Fill Out Your Maryland Quarterly Contribution Report Form

The Maryland Quarterly Contribution Report form serves as an essential tool for employers in the state to ensure compliance with unemployment insurance obligations. Each quarter, employers are required to report employee wages and make contributions to the state’s unemployment insurance program. This process is facilitated through an online system that enables streamlined filing, which includes establishing a user account with a unique username and PIN. Resources are available to assist with PIN retrieval and account creation, ensuring users can easily navigate the system. The report provides options for submitting contributions and wages, reviewing past filings, and managing account information. Payment methods are also detailed, including credit card, electronic checks, and paper checks. Employers have access to support and can find valuable information on annual ratings and benefits charge statements, making this form a critical component of maintaining effective employment practices in Maryland.

Maryland Quarterly Contribution Report Example

Larry Hogan |

Boyd K. Rutherford |

Governor |

Lt. Governor |

State of Maryland

Department of Labor, Licensing and Regulation

Division of Unemployment Insurance

Contributions Unit

Quarterly Contribution & Employment Report

Internet Filing

This guide will provide the information you need to find the application, establish a user name / PIN, file your Unemployment Insurance Contribution and Wage Report, and obtain additional information and services.

Rev. 12/27/2017

Table of Contents |

|

Welcome Page |

3 |

Forgot Your PIN? |

4 |

Automated PIN Reset Service |

5 |

Request My PIN Reset by |

6 |

New User Enrollment |

7 |

Related Web Sites |

9 |

Create a PIN |

10 |

Confirmation Page for Creating a PIN Successfully |

11 |

Employer Services and Information |

12 |

Quarterly Contribution & Employment Report Main Menu |

13 |

Review my Past Online Reports |

14 |

Review my Account History |

15 |

Review my Account History – Quarter Detail |

16 |

Modify my Account Information (Change my Address) |

17 |

View and Print an Annual Rating Notice |

18 |

View and Print Quarterly Benefit Charge Statements |

19 |

Request a |

20 |

Close my Unemployment Insurance Account |

21 |

Change my PIN |

22 |

Employer Help |

23 |

Confirmation Page for Logging Off Successfully |

24 |

Filing Option 1: File Contribution and Employment Report |

25 |

Automatic Calculation of Excess Wage Amount |

28 |

Automatic Calculation of Excess Wage Worksheet |

29 |

Filing Option 2: File Only a Contribution Report |

30 |

Filing Option 3: File Wages Using the |

31 |

Acceptable Record Formats |

32 |

Warning Page for Not Entering Any Wages |

35 |

Add Employee |

36 |

Warning Page after Clicking Cancel on Add Employee Page |

37 |

Summary of Contribution Report |

38 |

Contribution Report Confirmation page |

39 |

Payment Option 1: Credit Card |

40 |

Payment Option 1: Credit Card Verification Page |

42 |

Payment Option 1: Credit Card Confirmation Page |

43 |

Payment Option 2: Direct Debit (Electronic Check) Page |

44 |

Payment Option 2: Electronic Check Payment Verification Page |

45 |

Payment Option 2: Electronic Check Payment Confirmation Page |

46 |

Print Contribution Report Page |

47 |

Print Employment Report Page |

48 |

Payment Option 3: Paper Check Confirmation Page |

49 |

2

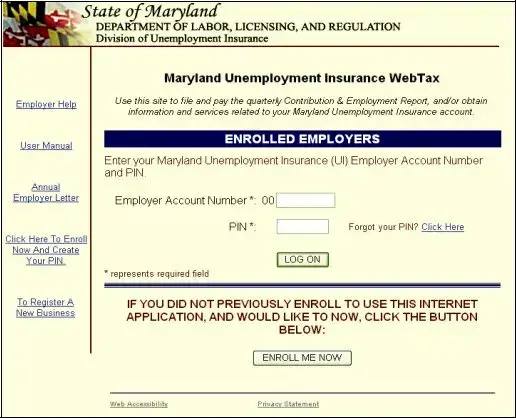

Welcome Page

In order to use this application, you must have registered as a user.

Are you a registered user? If you previously registered on this web site, log on by entering your Maryland Unemployment Insurance employer account number and your PIN and clicking the “Log On” button.

Are you new to this site? You must register and establish your PIN to use this application. To create a PIN for this application, click on the “Enroll Me Now” button.

3

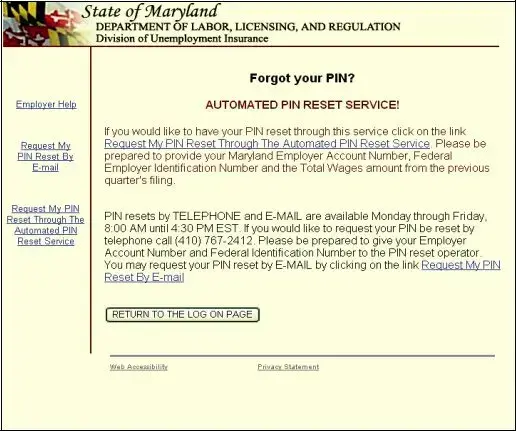

Forgot Your PIN?

Did you previously register but forget your PIN? There are three ways to reset your PIN:

1.Automated – Available 24 hours a day, seven days a week. Click on Request My PIN Reset Through The Automated PIN Reset Process. Enter your FEIN number, your Maryland UI account number, and the previous quarter’s total wages for Maryland UI. Once reset, you are able to immediately begin your session.

2.

3.Telephone – Available during normal business days, 8:00 – 4:30 by calling

(410)

4

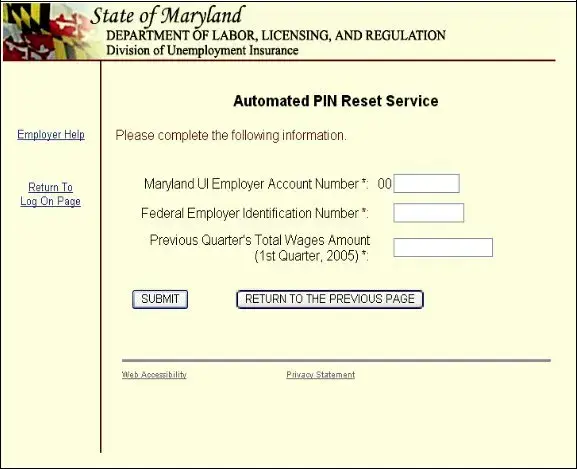

Automated PIN Reset Service

Did you forget your PIN? Now, you can

1.

2.

3.

4.

5.

6.

7.

Click on Request My PIN Reset Through The Automated PIN Reset Process Enter your Maryland Unemployment Insurance Account Number

Enter your Federal Employer Identification Number Enter your Previous Quarter’s Total Wages Amount Click “Submit”

Now you will see the “Create a PIN” page, as displayed on page 10 of this guide Follow the directions to create your new PIN

5

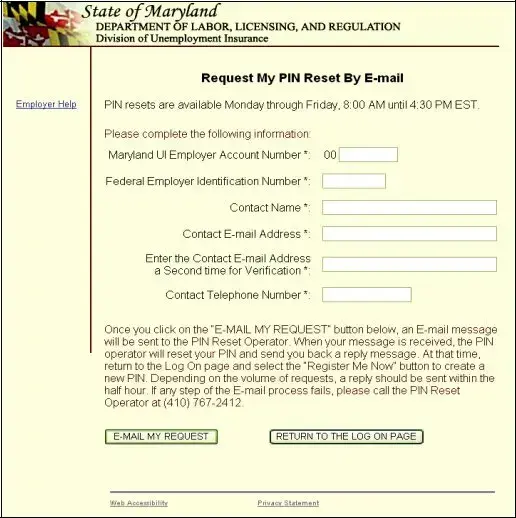

Request My PIN Reset by

If you want to contact us by

6

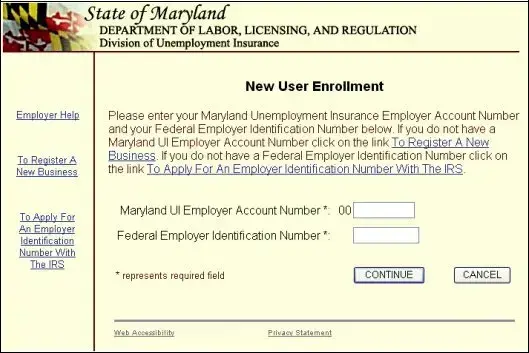

New User Enrollment

When you click “Enroll Me Now” on the Welcome page, you will see the New User Enrollment page. You must know your Maryland Unemployment Insurance Fund (MUIF)

Do you have a MUIF number?

!If you have a MUIF number, enter it now. The two leading zeros are

!If you do not have a MUIF number, you must register with the Division of Unemployment Insurance and obtain an account number before you use this application. There are two ways you can register and get a MUIF account number:

Online

For other State of Maryland

For other Maryland unemployment insurance related services visit www.mdunemployment.com .

7

Telephone – You may register by telephone if you call (410)

Do you know your FEIN?

!If you have a FEIN, enter your

!If you do not have FEIN, you must register with the Internal Revenue Service and obtain a FEIN before you use this application. You can find information for registering with the Internal Revenue Service at

8

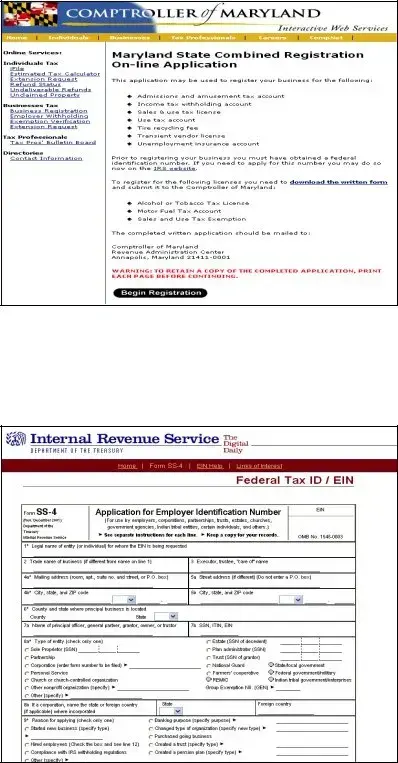

Related Web Sites

When you click on the “To Register A New Business” link to register your business online with the State of Maryland, you will see this page. After completing the Maryland State Combined Registration

When you click on the “To Apply For An Employer Identification Number With The IRS” link to register your business with the Internal Revenue Service, you will see this page. Please complete this information as requested.

9

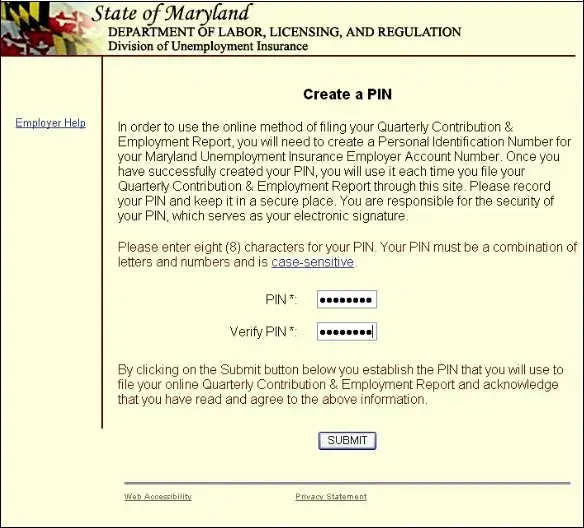

Create a PIN

Clicking on the “Enroll Me Now” button from the Welcome page will display the Create a PIN page. Follow the instructions on the page to establish a permanent PIN for this application. Your PIN will remain unchanged unless you choose to modify it within this application. (For more information about changing your PIN, refer to the Change Your PIN section on page 22)

When you have recorded your PIN and are ready to confirm the action, click “Submit”.

10

Form Characteristics

| Fact Name | Description |

|---|---|

| Governing Law | The Maryland Unemployment Insurance Law governs the Quarterly Contribution Report. |

| Purpose | The form is used to report employee wages and calculate unemployment insurance contributions. |

| Filing Frequency | Employers must file the Quarterly Contribution Report on a quarterly basis. |

| Online Access | The report can be filed online through the Division of Unemployment Insurance's web portal. |

| PIN Requirement | A personal identification number (PIN) is required for online filing and account access. |

| Automated PIN Reset | Users can reset their PIN through an automated process available 24/7. |

| Payment Options | Employers can choose to pay contributions via credit card, direct debit, or paper check. |

| Employer Services | Additional services include review of past reports and account history management. |

| Annual Rating Notice | Employers can view and print their annual rating notice through the online portal. |

Guidelines on Utilizing Maryland Quarterly Contribution Report

After gathering all necessary information and completing the steps outlined below, you will be ready to submit the Maryland Quarterly Contribution Report form. Ensure all details are accurate, as this report is an important part of maintaining your compliance with state regulations.

- Access the Maryland Department of Labor's website and navigate to the Unemployment Insurance section.

- If you are a new user, register by clicking on the “Enroll Me Now” button and create your unique PIN.

- For returning users, enter your Maryland Unemployment Insurance employer account number and your PIN to log in.

- Once logged in, select the option to file the Quarterly Contribution & Employment Report.

- Fill in all required fields accurately, including total wages for each employee and any contributions owed.

- Review your entries to ensure there are no mistakes before submitting the form. Look for any warnings or reminders provided by the system.

- Choose your preferred payment option for any contributions due – options typically include credit card, electronic check, or paper check.

- Follow the prompts to complete your payment successfully.

- Once everything has been confirmed, print or save a copy of your report and payment confirmation for your records.

What You Should Know About This Form

What is the Maryland Quarterly Contribution Report form?

The Maryland Quarterly Contribution Report form is a document that employers must file to report their unemployment insurance contributions and the wages they've paid to employees during a specific quarter. This form helps ensure that contributions are accurately calculated, and it plays a key role in maintaining the state's unemployment insurance system. Filing on time can help providers continue to offer support when workers need it most.

Who needs to file the report?

Any business or organization that has employees in Maryland and is subject to unemployment insurance laws must complete the Maryland Quarterly Contribution Report. This includes corporations, partnerships, and sole proprietorships that have employees earning wages in the state. Even if you've had no employees during the quarter, it's still necessary to file a report indicating that status.

How can I submit the Quarterly Contribution Report?

The report can be submitted online through the Maryland Department of Labor's Unemployment Insurance website. Employers need to log on to the system using their Maryland Unemployment Insurance account number and PIN. Once logged in, you can fill out the report and submit it electronically for a quicker processing time. Remember, submitting online is not only convenient, but it also provides immediate confirmation of submission.

What do I do if I forgot my PIN?

If you've forgotten your PIN, don't worry! There are several easy ways to reset it. You can use the automated PIN reset service available 24/7 on the website. Simply enter your Federal Employer Identification Number (FEIN), your Maryland UI account number, and last quarter's total wages. Alternatively, you can request a reset via e-mail or by calling the help desk during normal business hours. Each option is designed to get you back on track quickly.

What if my business had no employee wages during the quarter?

If your business had no employee wages or if you're not subject to unemployment contributions during the quarter, you still need to file a report. Just indicate that there were no wages during that quarter. This keeps your account in good standing and ensures compliance with state regulations.

What are the deadlines for filing the report?

The deadlines for submitting the Maryland Quarterly Contribution Report typically fall on the last day of the month following the end of the quarter. For instance, the report for the first quarter, ending March 31, is due by April 30. Keeping track of these deadlines is crucial; late submissions can lead to penalties and complications for your business.

Can I make changes to my report after submission?

Yes, you can make changes to your report after submission, but there are specific procedures you must follow. If you discover an error, you can contact the Contributions Unit of the Maryland Department of Labor for guidance. They will provide assistance on how to correct the report. Timely corrections are essential, as they help maintain accurate records and prevent complications down the line.

What payment options are available for contributions?

When it comes to paying your unemployment insurance contributions, there are a few options available. You can pay via credit card, directly through a debit (electronic check), or even by mailing a paper check. Each of these methods offers convenience and flexibility, allowing you to choose the one that works best for your business.

Common mistakes

Filling out the Maryland Quarterly Contribution Report form can be straightforward, but many encounter common pitfalls that can lead to delays and complications. One of the most frequent mistakes is failing to register as a user before attempting to log in. This is a necessary step; without it, users cannot access the portal. Take a moment to enroll and set up your username and PIN first.

Another common error is neglecting to reset a forgotten PIN correctly. The automated PIN reset option is often overlooked. Users can quickly retrieve their PIN by entering their Federal Employer Identification Number (FEIN) and other necessary details. Don’t hesitate to use this feature—it's designed to make the process easier.

Misreporting wage amounts is also a significant issue. It's crucial to enter the total wages accurately for the previous quarter. Many users mistakenly input incorrect figures, which can result in improper calculations of contributions and penalties. Take your time to review these numbers before submitting the report.

Some people overlook the importance of confirming their submission. After completing the report, it's essential to ensure that you receive a confirmation page. Without this confirmation, one may not realize that their submission didn’t go through, leading to missed deadlines and potential issues.

Additionally, not reviewing past reports can lead to inconsistencies. Ensure you check your previous filings for accuracy. Understanding your reporting history helps maintain compliance and makes it easier to spot any discrepancies in your current submission.

Lastly, individuals often forget to take advantage of the online help resources. The Maryland Department of Labor, Licensing and Regulation provides numerous guides and FAQs to assist users through the process. Don't hesitate to use these resources; they are there to help ensure your report is filled out correctly.

Documents used along the form

When managing unemployment insurance contributions in Maryland, several forms and documents accompany the Maryland Quarterly Contribution Report. Understanding these related documents helps ensure compliance and accuracy in reporting.

- Employer Services and Information: This document provides detailed guidance on employer responsibilities, useful resources, and information about ongoing compliance with unemployment insurance regulations.

- Annual Rating Notice: An annual notice that details an employer's unemployment insurance contribution rate, which is essential for understanding contribution obligations going forward.

- Quarterly Benefit Charge Statement: This statement reflects the charges against an employer's account for unemployment benefits paid to former employees, providing insight into how these charges affect an employer’s rate.

- Re-Certification of State UI Payments (IRS FUTA -490C): A form used to confirm the accuracy of state unemployment payments for tax purposes, helping maintain compliance with federal regulations.

- Contribution Report Confirmation Page: After submitting the contribution report, this confirmation page serves as proof of submission, important for record-keeping and future reference.

- Payment Verification Pages: These pages confirm the successful processing of payments, whether by credit card, electronic check, or paper check. They are crucial for ensuring that payments have been received and recorded correctly.

- Modification Request Form: This document enables employers to update information such as their business address or account details to ensure accuracy in communications and reporting.

It's vital for employers to be familiar with these documents. Timely and accurate submission of all related forms can prevent costly mistakes and potential penalties. Staying organized and informed is key to managing unemployment insurance responsibilities effectively.

Similar forms

- Employment Verification Form: Similar to the Maryland Quarterly Contribution Report, this document is used by employers to verify an employee's work history and earnings. Both serve to provide essential employment-related information to state agencies.

- Federal Unemployment Tax Act (FUTA) Form 940: This federal tax form is similar in purpose as it relates to employer contributions for unemployment insurance. It summarizes annual contributions and is filed with the IRS, ensuring compliance with federal regulations.

- State Unemployment Tax Act (SUTA) Report: This state-level form captures the same type of wage and contribution information as the Maryland report. It is critical for ensuring that employers meet their state unemployment insurance obligations.

- Wage and Tax Statement (W-2): This form is utilized by employers to report annual earnings and tax withholdings for each employee. Both reports track wages but serve different tax purposes and timelines.

- Quarterly Tax Return: Similar to the Quarterly Contribution Report, this document reports total taxable income and tax liabilities for the quarter. It is important for business tax compliance and financial tracking.

- Employee Withholding Allowance Certificate (W-4): While this form indicates how much tax an employer should withhold from an employee's wages, it shares the common theme of payroll and tax-related information.

- Annual Summary of Wage Payments: This document summarizes wages paid over the year, much like the quarterly report. It provides a comprehensive look at employee compensation for reporting purposes.

- Form 1099-MISC: This form is issued to independent contractors and captures payment information. While it relates to different employment types, it documents income similar to how the contribution report does for traditional employees.

- Payroll Report: This report includes detailed information about employee earnings and deductions during a specific period. It parallels the quarterly report in terms of tracking financial obligations related to employment.

- Employer’s Quarterly Federal Tax Return (Form 941): This form reports income taxes, Social Security tax, and Medicare tax withheld from employee wages. It aligns closely with the purpose of reporting contributions and obligations to the government.

Dos and Don'ts

When filling out the Maryland Quarterly Contribution Report form, it's essential to approach the process with care. Here are nine tips to help you navigate the form effectively:

- Do verify that you are registered as a user before attempting to log on.

- Don't forget to have your Maryland Unemployment Insurance employer account number ready.

- Do ensure you have accurate figures for the previous quarter’s total wages before starting.

- Don't rush through the sections; double-check every entry for accuracy.

- Do utilize the automated PIN reset option if you’ve forgotten your PIN.

- Don't hesitate to reach out via email or phone if you encounter difficulties.

- Do familiarize yourself with the different filing options available on the form.

- Don't assume that all information from the previous reports is correct; review it regularly.

- Do keep a printed copy of your submitted report for your records.

By following these guidelines, you can streamline the process and enhance the accuracy of your quarterly contributions. A little preparation goes a long way in ensuring compliance and avoiding potential issues.

Misconceptions

Understanding the Maryland Quarterly Contribution Report form is crucial for employers, but several misconceptions can lead to confusion. Here are five common misunderstandings about the form:

- The report is optional for all employers. Many employers believe that filing the Maryland Quarterly Contribution Report is optional. However, it is a mandatory requirement for employers to report their unemployment insurance contributions and wage information every quarter.

- All employers use the same filing process. Some think that every employer files the report in the same way. In reality, the process may differ based on an employer's size, payroll frequency, and specific business needs. Employers have options for filing, including online applications that cater to various preferences.

- You need to file the report to pay contributions. Many assume that the mere act of filing the report is equivalent to making payment for contributions. This is a misconception. Filing the report accurately must be followed by completing the appropriate payment transaction to avoid penalties.

- You can reset your PIN only during business hours. A common belief is that resetting a forgotten PIN can only be done during business hours. In fact, employers can reset their PINs online at any time using the automated reset service, making the process convenient and more straightforward.

- Information submitted can be changed easily after filing. Some employers think that once they submit their report, they can easily modify the information without consequences. While it is possible to amend reports, the process can be complicated and may involve additional steps, so it’s best to ensure accuracy before the initial submission.

By clarifying these misconceptions, employers can approach the Maryland Quarterly Contribution Report with more confidence and understanding.

Key takeaways

When filling out and using the Maryland Quarterly Contribution Report form, keep the following key takeaways in mind:

- Registration is Essential: To access the form, you must first register as a user. This step is crucial for securely managing your account.

- PIN Management: If you forget your PIN, you have multiple options to reset it. You can use an automated online service, email, or a phone call during business hours.

- Accurate Reporting: Be diligent in reporting wages and contributions accurately. Any discrepancies can lead to complications in your unemployment insurance status.

- Filing Options: You have different methods available for filing the report. You can submit the entire Contribution and Employment Report, just a Contribution Report, or wage details through the Web-Wage Application.

- Payment Methods: Payment options include credit card, direct debit, or paper check. Choose the method that best fits your needs for quick and efficient processing.

- Review Your History: Take advantage of the feature that allows you to review past online reports and account history. It’s beneficial for keeping track of your filings and contributions.

Browse Other Templates

Icici Pay Direct Card Balance Check - Make sure that the form is submitted to the right department at your local ICICI Bank branch.

Tax Collector's Office - Applicants are advised to file Form TC201 between March 2 and March 24, 2021, if needed income and expense information was not available by the original filing date.