Fill Out Your Massachusetts St 13 Form

The Massachusetts Form ST-13, also known as the Small Business Energy Exemption Certificate, provides a vital opportunity for qualifying small businesses to secure sales tax exemptions on energy purchases. Designed for businesses with a gross income of less than $1,000,000 in the previous calendar year, the form is essential for those aiming to maintain operational efficiency while managing expenses. A business must not only meet the income threshold but also employ five or fewer individuals. Each applicant is required to certify that the energy being acquired—be it gas, steam, electricity, or heating fuel—is meant solely for their use. The certification process requires that the purchaser maintains and provides sufficient documentation to support their eligibility. Additionally, it is crucial for vendors to understand that they bear the responsibility of verifying the claim unless they accept the ST-13 in good faith. To ensure compliance, businesses must submit the completed form to vendors before making purchases in a given calendar year. Failure to adhere to the outlined requirements could result in liability for any applicable use tax. This formal process not only promotes fairness in the marketplace but also reinforces the need for accurate record-keeping by both businesses and vendors involved.

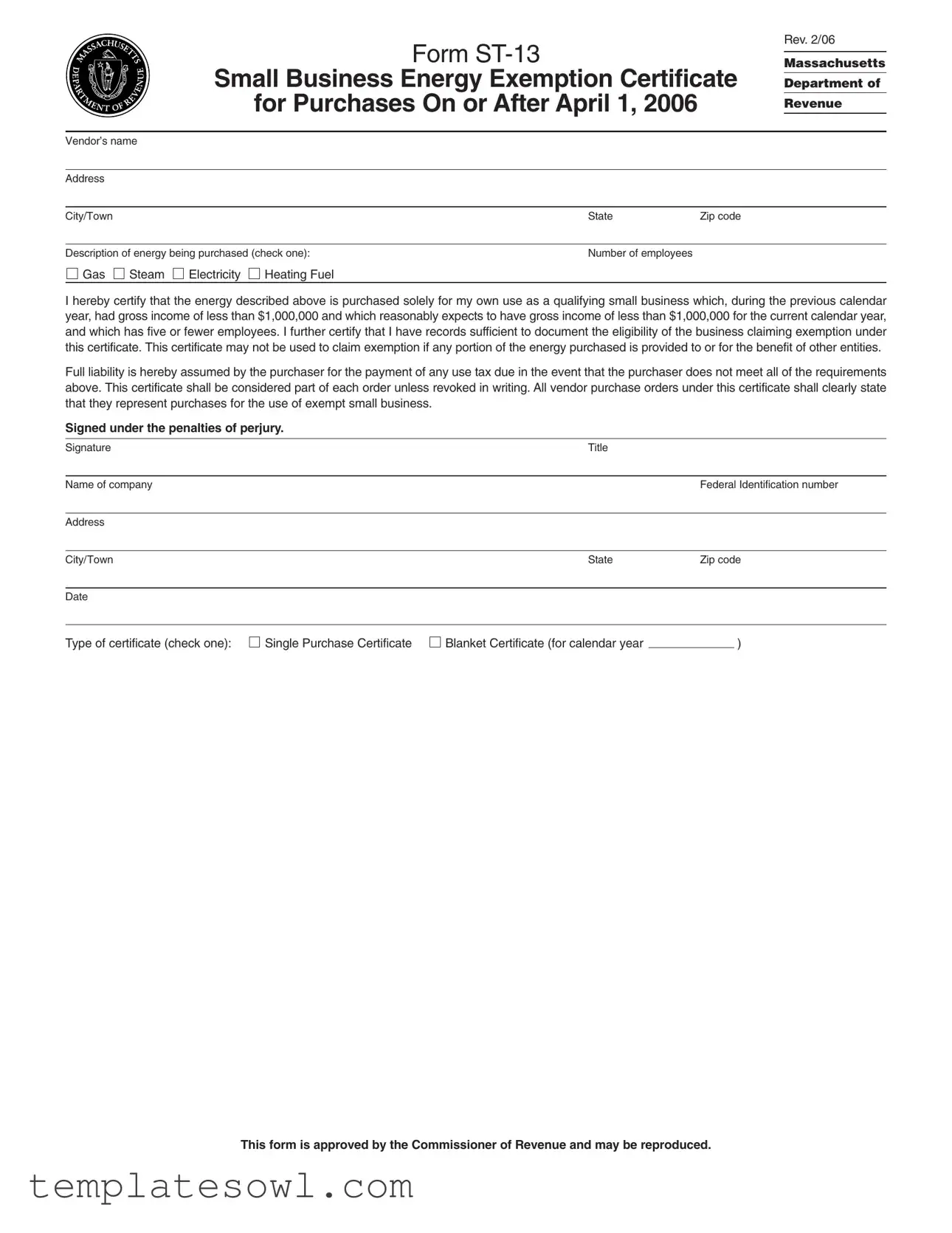

Massachusetts St 13 Example

Form

Small Business Energy Exemption Certificate

for Purchases On or After April 1, 2006

Rev. 2/06

Massachusetts

Department of

Revenue

Vendor’s name

Address

City/Town |

State |

Zip code |

|

|

|

Description of energy being purchased (check one): |

Number of employees |

|

Gas

Steam

Electricity

Heating Fuel

I hereby certify that the energy described above is purchased solely for my own use as a qualifying small business which, during the previous calendar year, had gross income of less than $1,000,000 and which reasonably expects to have gross income of less than $1,000,000 for the current calendar year, and which has five or fewer employees. I further certify that I have records sufficient to document the eligibility of the business claiming exemption under this certificate. This certificate may not be used to claim exemption if any portion of the energy purchased is provided to or for the benefit of other entities.

Full liability is hereby assumed by the purchaser for the payment of any use tax due in the event that the purchaser does not meet all of the requirements above. This certificate shall be considered part of each order unless revoked in writing. All vendor purchase orders under this certificate shall clearly state that they represent purchases for the use of exempt small business.

Signed under the penalties of perjury.

Signature |

Title |

|

|

|

|

Name of company |

|

Federal Identification number |

|

|

|

Address |

|

|

|

|

|

City/Town |

State |

Zip code |

|

|

|

Date |

|

|

Type of certificate (check one):

Single Purchase Certificate

Blanket Certificate (for calendar year |

|

) |

This form is approved by the Commissioner of Revenue and may be reproduced.

Form

General Information

All business entities with gross income of less than $1,000,000 for the previous calendar year and that reasonably expect to have gross income of less than $1,000,000 in the current calendar year, that have five or fewer employees are exempt from paying a sales tax on their purchases of gas, steam, electricity and heating fuel solely for their own use. A business that may not have had gross in- come during the preceding calendar year, such as a

Any purchaser which seeks this exemption must complete Form

Instructions to Vendors

The burden of proving that a business is entitled to the small busi- ness exemption is on the vendor unless the vendor accepts in good faith a copy of this certificate, Form

For each sale exempt from sales tax under the small business ex- emption, vendors must keep a record of the name, address, and federal identification number of the small business claiming the ex- emption, the sales price of each sale and a copy of Form

Instructions to Purchasers

A purchaser ordinarily must present this certificate to the vendor for each calendar year on or before the date of its first purchase of taxable fuel in each new calendar year. If a purchaser presents the certificate after this date, the certificate only applies to purchases made on or after the date the certificate is signed and presented to the vendor.

For purposes of this exemption, an “employee” includes any part- ner, owner or officer of the business who normally works for the business for thirty hours or more per week. Unless a taxpayer dem- onstrates otherwise, the Commissioner of Revenue will presume that any partner, owner or officer who regularly works for a business normally works for the business for thirty hours or more per week.

“Employee” also includes any other individual who is an employee as defined for federal tax withholding purposes under Internal Revenue Code (I.R.C.) Sec. 3401 and who normally works for the business for thirty hours per week or more and who is hired for a period of five months or more.

In determining number or employees, a business entity must con- sider all employees, not just employees at a particular location of the business.

If a business is a member of an affiliated group, as defined in I.R.C. Sec. 1504, all employees of all members of the group must be counted to determine whether the entire affiliated group qualifies as a small business.

The business must maintain adequate weekly employee time and wage records to substantiate any claim to this exemption.

If at any time a business that has claimed a small business exemp- tion under this certificate ceases to qualify for exemption, it must notify the vendor in writing.

A purchaser is liable for the payment of any use tax in the event that the purchaser is not eligible for the exemption.

For further information about the Small Business Energy Exemp- tion, see Massachusetts Regulation 830 CMR 64H.6.11; Technical Information Release

Warning: Willful misuse of this certificate may result in criminal tax evasion penalties of up to one year in prison and $10,000 ($50,000 for corporations) in fines.

If you have any questions about the acceptance or use of this cer- tificate, please contact the Massachusetts Department of Revenue at (617)

Form Characteristics

| Fact Name | Details |

|---|---|

| Purpose | Form ST-13 serves as an exemption certificate for small businesses to avoid sales tax on energy purchases. |

| Eligibility Criteria | A business must have gross income under $1,000,000 and five or fewer employees to qualify. |

| Effective Date | The form is valid for purchases made on or after April 1, 2006. |

| Governing Law | This form operates under Massachusetts Regulation 830 CMR 64H.6.11. |

| Vendor Responsibility | Vendors must keep accurate records of all transactions exempt from sales tax based on this certificate. |

| Record Keeping | Purchasers must maintain adequate records to prove eligibility for the exemption. |

| Penalty for Misuse | Improper use may lead to severe penalties, including fines and potential imprisonment. |

| Form Submission | A signed copy of the form must be given to the vendor to claim the exemption. |

| Type of Certificate | Businesses can choose between a Single Purchase Certificate or a Blanket Certificate for the calendar year. |

Guidelines on Utilizing Massachusetts St 13

Completing the Massachusetts Form ST-13, Small Business Energy Exemption Certificate, is essential for small businesses seeking a tax exemption on energy purchases. Before filling out the form, ensure your business meets the eligibility criteria: a gross income of less than $1,000,000 in the prior year, an anticipated similar income for the current year, and five or fewer employees. Once you have verified this information, follow the steps below to properly fill out the form.

- Begin by entering your vendor’s name in the designated field.

- Fill in the address of the vendor, including city/town, state, and zip code.

- Identify the type of energy being purchased by checking one of the boxes: Gas, Steam, Electricity, or Heating Fuel.

- Indicate the number of employees in your business.

- Read the certification statement carefully, confirming that your business meets the requirements and that you will provide records to document eligibility.

- Proceed to sign the form, indicating your signature and title.

- Enter the name of your company and your federal identification number.

- Fill out your business address in the fields provided, including city/town, state, and zip code.

- Include the date when the certificate is being signed.

- Select the type of certificate by checking either the Single Purchase Certificate or the Blanket Certificate (for the whole calendar year).

Once the form is filled out, it needs to be submitted to your vendor. This certificate will allow your small business to be exempt from sales tax on qualifying energy purchases for the specified period. Remember to keep a copy for your records, as it may be required for any future transactions or audits.

What You Should Know About This Form

What is the Massachusetts Form ST-13?

The Massachusetts Form ST-13 is known as the Small Business Energy Exemption Certificate. This certificate allows qualifying small businesses to purchase energy—such as gas, steam, electricity, and heating fuel—without paying sales tax. Small businesses with gross income of less than $1,000,000 in the previous calendar year and that expect to have similar income in the current year may qualify for this exemption.

Who qualifies as a small business for the ST-13 exemption?

To qualify for the ST-13 exemption, a business must meet certain criteria: it must have had gross income under $1,000,000 in the previous calendar year, reasonably expect similar income for the current year, and have five or fewer employees. New businesses that have not generated income yet may still qualify if they expect to meet these income requirements.

How do I complete the ST-13 form?

To complete Form ST-13, the business owner must provide information such as the business name, address, and federal identification number. The owner must also indicate the type of energy being purchased and certify that the energy is solely for their own use as a qualifying small business. It is essential to sign the form under penalties of perjury and clearly specify whether the certificate is for a single purchase or a blanket certificate covering the calendar year.

What should I do with the completed ST-13 form?

Once completed and signed, the form should be submitted to the vendor from whom the energy is being purchased. The form must be presented for each calendar year or when making a taxable purchase for the first time in a new year. This form is only valid for purchases made on or after the date it is signed.

What happens if I mistakenly use the ST-13 certificate?

If a business does not meet the eligibility criteria set out for the small business exemption but uses the ST-13 certificate, the purchaser may be liable for any sales tax owed. Furthermore, if the business ceases to qualify for the exemption, it must notify the vendor in writing to prevent future misuse.

What records do vendors need to keep regarding the ST-13?

Vendors must maintain proper records to substantiate the exemption claim. This includes keeping copies of the ST-13 form, the name and address of the claiming business, the federal identification number, and the sales price of each exempt sale. These records help the vendor prove that they acted in good faith in accepting the certificate.

What penalties might occur for misuse of Form ST-13?

Willful misuse of the ST-13 certificate can lead to serious consequences, including criminal tax evasion charges. Penalties for such misuse can entail imprisonment of up to one year and fines of $10,000 for individuals or $50,000 for corporations.

How can I get more information about the ST-13 form?

For additional information regarding the ST-13 form or the small business energy exemption, individuals can contact the Massachusetts Department of Revenue at (617) 887-MDOR. They provide guidance and clarification about the requirements and processes related to the exemption.

What items are covered under the ST-13 exemption?

The ST-13 exemption covers various types of energy purchases essential for business operations. Specifically, eligible energy types include gas, steam, electricity, and heating fuel, provided that these resources are used solely for the qualifying business’s own needs.

Common mistakes

Completing the Massachusetts ST 13 form, which is designed for small businesses seeking an energy exemption, can be straightforward. However, certain common mistakes can impede the process. One significant error is failing to accurately calculate the number of employees. Individuals sometimes miscount or overlook part-time employees and owners who regularly work for the business. All personnel who work thirty hours or more per week must be included. This oversight could jeopardize the exemption.

Another prevalent mistake arises from not checking the correct description of the energy being purchased. The form presents options such as gas, steam, electricity, and heating fuel. In some instances, individuals mistakenly select multiple options or select the incorrect energy type, leading to confusion and potential denial when the vendor reviews the certificate.

Moreover, many purchasers neglect to sign the form, which is a critical requirement. An unsigned form may be deemed invalid, causing automatic rejection of the exemption request. It is essential that every person submitting the certificate remembers to provide their signature, along with their title and date of completion. Omitting this step can lead to unnecessary delays and complications.

Lastly, using the form without understanding its effective date is another mistake. The exemption only applies to purchases made on or after the date the form is signed and presented to the vendor. Purchasers often present the certificate after the deadline for the current year, believing it covers prior purchases. This misinterpretation can result in unexpected tax liabilities. Understanding the requirements and adhering to the form’s specifications is vital for a successful exemption claim.

Documents used along the form

The Massachusetts ST-13 form serves as a vital document for qualifying small businesses seeking tax exemption on energy purchases. Beyond this form, several other documents and forms often accompany it to ensure proper processing and compliance with state revenue regulations. Below is a list of forms frequently used in conjunction with the ST-13, each with a brief description.

- Form ST-2: This form is used by organizations to apply for sales tax exemption, particularly non-profits. It certifies that a group or institution does not have to pay sales tax on certain purchases due to its tax-exempt status.

- Form ST-5: The Sales Tax Resale Certificate allows businesses to purchase items for resale without paying sales tax. This form is critical for vendors who sell taxable items to support their resale claims.

- Form ST-7: This document certifies that certain purchases are exempt from sales tax for specific categories, such as manufacturers or farmers. It serves as proof that the buyer is entitled to the exemption.

- Form ST-12: This form is similar to ST-2 but specifically applies to government entities. It verifies a government unit’s eligibility for sales tax exemptions on applicable purchases.

- IRS Form W-9: This form is necessary for businesses to provide their Tax Identification Number (TIN) to vendors. It helps ensure accurate reporting for tax purposes and might be requested by vendors accepting ST-13 forms.

- Massachusetts Form 355 or 355S: Used for corporate excise tax returns, these forms can clarify a small business's financial status when applying for exemptions under ST-13.

- Form 1099: This tax form reports various types of income other than wages. It may be relevant if a small business interacts with contractors or freelancers related to energy purchases.

- Form 941: This quarterly tax return form outlines a business's payroll taxes. Maintaining proper records as per this form can support the claims made on the ST-13.

- Form ST-9: Applicable to non-profit organizations for sales tax exemption claims, the ST-9 certifies that particular purchases are for exempt purposes.

- Form ST-8: This form outlines exemptions for purchases of energy-efficient appliances and equipment, complementing the ST-13 in cases where businesses invest in sustainable practices.

Understanding the various forms associated with the Massachusetts ST-13 allows businesses to navigate the exemption process efficiently. Each form serves a unique purpose that ensures compliance while potentially reducing tax burdens for small enterprises. Proper usage and understanding can lead to significant financial relief and operational efficiencies for qualifying businesses.

Similar forms

-

Form ST-2: This is the Sales Tax Exemption Certificate used by various organizations to claim exemption from sales tax on purchases. Like Form ST-13, it requires that the purchaser be exempt from sales tax, and it must be presented to vendors for the tax exemption to be honored.

-

Form ST-4: This form is for exempt organizations, such as charities or educational institutions, allowing them to purchase items without paying sales tax. Similar to ST-13, it certifies the entity’s exempt status during purchases.

-

Form ST-5: This is a Resale Certificate used by sellers who intend to resell purchased items. It parallels ST-13 by providing a certificate to vendors to prove tax exemption status during the purchase process.

-

Form ST-6: This form allows manufacturers to claim a sales tax exemption for tangible personal property used in the manufacturing process. Both ST-13 and ST-6 share the goal of helping qualifying businesses avoid sales tax on necessary purchases.

-

Form ST-12: This is the Sourcing Certificate for government entities, applicable to their purchases. Much like ST-13, it ensures that eligible governmental bodies do not incur sales tax on their qualifying purchases.

-

Form ST-8: This is the Exempt Use Certificate, allowing buyers to certify the exempt use of items purchased. Similar to ST-13, it requires a declaration that the purchase is for exempt purposes, aiding in tax documentation.

-

Form ST-20: This document is for motor vehicle sales tax exemption based on specific criteria. Both ST-20 and ST-13 focus on verifying eligibility for tax exemptions to streamline the process for specific types of purchases.

Dos and Don'ts

When filling out the Massachusetts ST-13 form, keeping a few essential dos and don’ts in mind can help ensure that the process goes smoothly. Here’s a helpful guide:

- Do verify that your business qualifies as a small business based on the income and employee criteria before starting the form.

- Don’t assume that all types of energy purchases are eligible; ensure the energy being purchased falls under the exemptions listed.

- Do complete all sections of the form accurately, including your business name, address, and federal identification number.

- Don’t leave any required fields blank; providing incomplete information can delay your tax exemption.

- Do sign and date the form to certify the accuracy of the information provided.

- Don’t forget to keep a copy of the signed form for your records and to give to the vendor.

- Do submit the completed form to the vendor before your first purchase of the taxable fuel each calendar year.

- Don’t present the certificate after the date of your first purchase; it will only apply to future purchases.

- Do maintain accurate records of employee time and wages to substantiate your small business status.

- Don’t misuse the certificate; willful misuse can result in severe penalties, including fines and potential imprisonment.

Misconceptions

Understanding the Massachusetts ST 13 form is essential for small business owners. However, several misconceptions can lead to confusion regarding its application and requirements. Here are six common misunderstandings:

- Misconception 1: The form applies to all businesses.

- Misconception 2: The exemption is automatically granted upon submission of the form.

- Misconception 3: Only physical stores can apply for the exemption.

- Misconception 4: The number of employees is calculated at a single location.

- Misconception 5: The form can be used for energy purchases benefiting other entities.

- Misconception 6: A new business cannot qualify for the exemption.

Only small businesses with gross income under $1,000,000 are eligible. If a business exceeds this threshold, it cannot claim the exemption.

The exemption is not automatic. Businesses must present the form to vendors at the time of purchase, and the vendors must keep appropriate records.

Any qualifying business type can apply, whether it operates online, in-person, or through other means, as long as it meets the criteria.

All employees across the entire business entity must be counted, not just those at one specific location.

This form strictly applies to energy purchased solely for the business’s own use. If the energy benefits other entities, the exemption does not apply.

Newly-formed businesses can qualify for the exemption if they reasonably expect to have income below the $1,000,000 threshold in their first year.

Key takeaways

- Form ST-13 allows small businesses in Massachusetts to claim an exemption from sales tax on certain energy purchases.

- To qualify, a business must have had gross income of less than $1,000,000 in the previous calendar year and expect the same for the current year.

- Businesses must also have five or fewer employees to be eligible for this exemption.

- The energy purchase must be for the business's own use. Sharing this energy with other entities disqualifies the exemption.

- Both Single Purchase and Blanket Certificates can be selected on Form ST-13. Choose according to your purchasing needs.

- A signed copy of Form ST-13 must be presented to the vendor before the purchase to claim the exemption.

- This exemption applies only to purchases made after the certificate is signed and presented.

- Keep thorough records, including the vendor’s name, address, and federal identification number when claiming the exemption.

- If circumstances change, and the business no longer qualifies, notify the vendor in writing.

- Misuse of this certificate can result in serious penalties, including fines and possible jail time.

Browse Other Templates

How to Add Availability in Resume - Knowing your availability helps us respect your time.

Clearinghouse Transcripts - This form supports students in maintaining control over their educational records and privacy rights.