Fill Out Your Loan Estimate Form

The Loan Estimate form is a crucial document in the home-buying process, serving as a financial blueprint for prospective borrowers. Designed to enhance transparency, it details key components of the loan being considered, such as the loan amount, interest rate, and monthly payments. Borrowers can find essential information regarding closing costs and the anticipated cash required to close the loan. The form compares expected payments over time, separates loan costs from other associated fees, and highlights the ultimate impact on monthly budgeting. It also includes vital comparisons, enabling borrowers to evaluate the financial commitments of the loan against others they may be considering. Furthermore, the Loan Estimate outlines important loan features, such as whether there are any prepayment penalties or balloon payments. By providing a comprehensive outlook on the financial implications of taking out a loan, the Loan Estimate empowers borrowers to make informed decisions as they embark on their homeownership journey.

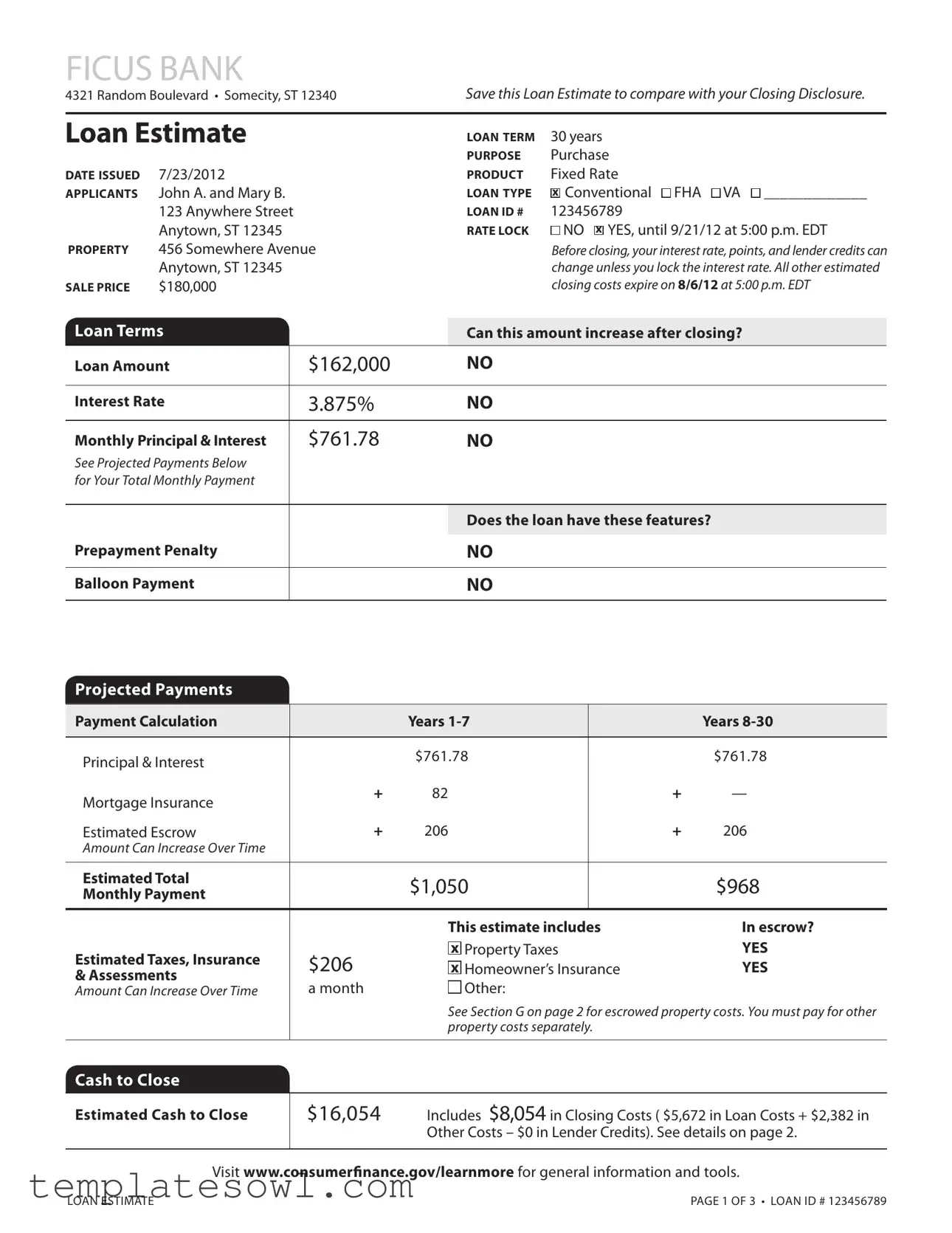

Loan Estimate Example

FICUS BANK

4321 Random Boulevard • Somecity, ST 12340Save this Loan Estimate to compare with your Closing Disclosure.

Loan estimate |

LOAN TeRM |

30 years |

|

|

|

PuRPOse |

Purchase |

DATe IssueD |

7/23/2012 |

PRODuCT |

Fixed Rate |

APPLICANTs |

John A. and Mary B. |

LOAN TyPe |

x Conventional FHA VA _____________ |

|

123 Anywhere Street |

LOAN ID # |

123456789 |

|

Anytown, ST 12345 |

RATe LOCK |

NO x YES, until 9/21/12 at 5:00 p.m. EDT |

PROPeRTy |

456 Somewhere Avenue |

|

Before closing, your interest rate, points, and lender credits can |

|

Anytown, ST 12345 |

|

change unless you lock the interest rate. All other estimated |

sALe PRICe |

$180,000 |

|

closing costs expire on 8/6/12 at 5:00 p.m. EDT |

Loan Terms |

|

Can this amount increase after closing? |

Loan Amount |

$162,000 |

NO |

|

|

|

Interest Rate |

3.875% |

NO |

|

|

|

Monthly Principal & Interest |

$761.78 |

NO |

See Projected Payments Below |

|

|

for Your Total Monthly Payment |

|

|

|

|

|

|

|

Does the loan have these features? |

Prepayment Penalty |

|

|

|

NO |

|

|

|

|

Balloon Payment |

|

NO |

|

|

|

Projected Payments

Payment Calculation |

|

years |

|

|

years |

|

|

|

|

|

|

Principal & Interest |

|

$761.78 |

|

|

$761.78 |

|

|

|

|

|

|

Mortgage Insurance |

+ |

82 |

|

+ |

— |

|

|

|

|

|

|

Estimated Escrow |

+ |

206 |

|

+ |

206 |

Amount Can Increase Over Time |

|

|

|

|

|

|

|

|

|

|

|

estimated Total |

|

$1,050 |

|

|

$968 |

Monthly Payment |

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

This estimate includes |

|

In escrow? |

|

estimated Taxes, Insurance |

$206 |

x Property Taxes |

|

yes |

|

x Homeowner’s Insurance |

|

yes |

|||

& Assessments |

|

||||

a month |

Other: |

|

|

||

Amount Can Increase Over Time |

|

|

|||

|

|

See Section G on page 2 for escrowed property costs. You must pay for other |

|||

|

|

property costs separately. |

|

|

|

|

|

|

|

|

|

Cash to Close |

|

|

|

|

|

|

|

|

|

||

estimated Cash to Close |

$16,054 |

Includes $8,054 in Closing Costs ( $5,672 in Loan Costs + $2,382 in |

|||

|

|

Other Costs – $0 in Lender Credits). See details on page 2. |

|||

|

|

|

|

|

|

Visit www.consumerinance.gov/learnmore for general information and tools.

LOAN ESTIMATE |

page 1 of 3 • Loan ID # 123456789 |

Closing Cost Details

Loan Costs

A. Origination Charges |

$1,802 |

.25 % of Loan Amount (Points) |

$405 |

Application Fee |

$300 |

Underwriting Fee |

$1,097 |

Other Costs

e. Taxes and Other Government Fees |

$85 |

||||||

Recording Fees and Other Taxes |

|

|

$85 |

||||

Transfer Taxes |

|

|

$0 |

||||

|

|

|

|

|

|

|

|

F. Prepaids |

|

|

$867 |

||||

Homeowner’s Insurance Premium ( |

6 months) |

$605 |

|||||

|

|

|

|

|

|

|

|

Mortgage Insurance Premium ( 0 |

months) |

$0 |

|||||

|

|

|

|

|

|

||

Prepaid Interest ( $17.44 per day for 15 days @ 3.875%) |

$262 |

||||||

Property Taxes ( 0 months) |

|

|

$0 |

||||

|

|

|

|

|

|

|

|

B. services you Cannot shop For |

$672 |

Appraisal Fee |

$405 |

Credit Report Fee |

$30 |

Flood Determination Fee |

$20 |

Flood Monitoring Fee |

$32 |

Tax Monitoring Fee |

$75 |

Tax Status Research Fee |

$110 |

G. Initial escrow Payment at Closing |

|

|

$413 |

|

Homeowner’s Insurance |

$100.83 per month for |

23mo. $202 |

||

Mortgage Insurance |

per month for |

0 |

mo. |

|

Property Taxes |

$105.30 per month for |

2 |

mo. |

$211 |

H. Other |

$1,017 |

Title – Owner’s Title Policy (optional) |

$1,017 |

C. services you Can shop For |

$3,198 |

Pest Inspection Fee |

$135 |

Survey Fee |

$65 |

Title – Insurance Binder |

$700 |

Title – Lender’s Title Policy |

$535 |

Title – Title Search |

$1,261 |

Title – Settlement Agent Fee |

$502 |

D. TOTAL LOAN COsTs (A + B + C) |

$5,672 |

I. TOTAL OTHeR COsTs (e + F + G + H) |

$2,382 |

|

|

J. TOTAL CLOsING COsTs |

$8,054 |

|

|

D + I |

$8,054 |

Lender Credits |

$0 |

Calculating Cash to Close |

|

|

|

Total Closing Costs (J) |

$8,054 |

Closing Costs Financed (Included in Loan Amount) |

$0 |

Down Payment/Funds from Borrower |

$18,000 |

Deposit |

– $10,000 |

Funds for Borrower |

$0 |

Seller Credits |

$0 |

Adjustments and Other Credits |

$0 |

estimated Cash to Close |

$16,054 |

|

|

LOAN ESTIMATE |

page 2 of 3 • Loan ID # 123456789 |

Additional Information About This Loan

LeNDeR NMLs/LICeNse ID

LOAN OFFICeR

NMLs ID

PHONe

Ficus Bank

Joe Smith 12345 joesmith@icusbank.com

MORTGAGe BROKeR NMLs/LICeNse ID LOAN OFFICeR NMLs ID

eMAIL PHONe

Comparisons |

use these measures to compare this loan with other loans. |

||

|

|

|

|

In 5 years |

$56,582 |

Total you will have paid in principal, interest, mortgage insurance, and loan costs. |

|

$15,773 |

Principal you will have paid of. |

||

|

|||

|

|

|

|

Annual Percentage Rate (APR) |

4.494% |

Your costs over the loan term expressed as a rate. This is not your interest rate. |

|

|

|

|

|

Total Interest Percentage (TIP) |

69.447% |

The total amount of interest that you will pay over the loan term as a |

|

|

|

percentage of your loan amount. |

|

|

|

|

|

Other Considerations

Appraisal |

We may order an appraisal to determine the property’s value and charge you for this |

|

appraisal. We will promptly give you a copy of any appraisal, even if your loan does not close. |

|

You can pay for an additional appraisal for your own use at your own cost. |

Assumption |

If you sell or transfer this property to another person, we |

|

will allow, under certain conditions, this person to assume this loan on the original terms. |

|

x will not allow this person to assume this loan on the original terms. |

Homeowner’s |

This loan requires homeowner’s insurance on the property, which you may obtain from a |

Insurance |

company of your choice that we ind acceptable. |

Late Payment |

If your payment is more than 15 days late, we will charge a late fee of 5% of the monthly |

|

principal and interest payment. |

Reinance |

Reinancing this loan will depend on your future inancial situation, the property value, and |

|

market conditions. You may not be able to reinance this loan. |

servicing |

We intend |

|

to service your loan. If so, you will make your payments to us. |

|

x to transfer servicing of your loan. |

Conirm Receipt

By signing, you are only conirming that you have received this form. You do not have to accept this loan because you have signed or received this form.

Applicant Signature |

Date |

Date |

LOAN ESTIMATE |

page 3 of 3 • Loan ID #123456789 |

Form Characteristics

| Fact Name | Fact Description |

|---|---|

| Loan Term | The Loan Estimate indicates a term of 30 years for the mortgage. |

| Issuance Date | This Loan Estimate was issued on July 23, 2012. |

| Property Details | The property referenced is located at 456 Somewhere Avenue, Anytown, ST 12345. |

| Interest Rate | The estimated interest rate for the loan is 3.875%. |

| Monthly Payment | The estimated monthly payment includes principal and interest totaling $761.78. |

| Estimated Cash to Close | Estimated cash to close is $16,054, which includes $8,054 in closing costs. |

| State-Specific Law | In some states, loan disclosure laws may apply. For example, California's Civil Code Section 2602 outlines disclosure requirements. |

Guidelines on Utilizing Loan Estimate

Completing the Loan Estimate form is an important step in your home financing journey. This document provides you with critical information about your loan terms and associated costs, allowing you to make informed comparisons with other loan offers. When filling out this form, accuracy is key to ensuring you can effectively evaluate your mortgage options.

- Personal Information: Enter your full names (e.g., John A. and Mary B.), as well as any other applicants if necessary.

- Loan Details: Fill in the purpose of the loan (e.g., Purchase), loan type (e.g., Conventional), and the loan amount (e.g., $162,000).

- Property Information: Insert the address of the property you are purchasing (e.g., 456 Somewhere Avenue, Anytown, ST 12345).

- Loan Term and Product: Specify the loan term (e.g., 30 years) and the product type (e.g., Fixed Rate).

- Rate Lock: Indicate whether you have locked the interest rate (e.g., Yes, until 9/21/12 at 5:00 p.m. EDT).

- Projected Payments: Calculate and fill in the monthly principal and interest payment (e.g., $761.78) as well as the estimated taxes and insurance costs (e.g., $206).

- Cash to Close: Enter the estimated cash to close (e.g., $16,054), including a breakdown of closing costs.

- Closing Cost Details: Provide details of different categories of closing costs, including origination fees, services you cannot shop for, and prepaids.

- Additional Information: Fill out lender information, including the lender’s name (e.g., Ficus Bank), loan officer’s contact, and any necessary NMLS or license IDs.

- Sign and Date: Once the form is completed, sign and date the document to acknowledge you have received it.

After you have filled out the Loan Estimate form, review the information carefully. This overview will guide you as you consider different mortgage options and their costs. It serves not only to inform you but also to assist in any discussions with lenders.

What You Should Know About This Form

What is a Loan Estimate form?

A Loan Estimate form is a document that lenders must provide to you within three business days of receiving your mortgage application. It outlines the key features of your loan, including estimated interest rates, monthly payments, and closing costs. This form helps you understand the financial aspects of your mortgage so you can make informed decisions.

Why is the Loan Estimate form important?

The Loan Estimate is important because it gives you a clear overview of what to expect from your loan. It allows you to compare offers from different lenders, ensuring you find the best terms and costs. By saving this form, you can also compare it with your Closing Disclosure, which you will receive before closing on your home.

Can the loan amount increase after closing?

No, the loan amount cannot increase after closing. The amount listed in the Loan Estimate reflects the total you'll be responsible for when fulfilling your loan agreement. However, other costs related to your mortgage may change over time.

What does the estimated monthly payment include?

The estimated monthly payment includes principal and interest, as well as any mortgage insurance and property taxes. You may also have additional costs like homeowner’s insurance that are accounted for in the escrow. The Loan Estimate provides a total monthly payment to help you budget effectively.

How can I lock my interest rate?

You can lock your interest rate by contacting your lender and requesting a rate lock. If your lender agrees, the interest rate will be secured for a specified period, which means it won’t change before closing, regardless of market conditions.

What happens if my monthly payment is late?

If your monthly payment is more than 15 days late, a late fee of 5% of your principal and interest payment will be charged. It's crucial to keep track of your payment dates to avoid these additional costs.

Can I sell my home and transfer the loan?

Yes, you can sell your home, and under certain conditions, the new buyer may assume your loan on the same terms. However, not all loans allow this feature, so you should review your Loan Estimate for specific terms regarding assumption.

Are there any prepayment penalties?

No, this loan does not have a prepayment penalty. That means you can pay off your loan early without incurring extra fees. This can be a beneficial option if you decide to pay off your mortgage ahead of schedule.

What are lender credits?

Lender credits are amounts that the lender offers to help cover your closing costs. In the Loan Estimate provided, there are $0 in lender credits, which means you’ll need to cover the full estimated closing costs out-of-pocket.

Where can I get more information about my loan?

You can visit www.consumerinance.gov/learnmore for more information and resources related to your loan. This website provides educational materials that can help you better understand how mortgages work and what to expect during the loan process.

Common mistakes

When filling out the Loan Estimate form, mistakes can lead to misunderstandings and potentially costly consequences. Here are seven common errors to avoid.

First, many applicants fail to double-check the loan terms. It's crucial to ensure the information matches what was discussed with the lender. For example, the interest rate or loan term may differ, leading to unexpected changes in monthly payments. Review each section carefully to avoid discrepancies.

Second, misunderstanding the estimated costs can create confusion. The Loan Estimate breaks down various fees, including loan costs and other costs. Applicants sometimes overlook items like the application fee or appraisal fee. Make sure to read through the cost breakdown thoroughly to avoid surprises at closing.

Third, failing to lock in the interest rate presents another common mistake. The rate can change unless you lock it with the lender. If you leave this unchecked, you could end up with a higher payment than originally intended. Confirm your rate lock status and understand its implications.

Fourth, not assessing the total estimated cash to close can lead to financial strain. This amount includes your down payment and closing costs. If applicants do not account for all the elements, they may find themselves short on funds come closing day. Make sure you have a clear picture of what you will need.

Fifth, some applicants neglect to consider future costs associated with the loan, such as property taxes and insurance. These ongoing expenses can significantly affect monthly budgeting. Review any asterisks or notes that indicate potential increases in estimated payments over time.

Sixth, misunderstandings regarding assumptions of the loan are frequent. If the property is sold, sometimes the loan may not be assumable by a buyer. It’s important to understand this feature, as it could impact future financial plans. Take time to review the assumptions section closely.

Finally, applicants often misinterpret the purpose of signing the Loan Estimate. Signing does not mean you are committed to the loan. It simply indicates that you have received the document. Being clear about what your signature means can help avoid unnecessary pressure to move forward.

Avoiding these common mistakes can enhance your experience with the Loan Estimate form. Attention to detail will help ensure you make informed decisions about your loan.

Documents used along the form

When you receive a Loan Estimate, it is important to understand that several other forms and documents accompany the loan process. These documents provide valuable information and clarify terms and responsibilities associated with your loan. Below is a list of common forms that you may encounter.

- Closing Disclosure: This document provides detailed information about the final terms of your loan, including costs related to closing. It must be provided to you at least three days before your closing date.

- Loan Application (1003 Form): This is a standard form used to apply for a mortgage. It gathers basic financial information about you, such as income, assets, and liabilities.

- Good Faith Estimate (GFE): A form that describes the loan terms and estimated closing costs, ensuring transparency prior to receiving the Loan Estimate. It is used mainly for comparison purposes.

- Borrower’s Certification and Authorization: This document confirms your identity and allows lenders to verify your financial information during processing and underwriting.

- Property Appraisal Report: An independent assessment of the property’s value, which helps ensure that the loan amount does not exceed the home's worth.

- Title Insurance Commitment: This document outlines the insurance coverage for potential defects in the title to the property. It protects against potential financial loss from claims against the property.

- Homeowner’s Insurance Policy: A policy that covers damage to your home and liability in case of accidents. Lenders typically require proof of this insurance before closing.

- Loan Estimate Comparison Chart: A tool that allows you to compare different loan offers side by side, highlighting key differences in rates and terms.

- First Payment Letter: A notice that provides details regarding your first mortgage payment, including the due date and payment amount.

- Escrow Account Disclosure: This form details how escrow accounts will function, including payment of property taxes and homeowners insurance, which are typically included in your monthly mortgage payment.

These documents are important in understanding the overall financial commitment and obligations involved in taking out a loan. By reviewing them carefully, you will have a clearer idea of what to expect throughout the loan process.

Similar forms

- Closing Disclosure: Like the Loan Estimate, this document provides a summary of the costs associated with the purchase of a home. It includes the final closing costs and loan terms, allowing for comparison with the Loan Estimate to check for any discrepancies.

- Good Faith Estimate (GFE): This document, often used for loans prior to the implementation of the Loan Estimate, lists the estimated costs of a loan, similar in intent to inform borrowers of expected closing costs.

- Mortgage Loan Application (Form 1003): This application form collects detailed information about the borrower's financial status, property information, and loan type. It complements the Loan Estimate by giving lenders a full picture of the borrower's qualifications.

- Truth in Lending Disclosure (TIL): This disclosure outlines the loan terms, including the Annual Percentage Rate (APR) and total interest paid over the life of the loan, similar to the Loan Estimate's comparisons section.

- Pre-Approval Letter: This document indicates that a lender has evaluated a borrower's creditworthiness and is willing to issue a loan up to a certain amount, similar to how the Loan Estimate indicates potential loan details.

- Loan Commitment Letter: This letter from a lender confirms they are willing to provide the specified loan amount under certain conditions. It provides clarity about the loan terms as the Loan Estimate does.

- Disclosure for Borrowers Rights: This document informs borrowers of their rights throughout the mortgage process, ensuring they are aware of their protection, akin to the information included in the Loan Estimate.

Dos and Don'ts

When filling out the Loan Estimate form, it’s important to be careful and thorough to ensure accuracy and clarity. Below are six things you should and shouldn’t do during this process:

- Do read all instructions carefully before starting.

- Do double-check all personal information for accuracy, such as names and addresses.

- Do compare the Loan Estimate against other estimates to identify the best offer.

- Do ask questions if anything is unclear or seems confusing.

- Don’t rush through the form without understanding each section.

- Don’t leave sections blank; provide estimates or notes if certain information is not available.

Following these guidelines will help you complete the Loan Estimate form accurately and confidently.

Misconceptions

The Loan Estimate form is a crucial document in the mortgage application process, designed to help borrowers understand the terms and costs associated with their loan. However, several misconceptions can lead to confusion. Here are six common misconceptions:

- Loan Estimates are Final Offers. Many borrowers believe that a Loan Estimate is a final quote from the lender. In reality, it is an estimate based on the information provided at the time. The actual amounts may change as the loan process continues.

- The Loan Estimate Includes All Costs. Another misconception is that the Loan Estimate captures every possible cost related to the loan. While it includes many essential costs, some fees may arise later or are outside the scope of this document, meaning borrowers should seek clarification on everything that they might incur.

- All Loan Estimates Are the Same. Borrowers often assume that all lenders will provide similar Loan Estimates. This is not the case; different lenders may offer varying terms, interest rates, and fees. It is important for borrowers to compare Loan Estimates from multiple lenders to find the best deal.

- Loan Estimates Are Permanent. Some people think the estimates remain unchanged throughout the loan process. However, certain conditions, such as changes in credit score or the type of loan, can trigger updates to the Loan Estimate. Borrowers should stay informed of any changes.

- A Lower Interest Rate Means Lower Overall Costs. It’s a common belief that the lowest interest rate always translates to the best deal. While interest rates significantly impact payments, other factors, like closing costs and loan terms, also play critical roles. Borrowers should consider the full picture when evaluating their options.

- Signing the Loan Estimate Commits Me to the Loan. Many borrowers think that by signing the Loan Estimate, they are obligated to proceed with the loan. In fact, signing simply acknowledges receipt of the form. Borrowers should feel free to shop around for better options before committing.

Understanding these misconceptions can help empower borrowers to make more informed decisions during the mortgage application process. Always seek guidance if unsure about the details in a Loan Estimate.

Key takeaways

The Loan Estimate form provides crucial details about the mortgage you are considering.

Keep a copy of this form to compare it later with the Closing Disclosure.

This form outlines the loan terms, including the interest rate and monthly payments.

Review the sections about closing costs—these can add up significantly.

Understand that your interest rate is subject to change unless you lock it in.

Be aware of any preliminary fees that may not be refundable if you decide not to close.

Look at the total estimated cash to close; this includes all costs you will need at settlement.

Know about the possibility of homeowner’s insurance being required for the loan.

Compare the Annual Percentage Rate (APR) with other loans to gauge overall costs.

Familiarize yourself with the loan features like potential prepayment penalties or balloon payments.

Browse Other Templates

What Does Fbn Stand for - Failure to file this statement can result in fines or consequences when doing business.

How to File Contempt of Court for Child Support in California - This affidavit serves not only as a complaint but as a call for legal resolution.