Fill Out Your Ls 54 Form

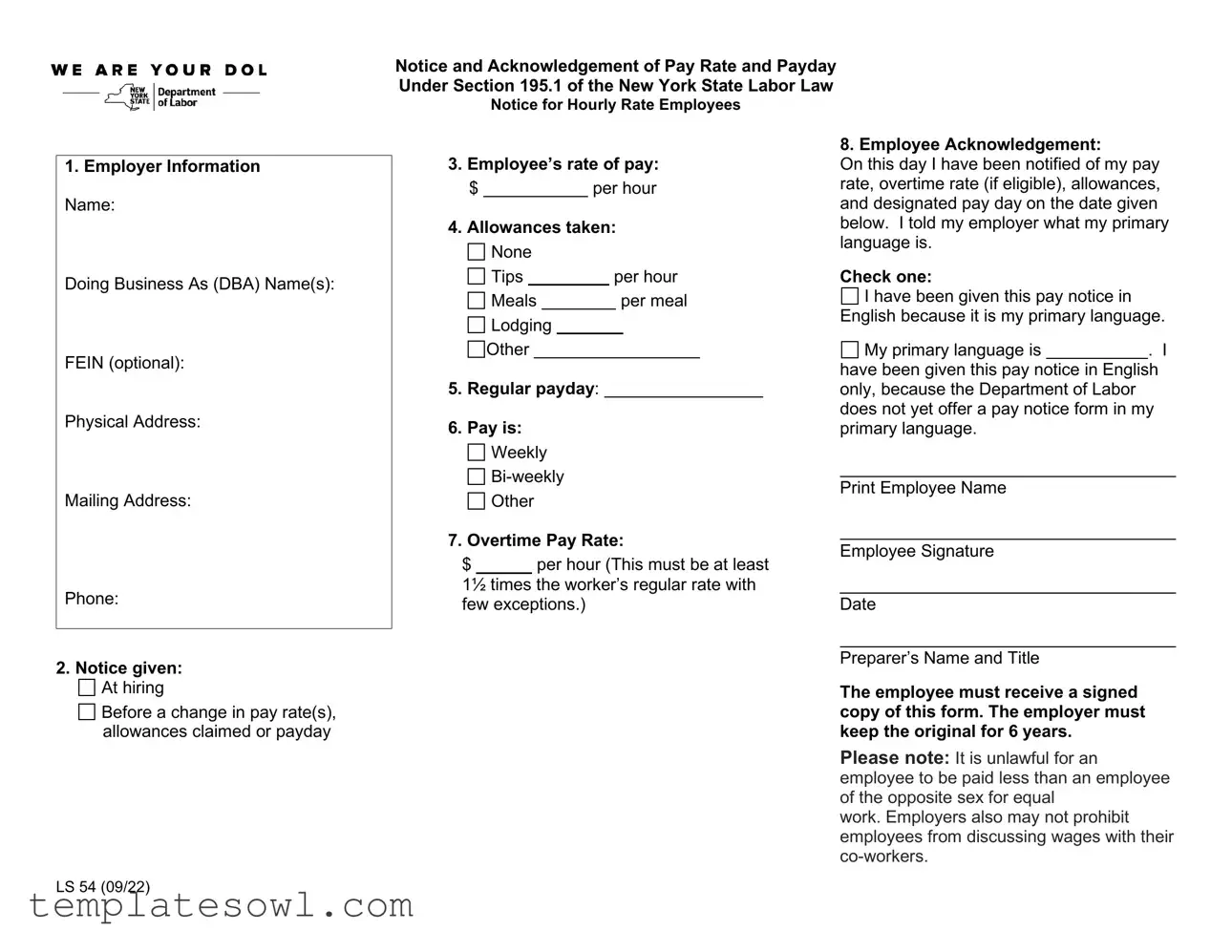

The LS 54 form plays a crucial role in ensuring that employees in New York are fully informed about their pay details. This form is particularly relevant for hourly rate employees and is designed to fulfill the requirements set forth in Section 195.1 of the New York State Labor Law. It includes essential information such as the employer’s specifics, including the College of Staten Island's physical address and contact details. The notice captures the employee's rate of pay, which should be clearly stated as a per-hour figure. Additionally, it allows for the acknowledgment of any allowances, whether that be tips, meals, or lodging, although for those not taking any allowances, a simple checkbox is provided. Regular payday information is also included, with designations for weekly, bi-weekly, or other schedules. The form specifies the overtime pay rate, which must comply with state regulations, ensuring workers are aware of their rights to overtime compensation. Lastly, it features an employee acknowledgment section where individuals can indicate their primary language and confirm receipt of this important information. This signed form serves as an official record, requiring the employer to retain the original for six years while providing a copy to the employee for their records and peace of mind.

Ls 54 Example

1. Employer Information

Name:

Doing Business As (DBA) Name(s):

FEIN (optional):

Physical Address:

Mailing Address:

Phone:

2. Notice given: |

Notice and Acknowledgement of Pay Rate and Payday Under Section 195.1 of the New York State Labor Law

Notice for Hourly Rate Employees

3. Employee’s rate of pay:

$ |

|

per hour |

4. Allowances taken:

None |

|

|

|

||||

Tips |

|

per hour |

|||||

Meals |

|

|

per meal |

||||

Lodging |

|

|

|

|

|||

Other |

|

|

|

|

|||

5.Regular payday:

6.Pay is:

Weekly

Weekly

Other

Other

7.Overtime Pay Rate:

$ per hour (This must be at least 1½ times the worker’s regular rate with few exceptions.)

8. Employee Acknowledgement:

On this day I have been notified of my pay rate, overtime rate (if eligible), allowances, and designated pay day on the date given below. I told my employer what my primary language is.

Check one:

I have been given this pay notice in English because it is my primary language.

I have been given this pay notice in English because it is my primary language.

My primary language is |

|

. I |

have been given this pay notice in English |

|

|

only, because the Department of Labor |

|

|

does not yet offer a pay notice form in my primary language.

Print Employee Name

Employee Signature

______________________________

Date

Preparer’s Name and Title

At hiring |

Before a change in pay rate(s), allowances claimed or payday

Before a change in pay rate(s), allowances claimed or payday

The employee must receive a signed copy of this form. The employer must keep the original for 6 years.

Please note: It is unlawful for an employee to be paid less than an employee of the opposite sex for equal

work. Employers also may not prohibit employees from discussing wages with their

LS 54 (09/22)

Form Characteristics

| Fact Name | Details |

|---|---|

| Form Title | Notice and Acknowledgement of Pay Rate and Payday Under Section 195.1 of the New York State Labor Law |

| Governing Law | New York State Labor Law, specifically Section 195.1 |

| Employer Information Requirements | Employers must provide their name, DBA name, FEIN, and physical and mailing addresses. |

| Pay Rate Notification | Employees must receive notification of their pay rate upon hiring or before a change in pay rate. |

| Pay Frequency | The form specifies that pay can be weekly, bi-weekly, or another schedule as determined by the employer. |

| Record Keeping Requirement | Employers are required to keep the original signed form for six years, while employees should receive a signed copy. |

Guidelines on Utilizing Ls 54

After completing the LS 54 form, the employer must ensure that the original copy is stored securely for a minimum of six years. Additionally, the employee should receive a signed copy of the completed form for their records.

- Provide the employer information, including the name and DBA name of the College of Staten Island.

- Include the Employer FEIN, if applicable, followed by the physical and mailing addresses.

- Enter the employer's phone number, ensuring accuracy for future communications.

- Select how notice was given by marking the appropriate box for either "At hiring" or "Before a change in pay rate(s), allowances claimed or payday."

- Fill in the employee's rate of pay, specifying the hourly rate in the designated field.

- Indicate allowances taken by marking the box for "None" or specifying each allowance, if any, such as tips, meals, or lodging.

- Specify the regular payday, which for this example is Thursday.

- Indicate the pay frequency by selecting "Weekly," "Bi-weekly," or "Other." For this case, select "Bi-weekly."

- Fill in the overtime pay rate. If eligible, provide the rate. If not applicable, write "N/A."

- In the Employee Acknowledgment section, complete all necessary fields. Print the employee's name, sign, and provide the date.

- Fill in the preparer's name and title at the bottom of the form.

- Ensure the employee receives a signed copy of the completed form. Store the original copy for a period of six years.

What You Should Know About This Form

What is the LS 54 form used for?

The LS 54 form is a notice and acknowledgment of pay rate and payday in New York State. It provides essential information about an employee's pay rate, overtime rate, allowances, and designated payday. Employers are required to provide this notice at the time of hiring or when there is a change in pay, ensuring transparency in compensation practices.

Who needs to fill out the LS 54 form?

Both the employer and the employee must properly complete the LS 54 form. Employers, like the College of Staten Island in this example, need to provide specific information about pay rates and schedules. Employees must acknowledge receipt of the form and confirm their understanding of their pay details. Remember, this acknowledgment is crucial for ensuring both parties are on the same page.

How often are paychecks issued according to the LS 54 form?

The LS 54 form specifies the regular payday, which, for the employer listed, is every Thursday. Pay can be issued on a weekly or bi-weekly basis, depending on what is indicated on the form. In this case, it is bi-weekly, so employees can expect their paychecks every two weeks. This regular schedule helps employees to plan their finances effectively.

What happens if an employee's primary language is not English?

If an employee's primary language is not English, they must check the option indicating this on the form. While the notice is provided in English, the employer must take steps to ensure the employee understands the terms outlined. If a version in the employee's primary language is not available, it is the employer's responsibility to provide clear communication, helping to avoid misunderstandings.

How long should the employer keep the LS 54 form?

Employers are required to keep the original signed LS 54 form for a minimum of six years. This retention is important for compliance with labor laws. It protects both the employer and the employee, providing a documented record of the agreed-upon pay rates and conditions if any disputes arise in the future.

Common mistakes

Filling out the LS-54 form accurately is essential for both employers and employees to ensure compliance with New York State Labor Law. However, several common mistakes can lead to misunderstandings and potential legal issues. Awareness of these pitfalls can aid in the proper completion of the form.

One frequent mistake is failing to provide accurate employer information. The name of the employer, including the "Doing Business As" (DBA) designation, must be clearly stated. If this information is incorrect or incomplete, it can cause complications in case of disputes or inquiries regarding the employee's pay rate and employment status.

Another common error occurs with the notice section. Employers must check the appropriate box, indicating whether notice was given at hiring or before a change in pay rate. Choosing the wrong option or leaving it unchecked can create issues regarding evidence of compliance with notification requirements. Documentation should be thorough to protect the rights of both parties.

Additionally, misreporting the employee’s rate of pay can lead to confusion. Employers should ensure that the hourly wage is filled in accurately, as any discrepancies can result in wrongful pay claims. It is crucial to verify this rate before submitting the form.

Many individuals overlook the section regarding allowances taken. Even if no allowances are present, it's vital to denote that by checking the "None" option. Omitting a response here could lead to assumptions regarding wage deductions, causing employees to feel misinformed about their earnings.

It is also important to specify the regular payday correctly, as this sustains transparency between employee and employer. Mislabeling the pay schedule, whether it is weekly, bi-weekly, or another frequency, can disrupt financial planning for employees and create unnecessary confusion.

Lastly, employees must provide their acknowledgment accurately. This section allows them to communicate their primary language and confirm receipt of the pay notice. Failing to fill out this part, or providing incorrect information, may limit an employee’s ability to understand their rights and protections under labor laws.

By avoiding these common mistakes when completing the LS-54 form, both employers and employees can foster a clearer and more compliant workplace environment.

Documents used along the form

The LS 54 form is primarily used to notify employees of their pay rate and payday, as mandated under New York State Labor Law. Employers often need to accompany this form with additional paperwork to ensure compliance with various labor regulations. Below is a list of documents that are commonly used alongside the LS 54 form, each serving a unique purpose in the employer-employee relationship.

- W-4 Form: This document is used by employees to indicate their tax withholding preferences. It informs the employer how much federal income tax to withhold from their paychecks.

- I-9 Form: This form verifies an employee's identity and eligibility to work in the United States. It must be completed by all new hires in compliance with immigration law.

- Direct Deposit Authorization Form: Employees can use this form to authorize their employer to deposit their paycheck directly into their bank account, ensuring timely payments.

- Employee Handbook Acknowledgment: This form confirms that the employee has received and reviewed the employer’s employee handbook, which outlines workplace policies and procedures.

- Emergency Contact Information Form: Employers often require employees to provide emergency contact details. This document ensures that the employer can reach someone on the employee’s behalf in case of an emergency.

- Health Insurance Enrollment Form: If offered, employees can use this form to enroll in health benefits provided by the employer. It outlines the options available and the terms related to coverage.

- State Disability Insurance Form: In some states, employers must provide employees with information regarding disability insurance. This form helps employees understand their rights and the benefits available to them.

- Time Off Request Form: Employees typically use this document to request leave from work for personal or medical reasons. It helps employers manage staffing and schedules effectively.

- Performance Review Acknowledgment: After performance reviews, this form provides a record that the employee has been informed of their evaluation and any feedback provided by their employer.

Each of these documents plays an essential role in promoting transparency and compliance in the employment process. Collectively, they create a comprehensive framework that supports both the employer's and the employee's rights and responsibilities, ensuring a smooth working relationship.

Similar forms

The LS 54 form is part of a broader category of documents that inform employees about their pay and employment terms. Here are six similar documents:

- Form W-2: This tax form is provided by employers to employees, detailing annual wages and tax withholdings. Like the LS 54, it is crucial for understanding compensation but is used for tax reporting rather than pay notification.

- Form I-9: This document verifies an employee's identity and authorization to work in the U.S. Similar to the LS 54, the Form I-9 ensures compliance with labor laws but focuses on employment eligibility rather than pay specifics.

- Employee Offer Letter: This letter outlines the terms and conditions of employment, including salary and benefits. Both documents serve to inform employees of essential information regarding their job, though the offer letter is typically issued before employment begins.

- Pay Stub: Provided regularly with each paycheck, this document details hours worked, deductions, and total pay received. Like the LS 54, it offers crucial insights into an employee's earnings and deductions but is issued after payment has been made.

- Form 1099: Issued to independent contractors, this form reports earnings from self-employment. It serves a similar purpose to the LS 54 in that it provides a formal outline of pay but is aimed at non-employees.

- Direct Deposit Authorization Form: This form allows employees to authorize their salary to be deposited directly into their bank accounts. Like the LS 54, it is a document related to pay, although it focuses on the method of payment rather than the amount.

Understanding these documents can help employees navigate their rights and responsibilities effectively. Each one plays a role in ensuring transparency and compliance in the employment relationship.

Dos and Don'ts

When filling out the LS 54 form, keep these important tips in mind:

- Do provide accurate employer information, including the full name and address.

- Don't leave any required fields blank; ensure all sections are completed.

- Do clearly communicate the employee’s pay rate and any applicable allowances.

- Don't forget to check the communication preferences for the employee's primary language.

- Do ensure the employee receives a signed copy of the form after it is filled out.

By following these guidelines, you can help ensure that the LS 54 form is completed correctly and efficiently.

Misconceptions

When it comes to the LS 54 form, misunderstandings can lead to confusion for both employers and employees. Here are six common misconceptions about this important document:

- Myth 1: The LS 54 form is only for full-time employees.

- Myth 2: Employers do not need to provide a copy of the LS 54 form to employees.

- Myth 3: The LS 54 form only needs to be issued once.

- Myth 4: The LS 54 form is optional for employers.

- Myth 5: The LS 54 form does not need to be kept on file for long.

- Myth 6: The LS 54 form can be verbally communicated to employees.

In reality, the LS 54 form is designed for all hourly rate employees, regardless of their full-time or part-time status. This means that even part-time workers should receive this form upon hiring.

Actually, it is a requirement for employers to provide a signed copy of the LS 54 form to the employee. This ensures that both parties have a clear understanding of the pay rate and other details of employment.

This is another misconception. If any changes occur in pay rate, allowances, or payday, the employer must issue a new LS 54 form to the employee. Keeping this information up to date is crucial.

Contrary to this belief, the LS 54 form is not optional. Under New York State Labor Law, employers are legally obligated to provide this notice to hourly rate employees to ensure transparency regarding pay practices.

In fact, employers are required to keep the original LS 54 form on file for six years. This retention is important for compliance and potential audits.

This is not the case. Communication regarding pay rates and paydays must be documented through the LS 54 form. Relying on verbal communication alone may lead to misunderstandings or disputes.

Understanding these misconceptions is key to ensuring compliance and fostering a positive working relationship between employers and employees.

Key takeaways

Here are some important points to remember about the LS 54 form:

- The LS 54 form serves as a notification for employees regarding their pay rates and paydays, in accordance with New York State Labor Law.

- Both the employer and employee must fill out and maintain their respective copies of the form. The employer retains the original for six years.

- Clear communication is paramount. The form includes a section where employees specify their primary language to ensure understanding of the pay notice.

- If there are allowances such as tips, meals, or lodging, the form enables the employer to disclose this information, although the example provides that none are taken.

Browse Other Templates

Wisconsin Boat Registration - Inaccuracies in the form can lead to legal repercussions for the applicant.

How to Get a Survivorship Deed Ohio - Applicable property must be clearly described for processing the deed.