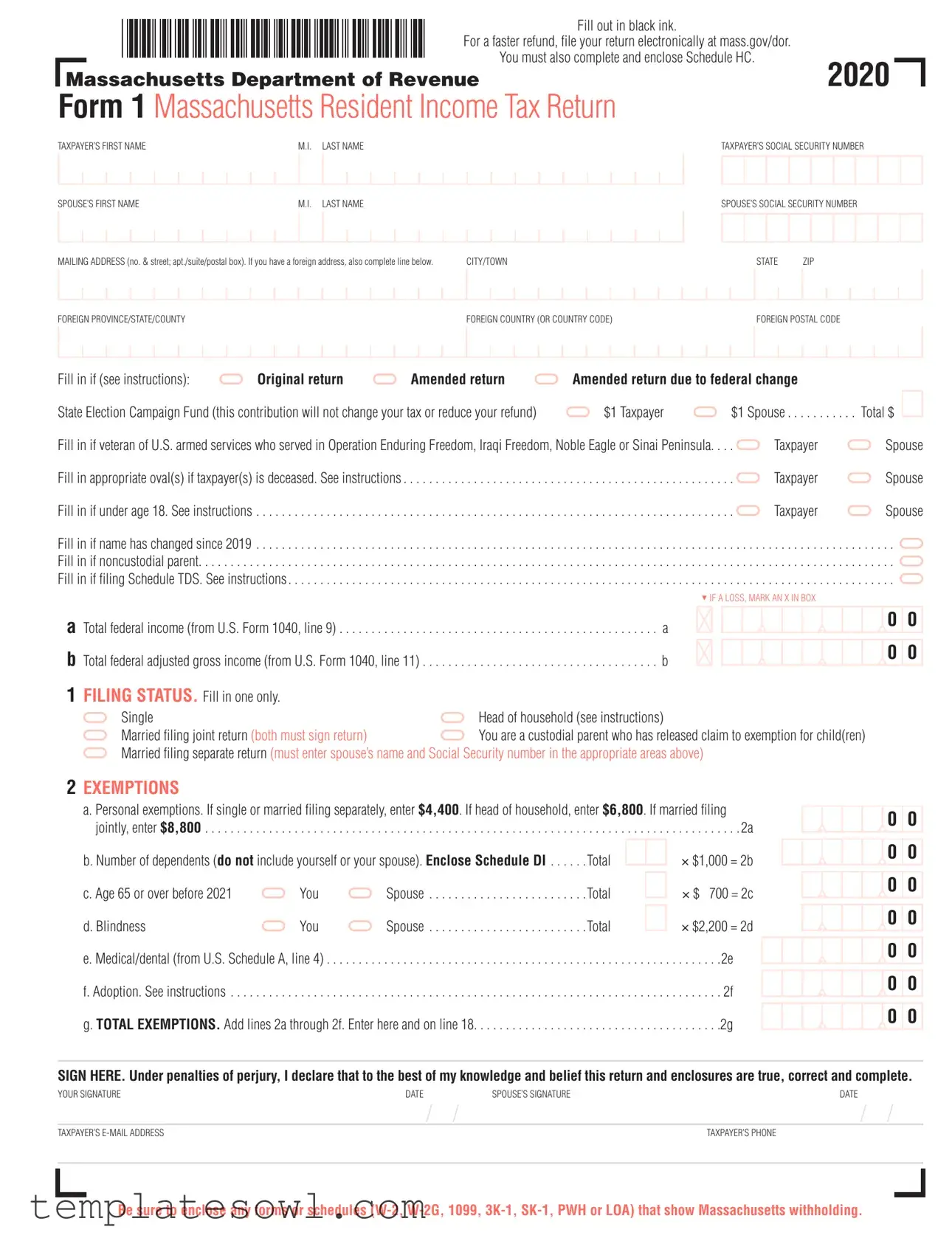

Fill Out Your Ma Resident Form

The Massachusetts Resident Income Tax Return, commonly referred to as Form 1, is a crucial document for any resident filing taxes in the state. Designed for individual taxpayers, the form requires essential information such as names, Social Security numbers, and a mailing address to ensure accurate processing. To facilitate a speedy refund, it is advisable to complete the return electronically at mass.gov/dor. An important aspect to remember is that Schedule HC must be filled out and included with the form, as it pertains to health care coverage, a critical element in Massachusetts tax filings. The form covers various categories including filing status, exemptions, income sources, deductions, and potential tax credits. Taxpayers will need to indicate their filing status—whether single, married filing jointly, or head of household—and report total income from wages, pensions, and other sources. Calculating deductions and exemptions can significantly influence the total taxable income, and a wealth of information is required to complete these sections accurately. Additionally, there are lines for credits and payments that may impact the final tax owed or refund expected. Completing the Massachusetts Resident form entails meticulous attention to detail on each line, ensuring that all necessary schedules and forms are attached for comprehensive tax reporting.

Ma Resident Example

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Fill out in black ink. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

For a faster refund, file your return electronically at mass.gov/dor. |

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

You must also complete and enclose Schedule HC. |

|

|

|

|

2020 |

|

|

||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||||

|

Massachusetts Department of Revenue |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Form 1 Massachusetts Resident Income Tax Return |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

TAXPAYER’S FIRST NAME |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

M.I. |

LAST NAME |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

TAXPAYER’S SOCIAL SECURITY NUMBER |

|

|

|

|||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

SPOUSE’S FIRST NAME |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

M.I. |

LAST NAME |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

SPOUSE’S SOCIAL SECURITY NUMBER |

|

|

|

|

|

|

||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

MAILING ADDRESS (no. & street; apt./suite/postal box). If you have a foreign address, also complete line below. |

|

|

CITY/TOWN |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

STATE |

ZIP |

|

|

|

|

|

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

FOREIGN PROVINCE/STATE/COUNTY |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

FOREIGN COUNTRY (OR COUNTRY CODE) |

|

|

|

|

|

|

|

|

FOREIGN POSTAL CODE |

|

|

|

|

|

|

|||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Fill in if (see instructions): |

|

|

|

|

|

|

|

|

Original return |

|

|

|

|

|

|

|

|

|

|

Amended return |

Amended return due to federal change |

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||||||||||||||||||||||||

|

State Election Campaign Fund (this contribution will not change your tax or reduce your refund) |

|

|

|

$1 Taxpayer |

|

$1 Spouse |

. . . . |

|

Total $ |

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Fill in if veteran of U.S. armed services who served in Operation Enduring Freedom, Iraqi Freedom, Noble Eagle or Sinai Peninsula. |

. |

. |

. |

|

|

Taxpayer |

|

Spouse |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Fill in appropriate oval(s) if taxpayer(s) is deceased. See instructions. |

.. . . . . . . . . . |

. . . . . . . . . . . . . |

. |

|

. |

|

|

Taxpayer |

|

Spouse |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Fill in if under age 18. See instructions. |

. . .. . . . . . . . . . . . . . . . . . . |

|

|

. . . . . . . . . . . . . . |

. |

|

|

|

Taxpayer |

|

Spouse |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Fill in if name has changed since 2019 . |

. . .. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . |

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Fill in if noncustodial parent. |

. |

|

. |

. |

. |

. |

. |

. |

|

. |

. |

. |

. |

. |

. |

. |

. |

. |

. |

. |

. |

. |

. |

. |

. |

|

. |

. |

. |

. |

. |

. |

. |

|

. |

. . |

. |

. . . |

. . . . |

. . . . |

. . . |

. |

|

. . . |

. . . . |

. . |

. . |

. . . |

. |

. . |

. |

. . . . |

. . . . |

. |

. |

. |

. . . |

. |

. . |

. . |

. . |

. . |

. |

. . |

. |

. . . |

. |

. . . |

|

. |

. . |

|

|

||||||||||

|

Fill in if filing Schedule TDS. See instructions |

|

|

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

5 IF A LOSS, MARK AN X IN BOX |

|

|

|

|

|

|

||||||||||||||

|

a Total federal income (from U.S. Form 1040, line 9) . |

. . . . . . . . . . . . . . . |

. . . . |

. . . . |

. a |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

0 |

0 |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

b Total federal adjusted gross income (from U.S. Form 1040, line 11) |

. . . . . . . . |

|

|

. . . . . |

. . . . |

|

b |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

0 |

0 |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

1FILING STATUS. Fill in one only.

|

Single |

|

Head of household (see instructions) |

Married filing joint return (both must sign return) |

|

You are a custodial parent who has released claim to exemption for child(ren) |

|

|

Married filing separate return (must enter spouse’s name and Social Security number in the appropriate areas above) |

||

2EXEMPTIONS

a. Personal exemptions. If single or married filing separately, enter $4,400. If head of household, enter $6,800. If married filing jointly, enter $8,800. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2a

.b. Number of dependents (do not include yourself or your spouse). Enclose Schedule DI |

. . |

.Total |

|

|

× $1,000 = 2b |

||||||

c. Age 65 or over before 2021 |

|

You |

|

Spouse |

. . . . . . . . |

. . |

. Total |

|

|

|

× $1,700 = 2c |

|

|

|

|||||||||

d. Blindness |

|

You |

|

Spouse |

. . . . . . . . |

. . |

. Total |

|

|

|

× $2,200 = 2d |

|

|

|

|||||||||

e. Medical/dental (from U.S. Schedule A, line 4). . |

. . . . . . . . . . |

. . . . . |

. . . . . |

. . . . . |

. . . . .2e |

|

f. Adoption. See instructions . . |

. . . . . . . . . . . . . . . . . . |

. . . . |

. . . . . |

. . . . . |

. . . . . 2f |

|

g. TOTAL EXEMPTIONS. Add lines 2a through 2f. Enter here and on line 18 |

. . . . . . . . . |

. . . . . . . . . . |

|

2g |

||

00

00

00

00

00

00

00

SIGN HERE. Under penalties of perjury, I declare that to the best of my knowledge and belief this return and enclosures are true, correct and complete.

|

YOUR SIGNATURE |

DATE |

SPOUSE’S SIGNATURE |

DATE |

|

|

|

|

|

|

/ |

/ |

/ |

/ |

|

|

TAXPAYER’S |

|

|

TAXPAYER’S PHONE |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Be sure to enclose any forms or schedules

2020 FORM 1, PAGE 2

TAXPAYER’S FIRST NAME |

|

|

|

|

|

|

M.I. LAST NAME |

TAXPAYER’S SOCIAL SECURITY NUMBER |

|||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

INCOME

3 Wages, salaries, tips and other employee compensation (from all Forms

4Taxable pensions and annuities. Attach any Form(s)

Massachusetts bank interest |

Exemption amount. If married filing jointly, enter $200; otherwise enter $100. |

00

00

5 a. |

|

|

|

|

|

|

|

|

0 |

0 |

b. |

|

|

|

0 |

0 |

|

a – b (not less than 0) = 5 |

|

|

|

|

|

|

|

|

0 |

0 |

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

0 |

0 |

|||||||||

6 a. Business/profession income or loss. Enclose Schedule C |

. . . . . . . . . . . . |

. . . . . . . .6a |

|

|

|

|

|

|

|

|

||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||

|

b. Farming income or loss. Enclose U.S. Schedule F |

|

|

|

|

|

6b |

|

|

|

|

|

|

|

|

0 |

0 |

|||||||||||||||

|

. . . |

. . . . . |

. . . . |

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||

7 |

If you are reporting rental, royalty, REMIC, partnership, S corporation, or trust income or loss, see instructions |

7 |

|

|

|

|

|

|

|

|

0 |

0 |

||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||

8 a. Unemployment compensation. See instructions |

|

|

|

|

|

|

8a |

|

|

|

|

|

|

|

|

0 |

0 |

|||||||||||||||

. . . |

. . . . . |

. . . . . |

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||

|

b. Massachusetts state lottery winnings |

. . . . . . . |

. . |

8b |

|

|

|

|

|

|

|

|

0 |

0 |

||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

9 |

Other income from Schedule X, line 5. Enclose Schedule X; not less than 0. . |

. . . . . . |

. . . . . . . |

. . . |

9 |

|

|

|

|

|

|

|

|

0 |

0 |

|||||||||||||||||

|

|

|

|

|

|

|

0 |

0 |

||||||||||||||||||||||||

10 |

TOTAL 5.0% INCOME. Add lines 3 through 9. Be sure to subtract any losses in lines 6 or 7 |

. . . . . . . |

10 |

|

|

|

|

|

|

|

|

|||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||

|

DEDUCTIONS |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

11 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

0 |

0 |

|||||||||

a. Amount you paid to Social Security, Medicare, Railroad, U.S. or Massachusetts retirement. Not more than $2,000 |

. . . . . |

. 11a |

|

|

|

|

||||||||||||||||||||||||||

|

|

|

|

|||||||||||||||||||||||||||||

|

b. Amount spouse paid to Social Security, Medicare, Railroad, U.S. or Massachusetts retirement. Not more than $2,000 |

. . 11b |

|

|

|

|

0 |

0 |

||||||||||||||||||||||||

|

|

|

|

|

||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

12 |

Child under age 13, or disabled dependent/spouse care expenses (from worksheet) |

|

|

|

|

12 |

|

|

|

|

|

|

0 |

0 |

||||||||||||||||||

. . . . . . . . . . |

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||

13Dependent member(s) of household under age 12, or dependent(s) age 65 or over (not you or your spouse) as of December. 31, 2020, or disabled dependent(s)

(only if single, head of household or married filing joint return and not claiming line 12). |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

0 |

0 |

|

a. Enter the number of qualifying dependents, but not more than two, in the box and then multiply by $3,600 |

|

|

× $3,600 = 13 |

|

|

|

|

14Rental deduction. Total rental deduction cannot exceed $3,000 ($1,500 if married filing separately). See instructions.

|

. . . . . . . . . . . . . . . . . . .a. Enter the total qualified rent paid in 2020 in the box then divide by 2 |

|

|

|

|

|

|

|

|

0 |

0 |

÷ 2 = 14 |

|

|

|

|

0 |

0 |

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||

15 |

Other deductions from Schedule Y, line 19. Enclose Schedule Y |

. . |

. |

15 |

|

|

|

|

|

|

|

|

|

|

0 |

0 |

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

16 |

TOTAL DEDUCTIONS. Add lines 11 through 15 . . |

. . . . . . . . . . . . . . . . . . . . . . |

|

. . . |

.16 |

|

|

|

|

|

|

|

|

|

|

0 |

0 |

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||

17 |

5.0% INCOME AFTER DEDUCTIONS. Subtract line 16 from line 10. Not less than 0 |

. . |

. |

17 |

|

|

|

|

|

|

|

|

|

|

0 |

0 |

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

18 |

Total exemption amount (from line 2g) |

|

|

|

|

|

|

|

|

|

|

18 |

|

|

|

|

|

|

|

0 |

0 |

|||

. . . . . . |

. . . . . . . . . . . . . . . . |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

19 |

5.0% INCOME AFTER EXEMPTIONS. Subtract line 18 from line 17. Not less than 0. If line 17 is less |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

0 |

0 |

|||||||||

|

than line 18, see instructions |

. . |

. |

19 |

|

|

|

|

|

|

|

|

|

|

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

20 |

INTEREST AND DIVIDEND INCOME (from Schedule B, line 38). Not less than 0. Enclose Schedule B . |

. . |

|

. |

.20 |

|

|

|

|

|

|

|

|

|

|

0 |

0 |

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||

21 |

TOTAL TAXABLE 5.0% INCOME. Add lines 19 and 20 . . |

. . . . . . . . . . . . . . . . . . . |

|

. . |

|

. |

.21 |

|

|

|

|

|

|

|

|

|

|

0 |

0 |

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

2020 FORM 1, PAGE 3

TAXPAYER’S FIRST NAME |

|

|

|

|

|

|

M.I. LAST NAME |

TAXPAYER’S SOCIAL SECURITY NUMBER |

|||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

22TAX ON 5.0% INCOME (from tax table). If line 21 is more than $24,000, multiply by .05.

Note: If choosing the optional 5.85% tax rate, fill in oval and see instructions |

. . . . . . . . . . . . . .22 |

2312% INCOME (from Schedule B, line 39). Not less than 0. Enclose Schedule B.

a. |

|

|

|

|

|

|

|

|

0 |

0 |

. . . . . . . . . . . . . . . . . . . . . . . . . × .12 = 23 |

|

|

|

|

|

|

|

|

|

|

24TAX ON

|

If filing Schedule |

. . . . . . . . . |

. |

. |

. |

24 |

|

If excess exemptions were used in calculating lines 20, 23 or 24, fill in oval and see instructions |

|

|

|

|

|

25 |

Credit recapture amount. Enclose Schedule CRS. See instructions |

. |

. |

. |

25 |

|

26 |

Additional tax on installment sales. See instructions |

. |

. |

. |

26 |

|

27 |

If you qualify for No Tax Status, fill in oval and enter 0 in line 28 (from worksheet) |

|

|

|

|

|

28 |

TOTAL INCOME TAX. Add lines 22 through 26 |

. |

. |

. |

28 |

|

29 |

CREDITS |

|

|

|

|

|

Limited Income Credit (from worksheet) |

. |

. |

|

.29 |

||

30 |

Income tax due to another state or jurisdiction (from worksheet). Not less than 0. Enclose Schedule OJC. . |

. |

. |

. |

30 |

|

31 |

Other credits (from Schedule CMS) |

. |

. |

|

.31 |

|

32 |

INCOME TAX AFTER CREDITS. Subtract total of lines 29 through 31 from line 28. Not less than 0 . . . . |

. |

. |

|

.32 |

|

33Voluntary fund contributions

a. Endangered Wildlife Conservation. . |

. . . . . . . . . . . . . . . . . . . |

. . . |

. . . . . |

. . . . . |

. . . . . 33a |

||||

b. Organ Transplant. . |

. . . . . . . . . . . . . . . . . . . . . . . . . |

. . . |

. . . . . |

. . . . . |

. . . . . 33b |

||||

c. Massachusetts Public Health HIV and Hepatitis Fund . . |

. . . . . . . . . . . |

. . . |

. . . . . |

. . . . . |

. . . . . 33c |

||||

d. Massachusetts U.S. Olympic. . |

. . . . . . . . . . . . . . . . . . . . . |

. . . |

. . . . . |

. . . . . |

. . . . . 33d |

||||

e. Massachusetts Military Family Relief. |

. . . . . . . . . . . . . . . . . . . |

. . . |

. . . . . . . . . . |

. . . . . 33e |

|||||

f. Homeless Animal Prevention And Care |

. . . . . . . . . . . . . . |

. . . . . . . . . . . . . . . . . . . . |

. . . |

|

|

|

33f |

||

Total. Add lines 33a through 33f . . |

. . . . . . . . . . . . . . . . . . . . |

. . . |

. . . . . |

. . . . . |

. . . . |

33 |

|||

34 Use tax due on Internet, mail order and other |

. . . |

. . . . . |

. . . . . |

. . . . |

34 |

||||

35Health Care penalty. Not less than 0 (from worksheet). Enclose Schedule HC.

|

a. You |

|

|

|

|

0 |

0 |

|

b. Spouse |

|

|

|

|

0 |

0 |

|

Total |

. |

. . . a + b = 35 |

|||

36 |

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||

AMENDED RETURN ONLY. Overpayment from original return. Not less than 0. See instructions |

|

36 |

|

|

|

|||||||||||||||||

|

|

|

|

|||||||||||||||||||

|

|

|

|

|||||||||||||||||||

37 |

INCOME TAX AFTER CREDITS, CONTRIBUTIONS, USE TAX and HC PENALTY. Add lines 32 through 36. . |

. |

37 |

|

|

|

||||||||||||||||

|

|

|

||||||||||||||||||||

0 0

00

00

00

00

0 0

00

00

00

00

00

00

00

00

00

00

00

00

00

00

00

2020 FORM 1, PAGE 4

TAXPAYER’S FIRST NAMEM.I. LAST NAMETAXPAYER’S SOCIAL SECURITY NUMBER

MASSACHUSETTS WITHHOLDING, PAYMENTS AND REFUNDABLE CREDITS

38 |

Massachusetts income tax withheld. Be sure to enclose any forms or schedules |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

0 |

|

0 |

||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

38 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||

39 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||

2019 overpayment applied to your 2020 estimated tax (from 2019 Form 1, line 49 or Form |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

0 |

|

0 |

||||||||||||||||||||||||||

|

Do not enter 2019 refund |

. |

39 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

40 |

2020 Massachusetts estimated tax payments. Do not include line 39 amount |

. |

.40 |

|

|

|

|

|

|

|

|

|

|

|

|

|

0 |

|

0 |

||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||||

41 |

Payments made with extension |

. |

41 |

|

|

|

|

|

|

|

|

|

|

|

|

|

0 |

|

0 |

||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||||

42 |

AMENDED RETURN ONLY. Payments made with original return. Not less than 0. See instructions |

. |

.42 |

|

|

|

|

|

|

|

|

|

|

|

|

|

0 |

|

0 |

||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||||

43 |

EARNED INCOME CREDIT. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

|

|

|

|

|

|

|

|

|

0 |

0 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

0 |

0 |

|||||||||||

|

a. Number of qualifying children |

|

|

b. Amount from U.S. return |

|

|

|

|

|

. |

. |

|

43b × .30 = 43 |

|

|

|

|

|

|||||||||||||||||||||||||||

|

Note: You cannot claim the Earned Income Credit if your filing status is married filing separately unless you qualify for an exception (see instructions). Fill in oval if |

|

|||||||||||||||||||||||||||||||||||||||||||

|

you qualify for this exception. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

44 |

Senior Circuit Breaker Credit. Enclose Schedule CB |

. . . |

. . . . . 44 |

|

|

|

|

|

|

0 |

|

0 |

|||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||||||||||

45 |

Other refundable credits (from Schedule CMS) |

. |

45 |

|

|

|

|

|

|

|

|

|

|

|

|

|

0 |

|

0 |

||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||||

46 |

Excess Paid Family Leave withholding. See instructions |

. |

.46 |

|

|

|

|

|

|

|

|

|

|

|

|

|

0 |

|

0 |

||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||||

47 |

TOTAL. Add lines 38 through 46 |

. |

47 |

|

|

|

|

|

|

|

|

|

|

|

|

|

0 |

|

0 |

||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||||

48 |

OVERPAYMENT. If line 37 is smaller than line 47, subtract line 37 from line 47. If line 37 is larger than line 47, |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

0 |

|

0 |

||||||||||||||||||||||||||

|

go to line 51. If line 37 and line 47 are equal, enter 0 in line 50 |

|

|

48 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

49 |

Amount of overpayment you want APPLIED to your 2021 ESTIMATED TAX |

|

|

49 |

|

|

|

|

|

|

|

|

|

|

|

|

|

0 |

|

0 |

|||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||

50 |

THIS IS YOUR REFUND. Subtract line 49 from line 48. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

R |

E |

F |

U |

N |

D |

|

|

0 |

0 |

|||||||||||||||||||||

|

Mail to: Massachusetts DOR, PO Box 7000, Boston, MA 02204 |

|

|

50 |

|

|

|

|

|

|

|||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||

|

Direct deposit of refund. See instructions. |

|

|

|

|

|

|

|

|

|

Type of account (select one): |

|

Checking |

||||||||||||||||||||||||||||||||

|

Routing number (first two digits must be 01 to 12 or 21 to 32) Account number |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Savings |

||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

51 |

TAX DUE. Subtract line 47 from line 37. Pay in full online at mass.gov/masstaxconnect |

. |

.51 |

|

|

|

|

|

|

|

|

|

|

|

|

|

0 |

|

0 |

||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||||

Or pay by mail. Make check payable to Commonwealth of Massachusetts. Write Social Security number(s) in memo section of check and be sure to sign check. Mail to: Massachusetts DOR, PO Box 7003, Boston, MA 02204.

These amounts will affect your refund or tax due:

Interest

0 0

Penalty

0 0

|

|

|

|

|

0 |

0 |

|

|

|

|

|

|

|

|

|

Exception. Enclose Form |

|

||||||

PRINT PAID PREPARER’S NAME |

PAID PREPARER’S SSN or PTIN |

PAID PREPARER’S PHONE |

DATE |

||

|

/ / |

|

( |

) |

|

PAID PREPARER’S SIGNATURE |

PAID PREPARER’S EIN |

|

|

|

|

|

|

|

|||

Fill in if |

DOR may discuss this return with the preparer |

I do not want my preparer to file my return electronically |

|||

BE SURE TO SIGN RETURN ON PAGE 1 AND ENCLOSE SCHEDULE HC.

FOR PRIVACY ACT NOTICE, SEE INSTRUCTIONS.

Form Characteristics

| Fact Name | Fact Description |

|---|---|

| Filing Method | For a faster refund, you should file your return electronically at mass.gov/dor. |

| Form Completion | Fill out the form using black ink to ensure clarity. |

| Additional Schedule | Schedule HC must be completed and enclosed with the return. |

| Governing Law | This form operates under Massachusetts General Laws Chapter 62. |

| Veteran Status | There are specific sections for veterans who served in notable military operations, ensuring they receive due recognition. |

Guidelines on Utilizing Ma Resident

Completing the Massachusetts Resident form requires careful attention to detail. After filling out the form, be sure to enclose the necessary schedules and supporting documentation to ensure the processing of your return. Below are the steps to guide you through filling out the form.

- Use black ink to fill out the form.

- Enter your first name, middle initial, and last name in the designated fields.

- Input your Social Security number accurately.

- If applicable, provide your spouse’s first name, middle initial, last name, and Social Security number.

- Fill in your mailing address, including the street number, street name, apartment/suite/postal box details, city/town, state, and ZIP code.

- If you have a foreign address, complete the additional fields for foreign province/state/county, country, and postal code.

- Indicate if you are filing an original return or an amended return.

- If applicable, indicate your contribution to the State Election Campaign Fund for both taxpayer and spouse.

- Mark whether you or your spouse are veterans of specific operations.

- Identify if the taxpayer or spouse is deceased, under age 18, or if your name has changed since 2019.

- Fill out the details regarding your filing status by selecting the appropriate oval.

- Input your exemptions, depending on your filing status, including the number of dependents and any applicable notes about age or blindness.

- Record your total income from various sources, including wages and pensions.

- Complete the section for deductions, providing necessary figures from your records or attached schedules.

- Calculate total taxable income and taxes owed based on the provided tables or calculations.

- Document any credits you may qualify for to reduce your tax liability.

- Determine your overpayment or tax due based on your calculations.

- If applicable, choose the method of receiving your refund or making payments if owed.

- Sign and date the return, ensuring to include your and your spouse’s signatures where needed.

- Attach any required forms or schedules, particularly Schedule HC.

What You Should Know About This Form

What is the Ma Resident form?

The Ma Resident form, also known as the Massachusetts Resident Income Tax Return, is a document for individuals residing in Massachusetts to report their income and calculate their state taxes due. Filing this form is necessary for anyone in Massachusetts who earns income and meets the state's tax requirements.

How do I file the Ma Resident form?

You can file the Ma Resident form either electronically or by mailing a paper version. For faster refunds, it is recommended to file electronically through the Massachusetts Department of Revenue website at mass.gov/dor. Regardless of which method you choose, ensure that you fill out the form completely and accurately before submission.

What information do I need to complete the form?

To fill out the Ma Resident form, you will need personal information such as your name, Social Security number, and mailing address. Additionally, prepare details about your income, including wages, pensions, and any other earnings. You must also report exemptions and any relevant deductions that apply to your situation.

Do I need to attach any additional forms?

Yes, alongside the Ma Resident form, you must complete and attach Schedule HC, which addresses health care coverage. If you have other specific credits or deductions you're claiming, you may also need to include additional schedules like Schedule Y or Schedule B.

What if I made a mistake on my original form?

If you realize there’s an error on your filed form, you can submit an amended return. This involves completing the Ma Resident form again, but marking it as an “amended return.” Be sure to provide the corrected information and any additional documentation necessary to support the changes.

Can I track my refund status?

Yes, after you submit your Ma Resident form, you can track the status of your refund through the Massachusetts Department of Revenue website. You will need to provide your Social Security number and some other identifying information to access your refund status.

What happens if I owe taxes?

If you owe taxes after filing the Ma Resident form, you should pay the amount due by the specified deadline to avoid penalties and interest. You can pay online via mass.gov/masstaxconnect or send a check payable to the Commonwealth of Massachusetts. Ensure to write your Social Security number in the memo section of the check for proper processing.

Common mistakes

Filling out the Massachusetts Resident form can seem straightforward, but there are common mistakes that can complicate the process. One frequent error occurs when individuals fail to use the correct ink color. The instructions clearly state that the form must be filled out in black ink. Using blue or any other color can affect the readability of the document and may cause delays in processing.

Another common misstep is neglecting to complete Schedule HC. This schedule is crucial as it pertains to health care coverage and must be enclosed with your tax return. Failing to include this schedule can lead to unnecessary delays and could potentially impact your eligibility for certain credits or deductions, causing complications that could have easily been avoided.

Inaccurately reporting Social Security numbers is another issue many face. Each taxpayer's Social Security number is uniquely tied to them and is vital for correct identification within the tax system. A typo in this section can result in a mismatch that complicates the processing of your return, potentially leading to delays or errors in your refund.

Furthermore, miscalculating exemptions can significantly alter your tax situation. It is important to carefully review the instructions provided on personal exemptions, dependent deductions, and any additional credits that may apply. Underestimating these amounts not only impacts your financial responsibility but can also result in penalties or additional assessments.

Lastly, overlooking the need for signatures can render an otherwise complete return invalid. Both the taxpayer and spouse (if applicable) must sign the return to confirm its accuracy and completeness. Without these signatures, the form will not be processed. In this regard, a simple act of forgetting to sign can lead to unnecessary complications in finalizing your tax return.

Documents used along the form

When filing the Massachusetts Resident Income Tax Return, several other forms and documents may be necessary to ensure proper reporting. These documents can provide essential information regarding income, deductions, and credits that can affect tax calculations. Here’s a brief overview of some commonly used documents alongside the MA Resident form:

- Schedule HC: This form is required to report your health care coverage for the year. It is essential for verifying compliance with the Massachusetts health insurance mandate.

- Schedule DI: This document is used to claim dependents. It includes details about qualifying dependents to ensure that applicable exemptions can be properly applied to the return.

- Schedule C: If you are self-employed or run a business, Schedule C is needed. It reports income and expenses related to your business activities, helping to determine your net profit or loss.

- Schedule B: This form reports interest and dividend income. If you have income from these sources, you must include it on your return using this schedule.

- Schedule D: If applicable, this schedule is required to report capital gains and losses from the sale of assets. It helps determine any tax owed or potential losses that can offset other gains.

- Schedule Y: For taxpayers claiming other deductions, Schedule Y outlines various deductions not listed on the main form. This includes specific expenses that can reduce taxable income.

- Form 1099: Issued by third parties, these forms report various types of income received throughout the year, including wages, dividends, and non-employee compensation. It’s crucial to include any applicable 1099 forms alongside your return.

Including these additional forms can help provide a complete representation of a taxpayer's financial situation. This completeness is key to ensuring accurate tax assessment and facilitating a smoother refund process if applicable.

Similar forms

- Federal Form 1040: Like the Massachusetts Resident form, the federal Form 1040 serves as an annual income tax return. Both forms require personal information, details of income, deductions, and claims for credits.

- California Resident Income Tax Return (Form 540): This California form mirrors the Massachusetts Resident form in that it is specifically designed for residents of California to report their income and claim deductions and credits. Both forms necessitate similar financial details.

- New York State Resident Income Tax Return (Form IT-201): This form serves a similar purpose, allowing individuals residing in New York to report their income and calculate state tax owed. Each form requires comprehensive income reporting.

- Illinois Individual Income Tax Return (Form IL-1040): Similar to the Massachusetts form, this document is for Illinois residents. It requires the declaration of income and deductions, leading to the determination of state tax liability.

- Pennsylvania Personal Income Tax Return (Form PA-40): Like the Massachusetts form, the PA-40 is used by state residents to report income and claim applicable credits and deductions, focusing on personal tax obligations.

- Texas Franchise Tax Report: This document serves a similar purpose for businesses operating in Texas, requiring reporting of revenue and deductions. While specific to businesses, it shares the foundational goal of tax reporting with the Massachusetts form.

- Florida Individual Income Tax Return: Although Florida does not impose a state income tax, any related forms for financial disclosures would be similar in seeking personal financial information, mirroring the Massachusetts format in structure.

- Ohio IT 1040: This form is used for filing Ohio resident income taxes, similar to the Massachusetts Resident form. Taxpayers report their income, apply deductions, and calculate their tax liability on both forms.

Dos and Don'ts

When filling out the Massachusetts Resident form, here are nine things to do and avoid:

- Do: Use black ink to complete the form.

- Do: Electronically file your return at mass.gov/dor for a quicker refund.

- Do: Complete and include Schedule HC for health care coverage.

- Do: Ensure your social security numbers are accurate and correctly entered.

- Do: Sign and date the return before submission.

- Don’t: Falsify any information on the form, as it is a legal document.

- Don’t: Forget to enclose any required forms, such as W-2 or 1099.

- Don’t: Leave any fields blank; complete all necessary information.

- Don’t: Submit the form without reviewing it for errors.

Misconceptions

Many people have misunderstandings about the Massachusetts Resident Form. Here are ten common misconceptions and clarifications regarding them:

- Black ink is mandatory: Some think that using blue or colored ink is acceptable. However, always use black ink when filling out the form to ensure better readability.

- Filing electronically is the only way to ensure a refund: While electronic filing does expedite refunds, you can still receive a refund by filing a paper return. It just may take longer.

- Skipping Schedule HC is fine if you don’t have health insurance: If you do not have health insurance, you must still complete and submit Schedule HC with your return.

- Only those with high income need to file: Everyone who meets the minimum income threshold and is a resident must file this form, regardless of how much they earn.

- Filing status only matters for couples: Filing status is important for all taxpayers. Even single filers must select an appropriate status, as it can affect tax calculations.

- Tax credits are automatic: Some believe taxes owed are automatically reduced by credits. In reality, you must claim specific credits on the form to receive benefits.

- All income is taxable: Many do not realize that certain types of income are not taxed, such as some social security benefits or certain types of interest income.

- It’s acceptable to omit non-taxable income: Non-taxable income still needs to be reported, even if it isn’t included in the taxable amount.

- Depreciation calculations are not necessary: Anyone who has rental property must correctly calculate depreciation, as this can impact taxable income.

- You can submit without all forms: Failing to attach required forms or schedules can delay processing. Ensure you include all necessary documentation when submitting your return.

Key takeaways

Filling out the Massachusetts Resident Form can be straightforward if you keep a few key points in mind. Here are some essential takeaways to make the process smoother for you:

- Use black ink: When filling out the form, always use black ink to ensure that your entries are easily readable.

- File electronically: For a quicker refund, consider filing your return electronically at mass.gov/dor.

- Schedule HC is required: Don’t forget to complete and enclose Schedule HC with your submission. This form relates to health care coverage and is essential for compliance.

- Keep your information secure: Be careful when entering your Social Security numbers and personal information. Double-check for accuracy to avoid delays.

- Understand your filing status: Decide your filing status accurately (single, married filing jointly, etc.) as it influences your tax calculations and exemptions.

- Exemption deductions: Know the exemptions available to you based on your circumstances. This may include personal exemptions, age-related exemptions, or deductions for dependents.

- Taxpayer signatures: Ensure that both you and your spouse, if filing jointly, sign the return. A missing signature can lead to processing delays.

- Review for accuracy: Before mailing, review your form thoroughly to confirm all calculations, deductions, and required documents are complete.

- Plan for payment methods: If you owe taxes, decide on your payment method early. You can pay electronically or by mail, but be mindful of deadlines to avoid penalties.

Browse Other Templates

Types of Court Petitions - Failure to obey the subpoena can result in legal penalties.

Oklahoma Sales Tax Exemption Certificate Example - False information on the affidavit may lead to criminal charges and fines up to $1,000.