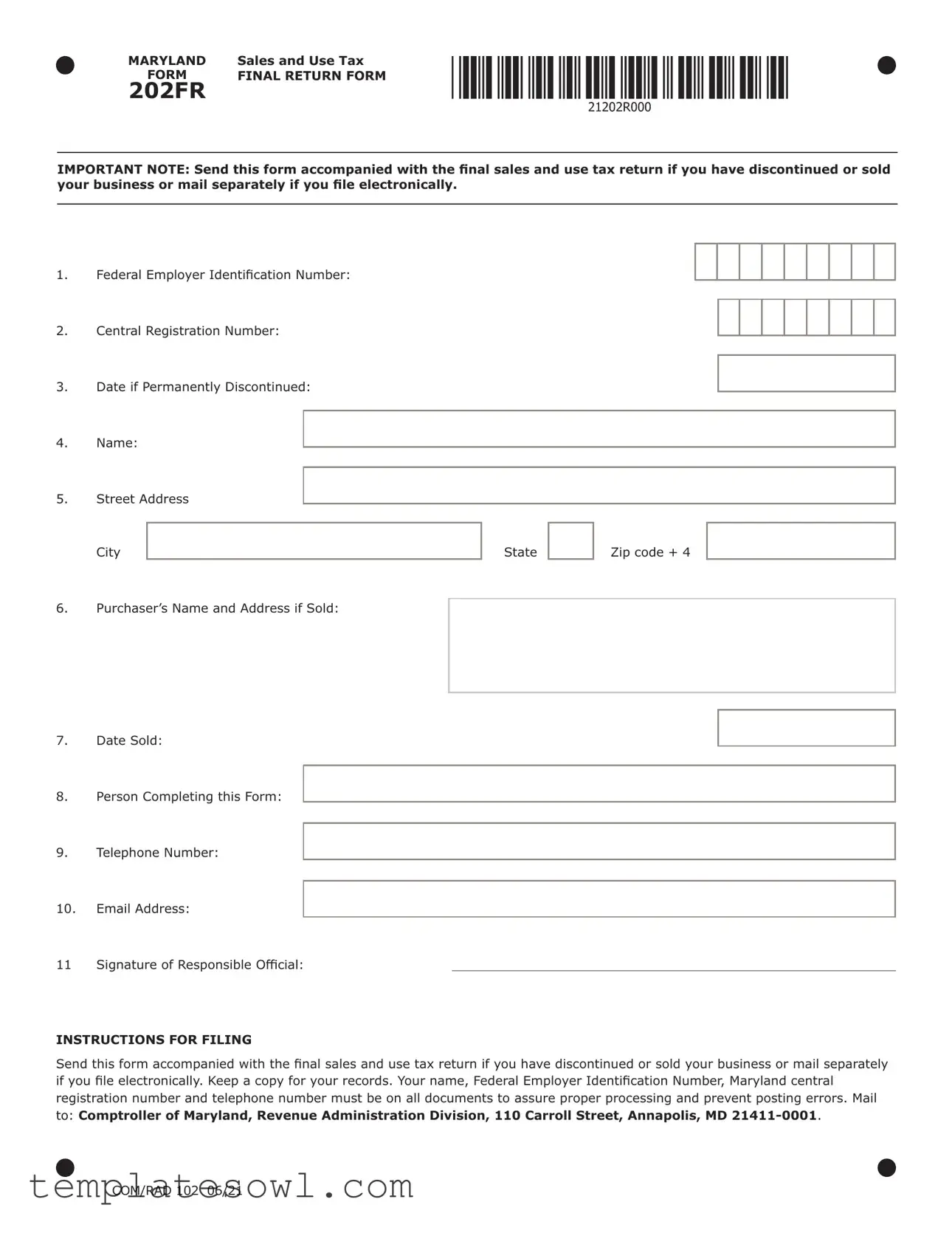

Fill Out Your Maryland Sales Use Tax 202 Form

The Maryland Sales and Use Tax 202 form is a crucial document for business owners who have discontinued or sold their business operations. Proper completion of this form ensures that the final sales and use tax obligations are met, preventing future complications with the state. Essential fields include the Federal Employer Identification Number and the Central Registration Number, which help identify the business. The form also requires details like the date the business was permanently discontinued and the purchaser's information if applicable. Importantly, the person responsible for filling out the form must provide their contact details, including a telephone number and email address, ensuring that communication remains clear. Once completed, this form must be mailed along with the final sales and use tax return, or submitted separately if filed electronically. Maintaining a copy is advisable for personal records. Prompt and accurate submission will facilitate proper processing and reduce the likelihood of errors. Mail the form to the Comptroller of Maryland to ensure compliance and avoid future tax complications.

Maryland Sales Use Tax 202 Example

MARYLAND |

Sales and Use Tax |

FORM |

FINAL RETURN FORM |

202FR |

|

IMPORTANT NOTE: Send this form accompanied with the final sales and use tax return if you have discontinued or sold your business or mail separately if you file electronically.

1.Federal Employer Identification Number:

2.Central Registration Number:

3.Date if Permanently Discontinued:

4.Name:

5.Street Address

City

6.Purchaser’s Name and Address if Sold:

7.Date Sold:

8.Person Completing this Form:

9.Telephone Number:

10.Email Address:

11 Signature of Responsible Official:

INSTRUCTIONS FOR FILING

State

Zip code + 4

Send this form accompanied with the final sales and use tax return if you have discontinued or sold your business or mail separately if you file electronically. Keep a copy for your records. Your name, Federal Employer Identification Number, Maryland central registration number and telephone number must be on all documents to assure proper processing and prevent posting errors. Mail to: Comptroller of Maryland, Revenue Administration Division, 110 Carroll Street, Annapolis, MD

COM/RAD 102 06/21

Form Characteristics

| Fact Name | Description |

|---|---|

| Purpose of Form | This form is used for filing the final sales and use tax return when a business is discontinued or sold. |

| Required Information | Key details such as Federal Employer Identification Number and Central Registration Number are necessary for processing. |

| Filing Instructions | Submit this form with the final return if discontinuing the business or send it separately if you file electronically. |

| Address for Submission | The form must be mailed to the Comptroller of Maryland at 110 Carroll Street, Annapolis, MD 21411-0001. |

| Governing Law | This form is governed by the Maryland Tax Code, particularly laws regarding sales and use tax. |

Guidelines on Utilizing Maryland Sales Use Tax 202

When you have discontinued or sold your business in Maryland and need to fill out the Sales and Use Tax Form 202, proper adherence to the instructions is essential for a smooth process. The steps below will guide you through completing this form accurately.

- Start by entering your Federal Employer Identification Number (FEIN) in the designated field.

- Provide your Central Registration Number in the next section.

- Indicate the Date if Permanently Discontinued where required.

- Fill in your Name as the business owner.

- Complete your Street Address, including the City, State, and Zip code + 4.

- If applicable, enter the Purchaser’s Name and Address if you sold the business.

- Provide the Date Sold in the respective section.

- Include your Name again as the person completing the form.

- Enter your Telephone Number.

- Add your Email Address for further communication.

- Finally, ensure the Signature of Responsible Official is filled out at the end.

After completing all sections, send this form along with your final sales and use tax return. If you've filed electronically, mail them separately. Retaining a copy for your records is highly recommended. Send everything to the:

Comptroller of Maryland,

Revenue Administration Division,

110 Carroll Street,

Annapolis, MD 21411-0001.

What You Should Know About This Form

What is the purpose of the Maryland Sales and Use Tax Form 202?

The Maryland Sales and Use Tax Form 202 is used by businesses that have either discontinued operations or have sold their business. This form notifies the state of Maryland about the change in status and ensures that all final sales and use tax returns are correctly filed. It is crucial for businesses to properly complete and submit this form to avoid any future tax issues.

How do I fill out the Maryland Sales and Use Tax Form 202?

Filling out the form involves several key details. You will need to provide your Federal Employer Identification Number, your Maryland Central Registration Number, and the date your business was permanently discontinued. Additionally, you must include your name and address, as well as the name and address of the purchaser if you sold your business. It is also important to include the date of sale, the name of the person completing the form, and their contact details, including telephone number and email address. Finally, a responsible official must sign the form.

Where do I send the completed Maryland Sales and Use Tax Form 202?

You should mail the completed Form 202 to the Comptroller of Maryland, specifically to the Revenue Administration Division at 110 Carroll Street, Annapolis, MD 21411-0001. If you are filing electronically, remember to send the form separately from your final sales and use tax return. Always keep a copy of the form for your records, just in case you need it in the future.

What happens if I don’t submit the Maryland Sales and Use Tax Form 202?

Failing to submit Form 202 can lead to complications. The state may assume your business is still operational, which could result in penalties or continued tax obligations. It’s essential to communicate any changes in your business status to prevent misunderstandings and possible financial repercussions. Submitting this form ensures that your records are up-to-date and that the state knows you are no longer conducting business.

Is there a deadline for submitting the Maryland Sales and Use Tax Form 202?

While specific deadlines may vary, it is generally advisable to submit Form 202 as soon as your business closes or is sold. Late submissions can lead to unnecessary checks and paperwork from the state's tax office. To ensure compliance, avoid delays by completing and mailing the form promptly along with your final tax return.

Common mistakes

Filling out the Maryland Sales and Use Tax Form 202 can be challenging. One common mistake is failing to include the Federal Employer Identification Number. This number is essential for identifying your business. Without it, the processing of your return could be delayed or even rejected.

Another frequent error is not providing a complete street address. The form specifically requests the street address, city, state, and zip code. Omitting any part of this information can create confusion and complications in the processing of your return.

Some individuals forget to indicate the Date of Permanently Discontinued if applicable. This information is crucial to inform the state that the business is no longer operating. A missing date can lead to misunderstandings about the tax obligations of the business.

It is also important to include the Name and Address of the Purchaser if the business has been sold. Failing to provide this information may result in the incorrect assignment of tax responsibilities, causing future issues for both the buyer and seller.

Not signing the form is another common oversight. The Signature of Responsible Official is required to verify that the information provided is accurate. If the form is not signed, it will be considered incomplete and may be returned.

Many people leave out their contact information, particularly the Telephone Number and Email Address. This information is crucial for any follow-up or clarification needed by the state. Without these details, communication can become difficult.

Some individuals neglect to keep a copy of the completed form for their records. Retaining a copy ensures that you have proof of submission and the information included, which is useful for future reference or in case of discrepancies.

Lastly, mailing the form to the wrong address can result in significant delays. Ensure you send the form to the correct destination: Comptroller of Maryland, Revenue Administration Division, 110 Carroll Street, Annapolis, MD 21411-0001. Take care to verify that all details are correct to prevent any issues with the submission.

Documents used along the form

The Maryland Sales and Use Tax 202 form is essential for any business that has either discontinued operation or been sold. Accompanying documents often play a crucial role in ensuring that all aspects of the sales tax requirements are fulfilled. Below is a list of additional forms that may be required or beneficial during this process.

- Final Sales and Use Tax Return: This form must be submitted if you are discontinuing your business or selling it. It records the final tax owed based on sales up to the date of discontinuation or transfer.

- Affidavit of Sale: In cases where a business is sold, this document serves as proof of the transaction. It includes details such as the buyer's information and the selling price.

- Business Discontinuation Notification: This is a formal notification sent to state authorities indicating that a business has ceased operations. It often details the reasons for closure and the business's final state of affairs.

- Change of Business Ownership Form: When a business changes hands, this form updates the relevant authorities about the new ownership. It typically includes information such as the new owner's details and the date of transfer.

- Tax Clearance Certificate: Obtaining this document certifies that all state taxes, including sales and use tax, have been paid. It is particularly important for business sales to ensure that liabilities do not transfer to the new owner.

- Notice of Transfer of Assets: This form is filed to formally report any major asset transfers during a business sale or closure, ensuring compliance with state regulations regarding asset allocation.

Business owners should pay careful attention to these documents when dealing with the Maryland Sales and Use Tax 202 form. Ensuring that all forms are accurately completed and submitted can help facilitate a smoother transition during the sale or discontinuation of a business.

Similar forms

- Maryland Sales and Use Tax Return (Form ST-100)

This form is for regular sales and use tax reporting. It requires details of sales, exemptions, and tax collected during a specific period. Like Form 202, it includes identification details but is applicable for ongoing operations rather than termination.

- Maryland Sales and Use Tax Exemption Certificate (Form ST-3)

This document allows buyers to purchase items without paying sales tax if exempt. Both forms require identification information but have different purposes regarding tax obligations.

- Maryland Application for Sales and Use Tax License (Form CR-1)

This is used when applying for a sales and use tax permit before beginning sales activity. It shares common sections for business identification but serves a different stage in the business lifecycle.

- Maryland Annual Report (Form 1)

This report is required for businesses to provide information on income, assets, and officers. It includes some of the same identification requirements as Form 202 but focuses more on overall business performance rather than tax discontinuation.

- IRS Form 8822-B (Change of Address or Responsible Party)

This IRS form is for updating the address or responsible party of a business. While it serves a different purpose, it also requires identification details and notifying authorities of changes.

- Maryland Personal Property Return (Form 1)

This document reports personal property owned by a business. Similar to Form 202, it involves listing assets and includes identification elements, though it pertains to property assessment rather than sales tax discontinuation.

Dos and Don'ts

Filing the Maryland Sales and Use Tax Form 202 can seem daunting, but a little preparation can make the process smoother. Here are some essential dos and don'ts to keep in mind.

- Do include your Federal Employer Identification Number, Maryland Central Registration Number, and your phone number on the form to ensure proper processing.

- Do keep a copy of the completed form for your records; it’s crucial for your personal documentation.

- Do send this form together with your final sales and use tax return if you have sold or discontinued your business.

- Do double-check all fields for accuracy before submitting, as errors can create delays in processing.

- Don't forget to include the date if you've permanently discontinued your business; this information is essential.

- Don't mail your form to the wrong address—ensure you send it to the Comptroller of Maryland at the designated location.

By following these simple guidelines, you can confidently complete the Maryland Sales and Use Tax Form 202 and avoid common pitfalls. Good luck!

Misconceptions

Understanding the intricacies of the Maryland Sales and Use Tax 202 form is essential, especially if you are closing or selling your business. Unfortunately, several misconceptions can lead to unnecessary confusion or errors. Here are seven common myths debunked:

- Filing the form is optional if I am closing my business. Many believe that submitting the form is not necessary. However, it is crucial to file the Sales and Use Tax 202 form to ensure all tax obligations are settled before closing.

- I don’t need to file if I have no sales tax to report. Some think that if there are no taxable sales during the final period, the form doesn't need to be filed. This is not true. Even if you have no tax to report, you must still file this form.

- It can be filed anytime after discontinuation. Another misconception is that timing is flexible. The Sales and Use Tax 202 form should be filed promptly after you discontinue or sell your business to avoid penalties.

- All businesses can combine their final return with the Sales and Use Tax 202 form. It is incorrect to assume that all businesses can file the forms together. If you file electronically, you must mail the Sales and Use Tax 202 form separately, as specified in the instructions.

- I can omit personal details if I am an LLC or corporation. Some believe that corporations don't need to include personal details. Regardless of your business structure, providing your name and contact information is essential for processing.

- Once submitted, there’s no need to keep a copy. This is a risky assumption. Always keep a copy of the Sales and Use Tax 202 form for your records in case you need to verify details or address discrepancies in the future.

- The address for mailing the form can be different. It is a mistake to think that you can send the form to any address. The proper mailing address is critical, and it should be directed to the Comptroller of Maryland's Revenue Administration Division as stated in the form.

Address these misconceptions to ensure a smooth business closure process in Maryland. Remember, clarity leads to compliance.

Key takeaways

Understanding and correctly completing the Maryland Sales Use Tax 202 form is essential for business owners who are discontinuing or selling their operations. Here are some key takeaways to keep in mind:

- Accompany the Form: Always send the 202 form alongside your final sales and use tax return if your business has been discontinued or sold.

- Separate Mailing for E-Filers: If you file electronically, submit the 202 form separately, rather than with your electronic submissions.

- Essential Information Required: Include your Federal Employer Identification Number (FEIN), Maryland central registration number, and a valid telephone number on all documents to avoid any processing errors.

- Keep a Copy: Retain a copy of the completed form for your records. This ensures that you have documentation in case of any future inquiries.

- Mailing Address: Send the completed form to the Comptroller of Maryland at 110 Carroll Street, Annapolis, MD 21411-0001.

- Signature of Responsible Official: Don’t forget to include the signature of a responsible official. This is vital for the authenticity of your submission.

Being thorough while filling out the Maryland Sales Use Tax 202 form can smooth the transition during the closure or sale of your business. Make sure to follow the guidelines correctly.

Browse Other Templates

Public Information Report - The completion of this form is a step towards responsible business closure.

Daily Food Tracker - Get a clear view of your eating habits over time.