lead to an incorrect tax return. One common error occurs when individuals neglect to input the total amount from box 5 of their SSA-1099 and RRB-1099 forms. This amount is crucial, as it's the starting point for determining taxable benefits. Omitting this step can throw off all subsequent calculations and likely lead to a math error notice from the IRS.

Another frequent issue arises when filers misinterpret their marital status. For couples who are married filing separately but lived apart for the entire year, it's vital to enter a "D" next to the word "benefits" on line 5a. Forgetting to make this entry might seem minor at first glance, but it can have serious repercussions for tax calculations and eligibility for certain deductions.

Calculating amounts incorrectly is also a prime mistake. Individuals often forget to multiply line 1 by 50% before proceeding. This operation is essential to derive the correct basis for later calculations. Skipping this step leads to an inflated figure on line 2, thereby skewing the assessment of taxable benefits.

Some may overlook the importance of combining all relevant income sources on line 3. Combining amounts from other lines, namely 1, 2b, 3b, 4b, and Schedule 1, line 22, is essential for an accurate assessment. Those who bypass this step may find themselves declaring a lower income than reality, which could influence their tax brackets.

A further pitfall occurs when individuals incorrectly assess whether the total on line 6 is less than that on line 5. If the amounts are inappropriately compared, it could lead to a misunderstanding about the tax liability for Social Security benefits. Always ensure this comparison is correct to avoid entering incorrect amounts on further lines.

Another area of concern is with write-in adjustments on the dotted line next to Schedule 1, line 36. Filers sometimes fail to include these necessary values, which are vital for the accurate computation of taxable benefits. Not addressing these adjustments adequately can artificially lower the total taxable income claimed.

In addition, individuals often overlook that if they are married filing separately and lived with their spouse at any time during the tax year, they should skip lines 8 through 15. Instead, they should multiply line 7 by 85% before moving to line 17. Missing this instruction can lead to incorrect calculations and confusion about tax obligations.

Finally, it’s crucial to double-check the final declaration you’re making on Form 1040, line 5b. If the calculations leading to this point have errors, it will result in reporting the wrong taxable amount. Always perform a last review of all lines to ensure accuracy before submission. Taking these steps can smooth the filing process and prevent unnecessary complications with the IRS.

Documents used along the form

The Lines 20A and 20B forms are frequently accompanied by several other documents that provide essential information for accurately completing tax filings. Below are some of those key documents that you may encounter. Each document plays an important role in calculating your tax obligations and ensuring compliance with IRS requirements.

- Form SSA-1099: This form reports the total amount of Social Security benefits received during the tax year. It is crucial for determining any tax liability associated with those benefits.

- Form RRB-1099: Similar to the SSA-1099, this form provides information about Railroad Retirement benefits. It is necessary for those receiving benefits from the Railroad Retirement Board.

- Form 1040: This is the standard individual income tax return form used by taxpayers to report annual income, claim tax deductions, and calculate tax liabilities. Lines 5a and 5b on this form are specifically for reporting Social Security benefits.

- Schedule 1: Attached to Form 1040, this schedule is used to report additional income and adjustments to income. Understanding how to navigate this schedule can aid in preparing an accurate return.

- Publication 915: This IRS publication details the taxation of Social Security benefits. It provides guidance on determining taxable amounts and contains information on the Lump-Sum Election, which may benefit some taxpayers.

- Lump-Sum Election Documentation: If you received a lump-sum payment that includes benefits from previous years, you may need to provide specific calculations to adjust the taxable amount. This is important to potentially lower your tax liability.

- IRS Math Error Notice: If the IRS identifies discrepancies in your tax return calculations, they will send a math error notice. It is vital to keep an eye out for this notice, as it may require timely correction to avoid penalties.

Understanding the function of each of these documents can significantly ease the tax preparation process. Accessing these forms and adhering to the guidelines can help ensure that your tax obligations are met accurately and timely.

Similar forms

The Lines 20A and 20B form offers guidance on how to manage social security benefits on your tax return. It is similar to several other documents that relate to tax filings and social security calculations. Below is a list of these similar documents and a brief explanation of how they are connected.

- Form SSA-1099: This form shows the total social security benefits you received in a year. Lines 20A and 20B use this information to determine if any benefits are taxable.

- Form RRB-1099: Like the SSA-1099, this form records benefits from the Railroad Retirement Board. It is also referenced in Lines 20A and 20B for tax calculations.

- Form 1040: This is the main tax return form for individuals. Lines 20A and 20B feed into specific lines of the Form 1040, detailing how much of your social security benefits are taxable.

- Schedule 1: This schedule is used to report additional income and adjustments. Lines 20A and 20B consider adjustments made on Schedule 1 when calculating taxable benefits.

- Publication 915: This IRS publication provides detailed instructions on how to report social security benefits. Lines 20A and 20B refer to this publication for those dealing with lump-sum payments.

- Taxable Social Security Benefits Worksheet: Similar in purpose, this worksheet helps taxpayers compute their taxable benefits. It performs a similar function as Lines 20A and 20B, offering a structured approach.

- Form 8889: This form is for Health Savings Accounts (HSAs) but may involve retired individuals who also receive social security. Understanding these benefits can affect overall tax strategy.

- Form 4852: This form acts as a substitute for a missing W-2 or 1099-R. It's relevant for retirees who may need to summarize their social security income on their taxes.

- Form 2439: A form issued to investors from mutual funds that shows undistributed long-term capital gains. Retirees may use this form to understand how these gains could interact with their social security benefits.

Dos and Don'ts

When filling out the Lines 20A and 20B form, it is important to be aware of both what to do and what to avoid. The following list provides essential reminders for a successful completion.

- Do: Carefully read all instructions before starting.

- Do: Ensure you have your Forms SSA-1099 and RRB-1099 available to accurately enter the total amount from box 5.

- Do: Double-check that you have noted any write-in adjustments on the dotted line next to Schedule 1, line 36.

- Do: Calculate the amounts correctly using the specified percentages.

- Do: Enter “D” if applicable, particularly when filing separately and living apart from your spouse.

- Don’t: Leave out any amounts from previous lines, as this can lead to errors.

- Don’t: Forget to verify if your social security benefits are taxable; always refer to the provided thresholds.

- Don’t: Skip the reading of exceptions in the instructions for lines 5a and 5b.

- Don’t: Attempt to calculate tax amounts without confirming your filing status.

- Don’t: Submit the form without checking for arithmetic mistakes or missing entries.

Misconceptions

Understanding the Lines 20A and 20B form can be challenging, and there are several misconceptions that often lead to confusion. Below is a list of common misunderstandings regarding this form, along with clear explanations.

- Misconception 1: All Social Security benefits are taxable.

- Misconception 2: You can use the 20A and 20B instructions without checking the exception rules.

- Misconception 3: You don't need to report Social Security benefits if you lived apart from your spouse.

- Misconception 4: Entering “D” next to benefits on line 5a is optional for married taxpayers.

- Misconception 5: You do not need to combine amounts from multiple lines as instructed.

- Misconception 6: If your income is low, you can skip the entire process.

- Misconception 7: A lump-sum payment does not affect the taxable amount of benefits.

- Misconception 8: You can disregard adjustments on Schedule 1.

- Misconception 9: You should always use the worksheet instead of the publication.

- Misconception 10: Completing the form incorrectly has no consequences.

Not all Social Security benefits are taxable. Whether your benefits are taxable depends on your total income and filing status.

It's crucial to read the exception rules in the instructions. Skipping this step can lead to errors in calculating taxable benefits.

If you are married filing separately and lived apart for the entire year, you still need to report your Social Security benefits, even though your calculation may differ.

For married taxpayers who lived apart for the entire year, entering “D” is mandatory to prevent IRS errors.

Following the instructions to combine amounts from various lines is essential. This ensures an accurate calculation of taxable benefits.

Even with low income, you must complete the calculations to determine if any part of your benefits is taxable.

If you receive a lump-sum payment for prior years, it may impact your tax. You can check the Lump-Sum Election details for potential reductions.

Adjustments listed on Schedule 1 must be considered, as they can affect your taxable benefits calculation.

The worksheet is useful, but there are situations where publications provide important details that could benefit you.

An incorrect or incomplete form can lead to IRS notices, overpayment of taxes, or even penalties. Accuracy is essential.

By addressing these misconceptions, individuals can better navigate the complexities of Lines 20A and 20B on their tax forms. Always consult the official IRS guidelines or a tax professional if uncertainty remains.

Key takeaways

Understanding how to fill out and use the Lines 20A 20B form can significantly impact your tax filing. Here are some key takeaways to consider:

- Begin by reviewing adjustments: Before starting, identify any write-in adjustments for Schedule 1, line 36, as instructed.

- Married filing separately: If you lived apart from your spouse all year, make sure to mark “D” next to the word "benefits" on line 5a to avoid IRS math errors.

- Read the exceptions before you fill out the form. Understanding whether your benefits are taxable can save you time and effort.

- Total benefits: Start by entering the total amount from box 5 of your Forms SSA-1099 and RRB-1099 on line 1.

- Line 2 requires you to multiply the amount on line 1 by 50%. This calculation is crucial for determining your taxable amount.

- On line 3, you will combine amounts from various lines on your Form 1040, which is essential for the overall calculation.

- If you have amounts listed on Form 1040, line 2a, make sure to enter those on line 4 to keep your calculations accurate.

- Determine if any portion of your social security benefits is taxable by comparing the calculated amounts on lines 5 and 6.

- Income thresholds: If you are married filing jointly, the threshold is $32,000, while it is $25,000 for single filers or specific other statuses.

- If taxable benefits apply, follow through the calculations thoroughly, as detailed in the subsequent lines, to ensure all estimates are accurate.

- Utilize resources: If you encounter complexities, remember that the IRS website and publications offer additional guidance and information.

By carefully following these steps, you can confidently navigate the lines 20A and 20B form as part of your tax preparation process.

Browse Other Templates

Business Partner Number Florida - The return should be filed during the designated reporting period noted at the top of the form.

Drop Ship Sales Tax - This certificate streamlines the process of tracking drop shipments for accounting and regulatory purposes.

Trial Notebook - Refine your trial preparation to maximize your case's potential.