Fill Out Your Masshousing Payoff Request Form

Managing mortgages effectively requires an understanding of the necessary procedures and documentation involved. One such crucial document is the MassHousing Payoff Request form, which facilitates the process of obtaining a payoff statement from MassHousing. This form is essential for borrowers who are either selling their property or refinancing their loans, as it outlines the necessary steps to provide clear and concise instructions for processing the request. Along with the completed form, borrowers must also include a signed authorization, enabling MassHousing to release the payoff statement to any applicable third parties. Several key details must be filled out, such as the borrower’s name, property address, and loan account number, all of which streamline the identification and processing of the request. Further, it’s important to note that borrowers must specify their desired payoff date, adhering to specific time constraints ranging from two to thirty days. Additionally, individuals must indicate the reason for their request, whether it be due to a sale, refinance, or another circumstance, and choose how they prefer to receive the payoff statement, whether by fax or mail. Understanding these components is vital for ensuring a smooth transaction, and responsiveness is key as MassHousing promises a turnaround time of just two business days for delivering the necessary figures.

Masshousing Payoff Request Example

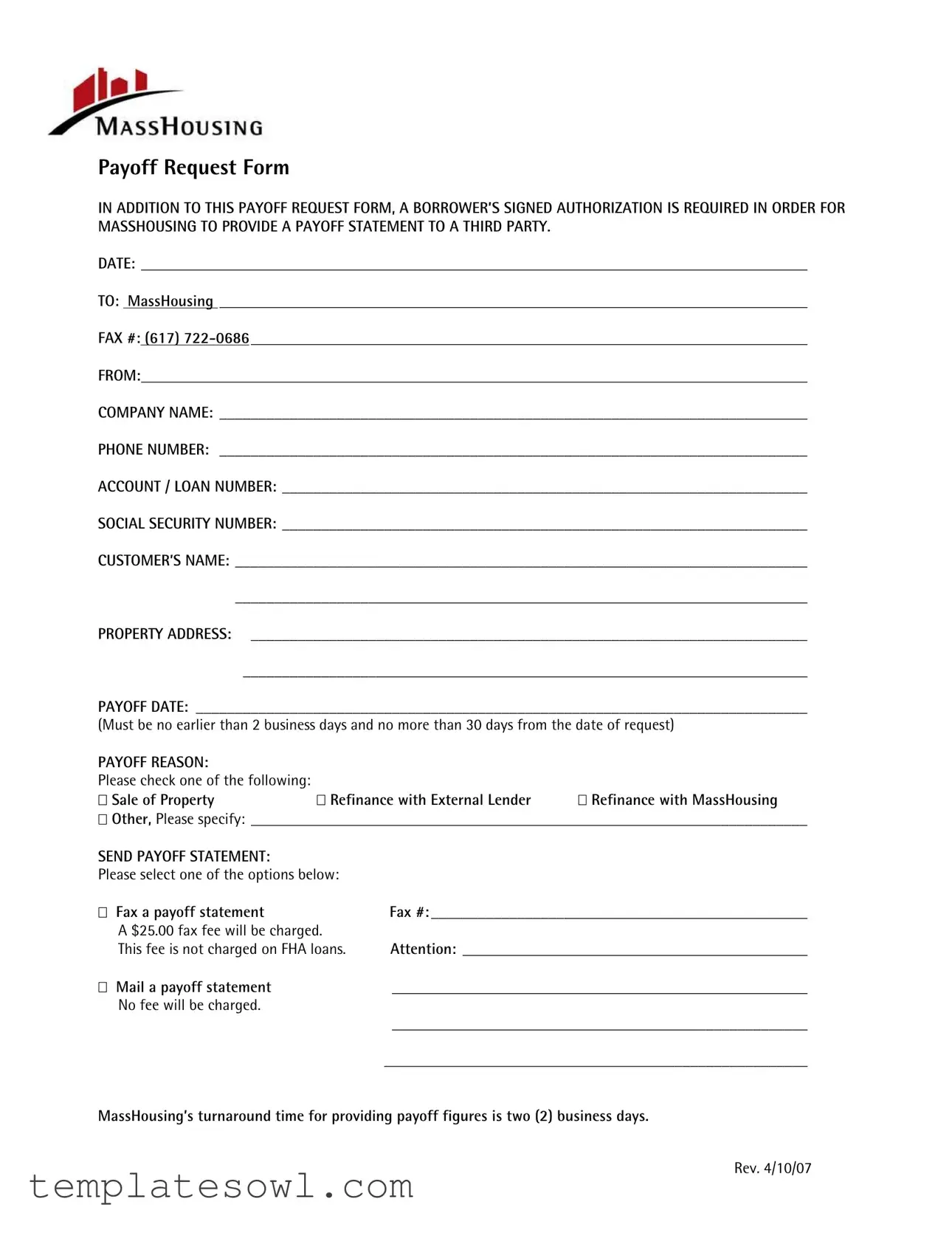

Payoff Request Form

IN ADDITION TO THIS PAYOFF REQUEST FORM, A BORROWER’S SIGNED AUTHORIZATION IS REQUIRED IN ORDER FOR MASSHOUSING TO PROVIDE A PAYOFF STATEMENT TO A THIRD PARTY.

DATE: _____________________________________________________________________________________

TO: MassHousing ___________________________________________________________________________

FAX #: (617)

FROM:_____________________________________________________________________________________

COMPANY NAME: ___________________________________________________________________________

PHONE NUMBER: ___________________________________________________________________________

ACCOUNT / LOAN NUMBER: ___________________________________________________________________

SOCIAL SECURITY NUMBER: ___________________________________________________________________

CUSTOMER’S NAME: _________________________________________________________________________

_________________________________________________________________________

PROPERTY ADDRESS: _______________________________________________________________________

________________________________________________________________________

PAYOFF DATE: ______________________________________________________________________________

(Must be no earlier than 2 business days and no more than 30 days from the date of request)

PAYOFF REASON: |

|

|

Please check one of the following: |

|

|

Sale of Property |

Refinance with External Lender |

Refinance with MassHousing |

Other, Please specify: _______________________________________________________________________

SEND PAYOFF STATEMENT:

Please select one of the options below:

Fax a payoff statement |

Fax #: ________________________________________________ |

A $25.00 fax fee will be charged. |

|

This fee is not charged on FHA loans. |

Attention: ____________________________________________ |

Mail a payoff statement |

_____________________________________________________ |

No fee will be charged. |

|

|

_____________________________________________________ |

|

______________________________________________________ |

MassHousing’s turnaround time for providing payoff figures is two (2) business days.

Rev. 4/10/07

Form Characteristics

| Fact Name | Description |

|---|---|

| Authorization Requirement | A signed authorization from the borrower is necessary for MassHousing to issue a payoff statement to a third party. |

| Form Date | The form must include the date of submission, as it is crucial for processing the request. |

| Recipient Information | The form should be directed to MassHousing, including their fax number (617) 722-0686. |

| Borrower Details | Essential information about the borrower, such as their name, social security number, and contact information, must be included. |

| Account Information | The account or loan number related to the mortgage must be provided on the form. |

| Payoff Date | The requested payoff date can only be set between 2 business days and 30 days from the date of the request. |

| Payoff Reasons | The borrower must indicate the reason for the payoff, with options including sale of property, refinance, or other reasons specified. |

| Statement Delivery Options | The borrower can choose to receive the payoff statement by fax for a fee or by mail at no charge. |

| Turnaround Time | MassHousing typically takes two business days to provide the requested payoff figures. |

Guidelines on Utilizing Masshousing Payoff Request

Once you have gathered the necessary information, it's time to fill out the MassHousing Payoff Request form. Accuracy is essential to ensure a smooth process, as this information will allow MassHousing to prepare your payoff statement efficiently. If you've never filled out a form like this before, don't worry; by following these steps, you'll be able to complete it with ease.

- Date: Write the date when you are completing the form at the top. Make sure it's accurate.

- To: Fill in "MassHousing" as the recipient.

- Fax Number: Enter the fax number (617) 722-0686 below the recipient's name.

- From: Write your name and contact information. This helps in identifying who the request is from.

- Company Name: If you’re representing a company, include its name in the designated field.

- Phone Number: Input your contact phone number to ensure MassHousing can reach you if necessary.

- Account/Loan Number: Enter your loan or account number accurately to avoid any confusion.

- Social Security Number: Provide your social security number to help verify your identity.

- Customer's Name: Write the name of the borrower as it appears on the account.

- Property Address: Detail the address of the property associated with the loan.

- Payoff Date: Indicate the date you want the payoff statement sent, ensuring it falls within the allowed window (2 to 30 days from the request date).

- Payoff Reason: Check the box that corresponds with your reason for this request, whether it's a sale, refinance, or something else.

- Send Payoff Statement: Choose how you would like to receive the payoff statement: by fax or by mail. If faxing, remember to provide the fax number and note the fee. If mailing, just ensure you have the correct address.

With these steps complete, you can submit the form to MassHousing by fax or mail based on your preference. Keep a copy of the form for your records. Once sent, expect them to process your request within two business days, providing you with the necessary figures for your next steps.

What You Should Know About This Form

What is the purpose of the MassHousing Payoff Request form?

The MassHousing Payoff Request form is designed to formally request a payoff statement for a loan. This statement outlines the total amount needed to pay off a loan in full. A borrower must submit this form along with a signed authorization to ensure that MassHousing can communicate the payoff details, particularly if the information needs to be shared with a third party.

What information is required to complete the Payoff Request form?

To complete the form, several critical pieces of information are needed. This includes the date of the request, the borrower’s account or loan number, property address, and the reason for the payoff. Additionally, you must provide a phone number, the customer's name, and either a fax number or mailing address to receive the payoff statement. Ensure that the payoff date chosen is between two business days and 30 days from the request date.

Is there a fee associated with the Payoff Request?

Yes, there is a fee for receiving a payoff statement via fax, which is $25. However, this fee does not apply to FHA loans. If you choose to receive your payoff statement by mail, there is no charge. It is important to select your preferred method of receiving the statement on the form accordingly.

How long does it take to receive a payoff statement once the form is submitted?

Once the Payoff Request form is submitted to MassHousing, the typical turnaround time is two business days. This allows for a prompt response, ensuring that borrowers can quickly move forward with their plans, whether selling a property or refinancing a loan.

Common mistakes

Filling out the MassHousing Payoff Request form can be straightforward, but many make common mistakes that can delay processing. A frequent error is neglecting to include a signed authorization from the borrower. Without this authorization, MassHousing cannot provide a payoff statement to a third party, which can halt the process entirely.

Another mistake involves the date. The requested payoff date must be between two business days and 30 days from the submission date. Many fail to adhere to this time frame, which leads to confusion and potential bumps in the road. To avoid this pitfall, verify the date before submitting the form.

Completing the contact information section accurately is crucial, yet some applicants skip this step or provide incomplete details. A missing phone number or incorrect fax number can complicate communication and cause delays in receiving the payoff statement.

The payoff reason section is also a common area for oversight. Applicants sometimes forget to check a box or fail to provide additional details when required. Choosing a specific reason helps expedite processing, as MassHousing can quickly classify and handle the request.

In addition, applicants often overlook the account or loan number. This number is essential for identifying the specific loan associated with the request. Failing to provide it may result in delays or miscommunications, potentially prolonging the payoff process.

The choice of how to receive the payoff statement can pose problems as well. Some individuals forget to select a method—whether to fax or mail the statement—leading to complications or delays in obtaining vital information.

Finally, not paying attention to the fax fee is a mistake many make. A $25.00 fee is applicable for faxed statements, although it is waived for FHA loans. Being clear about payment obligations can prevent unexpected costs during the process.

In summary, careful attention to detail while completing the MassHousing Payoff Request form can prevent these common errors. Meticulously verify all sections and requirements to ensure a swift and hassle-free experience.

Documents used along the form

The MassHousing Payoff Request form is an essential document when seeking a payoff statement. However, it is often accompanied by other important forms and documents to ensure the execution of the request is smooth and effective. Below is a list of common documents that may be needed in conjunction with the Payoff Request form.

- Borrower’s Signed Authorization: This document gives permission for MassHousing to share the payoff statement with a third party. It must be signed by the borrower to comply with privacy regulations.

- Authorization to Release Information: Similar to the signed authorization, this form specifies the type of information that can be disclosed. Its completion is crucial for maintaining borrower confidentiality.

- Loan Payoff Statement: This is an official statement detailing the remaining balance on the loan. It is generated by MassHousing upon receiving the Payoff Request, provided all required authorizations are in place.

- Closing Statement: This document, usually generated during the closing of the loan, lists all fees and payments associated with the loan process. It can be helpful in reconciling amounts during payoff.

- Proof of Identity: Documents such as a driver’s license or passport may be required to verify the identity of the borrower making the request.

- Property Title Document: A copy of the title can confirm ownership when property sale is the reason for the payoff request. This assures MassHousing that the correct property is being addressed.

- Seller’s Disclosure: In cases where the payoff is associated with a property sale, this document provides potential buyers with necessary information about the property's condition, which may indirectly relieve any financial concerns.

- Referral Agreement (if applicable): If a real estate agent or broker is involved in the transaction, this document outlines the terms of their engagement and confirms their legitimacy to act on the borrower’s behalf.

- Settlement Statement: This document summarizes the transaction details, including costs and payments being made. It offers an overview of the financial implications of the transaction.

Each of these documents plays a vital role in the payoff process. Ensuring proper documentation can facilitate a seamless experience and expedite the request for a payoff statement.

Similar forms

The MassHousing Payoff Request form shares similarities with several other financial documents. Each of these documents serves a specific purpose in the loan payoff process. Here’s a quick overview:

- Loan Payoff Statement Request: This document is typically used to formally ask a lender for a statement detailing the total amount needed to pay off a loan. Like the MassHousing form, it requires the borrower’s information and the account number to fetch correct figures.

- Authorization to Release Information: Similar to the authorization needed with the MassHousing form, this document allows a borrower to permit a third party to receive loan information. Consent must be given by the borrower, ensuring that privacy is respected.

- Request for Future Payment Amounts: This document requests an estimate of future payments or final payoff amounts over time. It has a similar purpose to the MassHousing form, as both help borrowers understand their financial obligations clearly.

- Refinance Application: When a borrower wants to refinance, they often have to provide a detailed application. While it's broader in scope, it can include a payoff request as part of the refinancing process. Clarity on payoff amounts is crucial here, just as it is in the MassHousing request.

Dos and Don'ts

When filling out the MassHousing Payoff Request form, it’s important to be mindful of a few key practices. Here’s a straightforward list to guide you:

- Do ensure all required fields are filled out completely. Missing information can delay processing.

- Do double-check your contact information. Provide accurate phone numbers and fax numbers to avoid any communication issues.

- Do specify the reason for the payoff. This helps clarify your request and ensures proper processing.

- Do allow for the appropriate payoff date. Remember, the date must be no earlier than two business days from your request.

- Do keep a copy of the form for your records. This provides proof of your request in case of any discrepancies.

- Don't forget to include a signed authorization. Without it, MassHousing cannot release the payoff statement to anyone but you.

- Don't request a payoff date that falls outside the established timeframe. This could delay your request.

- Don't assume that a fax fee applies to all loans. Remember, there's no fee for FHA loans, so ensure you know your loan type.

- Don't rush through the form. Take your time to avoid errors that could complicate your request.

- Don't ignore the turnaround time. Expect to wait two business days for the payoff figures, and plan accordingly.

Misconceptions

Understanding the MassHousing Payoff Request form can help ease the process for borrowers. However, there are several misconceptions that may lead to confusion. Below are common misunderstandings related to this form:

- All requests require a fee: Many borrowers believe that submitting the payoff request always incurs a charge. In reality, there is no fee for sending the statement by mail, although a $25 fax fee applies.

- A signed authorization is optional: It is a common belief that the borrower’s signed authorization is not necessary. In fact, this signed authorization is mandatory for MassHousing to release the payoff statement to any third party.

- Payoff dates can be any time: Some individuals think they can choose any date for the payoff. However, the requested payoff date must be between two business days and no more than 30 days from the date of the request.

- Payoff figures are provided immediately: There is a misconception that borrowers will receive payoff figures instantly. The actual turnaround time is two business days.

- Only one payoff reason can be selected: Borrowers often believe they can select only one reason for the payoff. However, it is acceptable to choose just one option from the list provided.

- Personal information is not required: Some may underestimate the importance of providing relevant personal information. Accurate details, such as the social security number and loan account number, are essential for processing.

- Emails can be used for requests: There is a misconception that electronic submissions suffice. However, the request must be faxed or mailed directly to MassHousing for processing.

Clearing up these misconceptions can facilitate a smoother experience when using the MassHousing Payoff Request form. Accurate completion and understanding of the requirements are crucial for a successful transaction.

Key takeaways

Here are some key takeaways regarding the filling out and usage of the MassHousing Payoff Request form:

- Borrower Authorization: A signed authorization from the borrower is essential for MassHousing to issue a payoff statement to anyone other than the borrower.

- Complete Information: Ensure all required fields, including customer name, account number, phone number, and property address, are filled out accurately to avoid delays.

- Payoff Date: The payoff date must fall between two business days and a maximum of 30 days from the date you submit the request.

- Reason for Payoff: Select a reason for the payoff from the provided options, such as sale of property or refinance.

- Delivery Method: Choose how you would like to receive the payoff statement—via fax or mail. Be mindful of the associated fees for faxing.

- Fax Fees: A fee of $25 will be charged for faxing the payoff statement unless the loan is an FHA loan, in which case no fee applies.

- Processing Time: MassHousing typically processes payoff requests within two business days, so plan your request accordingly.

- Accurate Contact Details: Double-check the fax number and mailing address entered to ensure the payoff statement reaches the intended recipient.

- Document Retention: Keep a copy of the completed Payoff Request form along with any necessary authorizations for your records.

- Revisions: Be aware that any incomplete forms may be delayed or rejected, necessitating revisions and resubmissions.

Browse Other Templates

Mv3617 Order for Ignition Interlock Exemptions - Vehicle identification details, including VINs, are necessary on the form.

Certificate of Discharge,Military Separation Record,Veteran's Service Record,Active Duty Release Certificate,Discharge Documentation,Military Exit Form,Service Record Summary,Release From Active Duty Report,Armed Forces Discharge Statement,Veteran Id - Members should ensure their DD 214 is accurate before filing for benefits.

Mony Life Insurance Beneficiary Change Form - Caution is advised when designating organizations, as their names must match official records exactly.