Fill Out Your Mass Mutual Policy Surrender Form

The Mass Mutual Policy Surrender form serves as a critical document for policyholders looking to manage their life insurance policies' benefits effectively. This form enables the policy owner to withdraw dividends, surrender additional benefits, or alter dividend options, thereby granting them flexibility in their financial planning. It outlines essential details, such as policy and insured names, owner information, and the specifics of each request. Particularly important is the section regarding tax implications, where policyholders are informed that distributions are subject to federal income tax withholding, and they must make an informed election regarding tax withholdings. A dedicated section is also included for payees and mailing addresses, ensuring that any proceeds are sent correctly, while detailed signature requirements cater to various ownership structures, making the form applicable for individuals, trusts, or corporations. With all these features, the Mass Mutual Policy Surrender form is designed to help policyholders navigate their options competently and responsively.

Mass Mutual Policy Surrender Example

Massachusetts Mutual Life Insurance Company and affiliates, Springfield MA

www.massmutual.com

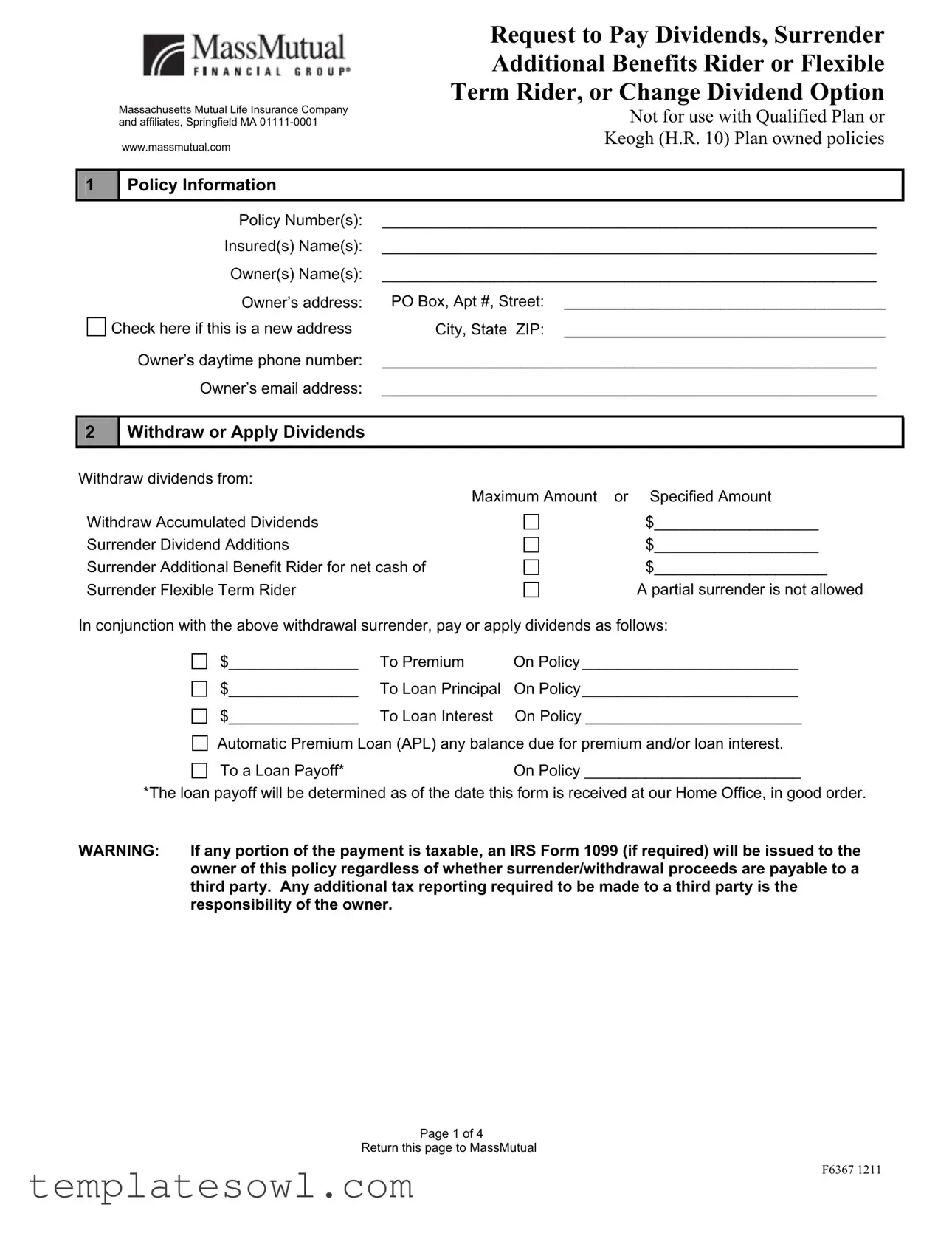

Request to Pay Dividends, Surrender Additional Benefits Rider or Flexible Term Rider, or Change Dividend Option

Not for use with Qualified Plan or

Keogh (H.R. 10) Plan owned policies

1

Policy Information

Policy Number(s): |

_________________________________________________________ |

|

Insured(s) Name(s): |

_________________________________________________________ |

|

Owner(s) Name(s): |

_________________________________________________________ |

|

Owner’s address: |

PO Box, Apt #, Street: |

_____________________________________ |

Check here if this is a new address |

City, State ZIP: |

_____________________________________ |

Owner’s daytime phone number: _________________________________________________________

Owner’s email address: _________________________________________________________

2

Withdraw or Apply Dividends

Withdraw dividends from: |

|

Maximum Amount |

or Specified Amount |

Withdraw Accumulated Dividends |

$___________________ |

Surrender Dividend Additions |

$___________________ |

Surrender Additional Benefit Rider for net cash of |

$____________________ |

Surrender Flexible Term Rider |

A partial surrender is not allowed |

In conjunction with the above withdrawal surrender, pay or apply dividends as follows:

|

$_______________ |

To Premium |

On Policy _________________________ |

|

$_______________ |

To Loan Principal |

On Policy_________________________ |

|

$_______________ |

To Loan Interest |

On Policy _________________________ |

|

Automatic Premium Loan (APL) any balance due for premium and/or loan interest. |

||

|

To a Loan Payoff* |

|

On Policy _________________________ |

*The loan payoff will be determined as of the date this form is received at our Home Office, in good order. |

|||

WARNING: |

If any portion of the payment is taxable, an IRS Form 1099 (if required) will be issued to the |

||

|

owner of this policy regardless of whether surrender/withdrawal proceeds are payable to a |

||

third party. Any additional tax reporting required to be made to a third party is the responsibility of the owner.

Page 1 of 4

Return this page to MassMutual

F6367 1211

Policy Number(s): ___________________________

Name(s) of Insured(s): _______________________

Request to Pay Dividends, Surrender Additional Benefits Rider or Flexible Term Rider, or Change Dividend Option

Not for use with Qualified Plan or Keogh (H.R. 10) Plans owned policies

3

Changes

Cancel Additional Benefits Rider premium as of the current paid to date (to be used in conjunction with the above surrender, and only in those instances where premiums for the Additional Benefits Rider are still being paid).

Cancel the

Change the Dividend Option to:

Pay dividends in cash

Apply dividend to premium (this option is not available for policies that are paid monthly)

Accumulate dividends at interest

Purchase

Cancel the Modified Payment Option (MPO)

4

Withholding Election and Required Notice

The distributions you receive from this policy are subject to Federal Income Tax withholding unless you elect not to have withholding apply. Withholding will apply only to the portion of your distribution that is includable in your income. If you elect no withholding or if you do not have enough withheld, you may be responsible for payment of estimated tax, and you may incur penalties if your withholding and estimated tax payments are not sufficient. If no election is made, any applicable taxes will be withheld. If taxes are withheld, receipt of your payment may be delayed by the calculations required.

NOTE! If you elect Federal Income Tax withholding, you are also electing State Income Tax withholding if applicable under relevant State law.

I have read the above notice regarding Federal Income Tax withholding and:

I do not want Federal Income Tax withheld from my payment.

I want Federal Income Tax withheld from my payment.

MEC WARNING: If your policy has been designated a Modified Endowment Contract (MEC), and you are under age 59 ½, any taxable gain may be subject to a 10% tax penalty. Please consult your tax advisor.

5Payee/Mailing Address

This section must be completed if the proceeds are to be made payable to and mailed to someone other than the policy owner at the address of record. Notary Public stamp may

apply, see Page2. .Exception: proceeds will only be payable to the trust itself on a

Payee Name: |

___________________________ |

Payee Address: |

___________________________ |

Payee Address: |

___________________________ |

City, State, Zip: |

___________________________ |

Distributions may not be sent to an agent/broker address.

6Delivery Options

Checks are mailed through the U.S. Postal Service First Class Mail unless otherwise requested.

U.S Postal Service - Mail (No charge – please allow 10 business days for normal delivery)

UPS Priority (The carrier charges a fee and cannot ship to a P.O. Box. Please provide the information requested below. If not provided, your surrender check will be mailed through the regular U.S. Postal Service.)

UPS Account Name__________________________

UPS Account Number ________________________

Zip Code associated with account # ____________

Page 2 of 4 |

F6367 1211 |

|

Return this page to MassMutual |

||

|

|

Request to Pay Dividends, Surrender |

|

Policy Number(s): _____________________________ |

Additional Benefits Rider or Flexible |

|

Term Rider, or Change Dividend Option |

||

|

Name(s) of Insured(s): _________________________

Not for use with Qualified Plan or Keogh (H.R. 10) Plans owned policies

7 Owner Tax ID Required Please enter your TAX ID (SSN or EIN as applicable)

Check one:

SSN

EIN

Under penalties of perjury, I certify that the above is my correct Taxpayer Identification Number, and I am a U.S. person (U.S. citizen or resident alien), and the Internal Revenue Service (IRS) has NOT notified me that I am subject to backup withholding. The IRS does not require your consent to any provision of this document other than the certifications required to avoid backup withholding.

8Individual, Joint or Multiple Owners Signature Section (All owners must sign.)

______________________________ |

_____________________________________________________ |

_______________ |

Printed Name of Owner |

Signature of Owner |

Date Signed |

______________________________ |

_____________________________________________________ |

_______________ |

Printed Name of Additional Owner |

Signature of Additional Owner |

Date Signed |

______________________________ |

_____________________________________________________ |

_______________ |

Printed Name of Additional Owner |

Signature of Additional Owner |

Date Signed |

9Corporate, Partnership or Trust Owned Signature Section

________________________________________________________________________________ |

________________ |

||

Printed Name of Corporation, Partnership or Trust |

|

Date of Trust |

|

|

I am the sole officer of the corporation listed |

||

____________________________________ |

__________________________________ |

___________ |

________________ |

Printed Name of Corporate Officer or Trustee |

Signature of Corporate Officer or Trustee |

Title |

Date Signed |

____________________________________ |

__________________________________ |

____________ |

________________ |

Printed Name of Corporate Officer or Trustee |

Signature of Corporate Office or Trustee |

Title |

Date Signed |

10 |

Assignee Signature Section |

|

|

______________________________ |

_____________________________________________ |

________________ |

|

Printed Name of Assignee |

Signature & Title |

Date Signed |

|

______________________________ |

_____________________________________________ |

________________ |

|

Printed Name of Additional Assignee |

Signature & Title |

Date Signed |

|

|

|

|

|

11 |

Notary Public Stamp (if applicable) |

|

|

|

|

|

|

A Notary Public stamp is required for distributions greater than $50,000 only if in conjunction with one of the following:

•Checks are made payable to someone other than the policy owner, or

•Proceeds are sent to an address other than the address of record, or

•Proceeds are sent to an address that has been changed in the past 30 days A Notary Public stamp can be obtained from most banks or credit unions.

Subscribed and sworn to before me this ______________________ day of _______________________________

______________________________________________________________________________________________

Signature of Notary Public (Official stamp/seal required) |

My commission expires |

Page 3 of 4

Return this page to MassMutual

F6367 1211

12 Signature Instructions

The following descriptions explain the signature requirements for each type of ownership arrangement.

Corporation, partnership, |

Include the full name of the corporation. Print or type the full name and corporate title of each |

limited partnership |

officer who signs. If the officer is the insured or a family member, we require the signature of |

|

another officer who is not related or, if all officers are related, the signature of two officers. If |

|

the insured is the only officer, we require one of the following: check the box titled Sole |

|

Officer in the signature section or a letter on company stationary to that effect or the |

|

insured’s signature with the corporate seal affixed. EXAMPLE - John Doe, |

|

President/Partner/General Partner, ABC Corporation |

Trust ** |

Those trustees required to sign under the trust agreement. Include the full name of the trust, |

|

the date of the trust agreement and the title(s) of the officer(s), if corporate trust, signing. |

|

EXAMPLE – Mary Smith as Trustee under the ABC Trust Agreement dated mm/dd/yyyy |

Custodian |

• In all states except South Carolina and Vermont, include the full name of the |

|

custodian “as custodian for (insert name of minor) under the (name of state)’s |

|

UTMA.” EXAMPLE |

|

UTMA. |

|

• In South Carolina and Vermont, include the name of the custodian “as custodian for |

|

(insert name of minor) under the (name of state)’s UGMA.” EXAMPLE |

|

as custodian for Alice Doe under the Vermont UGMA. |

Executor** |

Include the full name of the appointed executor, administrator, or personal representative, as |

|

“executor, administrator, or personal representative (list only one capacity) for the estate of |

|

(insert name of deceased), deceased.” If not previously submitted, a copy of the death |

|

certificate is required. EXAMPLE – Joan Doe, executor for the estate of Sam Doe, |

|

deceased. |

Legal Guardian |

Include the full name of the legal guardian/conservator, “as guardian/conservator of the |

/Conservator** |

estate of (insert name of person affected).” EXAMPLE – Joan Doe as Guardian/Conservator |

|

of the Estate of Sam Doe. |

Include the full name of the |

|

of Attorney) |

person).”EXAMPLE – Joan Doe, |

If the policy is assigned |

The owner and assignee must sign. Include the full name of the assignee. If the assignee is |

|

a corporation, also include the title(s) of all officer(s) signing. NOTE: If the right being |

|

exercised is granted to the assignee, only the assignee’s signature is required. |

** Copies of the legal document that established authority must be submitted with this form unless already on file.

13 Customer Service Information

Once you have reviewed and completed this form, please return pages

Mail to: |

|

|

MassMutual Financial Group |

MassMutual Customer Service Center: |

Internet Service |

Enterprise Document Management Hub |

Connection: |

|

1295 State Street |

Monday through Friday, 8 a.m. – 8 p.m. |

www.massmutual.com |

Springfield MA |

Eastern Time |

|

Fax to: |

|

|

Attention Life Hub |

|

|

|

|

|

|

Page 4 of 4 |

|

|

Retain this page for your records |

|

F6367 1211

Form Characteristics

| Fact Name | Description |

|---|---|

| Policy Ownership | The Mass Mutual Policy Surrender Form is not applicable to Qualified Plans or Keogh (H.R. 10) Plan owned policies. |

| Withdrawal Options | It allows the owner to withdraw accumulated dividends and surrender additional benefit riders or flexible term riders for cash value. |

| Tax Implications | Completion of this form can result in taxable proceeds. If taxable, the owner will receive an IRS Form 1099. |

| Notary Requirement | A notary public stamp is necessary for transactions exceeding $50,000 if payable to someone other than the policy owner. |

| Governing Law | This form is governed by Massachusetts state laws, specifically focusing on laws related to life insurance policies. |

Guidelines on Utilizing Mass Mutual Policy Surrender

Once you complete the Mass Mutual Policy Surrender form, you can submit it to MassMutual for processing. It is important to ensure that you provide accurate information to avoid any delays. After submitting the form, expect to receive further instructions or confirmations from MassMutual regarding your request.

- Gather your policy information, including the policy number, insured names, owner names, and owner's address.

- Fill in the owner's daytime phone number and email address.

- Decide whether to withdraw dividends and specify the amounts for any withdrawals.

- Indicate whether you want to apply dividends to premiums, loan principal, or loan interest.

- Fill in the payee name and address if the proceeds will be mailed to someone other than the policy owner.

- Choose a delivery option for the check, either through the U.S. Postal Service or UPS, and provide the necessary UPS account details if applicable.

- Enter the owner's Tax ID (SSN or EIN) and check the appropriate box.

- All owners must sign the signature section. If there are additional owners, include their printed names and signatures as well.

- If applicable, complete the corporate, partnership, or trust owned signature section with the necessary details.

- Complete the assignee signature section if applicable.

- If the distribution is greater than $50,000 and involves special conditions, obtain a Notary Public stamp.

- Review the form for any mistakes or missing information.

- Mail or fax the completed form to MassMutual using the provided contact information.

What You Should Know About This Form

What is the purpose of the Mass Mutual Policy Surrender form?

The Mass Mutual Policy Surrender form allows policy owners to formally request the surrender of their life insurance policy or specific riders attached to it. It provides instructions to withdraw dividends from the policy, apply them towards premiums or loan interests, and cancel additional benefit riders. Completing this form is crucial for processing your request with minimal delay, ensuring that you receive any cash value or dividends due to you.

Can I withdraw dividends from my policy or surrender additional riders?

Yes, you can withdraw accumulated dividends or surrender certain riders. The form allows you to specify the amount you wish to withdraw and to indicate how you want to apply these dividends, such as towards premiums or loan balances. Be aware that partial surrenders are not permitted, meaning you must consider your total withdrawal amount carefully. Also, note that any distributions may have tax implications, so consulting your tax advisor before proceeding is advisable.

What should I do if my address has changed?

If your address has changed since your last update, you should check the box on the form that indicates a new address and provide the updated information. This ensures that any future correspondence, including cash value distributions, is sent to the correct address. Make sure to also update your contact details, such as your phone number and email address, to facilitate communication.

Will I face any tax liabilities by surrendering my policy?

How do I ensure the proper delivery of my surrender check?

Common mistakes

People often make significant mistakes when completing the Mass Mutual Policy Surrender form, which can lead to processing delays or undesired outcomes. One common error is failing to provide accurate policy information. This includes omitting the policy number, the names of the insured, and the names of the owners. When this crucial information is not filled in correctly, it can hinder Mass Mutual from identifying the policy, causing unnecessary back-and-forth communication.

Another frequent mistake concerns the withdrawal amounts. Applicants may either withdraw too much or too little, misunderstanding the limits of what they can surrender. It is essential to specify maximum amounts accurately. If a person holds onto dividends or fails to clearly state how much to withdraw, they may end up missing out on potential benefits or face tax implications that arise from improper distributions.

Changes associated with the policy rider often confuse applicants. Many individuals neglect to indicate whether they wish to cancel additional benefits riders or fail to check the appropriate boxes for dividend options. Misunderstandings around these details can lead to ongoing premium payments or rejection of dividend application requests, which can impact future financial planning.

Lastly, applicants sometimes overlook the necessity of signatures. All owners must sign the form; failure to do so can lead to the whole application being rejected. In addition, different ownership structures—such as trusts or corporations—require specific signatures and documentation. Neglecting these requirements could not only delay processing but may also jeopardize the terms of the surrender itself.

Documents used along the form

When surrendering a Mass Mutual policy, several other forms and documents may also be required to ensure a smooth and comprehensive process. Each one serves a specific purpose in documenting the transaction and addressing any potential tax implications or guidelines. Below is a list of these forms and documents that you might need to consider along with the Mass Mutual Policy Surrender form.

- Tax Form 1099: This form is essential for reporting taxable distributions. If you withdraw or surrender part of your policy, expect to receive this form detailing any taxable amount.

- Owner Tax ID Documentation: You must provide either your Social Security Number (SSN) or Employer Identification Number (EIN). This documentation is necessary for tax reporting purposes.

- Withdrawal Request Form: If you are planning to withdraw dividends or make partial surrenders, this form outlines your request specifically and is necessary to process those transactions.

- Change of Address Form: If the address on record has changed recently, this form should be submitted to ensure all correspondence regarding the policy is directed to the correct location.

- Beneficiary Change Form: If you want to update the beneficiaries of your policy during this process, this form is required to document the changes legally.

- Payee Certification Form: This form is needed if the proceeds of the policy are to be paid to someone other than the policyowner, ensuring that the payment is correctly directed.

- Notary Public Certification: If the surrender amount exceeds $50,000 and certain conditions are met, a notary public’s verification of signatures may be required to safeguard the transaction.

- Loan Payoff Request Form: If there are outstanding loans against the policy, this form is essential to request a payoff of any loans before or during the surrender process.

- Dividends Reinvestment Option**: If you wish to change how dividends are managed (e.g., reinvested or taken as cash), this option form allows you to select your preferred method.

Understanding these accompanying documents can help ensure that your experience is efficient and aligned with your personal needs during the surrender process. Always feel free to reach out for assistance if any questions arise along the way.

Similar forms

The Mass Mutual Policy Surrender form shares similarities with several important documents that facilitate various financial transactions related to insurance policies. Below are four such documents, along with a brief explanation of how each resembles the surrender form:

- Policy Loan Request Form: This document allows policyholders to request a loan against the cash value of their life insurance policy. Like the surrender form, it requires the owner's signature, specifies the policy number, and outlines the amount being requested or surrendered.

- Withdrawal Request Form: Similar to the surrender form, this document is utilized when a policyholder wishes to withdraw funds from their policy. Both forms necessitate the completion of personal information, and details about the specific amounts to be withdrawn or surrendered are clearly recorded.

- Change of Beneficiary Form: This document is used to formally change the designated beneficiary of a policy. As with the surrender form, the policyholder needs to provide their name, policy number, and signature to validate the request, ensuring that it is processed accurately.

- Rider Request Form: This document allows the policyholder to add, remove, or change a rider associated with their policy. Like the surrender form, it contains sections regarding the policyholder's information, the specific actions requested, and requires the signature of the policy owner to authorize any changes.

Dos and Don'ts

When filling out the Mass Mutual Policy Surrender form, consider the following points to ensure a smooth process:

- Do read the instructions carefully before starting. This will help you understand what information is needed.

- Do provide accurate policy information, including the policy number and the insured's name.

- Do review your entries for any errors before submitting the form. Mistakes can lead to delays.

- Do keep a copy of the completed form for your records. This can be helpful for future reference.

- Do consult a tax advisor if you are unsure about the tax implications of surrendering your policy.

- Don't leave any required fields blank. Missing information can cause processing issues.

- Don't submit the form without proper signatures. All owners must sign before submission.

- Don't request payment to an address other than the one on file without completing the appropriate section.

- Don't ignore any tax withholding options. Understand how they affect your payment.

- Don't forget to check for any additional documentation needed based on your ownership type or circumstances.

Misconceptions

Misconception 1: The Mass Mutual Policy Surrender Form is only necessary when canceling a policy.

Many people believe this form is only for outright cancellations. However, it's also used for other actions like withdrawing dividends and surrendering riders. This form allows policy owners to manage their benefits in various ways, not just to terminate coverage.

Misconception 2: Completing the policy surrender form is a quick and simple process.

While the form may seem straightforward, it requires careful attention. Owners must provide detailed information, including tax identification numbers and specific instructions related to dividend applications. Mistakes could lead to delays in processing, so it's essential to review everything thoroughly.

Misconception 3: Tax implications are not a concern when surrendering a policy.

Many people overlook the potential tax consequences of withdrawing funds or surrendering benefits. If any portion of the payment is taxable, a 1099 form will be issued. Owners should seek advice from a tax professional to understand how these actions might impact their finances.

Misconception 4: The form always requires a notary public signature.

Some believe that notarization is mandatory for all transactions involving the policy surrender form. In fact, notary public stamps are only required for distributions over $50,000 under specific conditions. If you're unsure, it's always wise to check the form's requirements beforehand.

Key takeaways

Filling out and using the Mass Mutual Policy Surrender form is an important process. Here are seven key takeaways to keep in mind:

- Policy Information: Ensure all policy numbers, insured names, and owner details are correctly filled out. Incomplete or inaccurate information can lead to delays.

- Withdrawals and Surrenders: You can withdraw dividends or surrender options like the Additional Benefit Rider or Flexible Term Rider. However, note that partial surrenders are not allowed.

- Tax Implications: Remember that any received payment might be taxable. Acknowledge that the IRS could issue a Form 1099 if needed.

- Payee Details: Fill out the payee section only if someone other than the policy owner will receive the proceeds, as distributions cannot be sent to an agent's address.

- Tax ID Requirement: The owner must provide a Tax Identification Number (either SSN or EIN), confirming they are a U.S. person, to avoid backup withholding.

- Signatures Needed: All policy owners must sign. If it's a corporate or trust-owned policy, specific signatures based on your arrangement are required.

- Delivery Options: Check the delivery method for receiving funds. If you want faster delivery, you can choose UPS services but be ready to provide necessary details.

Completing the form accurately can lead to a smooth surrender process. Be attentive to each section's requirements to ensure timely processing.

Browse Other Templates

Tsaenrollment - Failure to pick up your TWIC Card in the specified time can result in cancellation.

Hacc Transcripts - Official transcripts can enhance educational and employment opportunities.

Cigna Provider Login Dental - Attestation of the urgency warrants special consideration during approval processes.