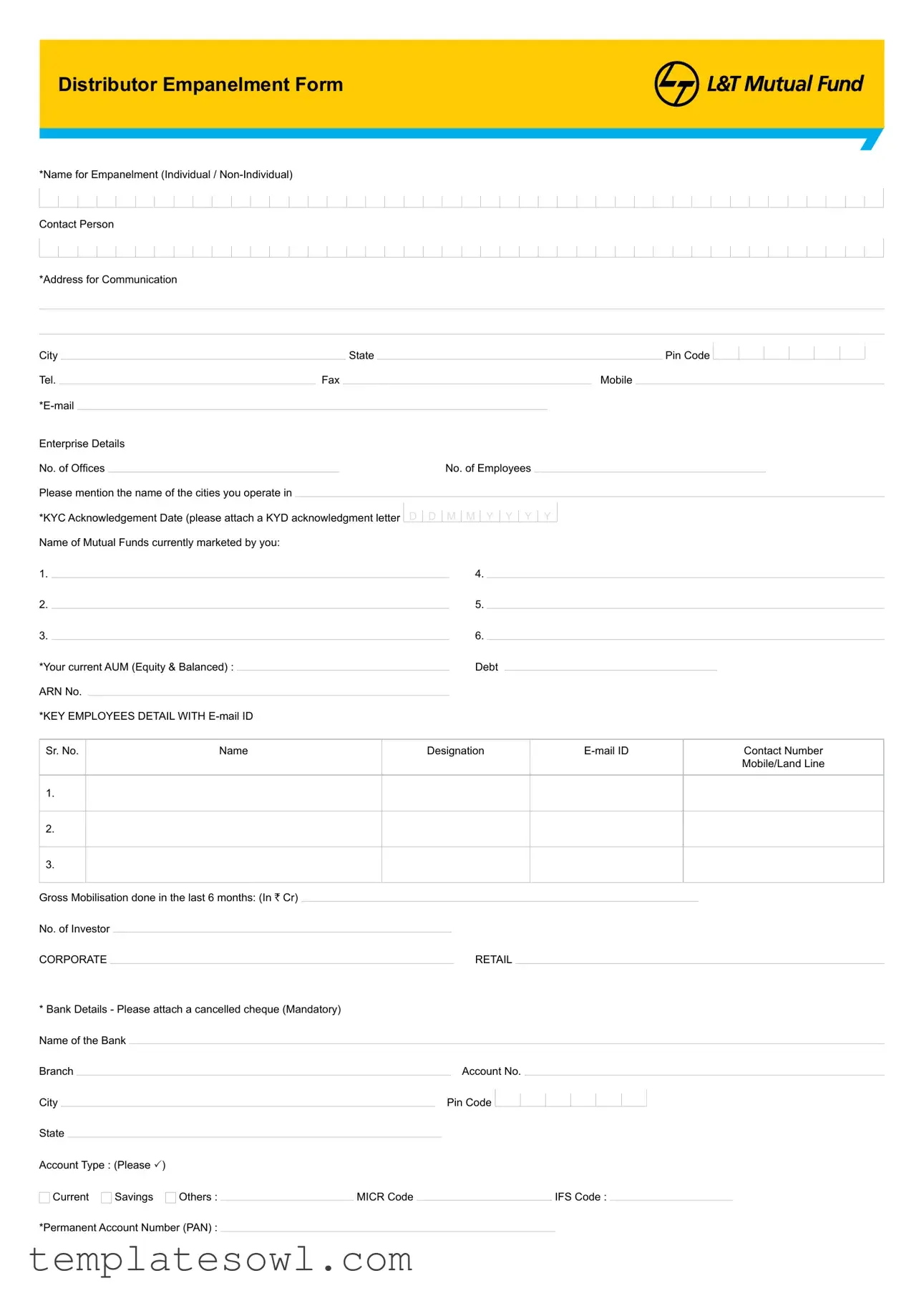

Fill Out Your Lt Mutual Fund Empanelment Form

The Lt Mutual Fund Empanelment Form is a crucial document for individuals and organizations looking to become authorized distributors of mutual fund schemes under the L&T Investment Management umbrella. This form captures essential information, including the distributor's name—whether representing an individual or a non-individual entity—as well as contact details and the address for communication. Additionally, it requires key enterprise details, such as the number of offices and employees, to provide insights into the distributor's operational capacity. A particularly important section requests information on the mutual funds that the distributor currently markets, establishing their experience in this field. Compliance measures are also embedded in the form, mandating the inclusion of a Know Your Customer (KYC) acknowledgment and a Permanent Account Number (PAN), reinforcing the regulatory framework under which the mutual fund operates. Furthermore, there are sections dedicated to providing bank details, key employees' information, and gross mobilization figures, which help establish credibility and financial integrity. Specific guidelines for individual and non-individual representatives streamline the documentation process, ensuring that all necessary certifications and compliance requirements are met for smooth functioning as a distributor.

Lt Mutual Fund Empanelment Example

Distributor Empanelment Form

*Name for Empanelment (Individual /

Contact Person

*Address for Communication

City |

|

|

|

|

|

|

State |

|

|

|

|

|

Pin Code |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

Tel. |

|

|

|

Fax |

|

|

|

|

Mobile |

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

Enterprise Details |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

No. of Ofices |

|

|

|

|

|

No. of Employees |

|

|

|

|

|

|

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

||||||||||||||

Please mention the name of the cities you operate in

*KYC Acknowledgement Date (please attach a KYD acknowledgment letter D D M M Y Y Y Y Name of Mutual Funds currently marketed by you:

1. |

|

|

4. |

|

|

|

|

2. |

|

|

5. |

|

|

|

|

3. |

|

|

6. |

|

|

|

|

*Your current AUM (Equity & Balanced) : |

|

|

Debt |

|

|

||

ArN No.

*KEY EMPloYEES DETAIl wITh

Sr. No. |

Name |

Designation |

Contact Number |

|

|

|

|

|

Mobile/land line |

|

|

|

|

|

1. |

|

|

|

|

|

|

|

|

|

2. |

|

|

|

|

|

|

|

|

|

3. |

|

|

|

|

|

|

|

|

|

Gross Mobilisation done in the last 6 months: (In ` Cr) |

|

No. of Investor |

|

CorPorATE |

rETAIl |

*Bank Details - Please attach a cancelled cheque (Mandatory)

Name of the Bank

Branch |

|

|

|

|

|

|

|

|

Account No. |

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

City |

|

|

|

|

|

|

|

|

|

Pin Code |

|

|

|

|

|

|

|

|

|

|

||

State |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

Account Type : (Please ) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

Current |

Savings |

others : |

|

MICr Code |

|

|

|

|

|

|

|

|

IFS Code : |

|

|

|||||||

*Permanent Account Number (PAN) :

NOMINATION DETAILS FOR BROKERAGE COMMISSION |

If Nominee is a minor |

|||||||

(For individuals and sole proprietorships) |

|

|

|

|

|

|||

Name |

|

|

|

Date of Birth of Nominee |

|

|

||

Address |

|

|

Name of legal Guardian |

|

|

|||

|

|

|

|

Address of |

||||

|

|

|

|

legal Guardian |

|

|||

relationship |

|

Signature of |

with Distributor |

|

legal Guardian |

Declaration:

1.we hereby declare that the information furnished is true and correct to the best of my knowledge.

2.we shall abide by the terms and conditions mentioned overleaf and agree to comply with the same.

*Signature :

(If on behalf of the company, the seal of the company must be afixed)

*Mandatory items

ChECK - LIST

Individual empanelment (Individual/hUF) (self attested copies)

1. Empanelment Form |

2. ArN Card |

4. Cancelled cheque copy as per bank mandate |

5. Details of |

|

Mobile number of key personal mentioned |

1.Empanelment Form

2.Certiicate of Registration issued by AMFl in the name of agency desiring empanelment (ARN No.)

3.Memorandum of Association/Articles of Association/ Partnership Deed (which ever applicable)

4.PAN Card

5.Board resolution

6.list of authorized signatories

7.Cancelled cheque copy as per bank mandate

8.Details of

9.KYD acknowledgment letter

3. PAN Card

6. KYD acknowledgment letter

* For Oficial Use Only

originator Name & Signature

Branch

Signature of Branch head (if applicable)

Signature of regional head

L&T Investment Management Ltd.

6th Floor, Mafatlal Centre, Nariman Point, Mumbai 400021 Tel.: 91 22 6655 4000 Fax: 91 22 6655 4200 www.lntmf.com

TERMS AND CONDITIONS FOR EMPANELMENT

The terms and conditions (“Terms and Conditions”) stated below and as may be amended from time to time are a binding contract between the Distributor and l&T Investment Management limited (“the AMC”), the asset management company to l&T Mutual Fund (“the Fund”) with respect to your appointment as a distributor of the schemes of l&T Mutual Fund and providing services as a Distributor and you agree to be legally bound by the same. Your appointment as a Distributor shall beat the sole discretion of the AMC.

Words and expressions used in the Terms and Conditions but not deined will have

the meaning ascribed to them in the Statement of Additional Information of the Fund/ Scheme Information Document(s) of the schemes of Fund and/or Securities and Exchange Board of India (Mutual Funds) regulations, 1996 as may be amended from time to time.

I.DISTRIBUTOR’S DECLARATIONS, REPRESENTATIONS & UNDERTAKINGS The Distributor declares, represents that:

a.the Distributor has obtained all necessary approvals, registrations and certiications

required from relevant authorities for the purposes of providing the services as a

Distributor and shall ensure that such approvals, registrations and certiications will remain in force. The Distributor further declares and represents that the Distributor

has not violated any of the conditions subject to which such approvals, registrations and certiications have been granted to the Distributor and that no disciplinary

or other proceedings have been commenced or indicated or threatened by the Securities and Exchange Board of India (“SEBl”) or any other competent authority against the Distributor and that the Distributor is not debarred /suspended from carrying on its normal activities. The Distributor will comply with all applicable laws, regulations and guidelines which govern the Distributor from time to time.

b.the Distributor shall in particular comply with the provisions of SEBI (Mutual Funds) regulations, 1996 (“SEBI regulations”) and guidelines issued by SEBI

and/or Association of Mutual Funds in lndia (“AMFI”) from time to time pertaining to mutual funds with speciic focus on regulations/guidelines on advertisements /

sales literature/marketing materials, code of conduct, transaction charges and self- certiication.

c.the Distributor shall not indulge in any kind of

d.the Distributor shall not use or design any advertising or sales material other than sales material released by the AMC relating to the Fund unless approved in writing by the AMC in advance.

e.the Distributor shall disclose various addenda/notices/other documents related to the schemes of the Fund at its ofices/websites.

f.the Distributor shall disclose all the commissions (in the form of trail commission or any other mode) payable to the Distributor for the different competing schemes of

various mutual funds from amongst which a scheme is being recommended to the investor. The Distributor shall furnish a certiicate to this effect from time to time if

requested by the AMC.

g.the Distributor shall comply with instructions and procedures as mutually agreed between the Distributor and the AMC and/or the registrar from time to time and shall also issue its own internal instructions to its employees, agents, servants and representatives selling the units of the schemes of the Fund through the Distributor, on similar lines.

h.the Distributor hereby certiies that all its employees, agents, servants and representatives engaged in sales and marketing of the Units of the schemes of

the Fund are registered with Association of Mutual Funds in lndia (AMFI) and have passed the necessary certiication examination as speciied under the SEBI

regulations and/or by SEBl and/or by AMFI.

i.the Distributor shall provide such assistance as may be required by investors/ registrar/the AMC to redress investor complaints and other issues relating to the distribution of Units by the Distributor, including

j.the Distributor undertakes that, except as speciically advised by the AMC in writing or as described in the Scheme lnformation Document of the schemes of the Fund, no action has been or will be taken in any jurisdiction by the Distributor independently of the AMC that will permit a public offering of Units or possession or distribution of the Scheme lnformation Document of the schemes of the Fund in any jurisdiction outside of India.

k.during the course of marketing and procuring subscriptions for the schemes, the Distributor shall not make or give any representation, statement or warranty or print or publish any information which is incorrect, incomplete or misleading (whether by reason of any omission to state a material fact or for any other reason) or which may be in any manner harmful to or against the interests of the AMC or which may result in a contravention of the provisions of the Securities and Exchange Board of lndia (Mutual Fund) regulations, 1996 or of any other applicable laws, rules, regulations or guidelines from time to time in force.

I.the Distributor represents and warrants that all statements made and information which has been and/or which may hereafter be given by the Distributor to the AMC for or in connection with the Distributor’s appointment and services as a distributor is and shall be correct and complete and is not and shall not be misleading (whether by reason of omission to state a material factor for any other reason).

m.the Distributor shall comply with all the statutory and other applicable requirements relating to anti money laundering and/or Know Your Client / Know Your Distributor guidelines issued and amended from time to time by any of the regulatory bodies

in India. In addition to the aforesaid, the AMC may require the Distributor to follow additional KYC guidelines speciied by it. In the event of non compliance

with the aforesaid regulatory requirements/guidelines and/or AMC guidelines, the AMC reserves the right to reduce from the brokerage/commission payable to the Distributor a reasonable amount which is incurred by the AMC for obtaining satisfactory evidence of the identity of the person who invest in the Fund through the Distributor.

n.the Distributor shall upon a reasonable notice from the AMC/the Fund/l&T Mutual Fund Trustee limited, the trustees to the Fund (“Trustees”) provide all such information, reports or documents obtained/maintained by it (including by its employees, agents, servants and representatives) in respect of the services provided in accordance with the Terms and Conditions, if required, under any applicable law/by any of the regulators.

o.the Distributor undertakes that all employees, agents and representatives of the

Distributor shall at all times maintain strict conidentiality with regard to all matters and documentation and information relating to the AMC/Fund, any schemes and

issues raised by the AMC/Fund/Trustees from time to time and shall not divulge or allow or cause to be divulged any conidential or proprietary information or know

how which it has received from the AMC/Fund/Trustees or which comes into its hands or into the hands of any of Its employees, agents and representatives.

p.the Distributor agrees that this relationship is expressly established subject to the AMC/Fund/Trustees being allowed to appoint other distributors to sell the Units of scheme(s) or to sell Units of scheme(s) directly to investors.

q.The Distributor declares if it provides any advisory services as speciied in the SEBI

regulations or the SEBl (Investment Advisers) regulations, 2013, the Distributor shall comply with all the requirements speciied in the aforesaid guidelines or as may speciied by any regulatory authority or AMFI from time to time.

r.The Distributor agrees and conirms that:

i.the Distributor if provides both the advisory and execution only services shall categorize customer relationships and/or transactions as either “Advisory” (i.e. Distributor represents to offer advice) or “Execution only” (i.e. those not booked as Advisory) and there shall be no third categorization.

ii.in cases where the customer relationship/transaction is categorized as “Execution only” and the Distributor has information to believe that the transaction is not appropriate for the customer, a written communication shall be made to the investor informing the customer regarding the unsuitability of the scheme of the mutual fund and such communication shall have to be duly

acknowledged and accepted by customer. The AMC shall have the right to request copies of such conirmations and the same shall be furnished by the

Distributor promptly.

iii.in cases where the customer relationship/transaction is categorized as

“Execution Only”, the Distributor shall obtain a conirmation from the customer that the transaction is ‘Execution only” prior to execution of the transaction.

iv.in cases where the customer relationship/transaction is categorized as “Execution only”, the Distributor shall not collect any fees from the customer and the Distributor shall be entitled only to the transaction charge(s) paid by the AMC to the Distributor in accordance with SEBl regulations.

s.The Distributor hereby conirms that, while selling/distributing schemes of mutual funds launched by the group companies/afiliates/associates of the Distributor, the Distributor shall make adequate disclosure to the customer regarding conlict of

interest arising from selling/distributing such schemes.

t.The Distributor conirms that a

required to act in such capacity and the Distributor will be responsible for the acts

and omissions of the

Trustees/Fund shall not be liable for any act or omission of the

u.The AMC will not be responsible for payment of any compensation or brokerage to

v.The Distributor shall comply with the following terms and conditions in case the Distributor proposes to gain access to the online platform for distributors set up by the AMC/l&T Group (“the website”):

i.the website is being made available to the Distributor to have access to certain information including information pertaining to the schemes of the Fund, Distributors’ client’s transaction details and/or account statement(s) either directly or through mail back or through any mode as may be decided by the AMC and other tools and utilities provided by the AMC from time to time. Subject to these terms and conditions, the AMC grants the Distributor

a

or amended by the AMC at any time.

ii.the Distributor shall only access, download and/or use the contents on the website in connection with his/its appointment as a distributor of the Fund and not for any other purpose whatsoever, whether commercial or personal.

iii.the intellectual property in all material provided on the website is held by the AMC unless otherwise stated. Except as expressly permitted herein or on the website. none of the material provided on the website may be copied, reproduced, distributed, republished, downloaded, displayed, posted, transferred or transmitted in any form or by any means, including, but not limited to, electronic, mechanical, photocopying, recording, or otherwise, without the prior written permission of the AMC. Further, the Distributor or its employees shall not transfer, reverse engineer, decompile, disassemble, modify or create derivate works based on the materials provided on the website except as permitted herein or by law.

iv.the copyright, trademarks, database rights, patents and all similar rights in and relating to the website and the information contained in it are owned by the l&T Group/the AMC, its licensors or relevant third party content providers. Nothing on the website should be construed as granting, by implication, estoppel, or

otherwise, any license or right to use any trademark displayed on the website without the written permission of the AMC or its relevant afiliate.

v.The Distributor shall be able to gain access to the secured contents on the website only through a User ID and password which shall be issued by the AMC. The AMC is entitled to disable the password at any time.

vi.The Distributor or its employee(s)shall not disclose the password to any other person and shall report any misuse of it to the AMC immediately.

vii.If the Distributor or its employee(s) allows any third party to gain or becomes aware that any third party has otherwise gained access to the contents of the website through his User ID and password, the Distributor will defend and indemnify the AMC, the Fund and theTrustees against any liability, claims, costs, expenses, losses, damages or penalties (including without limitation, reasonable attorneys fees and costs of appeal) arising out of claims or suits based upon, relating to or arising in connection with such access and/or use.

viii.The Distributor hereby undertakes that:

•it shall ensure that all employee(s)/sub broker(s) who are authorised to access and use the Website in terms hereof shall be notiied of the terms and

conditions set out herein;

•the AMC may issue an User ID and password to its

•it has obtained consent from its clients to have access to their account statement(s) and other data; and

•it shall and shall cause its employees to hold all materials provided on the Website conidential and not disclose the same to any person directly or indirectly

whether during the term of the distribution agreement or thereafter.

ix.In case a holder of units of the Fund deals through multiple distributors (including the Distributor) in a single folio, the Distributor shall not be able to view the account statement of such a holder but the Distributor shall be entitled to receive the details of transactions routed through it.

x.The Distributor shall not misuse any of the information, data, etc available to him through the website.

xi.The Distributor shall be solely responsible for the acts or omissions that might occur within the website through the use of the User ID and password allotted to him.

xii.The data and information provided on the website does not constitute advice and should not be relied upon while taking investment decisions.

xiii.whilst every reasonable precaution has been taken to ensure the accuracy, security and conidentiality of data and information available through the

website, the AMC, the Fund or the Trustees cannot be held responsible for any consequence of any action carried out by any user (authorised or unauthorised).

xiv.The AMC may suspend or withdraw the website at any time, and the Distributor acknowledges that the website is also subject to interruption for reasons beyond the AMC’s control. The AMC makes no warranty that its ability to provide the website will be interrupted. The AMC, the Fund or the Trustees shall not be liable for any loss or damage or other consequences arising from any such suspension, withdrawal or interruption or otherwise arising from the use or inability to use the website and its contents.

xv.The Distributor shall indemnify, defend and hold harmless the AMC, the Fund and the Trustees against any liability, claims, costs, expenses, losses, damages or penalties (including without limitation, reasonable attorneys fees and costs of appeal) arising out of its or its employees’ breach of the terms and conditions set out herein or acts or omissions resulting from the use of the website and/or its access.

II. FEES AND ChARGES OF ThE DISTRIBUTOR

The AMC shall pay to the Distributor fees for the services provided and shall from time to time communicate the brokerage structure (fees) to the Distributor. The Distributor acknowledges that the AMC shall be entitled to revise brokerage rates previously declared. All payments to the Distributor shall be subject to the relevant provisions of the Income Tax Act, 1961 and other applicable laws. In case the Distributor receives any fee which is not due or payable to the Distributor, the Fund/ AMC shall be entitled to recover or adjust all such amounts as are wrongly paid to the Distributor. The AMC shall have the right to suspend the brokerage payable to the Distributor if so directed by SEBI and /or AMFl or if there is a breach of these Terms and Conditions by the Distributor.

Ill. INDEMNITY

The Distributor shall indemnify and hold harmless the Fund, Trustees and the AMC against any losses, costs or claims which they might incur/suffer as a result of

(i)any unauthorized, misleading, false or inaccurate information, documentation, literature or representation relating to the Fund or the AMC which is made, issued or given by the Distributor (unless the information, documentation and/or literature has been provided or otherwise approved by the AMC) (ii) the negligence or

willful misconduct of the Distributor, or their employees, agents, representatives, afiliates, managers or advisors; (iii) breach of any of the terms, conditions,

declarations, representations, undertakings and warranties contained in the Terms and Conditions; or (iv) fraud, on part of the Distributor or its employees, agents and representatives.

IV. TERMINATION

a.The appointment of the Distributor shall stand terminated forthwith:

i.if the Distributor is found to be a minor or adjudicated as an insolvent or found to be of unsound mind by a court of competent jurisdiction;

ii.if the AMC is satisied that any statement made in the form was false or misleading or calculated to mislead;

iii.if Distributor acts in any other manner prejudicial to the interest of the AMC/ Fund; and

iv.in the event of a breach of any clauses of the Terms and Conditions or in the event of any negligence, willful default or fraud by the Distributor or its employees, agents and representatives.

b.Notwithstanding anything stated above, the appointment of the Distributor shall stand terminated at any time by the AMC by giving the Distributor a notice of at least 10 days without assigning any reason.

c.In the event the appointment is terminated, the Distributor will hand over to the AMC all the data, documents, reports, records and all other information and materials related to the other party within a period of 30 Business Days from the date of termination of appointment. After or before Notice of termination, the Distributor shall not do any act which is detrimental to the Fund, AMC or the scheme(s).

V.RELATIONShIP

None of the provisions of the Terms and Conditions shall be deemed to constitute a partnership between the AMC and Distributor, and the Distributor shall not have the authority to bind the AMC. Neither party hereto is the agent of the other nor there is a

VI. MISCELLANEOUS

a.The AMC offers nomination facility to the Distributor to enable the nominee to receive commissions on the business done before the demise of the Distributor provided the Distributor has complied with all the Terms and Conditions.

b.The Distributor shall not in any way pledge or have any lien or charge on the properties of the AMC/Fund in its possession, for the fees payable to the Distributor for distributing Units of the Fund.

c.All operating and servicing standards and procedures will be as speciied by the

AMC from time to time.

d.This agreement shall be construed in accordance with the laws of lndia and shall be subject to the exclusive jurisdiction of the competent courts in Mumbai only.

I/WE hEREBY CONFIRM AND DECLARE ThAT I/WE hAVE READ AND UNDERSTOOD ThESE TERMS AND CONDITIONS OF EMPANELMENT AS A DlSTRlBUTOR WITh ThE AMC AND AGREE TO ABIDE BY ThE SAME

Signature:

Name:

ArN Code:

call 1800 2000 400 or 1800 4190 200 |

email investor.line@lntmf.co.in |

www.lntmf.com |

|

|

|

our lines are open from 9.00 am to 6.00 pm, Monday to Friday

Mutual Fund investments are subject to market risks, read all scheme related documents carefully. |

Cl00704 |

Form Characteristics

| Fact Name | Description |

|---|---|

| Form Purpose | The Lt Mutual Fund Empanelment form is used by distributors seeking to be appointed as authorized sellers of the schemes of L&T Mutual Fund. It collects essential details about the distributor, including personal information, firm details, and compliance documentation. |

| Mandatory Information | Distributors must fill out required fields, such as contact information, KYC Acknowledgment Date, and Permanent Account Number (PAN). Additional documents include a canceled cheque and various registrations, dependent on whether the distributor is an individual or non-individual. |

| Governing Laws | The terms of the empanelment are governed by the applicable laws of India, particularly the Securities and Exchange Board of India (SEBI) regulations and guidelines laid out by the Association of Mutual Funds in India (AMFI). |

| Declaration Requirement | Distributors must declare the accuracy of the information provided, ensuring compliance with the terms and conditions of the empanelment. Furthermore, they must agree to abide by binding rules, which can be subject to amendments. |

Guidelines on Utilizing Lt Mutual Fund Empanelment

Once you have gathered your documents and are ready to proceed, you can start filling out the LT Mutual Fund Empanelment form. Be sure to follow each step closely to ensure accurate completion. Inaccuracies or missing information could delay your empanelment process.

- Begin by specifying whether the name for empanelment refers to an Individual or Non-Individual.

- Fill out the Contact Person and provide a comprehensive Address for Communication.

- Include the City, State, and Pin Code associated with the address.

- Provide complete contact details: Tel., Fax, and Mobile numbers.

- Ensure you enter a valid E-mail address.

- In the Enterprise Details section, indicate the No. of Offices and No. of Employees.

- List the cities where you operate.

- Fill in the KYC Acknowledgement Date, and attach a KYD acknowledgment letter.

- List the names of the Mutual Funds you currently market, up to six.

- Provide details of your current AUM in Equity & Balanced and Debt categories.

- List key employees: Include Name, Designation, E-mail ID, and Contact Number for each employee.

- Record Gross Mobilisation done in the last six months for both Corporate and Retail investors.

- Complete the Bank Details section and attach a cancelled cheque.

- List your Permanent Account Number (PAN).

- If applicable, provide Nomination Details for Brokerage Commission, including information about a minor nominee.

- Review the Declaration section and sign the form, ensuring that the company's seal is affixed if submitting on behalf of a company.

- Attach any required supporting documents according to whether you are an Individual or Non-Individual distributor.

- Submit the completed form along with all attachments for processing.

What You Should Know About This Form

What is the purpose of the LT Mutual Fund Empanelment form?

The LT Mutual Fund Empanelment form is designed for both individuals and organizations who wish to become distributors of L&T Mutual Fund's schemes. By completing this form, you provide essential information about yourself or your enterprise, including your experience in the mutual fund industry, details about your operations, and compliance with regulatory requirements. This information helps L&T Investment Management assess your application for empanelment and ensures that you meet the necessary qualifications to represent their products effectively.

What documents are required for completing the form?

When filling out the LT Mutual Fund Empanelment form, there are mandatory documents you need to submit. These differ slightly for individuals and non-individual entities. For individuals, you’ll need to include a self-attested copy of the Empanelment Form, your ARN Card, a cancelled cheque, and a KYD acknowledgment letter among others. Non-individual entities require additional documentation, such as a Certificate of Registration, Articles of Association, and a Board resolution. Always ensure that you check the latest checklist provided with the form for the most accurate and complete requirements.

How does the KYC process work within the empanelment application?

The Know Your Customer (KYC) process is critical in the empanelment of distributors. This process aims to verify the identity of potential distributors to prevent fraud and ensure compliance with financial regulations. You must provide a KYC acknowledgment letter along with the application, which confirms that your identity has been verified through appropriate channels. The KYC process is not just a one-time requirement; ongoing adherence to KYC guidelines is necessary throughout your relationship with L&T Mutual Fund.

What assurances can I expect once my empanelment application is submitted?

Once you submit your empanelment application, L&T Investment Management will review the information provided. While there is no guaranteed acceptance, you can trust that the review process will be thorough and fair. You will be kept informed about the status of your application, and if approved, you will receive a formal notification. Additionally, you will be provided guidance on how to access resources, training, and support to assist you in meeting the expectations of L&T Mutual Fund as a distributor.

Common mistakes

Filling out the Lt Mutual Fund Empanelment form can be an important process for distributors, but many individuals and companies make mistakes that can delay approval or lead to rejection. One common error is failing to complete all mandatory fields. Items marked with an asterisk are required, and omitting any of these can result in the application being returned. It's essential to double-check every section.

Another frequent oversight is submitting an outdated KYC Acknowledgement Date. This is crucial as regulators require up-to-date Know Your Customer (KYC) compliance. Without a valid and current acknowledgment document attached, the application may not proceed. Moreover, not including the necessary supporting documents, like the KYD acknowledgment letter or a cancelled cheque, can create significant barriers to processing.

Not listing all relevant mutual funds currently marketed is another mistake. It is important to be thorough and accurate in this part to provide a clear picture of the distributor's capabilities. Similarly, when individuals submit the form, they sometimes forget to include their Permanent Account Number (PAN). This can lead to immediate rejection, as PAN is critical for identification and taxation purposes.

Another area where errors commonly arise is in the section for key employees' details. Missing out on providing complete information, such as email IDs or contact numbers, can raise concerns about the distributor's organizational transparency. Additionally, failing to clearly state the gross mobilization done in the last six months could raise red flags, affecting the credibility of the application.

Misunderstandings regarding the bank details also occur. It is vital to ensure that all banking information is accurate, including the MICR and IFS codes, since incorrect details may cause issues with future fund transactions. Furthermore, when declaring nominee details, applicants often overlook specifying a legal guardian for minors, which is required for compliance.

Not attesting to the declarations made in the form can also lead to complications. It is essential that the distributor’s signature is accompanied by the company’s seal when the application is submitted on behalf of a non-individual entity. Lastly, an overlooked checklist can be detrimental. The checklist helps ensure all necessary documents are attached to the application, and failing to convert the checklist into completed tasks can result in delays.

Documents used along the form

The Lt Mutual Fund Empanelment Form is a crucial document for individuals or businesses seeking to become distributors of mutual fund schemes. Alongside this primary form, several other documents are typically required to complete the empanelment process. Here’s an overview of some commonly used forms and documents:

- ARN Card: The Association of Mutual Funds in India (AMFI) Registration Number (ARN) Card serves as proof of registration for mutual fund distributors. It is necessary to have this card, as it provides recognition to the distributor to conduct mutual fund operations legally.

- KYD Acknowledgement Letter: This letter confirms the completion of the Know Your Distributor (KYD) process. It is necessary for identifying the distributor and ensuring compliance with regulatory requirements related to investor protection and anti-money laundering.

- PAN Card: The Permanent Account Number (PAN) Card is a vital document for tax identification in India. Distributors must provide this document to comply with tax regulations and operational requirements established by the Income Tax Department.

- Cancelled Cheque: A cancelled cheque is required to verify the bank account information of the distributor. This document ensures that all transactions conducted by the distributor are routed correctly for fee and commission payments.

These documents, in conjunction with the Lt Mutual Fund Empanelment Form, create a comprehensive framework to proceed with the application for becoming a mutual fund distributor. Ensuring all required forms are filled out accurately and submitted will facilitate a smoother review and approval process by the asset management company.

Similar forms

-

Distributor Registration Form: Similar to the Lt Mutual Fund Empanelment form, this document collects essential information about the distributor. It requires details like the distributor’s name, contact information, and experience in the industry, focusing on verifying their qualifications to offer financial products.

-

Client Onboarding Form: Just like the empanelment form, the client onboarding form gathers critical information required for establishing a client relationship. It typically includes personal details, investment preferences, and compliance documentation, ensuring a thorough understanding of the client's profile.

-

Know Your Customer (KYC) Form: KYC forms serve a dual purpose similar to the Lt Mutual Fund Empanelment form. They collect personal identification information and verify the identity of the customers, helping firms comply with regulatory requirements aimed at preventing fraud and money laundering.

-

Tax Identification Number (TIN) Application: This document parallels the empanelment form by requiring identifying personal information and tax details, ensuring compliance with tax regulations while enabling effective taxation of investment income.

-

Business Registration Form: Like the Lt Mutual Fund Empanelment form, this document captures fundamental details about a business entity, such as its legal structure, address, and ownership information, establishing its legitimacy to operate in the financial services sector.

-

Service Agreement: This document outlines the terms of service, expectations, and responsibilities of both parties involved. Much like the empanelment form, it emphasizes mutual agreement and compliance with the outlined regulations and standards.

-

Investment Policy Statement (IPS): An IPS, akin to the empanelment form, delineates an investor's goals, risk tolerance, and investment strategies. This ensures that the financial advisor is aligned with the investor's objectives, promoting personalized investment management.

-

Brokerage Agreement: This form shares similarities with the Lt Mutual Fund Empanelment form as it establishes terms between brokers and clients. It outlines commission structures, client responsibilities, and compliance measures that both parties must adhere to during their professional relationship.

Dos and Don'ts

When filling out the Lt Mutual Fund Empanelment form, here are some helpful guidelines to follow:

- Do ensure all mandatory fields are filled out accurately.

- Do attach all required documents, such as KYC acknowledgment and PAN card.

- Do provide clear and legible contact information.

- Do verify your bank details by attaching a canceled cheque.

- Do keep a copy of the completed form for your records.

- Do not leave any mandatory fields blank.

- Do not submit false information; accuracy is essential.

- Do not forget to sign the form; your signature is required.

- Do not submit the form without checking for completeness.

- Do not ignore the terms and conditions; read them carefully.

Following these do's and don'ts can help ensure a smooth empanelment process.

Misconceptions

- Misconception 1: Only individuals can apply for empanelment.

- Misconception 2: All fields on the form are optional.

- Misconception 3: The empanelment process is quick and avoids any scrutiny.

- Misconception 4: Submitting a canceled cheque is not essential.

- Misconception 5: Once empaneled, there are no ongoing responsibilities.

- Misconception 6: The form does not require any financial documentation.

Many people believe that only individual distributors can fill out the Lt Mutual Fund Empanelment form. In reality, both individuals and non-individual entities, such as partnerships or companies, can apply for empanelment.

This is not true. There are mandatory fields in the form that must be filled out. Missing these required fields can lead to a delay in processing your application.

While the process can be straightforward, each application undergoes review and verification. Ensure that all your documents are accurate to avoid unnecessary delays.

Many applicants overlook this requirement. However, attaching a canceled cheque is mandatory, as it provides necessary banking details for compensation purposes.

Empanelment is just the start. Distributors must remain compliant with regulations and are responsible for maintaining their registration and reporting as required.

This misconception can lead to complications. Financial details, like the current AUM, are crucial. Ensure that you provide accurate financial information to reflect your capabilities.

Key takeaways

Key Takeaways for the LT Mutual Fund Empanelment Form:

- Complete Accuracy: Ensure that all information provided in the form is accurate and truthful. Any misinformation can lead to delays or rejection of your application.

- Mandatory Documents: Attach all required documents, including the canceled cheque and KYC acknowledgment letter. Missing documents can hinder the processing of your empanelment.

- Current AUM Disclosure: Clearly state your current Asset Under Management (AUM). This information is crucial for evaluating your capability as a distributor.

- Compliance Understanding: Familiarize yourself with the terms and conditions of empanelment. Understanding the obligations regarding ethical practices and necessary certifications can prevent conflicts with regulatory requirements.

Browse Other Templates

Form N-2 Instructions - Welders can reference this form for specific job requirements.

Active Duty Family Dental Enrollment Form,FMDP Enrollment Application,Tricare Family Member Dental Plan Election,Dental Insurance Enrollment for Family Members,Supplemental Dental Coverage Selection,Dependent Dental Coverage Application,Dental Plan E - Each family member’s details must be precisely listed to ensure correct coverage enrollment.