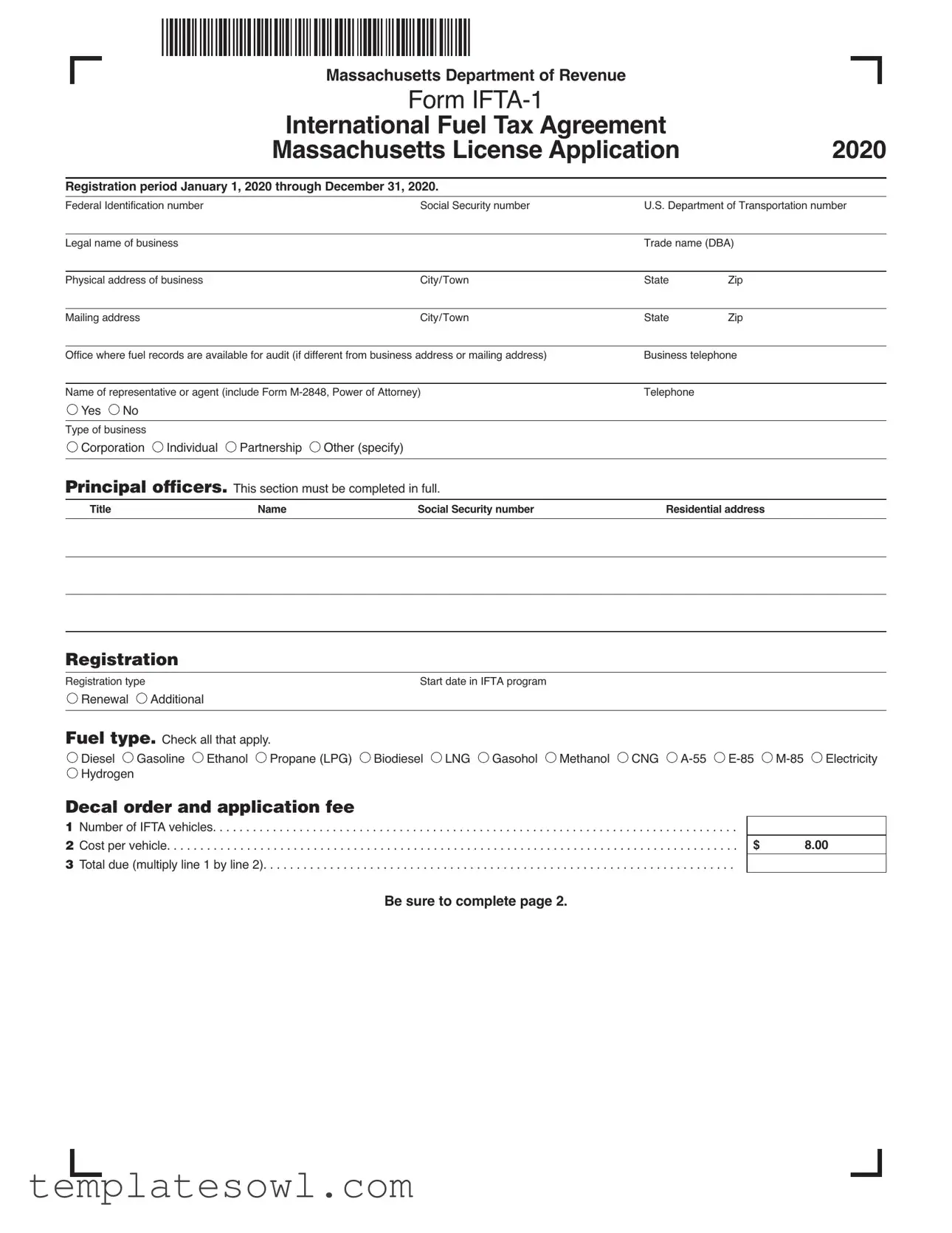

Fill Out Your Massachusetts Ifta Form

The Massachusetts International Fuel Tax Agreement (IFTA) form is crucial for businesses that operate vehicles across state lines. This form allows for streamlined management of fuel tax reporting and payments among numerous jurisdictions. During the registration period, January 1, 2020, through December 31, 2020, applicants must furnish detailed information about their business, including the physical address, principal officers, and the types of fuel used. The form requires compliance with the tax laws and reporting standards established by the Commonwealth of Massachusetts as well as the IFTA. It also emphasizes the importance of maintaining accurate records, as failure to comply may lead to the revocation of an IFTA license in all member jurisdictions. Applicants should also list any jurisdictions where they have operated, identify any bulk storage locations, and declare any prior registrations. Furthermore, the form stipulates that all declarations made must be truthful under the penalties of perjury, ensuring the integrity of the application process. The application fee, details about decal orders, and additional requirements for different types of businesses are also included in this important document.

Massachusetts Ifta Example

Massachusetts Department of Revenue

|

|

T |

|

|

|

|

International Fuel TaxAgreement |

|

|||

|

Massachusetts LicenseApplication |

2020 |

|||

|

|

|

|

||

Registration period January 1, 2020 through December 31, 2020. |

|

|

|

||

|

|

|

|

|

|

edeldetificatiue |

cia |

lcuty ueU |

|

eatfTsatiue |

|

|

|

|

|

|

|

Legalafbusiess |

|

|

Tdea( |

|

|

|

|

|

|

|

|

Physicaladdssfbusiess |

|

ityTw |

|

ate |

Zi |

|

|

|

|

|

|

iligaddss |

|

ityTw |

ate |

Zi |

|

|

|

|

|

|

|

fficewhefuelcsaavailablefaudit(ifdiffe |

|

tfbusiessaddssiligaddss |

siesstelehe |

|

|

|

|

|

|

|

|

afsetativeaget(icludePweft |

|

ey |

|

Telehe |

|

Yes |

|

|

|

|

|

|

|

|

|

|

|

Tyefbusiess |

|

|

|

|

|

ti dividual Paei the(secify |

|

|

|

|

|

|

|

|

|

||

Principal officers. Thissectistbecletedifull |

|

|

|

||

|

|

|

|

|

|

Title |

Name |

Social Security number |

|

Residential address |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Registration

egisttitye |

|

adateiTg |

eewal |

ditial |

|

Fuel type. heckallthataly |

|

|

iesel |

aslie hal Pae(LP diesel L ashl t |

hal ectcity |

ydge |

|

|

Decal order and application fee

1uefTvehicles

2stevehicle

3Ttaldue(ltilyliebylie

$8.00

Be sure to complete page 2.

Jurisdictions. illithevalexttayjusdictiiwhichyutvel

– aba |

||||

– za |

Canadian provinces: |

|||

Bulk storage

yuitaibulkstgefYeslistthejusdictiwhethefuelisitaied

Yes

Yes

Prior registration

dicateayTjusdicti(siwhichyuacutlywe |

viuslygisted(te“e”ifyuhaveevebeegisted |

fT |

Important information

asyuTliceseevebeevkediayTjusdicti

Yes

Yes

ListayTjusdictiiwhichyuTliceseiscutlyvked

Declaration

The applicant agrees to comply with reporting, payment,

Under the penalties of perjury, I declare that I have examined this application, and to the best of my knowledge and belief it is true, correct and complete.

thzedsigatu(t |

Title |

ate |

Telehe |

|

|

|

|

gatufweaeefficefage |

|

|

|

Instructions

etfeeswithalicatiettacestbeiUfu |

dskecheckayablet |

Commonwealth of Massachusettsilt |

Massachusetts |

|||

Department of Revenue, P.O. Box 7027, Boston, MA02204. |

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Tstctis

teyuedellyedetificatiuefehas beeissuedeteyucialcutyue

ltcksthatgiteateadweighthau aquidthaveaeatfTsatiue futheifticall

tethelegalafthebusiessThelegalaisthe udewhichthebusiesswstheeyacquisdebt cti’slegalaistheathataeaitsceif fictifthebusiessisaaeithelegal theathataeaitsaeiagetThelega afasleetiistheaftheidividual fthebusiess

fthecayhasa(“digbusiessas”etethattwi beusedtestablishyuaccut

tethebusiessaddssfthecay

tetheiligaddssyuwishtceiveyulicesedecals adtus

tewhethefuelcswillbeavailablefaudit

tetheteleheuefthecay

illitheaatevaladcletetheaadfu

dss ifyuagivigPwefteytautsideaget se tativeYustalssubtaPweftey(

illitheaatetyefbusiessbasedthefede

tetheastitlescialcutyueadsidecead dssesfthecialctefficeeaei dividualweexecutadisttceivetstees fiduciaes

Renewal. illiifyuhavehadalicesefewali catsstgistelieatssgvsstaxc istegfTyuylgityuaccuttedecals

tAdditional. illiifcutlylicesedfadeedaddi tialdecals

ds |

tethedateyubegawillbegiTissachusetts |

|

|

basedthecutidetificatiueeted |

|

|

illivalsfalltyesffuelused |

|

a |

tetheuefTvehiclesyuaalyigfadlt |

i |

|

||

icate |

lyby$btacheckfsultigautayablet |

Com- |

ais |

monwealth of Massachusettsecalsatvehiclesecific |

|

adextdecalscabeed |

|

|

l |

|

|

we |

illithevalfalljusdictisiwhichtveligwi |

llbede |

|

Tveligstbedeissachusettsadethejusdic |

|

lltitqualifyfT

fbulkstgeisitaiedfilliYesadetethejusdicti whefuelisitaiedtheisefilli

ListtheTejusdicti(siwhichyuagisted havebeegistedfT

|

illitheaateYesvalastwhetheyu |

|

Tli |

|

cesehasevebeevkedListayTjusdictiiwhich |

|

|

|

yuTliceseiscutly |

vked |

|

llad |

Ptahavethealicatisigedbyaauthzede |

|

|

|

adetethetitlefesigigthealicatiT |

|

healicati |

|

stbesigedbytheweaefficeeauth |

zed |

|

|

ithe“Pcialfficesectitheftfthisalica |

tiac |

|

l ue |

cetigssibilityfthevalidityftheiftic |

taied |

|

ithealicati |

|

|

|

|

|

|

|

|

eviewalicatitesuthatitiscleteefythe |

check |

|

|

autthattheiligaddssisthealicatiad |

thatitis |

|

|

sigedThealicatiwillbetuedifitistc |

letewhich |

|

|

willcausedelaysiitscessig |

|

|

ectteg |

ayadditialquestiscallat |

|

Form Characteristics

| Fact Name | Description |

|---|---|

| Form Title | This is the Massachusetts International Fuel Tax Agreement (IFTA) License Application form. |

| Registration Period | The registration period for this form is January 1, 2020, through December 31, 2020. |

| Governing Laws | The application is governed by the Massachusetts Tax Law and the International Fuel Tax Agreement. |

| License Requirements | Applicants must comply with various reporting, payment, and record-keeping requirements as specified in relevant laws. |

| Penalties for Non-Compliance | Failure to comply may result in revocation of the IFTA license across all member jurisdictions. |

Guidelines on Utilizing Massachusetts Ifta

Completing the Massachusetts IFTA form can seem daunting, but following the steps outlined below will help streamline the process. Ensure you have the necessary information on hand to avoid delays. Once you've filled out the form accurately, submitting it on time will ensure compliance with state requirements.

- Begin by filling out your Identification Information. This includes your legal business name, physical address, and contact information.

- Complete the section on Principal Officers, listing their titles, names, social security numbers, and residential addresses.

- Indicate the type of business entity you are (e.g., individual, partnership, corporation) by checking the appropriate box.

- Provide details about the Fuel Type you will be using and check all applicable boxes for types of fuel, including diesel and gasoline.

- Fill in the Decal Order and Application Fee section. Enter the number of vehicles and calculate the total due. The fee is $8.00 per vehicle.

- Complete the Jurisdictions section by listing all jurisdictions where you intend to travel. Include U.S. states and Canadian provinces.

- If applicable, check the box for Bulk Storage Units and indicate the jurisdictions where fuel is stored.

- If you have a prior registration, detail any jurisdictions where you have previously been registered.

- Read and agree to the Declaration statement regarding compliance with reporting and payment requirements.

- Sign and date the application form. Ensure it is signed by an authorized individual.

- Make out a check for the application fee made payable to the Commonwealth of Massachusetts and include it with your application.

After completing these steps, double-check your information for accuracy. Send the form and payment to the address specified on the form to avoid any processing issues. Being thorough now will save you time later during the review process.

What You Should Know About This Form

What is the Massachusetts IFTA form?

The Massachusetts IFTA form is an application for the International Fuel Tax Agreement. This form is specifically for businesses that operate commercial vehicles across the states covered by this agreement. It is important for fuel tax reporting and ensuring compliance with various jurisdictions.

Who needs to fill out the IFTA form?

If you operate a motor vehicle that travels across state lines for business and uses fuel, you’ll need to complete the IFTA form. This applies to both individuals and businesses that meet certain criteria, including those with commercial trucks and buses.

When is the registration period for the IFTA in Massachusetts?

The registration period typically starts on January 1 and ends on December 31 each year. Be sure to renew your registration before the deadline to avoid any interruptions in your fuel tax compliance.

What information do I need to provide on the application?

You will need to provide your business address, type of business, and information about the principal officers. Additionally, make sure to specify the type of fuel you use and any jurisdictions where you plan to operate.

How much does it cost to apply for IFTA?

The application fee is $8.00 per vehicle. Ensure that the payment is submitted along with your application to avoid delays.

What if my business operates in multiple jurisdictions?

If your business operates across various jurisdictions, you must list all of them on the IFTA application. This includes both U.S. states and Canadian provinces where you travel. Accurate reporting helps ensure compliance and avoid penalties.

What happens if I don’t comply with IFTA regulations?

If you fail to comply with IFTA regulations, Massachusetts may withhold any refunds due if you have outstanding fuel tax payments. Non-compliance can also lead to having your IFTA license revoked in all member jurisdictions, so it’s crucial to stay up to date.

Can I get my IFTA application signed by someone else?

The application must be signed by an authorized person within your business. This could be the owner or another designated individual. Make sure they hold the appropriate authority to sign documents on behalf of your business.

What do I do if I have additional questions about the IFTA form?

If you have more questions, it’s best to reach out to the Massachusetts Department of Revenue directly. They can provide further clarification and assistance with the IFTA application process.

Common mistakes

Filling out the Massachusetts International Fuel Tax Agreement (IFTA) form can be a straightforward process if approached correctly. However, individuals often make mistakes that can lead to delays or complications. One common error is providing incorrect identification details. It's crucial to ensure that the legal business name, physical address, and mailing address are accurately entered. Mistakes in this section might cause the form to be rejected or delays in processing the application.

Another frequent issue arises from incomplete jurisdictions. Applicants need to list all the jurisdictions in which they operate. Failing to include all relevant jurisdictions can result in tax liabilities or penalties, as state regulations may require detailed reporting of all travel areas. Double-checking this section can help prevent future legal or financial complications.

Many individuals also overlook the fuel types section. Selecting the appropriate fuel types is critical for proper reporting and tax assessments. Common choices may include diesel, propane, and gasoline. Incorrectly marking this section can lead to erroneous tax calculations and potential audits, adding unnecessary stress and complications.

Another mistake often made relates to the signature and date. The application must be signed by an authorized individual and dated correctly. Omitting either of these elements can lead to the application being deemed invalid, resulting in processing delays. Always ensure the correct person signs off and the document is dated appropriately.

Additionally, failing to include the application fee is a common error. Applicants must ensure that they attach an appropriate payment, as mentioned in the form instructions. Incomplete payments can lead to rejection of the application and delays in receiving the necessary decals.

Finally, many applicants forget to pay attention to the bulk storage information. If fuel is stored in bulk, this must be correctly reported, detailing where the fuel is situated. Neglecting this step could lead to accountability issues in the future, complicating the applicant's operations across different jurisdictions.

Documents used along the form

The Massachusetts International Fuel Tax Agreement (IFTA) form is important for commercial vehicle operators engaging in interstate travel. Alongside this form, several other documents may be required to ensure compliance with various regulations and facilitate efficient operations. Below is a list of such forms and documents that are commonly used in conjunction with the Massachusetts IFTA form.

- IFTA Quarterly Tax Return: This form details the fuel consumed and miles traveled in each member jurisdiction during a specific quarter. It helps ensure fuel tax is appropriately accounted for.

- IFTA Decal Application: This document is used to request IFTA decals, which must be displayed on qualifying commercial vehicles traveling in member jurisdictions.

- Fuel Purchase Receipts: Detailed receipts from fuel purchases are essential for reporting fuel consumption. Keeping these accurate helps support claims made on IFTA returns.

- Mileage Records: These records document the distance traveled by a vehicle in each jurisdiction. They are necessary for accurate reporting in the IFTA Quarterly Tax Return.

- Proof of Vehicle Registration: Vehicles must be registered for IFTA compliance. Documentation showing current registration is often required.

- Tax Exemption Certificates: Specific businesses may qualify for tax exemptions. Certificates proving eligibility may need to be submitted for certain fuel purchases.

- IFTA Tax Rate Charts: These charts outline applicable tax rates for fuel in each member jurisdiction. They are useful for calculating tax liabilities.

- Fuel Tax Audit Reports: In the event of an audit, records and reports from previous audits may be requested to ensure compliance with fuel tax regulations.

- State-Specific Fuel Tax Forms: Some states may have their forms associated with fuel tax compliance, which may also need to accompany the IFTA paperwork.

- Power of Attorney Form: If an individual or another entity is handling IFTA matters on behalf of the business, a power of attorney form may be required to authorize them.

Understanding and preparing these documents in conjunction with the Massachusetts IFTA form helps ensure proper compliance with fuel tax regulations. Keeping thorough records and required forms readily available can facilitate an efficient process for commercial vehicle operations.

Similar forms

-

Form 2290 (Heavy Highway Vehicle Use Tax Return): This document is used by businesses to report and pay the federal excise tax on heavy vehicles. Like the Massachusetts IFTA form, it requires information about the vehicle's identification and business operations and ensures compliance with specific tax obligations.

-

State Sales Tax Permit: Businesses must obtain this permit to collect sales tax from customers. Similar to the IFTA form, it provides the state with vital information about the business's operations and its compliance with tax collection duties.

-

Form 941 (Employer's Quarterly Federal Tax Return): This form is used to report income taxes withheld from employees and the employer's portion of Social Security and Medicare taxes. It shares the same principle of maintaining accurate records for tax purposes as the IFTA form.

-

Business License Application: Businesses often need this document to legally operate in a state or municipality. Like the IFTA application, it gathers essential information about the business and ensures compliance with local regulations.

-

State Fuel Tax Registration: This registration establishes a business’s authority to collect fuel taxes within a state. Its objectives and the required information about operations are akin to those of the Massachusetts IFTA form.

-

Annual Report for Corporations: Corporations submit this report to maintain good standing. It parallels the IFTA form in documenting business information—ensuring transparency and adherence to state regulations.

-

IRS Form W-9 (Request for Taxpayer Identification Number and Certification): This form is used by businesses to provide their taxpayer identification number to another party. It serves a similar purpose of validating business identity as the IFTA form does for fuel tax compliance.

Dos and Don'ts

When filling out the Massachusetts IFTA form, there are several best practices to follow and some common pitfalls to avoid. Here’s a concise guide to help you through the process:

- Do: Double-check your business information for accuracy.

- Do: Include all necessary signatures on the application.

- Do: Keep a record of all submitted documents for future reference.

- Do: Ensure that all applicable fees are included with your application.

- Do: Update your application if your business information changes.

- Don't: Leave any sections of the form blank.

- Don't: Submit incomplete or inaccurate tax information.

- Don't: Ignore the instructions provided with the form.

- Don't: Forget to check the jurisdiction list before finalizing your application.

- Don't: Delay in submitting your application, as it may affect your licensing.

Following these guidelines can help ensure a smooth completion of the Massachusetts IFTA form and streamline your licensing process.

Misconceptions

Here are some common misconceptions about the Massachusetts IFTA form:

- The IFTA form is only for large trucking companies. Many people believe that only large carriers need to fill out the IFTA form. In fact, any business that operates qualified vehicles across state lines must comply, regardless of size.

- Filing the IFTA form is optional. Some individuals think that submitting the form is optional if they don’t use their vehicle frequently. However, it is mandatory for any company that travels between different jurisdictions and has to report fuel usage.

- There is no penalty for late submissions. Some might assume they can submit the form whenever they want without consequences. Late submissions can lead to penalties and interest on outstanding taxes, which can add up quickly.

- All fuel types need to be reported the same way. It’s a misconception that all types of fuel are reported in a uniform manner. Different fuel sources, such as diesel or gasoline, may have unique requirements, and it’s important to follow the specific instructions for each type.

- The IFTA form is the same as state fuel tax forms. Some people confuse the IFTA form with state-specific fuel tax forms. The IFTA form consolidates reporting across multiple jurisdictions, while state forms are only for that specific state.

- Once submitted, the IFTA form cannot be changed. There is a belief that after you send in the IFTA form, you cannot make any adjustments. If you discover an error, you can file an amended form to correct any mistakes.

Key takeaways

1. Complete All Sections

When filling out the Massachusetts IFTA form, be sure to complete all sections. This includes information about your business identity and the fuel types you will be using. Missing information can lead to delays in processing.

2. Understand Your Obligations

The form requires you to agree to comply with various reporting and payment requirements. Understand that failing to meet these obligations can result in penalties, including the revocation of your IFTA license. It’s essential to keep records and make timely payments.

3. Keep an Eye on Deadlines

Registration for the International Fuel Tax Agreement runs for a specific period, so be aware of deadlines. Make sure to submit your application by the required date to avoid issues with your license.

4. Ensure Accuracy and Truthfulness

Under penalties of perjury, you must declare that your application is true, correct, and complete. Take the time to review your entries. Accuracy is key, as mistakes can lead to verification issues or even legal repercussions.

Browse Other Templates

How to Get Your College Transcript - Students are encouraged to keep a copy of this request form for their records.

State of Georgia Separation Notice - The Separation Notice form also includes fields for remuneration paid after separation, offering clarity on final payments due to the employee.