Fill Out Your List Of Creditors Form

The List of Creditors form is a critical document used in bankruptcy proceedings, serving to ensure that the information pertaining to your creditors is organized and properly formatted for the court's electronic systems. By adhering to specific guidelines when completing this form, you can help prevent delays in processing your case. This form requires that lists be typed on a single page and arranged in a single column to facilitate accurate scanning. Each entry must feature no more than five lines and should not exceed 40 characters per line. Important inhabitants of the creditor matrix, such as the Debtor and the U.S. Trustee, should be excluded, as they are automatically notified by the court. Attention to detail is essential; therefore, it is advised to avoid unnecessary markings, non-standard paper, and other formatting issues that could impede the reading of your creditor list. By following these guidelines, you can ensure that the process runs more smoothly, minimizing the likelihood of additional submissions due to scanning errors. Proper completion of the List of Creditors form ultimately plays a vital role in the success of your bankruptcy filing, allowing for a seamless communication process between you and the creditors involved.

List Of Creditors Example

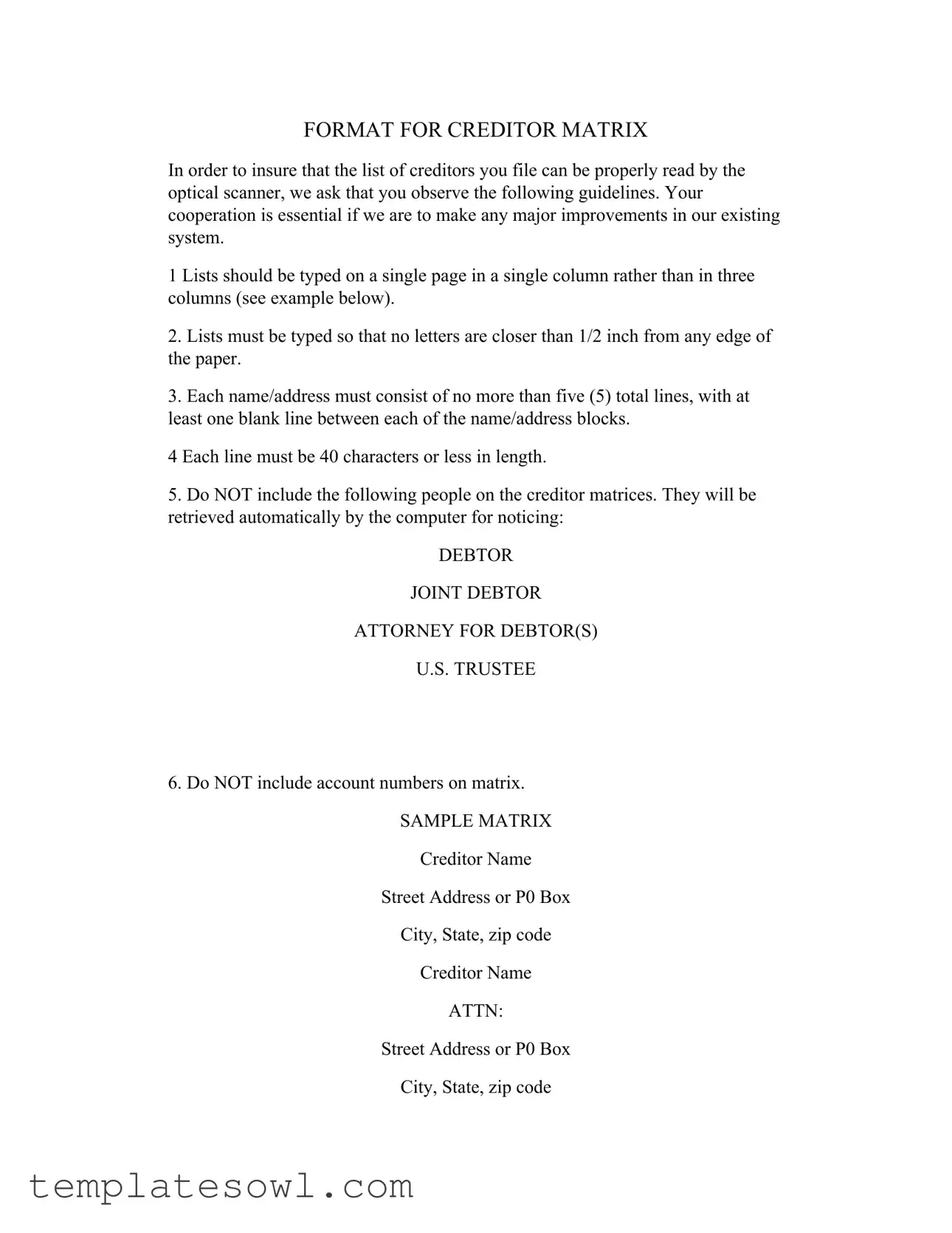

FORMAT FOR CREDITOR MATRIX

In order to insure that the list of creditors you file can be properly read by the optical scanner, we ask that you observe the following guidelines. Your cooperation is essential if we are to make any major improvements in our existing system.

1 Lists should be typed on a single page in a single column rather than in three columns (see example below).

2.Lists must be typed so that no letters are closer than 1/2 inch from any edge of the paper.

3.Each name/address must consist of no more than five (5) total lines, with at least one blank line between each of the name/address blocks.

4 Each line must be 40 characters or less in length.

5.Do NOT include the following people on the creditor matrices. They will be retrieved automatically by the computer for noticing:

DEBTOR

JOINT DEBTOR

ATTORNEY FOR DEBTOR(S)

U.S. TRUSTEE

6.Do NOT include account numbers on matrix.

SAMPLE MATRIX

Creditor Name

Street Address or P0 Box

City, State, zip code

Creditor Name

ATTN:

Street Address or P0 Box

City, State, zip code

UNITED STATES BANKRUPTCY COURT

DISTRICT OF NEW HAMPSHIRE

THINGS TO AVOID ON CREDITOR MATRIX

Although the court is using sophisticated equipment and software to insure accuracy in creditor list reading, certain problems still occur. By following these guidelines, the court will avoid delays or additional effort in mailing notices.

The following problems can prevent your lists from being read by the optical scanner, requiring you to

AVOID:

1.Extra marks on the list - such as letterhead, dates, debtor names, coffee stains, handwritten marks.

2.

8 1/2 x 11 standard paper.

3.Poor quality type caused by submitting a photocopy or carbon.

4.Stray marks should be avoided. Do not type lines, debtor names, page numbers, or anything else on the front of the creditor list Any identifying marks you choose to add can be typed on the back of the list.

5.Upper case only (all capital letters) should be avoided. Type in upper and lower case as you would on a letter.

6.Zip code must be on the last line. Nine digit zip code should be typed with a hyphen separating the two groups of digits. Do NOT type attention lines or account numbers on the last line. If you must use an attention line, it should be the second line of the name/address. (The zip code must be at the end for the zip code sorting equipment to find it.)

Form Characteristics

| Fact Name | Description |

|---|---|

| Format Guidelines | Lists should be typed on a single page in one column, not three columns. |

| Margins | No letters should be closer than 1/2 inch from any edge of the paper. |

| Line Limit | Each name/address must have no more than five lines, with a blank line between entries. |

| Character Limit | Each line of the address must not exceed 40 characters in length. |

| Exclusions | Do not include the debtor, joint debtor, attorney for debtor(s), or U.S. Trustee in the creditor list. |

| Account Numbers | Account numbers should not be included on the creditor matrix. |

| Avoid Certain Materials | Non-standard paper types and extra marks can cause issues with the optical scanner. |

| Case Format | Use upper and lower case letters instead of all capital letters for best readability. |

Guidelines on Utilizing List Of Creditors

After completing the List of Creditors form, you will need to review everything carefully before submitting it. This is essential for ensuring all creditors are accurately listed and the form meets the court's specific requirements. Keep in mind that following these guidelines will help prevent any delays in processing.

- Use 8 1/2 x 11 standard white paper for your list.

- Type your list in a single column. Avoid multi-column formatting.

- Make sure no letters are closer than 1/2 inch from any edge of the paper.

- Limit each name/address to a maximum of five lines, with at least one blank line in between each entry.

- Ensure that each line is 40 characters or less.

- Do not include the following individuals on the list: Debtor, Joint Debtor, Attorney for Debtor(s), and U.S. Trustee.

- Leave out any account numbers from your list.

- Type in upper and lower case letters, not all caps.

- Place the zip code on the last line, ensuring it follows the format of a nine-digit zip code with a hyphen separating the two groups of digits.

- If necessary, add attention lines on the second line of the name/address, but keep the zip code on the last line.

- Review your document for any stray marks, coffee stains, or non-standard paper issues.

After you complete these steps, review your List of Creditors again. Ensure it meets all requirements before you send it to the court.

What You Should Know About This Form

What is the purpose of the List of Creditors form?

The List of Creditors form is essential for filing bankruptcy. This document helps the court identify and notify all your creditors about the bankruptcy proceedings. An accurate and complete list ensures that creditors receive legal notice of the situation, which facilitates the overall process and protects your legal rights.

What guidelines should I follow when preparing the List of Creditors?

When preparing the List of Creditors, be sure to follow specific formatting guidelines. Type the list on a single page in a single column, avoiding any extra marks or non-standard paper. Each name and address block must fit within five lines, and lines should not exceed 40 characters. Remember to leave a blank line between each block. Do not include account numbers or the names of certain people, like the debtor or the attorney for the debtor, as these are generated automatically by the court’s system.

What common mistakes should I avoid with the List of Creditors?

To prevent delays, avoid common mistakes such as using non-standard paper, including handwritten marks, or submitting poor-quality copies. Ensure that you do not include any identifying marks on the front of the document; instead, place them on the back. Use both upper and lower case for text, and ensure the nine-digit zip code is correctly formatted on the last line of each address. Following these guidelines will help your list be properly scanned and processed.

What happens if I do not follow the formatting rules for the List of Creditors?

If the List of Creditors does not meet the specified formatting rules, the court may have difficulties reading it. This could lead to the requirement for you to resubmit the list in an acceptable format, causing unnecessary delays in your bankruptcy process. It is crucial to follow the guidelines meticulously to ensure a smooth and efficient procedure.

Common mistakes

Filling out the List of Creditors form can seem straightforward, but many people make mistakes that can delay their bankruptcy process. Recognizing these common pitfalls can help ensure accuracy and efficiency. One frequent error is placing creditors' names and addresses in more than one column. The guidelines stipulate that this list should be typed on a single page in a single column. Using multiple columns can confuse the optical scanner, leading to processing delays.

Another mistake involves formatting the document incorrectly. It is essential to ensure that no letters are closer than 1/2 inch from any edge of the paper. Failure to adhere to this guideline often results in crucial information being cut off, making it impossible for the court to read the form accurately.

Also, many overlook the requirement regarding the number of lines in each name/address block. Each entry must consist of no more than five lines with at least one blank line in between each block. Ignoring this rule can lead to confusion and mismanagement of creditor information.

Length is equally important. Each line in the creditor list must not exceed 40 characters. When people type longer lines, it can lead to characters being cut off in the scanning process, which may result in incomplete or incorrect records.

Omitting necessary information is another common error. A significant guideline is to avoid including certain parties such as the debtor and the U.S. Trustee on the creditor list. These entities are automatically retrieved by the computer system, and their inclusion can lead to duplicative and unnecessary entries.

While it might be tempting to include account numbers for convenience, this is also discouraged. Account numbers should never be part of the creditor matrix, as they could confuse the processing system.

In addition to these formatting issues, people often submit forms with extra marks—like letterhead, handwritten notes, or coffee stains. Such markings can hinder the optical scanner's ability to read the document, necessitating a re-submission.

The choice of paper can also affect how the scanning system reads the information. Non-standard paper—such as colored, onion skin, or half-sized paper—should be avoided. Always stick to standard 8 1/2 x 11 paper to meet the requirements.

Poor quality type can cause significant problems as well. Submitting photocopies or carbon copies often leads to unclear text that the scanner cannot accurately interpret, resulting in processing errors.

Lastly, avoid using all upper-case letters in the list. Instead, typing in upper and lower case improves the readability of the information. Likewise, the positioning of the zip code is crucial; it needs to be placed on the last line of the address with the nine-digit format displayed correctly. Attention lines or account numbers should never be on this line, as it can lead to complications in sorting and processing.

Documents used along the form

The List of Creditors form is an important document used in bankruptcy proceedings. It identifies the individuals and entities that a debtor owes money to. When filing for bankruptcy, several other forms and documents are typically required to support the petition. Below is a list of these additional forms, along with a brief description of each.

- Bankruptcy Petition: This is the primary document that initiates the bankruptcy process. It outlines the debtor's financial situation, including assets, liabilities, income, and expenses.

- Schedules of Assets and Liabilities: These schedules provide detailed information about the debtor's assets, liabilities, and any exemptions that may apply.

- Statement of Financial Affairs: This form includes a series of questions about the debtor's financial history, including income, expenses, and prior bankruptcy filings.

- Means Test Form: Used to determine eligibility for Chapter 7 bankruptcy, this form assesses the debtor's income and expenses against the median income in their state.

- Proof of Claim Form: Creditors use this form to assert their claim against the debtor's estate. It provides details on the amount owed and the basis for the claim.

- Notice of Bankruptcy Filing: This document informs creditors and interested parties of the bankruptcy filing and outlines their rights regarding the case.

- Debtor Education Certificate: Obtained after completing a financial management course, this certificate must be submitted before debts can be discharged.

- Reaffirmation Agreement: In some cases, debtors may choose to reaffirm certain debts, committing to repay them even after bankruptcy. This form outlines those agreements.

- Chapter 13 Plan: For those filing under Chapter 13, this document details how the debtor plans to repay creditors over time, typically through a payment plan.

- Local Bankruptcy Forms: Courts may require specific forms unique to their jurisdiction, which need to be completed and submitted along with other paperwork.

Each of these documents serves a crucial role in the bankruptcy process. Together, they help ensure that the case is handled efficiently and that all parties involved are informed about their rights and responsibilities. It’s essential to complete these forms accurately to avoid delays in the bankruptcy proceedings.

Similar forms

-

Creditor Contact List: This document is similar in that it serves the purpose of providing names and contact information for individuals or businesses to whom money is owed. Like the List of Creditors form, a Creditor Contact List requires clear organization and accuracy in details to ensure proper communication.

-

Formal Demand Letter: A formal demand letter often includes a list of creditors, especially when seeking repayment. It also demands specific action from the debtor, and must be carefully formatted to present a professional appearance, just as the List of Creditors requires clear presentation.

-

Debt Verification Letter: When someone disputes a debt, they may send a Debt Verification Letter requesting details about the amount owed and the creditor. This document often references the same creditors listed, thus needing accurate and clear creditor information similar to that found in the List of Creditors.

-

Bankruptcy Petition: The bankruptcy petition includes significant financial data, including a list of all creditors. This petition must follow specific formatting rules, much like those for the List of Creditors, to ensure proper processing by the court.

-

Payment Plan Agreement: This agreement outlines the terms under which a debtor agrees to pay back creditors. It usually lists creditors and emphasizes clarity and organization, similar to the meticulous format required in the List of Creditors.

-

Credit Report: A credit report reflects the credits and debts an individual has, clearly showing the creditors involved. Accuracy is crucial in both documents, as errors can lead to misunderstandings and complications.

-

Financial Disclosure Statement: This statement lists debts, assets, and incomes. Creditors are named specifically, and the formatting needs to be precise, paralleling the requirements of the List of Creditors to maintain a formal presentation.

-

Loan Application: When applying for a loan, applicants must list their existing creditors. This list must be accurate and formatted correctly to ensure the lender understands the applicant’s financial situation, akin to the expectations for the List of Creditors.

-

Notice of Default: Similar to the List of Creditors, a Notice of Default may include names of creditors to whom debts are owed. It must clearly present all details in an easily readable format to ensure that the proper parties are notified.

Dos and Don'ts

When filling out the List of Creditors form, attention to detail is vital. Here are five things to remember, as well as a few pitfalls to avoid.

- Do type your list on a single page. Use a single column format to ensure clarity.

- Do maintain proper spacing. Leave at least one blank line between each creditor's name and address.

- Do keep each line under 40 characters. This makes it easier for the scanning equipment to read your information accurately.

- Do follow the name/address guidelines. Each entry should consist of no more than five lines total.

- Do not include specific individuals. Avoid listing the debtor, joint debtor, attorney for debtor(s), and the U.S. Trustee as they will be automatically retrieved.

Now, here are some actions to avoid when preparing your submission:

- Avoid including extra marks. This includes letterhead, dates, and any other handwritten notes.

- Steer clear of using non-standard paper. Stick to the standard size of 8 1/2 x 11 inch white paper.

- Don't submit poor-quality type. Ensure your list is printed clearly and not a photocopy or carbon print.

- Refrain from adding stray marks. Type only necessary information on the front of the list.

- Keep upper case letters to a minimum. Use a mix of upper and lower case as appropriate.

Misconceptions

Misunderstandings about the List of Creditors form can lead to complications in your bankruptcy process. Here are nine common misconceptions, along with clarifications to help you navigate the requirements effectively.

- The List of Creditors must be handwritten. This is incorrect. The form should always be typed. Handwritten entries can result in readability issues and may delay your case.

- Multiple columns are acceptable for listing creditors. In reality, you must use a single column format. Using multiple columns can confuse the optical scanning equipment used by the court.

- Names and addresses can go up to any length. Each name and address must not exceed five lines and should be limited to 40 characters per line. This ensures clarity and compliance.

- There is no need to leave blank space between entries. Actually, you must provide at least one blank line between each creditor's name and address. This helps maintain organization.

- All relevant parties must be included in the creditor list. This is a misconception. Key parties such as the debtor, joint debtor, and attorney for the debtor do not need to be listed. They are automatically accounted for by the court's system.

- Account numbers should be included for identification. This is false. You should not include account numbers in your creditor matrix. Omitting this information streamlines the processing of your case.

- Any type of paper is acceptable for submission. In fact, only standard 8½ x 11-inch paper should be used. Avoid colored or non-standard paper to prevent scanning issues.

- Typos and stray marks won’t affect the submission. This could not be more wrong. Any extra marks, typos, or stray characters can lead to misreading by the optical scanner, necessitating resubmission.

- All capital letters are preferred for clarity. This is not the case. Using upper and lower case letters is important for readability. Typing in all caps can lead to confusion in the scanning process.

Understanding these misconceptions can significantly improve the accuracy of your creditor list and expedite your bankruptcy proceedings. Proper formatting and attention to detail are paramount in ensuring effective communication with the court.

Key takeaways

The List of Creditors form is a critical document in the bankruptcy process. Completing this form accurately ensures that creditors are notified appropriately. The following takeaways are essential for filling out and using the form effectively.

- Type on a single page: Lists should be typed on a single page in a single column format. Avoid using multi-column layouts to enhance readability.

- Avoid edge proximity: Ensure that no letters are closer than ½ inch from the paper's edge. This is important for the optical scanner's functionality.

- Limit name/address lines: Each name or address block must consist of no more than five total lines. At least one blank line should separate each block.

- Character length restriction: Each line of the creditor list should contain 40 characters or less. Adhering to this keeps the list organized and legible.

- Omit specific individuals: Do not include the debtor, joint debtor, attorney for debtor(s), or U.S. trustee on the creditor matrix, as these will be noted automatically by the court.

- No account numbers: Account numbers must not be included in the matrix. Their absence streamlines the notification process.

- Maintain paper standards: Use standard 8 ½ x 11 paper. Avoid non-standard types like onion skin or colored paper to prevent complications.

- Proper zip code formatting: The zip code must appear on the last line with a hyphen for a nine-digit code. Attention lines should be positioned above the zip code.

By adhering to these guidelines, the process for submitting the List of Creditors can be significantly improved, helping to ensure timely notifications and preventing delays.

Browse Other Templates

Washington Quest Card Balance - Use the activation code from your email to proceed.

Ig a - Potential hires are encouraged to approach the form with clarity and honesty for the best outcome.