Fill Out Your Mae Note Form

The Mae Note form is a critical document often utilized in adjustable-rate mortgage (ARM) agreements. Designed for loans linked to the one-year Treasury Index, this form contains essential information and terms about the borrowing process. One major aspect is the flexibility it offers in interest rates, as they can change over time based on a predetermined schedule. However, this flexibility comes with established rate caps, limiting how much the interest rate can increase or decrease at any given change date. The form outlines the borrower's promise to repay the principal amount, including the agreed-upon interest, through monthly payments. Notably, borrowers have the option to make prepayments without incurring extra charges, allowing them to pay off their loans faster if they choose. In addition to structuring payments, the Mae Note form includes provisions for late charges, consequences of default, and various borrower protections. Understanding this form is crucial for anyone considering an adjustable-rate loan, ensuring that they are aware of their obligations and rights as they embark on their borrowing journey.

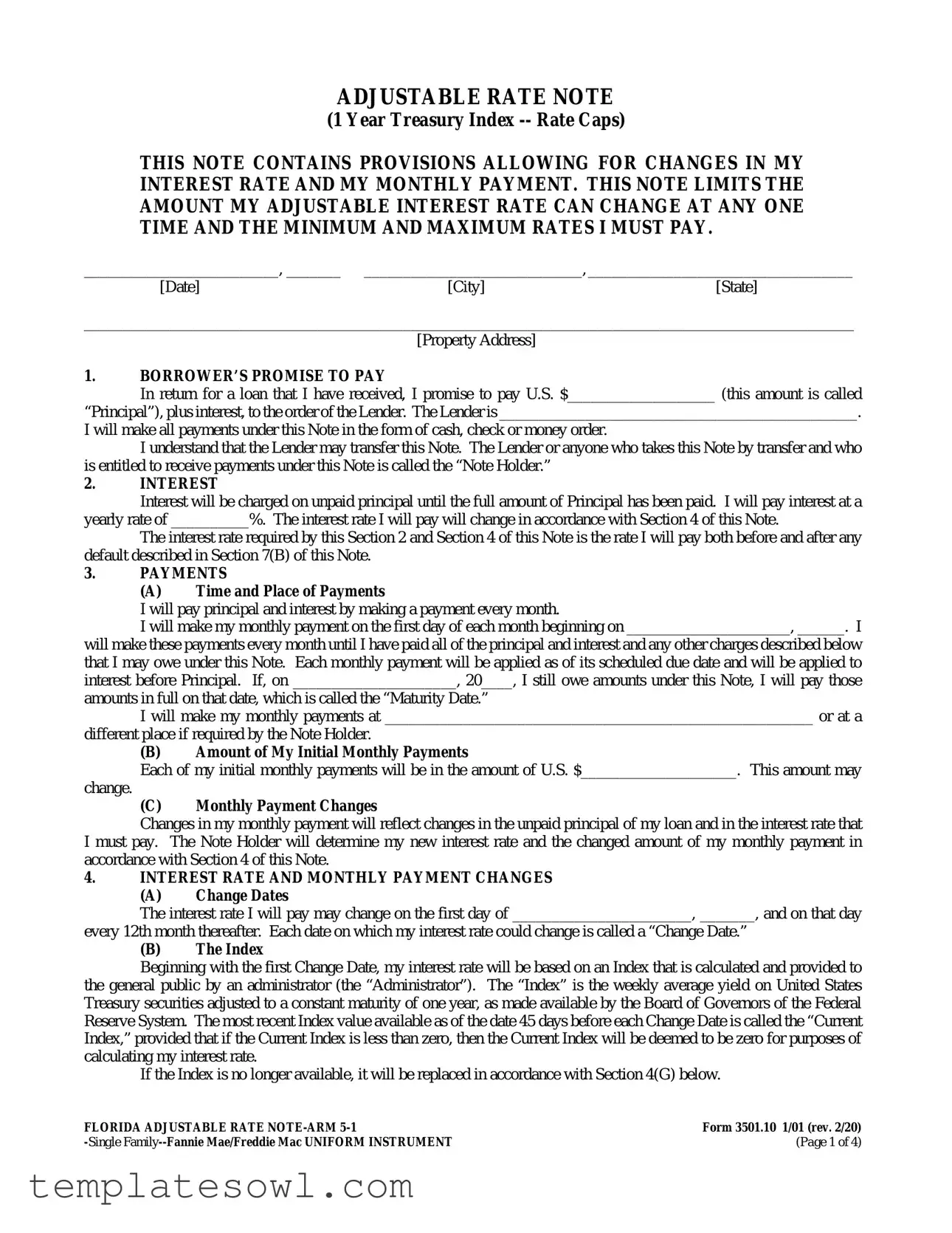

Mae Note Example

ADJUSTABLE RATE NOTE

(1 Year Treasury Index

THIS NOTE CONTAINS PROVISIONS ALLOWING FOR CHANGES IN MY INTEREST RATE AND MY MONTHLY PAYMENT. THIS NOTE LIMITS THE AMOUNT MY ADJUSTABLE INTEREST RATE CAN CHANGE AT ANY ONE TIME AND THE MINIMUM AND MAXIMUM RATES I MUST PAY.

_________________________, _______ ____________________________, __________________________________

[Date][City][State]

___________________________________________________________________________________________________

[Property Address]

1.BORROWER’S PROMISE TO PAY

In return for a loan that I have received, I promise to pay U.S. $___________________ (this amount is called

“Principal”), plus interest, to the order of the Lender. The Lender is ______________________________________________.

I will make all payments under this Note in the form of cash, check or money order.

I understand that the Lender may transfer this Note. The Lender or anyone who takes this Note by transfer and who is entitled to receive payments under this Note is called the “Note Holder.”

2.INTEREST

Interest will be charged on unpaid principal until the full amount of Principal has been paid. I will pay interest at a yearly rate of __________%. The interest rate I will pay will change in accordance with Section 4 of this Note.

The interest rate required by this Section 2 and Section 4 of this Note is the rate I will pay both before and after any default described in Section 7(B) of this Note.

3.PAYMENTS

(A)Time and Place of Payments

I will pay principal and interest by making a payment every month.

I will make my monthly payment on the first day of each month beginning on _____________________, ______. I

will make these payments every month until I have paid all of the principal and interest and any other charges described below that I may owe under this Note. Each monthly payment will be applied as of its scheduled due date and will be applied to interest before Principal. If, on _____________________, 20____, I still owe amounts under this Note, I will pay those

amounts in full on that date, which is called the “Maturity Date.”

I will make my monthly payments at _______________________________________________________ or at a

different place if required by the Note Holder.

(B)Amount of My Initial Monthly Payments

Each of my initial monthly payments will be in the amount of U.S. $____________________. This amount may

change.

(C)Monthly Payment Changes

Changes in my monthly payment will reflect changes in the unpaid principal of my loan and in the interest rate that I must pay. The Note Holder will determine my new interest rate and the changed amount of my monthly payment in accordance with Section 4 of this Note.

4.INTEREST RATE AND MONTHLY PAYMENT CHANGES

(A)Change Dates

The interest rate I will pay may change on the first day of _______________________, _______, and on that day

every 12th month thereafter. Each date on which my interest rate could change is called a “Change Date.”

(B)The Index

Beginning with the first Change Date, my interest rate will be based on an Index that is calculated and provided to the general public by an administrator (the “Administrator”). The “Index” is the weekly average yield on United States Treasury securities adjusted to a constant maturity of one year, as made available by the Board of Governors of the Federal Reserve System. The most recent Index value available as of the date 45 days before each Change Date is called the “Current Index,” provided that if the Current Index is less than zero, then the Current Index will be deemed to be zero for purposes of calculating my interest rate.

If the Index is no longer available, it will be replaced in accordance with Section 4(G) below.

FLORIDA ADJUSTABLE RATE |

Form 3501.10 1/01 (rev. 2/20) |

(Page 1 of 4) |

(C)Calculation of Changes

Before each Change Date, the Note Holder will calculate my new interest rate by adding

__________________________ ____________________ percentage points (___________%) (the “Margin”) to the Current

Index. The Margin may change if the Index is replaced by the Note Holder in accordance with Section 4(G)(2) below. The Note Holder will then round the result of the Margin plus the Current Index to the nearest

The Note Holder will then determine the amount of the monthly payment that would be sufficient to repay the unpaid principal that I am expected to owe at the Change Date in full on the Maturity Date at my new interest rate in substantially equal payments. The result of this calculation will be the new amount of my monthly payment.

(D)Limits on Interest Rate Changes

The interest rate I am required to pay at the first Change Date will not be greater than ______________% or less than

______________%. Thereafter, my interest rate will never be increased or decreased on any single Change Date by more

than one percentage point (1.0%) from the rate of interest I have been paying for the preceding 12 months. My interest rate will never be greater than ______________% or less than _________%.

(E)Effective Date of Changes

My new interest rate will become effective on each Change Date. I will pay the amount of my new monthly payment beginning on the first monthly payment date after the Change Date until the amount of my monthly payment changes again.

(F)Notice of Changes

The Note Holder will deliver or mail to me a notice of any changes in my interest rate and the amount of my monthly payment before the effective date of any change. The notice will include information required by law to be given to me and also the title and telephone number of a person who will answer any question I may have regarding the notice.

(G) Replacement Index and Replacement Margin

The Index is deemed to be no longer available and will be replaced if any of the following events (each, a “Replacement Event”) occur: (i) the Administrator has permanently or indefinitely stopped providing the Index to the general public; or (ii) the Administrator or its regulator issues an official public statement that the Index is no longer reliable or representative.

If a Replacement Event occurs, the Note Holder will select a new index (the “Replacement Index”) and may also select a new margin (the “Replacement Margin”), as follows:

(1)If a replacement index has been selected or recommended for use in consumer products, including residential

(2)If a replacement index has not been selected or recommended for use in consumer products under Section (G)(1) at the time of a Replacement Event, the Note Holder will make a reasonable, good faith effort to select a Replacement Index and a Replacement Margin that, when added together, the Note Holder reasonably expects will minimize any change in the cost of the loan, taking into account the historical performance of the Index and the Replacement Index.

The Replacement Index and Replacement Margin, if any, will be operative immediately upon a Replacement Event and will be used to determine my interest rate and monthly payments on Change Dates that are more than 45 days after a Replacement Event. The Index and Margin could be replaced more than once during the term of my Note, but only if another Replacement Event occurs. After a Replacement Event, all references to the “Index” and “Margin” will be deemed to be references to the “Replacement Index” and “Replacement Margin.”

The Note Holder will also give me notice of my Replacement Index and Replacement Margin, if any, and such other information required by applicable law and regulation.

5.BORROWER’S RIGHT TO PREPAY

I have the right to make payments of Principal at any time before they are due. A payment of Principal only is known as a “Prepayment.” When I make a Prepayment, I will tell the Note Holder in writing that I am doing so. I may not designate a payment as a Prepayment if I have not made all the monthly payments due under the Note.

I may make a full Prepayment or partial Prepayments without paying a Prepayment charge. The Note Holder will use my Prepayments to reduce the amount of Principal that I owe under this Note. However, the Note Holder may apply my Prepayment to the accrued and unpaid interest on the Prepayment amount, before applying my Prepayment to reduce the Principal amount of the Note. If I make a partial Prepayment, there will be no changes in the due dates of my monthly payment unless the Note Holder agrees in writing to those changes. My partial Prepayment may reduce the amount of my monthly payments after the first Change Date following my partial Prepayment. However, any reduction due to my partial Prepayment may be offset by an interest rate increase.

FLORIDA ADJUSTABLE RATE |

Form 3501.10 1/01 (rev. 2/20) |

(Page 2 of 4) |

6.LOAN CHARGES

If a law, which applies to this loan and which sets maximum loan charges, is finally interpreted so that the interest or other loan charges collected or to be collected in connection with this loan exceed the permitted limits, then: (a) any such loan charge shall be reduced by the amount necessary to reduce the charge to the permitted limit; and (b) any sums already collected from me which exceeded permitted limits will be refunded to me. The Note Holder may choose to make this refund by reducing the Principal I owe under this Note or by making a direct payment to me. If a refund reduces Principal, the reduction will be treated as a partial Prepayment.

7.BORROWER’S FAILURE TO PAY AS REQUIRED

(A)Late Charges for Overdue Payments

If the Note Holder has not received the full amount of any monthly payment by the end of ______________ calendar

days after the date it is due, I will pay a late charge to the Note Holder. The amount of the charge will be ______________%

of my overdue payment of principal and interest. I will pay this late charge promptly but only once on each late payment.

(B)Default

If I do not pay the full amount of each monthly payment on the date it is due, I will be in default.

(C)Notice of Default

If I am in default, the Note Holder may send me a written notice telling me that if I do not pay the overdue amount by a certain date, the Note Holder may require me to pay immediately the full amount of Principal which has not been paid and all the interest that I owe on that amount. That date must be at least 30 days after the date on which the notice is mailed to me or delivered by other means.

(D)No Waiver By Note Holder

Even if, at a time when I am in default, the Note Holder does not require me to pay immediately in full as described above, the Note Holder will still have the right to do so if I am in default at a later time.

(E)Payment of Note Holder’s Costs and Expenses

If the Note Holder has required me to pay immediately in full as described above, the Note Holder will have the right to be paid back by me for all of its costs and expenses in enforcing this Note to the extent not prohibited by applicable law. Those expenses include, for example, reasonable attorneys’ fees.

8.GIVING OF NOTICES

Unless applicable law requires a different method, any notice that must be given to me under this Note will be given

by delivering it or by mailing it by first class mail to me at the Property Address above or at a different address if I give the Note Holder a notice of my different address.

Any notice that must be given to the Note Holder under this Note will be given by delivering it or by mailing it by first class mail to the Note Holder at the address stated in Section 3(A) above or at a different address if I am given a notice of that different address.

9.OBLIGATIONS OF PERSONS UNDER THIS NOTE

If more than one person signs this Note, each person is fully and personally obligated to keep all of the promises

made in this Note, including the promise to pay the full amount owed. Any person who is a guarantor, surety or endorser of this Note is also obligated to do these things. Any person who takes over these obligations, including the obligations of a guarantor, surety or endorser of this Note, is also obligated to keep all of the promises made in this Note. The Note Holder may enforce its rights under this Note against each person individually or against all of us together. This means that any one of us may be required to pay all of the amounts owed under this Note.

10.WAIVERS

I and any other person who has obligations under this Note waive the rights of Presentment and Notice of Dishonor. “Presentment” means the right to require the Note Holder to demand payment of amounts due. “Notice of Dishonor” means the right to require the Note Holder to give notice to other persons that amounts due have not been paid.

11.UNIFORM SECURED NOTE

This Note is a uniform instrument with limited variations in some jurisdictions. In addition to the protections given

to the Note Holder under this Note, a Mortgage, Deed of Trust, or Security Deed (the “Security Instrument”), dated the same date as this Note, protects the Note Holder from possible losses which might result if I do not keep the promises which I make in this Note. That Security Instrument describes how and under what conditions I may be required to make immediate payment in full of all amounts I owe under this Note. Some of those conditions are described as follows:

If all or any part of the Property or any Interest in the Property is sold or transferred (or if Borrower is not a natural person and a beneficial interest in Borrower is sold or transferred) without Lender’s prior written consent, Lender may require immediate payment in full of all sums secured by this Security Instrument. However, this option shall not be exercised by Lender if such exercise is prohibited by Applicable Law. Lender also shall not exercise this option if: (a) Borrower causes to be submitted to Lender information required by Lender to evaluate the intended transferee as if a new loan were being made to the transferee; and (b) Lender reasonably determines that Lender’s security will not be impaired

FLORIDA ADJUSTABLE RATE |

Form 3501.10 1/01 (rev. 2/20) |

(Page 3 of 4) |

by the loan assumption and that the risk of a breach of any covenant or agreement in this Security Instrument is acceptable to Lender.

To the extent permitted by Applicable Law, Lender may charge a reasonable fee as a condition to Lender’s consent to the loan assumption. Lender may also require the transferee to sign an assumption agreement that is acceptable to Lender and that obligates the transferee to keep all the promises and agreements made in the Note and in this Security Instrument. Borrower will continue to be obligated under the Note and this Security Instrument unless Lender releases Borrower in writing.

If Lender exercises the option to require immediate payment in full, Lender shall give Borrower notice of acceleration. The notice shall provide a period of not less than 30 days from the date the notice is given in accordance with Section 15 within which Borrower must pay all sums secured by this Security Instrument. If Borrower fails to pay these sums prior to the expiration of this period, Lender may invoke any remedies permitted by this Security Instrument without further notice or demand on Borrower.

12.DOCUMENTARY TAX

The state documentary tax due on this Note has been paid on the mortgage securing this indebtedness.

WITNESS THE HAND(S) AND SEAL(S) OF THE UNDERSIGNED.

_______________________________________ (Seal)

_______________________________________(Seal)

_______________________________________(Seal)

FLORIDA ADJUSTABLE RATE |

Form 3501.10 1/01 (rev. 2/20) |

(Page 4 of 4) |

Form Characteristics

| Fact Name | Description |

|---|---|

| Interest Rate Changes | The interest rate on this note is adjustable based on the 1 Year Treasury Index, with specific limits on how much it can increase or decrease at each adjustment period. |

| Monthly Payment Structure | Borrowers must make monthly payments that may change based on the loan's unpaid principal and interest rate adjustments described in Section 4. |

| Prepayment Rights | Borrowers can make principal payments before they are due without incurring a prepayment charge, limiting interest costs. |

| Governing Law | This form adheres to the laws applicable to adjustable-rate mortgages in each state, which may vary. Check state-specific regulations. |

Guidelines on Utilizing Mae Note

Once you have gathered your information, it’s essential to fill out the Mae Note form accurately. Mistakes can lead to complications in the loan process. Follow these instructions step-by-step to ensure the form is completed correctly.

- Date: Write the date the form is completed.

- City and State: Enter the city and state where the loan transaction takes place.

- Property Address: Provide the full address of the property being financed.

- Borrower’s Promise to Pay: Input the total loan amount you will owe in U.S. dollars as "Principal," and specify your lender's name.

- Interest Rate: Fill in the yearly interest rate percentage you will be charged.

- Monthly Payment Start Date: State the first date you will make your monthly payment.

- Initial Monthly Payment: Indicate the amount of your initial monthly payment in U.S. dollars.

- Change Dates: Document the dates when your interest rate may change every 12 months starting from the specified date.

- Current Index: Note the percentage points to be added to the Current Index for the interest rate adjustments.

- Limits on Interest Rate Changes: Enter the maximum and minimum interest rates allowed during the loan period.

- Notice of Changes: Confirm the person’s title and contact information who will provide you with updates regarding your interest rate and payments.

- Borrower’s Right to Prepay: Acknowledge your intention regarding prepayment of principal and any applicable terms.

- Loan Charges: Affirm understanding of maximum charges related to your loan.

- Borrower’s Signature: Ensure each borrower signs where indicated. If applicable, include seals for additional signers.

What You Should Know About This Form

What is a Mae Note?

A Mae Note, specifically an Adjustable Rate Note, is a financial document related to a mortgage that allows for changes in the interest rate and monthly payments over time. This type of note is often used by lenders to provide flexibility in loan terms, adjusting payments according to market conditions and the index rate tied to U.S. Treasury securities.

How does the interest rate change?

The interest rate on a Mae Note can change based on an Index, which is usually linked to the yield on U.S. Treasury securities. These changes typically occur on predetermined dates known as Change Dates, which happen annually. The new interest rate is calculated by adding a specified number of percentage points to the Index figure available 45 days before the Change Date. This ensures that borrowers are kept informed about when and how their rates may fluctuate.

What happens if I miss a payment?

If a payment is not received by the lender within a designated timeframe, late charges may apply. Specifically, if the lender does not receive the full payment within a certain number of days after the due date, a late fee will be charged. This situation may also lead to default, which could prompt the lender to demand the repayment of the full remaining loan amount.

Can I make extra payments on my loan?

Yes, borrowers have the right to make prepayments—payments made towards the principal before they are due. Prepayments can be full or partial and do not incur additional charges. However, the lender may first apply prepayments to any accrued interest before reducing the principal amount. This option allows borrowers to lessen their overall debt more quickly without penalties.

How are my monthly payments determined?

Initially, monthly payments are set based on the loan amount and interest rate. As the interest rate changes, the monthly payment may adjust accordingly. Following each Change Date, the lender recalculates the required payment based on the remaining unpaid principal and the new interest rate, ensuring that the loan can still be fully repaid by the Maturity Date.

What information will I receive about changes to my loan?

The lender is required to provide written notice of any changes in the interest rate or monthly payment before they take effect. This notice will include details mandated by law, such as the new rates and effective dates, as well as contact information for someone who can answer any questions about these changes.

What if I want to sell or transfer my property?

If a borrower wishes to sell or transfer their property, the lender may require the immediate repayment of the full loan amount unless certain conditions are met. To prevent the lender from demanding full payment, the borrower must provide the information needed for the lender to evaluate the new owner. If deemed acceptable, the lender can allow the assumption of the loan by the new buyer.

Common mistakes

When filling out the Mae Note form, many people make mistakes that can lead to complications later on. One common error is forgetting to include all necessary dates. It’s important to fill out the date when the loan agreement takes effect, as well as other relevant dates such as when payments begin. Missing these key details can create confusion and lead to miscommunication with the lender.

Another mistake often made is leaving blank fields or using placeholders. For example, if you see a prompt that requires a specific amount for the principal or the interest rate, don’t leave it blank. Filling these fields accurately ensures the document is complete and legally binding. Using placeholders instead of actual figures may lead to delays in processing your loan.

People also sometimes neglect to double-check the spelling of their names and the property address. Mistakes in personal information can cause issues with loan approval and property registration. Always verify that everything is correct before submitting the form. A small typo could create a significant headache later.

Additionally, individuals often overlook the need to provide accurate information regarding the lender. You should ensure that the lender’s name and contact details are correctly listed. Incomplete or incorrect lender information can disrupt communication about the loan, which is crucial for timely payments and notifications about any changes.

Another mistake people make is misunderstanding the payment structure. It’s essential to fully grasp how monthly payments will be calculated and when changes might occur. Failure to understand this can result in unexpected financial burdens down the road. Make sure you comprehend how adjustments to your interest rate could affect your monthly payments.

Some borrowers skip reading the entire form carefully. This can lead to being unaware of important terms or conditions. It’s vital to understand your rights and obligations outlined in the Mae Note. Failing to read everything can result in unfavorable terms that could have been negotiated or addressed prior to finalizing the document.

Lastly, individuals sometimes forget to sign and date the document in the required places. Signatures are necessary for the validation of the document. Without them, the Mae Note is not legally binding. Ensure you have signed where needed before submission, to avoid any unnecessary delays.

Documents used along the form

The Mae Note form is critical in the context of adjustable-rate mortgage loans, which can change in interest rates over time. Alongside the Mae Note, several other documents are typically utilized in the loan process. These documents prepare both the borrower and lender to navigate their financial commitments effectively. Below is a list of common forms and documents associated with the Mae Note.

- Security Instrument: This document, such as a Mortgage or Deed of Trust, provides the lender with security for the loan. It outlines the terms under which the lender can claim the property if the borrower defaults on the loan.

- Loan Estimate: The Loan Estimate form outlines the key terms and estimated closing costs associated with the loan. This document is essential for borrowers to understand what they will owe and when.

- Closing Disclosure: This form provides final details about the mortgage loan, including the loans terms, projected payments, and how much the borrower will pay in total. The Closing Disclosure must be provided to the borrower at least three days before closing.

- Promissory Note: While the Mae Note serves as an adjustable-rate note, a general Promissory Note is often signed to acknowledge the borrower's promise to repay the loan. It includes specific details like the loan amount, repayment schedule, and interest rate.

- Affidavit of Occupancy: This document confirms that the borrower intends to occupy the property as their primary residence. Lenders often require this affidavit to ensure that loan terms are being adhered to.

Understanding the purpose of these documents is essential for borrowers as they navigate the mortgage process. Each form serves a distinct role in ensuring that both parties are informed and protected throughout the loan duration.

Similar forms

- Promissory Note: Like the Mae Note, a Promissory Note serves as a written promise to pay a specified amount of money to a lender. Both documents include details about the loan amount, interest rate, repayment schedule, and the obligations of the borrower in case of default.

- Mortgage Agreement: This document secures the loan against the property purchased. Similar to the Mae Note, it outlines the borrower's responsibilities and the consequences of failing to fulfill those obligations. Both documents work together to protect the lender's interest in the property.

- Deed of Trust: A Deed of Trust is used in some states and serves a similar purpose to a Mortgage Agreement. Both documents outline the borrower's promise to repay the loan and offer the lender a claim against the property in case of default. Like the Mae Note, it is a legally binding agreement.

- Loan Estimate: This document provides borrowers with a detailed breakdown of loan terms, including interest rates, monthly payments, and estimated closing costs. While the Mae Note focuses primarily on the repayment of the loan, the Loan Estimate gives a broader picture of the financial commitment and is essential for informed decision-making.

- Adjustable Rate Mortgage (ARM) Disclosure Statement: This document details the terms of an adjustable rate mortgage, outlining how and when interest rates may change over the life of the loan. Much like the Mae Note, it explains the mechanics of interest rate changes and how these will affect monthly payments, keeping borrowers informed about potential variability in their financial obligations.

Dos and Don'ts

When filling out the Mae Note form, clarity and accuracy are essential. Here are six key do's and don'ts to keep in mind:

- Do provide accurate personal information. Fill in your name, date, city, state, and property address correctly to avoid complications.

- Do clearly state the loan amount. Ensure the principal amount is entered without errors, as this serves as the foundation of your loan agreement.

- Do understand the interest rate terms. Read carefully how the interest rate can change and ensure you comprehend the implications of any adjustments.

- Do note the payment schedule. Make sure to check the due dates for your monthly payments and be clear about when your first payment is expected.

- Don't omit any required signatures. Ensure that all parties involved in the loan agreement sign the document where indicated to validate the agreement.

- Don't ignore the disclaimers and conditions. Read all sections thoroughly to understand your rights, obligations, and any penalties for late payments or defaults.

Misconceptions

- Misconception 1: The Mae Note form locks in a fixed interest rate for the entire loan term.

- Misconception 2: You can miss payments without consequences.

- Misconception 3: All payments will go towards the principal balance first.

- Misconception 4: You cannot make extra payments toward the principal.

- Misconception 5: Rates change at random times.

- Misconception 6: The lender will not inform you of interest rate changes.

- Misconception 7: There are no limits to how high your interest rate can go.

- Misconception 8: You are only responsible for your portion of the loan.

- Misconception 9: The lender can't refuse a transfer of the loan.

- Misconception 10: Once you sign the note, you can’t change the payment terms.

This is incorrect. The Mae Note allows for changes in the interest rate based on an index. This means your payment amount may fluctuate, especially after change dates.

Missed payments can lead to late charges and default. If you don’t pay on time, the lender has the right to demand full repayment of the outstanding amount.

Payments are applied to interest first, before reducing the principal balance. This can increase the time it takes to pay off your loan.

You have the right to make prepayments at any time. This can help reduce the total interest you pay over the life of the loan.

Interest rates change on specific dates called "Change Dates." These occur annually, providing a predictable schedule for rate adjustments.

The lender is obligated to notify you of any changes in your interest rate and monthly payment before they take effect. This communication is key for budgeting.

The Mae Note specifies limits on interest rate increases. Your rate cannot increase by more than one percentage point on any given change date.

If multiple borrowers sign the note, each is fully responsible for the entire loan amount, not just their share. Any borrower can be required to pay the full amount.

The lender retains the right to approve any transfer of the loan or its obligations. They can refuse a transfer if conditions are not met.

While the note outlines your responsibilities, you can negotiate terms such as payment alterations with the lender, particularly when unforeseen situations arise.

Key takeaways

The Mae Note form is a critical document for borrowers considering an adjustable rate mortgage. Here are key takeaways to consider:

- Understanding Interest Rate Changes: The interest rate on your loan can change annually based on an Index, specifically the weekly average yield on U.S. Treasury securities adjusted to one year. This means your monthly payments may vary over time.

- Payment Structure: Monthly payments include both principal and interest. Payments are due on the first day of each month. It is important to know that any late payments may incur additional charges.

- Prepayment Options: Borrowers have the right to prepay their principal without incurring any fees. However, it’s essential to notify the lender in writing when making a prepayment.

- Notification of Rate Changes: The lender is required to inform borrowers of any changes to the interest rate and monthly payment amounts prior to the effective change date. This notice will include important contact details for any questions.

Browse Other Templates

Dw1 Form - Understanding the differences between an independent contractor and an employee is crucial for form completion.

How to Write a Contract for Rental Property - Guests staying beyond a certain time without consent can breach the agreement.