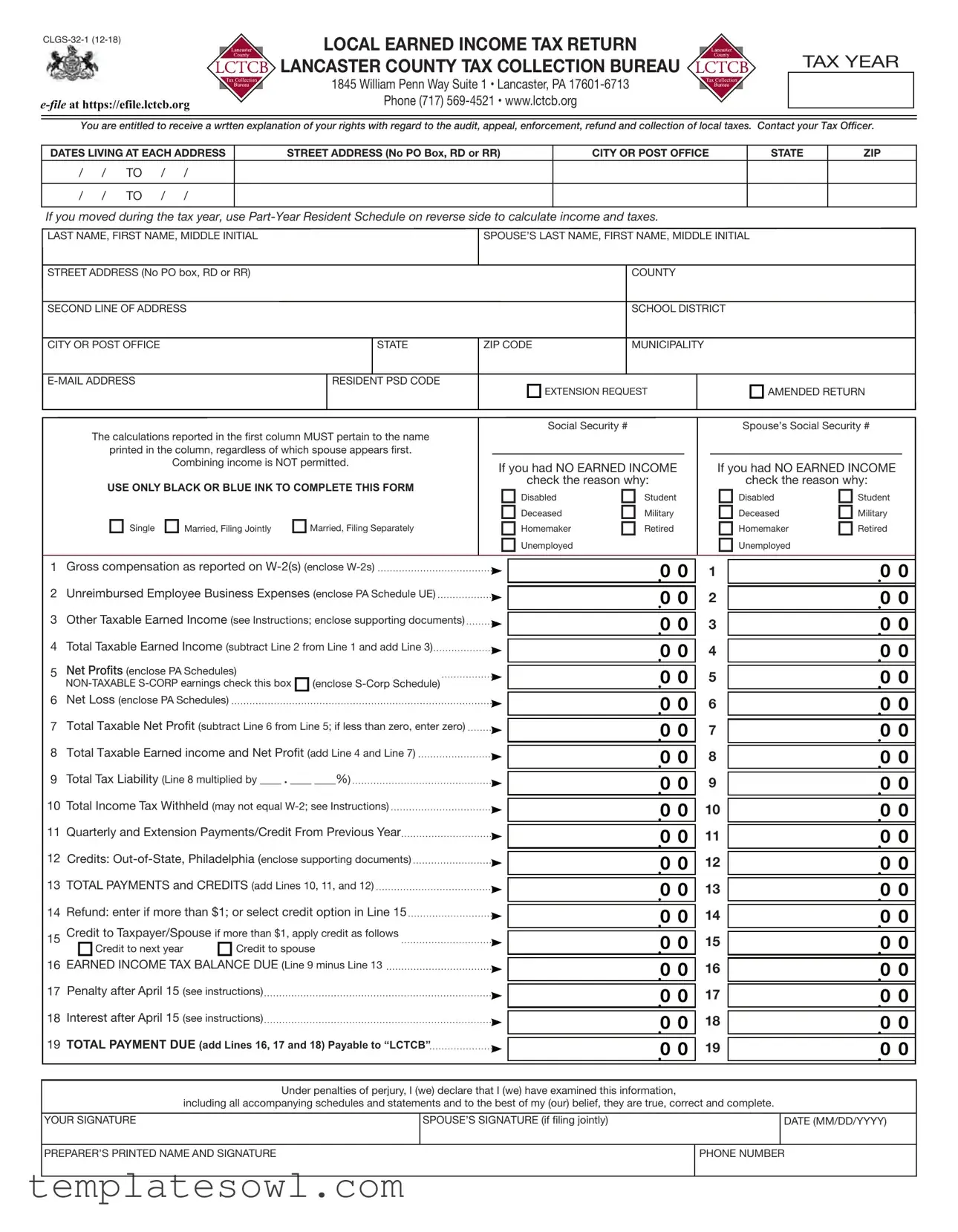

Fill Out Your Local Tax Lancaster Form

The Local Tax Lancaster form, officially known as CLGS-32-1 (12-18), serves as an essential tool for individuals residing in Lancaster County, Pennsylvania, to report their earned income tax obligations. This form can be crucial for ensuring compliance with local tax laws and helps residents accurately calculate their tax liabilities based on their income and various deductions. Upon completing the form, taxpayers need to disclose their personal information, including names, addresses, and tax identification numbers. Notably, if individuals have moved during the tax year, they must utilize the Part-Year Resident Schedule on the reverse side. This provision aids in determining income and taxes appropriately for different residences. Throughout the form, individuals will report their gross compensation, list any unreimbursed employee business expenses, and document additional taxable income, ensuring they understand how to account for their earnings. Significant sections include the calculation of net profits or losses for self-employed individuals and directives for retirees, who may not owe any earned income tax depending on their income sources. Furthermore, the form highlights important instructions regarding requesting extensions, amending returns, and managing refunds or credits. Completing this form accurately is paramount for avoiding penalties and ensuring the fair assessment of local taxes owed. By adhering to the guidelines provided, Lancaster County residents can navigate their local tax responsibilities with confidence.

Local Tax Lancaster Example

|

LOCAL EARNED INCOME TAX RETURN |

|

|

|

|

|

|

|

|

|

|

|

|

LANCASTER COUNTY TAX COLLECTION BUREAU |

|

|

TAX YEAR |

|

|

1845 William Penn Way Suite 1 • Lancaster, PA |

|

|

|

|

Phone (717) |

|

|

|

|

|

|

|

|

You are entitled to receive a wrtten explanation of your rights with regard to the audit, appeal, enforcement, refund and collection of local taxes. Contact your Tax Officer.

DATES LIVING AT EACH ADDRESS |

|

STREET ADDRESS (No PO Box, RD or RR) |

CITY OR POST OFFICE |

|

STATE |

ZIP |

|||||

/ |

/ |

TO |

/ |

/ |

|

|

|

|

|

|

|

/ |

/ |

TO |

/ |

/ |

|

|

|

|

|

|

|

If you moved during the tax year, use |

|

|

|||||||||

LAST NAME, FIRST NAME, MIDDLE INITIAL |

|

SPOUSE’S LAST NAME, FIRST NAME, MIDDLE INITIAL |

|

|

|||||||

|

|

|

|||||||||

|

|

|

|

|

|

|

|

||||

STREET ADDRESS (No PO box, RD or RR) |

|

|

COUNTY |

|

|

||||||

SECOND LINE OF ADDRESS |

|

|

SCHOOL DISTRICT |

|

|

||||||

|

|

|

|

|

|

|

|

|

|

||

CITY OR POST OFFICE |

|

|

|

STATE |

ZIP CODE |

MUNICIPALITY |

|

|

|||

|

RESIDENT PSD CODE |

|

EXTENSION REQUEST |

|

|

AMENDED RETURN |

|

|

||||

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

Social Security # |

|

|

Spouse’s Social Security # |

|

|

||

The calculations reported in the first column MUST pertain to the name |

|

|

|

|

|

|

||||||

|

|

|

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|||

printed in the column, regardless of which spouse appears first. |

|

|

|

|

|

|

|

|

|

|

||

|

Combining income is NOT permitted. |

|

|

If you had NO EARNED INCOME |

|

|

If you had NO EARNED INCOME |

|

|

|||

USE ONLY BLACK OR BLUE INK TO COMPLETE THIS FORM |

|

|

check the reason why: |

|

|

check the reason why: |

|

|

||||

|

|

Disabled |

Student |

|

|

Disabled |

Student |

|

|

|||

|

|

|

|

|

|

|

|

|

||||

Single |

Married, Filing Jointly Married, Filing Separately |

|

|

Deceased |

Military |

|

|

Deceased |

Military |

|

|

|

|

|

Homemaker |

Retired |

|

|

Homemaker |

Retired |

|

|

|||

|

|

|

|

|

Unemployed |

|

|

|

Unemployed |

|

|

|

1Gross compensation as reported on

2Unreimbursed Employee Business Expenses (enclose PA Schedule UE)

3Other Taxable Earned Income (see Instructions; enclose supporting documents)

4Total Taxable Earned Income (subtract Line 2 from Line 1 and add Line 3)

5Net Profits (enclose PA Schedules)

6Net Loss (enclose PA Schedules)

7Total Taxable Net Profit (subtract Line 6 from Line 5; if less than zero, enter zero)

8Total Taxable Earned income and Net Profit (add Line 4 and Line 7)

9Total Tax Liability (Line 8 multiplied by ____ . ____ ____%)

10Total Income Tax Withheld (may not equal

11Quarterly and Extension Payments/Credit From Previous Year

12Credits:

13TOTAL PAYMENTS and CREDITS (add Lines 10, 11, and 12)

14Refund: enter if more than $1; or select credit option in Line 15

15Credit to Taxpayer/Spouse if more than $1, apply credit as follows

Credit to next year Credit to spouse

EARNED INCOME TAX BALANCE DUE (Line 9 minus Line 1316

17 Penalty after April 15 (see instructions)

18 Interest after April 15 (see instructions)

19 TOTAL PAYMENT DUE (add Lines 16, 17 and 18) Payable to “LCTCB”

0 0 |

|

|

1 |

||

0 0 |

|

|

2 |

||

0 0 |

|

|

3 |

||

0 0 |

|

|

4 |

||

0 0 |

|

|

5 |

||

0 0 |

|

|

6 |

||

0 0 |

|

|

7 |

||

0 0 |

|

|

8 |

||

0 0 |

|

|

9 |

||

0 |

0 |

|

10 |

||

0 0 |

|

|

11 |

||

0 0 |

|

|

12 |

||

0 0 |

|

|

13 |

||

0 0 |

|

|

14 |

||

0 0 |

|

|

15 |

||

0 0 |

|

|

16 |

||

0 0 |

|

|

17 |

||

0 0 |

|

|

18 |

||

0 0 |

|

|

19 |

||

00

00

00

00

00

00

00

00

00

00

00

00

00

00

00

00

00

00

00

Under penalties of perjury, I (we) declare that I (we) have examined this information,

including all accompanying schedules and statements and to the best of my (our) belief, they are true, correct and complete.

YOUR SIGNATURE

SPOUSE’S SIGNATURE (if filing jointly)

DATE (MM/DD/YYYY)

PREPARER’S PRINTED NAME AND SIGNATURE

PHONE NUMBER

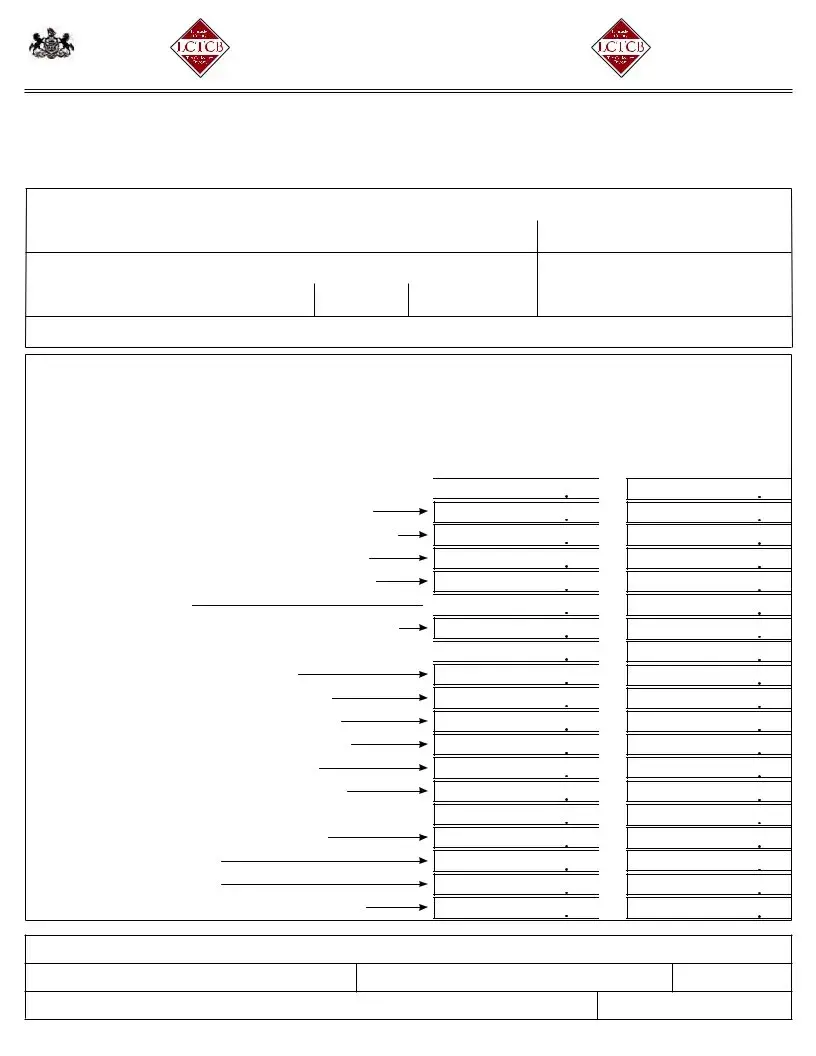

Report passive or unearned

TAXPAYER

.0 0

TAXPAYER SPOUSE

.0 0

Current Residence |

|

|

|

|

|

|

|

(street address) |

|

|

|

# months at this address |

|||||

Employer (1) |

|

|

|

|

|

|

|

|

|

(municipality, State, ZIP) |

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Income |

$ |

|

|

divided by 12 months X |

|

|

(months at this address) = $ |

|

|

|

|

|

|||||

Withholding |

$ |

|

|

divided by 12 months X |

|

|

(months at this address) = $ |

|

|

|

|

||||||

Employer (2) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Income |

$ |

|

|

divided by 12 months X |

|

|

(months at this address) = $ |

|

|

|

|

|

|||||

Withholding |

$ |

|

|

divided by 12 months X |

|

|

(months at this address) = $ |

|

|

|

|

|

|||||

Current Residence Total Income $ |

|

|

Total Local Tax Withheld $ |

|

|

|

|

|

|||||||||

Put the Total Income on Line 1 and the Tax Withheld on Line 10 of the Local Earned Income Tax Return for your current residence taxing jurisdiction.

Previous Residence |

|

|

|

|

|

|

|

|

(street address) |

|

|

|

# months at this address |

|||||

Employer (1) |

|

|

|

|

|

|

|

|

|

|

(municipality, State, ZIP) |

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Income |

$ |

|

|

divided by 12 months X |

|

|

|

|

(months at this address) = $ |

|

|

|

|

|||||

Withholding |

$ |

|

|

divided by 12 months X |

|

|

|

|

(months at this address) = $ |

|

|

|

||||||

Employer (2) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Income |

$ |

|

|

divided by 12 months X |

|

|

|

|

(months at this address) = $ |

|

|

|

|

|||||

Withholding |

$ |

|

|

divided by 12 months X |

|

|

|

|

(months at this address) = $ |

|

|

|

|

|||||

Previous Residence Total Income $ |

|

|

Total Local Tax Withheld $ |

|

|

|

|

|

||||||||||

PuttheTotal Income on Line1and theTaxWithheld on Line10 ofthe Local Earned IncomeTaxReturn foryour previousresidencetaxing jurisdiction.

If you moved within LCTCB’s jurisdiction please see special instructions for calculating a blended tax rate.

LINE 10: DISTRESSED/COMMUTER LOCAL TAX WITHHELD WORKSHEET

(Complete worksheet if you work in an area where the

|

(1) |

(2) |

(3) |

(4) |

(5) |

(6) |

(7) |

|

Local Wages |

Tax Withheld |

Resident EIT Rate |

Workplace Location |

Column (4) minus |

Disallowed |

Credit Allowed for |

|

Column (3) |

Withholding Credit |

Tax Withheld |

||||

|

Tax Form Line 9 |

(See Instructions) |

If less than 0 enter 0 |

Col (1) times Col (5) |

Col (2) minus Col (6) |

||

Example |

$10,000.00 |

$130.00 |

1.25% |

1.30% |

0.05% |

$5.00 |

$125.00 |

1. |

|

|

|

|

|

|

|

2. |

|

|

|

|

|

|

|

3. |

|

|

|

|

|

|

|

|

TOTAL Enter this amount on Line 10 |

|

|

||

EARNED INCOME: Taxed in other state as shown on the state tax return. |

|

|

Enclose a copy of state return or credit will be disallowed |

(1) |

|

Local tax rate as specified on the front of this form |

x |

|

Tax Liability Paid to other state(s) |

(3) |

(2) |

|

||

PA Income Tax (line 1 x PA Income Tax rate for year being reported) |

(4) |

|

CREDIT to be used against Local Tax |

|

|

(Line 3 minus line 4) On line 12 enter this amount |

|

|

or the amount on line 2 worksheet, whichever is less. (If less than zero, enter zero) |

(5) |

|

A NOTE FOR RETIRED AND/OR SENIOR CITIZENS

If you are retired and are no longer receiving a salary, wages or income from a business, you may not owe an earned income tax. Social Security payments from qualified pension plans, interest and/or dividends accrued from bank accounts and/or investments are not subject to local earned income tax. If you received an Annual Local Earned Income Tax Return, please check the “retired” box on the front of the form and return it to your tax collector. If you still receive wages from a

Form Characteristics

| Fact Name | Details |

|---|---|

| Governing Authority | The Local Earned Income Tax Return Lancaster is governed by Pennsylvania Act 511. |

| Filing Deadline | The form must be submitted by April 15 of the following tax year. |

| Preparation Instructions | Only black or blue ink should be used to complete this form. |

| Income Sources | Taxable income can include gross compensation, unreimbursed employee expenses, and other earned income. |

| Amended Returns | Taxpayers may file an amended return if there are changes to the originally reported information. |

| Special Considerations | If the taxpayer moved during the year, the Part-Year Resident Schedule must be used. |

| Refund Criteria | Taxpayers may receive a refund if the total payments exceed their tax liability. |

| Contact Information | For inquiries, contact the Lancaster County Tax Collection Bureau at (717) 569-4521. |

Guidelines on Utilizing Local Tax Lancaster

Filling out the Local Tax Lancaster form requires careful attention to detail. This process involves reporting your earned income and any deductions or credits that apply. After completing this form, it will need to be submitted to the Lancaster County Tax Collection Bureau for processing.

- Start by writing your personal information at the top of the form, including your last name, first name, middle initial, and your spouse’s name if applicable.

- Fill in your street address, city, state, zip code, and municipality. Make sure you do not use a PO Box.

- Enter your e-mail address and the Resident PSD Code in the designated fields.

- Indicate whether you are requesting an extension or filing an amended return by checking the appropriate boxes.

- Provide your Social Security Number and your spouse's Social Security Number if filing jointly.

- If you had no earned income, check the reasons that apply to you and your spouse.

- Report your gross compensation from W-2 forms. Attach the W-2s to your form.

- Deduct any unreimbursed employee business expenses using the PA Schedule UE, and include it with your submission.

- Calculate any other taxable earned income and include supporting documents as necessary.

- Add the figures from line 1, subtract line 2, and add line 3 to find your total taxable earned income, reported on line 4.

- Report net profits and include any supporting PA schedules.

- If applicable, check the box for non-taxable S-Corp earnings and include the corresponding S-Corp Schedule.

- Calculate your total taxable net profit on line 7 and combine it with your line 4 total on line 8.

- Multiply your line 8 total by the local tax rate to find your total tax liability on line 9.

- Document any income tax withheld, including any quarterly payments or credits from the prior year.

- Apply any out-of-state credits if relevant, including all necessary supporting documentation.

- Calculate your total payments and credits by summing lines 10, 11, and 12. Enter this on line 13.

- If applicable, report any refund due and check how you would like to apply it on lines 14 and 15.

- Determine your balance due by subtracting line 13 from line 9, and report any additional penalty or interest on lines 16, 17, and 18 if applicable.

- Calculate the total payment due and ensure it is payable to "LCTCB."

- Sign and date the form, and provide your preparer’s information if someone else assisted in the completion.

What You Should Know About This Form

What is the Local Tax Lancaster form?

The Local Tax Lancaster form, also known as CLGS-32-1, is used to report earned income and calculate local taxes for residents of Lancaster County, Pennsylvania. It is important for anyone living or working in the area to accurately report their income to comply with local tax regulations.

Who needs to file this form?

How can I submit the form?

What if I moved during the tax year?

What should I do if I had no earned income?

How do I resolve tax balance due?

Is there a penalty for late filing?

Can I claim credits against my local tax?

Common mistakes

Filling out the Local Earned Income Tax Return for Lancaster County can be a straightforward process, but there are common mistakes that individuals often make. One significant error is failing to accurately indicate all addresses where one resided during the tax year. If an individual moved during that time, it's crucial to complete the Part-Year Resident Schedule. Neglecting to report accurate residency dates can lead to discrepancies in tax calculations, resulting in complications later.

Another frequent mistake involves combining earned income for spouses. The form specifies that the calculations reported must correspond to the individual names provided in the columns. It's important to remember that each spouse's income should be separated, as combining them could result in inaccuracies that may affect overall tax liability. Each spouse must complete their column, reflecting only their income and associated taxes.

One must also pay close attention to the instructions regarding the use of ink. The form requires the use of black or blue ink exclusively. Utilizing any other color can lead to processing delays or even rejection of the form. This seemingly small detail can significantly affect the timely handling of the tax return.

Lastly, many individuals overlook the requirement to enclose supporting documents such as W-2 forms and schedules. When reporting gross compensation or unreimbursed employee business expenses, it is essential to provide all necessary documentation to substantiate the claims made on the form. Without these, the tax return may be considered incomplete, leading to further inquiries and potential penalties.

Documents used along the form

The Local Tax Lancaster form is an essential document for residents of Lancaster County, Pennsylvania, who need to report their earned income tax. However, there are several other forms and documents often used alongside this one to ensure accurate reporting and compliance with local tax regulations. Below is a list of these additional documents.

- W-2 Form: This is an earnings statement provided by employers. It details the amount of money earned and the taxes withheld from an employee's pay throughout the year. Including W-2s is mandatory when filing the Local Tax Lancaster form.

- PA Schedule UE: This form is used to report unreimbursed employee business expenses. If you have incurred business-related costs that were not reimbursed by your employer, you'll need to fill out this schedule to deduct those expenses from your taxable income.

- PA Schedule C: For self-employed individuals, this schedule reports income and expenses related to business activities. It helps calculate the net profit or loss, which is necessary when determining local tax liabilities.

- Part-Year Resident Schedule: If you moved during the tax year, this schedule is crucial for calculating the income earned and taxes owed in multiple jurisdictions. It allows you to report income separately for the periods you lived in each location.

- S-Corporation Schedule: This form is used specifically for reporting any passive or unearned income derived from S-Corporations. If you or your spouse have interests in an S-Corp, it's essential to include this information when filing.

- Extension Request Form: Sometimes taxpayers need more time to file their taxes. This form allows you to request an extension for submitting your Local Tax Lancaster form, ensuring you don’t miss deadlines.

Using these documents can streamline the tax preparation process and help avoid potential errors. Ensuring that all relevant forms are completed and submitted can ease any future dealings with local tax authorities.

Similar forms

- 1040 Form: Similar in purpose, the 1040 Form is used for individual income tax returns at the federal level. Both forms require income reporting, deductions, and credits.

- W-2 Form: This form summarizes an employee's annual wages and the amount of taxes withheld. It is often referenced when filling out the Local Tax Lancaster form to determine earned income.

- PA Schedule UE: This document details unreimbursed employee business expenses, similar to the deductions section of the Local Tax Lancaster form. It specifies what can be deducted to calculate taxable income.

- K-1 Form: Used to report income from partnerships, S corporations, estates, and trusts, it functions similarly to report earned income from varied sources.

- Local Earned Income Tax Return (generic): Various localities have their own forms for earned income taxes, much like the Local Tax Lancaster form. They share the core elements of income reporting and tax liability calculation.

- State Tax Return: State tax returns track income in relation to state tax obligations. Like the Local Tax Lancaster form, state returns require detailed income information and tax calculations.

- Estimated Tax Payment Form: This form is completed if individuals expect to owe a certain amount of tax and make installment payments. It shares similarities in its aim to report expected income against taxes owed.

Dos and Don'ts

When filling out the Local Tax Lancaster form, here are seven key actions to keep in mind:

- Use black or blue ink. This ensures that your information is legible, which is crucial for processing.

- Double-check your Social Security numbers for accuracy. Small errors can delay your return.

- Include all required supporting documents, such as W-2 forms. Missing documents may result in complications.

- Clearly indicate any extension requests or amendments if applicable. Clarity helps manage your filing status.

- Carefully complete the lines related to your earned income and taxes. Mistakes may lead to incorrect calculations.

- Make sure to sign both your and your spouse's sections if filing jointly. Unsigned forms may be rejected.

- Submit the form on time to avoid penalties and interest. Timely filings help maintain your good standing.

Equally important are the actions to avoid during this process:

- Do not use a PO Box as your address. Only physical addresses are acceptable.

- Do not combine income with your spouse if filing separately. Each person's income must be reported individually.

- Avoid leaving any required fields blank. Incomplete forms may lead to processing delays.

- Do not forget to check the correct boxes for status, such as “Disabled” or “Retired.” This information is vital for determining eligibility.

- Don’t forget to calculate your total taxable income accurately. Errors in calculations can change your tax liabilities.

- Do not hesitate to seek help if you're uncertain about any part of the form. Misunderstandings can create more issues down the line.

- Avoid procrastination. Completing the form well before the deadline minimizes stress and last-minute errors.

Misconceptions

The Local Tax Lancaster form, also known as CLGS-32-1, has some common misconceptions that can lead to confusion. Here are eight of those misconceptions, along with clarifications about each.

- Misconception 1: Only people with a W-2 form need to file this return.

- Misconception 2: If I am retired, I do not need to file the form at all.

- Misconception 3: Amending the return is not necessary if I made an error.

- Misconception 4: I can combine my income with my spouse's income before filing.

- Misconception 5: Local earned income tax does not apply to students.

- Misconception 6: I do not need to include taxes withheld from my paycheck on this form.

- Misconception 7: I can file the form online for free.

- Misconception 8: The form does not require my signature.

This is incorrect. Even if you do not receive a W-2, you may still need to file if you have other forms of earned income.

Retired individuals must file the form only if they have received income from part-time work or a business. Social Security and other retirement income generally do not require filing.

This is false. If you realize there is an error after filing, you should complete an amended return to correct the mistake.

That is not allowed. Each spouse's income must be reported separately on the form.

Students are subject to local earned income tax on any earned income they receive, just like other taxpayers.

This is incorrect. You must report any local tax withheld, as it factors into your total tax liability.

The e-filing option may have fees associated with it, depending on the service used. Always check for any costs before proceeding.

A signature is indeed required to validate your return. Failure to sign may delay processing.

Addressing these misconceptions is crucial for ensuring compliance and accuracy when filing the Local Tax Lancaster form.

Key takeaways

Understanding the Local Tax Lancaster Form is essential for residents and part-year residents in Lancaster County, Pennsylvania. Here are key takeaways to help navigate the filling out and use of the Local Earned Income Tax Return:

- The form is officially designated CLGS-32-1 (12-18) and can be completed electronically at https://efile.lctcb.org.

- Individuals must accurately report their income, including W-2 forms and other relevant documents such as PA Schedule UE for unreimbursed expenses and supporting evidence for other taxable earned income.

- If a resident moves during the year, it is necessary to use the Part-Year Resident Schedule provided on the reverse side of the form to calculate both income and corresponding taxes.

- The form requires separate calculations for each spouse, ensuring that income is not combined if married. Each spouse must fill out their information individually.

- For those who had no earned income, it is important to check the specific reasons on the form, such as being disabled, a student, or retired.

- Local earned income tax payments made during the year should be documented and added together. Credits from previous years and any payments made need to be accurately reflected on the form.

- Failure to file or inaccuracies may result in penalties and interest charges for late payment, making it critical to adhere to deadlines and rules when completing the form.

Browse Other Templates

Alabama Affidavit Form - Return information must be documented with attention to detail.

Cpcc Student Records - The form must be submitted to the Student Records Office for processing.