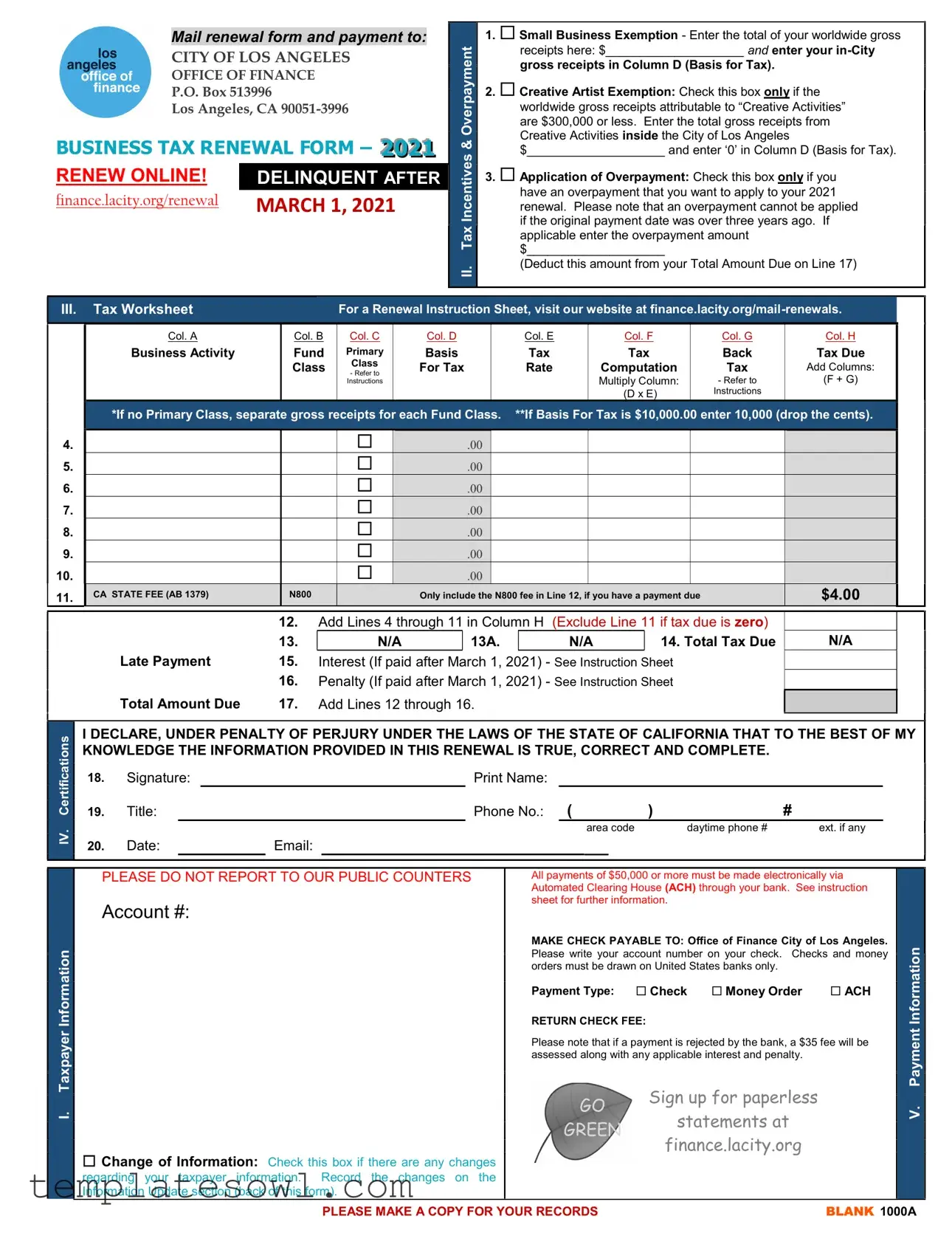

Fill Out Your Los Angeles 1000A Form

The Los Angeles 1000A form is essential for businesses operating within the city, ensuring compliance with local tax regulations. Each year, businesses must renew their tax registration using this form to maintain their legal standing and eligibility for certain incentives. This includes options like the Small Business Exemption and the Creative Artist Exemption, which can help reduce tax burdens for qualifying businesses. Additionally, the form allows for the application of any overpayments, offering financial relief to those who may have paid more than required in previous years. For categorizing business activities, the form provides detailed worksheets to calculate the appropriate tax due based on gross receipts. Timely payment is critical, as late submissions incur penalties and interest. The form also features sections to update taxpayer information, ensuring that the city maintains accurate records. It’s important to note that all major payments must be processed electronically, reinforcing the need for businesses to stay up-to-date with their tax obligations. Navigating the details of the 1000A form may seem daunting, but understanding its components simplifies the renewal process and supports responsible business management in Los Angeles.

Los Angeles 1000A Example

Mail renewal form and payment to:

CITY OF LOS ANGELES

OFFICE OF FINANCE

P.O. Box 513996

Los Angeles, CA

BUSINESS TAX RENEWAL FORM – 2021

RENEW ONLINE! |

DELINQUENT AFTER |

finance.lacity.org/renewal |

MARCH 1, 2021 |

|

II. Tax Incentives & Overpayment

1. Small Business Exemption - Enter the total of your worldwide gross receipts here: $____________________ and enter your

2. Creative Artist Exemption: Check this box only if the

worldwide gross receipts attributable to “Creative Activities” are $300,000 or less. Enter the total gross receipts from Creative Activities inside the City of Los Angeles

$____________________ and enter ‘0’ in Column D (Basis for Tax).

3. Application of Overpayment: Check this box only if you have an overpayment that you want to apply to your 2021 renewal. Please note that an overpayment cannot be applied if the original payment date was over three years ago. If applicable enter the overpayment amount $____________________

(Deduct this amount from your Total Amount Due on Line 17)

III. Tax Worksheet |

|

For a Renewal Instruction Sheet, visit our website at |

|||||

Col. A |

Col. B |

Col. C |

Col. D |

Col. E |

Col. F |

Col. G |

Col. H |

Business Activity |

Fund |

Primary |

Basis |

Tax |

Tax |

Back |

Tax Due |

|

Class |

Class |

For Tax |

Rate |

Computation |

Tax |

Add Columns: |

|

|

- Refer to |

|

|

Multiply Column: |

- Refer to |

(F + G) |

|

|

Instructions |

|

|

|||

|

|

|

|

|

(D x E) |

Instructions |

|

4.

5.

6.

7.

8.

9.

10.

11.

11.

IV. Certifications

*If no Primary Class, separate gross receipts for each Fund Class. **If Basis For Tax is $10,000.00 enter 10,000 (drop the cents).

|

|

.00 |

|

|

|

.00 |

|

|

|

.00 |

|

|

|

.00 |

|

|

|

.00 |

|

|

|

.00 |

|

|

|

.00 |

|

CA STATE FEE (AB 1379) |

N800 |

Only include the N800 fee in Line 12, if you have a payment due |

$4.00 |

12. Add Lines 4 through 11 in Column H (Exclude Line 11 if tax due is zero)

|

13. |

N/A |

13A. |

N/A |

14. Total Tax Due |

N/A |

Late Payment |

15. |

Interest (If paid after March 1, 2021) - See Instruction Sheet |

|

|||

|

16. |

Penalty (If paid after March 1, 2021) - See Instruction Sheet |

|

|||

Total Amount Due |

17. |

Add Lines 12 through 16. |

|

|

|

|

I DECLARE, UNDER PENALTY OF PERJURY UNDER THE LAWS OF THE STATE OF CALIFORNIA THAT TO THE BEST OF MY KNOWLEDGE THE INFORMATION PROVIDED IN THIS RENEWAL IS TRUE, CORRECT AND COMPLETE.

18. |

Signature: |

Print Name: |

|

|

|

19. |

Title: |

Phone No.: ( |

) |

|

# |

|

|

|

area code |

daytime phone # |

ext. if any |

20. |

Date: |

Email: |

|

|

|

I. Taxpayer Information

PLEASE DO NOT REPORT TO OUR PUBLIC COUNTERS

Account #:

Change of Information: Check this box if there are any changes regarding your taxpayer information. Record the changes on the Information Update section (back of this form).

All payments of $50,000 or more must be made electronically via Automated Clearing House (ACH) through your bank. See instruction sheet for further information.

MAKE CHECK PAYABLE TO: Office of Finance City of Los Angeles. Please write your account number on your check. Checks and money orders must be drawn on United States banks only.

Payment Type: Check Money Order |

ACH |

RETURN CHECK FEE:

Please note that if a payment is rejected by the bank, a $35 fee will be assessed along with any applicable interest and penalty.

GO |

Sign up for paperless |

|

statements at |

||

GREEN |

||

finance.lacity.org |

||

|

V. Payment Information

PLEASE MAKE A COPY FOR YOUR RECORDS |

BLANK 1000A |

|

IF YOU HAVE CHANGES TO YOUR ACCOUNT, PLEASE CHECKMARK |

2021 |

|

THE APPROPRIATE BOX BELOW AND FILL IN THAT SECTION |

|

|

|

|

Account #: |

Name: |

|

Tax Registration Certificates are not transferable. If your business is sold or transferred to another

NOTE: entity or you purchase a business, a new Tax Registration Certificate is required. If you have moved out of the City of Los Angeles, but continue to solicit or promote business activities within the City of Los

Angeles for seven or more days a year, you are still required to file a business tax renewal.

VI. Information Update

A. |

Doing Business As (DBA) |

|

|

|

Effective: |

/ |

/ |

|

B. |

|

Mailing Address |

|

|

|

Effective: |

/ |

/ |

|

|

City: |

|

|

State: |

Zip: |

|

|

|

|

Is this a residential address? |

YES |

NO |

(Check one) |

|

|

|

C. |

|

Legal Name Change |

|

|

|

Effective: |

/ |

/ |

|

|

New Telephone Number: |

( |

) |

|

|

|

|

D. |

|

Business Address: |

|

|

|

Effective: |

/ |

/ |

|

|

City: |

|

|

State: |

Zip: |

|

|

|

|

Is this a residential address? |

YES |

NO |

(Check one) |

|

|

|

VII. Vendor / Subcontractor / Commercial Tenant Listing

E. |

|

Rental Property Sold |

Effective: |

/ |

/ |

|

F. |

Entire Business(es) Sold or Discontinued |

Effective: |

/ |

/ |

|

|

G. |

|

Individual Business Activity Sold or Discontinued |

Effective: |

/ |

/ |

Fund/Class(es) |

H. Fiscal year reporting START – fiscal year beginning:

The Los Angeles Municipal Code requires you to provide a list of all

If you are an owner, lessor or sublessor, of office and/or commercial space in the City of Los Angeles, The Los Angeles Municipal Code requires that you provide the Office of Finance the following information regarding your commercial tenants.

NAME |

COMPLETE ADDRESS including SUITE NUMBER |

PHONE NO. INVOICED AMOUNT / RENTAL |

(PLEASE USE ADDITIONAL SHEETS IF NECESSARY)

Form Characteristics

| Fact Name | Description |

|---|---|

| Form Purpose | The Los Angeles 1000A form is a Business Tax Renewal Form used to renew business tax in the City of Los Angeles. |

| Submission Address | Mail completed forms and payment to the CITY OF LOS ANGELES OFFICE OF FINANCE, P.O. Box 513996, Los Angeles, CA 90051-3996. |

| Online Renewal | Business owners can renew online at finance.lacity.org/renewal. |

| Deadline | The renewal deadline is March 1st each year. Late payments incur penalties. |

| Small Business Exemption | Small businesses can claim an exemption based on their worldwide gross receipts. |

| Creative Artist Exemption | Creative artists with gross receipts of $300,000 or less can also claim an exemption. |

| Overpayment Option | Taxpayers can apply any overpayment from previous years to their current renewal. |

| Late Payment Fees | Interest and penalties apply to payments made after March 1, 2021. Refer to the instruction sheet for details. |

| Payment Methods | Payments can be made via check, money order, or ACH. A $35 fee applies for return checks. |

| Legal Requirements | Tax Registration Certificates are non-transferable and a new certificate is required when a business changes ownership. |

Guidelines on Utilizing Los Angeles 1000A

After gathering the necessary information, you will be ready to fill out the Los Angeles 1000A form. Completing this renewal form accurately is essential for ensuring your business tax is processed correctly. Follow these steps to fill out the form seamlessly.

- Begin by entering your taxpayer information at the top of the form. This includes your Account Number and any changes regarding your information.

- If applicable, indicate whether your business is eligible for a Small Business Exemption or a Creative Artist Exemption by checking the appropriate box. Provide the required gross receipts data and enter amounts as instructed.

- In the Tax Worksheet section, fill out the columns according to your business activities. It's important to multiply and add columns as specified in the instructions. Make sure to include all relevant information from Columns A through H.

- Calculate the Total Tax Due by adding up the necessary lines indicated in the form. Don’t forget to add any applicable late payment interest and penalties.

- Sign the declaration to affirm that the information you have provided is accurate. Include your printed name, title, and daytime phone number.

- Finally, provide the date and your email address for additional correspondence.

- Select your payment type, and make the payment as instructed, ensuring to read all payment details carefully.

Once you have completed the form, review it for accuracy before submission. Mail your renewal form, along with the appropriate payment, to the specified address to ensure timely processing. Keep a copy for your records as proof of submission.

What You Should Know About This Form

What is the Los Angeles 1000A form?

The Los Angeles 1000A form is the Business Tax Renewal Form. Businesses in Los Angeles must complete this form annually to renew their business tax registration. It collects information about your business activities and gross receipts to calculate the tax due. This form is essential for compliance with the city's tax regulations.

How can I submit the Los Angeles 1000A form?

You can submit the Los Angeles 1000A form either by mailing it to the City of Los Angeles Office of Finance or by renewing online through the city’s finance website. If you choose to mail it, send the completed form and payment to the specified P.O. Box. Always ensure to check the renewal deadline to avoid any late fees.

What if I need to make changes to my business information?

If there are changes to your business, such as a new address or legal name change, you can check the appropriate box on the form and fill in the new information. It’s essential to keep your records updated to ensure compliance and accurate communication with the city.

What tax incentives can I apply for on the form?

The form includes sections for specific tax exemptions, such as the Small Business Exemption and the Creative Artist Exemption. If your business qualifies for these exemptions, be sure to fill out the related fields, enter your gross receipts, and apply the exemption accordingly to reduce your taxable amount.

What happens if I miss the renewal deadline?

If you miss the renewal deadline of March 1, penalties and interest may apply to your tax due. It's crucial to submit your form and payment promptly to avoid these additional costs. Late payments incur both interest and penalties, which can accumulate quickly.

What payment methods are accepted for the 1000A form?

You can pay your business tax renewal with a check, money order, or electronically via ACH if your payment exceeds $50,000. Make sure that checks and money orders are drawn from U.S. banks and that you include your account number on the payment to ensure it is correctly applied.

What should I do if I believe I've overpaid my business tax?

If you suspect you have overpaid, you may check the corresponding box on the form to apply that overpayment to your renewal. Keep in mind that you can only apply overpayments made within the last three years. Record your overpayment amount on the form to adjust the total amount due.

Common mistakes

Filling out the Los Angeles 1000A form requires careful attention to detail. One common mistake is not entering accurate gross receipts. When applicants report their worldwide gross receipts or their in-City gross receipts, inaccuracies can lead to significant problems. This withholding of exact figures may result in overpayment or underpayment, which can come with penalties.

Another frequent error occurs when individuals overlook the deadlines. If the form is submitted after March 1st, the applicant may face interest and penalty fees. Marking important dates on a calendar can help mitigate this mistake. Ensuring your payment arrives on time is just as crucial as filling out the form correctly.

People often fail to check the appropriate boxes under tax incentives or overpayment sections. For instance, if you qualify for the Small Business Exemption but do not check the box, you could miss out on potential savings. Furthermore, if you have an overpayment but do not check the associated box, that amount will not be applied to this year's tax, leading to unnecessary stress and complications.

A significant oversight arises from not completing the tax worksheet properly. Each column must align with the specific calculations outlined in the instructions. Missing or incorrect entries can skew total amounts due, resulting in either late fees or overpayments that necessitate a refund process.

Applicants sometimes forget to sign the form. Without a signature, the Office of Finance cannot process the application, which delays the entire renewal process. It’s essential to double-check that all required signatures are present before submitting your form.

Finally, many individuals neglect the information update section. If there are any changes to the business information, such as an address or business name, failing to update this can add to confusion and complications for the city’s records. Keeping the tax office informed helps avoid potential audits or inquiries in the future.

Documents used along the form

The Los Angeles 1000A form is primarily used for business tax renewal in the City of Los Angeles. Alongside this form, various other documents facilitate compliance with local tax regulations and support business activities. This list includes essential forms that business owners may frequently encounter.

- Los Angeles Business Tax Registration Certificate: This certificate registers a business with the City of Los Angeles and is required for any business operating within city limits.

- Form N800: This form is necessary for businesses that should include a specific fee mandated by California state law, such as the AB 1379 fee related to certain business activities.

- Business License Application: A separate application that allows a business to legally operate within Los Angeles. It's essential for obtaining a valid business license, demonstrating compliance with local regulations.

- Certificate of Good Standing: This document, provided by the state, verifies that a business is legally registered and compliant with state regulations, often required for various transactions.

- Employment Tax Forms: Businesses must submit these forms to report employee earnings and withholdings. They are crucial for compliance with federal and state tax laws.

- Sales Tax Permit: Required for businesses selling goods or services subject to sales tax. This permit allows the collection of sales tax from customers and ensures proper remittance to the state.

- Property Tax Statements: A notification sent to property owners regarding property tax obligations, which is critical for businesses maintaining real estate in Los Angeles.

- Federal Employer Identification Number (EIN) Application: This form is used to apply for an EIN, a unique number necessary for tax purposes, especially when hiring employees.

- Annual Business Report: Many businesses are required to submit an annual report that updates the city on their activities and finances, assisting in maintaining compliant business operations.

- Tax Incentive Application: This document is used to apply for any available tax incentives, such as credits for small businesses or creative industries, aiming to reduce the overall tax burden.

Collectively, these forms and documents play an important role in ensuring that businesses comply with the various tax obligations applicable in Los Angeles. Owners should be aware of their requirements to avoid penalties and ensure smooth operational processes.

Similar forms

- IRS Form 1040: Individual Income Tax Return - Like the Los Angeles 1000A form, this form is used to report income earned during the previous year and determine tax liability. Both require detailed financial information and are critical for calculating taxes owed.

- California Form 540: Individual Income Tax Return - Similar in purpose to the 1000A, this form focuses on state tax obligations. It requires reporting of income, deductions, and credits, ensuring compliance with California tax laws.

- California Form 100: Corporation Franchise or Income Tax Return - This document is essential for corporations operating within California, paralleling the 1000A in purpose. It assesses tax liabilities based on corporate income similarly to how the 1000A assesses business taxes.

- California Form 568: Limited Liability Company Return of Income - Like the 1000A form, it convenes the reporting of income and determining tax for an LLC. Both documents require discrepancies and exemptions to be reported in a structured format.

- California Form 109: Cooperative Corporation Income Tax Return - This form evaluates the income of cooperative entities, much like the business tax assessment on the 1000A. Both require detailed inputs about financial performance within the tax year.

- California Sales Tax Return - This return is similar as it collects vital tax information from businesses. While the focus differs to sales and use tax, both forms serve their respective jurisdictions in compiling tax liability information.

- California Form 3800: For Business Credits - This form allows businesses to apply for tax credits, akin to the exemptions available on the 1000A. Both provide ways to lessen tax burdens, seen in the nuances of reporting receipts and taxes owed.

- Los Angeles Business Registration Application - Though an initial document, this form bears similarity in terms of basic business tax information. It captures the necessary details for business compliance with local regulations, laying groundwork for subsequent filings such as the 1000A.

Dos and Don'ts

When completing the Los Angeles 1000A form, ensuring accuracy and compliance is crucial. To assist with this process, here is a list of things you should and shouldn't do:

- Double-check your information. Ensure that all entries, particularly financial figures, are accurate and complete.

- Use legible handwriting. If filling out the form by hand, write clearly to avoid misinterpretation.

- Provide necessary documentation. If exemptions or deductions apply, include any required paperwork to substantiate your claims.

- Clearly mark changes. If you are updating your taxpayer information, clearly indicate these changes on the form.

- Use a reliable payment method. Make sure to choose a payment option that is secure and appropriate for your business, such as checks or ACH.

- Submit by the deadline. To avoid penalties, make sure to send your completed form and payment before the due date.

- Keep a copy for your records. Always retain a copy of your submitted form for future reference.

- Don't rush through the form. Take your time to ensure every section is filled out properly and thoroughly.

- Don't ignore instructions. Pay close attention to any specific instructions provided on the form or in accompanying materials.

- Don't leave blank spaces. If a section does not apply to you, note it as “N/A” instead of leaving it blank.

- Don't make random changes. Avoid altering the form's structure or the order of sections, as this could lead to confusion.

- Don't forget the signature. Ensure that the form is signed where required, affirming the accuracy of the information provided.

- Don't use non-United States banks. Payments must be drawn from U.S. banks, so avoid using international banking options.

- Don't underestimate the importance of deadlines. Mark your calendar and plan ahead to meet all submission dates.

By following these guidelines, you can navigate the renewal process smoothly and with confidence.

Misconceptions

Misconceptions about the Los Angeles 1000A form can lead to confusion. Here are five common misunderstandings:

- The 1000A form is only for large businesses. In fact, it is also designed for small businesses. Businesses with gross receipts below certain thresholds can qualify for exemptions.

- You can submit the form at any time without penalties. The form has a strict deadline. If you fail to submit it by March 1, 2021, your account will become delinquent and incur interest and penalties.

- Only businesses physically located in Los Angeles need to file. This is incorrect. If you conduct business activities within Los Angeles for seven or more days a year, you must file, regardless of your business's physical location.

- All payments must be made via check or money order. This is a misconception. For payments of $50,000 or more, electronic payment through Automated Clearing House (ACH) is required.

- Overpayments can be applied indefinitely. This is misleading. An overpayment can only be applied if the original payment date was within the last three years.

Understanding the actual requirements of the Los Angeles 1000A form can help ensure compliance and avoid unnecessary penalties.

Key takeaways

Completing the Los Angeles 1000A form is essential for business tax renewal. Here are key takeaways to consider:

- Mailing Details: Send the renewal form and payment to the Office of Finance at the specified P.O. Box in Los Angeles.

- Online Renewal: Consider renewing online to facilitate a smoother process and avoid delinquency.

- Tax Incentives: Small Business Exemption and Creative Artist Exemption may reduce tax liabilities. Ensure to fill in gross receipts accurately.

- Overpayment Application: If applicable, indicate any overpayment amount to be deducted from your total amount due.

- Accurate Tax Calculation: Carefully follow the instruction sheet to compute tax due based on gross receipts and tax rates.

- Electronic Payments: For payments of $50,000 or more, use electronic Automated Clearing House (ACH) transfers through your bank.

- Signature Requirement: The form must be signed, declaring that the provided information is true and correct under penalty of perjury.

- Change of Information: Check the box for any changes to your taxpayer information and update accordingly on the back of the form.

- Disclosure Compliance: Be aware that non-financial information may be subject to public disclosure under California Public Records Act.

These points will assist in navigating the Los Angeles 1000A renewal process efficiently and correctly.

Browse Other Templates

What Documents Are Needed for Citizenship - Submit Form N-648 if you are requesting a disability exception to testing.

Teacher Degree Illinois - Each certificate request must be detailed; this form can only be used for one certificate type.