Fill Out Your Lynch Beneficiary Designation Form

Understanding the Lynch Beneficiary Designation form is pivotal for anyone looking to ensure their financial accounts are distributed according to their wishes after their passing. Designed specifically for various account types like IRAs, Health Savings Accounts, and Education Savings Accounts, this form allows individuals to designate primary and contingent beneficiaries. By completing it, you can replace any prior beneficiary designations, ensuring your intentions are clear and up to date. It provides a structured way to name individuals or entities, such as your estate or trusts, while needing careful attention to details like social security numbers and relationships. Moreover, it highlights the significance of correctly specifying beneficiary relationships, as this can directly affect distributions and tax implications. It's important to note that while all fields are not required, providing comprehensive information can facilitate easier identification and distribution of your assets later. If changes are needed, the form allows for easy updates; however, such designations are only effective when Merrill accepts and processes them. In cases where primary beneficiaries predecease you, the form provides clarity on how remaining shares are distributed among the living beneficiaries. As meticulous as it may seem, completing this form correctly can provide peace of mind, knowing that your assets will transition smoothly, reflecting your desires in accordance with your life plans.

Lynch Beneficiary Designation Example

Beneficiary Designation Form

MERRILL~.

A BANIK OF AMIUl'ICA C:OMPAN"I'

This form is to be used to designate beneficiaries or to replace all prior beneficiary designations at Merrill for the accounts listed below.

n IRA |

n BASIC™ |

n Archer Medical Savings Account (MSA) |

n IRRA® |

n SEP IRA |

n Health Savings Account (HSA) |

n Roth IRA |

n SIMPLE IRA |

n Merrill Lynch Education Savings Account® (MLESA)* |

Instructions:

nUse one form per client. Additional clients must use a separate Beneficiary Designation Form.

nAdditional instructions for completing this form appear below and throughout the form.

nForward your completed form, in its entirety (pages

Advisory Center. |

|

Merrill Lynch Wealth Management Clients |

Merrill Edge |

Please contact your personal advisor to obtain your |

Investing Clients |

advisor's office fax number or address for |

Fax to: 866.994.7807 |

prompt processing. |

Or, you can mail to the following address: |

|

Merrill • P.O. Box 29002, Hot Springs, AR |

nPlease retain a copy of this form for your records.

Completing Designation/Change of Beneficiary(ies):

nDesignating or changing your beneficiary(ies) has important consequences. We urge you to consult your attorney and/or tax advisor before completing this form.

nYou may name one or more individuals and/or entities to be the primary or contingent beneficiary(ies) of your account, including your estate, trust or other entity. For all beneficiary(ies) named, the percentages must total 100%, (Percentages up to the hundredth decimal may be used).

For individuals, please indicate the legal name, social security number, date of birth, and relationship for each beneficiary. Depending on your designation, the relationship field may affect your Required Minimum Distribution (RMD) calculation. Therefore, it is important to specify the correct relationship (i.e. spouse,

nPlease do not submit copies of your will or trust document. If an estate or trust is designated, Merrill shall rely solely upon the instructions of the executor/administrator or trustee and shall have no responsibility for monitoring the terms of the will or trust.

nAfter your death, the balance in your account(s) shall be distributed to the primary beneficiary(ies) in proportion to the payment percentages indicated. If a primary beneficiary predeceases you, his/her share will be distributed to the remaining primary beneficiary(ies) in proportion to the payment percentages. If no primary beneficiary(ies) survive you, the balance will be distributed to your contingent beneficiary(ies) in the same manner. If no primary or contingent beneficiary(ies) survive you, or if no beneficiary is in effect at the time of your death, we will pay your IRA balance to your surviving spouse, or, if you are not survived by a spouse, to your estate.

nChanging your beneficiary – You may change your beneficiary designation at any time and as often as you wish. Any designation or change of beneficiary is not effective until we receive and accept it. All beneficiary designations must be compatible with our administrative and operational requirements, which may change at any time.

nOptional Designations – Please consult a tax and/or legal professional for further explanation. You may choose only “per stirpes” or “per capita”, but not both, for beneficiaries in the same class (i.e., primary or contingent).

n Per Stirpes is a method of dividing an account where surviving descendants of a deceased beneficiary effectively take the place of their deceased ancestor as primary beneficiary(ies) so that they take the share to which their ancestor was entitled (had he/she lived).

n A Per Capita division of property is an equal division among all named beneficiaries and surviving descendants of deceased ancestors.

n Customized Designations – If your beneficiary designation includes any alterations to the form, provisions in addition to the election of beneficiaries, or if you require additional space to write your designation, please submit your designation on a separate page(s) and attach it to this form. Please write “See Attached” in Section 2, under the Name field. This will be considered a “customized beneficiary designation.” Please note: all customized beneficiary designations must be reviewed for compatibility with Merrill administrative and operational requirements, which may change over time. Please contact your Merrill Lynch Wealth Management Advisor, Client Associate, or the Merrill Advisory Center for more information on customized designations.

*For Merrill Lynch Education Savings Accounts (MLESA), the words “me” and “my” shall refer to the “Student” or “Students,” and the words “you” and “yours” refer to the “Guardian” or the “Guardians” where applicable.

1 of 3

|

|

|

Branch Office Instructions: Form must be branch scanned to each account. |

|

||

|

|

|

|

|

|

|

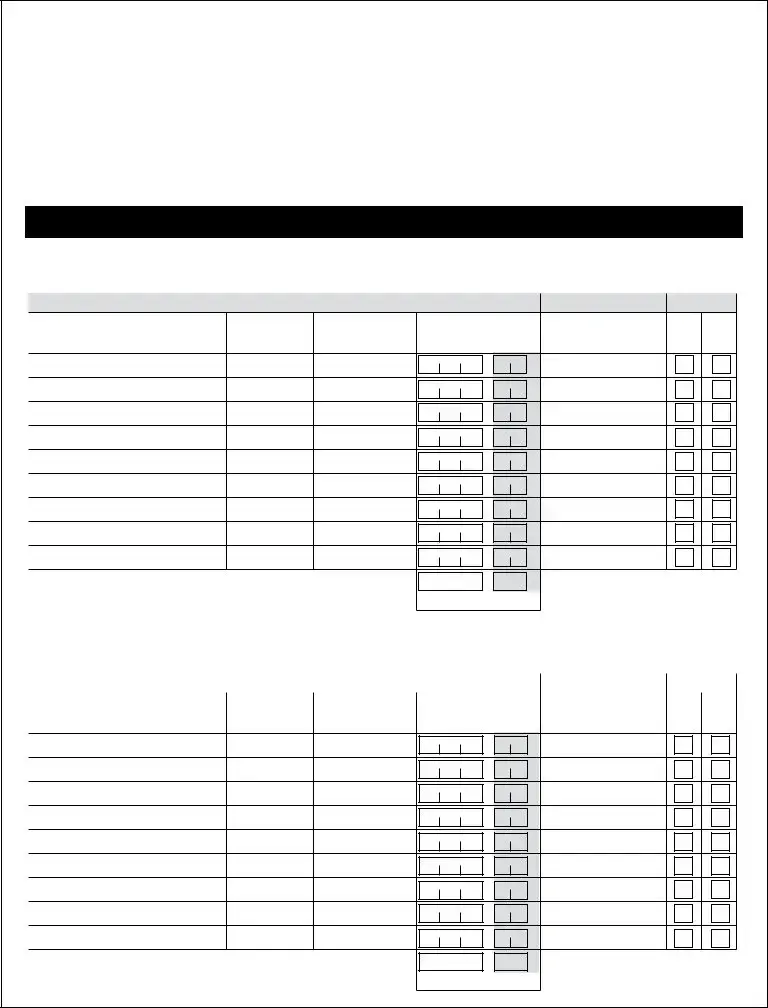

1: Account Information |

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

Account Numbers (Designation will apply to all accounts listed below.) |

|

||

|

|

|

|

|

|

|

|

|

|

Required |

|

||

Client Name (One client per form. Additional clients must |

|

|

|

|

|

|

|

|

|

|

|

|

|

complete a separate Beneficiary Designation Form). |

1 |

5 |

|

|

||

|

2 |

|

6 |

|

|

|

|

3 |

|

7 |

|

|

|

|

4 |

|

8 |

|

|

|

2: Designation/Change of Beneficiary(ies)

PRIMARY BENEFICIARY(IES): I hereby designate the person(s) or entity(ies) named below as primary beneficiary(ies). You may choose only

“per stirpes” or “per capita”, but not both, in this section. Please refer to the instructions page for more information on these fields required and consult a tax and/or legal professional for further explanation about per stirpes and per capita.

I |

Required |

|

|

|

Optional |

Optional |

|

Name |

Date of Birth |

Relationship |

Share % |

Tax Identification |

Per Per |

||

(MM/DD/YYYY) |

(Enter as XXX.XX) |

Number |

Stirpes Capita |

||||

|

|

||||||

|

|

I |

I |

. [u |

% |

□ □ |

|

|

|

|

|

. [u |

|

||

|

|

I |

I |

% |

□ □ |

||

|

|

|

|

. [u |

|

||

|

|

I |

I |

% |

□ □ |

||

|

|

|

|

. [u |

|

||

|

|

I |

I |

% |

□ □ |

||

|

|

|

|

. [u |

|

||

|

|

I |

I |

% |

□ □ |

||

|

|

|

|

. [u |

|

||

|

|

I |

I |

% |

□ □ |

||

|

|

|

|

. [u |

|

||

|

|

I |

I |

% |

□ □ |

||

|

|

|

|

. [u |

|

||

|

|

I |

I |

% |

□ □ |

||

|

|

|

|

. [u |

|

||

|

|

I |

I |

% |

□ □ |

||

|

|

|

100 |

00 |

% |

||

|

|

|

|

||||

|

|

|

|

. CJ |

|

|

|

|

|

Must Total 100.00% |

|

|

|||

CONTINGENT BENEFICIARY(IES): If there are no primary beneficiary(ies) living at the time of my death, I hereby specify that the balance be distributed to the contingent beneficiary(ies). You may choose only “per stirpes” or “per capita”, but not both, in this section. Please refer to the instructions page for more information on these fields required and consult a tax professional for further explanation about per stirpes and per capita.

I |

|

Required |

|

|

Optional |

Optional |

|

|

Name |

Date of Birth |

Relationship |

Share % |

Tax Identification |

Per |

Per |

|

(MM/DD/YYYY) |

(Enter as XXX.XX) |

Number |

Stirpes Capita |

|||

|

|

|

|||||

|

I |

I |

. [u |

% |

□ □ |

|

I |

I |

. [u |

% |

□ □ |

|

I |

I |

. [u |

% |

□ □ |

|

□ □ |

||||

|

I |

I |

. [u |

% |

|

|

I |

I |

. [u |

% |

□ □ |

|

I |

I |

. [u |

% |

□ □ |

|

□ □ |

||||

|

I |

I |

. [u |

% |

|

|

I |

I |

. [u |

% |

□ □ |

|

□ □ |

||||

|

I |

I |

. [u |

% |

|

|

|

100 |

. CJ |

% |

|

|

|

00 |

|

|

|

NOTE: You must sign and date this form in Section 3 on the following page. |

Must Total 100.00% |

|

|

||

|

|

|

|

|

|

2 of 3

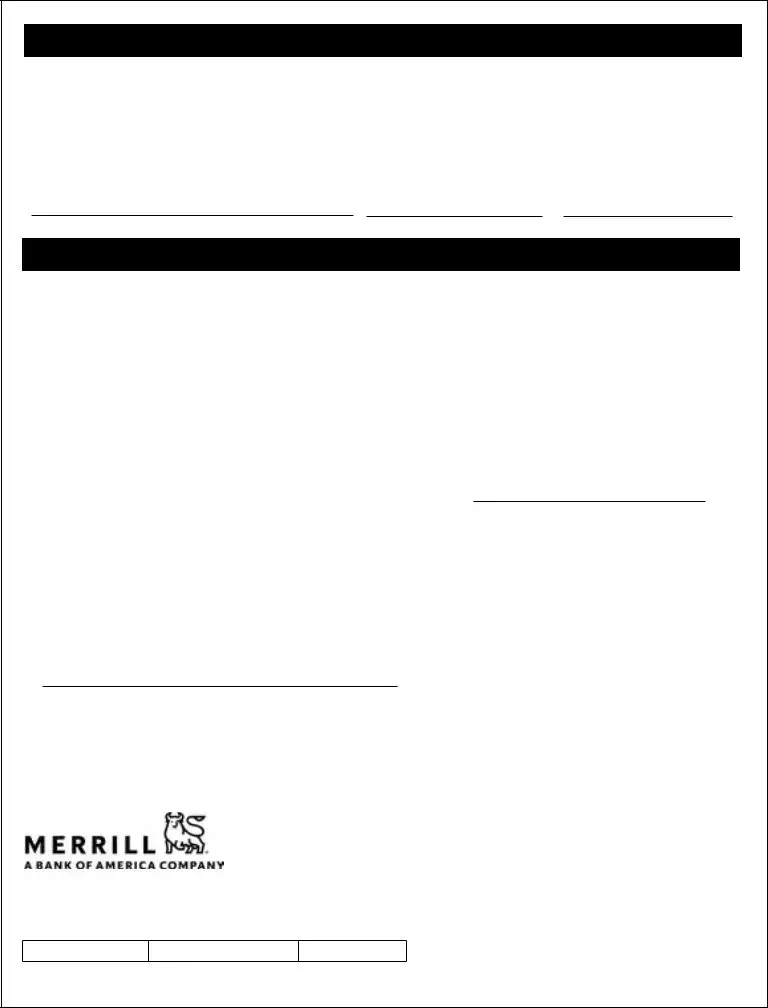

3: Signature

INSTRUCTIONS: You must sign and date your Beneficiary Designation Form in order for it to become effective when received and accepted by Merrill. If you are signing on behalf of the client, include your title in the signature line below and ensure the proper documentation authorizing you to do so is on file and approved. The designation will not be valid without proper approval of authorization.

I understand that if no designated beneficiary survives me, or if no beneficiary designation is in effect at my death, the account balance(s) will be paid to my spouse, or if I am not survived by a spouse, to my estate. I am aware that this form replaces all prior beneficiary designations for

the account(s) listed on this form, becomes effective when received and accepted by Merrill, and will remain in effect until I deliver to Merrill another designation form with a later date.

Signature and Title (e.g. Guardian, Conservator, POA) |

Date (MM/DD/YYYY) |

Daytime Telephone |

4: To be Completed ONLY for BASIC Accounts

INSTRUCTIONS:

Spouse’s Consent to Alternate Beneficiary Designation:

nIf you are not married, the plan administrator or notary public does not have to sign the form.

nIf you are married, your spouse must sign and date this section if you designate someone other than your spouse as beneficiary.

nThe plan administrator or a notary public must sign to certify your spouse’s signature.

Unavailability of Spouse’s Consent:

If you cannot obtain your spouse’s consent, your employer must indicate and certify the reason (see below).

I certify under penalty of perjury that I am not married as of the date this form is signed. I understand that if I marry after this date, the rules for married individuals will apply to me.

Spouse’s Consent to Alternate Beneficiary designation:

“I am the spouse of the participant who made the beneficiary designation on this form and I consent to it. I understand that if someone other than me has been designated beneficiary, my consent means that I give up my rights I may have under the Plan and applicable law (other than rights I may later have as the survivor in a joint annuity with the participant)

to receive those amounts payable under the Plan by reason of the participant’s death to which I would otherwise be entitled if I were the participant’s sole beneficiary.”

Spouse’s consent unavailable because:

Participant’s spouse cannot be located.

Other

“It has been established to my satisfaction that the consent of the participant’s spouse to the participant beneficiary designation of this form cannot be obtained for the reason indicated.”

Signature of Plan Administrator |

Date (MM/DD/YYYY) |

Spouse’s Signature |

|

Date (MM/DD/YYYY) |

|

|

|

Signature of Plan Administrator or Notary Public |

Date (MM/DD/YYYY) |

|

|

|

|

Notary Title/Commission |

Expiration Date (MM/DD/YYYY) |

|

MERRILL~

A BA N!K OF' AIMI[ 'I CA C,OIMPA.N'Y

Merrill Lynch, Pierce, Fenner & Smith Incorporated (also referred to as "MLPF&S" or "Merrill") makes available certain investment products sponsored, managed, distributed or provided by companies that are affiliates of Bank of America Corporation ("BofA Corp."). MLPF&S is a registered

Investment products:

Are Not FDIC Insured

Are Not Bank Guaranteed

May Lose Value

© 2021 Bank of America Corporation. All rights reserved.

Code

3 of 3

Form Characteristics

| Fact Name | Description |

|---|---|

| Purpose of the Form | This form is designed to designate beneficiaries for various accounts, replacing all prior designations. |

| Applicable Accounts | The form applies to IRAs, Health Savings Accounts, and other specific account types as listed. |

| Importance of Accurate Designation | Correctly naming beneficiaries can have significant implications for required minimum distributions and estate taxes. |

| Primary vs. Contingent Beneficiaries | Primary beneficiaries receive assets first; contingent beneficiaries receive assets only if no primary beneficiaries survive. |

| Relationship Disclosure | It is necessary to disclose the relationship to each beneficiary, which may impact distribution calculations. |

| State-Specific Laws | Beneficiary designations may be governed by state laws regarding estates, requiring consultation with legal professionals. |

Guidelines on Utilizing Lynch Beneficiary Designation

After completing the Lynch Beneficiary Designation form, the next steps involve ensuring that the form is correctly submitted to Merrill Lynch. It is important to retain a copy for your records, as well as to consult with your financial advisor regarding any questions or clarifications about your beneficiary designations.

- Begin by filling in the account information section. Include all relevant account numbers to which the designation applies. Only one client should be listed per form.

- In the designation section, start with the Primary Beneficiary(ies). Here, you will enter the legal names, social security numbers, dates of birth, relationships, and shares (%) for each beneficiary. Ensure that the total percentage equals 100%.

- Decide whether the distribution should be “per stirpes” or “per capita.” Only choose one method for your primary beneficiaries.

- Next, fill out the Contingent Beneficiary(ies) section. Similar to the primary beneficiaries, provide all required details and ensure that their total percentage also equals 100%.

- Again, choose either “per stirpes” or “per capita” for your contingent beneficiaries.

- Move to the signature section. Here, you must sign and date the form. This step is crucial for the validity of the designation. If someone is signing on your behalf, indicate their title in the designated area.

- If applicable, complete the spouse’s consent section only for BASIC accounts. Your spouse must sign if you designate someone other than them as the beneficiary. A plan administrator or notary must verify the spouse's signature.

- Finally, submit the completed form. Forward it to your Merrill Lynch Wealth Management Advisor, Client Associate, or the Merrill Advisory Center for processing.

What You Should Know About This Form

What is the Lynch Beneficiary Designation form used for?

The Lynch Beneficiary Designation form is utilized to name beneficiaries for various financial accounts held at Merrill. By completing this form, you can designate who will receive the assets in your account upon your death. It can also replace any prior beneficiary designations, ensuring that your current wishes are clearly stated and legally recognized.

How do I complete the Lynch Beneficiary Designation form?

To complete the form, first ensure you use one form per client. You will need to provide your personal information, account numbers, and details regarding your chosen beneficiaries. Specify their names, relationships to you, and their respective shares. It is essential that the total percentages equal 100% and that you provide as much information as possible for proper identification. After filling it out, submit the entire form to your Merrill Lynch Wealth Management Advisor or the Merrill Advisory Center for processing.

Can I change my beneficiary designation after I complete the form?

Yes, you can change your beneficiary designation at any time. You are not limited to making one change; you may update it as frequently as necessary. However, keep in mind that any new designation will not take effect until it has been received and accepted by Merrill. Always ensure that your updated designations comply with administrative requirements.

What happens if a primary beneficiary predeceases me?

If a primary beneficiary passes away before you do, their share will be redistributed among the remaining primary beneficiaries according to the percentages you indicated on the form. In the unfortunate event that no primary beneficiaries survive you, the account balance will then pass to the contingent beneficiaries, following the same proportional distribution rules.

What is the difference between "per stirpes" and "per capita" designations?

"Per stirpes" means that if a beneficiary dies before you, their share will be divided among that beneficiary's descendants, effectively stepping into their place. Conversely, "per capita" means that the assets will be distributed equally among all surviving named beneficiaries. You cannot use both designations for the same group of beneficiaries, so it’s important to understand the implications of each choice.

Do I need to consult a professional before filling out the form?

While it is not mandatory, it is highly recommended to consult with a legal or tax advisor before completing the form. Your choice of beneficiaries can have significant financial and legal implications, particularly concerning tax liabilities and inheritance rules. A professional can help ensure that your designations align with your overall estate planning goals.

Common mistakes

Completing the Lynch Beneficiary Designation form can be straightforward, but many people slip up along the way. One common mistake is not using a separate form for each client. Each individual must fill out their own form, so if you are managing accounts for multiple clients, it’s essential to ensure everyone has their documentation squared away. Failing to follow this guideline can lead to confusion and delays in processing beneficiary designations.

Another frequent error involves overlooking the need to provide complete information about the beneficiaries. For individuals, the form asks for the legal name, social security number, date of birth, and relationship. Missing even one detail can delay distributions and complicate matters for your heirs. Ensuring you provide all requested information helps simplify the process when it's time to execute your wishes.

The calculation of share percentages is another area where mistakes often occur. The total of all shares must equal 100%. If one or more percentages are incorrectly calculated, the form may be deemed invalid. Checking your math in advance can save you the hassle of having to redo the entire process. It’s a simple step, but one worth taking for peace of mind.

Another significant error occurs when people write ambiguous instructions, such as "See my will" or "as per trust." Such language leads to invalid designations because financial institutions typically require explicit information on the form itself. Instead, make sure to fill in the beneficiary information directly on the form to avoid complications later.

For married individuals, failing to obtain a spouse's consent can pose serious issues. If you designate someone other than your spouse as a beneficiary, their signature is mandatory. Skipping this step could result in your designation being unenforceable, meaning the default rules concerning your estate would apply instead.

People sometimes also neglect to keep a copy of the completed form. Retaining a copy for your records is vital, as it allows you to reference what you submitted and provides a safeguard in case of disputes or confusion in the future. It's a simple act that fortifies your intentions.

Another often-overlooked aspect is the deadline for updates. Life changes such as marriage, divorce, or births necessitate revising your beneficiary designations. If you delay, your assets might not go to the intended recipients. Regularly reviewing these forms can help ensure that your choices reflect your current situation.

Moreover, using "per stirpes" and "per capita" interchangeably is a mistake that many make. These terms describe different methods of inheritance, and you are only allowed to select one. Misunderstanding this can lead to unintentional consequences for how your estate is distributed.

Additionally, customized designations are not as straightforward as they may seem. If you require modifications beyond those allowed on the form, you must clearly attach those changes. Failure to do so could lead to compatibility issues with Merrill’s administrative requirements.

Finally, ensure your signature is present. Even if you fill out the form correctly, it won't be effective without your signature. Don’t rush through this final step; a missing signature could nullify all other efforts you've made. Take the time to make sure everything is in order, and your wishes will be honored.

Documents used along the form

When completing the Lynch Beneficiary Designation form, it's important to have a good understanding of other related documents that may be required or beneficial in the process. Each of these documents serves a specific purpose and can help ensure that your wishes are clearly outlined. Here is a list of some of these documents:

- Last Will and Testament: This document outlines how you wish your assets to be distributed upon your death. It can provide clarity and serve as a guide for your executor in managing your estate.

- Powers of Attorney: This form allows you to appoint someone to make decisions on your behalf in case you become incapacitated. There are different types, including financial and healthcare powers of attorney.

- Trust Documents: A trust can help manage your assets during your lifetime and distribute them after your death, often bypassing probate. This can allow beneficiaries to access funds more quickly.

- Health Care Directive: Also known as a living will, this outlines your healthcare preferences in case you are unable to communicate your wishes. It designates someone to make medical decisions for you.

- Estate Inventory List: This list details all of your assets, providing a clear picture of what you own. It can help executors during the settling of your estate.

- Retirement Account Statements: Including documents for accounts such as IRAs or employer-sponsored plans can help clarify the beneficiary designations for these accounts.

- Title Documents: These documents establish the ownership of real estate or significant assets. They are important to discuss with your attorney to ensure correct designations.

- Tax Returns: Past tax returns may provide insight into your financial situation and how to best structure your estate plans moving forward.

Understanding these documents can greatly enhance your planning process and provide peace of mind. It is wise to consult with a legal professional to navigate these important matters effectively.

Similar forms

-

The Will serves as a legal document that outlines how a person's assets and properties should be distributed upon their death. Like the Lynch Beneficiary Designation form, a will allows individuals to specify beneficiaries, detailing who will receive what. Both documents play fundamental roles in estate planning and ensure that an individual's wishes are honored after they pass away.

-

The Trust Agreement is another important document that functions similarly to the Lynch Beneficiary Designation form. A trust allows for the management and distribution of assets during a person's lifetime and after their death. As with the beneficiary form, individuals can name specific beneficiaries and provide instructions on how their assets should be distributed, offering greater flexibility and control over asset management.

-

The Power of Attorney (POA) is a document that designates an agent to make decisions on behalf of an individual should they become incapacitated. While it is not focused on asset distribution like the Lynch form, it shares a similar purpose of establishing clear directives that have legal backing, ensuring that the person's wishes are followed even when they cannot express them directly.

-

The Health Care Proxy is a document that allows individuals to appoint someone to make medical decisions on their behalf. Like the Lynch Beneficiary Designation form, it emphasizes the importance of having clear designations in place to ensure that one's preferences are honored, providing peace of mind that decisions will be made by trusted individuals.

-

The Retirement Account Beneficiary Designation Form is a specific document used for retirement accounts, such as IRAs and 401(k)s. It directly parallels the Lynch Beneficiary Designation form by naming beneficiaries for retirement assets, ensuring that these funds are distributed according to the account holder's wishes upon their death, thus avoiding complications and delays in the process.

Dos and Don'ts

When filling out the Lynch Beneficiary Designation form, here are some important dos and don'ts to keep in mind:

- Do use one form per client and ensure that each additional client uses a separate form.

- Do provide complete information for each beneficiary, including legal names and relationships.

- Do retain a copy of the completed form for your records.

- Do consult a legal or tax professional if you have questions about designating beneficiaries.

- Don't submit copies of your will or trust documents with the form.

- Don't leave any required fields blank; provide as much information as possible.

- Don't use phrases like "as per will" or "as per trust" in your beneficiary designations.

- Don't forget to sign and date the form for it to be effective.

Misconceptions

Here are six misconceptions about the Lynch Beneficiary Designation Form and their explanations:

-

It is only necessary to fill out the form once.

Many people believe that completing the form is a one-time task. In reality, you can change your beneficiary designation at any time. Any changes you make will take effect only after they are received and accepted by Merrill.

-

All beneficiary designations are automatically valid.

This form must meet specific administrative and operational requirements. Any designations that are not compliant may be considered invalid.

-

It’s sufficient to write “as per will” or “as per trust.”

Designations that include such phrases will not be accepted. Complete names and details of each beneficiary are essential for validity.

-

Once my beneficiaries are named, I will not need to update the form.

Your personal circumstances can change, which may warrant updating your beneficiary designations. Always keep it current.

-

I don’t need to provide all information about my beneficiaries.

Although not all fields are required, providing as much information as possible is crucial to identify and locate your beneficiaries promptly after your passing.

-

Customized designations are straightforward and do not require special approval.

While you can submit customized designations, they must be reviewed for compatibility with Merrill's requirements. Be sure to check with your advisor for guidance.

Key takeaways

When filling out and using the Lynch Beneficiary Designation form, consider these key points:

- One form per client: You must complete a separate Beneficiary Designation Form for each client.

- Review consequences: Designating or changing beneficiaries can have significant implications. Consulting a legal or tax professional is advised before proceeding.

- Completion of information: Include all necessary details for each beneficiary, such as name, Social Security number, date of birth, and relationship. The correct relationship affects calculations for Required Minimum Distributions (RMDs).

- Invalid designations: Phrases like "as per will" or "as per trust" will not be accepted and are considered invalid.

- Changes are allowed: You can change your beneficiaries at any time. However, remember that these changes are only effective once received and accepted by Merrill.

- Distribution rules: When a primary beneficiary predeceases you, their share goes to the remaining primary beneficiaries. If none survive, contingent beneficiaries will receive the assets.

- Customizations require care: If you alter any part of the form or require additional space, submit a separate page. Label it “See Attached.” Each customization must meet operational requirements.

Browse Other Templates

Aetna Po Box - Review the Member Handbook for claims and pre-authorizations.

Discrete Math High School - Investigate the criteria for membership in sets.

Dd Form 2492 - The form reflects the Department of Defense's commitment to maintaining health standards among service members.