Fill Out Your Ma Resale Certificate Form

The Massachusetts Resale Certificate form plays a crucial role in the state’s tax system, particularly for businesses engaged in the sale of tangible personal property. It enables buyers to purchase goods without being burdened by sales tax when they intend to resell those items in the regular course of their business. The form requires specific details, including the name and address of the purchaser, the type of business, and a declaration of the intended resale. In addition to providing essential information, it requires the signature of the purchaser, certifying under the penalty of perjury that the goods are indeed for resale purposes. Vendors must be vigilant, as the form is not just a simple piece of paperwork; it carries significant legal implications. When completed correctly, the Resale Certificate protects both the vendor and the purchaser from unnecessary tax obligations. However, it's also vital for purchasers to understand that misuse of this certificate can lead to severe penalties, including fines and even jail time for tax evasion. This underscores the importance of accurately completing and retaining the form as part of their permanent records. Through compliance with these regulations, businesses in Massachusetts can efficiently navigate the complexities of sales tax and ensure smooth operations in their trade.

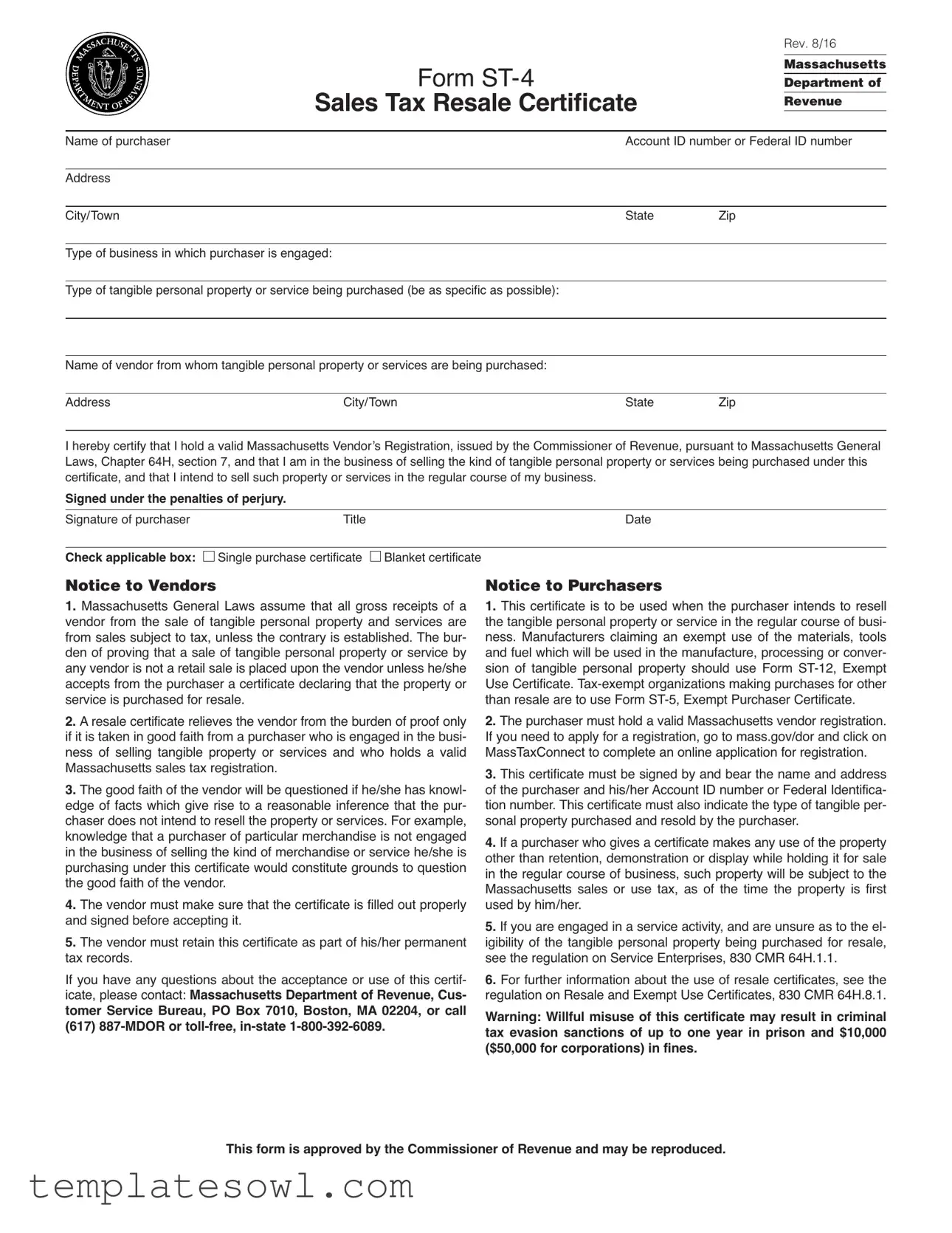

Ma Resale Certificate Example

orm

Sales Tax Resale Certificate

Rev. 8/16

Massachusetts

Department of

Revenue

me of purser |

|

unt numer or eerl numer |

||

|

|

|

|

|

ress |

|

|

|

|

|

|

|

|

|

itTown |

|

|

te |

ip |

|

|

|

||

Tpe of usiness in wi purser is ene |

|

|

||

|

|

|

||

Tpe of tnile personl propertor ser ein purse e |

s spefis possile) |

|

||

|

|

|

||

|

|

|

||

me of nor from wom tnile personl propertor sers re |

ein purse |

|

||

|

|

|

|

|

ress |

|

itTown |

te |

ip |

|

|

|

|

|

erertiftt |

ol li ssusetts enors e |

istrtion issue te ommissioner of enue pursunt to ss |

usetts enerl |

|

ws pter |

seion n tt m in te usine |

ss of sellin te kin of tnile personl propertor sers |

ein purse uner tis |

|

rtifite n tt inten to sell su propertor sers i |

n te reulr urse of musiness |

|

||

Signed under the penalties of perjury. |

|

|

||

|

|

|

|

|

nture of purser |

Title |

te |

|

|

|

|

|

|

|

Check applicable box: |

nle purse rtifite nket rtifite |

|

|

|

Notice to Vendors

1.ssusetts enerl ws ssume tt ll ross reipts of nor from te sle of tnile personl propertn sers re

from sles suje to t unless te ntrris estlise Te |

|

ur |

||

en of pron tt sle of tnile personl propertor |

|

ser |

||

nnor is not retil sle is pl upon te nor un |

|

|

less ese |

|

pts from te purser |

rtifite erin tt te prope |

|

|

rtor |

ser is purse for resle |

|

|

|

|

2. resle rtifite relies te nor from te uren of proof |

onl |

|||

if it is tken in oo fit from purser wo is |

|

ene in te usi |

||

ness of sellin tnile propertor sers n wo ols |

l |

i |

||

ssusetts sles treistrtion |

|

|

|

|

3. Te oo fit of te nor will e questione if e |

|

|

se s knowl |

|

ee of fs wi i rise to |

resonle inferen tt |

|

|

te pur |

ser oes not inten to resell te propertor sers or empl |

e |

|||

knowlee tt purser of prtilr mernise is not en |

|

e |

||

in te usiness of sellin te kin of mer |

nise or ser ese is |

|||

pursin uner tis rtifite woul nstitute rouns to q |

|

uestion |

||

te oo fit of te nor |

|

|

|

|

4. Te nor must mke sure tt te rtifite is fille out pro |

perl |

|||

n sine efore ptin it |

|

|

|

|

5. Te nor must retin tis rtifite s prt of iser permn |

ent |

|||

trers |

|

|

|

|

f u nquestions out te ptn or use of tis |

|

|

r tif |

|

ite plese nt |

Massachusetts Department of Revenue, Cus- |

|||

tomer Service Bureau, PO Box 7010, Boston, MA 02204, or call (617)

Notice to Purchasers

1. Tis rtifite is to e use wen te purser intens to |

resell |

|

te tnile personl propertor ser in te reulr urse of |

usi |

|

ness nufurers imin n empt use of te mterils tools |

|

|

n fuel wi will e use in te mnufure prossin |

or nr |

|

sion of tnile personl propertsoul use orm mpt |

|

|

se ertifite Tmpt orni |

tions mkin purses for oter |

|

tn resle re to use orm |

mpt rser |

ertifite |

2. Te purser must ol li ssusetts nor reis |

trtion |

|

f u nee to pplfor reistrtion o to mssoor n |

ion |

|

ssTonne to mplete n online pplition for reistrti |

on |

|

3. Tis rtifite must e sine n er te nme n |

ress |

|

of te purser n iser unt |

numer or eerl ent |

ifi |

tion numerTis rtifite must lso inite te te of |

tnile per |

|

sonl propertpurse n resol te purser |

|

|

4. f purser wo is rtifite mkes nuse of te propert |

|

|

oter tn retention emonstrtion or isplwile olin |

it for sle |

|

in te reulr urse of usiness su propertwill e suje t |

o te |

|

ssusetts sles or use t s of te time te propertis first |

|

|

use imer |

|

|

5. f u re ene in ser itn re unsure s to |

te el |

|

iiilitof te tnile personl propertein purse |

for resle |

|

see te reultion on r terprises |

|

|

6. or furter informtion out te use of resle rtifites se |

e te |

|

reultion on esle n mpt se ertifites |

|

|

Warning: Willful misuse of this certificate may result in criminal tax evasion sanctions of up to one year in prison and $10,000 ($50,000 for corporations) in fines.

This form is approved by the Commissioner of Revenue and may be reproduced.

Form Characteristics

| Fact Name | Description |

|---|---|

| Purpose | The MA Resale Certificate is used by purchasers who plan to resell tangible personal property in the regular course of business. |

| Governing Law | This form is governed by Massachusetts General Laws Chapter 64H, Section 6. |

| Requirements | Purchasers must complete and sign the certificate, including their name, address, and the type of property being purchased for resale. |

| Validity | The certificate must be retained by the seller as proof of tax-exempt sales; improper use may lead to penalties. |

Guidelines on Utilizing Ma Resale Certificate

Filling out the MA Resale Certificate form helps ensure compliance with sales tax regulations when purchasing items for resale. To get started, follow these clear and straightforward steps to complete the form accurately.

- Provide your name in the space labeled “Name of Purchaser”.

- Enter your address, including the street, town, and zip code.

- Indicate the type of business you operate in the corresponding field.

- Fill in your Massachusetts sales tax registration number or federal identification number.

- Specify the type of tangible personal property you are purchasing.

- List the name of the seller from whom you are purchasing the property.

- Include the seller’s address, including the street, town, and zip code.

- Check the applicable box to indicate whether this is a resale certificate or a blanket certificate.

- Sign the form, including your title, to certify that the information is accurate. Remember, signing under penalties of perjury is a serious matter.

After completing the form, keep a copy for your records. This will serve as proof of your purchase for resale purposes. If there are any questions related to the use of the certificate, it is advisable to reach out to the Massachusetts Department of Revenue for assistance.

What You Should Know About This Form

What is the purpose of the MA Resale Certificate form?

The MA Resale Certificate form allows a buyer to purchase tangible personal property without paying sales tax, provided the buyer intends to resell the purchased items in the regular course of business. This certificate ensures that the seller does not incur tax liability on the sale of their items, as the tax is deferred until the final consumer purchases the goods.

Who can use the MA Resale Certificate?

Only buyers who are engaged in the business of selling tangible personal property can use this certificate. This applies to businesses that regularly sell these types of goods and plan to resell the items purchased. If a buyer uses the property for other purposes, they may be liable for sales tax at the time of purchase.

What are the consequences of misusing the MA Resale Certificate?

Using the MA Resale Certificate incorrectly can lead to serious penalties. Willful misuse may result in criminal tax evasion, potentially leading to up to one year in prison and fines reaching $10,000. Corporations could face fines up to $50,000. Therefore, it's vital to ensure the certificate is filled out accurately and used only for its intended purpose.

How should the MA Resale Certificate be completed?

The MA Resale Certificate must be completed with accurate information regarding the purchaser's name, address, and tax identification number. It should specify the type of tangible personal property being purchased. Once filled out, it must be signed by the purchaser or an authorized agent. Keeping a copy of the certificate is advisable as part of the seller's permanent records.

Common mistakes

Filling out the Massachusetts Resale Certificate form correctly is crucial for avoiding complications during transactions. However, many people make common mistakes that can lead to serious issues for themselves or their businesses. Here are six frequent errors to watch out for.

First, some individuals forget to provide complete and accurate information. The form requires details such as the name of the purchaser, their address, and whether they have a sales tax registration number. Missing any of these crucial details can render the certificate invalid. It’s essential to double-check that all parts of the form are filled out correctly.

Second, many people fail to sign the form. It’s not enough to fill out the fields; the signature is a declaration under penalties of perjury. Without it, the certificate is not binding and does not serve the intended purpose of exempting the purchase from sales tax. A simple oversight like this could lead to unexpected tax liabilities.

Another common mistake involves incorrectly indicating the type of property being purchased for resale. The form requires specific descriptions of the tangible personal property. It’s important to be clear and precise to ensure the tax exemption applies correctly. Vague descriptions can lead to misunderstandings with tax authorities.

Additionally, some purchasers forget to retain a copy of the signed certificate for their records. This document not only serves as proof of exemption for the seller but also protects the purchaser if questions arise later. Keeping good records helps avoid complications with the Massachusetts Department of Revenue.

Lastly, people sometimes misuse the resale certificate. It should only be used when intending to resell the property in the regular course of business. If someone uses it for personal purchases or items not intended for resale, they may face penalties, including fines and potential criminal charges. Always ensure that the intent aligns with the legal purpose of the certificate.

By avoiding these common pitfalls, individuals can better navigate the process of using the Massachusetts Resale Certificate and protect themselves against unnecessary penalties and complications.

Documents used along the form

The following is a list of documents often used in conjunction with the Massachusetts Resale Certificate. Each document serves a specific purpose and supports the resale process. Review each description to understand their importance.

- Massachusetts Sales Tax Registration Certificate: This certificate confirms that a business is registered to collect sales tax in Massachusetts. Businesses must have this document to legally collect and remit sales tax.

- Sales Invoice: A sales invoice details the transaction between a buyer and a seller. It includes information about the items sold, the price, and the sales tax charged, documenting the sale for tax purposes.

- Purchase Order: This document is issued by a buyer to a seller, outlining the details of the goods or services required. It serves as a request for purchase and can be referenced for resale purposes.

- Vendor Account Application: This application establishes a relationship between a vendor and a purchaser. It provides necessary details for extending credit and processing sales efficiently.

- Retail Sales Certificate: This certificate is often issued by retailers to prove their status as resellers, enabling them to purchase goods without paying sales tax at the time of purchase.

- Exempt Use Certificate: This certificate allows a buyer to purchase items tax-free if these items will be used in a way that qualifies for an exemption. It is necessary for businesses that buy qualifying products.

- Manufacturer’s Exemption Certificate: Manufacturers use this certificate to purchase materials and equipment without paying sales tax, provided these items are for sale or production in their business.

- Form ST-5: Sales Tax Exempt Certificate: This form allows certain organizations, such as non-profits or government entities, to purchase goods exempt from sales tax due to their tax-exempt status.

- Return Policy Document: A formal return policy clarifies the terms under which products can be returned. It helps establish clear terms for buyers and sellers and can support resale transactions.

- Annual Sales Tax Return: This is the report submitted to the state that summarizes sales and use taxes collected during the year. Businesses are required to file this return, helping to ensure compliance with tax laws.

Utilizing these documents appropriately can facilitate smoother transactions and maintain compliance with tax regulations in Massachusetts. Ensure all necessary forms are complete and properly filed to avoid potential issues with the Department of Revenue.

Similar forms

- Sales Tax Exemption Certificate: Similar to the MA Resale Certificate, this document allows a purchaser to buy goods without paying sales tax if the items are intended for resale or are exempt from tax due to their nature, like certain manufacturing equipment or medical supplies. Both documents require a signature and indicate the buyer's intent regarding the goods purchased.

- Use Tax Certificate: This form is used when a buyer purchases items for use rather than for resale, but wants to affirm that a certain use is exempt from sales tax. Like the resale certificate, it requires documentation of the buyer's tax status and purpose for acquiring the items.

- Vendor's Certificate: Vendors may request this certificate from buyers to verify that sales are exempt from sales tax under applicable laws. This document is akin to the MA Resale Certificate, as it is issued to support tax-exempt transactions and requires identification of both parties involved.

- Direct Pay Permit: This document allows businesses to purchase goods and services without paying sales tax at the point of sale. Instead, businesses report and pay the sales tax directly to the state, similar to the resale certificate where the intention is to resell the goods without incurring sales tax upfront.

- Manufacturing Exemption Certificate: Manufacturers use this form to claim exemptions for purchases of materials that will be incorporated into manufactured products. It parallels the resale certificate in that it both substantiates claims for tax benefits and needs proper documentation regarding the nature of the transaction.

Dos and Don'ts

When filling out the Massachusetts Resale Certificate form, there are important do's and don'ts to consider. Following these guidelines can help ensure compliance and smooth processing.

- Do: Ensure that the certificate is filled out completely and accurately before submitting it.

- Do: Retain a copy of the certificate as part of your permanent business records for future reference.

- Do: Confirm that your business is registered with the Massachusetts Department of Revenue, if applicable.

- Don't: Submit the form without the appropriate signatures from authorized personnel.

- Don't: Use the certificate for transactions unrelated to the resale of personal property.

- Don't: Ignore state guidelines regarding the proper use and limits of the resale certificate; this could lead to penalties.

By adhering to these points, you can navigate the resale process with confidence and avoid potential issues.

Misconceptions

There are several misconceptions regarding the Massachusetts Resale Certificate form. Understanding the facts can help individuals and businesses use the certificate appropriately.

- The Resale Certificate is only for retailers. This is inaccurate. The certificate can be used by any business intending to resell tangible personal property, not just retailers.

- All purchases made under a Resale Certificate are exempt from sales tax. This is not the case. The certificate only applies to purchases intended for resale in the normal course of business.

- There is no need to complete the Resale Certificate correctly. This is false. The certificate must be filled out completely and accurately; incomplete information can lead to issues with tax compliance.

- Using a Resale Certificate for non-resale purchases is acceptable. This is incorrect. The misuse of the certificate for purchases not intended for resale can result in penalties.

- Only the original purchaser can use the certificate. This is misleading. While the certificate must be filled out by the purchaser, it can be presented to multiple vendors as long as the use remains for resale.

- Sellers can ignore the Resale Certificate if they feel uncertain about the purchaser's intentions. This is not true. Sellers need to retain the certificate as proof of a legitimate sale for resale purposes, regardless of their personal feelings about the transaction.

Key takeaways

Filling out and using the Massachusetts Resale Certificate form is an important step for businesses looking to make tax-exempt purchases. Here are some key takeaways to consider:

- The Resale Certificate is designed for individuals or businesses intending to resell goods in the regular course of their business.

- Complete the form with accurate information including your name, address, and seller’s registration number.

- Make sure to specify the type of tangible personal property you intend to purchase for resale.

- It is essential to sign the certificate to validate it, as unsigned forms may be considered invalid.

- The completed certificate should be retained as part of the vendor's permanent records.

- This document protects sellers from liability in the event of an audit regarding tax-exempt transactions.

- The form is valid only if the purchaser is engaged in the business of selling tangible personal property.

- Vendors may challenge the validity of the resale certificate if they have reason to believe the purchaser does not intend to resell the items.

- Misusing the Resale Certificate can lead to serious penalties, including fines and potential imprisonment.

- For assistance or questions about the form, contact the Massachusetts Department of Revenue.

Understanding these aspects can help ensure that your business stays compliant while taking advantage of the benefits afforded by the Resale Certificate.

Browse Other Templates

Sky Zone Donation Request - Timeliness of your submission can affect our ability to support your event.

New Colorado License - Applicants must be sure to include accurate vehicle identification numbers (VIN).