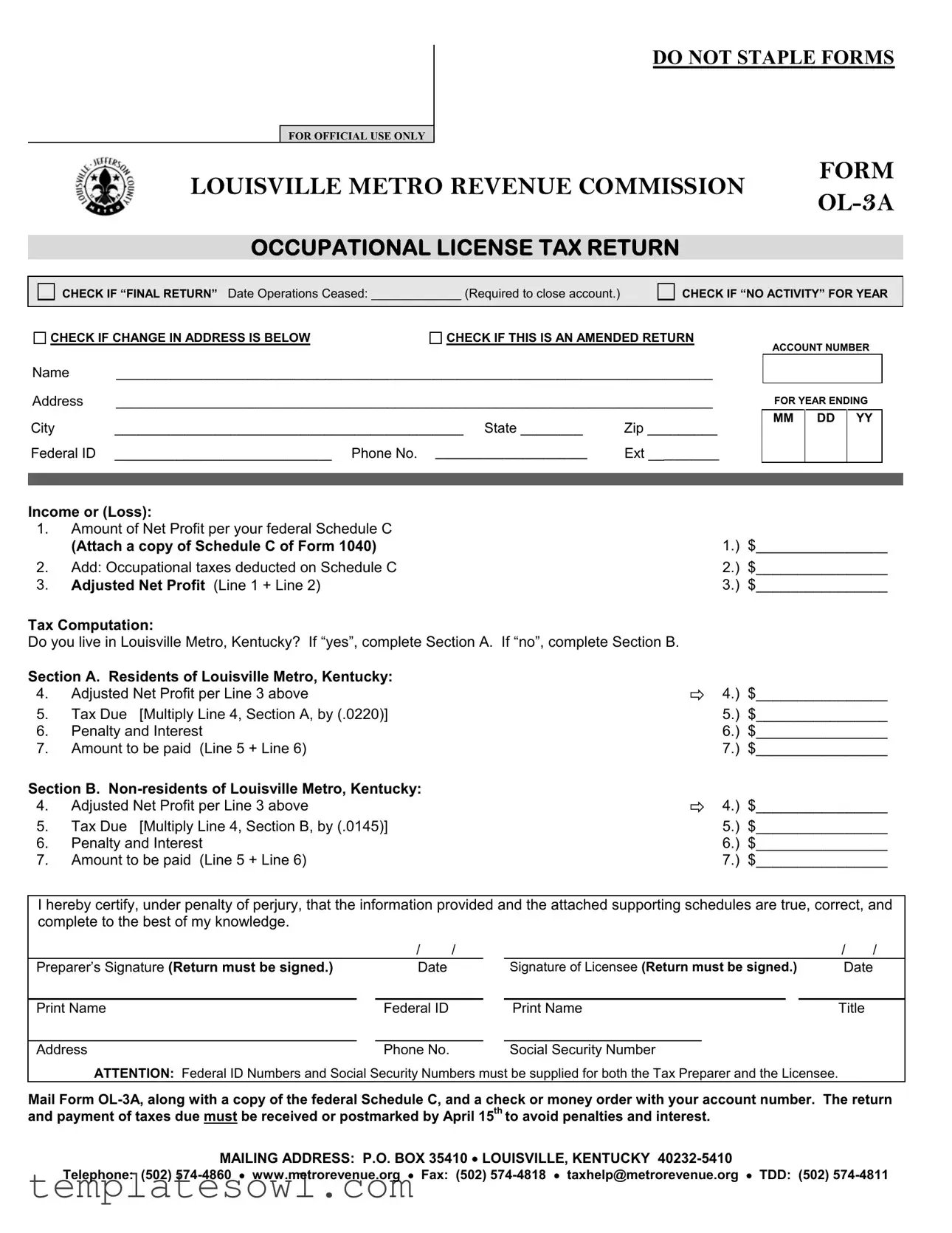

Fill Out Your Louisville Metro Ol 3 Form

The Louisville Metro OL-3 form serves as a critical tool for individuals conducting business in Louisville, Kentucky, by outlining the process for filing an Occupational License Tax Return. This form is specifically designed for individuals rather than corporations or partnerships, making it essential for sole proprietors and self-employed individuals. It gathers essential information, including personal details, income, and tax calculations based on net profits. A key aspect of this form is the distinction between residents and non-residents of Louisville Metro, as it determines the applicable tax rate: 2.2% for residents and a lower rate for non-residents. The OL-3 form also includes provisions for declaring a final return, reporting no activity, updating addresses, and addressing amendments. Additionally, it imposes strict deadlines, requiring the return to be filed by April 15, which is crucial to avoid penalties and interest. Missing these deadlines can lead to significant financial repercussions, so understanding the intricacies of the form is vital for compliance and financial planning.

Louisville Metro Ol 3 Example

FOR OFFICIAL USE ONLY

DO NOT STAPLE FORMS

LOUISVILLE METRO REVENUE COMMISSION

FORM

OCCUPATIONAL LICENSE TAX RETURN

CHECK IF “FINAL RETURN” Date Operations Ceased: _____________ (Required to close account.)

CHECK IF “NO ACTIVITY” FOR YEAR

CHECK IF CHANGE IN ADDRESS IS BELOW

CHECK IF THIS IS AN AMENDED RETURN

ACCOUNT NUMBER

Name |

_____________________________________________________________________________ |

|

Address |

_____________________________________________________________________________ |

|

City |

_____________________________________________ State ________ |

Zip _________ |

Federal ID |

____________________________ Phone No. ______________________ |

Ext __________ |

Income or (Loss):

1.Amount of Net Profit per your federal Schedule C

FOR YEAR ENDING

MM DD YY

(Attach a copy of Schedule C of Form 1040)

2.Add: Occupational taxes deducted on Schedule C

3.Adjusted Net Profit (Line 1 + Line 2)

Tax Computation:

Do you live in Louisville Metro, Kentucky? If “yes”, complete Section A. If “no”, complete Section B.

Section A. Residents of Louisville Metro, Kentucky:

4.Adjusted Net Profit per Line 3 above

5. Tax Due [Multiply Line 4, Section A, by (.0220)]

6.Penalty and Interest

7.Amount to be paid (Line 5 + Line 6)

Section B.

4.Adjusted Net Profit per Line 3 above

5. Tax Due [Multiply Line 4, Section B, by (.0145)]

6.Penalty and Interest

7.Amount to be paid (Line 5 + Line 6)

1.) |

$________________ |

2.) |

$________________ |

3.) |

$________________ |

4.) $________________

5.) $________________

6.) $________________

7.) $________________

4.) $________________

5.) $________________

6.) $________________

7.) $________________

I hereby certify, under penalty of perjury, that the information provided and the attached supporting schedules are true, correct, and complete to the best of my knowledge.

|

/ |

/ |

|

|

|

|

|

/ |

/ |

|

Preparer’s Signature (Return must be signed.) |

|

Date |

|

|

Signature of Licensee (Return must be signed.) |

Date |

||||

|

|

|

|

|

|

|

|

|

|

|

Print Name |

|

Federal ID |

|

|

Print Name |

Title |

|

|||

|

|

|

|

|

|

|

|

|

||

Address |

|

Phone No. |

|

|

Social Security Number |

|

|

|||

ATTENTION: Federal ID Numbers and Social Security Numbers must be supplied for both the Tax Preparer and the Licensee. |

|

|

||||||||

Mail Form

MAILING ADDRESS: P.O. BOX 35410 LOUISVILLE, KENTUCKY

Telephone: (502)

GENERAL INSTRUCTIONS

Explanation of Occupational Taxes: The Louisville Metro Revenue Commission (hereinafter referred to as the “Revenue Commission”) collects Occupational License Fees/Taxes (hereinafter referred to as “Occupational Taxes”) on all income resulting from transacting business within Louisville Metro, Kentucky. There is no minimum earned income amount before you are liable for filing a tax return. The occupational tax is imposed upon the privilege of engaging in a business, profession, occupation, or trade within Louisville Metro, Kentucky, regardless of the legal residence of the person so engaged. Louisville Metro includes the area within the boundaries of Jefferson County, Kentucky. The current rate for Occupational Taxes totals 2.2% (.0220). This total is distributed as follows: 1.25% (.0125) to Louisville Metro Government;

.2% (.0020) to Transit Authority of River City (TARC); and .75% (.0075) to the Louisville or Anchorage Public School Boards. The occupational license tax rate is applicable to the “net profits” of business entities, independent contractors and self- employed individuals, and to the gross employee compensation of employed individuals. Individuals who reside outside Louisville Metro, Kentucky, are exempt from the School Board tax.

Who May Use This Form: This return may be used only if all of the following apply:

(a)You are an individual (not a corporation or a partnership).

(b)You had no employees for the calendar year.

(c)You are not a domestic servant or a minister.

(d)You were not engaged in the activity of selling alcoholic beverages.

(e)All of your income per Schedule C was earned in Louisville Metro, Kentucky.

(f)You were either a resident for the entire year or a

NOTE: If you meet the conditions above and you had no business expenses, you should file Form

The salaries and wages of domestic servants and duly ordained ministers of religion are exempt from all the local occupational taxes, except the (.0075) School Board’s tax. Domestic servants and ordained ministers must use Form

Period Covered: Form

Extensions: If an extension of time for filing is required, a separate extension request to the Louisville Metro Revenue Commission is mandatory in all cases. You must file Form

15th.

Payment of Occupational Taxes: interest. The deadline is April 15th. Metro Revenue Commission.

The occupational taxes must be paid in full at the time of filing to avoid penalties and Do not send cash through the mail. Please make your check payable to the Louisville

Penalty and Interest: There is a penalty of five percent (5%) per month or a fraction of a month to a maximum of

Failure to File Return and/or Pay Occupational Tax: Any person (including a corporation) who willfully fails to prepare or file a timely return, or who willfully prepares or files a false or inaccurate return, is subject, upon conviction, to a fine not exceeding $100.00. The failure of any person to receive a return shall not excuse him or her from filing a return or from paying the proper occupational tax.

Form Characteristics

| Fact Name | Description |

|---|---|

| Purpose of Form OL-3A | This form is used to report and pay occupational license taxes on income earned within Louisville Metro, Kentucky. It applies to individuals who meet specific criteria. |

| Governing Law | The collection of occupational license taxes is governed by local regulations specific to Louisville Metro, Kentucky, which mandate the filing of Form OL-3A. |

| Submission Requirements | Tax filers must submit the OL-3A along with a copy of their federal Schedule C by April 15th. Failure to do so may result in penalties and interest. |

| Tax Rates | Residents of Louisville Metro are subject to a tax rate of 2.2% on net profits, while non-residents pay a reduced rate of 1.45%. |

Guidelines on Utilizing Louisville Metro Ol 3

After completing the Louisville Metro Occupational License Tax Return Form OL-3A, it is essential to ensure that all information is accurate and that the form is submitted on time to avoid any penalties. Below is a detailed guide to filling out this form correctly.

- Mark if this is a final return by checking the appropriate box.

- If applicable, indicate the date operations ceased in the space provided.

- Check the box for "No Activity" for the year if this applies to you.

- Check the box for a change of address if applicable.

- Check if this is an amended return.

- Fill in your account number.

- Write your name on the designated line.

- Complete your address, including city, state, and zip code.

- Provide your Federal ID number.

- Enter your phone number and extension if applicable.

- Report the amount of net profit as stated in your federal Schedule C for the year ending date (MM DD YY). Attach a copy of Schedule C of Form 1040 to the return.

- Add any occupational taxes deducted on Schedule C.

- Calculate the adjusted net profit by adding the amounts from the previous two lines.

- Determine if you live in Louisville Metro, Kentucky. Based on your residency, proceed to either Section A or Section B.

- If you are a resident (Section A), enter your adjusted net profit from the previous line, then multiply by .0220 to calculate tax due. Record any penalties and interest, and sum these to find the total amount payable.

- If you are a non-resident (Section B), enter your adjusted net profit from the previous line, then multiply by .0145 to calculate tax due. Similarly, record any penalties and interest, and sum these to find the total amount payable.

- Confirm that all calculations are correct.

- Sign and date the form where indicated, ensuring both the preparer and licensee signatures are present as required.

- Print names, federal ID, title, address, and phone number as requested on the form.

- Provide social security numbers for both the tax preparer and licensee.

- Make a check or money order payable to the Louisville Metro Revenue Commission and include it with the completed form.

- Mail the completed Form OL-3A, Schedule C, and payment to the addressed mailing location.

What You Should Know About This Form

What is the Louisville Metro OL-3 form used for?

The Louisville Metro OL-3 form is an Occupational License Tax Return. This form must be filed by individuals who are engaged in business, profession, occupation, or trade within Louisville Metro, Kentucky. It reports income earned throughout the year and calculates the applicable occupational tax owed. The form serves as a way for the Louisville Metro Revenue Commission to collect taxes on business income, ensuring compliance with local tax laws.

Who is required to file the OL-3 form?

This form is specifically for individuals who do not have employees and are not corporations or partnerships. Applicants must have earned all income reported on Schedule C within Louisville Metro. If you are a domestic servant, a minister, or have been selling alcoholic beverages, you need to use different forms. Individuals should also file if they had no business expenses and earned income throughout the calendar year.

What information do I need to complete the OL-3 form?

To fill out the OL-3 form, you will need your full name, address, and account number. Your federal ID and phone number must also be included. You should prepare your federal Schedule C, as it details your income or loss for the year. This information is crucial, as it forms the basis for calculating your tax due. If applicable, you should also indicate if this is your final return, if there's been no activity, or if an address change has occurred.

What is the deadline for submitting the OL-3 form?

The completed OL-3 form, along with any required payments, must be postmarked or received by April 15th each year. It is important to adhere to this deadline to avoid penalties and interest. If you require more time to file, you may request an extension using Form OL-3E or by submitting a copy of your federal extension application, ensuring it is also submitted before the original due date.

What penalties may be imposed for late filing or payment?

Filing the OL-3 form late can result in serious penalties. There is a penalty of five percent per month for failure to file, which can total up to twenty-five percent of the tax due. Additionally, there is a separate five percent penalty for late payments. Interest on unpaid taxes accrues at twelve percent annually from the due date until payment is made. It is vital to avoid these penalties by filing on time.

What if I am a resident outside Louisville Metro?

If you reside outside Louisville Metro but have earned income from business activities within its boundaries, you are still required to file the OL-3 form. However, the tax rate may differ. Non-residents will use the calculations outlined in Section B of the form, which applies a lower tax rate than that for residents. Ensure all income reported was earned in the area to comply with the regulations.

How should I mail the completed OL-3 form?

Once you have completed the OL-3 form and attached your federal Schedule C, you need to include your payment as well. Do not send cash through the mail; instead, write a check or money order made payable to the Louisville Metro Revenue Commission. Mail everything to the designated address — P.O. Box 35410, Louisville, Kentucky 40232-5410. It is advisable to keep a copy of everything sent for your records.

Common mistakes

When completing the Louisville Metro OL-3 form, many people inadvertently make mistakes that can lead to complications in their tax filing. One common error is failing to check the appropriate boxes at the top of the form. Indicating whether this is a “Final Return,” “No Activity,” or an “Amended Return” is crucial. Missing this step may result in the form being processed incorrectly, which can delay the return or create additional penalties.

Another mistake involves neglecting to provide accurate income details. The form requires the amount of Net Profit as reported on your federal Schedule C. If this figure is left blank, or if the wrong amount is entered, it could significantly alter your tax calculations. Always ensure that your attached Schedule C aligns perfectly with the figures stated on the OL-3 form to avoid issues with the Revenue Commission.

People often forget to sign the form. Both the preparer and the licensee must provide their signatures. Missing signatures can lead to the form being returned, causing unnecessary delays and potential fines. Take a moment to ensure that all required signatures are included before submitting.

Additionally, omitting the Federal ID and Social Security Numbers for both the tax preparer and licensee is a frequent oversight. This information is essential for processing the return, so double-check that these identifiers are filled in accurately. Leaving them out may result in the Revenue Commission being unable to verify the return.

Some filers fail to calculate the tax correctly as dictated in the form's instructions. Whether you are a resident or non-resident of Louisville Metro, the formula to compute the tax due varies. For residents, you multiply by 0.0220, while for non-residents, the rate is 0.0145. Miscalculating the tax amount can lead to issues in your tax standing, so ensure you follow these guidelines carefully.

Moreover, individuals often forget the deadline for submitting their returns. The OL-3 form must be postmarked by April 15th to avoid penalties and interest. Setting reminders ahead of this deadline can help ensure timely submission and prevent fines.

Finally, many individuals do not read the instructions thoroughly, leading to misunderstandings about what is required. It's important to understand whether you qualify to use the OL-3A form and to follow all guidelines provided. Taking the time to read through the instructions can save you from common pitfalls and ensure your tax return is properly filed.

Documents used along the form

When dealing with business matters in Louisville Metro, several forms and documents are commonly used in conjunction with the Louisville Metro OL-3 form. Understanding these documents will help ensure compliance with local tax requirements and make the filing process smoother. Here’s a brief overview of some important forms you might encounter.

- Form OL-3EZ: This simplified return is available for individuals with no business expenses who meet certain qualifications. It's particularly useful if you operated as a sole proprietor in Louisville Metro and had no employees.

- Form OL-3E: This extension request form must be filed if you need additional time to submit your OL-3A. It's crucial to complete this by the original due date to ensure you avoid penalties.

- Schedule C (Form 1040): This federal tax form details income and expenses for sole proprietors and is required to be attached to Form OL-3A. It helps determine your business's net profits.

- Form W-2: If you are an employer, this form is essential for reporting wages paid to employees, as well as taxes withheld. It provides necessary information for the employee's filing as well.

- Form 1099-MISC: Use this form to report payments made to independent contractors or freelancers who are not your employees. Ensure that you provide this form to freelancers providing services within Louisville Metro.

- Form OL-3NR: Non-residents who earned income within Louisville Metro must use this return to report their income and pay the appropriate taxes. Compliance with local tax rules is critical for non-residents.

- Form LOI: This "Letter of Instruction" is often included with tax forms to guide filers on how to complete and submit their returns. It may contain specific notes or reminders to avoid common mistakes.

- Form OL-3V: This form is utilized for making estimated payments of occupational taxes throughout the year. If you're a business expecting to owe taxes, using this form can facilitate timely payments and help avoid hefty end-of-year bills.

Understanding these documents can empower you as a business owner or independent contractor operating in Louisville Metro. By being informed about the forms that accompany the OL-3A, you can navigate the tax filing process more effectively and ensure compliance with local regulations.

Similar forms

-

IRS Form 1040: This is the individual income tax return that reports an individual's annual income and calculates taxes owed. Like the OL-3A form, it requires supporting documentation like schedules for profit reporting.

-

Schedule C: This document details profit or loss from a business. The OL-3A form references Schedule C to compute net profits, emphasizing transparency in income reporting.

-

IRS Form W-2: This form reports wages paid to employees and taxes withheld. Similar to the OL-3A, it is a vital part of tax reporting for those earning income within a jurisdiction.

-

IRS Form 1099-MISC: For self-employed individuals, this form reports various kinds of income. The OL-3A captures similar self-employment earnings, highlighting the need for accurate income assessments.

-

Occupational Tax Return (varies by municipality): Many local governments require similar occupational tax returns, which assess individuals or entities for engaging in local business activities, much like Kentucky's OL-3A.

-

State Income Tax Return: Individuals are often required to submit a state tax return with similar income reporting protocols, engaging taxpayers in verifying earnings as done in the OL-3A.

-

Form OL-3EZ: An abbreviated version for simpler situations, this form references similar income and filing requirements while catering to taxpayers without business expenses, aligning with the OL-3A's broader scope.

-

Business License Application: This document is necessary to legally operate a business in many jurisdictions. Likewise, the OL-3A form confirms compliance with local income standards to ensure legality in operations.

-

Account Closure Form: Used when businesses cease operations, this document is similar in its requirement for individuals to provide clear declarations regarding operational status, akin to the OL-3A.

-

Amended Tax Return (Form 1040X): Taxpayers use this form to correct previously submitted tax returns. Like the OL-3A's amended return option, it allows individuals to rectify any reporting discrepancies.

Dos and Don'ts

When completing the Louisville Metro OL-3 form, there are several key practices to follow and certain pitfalls to avoid. Adhering to these guidelines will help ensure a smooth filing process.

- Do read the instructions carefully before starting to fill out the form.

- Do double-check all personal and financial information for accuracy.

- Do attach a copy of your federal Schedule C as required.

- Do ensure both the tax preparer and licensee's Federal ID numbers are provided.

- Don’t forget to sign the form; both the preparer's and licensee's signatures are mandatory.

- Don’t use staples or paper clips, as forms should be kept flat for processing.

- Don’t miss the April 15th deadline for filing and payment to avoid penalties.

- Don’t send cash when mailing your payment; instead, use a check or money order.

By following these recommendations, individuals can mitigate errors and ensure compliance with the filing requirements for the Louisville Metro OL-3 form.

Misconceptions

- Misconception 1: Only businesses with high earnings need to file the OL-3 form.

- Misconception 2: Independent contractors are exempt from filing.

- Misconception 3: Filing the OL-3 form is optional for non-residents.

- Misconception 4: Domestic servants do not have to file any form.

- Misconception 5: The tax rate is flat for everyone.

- Misconception 6: You can file the OL-3 form at any time during the year.

- Misconception 7: If the OL-3 form is not received, you are exempt from filing.

- Misconception 8: You cannot request an extension for filing.

- Misconception 9: Penalties do not apply if you file late.

- Misconception 10: The tax is only assessed on net profits.

In reality, there is no minimum income threshold. Anyone earning income from conducting business within Louisville Metro must file the OL-3 form.

This is incorrect. Independent contractors are required to file the OL-3 form if they meet the necessary criteria, regardless of their employment status.

Non-residents must file the OL-3 if they earned income in Louisville Metro. The form applies to anyone conducting business within the area, regardless of residency.

While domestic servants are exempt from most local occupational taxes, they still need to file a specific form (OL-3) if applicable.

The tax rate varies based on residency status. Residents pay at a higher rate (2.2%), while non-residents pay a lower rate (1.45%).

Form OL-3 must be filed by April 15 for it to be considered timely. Late submissions can incur penalties and interest.

Not receiving the form does not exempt you from the obligation to file. Taxpayers should ensure they submit a return even if they did not receive a notice.

Contrary to this belief, you can request a six-month extension using Form OL-3E or by submitting a federal extension application.

Filing late incurs penalties. Specifically, there’s a five percent penalty for each month the return is late, up to a maximum of twenty-five percent.

While net profits are taxed, gross compensation received by employed individuals is also subject to the occupational license tax, highlighting a broader scope.

Key takeaways

Filling out and using the Louisville Metro OL-3 form can be straightforward if you keep a few essential points in mind. Here are key takeaways to consider:

- Eligibility Criteria: Only individuals who meet specific conditions may use this form. These conditions include being a resident or non-resident for the entire year, having no employees, and earning all income in Louisville Metro. If you do not meet these criteria, you may need a different form.

- Payment Deadlines: The return and payment of any taxes due must be completed by April 15th. Late submissions incur penalties and interest, so timely filing is crucial to avoid extra costs.

- Tax Rates: The occupational tax rate is 2.2% for residents and 1.45% for non-residents of Louisville Metro. Ensure you calculate the correct amount based on your adjusted net profit.

- Certification Requirement: The form must be signed by both the preparer and the licensee. Signing certifies that the information provided is accurate, and failure to do so can lead to legal consequences.

By keeping these takeaways in mind, you can navigate the OL-3 form process with greater ease and ensure compliance with local regulations.

Browse Other Templates

Indiana Resale Certificate - Out-of-state purchasers may be subject to state regulations regarding tax exemptions.

Form Fl-155 - Ensure to cross-check financial figures on FL-155 for accuracy.