Fill Out Your Llc 5 25 Form

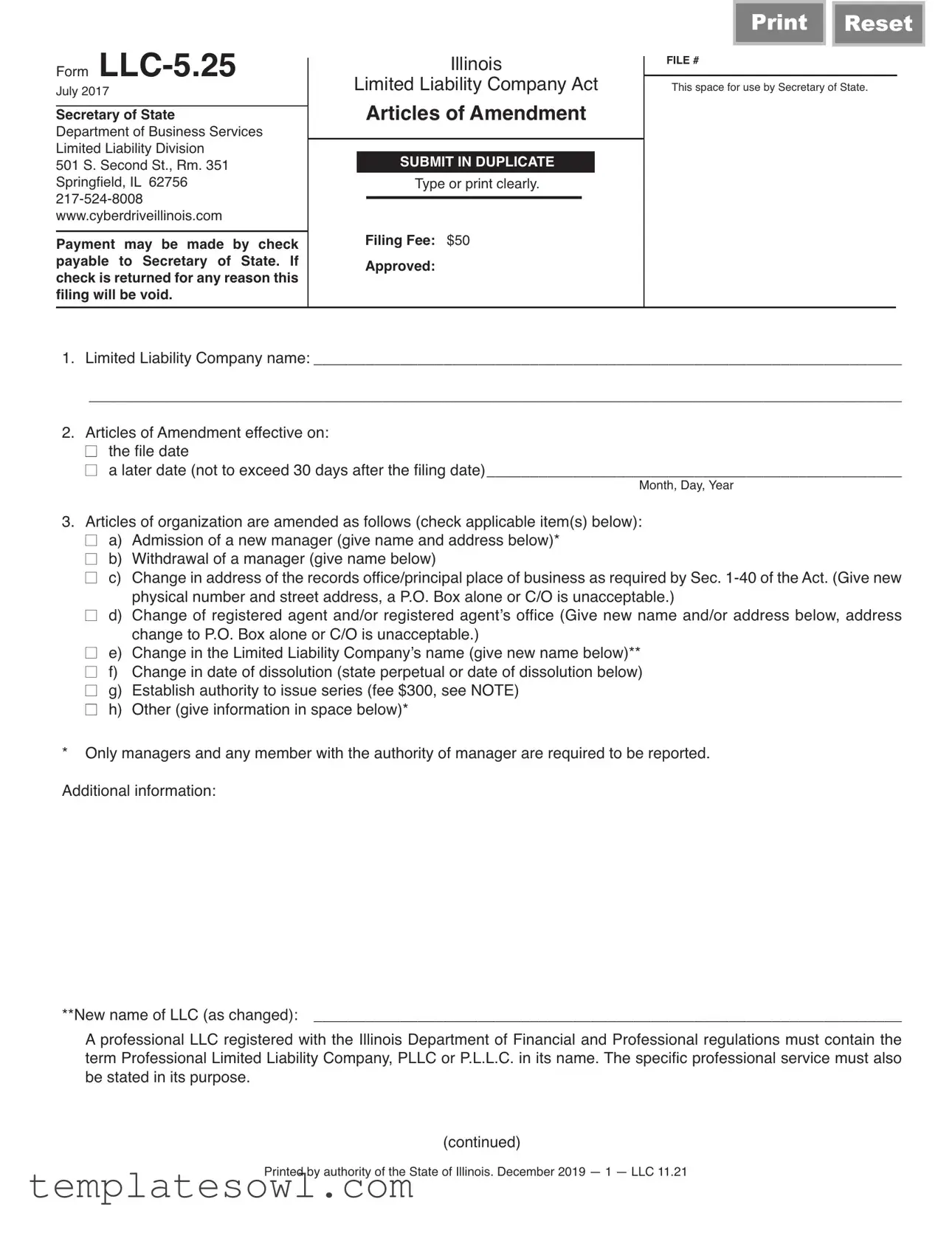

The LLC-5.25 form is a crucial document for those managing limited liability companies in Illinois. It serves as the official method for amending your LLC's organizational structure, ensuring compliance with the Illinois Limited Liability Company Act. Changes can include admitting or withdrawing a manager, updating the principal place of business, or modifying the registered agent. Notably, if you need to change the LLC’s name, this form facilitates that process as well. Keep in mind that there are specific requirements regarding the professional designation for specialized services. Each amendment requires a clear description and signature, affirming accuracy and authority under penalties of perjury. A filing fee of $50 is necessary, and timely payment is essential to avoid voiding your submission. For certain amendments, like the establishment of series, additional considerations may also apply. Whether you’re evolving your business structure or adjusting operational guidelines, filling out the LLC-5.25 form correctly ensures your LLC remains compliant and up-to-date with state requirements.

Llc 5 25 Example

Form

July 2017

Secretary of State

Department of Business Services Limited Liability Division

501 S. Second St., Rm. 351 Springfield, IL 62756

Payment may be made by check payable to Secretary of State. If check is returned for any reason this filing will be void.

Illinois

Limited Liability Company Act

Articles of Amendment

Type or print clearly.

Filing Fee: $50

Approved:

Print Reset

FILE #

This space for use by Secretary of State.

1. Limited Liability Company name: ____________________________________________________________________

______________________________________________________________________________________________

2. Articles of Amendment effective on: |

||

n |

the file date |

|

n |

a later date (not to exceed 30 days after the filing date)________________________________________________ |

|

|

|

Month, Day, Year |

3. Articles of organization are amended as follows (check applicable item(s) below): |

||

n |

a) |

Admission of a new manager (give name and address below)* |

n |

b) |

Withdrawal of a manager (give name below) |

n |

c) |

Change in address of the records office/principal place of business as required by Sec. |

n |

d) |

physical number and street address, a P.O. Box alone or C/O is unacceptable.) |

Change of registered agent and/or registered agent’s office (Give new name and/or address below, address |

||

n |

e) |

change to P.O. Box alone or C/O is unacceptable.) |

Change in the Limited Liability Company’s name (give new name below)** |

||

n |

f) |

Change in date of dissolution (state perpetual or date of dissolution below) |

n |

g) |

Establish authority to issue series (fee $300, see NOTE) |

n |

h) |

Other (give information in space below)* |

* Only managers and any member with the authority of manager are required to be reported. Additional information:

**New name of LLC (as changed): ____________________________________________________________________

A professional LLC registered with the Illinois Department of Financial and Professional regulations must contain the term Professional Limited Liability Company, PLLC or P.L.L.C. in its name. The specific professional service must also be stated in its purpose.

(continued)

Printed by authority of the State of Illinois. December 2019 — 1 — LLC 11.21

4.The amendment was approved in accordance with Section

5.I affirm, under penalties of perjury, having authority to sign hereto, that these Articles of Amendment are to the best of my knowledge and belief, true, correct and complete.

Dated: ___________________________, ______________

Month/DayYear

________________________________________________

Signature

________________________________________________

Name and Title (type or print)

________________________________________________

If applicant is signing for a company or other entity,

state name of company or entity.

NOTE:

The following paragraph is adopted when Item 3g is checked:

The operating agreement provides for the establishment of one or more series. When the company has filed a Certificate of Designation for each series, which is to have limited liability pursuant to Section

Form Characteristics

| Fact Name | Description |

|---|---|

| Form Identification | The LLC-5.25 is the official form for Articles of Amendment for Limited Liability Companies in Illinois. |

| Governing Law | This form is governed by the Illinois Limited Liability Company Act. |

| Filing Fee | The filing fee for submitting the LLC-5.25 is $50. |

| Filing Method | Payment can be made by check, which must be payable to the Secretary of State. |

| Return Check Consequence | If a submitted check is returned for any reason, the filing will become void. |

| Amendment Approval | The amendment must be approved according to Section 5-25 of the Illinois Limited Liability Company Act. |

| Effective Date Options | The Articles of Amendment can be effective on the filing date or a later date, not exceeding 30 days after filing. |

| Series Establishment Fee | A fee of $300 applies when establishing authority to issue series within the LLC. |

Guidelines on Utilizing Llc 5 25

After completing the LLC-5.25 form, submit it to the Secretary of State’s office in Illinois. Ensure all information is accurate to prevent any issues with processing your amendment. Keep copies of everything for your records.

- First, clearly print the name of your Limited Liability Company (LLC) at the top of the form.

- Indicate the effective date for the Articles of Amendment. You can choose either the file date or a later date, which cannot exceed 30 days from the filing date.

- In the next section, check the applicable item(s) for the amendments. Choose from options such as admitting a new manager, withdrawing a manager, changing the address, or updating the LLC's name, among others.

- If applicable, provide the specific details for each item you checked. For example, if you are changing the address, you need to write the new address clearly.

- Confirm that the amendment complies with Section 5-25 of the Illinois Limited Liability Company Act.

- Date the form by entering the month, day, and year.

- Sign the form where indicated. If someone is signing on behalf of the LLC, include their name and title.

- If applicable, include the name of the company or entity if the signer is authorized to act on behalf of the LLC.

Once you have filled out the form completely, review it for accuracy. After that, mail it to the Secretary of State along with the payment of the filing fee. If you chose to pay by check, make it payable to the Secretary of State.

What You Should Know About This Form

What is the purpose of the LLC-5.25 form?

The LLC-5.25 form is used in Illinois to make changes to an existing Limited Liability Company (LLC). This form allows you to amend your LLC's articles of organization. Common reasons for filing this form include adding or withdrawing managers, changing the registered agent, updating the principal place of business, or changing the LLC’s name. It is essential for maintaining accurate records with the Secretary of State.

What are the filing fees associated with the LLC-5.25 form?

The filing fee for the LLC-5.25 form is $50. When submitting the form, payment can be made via check, which must be made out to the Secretary of State. Be cautious because if your check bounces for any reason, the filing will become void, and you will need to re-submit it.

How long does it take for the amendment to become effective?

The article of amendment will become effective either on the file date or on a later date you specify, provided it is within 30 days of the filing date. If you leave this section unfilled, the default is the file date. It's crucial to plan accordingly to ensure that any changes are recognized when needed.

Who can sign the LLC-5.25 form?

The form must be signed by someone with authority, typically a manager or a member with managerial authority. You will also need to include your title and ensure that the information provided is accurate to the best of your knowledge. This signature affirms the legality of the amendment and its compliance with the Illinois Limited Liability Company Act.

Common mistakes

Filling out the LLC-5.25 form can be a straightforward process, but many individuals make common mistakes that can cause delays or complications in the amendment of their Limited Liability Company. Understanding these mistakes can save time and ensure smoother progression in the filing process.

One frequent error is illegibility due to unclear handwriting. When completing the form, it is crucial to type or print clearly. Illegible entries can lead to misunderstandings or rejections. This is particularly important in sections that require specific dates or names. Double-checking for clarity before submission can help avoid unnecessary problems.

Another mistake often made involves the selection of the amendment items. Individuals sometimes forget to check the appropriate boxes in Section 3. Omitting critical items or mistakenly checking options that do not apply can lead to inaccurate filings. It is essential to carefully review the choices and ensure that all relevant amendments are selected correctly.

Additionally, failing to indicate a correct effective date for the articles of amendment is a common blunder. In Section 2, applicants need to choose whether the amendments take effect on the filing date or a later specified date. Not providing a clear indication can create confusion, leading to delays in processing. Always confirm the effective date before finalizing the submission.

Lastly, a significant mistake is not signing the form or providing the proper title. Legal documents require a signature from an authorized person, typically a manager or member of the LLC. If the form lacks a signature or if the signatory does not include their title or the name of the company they represent, the filing may be considered incomplete. Always ensure the form is signed at the appropriate section.

Documents used along the form

When filing the LLC-5.25 form to amend your Limited Liability Company (LLC) articles in Illinois, there are several other forms and documents that might be necessary or useful to complete your filing effectively. Each document serves a specific purpose and plays a critical role in ensuring compliance with state regulations.

- LLC Articles of Organization: This is the foundational document that establishes your LLC. It outlines key details about your business, including its name, address, and the management structure.

- Operating Agreement: An internal document that details the ownership and operating procedures of the LLC. While it is not required to be filed with the state, having an operating agreement is essential for managing your LLC's operations and resolving conflicts among members.

- Certificate of Good Standing: This document certifies that your LLC is compliant with state regulations and has fulfilled all necessary filings. A Certificate of Good Standing may be required by banks or partners as proof of legitimacy.

- Registered Agent Consent Form: If you are changing your registered agent, this form confirms the new agent's consent to act on behalf of the LLC. This ensures there is a reliable point of contact for legal documents.

- Illinois Business Tax Registration: Depending on your business activities, you may need to register for various state taxes. This registration is crucial for compliance and to avoid any legal issues related to tax obligations.

- LLC Annual Report: Depending on your state's regulations, you may need to file an annual report to maintain good standing. This document provides updated details about your LLC and confirms that your business is still operating in compliance with state laws.

Being aware of these additional forms and documents can significantly ease the process of amending your LLC's articles. Attention to detail and prompt filing of all necessary paperwork will aid in maintaining compliance and protecting your business interests.

Similar forms

- Form LLC-1.55: Articles of Organization - This document establishes a Limited Liability Company (LLC) in Illinois, detailing its name and structure. It serves as the foundational form, whereas the LLC 5.25 amends existing details.

- Form LLC-1.40: Articles of Dissolution - This form formally dissolves an LLC, documenting the end of its legal existence. Unlike the LLC 5.25, which amends current articles, the LLC 1.40 represents a final action.

- Form LLC-1.20: Application for Certificate of Good Standing - This document certifies that an LLC is compliant with state requirements. It may accompany amendments to demonstrate ongoing compliance after changes are made via the LLC 5.25.

- Form LLC-4.15: Reservation of Limited Liability Company Name - This form allows a business to reserve an LLC name prior to registration. Its purpose is proactive, contrasting with the reactive nature of the LLC 5.25, which modifies existing information.

- Form LLC-5.30: Articles of Conversion - This document is used when converting an entity type to an LLC. It shares purpose similarities with the LLC 5.25, as both can change structural elements of a business.

- Form LLC-5.10: Certificate of Amendment - Similar to the LLC 5.25, this document amends the original articles, including changes to the company’s name or structure. However, it handles other types of entities outside of LLCs.

- Form LLC-5.35: Statement of Change of Registered Agent - This form specifically updates the registered agent's details. While it focuses on one aspect, the LLC 5.25 can address several changes simultaneously.

Dos and Don'ts

When filling out the LLC-5.25 form, keep these important do's and don'ts in mind:

- Do type or print clearly to avoid confusion.

- Do ensure payment of the $50 filing fee is included with your submission.

- Do accurately provide the new name of the LLC if it is changing.

- Do check all applicable amendments to ensure proper filing.

- Don't use a P.O. Box alone for the address; a physical address is required.

- Don't sign the form unless you have the authority to do so.

Misconceptions

Understanding the LLC 5 25 form is crucial for compliance and effective business management. Here are six common misconceptions:

- The form is only for changing the company name. Many believe the LLC 5 25 is solely for name changes. In reality, it encompasses various amendments, including changes in management, addresses, and more.

- Filing is optional if there are no changes. Some think they can ignore the LLC 5 25 if no amendments are needed. However, regular updates ensure compliance with state regulations and help maintain good standing.

- Amendments take a long time to process. There is a belief that the approval process is excessively slow. Generally, as long as the form is filed correctly and completely, amendments are processed efficiently by the state.

- A single amendment can address multiple changes. Many assume they must file separate forms for each amendment. In fact, several amendments can be included on the same form, simplifying the process.

- You can send any payment method for the filing fee. Some individuals think that payment methods other than checks are acceptable. The form specifically states that payment must be made by check payable to the Secretary of State.

- Using a P.O. Box is always acceptable for addresses. It’s a misconception that P.O. Boxes can be used as a principal place of business address. The form requires a physical street address, as a P.O. Box alone is unacceptable.

Being aware of these misconceptions can help ensure that your amendments are filed correctly and on time.

Key takeaways

The following are key takeaways regarding the completion and usage of the LLC-5.25 form:

- The form is used for amending the Articles of Organization of a Limited Liability Company in Illinois.

- A filing fee of $50 is required when submitting the form.

- Clearly type or print all information to ensure readability.

- Amendments can be effective on the date of filing or a specified later date, not exceeding 30 days after the filing.

- Several types of amendments can be made, including changes in management, registered agent, principal office address, and company name.

- If the name of the LLC is changed, it must comply with the requirements for a professional LLC, if applicable.

- A statement affirming the accuracy of the information must be signed under penalties of perjury.

- Only managers or any member with management authority must be reported for specific changes.

- If establishing a series within the LLC, additional fees may apply and a Certificate of Designation must be filed.

- Payments are to be made via check, payable to the Secretary of State. Returned checks will void the filing.

These points highlight the essential information necessary for completing the LLC-5.25 form efficiently and correctly.

Browse Other Templates

Who Is Exempt From Ifta - The declaration section confirms that the applicant agrees to comply with all reporting and payment requirements.

Genealogy Research Forms - Each family’s unique story is honored with the detail this form captures.