Fill Out Your Ma Exempt St 12 Form

The MA Exempt ST-12 form is an essential document for businesses and individuals looking to navigate the complexities of sales tax exemptions in Massachusetts. This form allows purchasers to certify that certain tangible personal property is either exempt from sales or use tax or qualifies for special treatment under Massachusetts General Laws. The form specifically caters to various situations, including agricultural production, commercial fishing, and manufacturing processes where materials, tools, or fuel become vital components in the sale of goods. Additionally, it covers exemptions for energy sources used in residential energy systems and prewritten software available for multiple tax jurisdictions. Completing the ST-12 requires precise documentation, including a detailed description of the property and the purpose for which it is acquired. By filling out this form, vendors can alleviate their burden of proof regarding tax exemptions, provided they receive it in good faith. However, for all its advantages, misusing the ST-12 can lead to severe penalties. It’s crucial for users to fully understand the scope of this form and ensure compliance to enjoy its benefits without legal pitfalls.

Ma Exempt St 12 Example

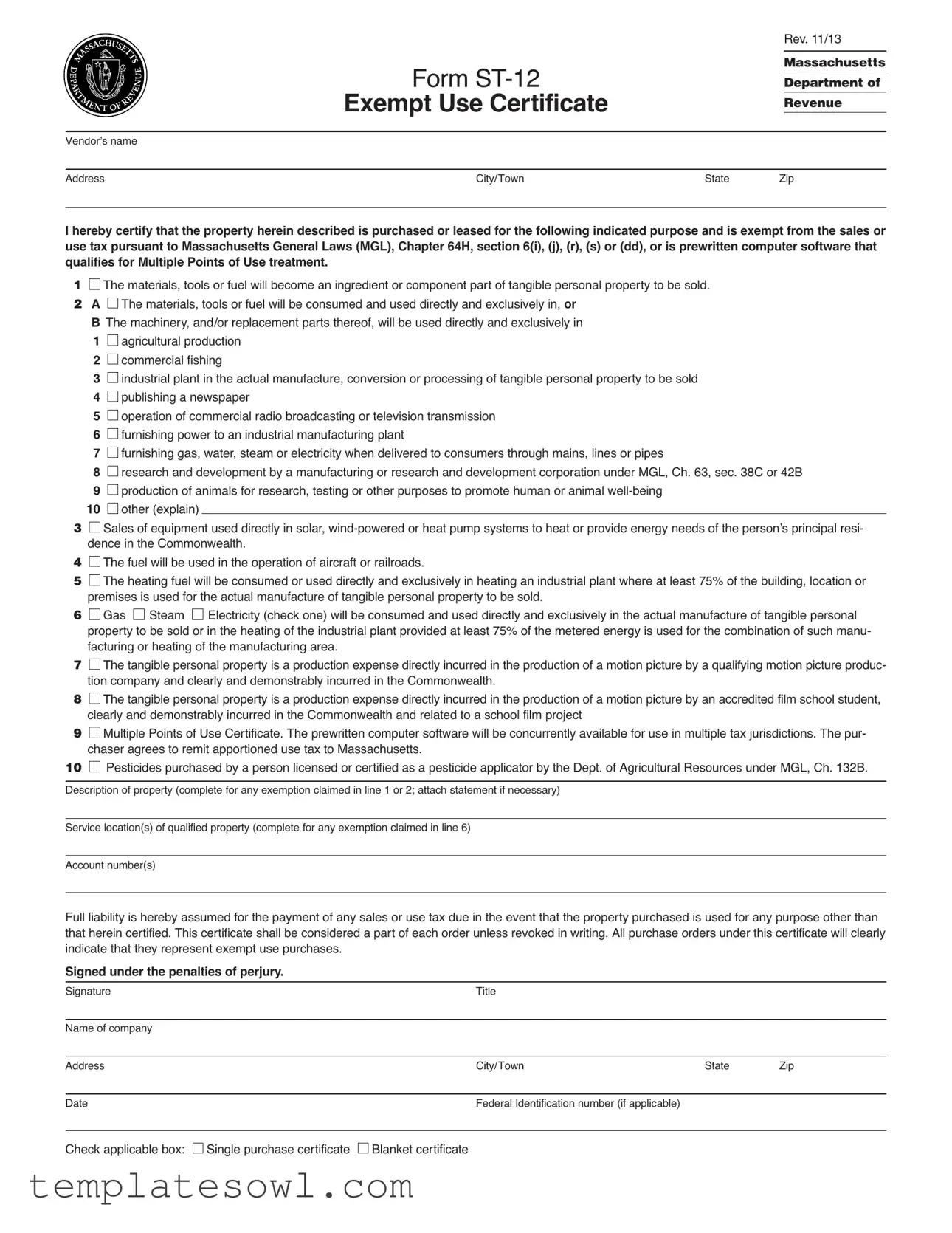

Form

Exempt Use Certificate

Rev. 11/13

Massachusetts

Department of

Revenue

Vendor’s name

Address |

City/Town |

State |

Zip |

I hereby certify that the property herein described is purchased or leased for the following indicated purpose and is exempt from the sales or use tax pursuant to Massachusetts General Laws (MGL), Chapter 64H, section 6(i), (j), (r), (s) or (dd), or is prewritten computer software that qualifies for Multiple Points of Use treatment.

1 The materials, tools or fuel will become an ingredient or component part of tangible personal property to be sold.

The materials, tools or fuel will become an ingredient or component part of tangible personal property to be sold.

2A  The materials, tools or fuel will be consumed and used directly and exclusively in, or B The machinery, and/or replacement parts thereof, will be used directly and exclusively in 1

The materials, tools or fuel will be consumed and used directly and exclusively in, or B The machinery, and/or replacement parts thereof, will be used directly and exclusively in 1  agricultural production

agricultural production

2  commercial fishing

commercial fishing

3  industrial plant in the actual manufacture, conversion or processing of tangible personal property to be sold 4

industrial plant in the actual manufacture, conversion or processing of tangible personal property to be sold 4  publishing a newspaper

publishing a newspaper

5 operation of commercial radio broadcasting or television transmission

operation of commercial radio broadcasting or television transmission

6 furnishing power to an industrial manufacturing plant

furnishing power to an industrial manufacturing plant

7 furnishing gas, water, steam or electricity when delivered to consumers through mains, lines or pipes

furnishing gas, water, steam or electricity when delivered to consumers through mains, lines or pipes

8 research and development by a manufacturing or research and development corporation under MGL, Ch. 63, sec. 38C or 42B

research and development by a manufacturing or research and development corporation under MGL, Ch. 63, sec. 38C or 42B

9 production of animals for research, testing or other purposes to promote human or animal

production of animals for research, testing or other purposes to promote human or animal

10 other (explain)

other (explain)

3 Sales of equipment used directly in solar,

Sales of equipment used directly in solar,

4 The fuel will be used in the operation of aircraft or railroads.

The fuel will be used in the operation of aircraft or railroads.

5 The heating fuel will be consumed or used directly and exclusively in heating an industrial plant where at least 75% of the building, location or premises is used for the actual manufacture of tangible personal property to be sold.

The heating fuel will be consumed or used directly and exclusively in heating an industrial plant where at least 75% of the building, location or premises is used for the actual manufacture of tangible personal property to be sold.

6 Gas

Gas  Steam

Steam  Electricity (check one) will be consumed and used directly and exclusively in the actual manufacture of tangible personal property to be sold or in the heating of the industrial plant provided at least 75% of the metered energy is used for the combination of such manu- facturing or heating of the manufacturing area.

Electricity (check one) will be consumed and used directly and exclusively in the actual manufacture of tangible personal property to be sold or in the heating of the industrial plant provided at least 75% of the metered energy is used for the combination of such manu- facturing or heating of the manufacturing area.

7 The tangible personal property is a production expense directly incurred in the production of a motion picture by a qualifying motion picture produc- tion company and clearly and demonstrably incurred in the Commonwealth.

The tangible personal property is a production expense directly incurred in the production of a motion picture by a qualifying motion picture produc- tion company and clearly and demonstrably incurred in the Commonwealth.

8 The tangible personal property is a production expense directly incurred in the production of a motion picture by an accredited film school student, clearly and demonstrably incurred in the Commonwealth and related to a school film project

The tangible personal property is a production expense directly incurred in the production of a motion picture by an accredited film school student, clearly and demonstrably incurred in the Commonwealth and related to a school film project

9 Multiple Points of Use Certificate. The prewritten computer software will be concurrently available for use in multiple tax jurisdictions. The pur- chaser agrees to remit apportioned use tax to Massachusetts.

Multiple Points of Use Certificate. The prewritten computer software will be concurrently available for use in multiple tax jurisdictions. The pur- chaser agrees to remit apportioned use tax to Massachusetts.

10 Pesticides purchased by a person licensed or certified as a pesticide applicator by the Dept. of Agricultural Resources under MGL, Ch. 132B.

Pesticides purchased by a person licensed or certified as a pesticide applicator by the Dept. of Agricultural Resources under MGL, Ch. 132B.

Description of property (complete for any exemption claimed in line 1 or 2; attach statement if necessary)

Service location(s) of qualified property (complete for any exemption claimed in line 6)

Account number(s)

Full liability is hereby assumed for the payment of any sales or use tax due in the event that the property purchased is used for any purpose other than that herein certified. This certificate shall be considered a part of each order unless revoked in writing. All purchase orders under this certificate will clearly indicate that they represent exempt use purchases.

Signed under the penalties of perjury.

Signature |

Title |

|

|

|

|

|

|

Name of company |

|

|

|

|

|

|

|

Address |

City/Town |

State |

Zip |

|

|

|

|

Date |

Federal Identification number (if applicable) |

|

|

Check applicable box:

Single purchase certificate

Single purchase certificate

Blanket certificate

Blanket certificate

Form

General Information

Certain consumers may not be required to pay a sales tax if the property they purchase is to be used in a manner which exempts it from taxation.

If tangible personal property, including fuel, gas, steam or electric- ity is purchased and that purchase qualifies for an exemption from the sales or use tax, the purchaser may present an exempt use certificate to the vendor to certify that the property will be used in an exempt manner. The burden of proving that a sale of tangible personal property by any vendor is exempt from tax is on the ven- dor, unless the vendor accepts from the purchaser a certificate declaring that the property is exempt from tax. The Multiple Points of Use Certificate claimed on line 9 is only applicable to prewritten computer software that will be concurrently available for use in multiple tax jurisdictions.

Notice to Vendors

The vendor must make sure that the certificate is completed prop- erly and signed before accepting it.

An exempt use certificate relieves the vendor from the burden of proof only if it is taken in good faith from a purchaser who, at the time of purchase, intends to use the property in an exempt man- ner, or is unable to ascertain at the time of purchase that it will be used in an exempt manner.

A Multiple Points of Use Certificate claimed on line 9 relieves the vendor from the obligation to collect, pay, or remit the applicable tax on sales of prewritten software.

The exemption claimed on line 10 for sales to a person licensed or certified as a pesticide applicator by the Department of Agricultural Resources under MGL, Ch. 132B only applies to sales of pesticides, including insecticides, herbicides, fungicides, miticides and all mate- rials registered with the Environmental Protection Agency as pesti- cides under Federal Insecticide, Fungicide and Rodenticide Act as well as other pesticides commonly regarded in the same category and for the same purpose. See TIR

The vendor must retain this certificate as part of his/her tax rec- ords. For further information regarding the requirements for retain- ing records, see Massachusetts Regulation, 830 CMR 62C.25.1.

Notice to Contractors

This form may be used by a contractor when purchasing or leasing tangible personal property from a vendor in connection with fulfilling a contract with its customer if the property will be used for one of the exempt uses described in Massachusetts General Laws (MGL) chapter 64H, section 6(r) or (s), which include the following: use di- rectly and exclusively in an industrial plant in the actual manufac- ture of tangible personal property to be sold; in the furnishing of power to an industrial manufacturing plant; in the furnishing of gas, water, steam or electricity when delivered to consumers through mains, lines or pipes; in research and development by a manufac- turing corporation or research and development corporation; in ag- ricultural production; in commercial fishing.

A contractor purchasing property exempt under MGL chapter 64H, section 6(r) or (s), may sign and present this form to its vendor. The contractor bears the burden of proof of demonstrating on audit that the items purchased are or will be used in an exempt manner. In the event that the items do not qualify for exemption under section 6(r) or (s), the contractor will be liable for the tax. An exempt use cer- tificate furnished by the contractor’s customer to the contractor will not relieve the contractor from liability. See DD

Notice to Purchasers

This form is not to be used by an exempt organization (use Form

If a purchaser makes any use of the property other than an exempt use, such property will be subject to the Massachusetts sales or use tax, as of the time the property is first used.

For any exemption claimed in line 1 or 2, the purchaser must pro- vide a description of the exempt property. For any exemption claimed in line 6 for the purchase of gas, steam or electricity, the purchaser must provide the service locations of the qualified prop- erty and utility account numbers. Attach an additional statement if more space is needed.

A purchaser submitting a Multiple Points of Use Certificate by checking line 9 agrees to report and remit the applicable sales or use tax to the jurisdictions where the software will be used, using any reasonable, but consistent and uniform, method of apportion- ment that is supported by the purchaser’s business records, as they exist at the time a return is filed. See TIR

If at any time a business that has presented this certificate ceases to qualify for the exemption, it must revoke in writing the Form ST- 12 it has given to its vendor(s).

For further information regarding the acceptance or use of exempt use certificates see Massachusetts Regulation, 830 CMR 64H.8.1.

Warning: Willful misuse of this certificate may result in crimi- nal tax evasion penalties of up to one year in prison and $10,000 ($50,000 for corporations) in fines.

If you have any questions about the acceptance or use of this cer- tificate, please contact: Massachusetts Department of Revenue,

Customer Service Bureau, PO Box 7010, Boston, MA 02204; (617)

printed on recycled paper

printed on recycled paper

Form Characteristics

| Fact Name | Details |

|---|---|

| Form Purpose | The ST-12 Exempt Use Certificate is utilized by consumers in Massachusetts to certify that certain purchases are exempt from sales or use tax. |

| Governing Laws | This form is governed by the Massachusetts General Laws (MGL), Chapter 64H, specifically sections 6(i), (j), (r), (s), and (dd). |

| Qualified Uses | Eligible uses include agricultural production, commercial fishing, and manufacturing processes involving tangible personal property. |

| Multiple Points of Use | The form permits a purchaser to apply for an exemption for prewritten computer software if it will be used concurrently across multiple tax jurisdictions. |

| Vendor Obligations | Vendors must ensure the ST-12 form is properly completed and signed before accepting it to benefit from the sales tax exemption. |

| Contractor Use | Contractors can use the ST-12 when purchasing materials for exempt projects, provided the materials will be used in defined exempt manners. |

| Record-Keeping | Vendors are required to retain the completed ST-12 form as part of their tax records to substantiate tax exemption claims. |

| Penalties | Improper use of the ST-12 form can lead to serious penalties, including fines and possible imprisonment for tax evasion. |

Guidelines on Utilizing Ma Exempt St 12

After gathering the necessary information, you can proceed to fill out the MA Exempt ST-12 form. This form certifies that the property you are purchasing or leasing is exempt from sales or use tax under specific conditions according to Massachusetts law. Following the right steps will ensure proper completion and submission.

- Begin by entering the vendor’s name, which is the name of the business or individual from whom you are purchasing the property.

- Next, provide the address of the vendor, including the city/town, state, and zip code.

- In the designated area, certify the purpose of the purchase by selecting one of the exemption categories listed in the form.

- If applicable, in line 2, indicate whether the materials, tools, or fuel will be used in specific industrial activities by choosing between the options available.

- For exemptions claimed in line 1 or 2, complete the description of property section, ensuring you detail the items purchased.

- If claiming an exemption in line 6 for energy purchases, complete the service location(s) of qualified property along with the respective account number(s).

- Assume full liability for any sales or use tax that may become due in the event the property is used for non-exempt purposes by signing the form.

- Record your title (your position in the company), name of the company, and address, including city/town, state, and zip code.

- Date the form by providing today’s date.

- If applicable, include the federal identification number.

- Select the appropriate box to indicate whether this is a single purchase certificate or a blanket certificate.

What You Should Know About This Form

What is the purpose of the MA Exempt ST-12 form?

The MA Exempt ST-12 form serves as a certificate used by purchasers to claim exemption from sales or use tax for specific tangible personal property. This form is applicable when the property is used in a manner recognized as exempt under Massachusetts General Laws, such as agricultural production, industrial manufacturing, or certain types of energy consumption. By presenting this certificate to the vendor, the purchaser certifies that the property will be used in an exempt manner.

Who qualifies to use the MA Exempt ST-12 form?

This form can be used by individuals or businesses purchasing property that is eligible for a tax exemption. Examples include farmers, manufacturers, and organizations engaged in qualifying research and development. However, it is important to note that organizations seeking broader exemptions should use a different form, specifically the ST-5 for exempt organizations.

What types of property can be exempt under the MA Exempt ST-12 form?

The form covers a variety of property types that can be exempted, including materials, tools, fuel, and machinery. For instance, materials that become components of products sold, fuel used for heating in industrial plants, and certain equipment for renewable energy systems are all examples of property that may qualify for exemption. Additionally, prewritten computer software available for use in multiple tax jurisdictions can also be claimed under the Multiple Points of Use provision on the form.

What is the vendor's responsibility when accepting the MA Exempt ST-12 form?

Vendors are required to ensure that the ST-12 form is completed accurately and signed before accepting it. When accepted in good faith, the form relieves vendors from the burden of proving that the transaction qualifies for tax exemption. However, vendors must retain the certificate as part of their tax records, as they could be held liable if the property is later found not to be exempt.

What are the consequences of misusing the MA Exempt ST-12 form?

Misuse of the ST-12 form can lead to severe penalties, including criminal tax evasion charges, which may result in imprisonment and substantial fines. It is crucial for businesses and individuals to understand the requirements and restrictions of the form to avoid unintended misuse and potential legal repercussions.

Common mistakes

When completing the Ma Exempt ST-12 form, several common mistakes can occur, potentially jeopardizing the validity of the exemption claimed. First, one significant error is failing to provide a clear and specific description of the property being purchased. Each exempt use claimed under lines 1 or 2 requires an accurate description. Without this detail, vendors may question the legitimacy of the exemption.

Another frequent mistake is not indicating the correct purpose for the exemption. Each category of exempt use is distinct and must be marked accordingly. For example, selecting “agricultural production” when intending to use the items for another exempt purpose can lead to issues. It is essential to ensure that the selected purpose aligns precisely with the intended use of the property.

Moving on, not signing the form is another error that can lead to complications. A signature under the penalties of perjury is crucial. Without a signature, the form may be deemed incomplete, thus nullifying the exemption. It is a simple step that should not be overlooked.

Moreover, not understanding the type of certificate being used can result in mistakes. Filling out the form as a blanket certificate when only a single purchase is intended may confuse vendors and potentially compromise the tax exemption. Clarity on whether a single or blanket certificate is applicable is vital.

Another point to consider is ignoring the need for utility account numbers or service locations when applicable. For exemptions claimed under line 6 regarding gas, steam, or electricity, providing service locations and account numbers is necessary. Failing to include this information can invalidate the claimed exemption.

Lastly, neglecting to understand the penalties associated with misuse or improper completion of the form poses a serious risk. Willful misuse could lead to significant fines and even criminal charges. Awareness of these consequences serves as motivation to complete the form accurately and responsibly.

Documents used along the form

The Massachusetts Exempt Use Certificate, Form ST-12, is designed for consumers who want to purchase certain items without incurring sales tax. When utilizing this form, it is often accompanied by other documentation that further supports the claim for exemption. Below are some additional forms and documents that may commonly be used alongside the ST-12 form.

- Form ST-5: This form is used by exempt organizations, such as charities and certain government entities, to certify their tax-exempt status. It allows these organizations to purchase goods and services without paying sales tax, provided the purchases are related to their exempt purposes.

- Form ST-12EC: This is an Exempt Use Certificate specifically for containers used to transport food or drink off-premises. It certifies that the containers are used solely for exempt purposes, thus qualifying for tax exemption.

- Form ST-13: This form is used to claim the small business energy exemption. Businesses meeting certain criteria can use it to purchase energy or utility services without incurring sales tax, supporting their operational needs.

- Multiple Points of Use Certificate: Often utilized for prewritten computer software, this certificate confirms that the software will be used across multiple tax jurisdictions. It ensures that appropriate sales and use taxes are remitted to each jurisdiction based on usage.

- Purchase Orders: When making exempt purchases, it is essential that purchase orders clearly indicate the transaction is for an exempt use. These documents help maintain clarity and formality in financial dealings, and they become part of the tax records.

- Utility Account Documentation: For any exemption related to the purchase of gas, steam, or electricity, documentation showing service locations and utility account numbers must be provided. This supports the claim that the utilities are being used in a manner that qualifies for exemption.

By using these additional forms and documents in conjunction with Form ST-12, consumers can better ensure compliance with Massachusetts tax laws while leveraging available exemptions. Keeping accurate records is key to navigating the complexities of tax-exempt purchases.

Similar forms

- Form ST-5: This form, also known as the Sales Tax Exempt Organization Certificate, is similar because it allows exempt organizations to certify their purchases are not subject to sales tax, akin to how the ST-12 certifies exempt use for specific property. Both ensure that eligible entities are not taxed on qualified transactions.

- Form ST-12EC: This Exempt Use Certificate for Containers is used for transport-related purchases, specifically food or drinks. Like the ST-12, it serves to exempt certain purchases from sales tax, but it is focused on containers instead of broader property use.

- Form ST-13: The Small Business Energy Exemption Form is similar in purpose as it seeks to exempt small businesses from certain taxes related to energy purchases. Like ST-12, it supports specific exemptions under Massachusetts law but targets energy-related purchases.

- Form ST-3B: This form is designated for claiming sales tax exemptions on items purchased for resale. Similar to ST-12, it allows purchasers to avoid taxes when acquiring property they plan to resell rather than use.

- Form ST-6: This form serves the purpose of claiming a sales tax exemption for certain agricultural products. While the ST-12 focuses on various uses of property, ST-6 specifically addresses exemptions related to agriculture.

- Form ST-A1: This is a Blanket Exemption Certificate used for recurring tax-exempt purchases by certain entities. Similar to ST-12, it provides a streamlined method for claiming exemptions, making repeated tax-exempt transactions more straightforward.

- Form ST-9: Known as the Resale Certificate, this allows businesses to purchase certain items without paying sales tax when those items will be resold. Like ST-12, it certifies that the purchased items will not be subject to taxation.

- Form ST-10: Similar in structure and intent, this form facilitates the exemption of purchases made by government entities, similar to the ST-12 in that they both provide a means for certifying tax exemptions for specified purposes.

Dos and Don'ts

When filling out the MA Exempt ST-12 form, it is essential to follow some guidelines to avoid common pitfalls. Below is a list of things you should and should not do:

- Do carefully read the instructions on the form before starting your application.

- Do provide a clear description of the property being purchased to support your claim for exemption.

- Do ensure that your certification is signed and includes the correct title and name of your company.

- Do keep a copy of the completed form for your records for future reference.

- Don't leave any sections blank; complete all required fields to avoid processing delays.

- Don't use this form for purchases that do not fall under the specified exemptions.

- Don't forget to revoke the certificate in writing if your business no longer qualifies for the exemptions.

Misconceptions

- Only Certain Businesses Can Use It: A common myth is that only large corporations can use the MA Exempt ST-12 form. In reality, any business that qualifies for an exemption can submit this form.

- The Form Is Only For Purchasing: Many people believe the ST-12 is strictly for purchases. However, it can also be used for leasing certain types of property.

- All Types of Property Qualify: Some mistakenly think that all types of property are eligible for exemption. Only specific categories like industrial materials, agricultural tools, and certain energy sources qualify.

- It’s an Automatic Exemption: There’s a belief that submitting the form guarantees an exemption. The reality is that the burden of proving the property will be used in an exempt manner is on the purchaser.

- No Need for Further Documentation: Some think that once they complete the ST-12, no additional details are needed. In fact, descriptions of the property and service locations are required for particular exemptions.

- Vendors Don’t Need to Worry: A misconception exists that vendors can accept the form without caution. Vendors must ensure the form is accurately completed and signed to be relieved from the burden of proof.

- Every Use is Exempt: Not all uses of property are exempt. If the property is used for any purpose outside of the exemption, tax liability will apply.

- One-Time Use Only: Many believe this certificate can only be used once. In fact, it can function as a blanket certificate for ongoing purchases as long as the exempt use remains valid.

- Pesticide Businesses are Exempt by Default: Another misconception is that all pesticide-related purchases automatically qualify for exemption. This is not true without proper certification.

- Misusing the Certificate is Harmless: Some individuals think that misusing the ST-12 may not lead to serious consequences. However, willful misuse can result in significant legal penalties, including fines and imprisonment.

Key takeaways

When dealing with the Massachusetts Exempt Use Certificate Form ST-12, there are several important points to keep in mind to ensure correct usage and compliance. Here are some key takeaways:

- Purpose of the Form: The ST-12 form certifies that the property purchased will be used for an exempt purpose, as outlined by Massachusetts law. It must be presented to vendors to avoid sales tax.

- Identifying Exempt Uses: Various exempt uses are listed on the form. It's crucial to check the appropriate box that corresponds to how the property will be utilized. This might include agricultural production or industrial manufacturing.

- Clarity and Accuracy: Complete the form accurately. Any exemptions claimed must be clearly explained. Attach additional statements if extra space is needed for descriptions or service locations.

- Vendor Responsibilities: Vendors must ensure that the ST-12 form is signed and properly filled out. This protects them from having to collect sales tax, provided the certificate is accepted in good faith.

- Consequences of Misuse: Misusing this form can lead to serious penalties, including fines and imprisonment for tax evasion. It's vital to ensure compliance to avoid legal issues.

While navigating the ST-12 form might seem daunting, understanding these key points can help facilitate its proper use and protect against potential tax implications. Always consult with a tax professional if you have questions or concerns regarding your specific situation.

Browse Other Templates

IMM5562e CIC - This form plays an essential role in your overall immigration application.

London, Ky 40742-7656 - This page may also be used to confirm agreement to provide additional documentation if needed.

Utah Sui Rate - A late penalty of $25.00 minimum may be applied for tardy submissions.