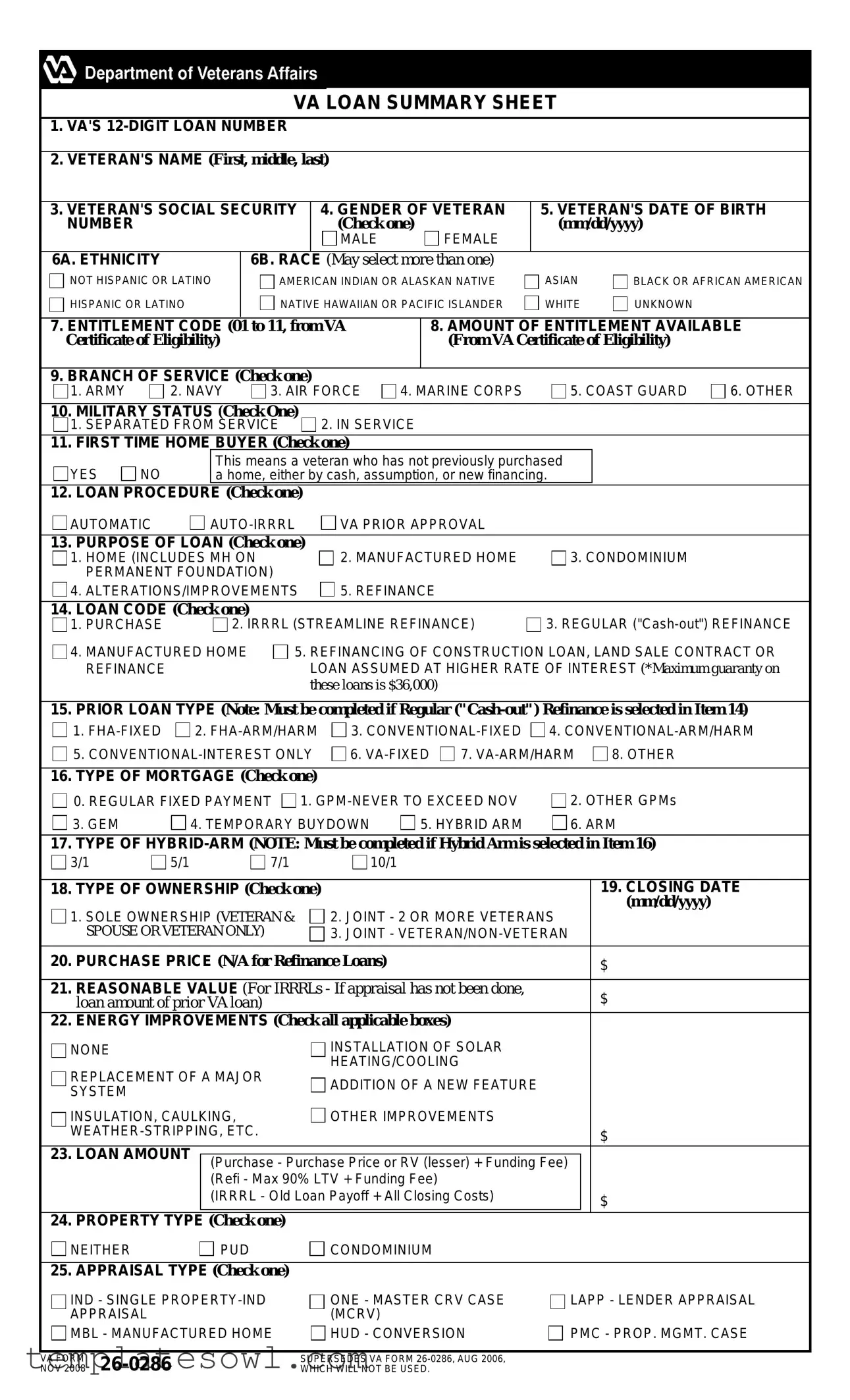

Fill Out Your Loan Summary Sheet Form

The Loan Summary Sheet form is an essential document in the process of securing a VA loan, specifically tailored for veterans seeking home financing options. This form captures crucial information related to the veteran's identity, military service, and loan details. Within its structured layout, the form includes fields for the veteran's name, social security number, date of birth, and other personal demographics, ensuring that the lender has all necessary verifying information. Important sections address the type of service the veteran has participated in, their entitlement code, and the purpose of the loan, such as purchasing a home or refinancing an existing loan. Additionally, the form requires details about the loan type, including various mortgage options and property classifications. Factors like the loan amount, closing date, and any applicable energy improvements must also be included to provide a full picture of the loan's context. Through this comprehensive approach, the Loan Summary Sheet facilitates a structured assessment of the veteran's eligibility and financial needs, ensuring that the loan process is both streamlined and equitable.

Loan Summary Sheet Example

VA LOAN SUMMARY SHEET

1.VA'S

2.VETERAN'S NAME (First, middle, last)

|

|

|

|

|

|

||||

3. VETERAN'S SOCIAL SECURITY |

|

4. GENDER OF VETERAN |

5. VETERAN'S DATE OF BIRTH |

||||||

NUMBER |

|

|

|

(Check one) |

(mm/dd/yyyy) |

|

|||

|

|

|

|

MALE |

|

FEMALE |

|

|

|

6A. ETHNICITY |

|

6B. RACE (May select more than one) |

|

|

|

||||

NOT HISPANIC OR LATINO |

AMERICAN INDIAN OR ALASKAN NATIVE |

ASIAN |

BLACK OR AFRICAN AMERICAN |

||||||

HISPANIC OR LATINO |

NATIVE HAWAIIAN OR PACIFIC ISLANDER |

WHITE |

UNKNOWN |

|

|||||

|

|

|

|

|

|||||

7. ENTITLEMENT CODE (01 to 11, from VA |

|

8. AMOUNT OF ENTITLEMENT AVAILABLE |

|||||||

Certificate of Eligibility) |

|

|

|

|

(From VA Certificate of Eligibility) |

|

|||

|

|

|

|

|

|

|

|

||

9. BRANCH OF SERVICE (Check one) |

|

4. MARINE CORPS |

5. COAST GUARD |

6. OTHER |

|||||

1. ARMY |

2. NAVY |

3. AIR FORCE |

|||||||

10. MILITARY STATUS (Check One) |

2. IN SERVICE |

|

|

|

|||||

1. SEPARATED FROM SERVICE |

|

|

|

||||||

11. FIRST TIME HOME BUYER (Check one)

YES |

NO |

This means a veteran who has not previously purchased |

|

|

|

a home, either by cash, assumption, or new financing. |

|

|

|||

|

|

|

|

|

|

12. LOAN PROCEDURE |

(Check one) |

|

|

|

|

AUTOMATIC |

VA PRIOR APPROVAL |

|

|

||

13. PURPOSE OF LOAN (Check one) |

2. MANUFACTURED HOME |

3. CONDOMINIUM |

|||

1. HOME (INCLUDES MH ON |

|||||

PERMANENT FOUNDATION) |

|

|

|

||

4. ALTERATIONS/IMPROVEMENTS |

5. REFINANCE |

|

|

||

14.LOAN CODE (Check one)

1. PURCHASE |

2. IRRRL (STREAMLINE REFINANCE) |

3. REGULAR |

|

4. MANUFACTURED HOME |

5. REFINANCING OF CONSTRUCTION LOAN, LAND SALE CONTRACT OR |

||

REFINANCE |

|

LOAN ASSUMED AT HIGHER RATE OF INTEREST (*Maximum guaranty on |

|

|

|

these loans is $36,000) |

|

15.PRIOR LOAN TYPE (Note: Must be completed if Regular

1.

1.  2.

2.  3.

3.  4.

4.

5. |

6. |

8. OTHER |

|||

|

|

|

|

|

|

16. TYPE OF MORTGAGE (Check one) |

|

|

|

|

|

0. REGULAR FIXED PAYMENT 1. |

2. OTHER GPMs |

||||

3. GEM |

4. TEMPORARY BUYDOWN |

5. HYBRID ARM |

6. ARM |

||

17.TYPE OF

3/1 |

5/1 |

7/1 |

10/1 |

|

|

|

18. TYPE OF OWNERSHIP (Check one) |

|

19. CLOSING DATE |

1. SOLE OWNERSHIP (VETERAN & |

2. JOINT - 2 OR MORE VETERANS |

(mm/dd/yyyy) |

|

||

SPOUSE OR VETERAN ONLY) |

3. JOINT - |

|

|

|

|

20. PURCHASE PRICE (N/A for Refinance Loans) |

$ |

|

|

|

|

21. REASONABLE VALUE (For IRRRLs - If appraisal has not been done, |

$ |

|

loan amount of prior VA loan) |

|

|

22.ENERGY IMPROVEMENTS (Check all applicable boxes)

NONE |

|

INSTALLATION OF SOLAR |

|

REPLACEMENT OF A MAJOR |

HEATING/COOLING |

|

|

ADDITION OF A NEW FEATURE |

|

||

SYSTEM |

|

|

|

|

|

|

|

INSULATION, CAULKING, |

OTHER IMPROVEMENTS |

|

|

|

$ |

||

23. LOAN AMOUNT |

|

|

|

(Purchase - Purchase Price or RV (lesser) + Funding Fee) |

|

||

|

|

||

|

(Refi - Max 90% LTV + Funding Fee) |

|

|

|

(IRRRL - Old Loan Payoff + All Closing Costs) |

$ |

|

|

|

|

|

24. PROPERTY TYPE |

(Check one) |

|

|

NEITHER |

PUD |

CONDOMINIUM |

|

25. APPRAISAL TYPE (Check one)

IND - SINGLE

MBL - MANUFACTURED HOME

MBL - MANUFACTURED HOME

ONE - MASTER CRV CASE |

LAPP - LENDER APPRAISAL |

(MCRV) |

|

HUD - CONVERSION |

PMC - PROP. MGMT. CASE |

NOV 2008 |

WHICH WILL NOT BE USED. |

VA FORM |

SUPERSEDES VA FORM |

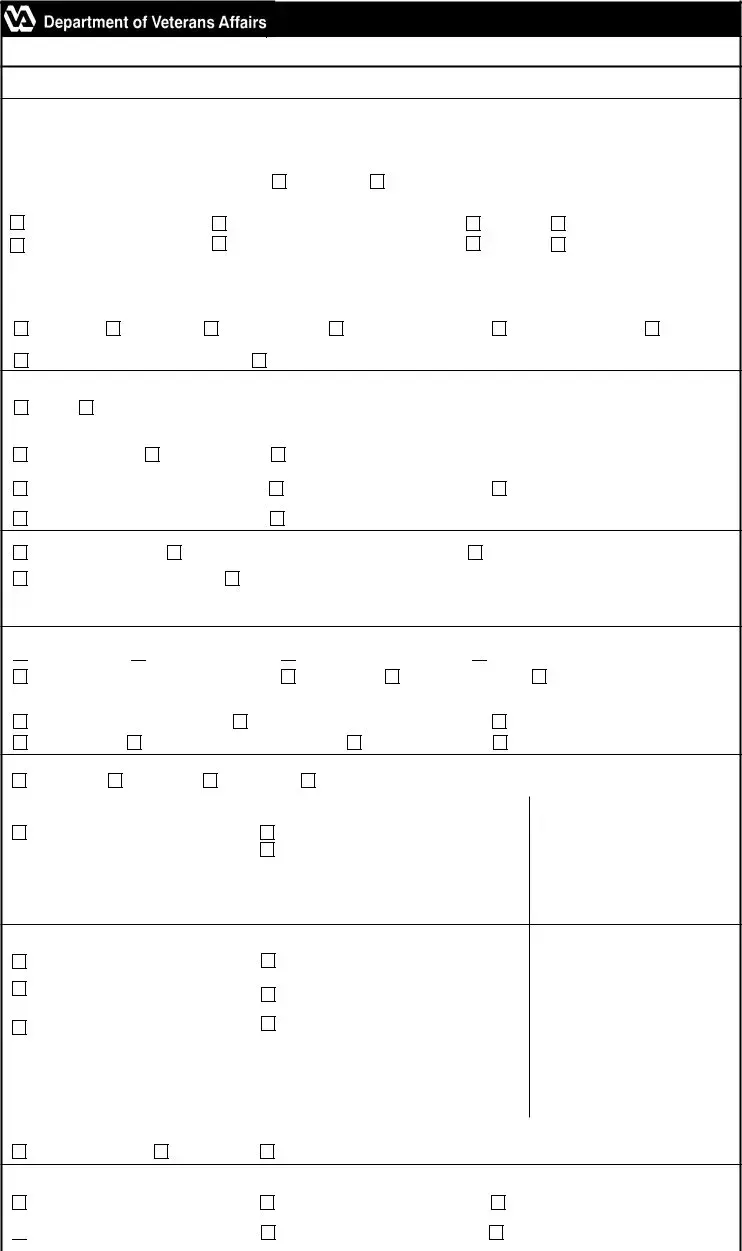

26. TYPE OF STRUCTURE (Check one)

1. CONVENTIONAL |

2. SINGLEWIDE M/H |

3. DOUBLEWIDE M/H |

CONSTRUCTION |

|

|

4. M/H LOT ONLY |

5. PREFABRICATED HOME |

6. CONDOMINIUM CONVERSION |

27. PROPERTY DESIGNATION (Check one)

1. EXISTING OR USED HOME, CONDO, M/H |

2. APPRAISED AS PROPOSED CONSTRUCTION |

|||

3. NEW EXISTING - NEVER OCCUPIED |

4. ENERGY IMPROVEMENTS |

|||

|

|

|

|

|

28. NO. OF UNITS (Check one) |

|

|

29. MCRV NO. |

|

SINGLE |

TWO UNITS |

THREE UNITS |

FOUR OR MORE |

|

|

|

|||

30. MANUFACTURED HOME CATEGORY(Check one) |

||||

0. OTHER - NOT M/H |

|

1. M/H ONLY (RENTED SPACE) |

||

2. M/H ONLY |

|

7. M/H ON PERMANENT FOUNDATION |

||

31. PROPERTY ADDRESS |

|

|

|

32. CITY |

33. STATE |

34. ZIP CODE |

35. COUNTY |

36. LENDER VA ID NUMBER |

37. AGENT VA ID NUMBER (If applicable) |

38. LENDER LOAN NUMBER |

|

FOR LAPP CASES ONLY

|

|

|

39. LENDER SAR ID NUMBER |

|

|

|

|

|

40. GROSS LIVING AREA |

41. AGE OF PROPERTY (Yrs.) |

42. DATE SAR ISSUED NOTIFICATION |

(Square Feet) |

|

OF VALUE (mm/dd/yyyy) |

|

|

|

43. TOTAL ROOM COUNT |

44. BATHS (No.) |

45. BEDROOMS (No.) |

46.IF PROCESSED UNDER LAPP, WAS THE FEE APPRAISER'S ORIGINAL VALUE ESTIMATE CHANGED OR REPAIR RECOMMENDATIONS REVISED, OR DID THE SAR OTHERWISE MAKE SIGNIFICANT ADJUSTMENTS?

YES (If "Yes," there must be written justification by fee appraiser and/or SAR) |

NO |

|

||||

|

INCOME INFORMATION (Not Applicable for IRRRLs) |

|

||||

47A. LOAN PROCESSED UNDER VA RECOGNIZED AUTOMATED UNDERWRITING SYSTEM |

||||||

YES |

NO (If "Yes," Complete Item 47B and 47C) |

|

|

|||

47B. WHICH SYSTEM WAS USED? |

01. LP |

|

47C. RISK CLASSIFICATION |

|||

02. DU |

03. PMI AURA |

04. CLUES |

05. ZIPPY |

|

1. APPROVE |

2. REFER |

|

|

|

|

|

|

|

48.CREDIT SCORE (Enter the median credit score for the veteran only)

49. LIQUID ASSETS |

|

$ |

|

|

|

|

|

|

50. TOTAL MONTHLY GROSS INCOME |

(Item 31+Item 38 from |

$ |

VA Form |

|

|

51. RESIDUAL INCOME |

|

$ |

|

|

|

|

|

|

52. RESIDUAL INCOME GUIDELINE |

|

$ |

|

|

53.DEBT- INCOME RATIO (If Income Ratio is over 41% and Residual Income is not 120% of guideline, statement of justification signed by underwriter's supervisor must be included on or with VA Form

|

|

|

|

|

|

|

|

|

% |

54. SPOUSE INCOME CONSIDERED |

|

55. SPOUSE'S INCOME AMOUNT (If considered) |

|||||||

YES |

NO |

(If "Yes," Complete Item 55) |

|

$ |

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

DISCOUNT INFORMATION (Applicable for All Loans) |

|

||||||

56. DISCOUNT POINTS CHARGED |

|

|

|

% OR |

$ |

|

|||

|

|

|

|

|

|

|

|

||

57. DISCOUNT POINTS PAID BY VETERAN |

|

|

|

% OR |

$ |

|

|||

|

|

|

|

|

|

|

|

||

58. TERM (Months) |

|

59. INTEREST RATE |

|

|

60. FUNDING FEE EXEMPT |

||||

|

|

|

|

|

% |

|

Y - EXEMPT |

N - NOT EXEMPT |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

FOR IRRRLS ONLY |

|

|

|

|||

61. PAID IN FULL VA LOAN NUMBER |

|

|

|

|

|

||||

|

|

|

|

|

|

||||

62. ORIGINAL LOAN AMOUNT |

|

63. ORIGINAL INTEREST RATE |

|||||||

$ |

|

|

|

|

|

|

|

|

% |

|

|

|

|

|

|

|

|

|

|

64. REMARKS |

|

|

|

|

|

|

|

|

|

VA FORM

Form Characteristics

| Fact Name | Details |

|---|---|

| VA Loan Number | The form requires a 12-digit VA loan number, which is essential for tracking and managing the loan. |

| Veteran Identification | Information regarding the veteran includes name, Social Security number, gender, and date of birth. |

| Entitlement Information | The form captures the entitlement code and the amount of entitlement available as per the VA Certificate of Eligibility. |

| Military Service Details | The veteran's branch of service and military status are indicated, including provisions for first-time homebuyers. |

| Loan Purpose | Various loan purposes may be indicated, including home purchase, refinance, or improvements, along with specific loan codes. |

| Property and Loan Details | The form requires details about the property type, appraisal type, loan amount, and ownership type along with additional demographic information. |

Guidelines on Utilizing Loan Summary Sheet

Filling out the Loan Summary Sheet requires attention to detail and accuracy. This important document collects essential information related to the veteran’s loan application, so it’s crucial to ensure that all sections are completed correctly. Once you've gathered all the necessary details, follow these steps to complete the form efficiently.

- VA's 12-Digit Loan Number: Enter the unique loan number assigned by the VA.

- Veteran's Name: Fill in the veteran's first, middle, and last names.

- Veteran's Social Security Number: Provide the veteran’s social security number.

- Gender of Veteran: Check the appropriate box for male or female.

- Veteran's Date of Birth: Input the date in mm/dd/yyyy format.

- Ethnicity: Indicate whether the veteran is Hispanic or Latino.

- Race: Select all applicable options for the veteran’s race.

- Entitlement Code: Provide the entitlement code as listed on the VA Certificate of Eligibility.

- Amount of Entitlement Available: State the amount sourced from the VA Certificate of Eligibility.

- Branch of Service: Check the box corresponding to the veteran's branch of service.

- Military Status: Indicate whether the veteran is currently in service or separated from service.

- First Time Home Buyer: Check “Yes” if this is the veteran's first home purchase; otherwise, check “No.”

- Loan Procedure: Select the applicable procedure (Automatic, Auto-IRRRL, or VA Prior Approval).

- Purpose of Loan: Check one box indicating the purpose of the loan.

- Loan Code: Indicate the type of loan being applied for.

- Prior Loan Type: Complete this section if Regular ("Cash-out") Refinance is selected.

- Type of Mortgage: Check the appropriate box detailing the type of mortgage.

- Type of Hybrid-ARM: If applicable, indicate the type of hybrid-arm loan.

- Type of Ownership: Specify the type of ownership applicable to the loan.

- Closing Date: Enter the expected closing date in mm/dd/yyyy format.

- Purchase Price: For purchase loans, provide the purchase price; this is not applicable for refinance loans.

- Reasonable Value: Indicate the loan amount of the prior VA loan for IRRRLs.

- Energy Improvements: Check all applicable boxes related to energy improvements.

- Loan Amount: Enter the total loan amount based on the type of loan and associated fees.

- Property Type: Select the property type for the loan.

- Appraisal Type: Indicate the type of appraisal being used.

- Type of Structure: Check the appropriate box that describes the property structure.

- Property Designation: Specify the property designation as applicable.

- Number of Units: Indicate how many units are involved.

- Manufactured Home Category: Select the applicable category for manufactured home loans.

- Property Address: Fill in the complete property address.

- City, State, Zip Code: Provide these details for the property address.

- County: Enter the county where the property is located.

- Lender VA ID Number: Include the lender's VA ID number.

- Lender Loan Number: If applicable, fill in the lender loan number for LAPP cases.

- Gross Living Area: Indicate the total square feet of the living area.

- Age of Property: State the age of the property in years.

- Date SAR Issued: Enter the date of the SAR notification in mm/dd/yyyy format.

- Total Room Count: Provide the total number of rooms in the property.

- Baths: Indicate the number of baths in the property.

- Bedrooms: Fill in the number of bedrooms.

- Significant Adjustments: Answer whether any adjustments were made or recommends revisions.

- Loan Processed Under Automated Underwriting System: Indicate if this applies and provide specific system used and risk classification.

- Credit Score: Enter the median credit score for the veteran.

- Liquid Assets: Report the total liquid assets available.

- Total Monthly Gross Income: Indicate the total monthly gross income.

- Residual Income: State the veteran's residual income.

- Residual Income Guideline: Provide the income guideline for reference.

- Debt-Income Ratio: If necessary, justify any ratios above the specified percentage.

- Spouse Income Considered: Indicate whether the spouse's income is included.

- Spouse's Income Amount: Provide the spouse's income if considered.

- Discount Points Charged: Enter the discount points charged as a percentage or dollar amount.

- Discount Points Paid by Veteran: State any points paid by the veteran.

- Term: Indicate the term of the loan in months.

- Interest Rate: Enter the interest rate for the loan.

- Funding Fee Exempt: Mark whether the veteran is exempt from the funding fee.

- Paid in Full VA Loan Number: Provide the number if applicable.

- Original Loan Amount: Note the original loan amount.

- Original Interest Rate: Include the original interest rate for the loan.

- Remarks: Add any additional remarks or comments pertinent to the loan summary.

What You Should Know About This Form

What is the purpose of the Loan Summary Sheet form?

The Loan Summary Sheet serves to collect essential information related to a veteran's application for a VA loan. It includes personal details about the veteran, information about their entitlement, the loan amount, type of property, and other financial specifics. This form is crucial for lenders to assess the eligibility and determine the best loan options available for veterans.

What information is required from the veteran on the Loan Summary Sheet?

The form requires various personal and financial details, including the veteran's 12-digit loan number, name, social security number, gender, and date of birth. Additionally, it asks for information such as ethnicity, race, branch of service, military status, loan purpose, and details about the property type and value.

How does the veteran's entitlement code factor into the loan process?

The entitlement code reflects the veteran's eligibility for a VA loan, indicating the amount of guaranty the VA provides for the loan. It ranges from 01 to 11, which helps lenders determine the maximum loan amount a veteran can obtain based on their eligibility status. This code is crucial for borrowers as it affects potential down payment requirements and loan limits.

What does "first-time home buyer" mean in this context?

This designation indicates whether the veteran is buying a home for the first time. If a veteran checks "YES," this means they have not previously purchased a home through cash transactions, loan assumptions, or new financing. This status may influence loan options and benefits offered, ensuring the veteran receives targeted assistance during the buying process.

What types of loans does the Loan Summary Sheet cover?

The form accommodates various loan types, including standard purchases, streamline refinances, cash-out refinances, and loans specific to manufactured homes or condominiums. Lenders need to clarify the loan's purpose to tailor the financing options appropriately, whether it is to purchase a home or refinance an existing loan.

What is the significance of the military status section?

The military status section indicates whether the veteran is currently in service or has been separated from service. This distinction is vital for the lender, as it can impact the eligibility for certain types of VA loans and the terms offered. Active-duty service members might have different loan conditions compared to veterans who are no longer in active service.

How are loan amounts calculated on the Loan Summary Sheet?

The loan amount is determined based on the lesser of the purchase price or the reasonable value of the property plus any applicable funding fee. For refinancing, the maximum loan-to-value ratio (LTV) is capped at 90%. The calculations ensure that the loan provided is appropriate and manageable based on the veteran's financial situation.

What information about the property does the Loan Summary Sheet capture?

The form gathers comprehensive details about the property, including its type, address, closing date, energy-efficient improvements, and the number of units. This information helps lenders assess the property’s value and suitability for VA financing and ensures compliance with the requirements under VA regulations.

Why is credit score included in the Loan Summary Sheet?

The credit score is a crucial element of the application process as it helps lenders evaluate the veteran's creditworthiness and ability to repay the loan. A median credit score provides a snapshot of the veteran's financial health, influencing loan terms, interest rates, and potential approvals.

Are there any costs associated with the loan that must be disclosed?

Yes, the Loan Summary Sheet includes a section for detailing discount points charged and how much the veteran is paying. These costs can affect the overall expense of obtaining the loan. Transparency regarding these costs ensures that veterans are fully informed about their financial commitments before proceeding with the loan application.

Common mistakes

Filling out the Loan Summary Sheet form is a critical step for veterans seeking a VA loan. However, errors can lead to delays or complications. One common mistake is not correctly entering the VA's 12-digit loan number. This number is essential for processing your loan, and any inaccuracy can cause significant holdups in your application.

Another frequent error occurs with the veteran's name section. Omitting middle names or incorrectly spelling first or last names can create discrepancies with official records. These inaccuracies may require additional documentation to rectify, adding unnecessary delays to your loan approval process.

Many individuals also forget to include the correct Social Security Number. This information is vital for verifying identity and assessing creditworthiness. Double-checking this detail is essential to prevent delays in processing your loan application due to mismatched information.

Incorrectly selecting the veteran’s gender or failing to check the appropriate boxes for ethnicity and race can also create issues. These sections, while seemingly minor, are important for statistical and eligibility purposes. Errors in this area can complicate the review process.

Another significant pitfall is misunderstanding the purpose of the loan. Specifically, it is crucial to correctly check the appropriate option for the purpose of the loan. Choosing the wrong category, such as indicating a renovation when refinancing, can lead to misinterpretations by the lender and possibly affect loan eligibility.

Lastly, applicants often miscalculate the loan amount or inaccurately provide the purchase price. This mistake can have serious repercussions, as an incorrect loan amount can lead to funding complications. It's essential to ensure that the figures align properly with your documentation to maintain consistency throughout the application.

Documents used along the form

The Loan Summary Sheet is a crucial document in the process of obtaining a VA loan. It outlines essential details about the loan and the veteran borrower. However, several other forms and documents are frequently used alongside this form. Each has its specific purpose in ensuring that the loan process flows smoothly. Below are some of the most common forms you may encounter.

- VA Certificate of Eligibility: This document establishes a veteran's eligibility for a VA loan, confirming their military service and entitlement to benefits.

- VA Loan Application (VA Form 26-1880): The application form collects personal and financial information from the borrower to assess their readiness for a loan.

- Appraisal Report: An appraisal determines the fair market value of the property being purchased, ensuring that the loan amount is justified.

- Credit Report: This report provides insight into the veteran's credit history and score, which lenders use to gauge creditworthiness.

- Income Verification Documents: This includes pay stubs, tax returns, and bank statements to confirm the veteran's income and financial stability.

- Debt-to-Income Ratio Calculation: This document outlines the ratio of the veteran's monthly debt payments to their gross monthly income, providing a measure of their financial health.

- Letter of Explanation: If there are any discrepancies in the veteran's credit report or income, this letter explains the issues to the lender.

- Loan Estimate (LE): This form outlines the expected costs and terms of the loan, allowing the veteran to compare different lending options.

- Closing Disclosure (CD): This final disclosure provides a detailed breakdown of the final loan terms and closing costs before the loan is finalized.

- Power of Attorney (if applicable): In cases where a veteran is unable to attend the closing, this document grants another individual the authority to sign on their behalf.

Understanding these additional documents can help streamline the borrowing process. Each form plays a significant role in clarifying the terms, costs, and overall requirements associated with securing a VA loan. Being well-informed about each component can ease the journey to homeownership for veterans.

Similar forms

- Loan Estimate: Similar to the Loan Summary Sheet, the Loan Estimate provides an overview of the loan terms. It outlines the estimated monthly payments, interest rates, and closing costs associated with the mortgage, giving borrowers a clear picture of their financial commitment.

- Application Checklist: An Application Checklist helps guide potential borrowers through the necessary documents needed for their loan application. Like the Loan Summary Sheet, it categorizes information needed from the borrower, making the process more organized and efficient.

- Credit Report: The Credit Report summarizes a borrower’s credit history and assesses their creditworthiness. While the Loan Summary Sheet focuses on the loan specifics, both documents share a purpose of informing lenders about key aspects of the borrower's financial background.

- Closing Disclosure: The Closing Disclosure is provided shortly before closing and details the final terms of the loan. It mirrors the Loan Summary Sheet in that it includes vital information such as the loan amount, interest rate, and associated fees, ensuring the borrower understands what they are agreeing to.

- Certificate of Eligibility (COE): The COE confirms a veteran's eligibility for a VA loan. Just like the Loan Summary Sheet verifies key aspects of the loan process and requirements, it also references the COE to establish the entitlement available to the borrower.

Dos and Don'ts

Things to Do When Filling Out the Loan Summary Sheet:

- Ensure all information is accurate and up-to-date.

- Double-check the veteran's Social Security number for correctness.

- Select appropriate options for ethnicity, race, and military service.

- Clearly indicate the purpose of the loan in the designated section.

- Provide the complete property address, including state and zip code.

- Make sure to capture and enter financial information such as income and debts accurately.

Things to Avoid When Filling Out the Loan Summary Sheet:

- Do not leave any fields blank, unless they are marked as not applicable.

- Avoid using abbreviations or unclear acronyms that might confuse the reviewers.

- Do not enter information that conflicts with other documents submitted.

- Refrain from submitting the form with unresolved questions or errors.

- Do not overlook reviewing the entire form before submission.

- Avoid using estimates instead of actual figures, especially for income and loan amounts.

Misconceptions

The Loan Summary Sheet is an essential document for veterans looking to secure a loan through the VA. However, there are misconceptions that can lead to confusion. Here are six common misunderstandings about this form.

- It is only for first-time homebuyers. Many believe that the Loan Summary Sheet is strictly for veterans purchasing their first home. In reality, it can also be used for refinancing or purchasing additional properties.

- All veterans qualify automatically. Some assume that if they are veterans, they automatically qualify for a loan without any further requirements. However, eligibility depends on factors such as service record, income, and credit history.

- The form is overly complicated. While the form may appear lengthy and dense at first glance, it is structured to collect vital information. Completing it can simplify the loan process when approached methodically.

- After submission, there are no changes allowed. Many think that once the Loan Summary Sheet is submitted, no adjustments can be made. In fact, veterans can update or correct information before final approval is granted.

- The purpose of a loan is limited. Some veterans may believe that VA loans can only be used for purchasing a traditional home. However, the Loan Summary Sheet accommodates various types of properties, including condos and manufactured homes.

- The Loan Summary Sheet is unnecessary. Another misconception is that this form is optional. It's critical for processing a VA loan. Properly completing and submitting it ensures that veterans receive the benefits they deserve.

Understanding these misconceptions can help veterans navigate the loan process more effectively. The Loan Summary Sheet is a vital tool that contributes to obtaining the financial support needed for homeownership.

Key takeaways

When filling out and using the Loan Summary Sheet form, several important aspects must be considered to ensure completeness and accuracy. Below are key takeaways to remember:

- Provide Accurate Information: Ensure that all details, such as the veteran's name, social security number, and VA loan number, are correct. Mistakes can lead to delays in processing.

- Check All Required Sections: Each section of the form needs to be appropriately filled in. This includes demographic information and loan specifics like purpose and type of ownership.

- Indicate the Loan Purpose: Clearly specify the loan’s purpose by checking the appropriate box. This could include purchasing a home, refinancing, or making alterations.

- Understand Eligibility Codes: The entitlement code and available entitlement amount must be filled in accurately based on the VA Certificate of Eligibility.

- Consider Residual Income Requirements: Ensure that the residual income is calculated and included. This can affect the approval of the loan, particularly if it does not meet VA guidelines.

- Review Before Submission: Double-check the entire form for any missing information or errors before submitting it. This will help in expediting the loan approval process.

Browse Other Templates

Living Will Downloadable 5 Wishes Printable Version - This form helps protect your preferences, even if you cannot voice them in the moment.

Qdro Form for Divorce - The form reinforces the importance of equitable asset division in divorce.

Std 640 - Rehire decisions can significantly impact the applicant's chances of employment.