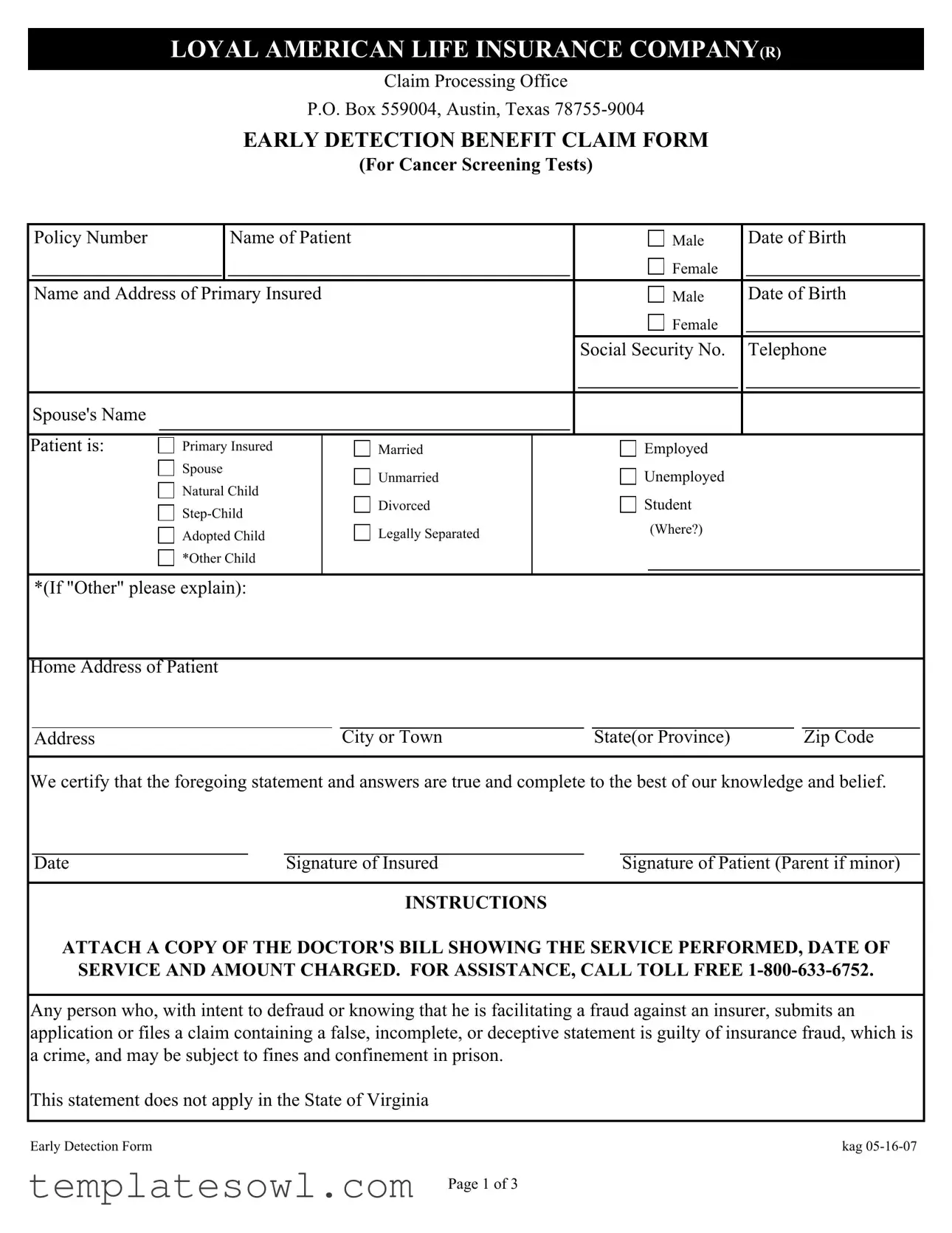

Fill Out Your Loyal American Claim Form

The Loyal American Claim form is an essential document for individuals seeking benefits related to cancer screening tests under their insurance policy. This form is designed to capture necessary information about the patient, such as their name, date of birth, and relationship to the primary insured. It categorizes patients into various statuses, including being a natural child or a step-child, to ensure accurate identification and processing of claims. Key sections also require signatures and certification of the information provided, underscoring the importance of honesty and accuracy in submissions. Furthermore, the form includes a critical authorization section that allows healthcare providers to share pertinent treatment information with the insurance company. Attachments such as a copy of the doctor’s bill need to accompany the claim, further streamlining the processing by providing essential details like service dates and charges. Assistance is readily available through a toll-free number, making the process more manageable for claimants. Understanding how to properly complete and submit this form can significantly impact the timeliness and success of receiving benefits.

Loyal American Claim Example

LOYAL AMERICAN LIFE INSURANCE COMPANY(R)

Claim Processing Office

P.O. Box 559004, Austin, Texas

EARLY DETECTION BENEFIT CLAIM FORM

(For Cancer Screening Tests)

|

Policy Number |

|

|

Name of Patient |

|

|

|

Male |

|

Date of Birth |

|

|

|

|

|

|

|

|

|

|

Female |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Name and Address of Primary Insured |

|

|

|

Male |

|

Date of Birth |

|

||||

|

|

|

|

|

|

|

|

Female |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Social Security No. |

|

Telephone |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Spouse's Name |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

||||

Patient is: |

Primary Insured |

Married |

|

|

Employed |

|

|

|||||

|

|

Spouse |

Unmarried |

|

|

Unemployed |

|

|

||||

|

|

Natural Child |

|

|

|

|

||||||

|

|

Divorced |

|

|

Student |

|

|

|||||

|

|

|

|

|

|

|||||||

|

|

|

|

|

(Where?) |

|

|

|||||

|

|

Adopted Child |

Legally Separated |

|

|

|

|

|||||

|

|

*Other Child |

|

|

|

|

|

|

|

|

||

*(If "Other" please explain):

Home Address of Patient |

|

|

|

Address |

City or Town |

State(or Province) |

Zip Code |

We certify that the foregoing statement and answers are true and complete to the best of our knowledge and belief.

Date |

Signature of Insured |

Signature of Patient (Parent if minor) |

INSTRUCTIONS

ATTACH A COPY OF THE DOCTOR'S BILL SHOWING THE SERVICE PERFORMED, DATE OF SERVICE AND AMOUNT CHARGED. FOR ASSISTANCE, CALL TOLL FREE

Any person who, with intent to defraud or knowing that he is facilitating a fraud against an insurer, submits an application or files a claim containing a false, incomplete, or deceptive statement is guilty of insurance fraud, which is a crime, and may be subject to fines and confinement in prison.

This statement does not apply in the State of Virginia

Early Detection Form |

kag |

Page 1 of 3

AUTOHORIZATION FORM FOR DISCLOSURES OF A CLAIMANT'S PROTECTED HEALTH INFORMATION

I hereby authorize the disclosure of protected health information about me as described below.

1. The Company, as used in this authoriztion, shall mean:

Great American Life Insurance Company's (R) Long Term Care Division

Great American Life Insurance Company's (R) Long Term Care Division

Loyal American Life Insurance Company (R)

Loyal American Life Insurance Company (R)

United Teacher Associates Insurance Company

United Teacher Associates Insurance Company

2.I authorize all health care providers who have provided treatment or other health care services to me to disclose all information regarding my treatment to the Company's claims and underwriting representatives by and through the Company's contracted agent, Web ISG.

3.The information which is described above will be disclosed to the Company to determine my entitlement to benefits under my health benefits plan or policy.

4.I understand that I may revoke this authorization in writing at any time, except to the extent that action has been taken by the Company in reliance on this authorization, by sending a written revocation to the Company's Claims Department at P.O. Box 26580, Austin, Texas

5.This authorization will expire

6.I understand that the information which will be provided under this authorization is necessary for the Company to evaluate my entitilement to benefits under my health benefits plan or policy and that the Company will condition the provision of payment benefits to me on my providing this authorization, and my claim may be denied if I refuse to provide this authorization.

7.I understand that if the person or entity that receives my protected health information is not a health care provider or health plan covered by the federal privacy regulations, the information may be redisclosed by such person or entity and will likely no longer be protected by the federal privacy regulations. In the case of this authorization, however, the information described above will be received by a health plan which is covered by the federal privacy regulations.

8.I understand that a photocopy, facsimile copy, or electronic copy of this authorization shall be considered as effective and valid as the original.

9.I understand that I or my personal representative am entitled to receive a copy of this authorization upon request.

Page 2 of 3

If you are the representative of the claimant, decribe the scope of your authority to act on the claimant's behalf:

Claimant Name

Name of claimant's personal representative, if applicable

Relationship of personal representative to the claimant

Signature of claimant (or claimant's representative)

Date of claimant's (or claimant's representative) signature

A signed copy of this form will be provided any time upon request.

Page 3 of 3

Form Characteristics

| Fact Name | Description |

|---|---|

| Company Name | The form is associated with Loyal American Life Insurance Company, a recognized provider of insurance products. |

| Purpose | This form is intended for submitting claims under the Early Detection Benefit for cancer screening tests. |

| Submission Address | Claims must be sent to the Processing Office at P.O. Box 559004, Austin, Texas 78755-9004. |

| Required Documentation | A copy of the doctor's bill showing the service performed, date of service, and amount charged must be attached. |

| Signature Requirement | Both the insured and the patient (or parent if the patient is a minor) must sign the form for processing. |

| Fraud Warning | The form includes a warning about insurance fraud, highlighting potential criminal consequences for false claims. |

| Authorization Duration | The authorization for disclosure of protected health information is valid for 24 months from the date signed. |

| Revocation Process | A written revocation of the authorization can be submitted to the Company's Claims Department at any time. |

| State-Specific Law | The fraud warning notice does not apply in the State of Virginia, indicating differing state-specific regulations. |

Guidelines on Utilizing Loyal American Claim

Completing the Loyal American Claim form involves several straightforward steps. After the form is filled out correctly and signed, it should be submitted along with any required documentation, such as the doctor's bill, to ensure efficient processing.

- Obtain the Loyal American Claim form from the official website or contact the customer service for a copy.

- Fill in the policy number at the top of the form.

- Provide the name of the patient and mark their gender, including date of birth.

- Enter the primary insured's name and address, along with their gender and date of birth.

- Include the social security number and telephone number of the primary insured.

- Indicate the spouse's name and select the patient's relationship status.

- List the home address of the patient, including city, state, and zip code.

- Certify that the information provided is true and complete by signing the form. If the patient is a minor, a parent should sign on their behalf.

- Attach a copy of the doctor’s bill that details the service performed, date of service, and amount charged.

- If applicable, fill out the authorization form for disclosure of protected health information, providing the claimant's name and the relationship of any personal representative.

- Submit the completed form and the supporting documents to the claim processing office at the provided address.

What You Should Know About This Form

What is the Loyal American Claim form used for?

The Loyal American Claim form serves as a request for benefits associated with cancer screening tests. It is designed for patients who have undergone such screenings and need to submit a claim to receive reimbursement or payment for the services rendered. Completing this form helps ensure the insurance company processes claims accurately and efficiently.

What information is required on the form?

The claim form requires several pieces of information. Be prepared to provide the policy number, the patient's name, date of birth, and Social Security number. Additionally, details about the primary insured, including their name, address, and marital status, must be included. Information about the medical services, such as a copy of the doctor's bill indicating the service performed, date, and amount charged is also essential.

How do I submit the claim form?

To submit the Loyal American Claim form, fill it out completely and attach a copy of the relevant doctor's bill. The completed form and supporting documents should be mailed to the Loyal American Life Insurance Company's Claims Processing Office at P.O. Box 559004, Austin, Texas 78755-9004. Ensure that all information is accurate to facilitate timely processing.

What should I do if I need assistance with the claim form?

If you require help with the Loyal American Claim form, you can call the company's toll-free assistance line at 1-800-633-6752. Customer service representatives are available to guide you through the claims process and answer any questions you may have about completing the form.

How long does it take to process my claim?

The time required to process a claim can vary based on several factors, including the completeness of the submitted information and the number of claims being processed at any given time. Generally, it may take several weeks for your claim to be reviewed and processed. You may check your claim status by contacting customer service if you have not received communication within a reasonable timeframe.

What happens if I submit false information on the claim form?

Submitting false or deceptive information on the Loyal American Claim form is considered insurance fraud, a serious offense that could lead to legal consequences. Penalties may include fines or imprisonment. It is crucial to provide truthful and complete information to avoid any risk of fraud accusations.

Can I revoke my authorization for the disclosure of health information?

Yes, you have the right to revoke your authorization for the disclosure of your protected health information at any time. This must be done in writing and sent to the Company's Claims Department. However, be aware that the revocation will not affect any actions taken by the company based on your authorization prior to its revocation.

What should I do if I have health information privacy concerns?

Your privacy is important, and you should be aware that if your protected health information is disclosed to a person or entity not covered by federal privacy regulations, it may no longer be protected. If you have concerns, consider discussing them with the insurance company before submitting your claim to ensure you are comfortable with the process.

Can I receive a copy of the authorization form?

Definitely. You are entitled to request a copy of the authorization form at any time. The company is required to provide you with a signed copy upon request. This ensures that you have a record of your authorization for your personal information and claims processing.

Common mistakes

Completing the Loyal American Claim form can seem straightforward, but there are common pitfalls. One of the most frequent mistakes is failing to include a complete and correct policy number. Without this crucial information, the processing of the claim is likely to be delayed or even rejected. Always double-check that you have filled in the policy number accurately before submitting the form.

An incomplete patient and insured information section represents another major error. Individuals often overlook details such as dates of birth or miss including the social security number. These sections are critical in verifying identity and eligibility for benefits, so ensure that all information is provided clearly and completely.

Sometimes, claimants forget to attach a copy of the necessary documentation. The instructions specify the need for a copy of the doctor’s bill showing services performed, date of service, and amount charged. Not including this documentation may lead to automatic disqualification of the claim, which can be easily avoided by following the guidelines closely.

Another common mistake occurs during the signature process. Many individuals neglect to have the necessary parties sign the form. If the patient is a minor, for example, it is essential that the parent or guardian signs in the designated area. Missing signatures can result in further delays as the claim will be considered incomplete.

Finally, be aware of the authorization section. Failing to properly authorize the disclosure of protected health information can lead to significant issues. It’s important to understand that without this authorization, the company may not process the claim. Ensure that every section requiring a signature is completed, and consider confirming your understanding of the implications of the authorization before submitting.

Documents used along the form

The process of filing a claim with Loyal American Life Insurance Company can involve several important documents to ensure a smooth and proper handling of your case. Each of these forms serves a unique purpose in helping to process your claim efficiently. Understanding these documents will guide you through the claims process and help to provide necessary information to the insurance company.

- Claim Dispute Form: This document is used if there is a disagreement regarding the outcome of a claim. It allows the claimant to formally challenge the decision made regarding their claim and provides details about the reasons for the dispute.

- Patient Information Form: This form collects basic information about the patient, including medical history and current health conditions. It is often required to assess eligibility for certain benefits and services.

- Health Care Provider Statement: A statement from the medical provider detailing the services rendered, diagnosis, and the costs incurred. This is essential to show proof of treatment and validate the claim.

- Release of Information Form: This legal document allows the insurance company to obtain necessary medical records from healthcare providers. It is crucial for verifying the health information needed to process the claim.

- Policyholder Verification Form: This form confirms the identity of the policyholder and ensures that the claim is being processed for the right individual. It may require personal details, policy numbers, and verification signatures.

Gathering these forms alongside your Loyal American Claim form will facilitate a clearer and more efficient claims process. Always keep copies of all submitted documents for your records. Should you have questions about any of these forms, consider reaching out to the claims department for assistance.

Similar forms

- Health Insurance Claim Form: Similar to the Loyal American Claim form, this document is used to submit a claim for benefits related to medical services. It collects basic patient information and details of the services provided to ensure proper processing of claims.

- Life Insurance Claim Form: This form is designed to claim benefits from a life insurance policy. Like the Loyal American Claim form, it requires information about the insured and may require proof of death and related documentation to substantiate the claim.

- Disability Insurance Claim Form: This document is submitted for insurance benefits due to disability. It often requires similar personal and medical information, ensuring that claims are processed efficiently and accurately, much like the Loyal American Claim form.

- Medicare Claim Form: Used for filing claims under Medicare, this form shares similarities in requiring detailed information about medical services received and relevant charges. Both forms aim to facilitate the reimbursement process based on specific coverage.

- Accident Claim Form: This form addresses injuries resulting from accidents, demanding patient and treatment details. It mirrors the Loyal American Claim form by also needing supporting documentation, like medical bills, to process claims successfully.

- Extended Care Insurance Claim Form: This form is relevant for claims related to long-term care services. It includes personal information and need for care, reflecting the structure of the Loyal American Claim form to ensure clear communication of the claimant’s needs.

Dos and Don'ts

- DO: Carefully fill out all required information to ensure completeness.

- DO: Attach a copy of the doctor's bill that includes the date of service and amount charged.

- DO: Sign the form; both the insured and the patient (or parent if the patient is a minor) must provide signatures.

- DO: Keep a copy of the completed claim form and attachments for your records.

- DON'T: Provide false or misleading information; doing so constitutes insurance fraud.

- DON'T: Forget to include the necessary authorization for the disclosure of protected health information.

- DON'T: Submit the form without reviewing it for accuracy and completeness first.

Misconceptions

Understanding the Loyal American Claim form can help streamline your claims process. Here are 10 common misconceptions about this form:

- Only the Primary Insured Can File a Claim - Many believe that only the primary insured individual can submit a claim, but other authorized representatives, such as spouses or legal guardians, are also allowed to file on behalf of the patient.

- No Need for Supporting Documents - It is a common mistake to think that supporting documents are not necessary. A copy of the doctor's bill showing services rendered must be attached to the claim form.

- Authorization Is Optional - Some individuals assume that signing the authorization for disclosure of health information is optional. In fact, it is required to evaluate your benefits entitlement.

- The Form Is Only for Cancer Screening - Many might think the form is limited to cancer screening tests. However, it can also cover other related healthcare services, depending on the policy.

- Claims Are Automatically Approved - People often believe that submitting a claim guarantees payment. Each claim is subject to review and must meet the policy's eligibility criteria.

- Filing Delay Doesn't Matter - Some may feel filing a claim late is inconsequential. However, claims typically have a deadline, and delays could result in denial.

- Claims Processing Is Always Fast - There’s a misconception that all claims are processed quickly. The time for processing can vary based on the complexity of the claim and the clarity of the information provided.

- Fax or Email Copies Aren't Allowed - Some assume that only original forms are accepted. A photocopy or electronic version of signed documents can be valid as long as they fulfill the required conditions.

- Protected Health Information Is Always Secure - Many think their health information is entirely secure once submitted. While protections are in place, there is always a risk of breaches, especially if the information is shared with non-covered entities.

- You Can't Change Your Authorization Later - It is often believed that once an authorization is signed, it can't be changed. In reality, you can revoke or modify your authorization in writing at any time.

These misconceptions can lead to confusion and delays. Understanding these points can help you navigate the claims process effectively.

Key takeaways

Here are important points to consider when filling out and using the Loyal American Claim form:

- Complete All Required Fields: Ensure every section of the form is completed accurately. Missing information may delay the processing of your claim.

- Attach Necessary Documentation: Include a copy of the doctor's bill that displays the service performed, the date of service, and the amount charged. This documentation is critical for your claim to be considered.

- Read the Authorization Carefully: Understand the authorization section related to the disclosure of your protected health information. This is necessary for the evaluation of your claim.

- Signatures Are Important: The form requires signatures from both the insured and the patient (or a parent if the patient is a minor). Ensure both signatures are included before submitting.

- Keep a Copy for Your Records: Always make a copy of the completed claim form and any attached documents for your records. This can help track the progress of your claim.

For assistance, a toll-free number is available: 1-800-633-6752. Reach out if questions arise during the completion of your claim form.

Browse Other Templates

Marker Casino Meaning - The credit department will inform you of your application status.

Coworx Staffing Login - The Break and Meal Period Policy is available online for reference.

Piggly Wiggly Careers - State your preference for full-time or part-time work.