Fill Out Your Md Wcc Ic 02 Form

The Md Wcc Ic 02 form is a crucial document for sole proprietors operating in Maryland, specifically concerning their workers' compensation status. This form is submitted to the Maryland Workers’ Compensation Commission. It serves to confirm whether a sole proprietor has opted to cover themselves under Maryland's workers' compensation system. By signing the form, the individual attests to their status with a checkbox indicating their choice. Options include affirming their election to become a covered employee as per the Labor and Employment Article or stating that they have chosen not to opt in. The form requires essential details such as the sole proprietor's name, Social Security number or Federal Employer Identification Number (FEIN), and address. Compliance is essential; if the sole proprietor decides to hire employees, they must obtain workers’ compensation insurance for those workers. The signed declaration under penalty of perjury reinforces the importance of truthful reporting. This ensures that both the sole proprietor and their future employees, if any, have protection under the law.

Md Wcc Ic 02 Example

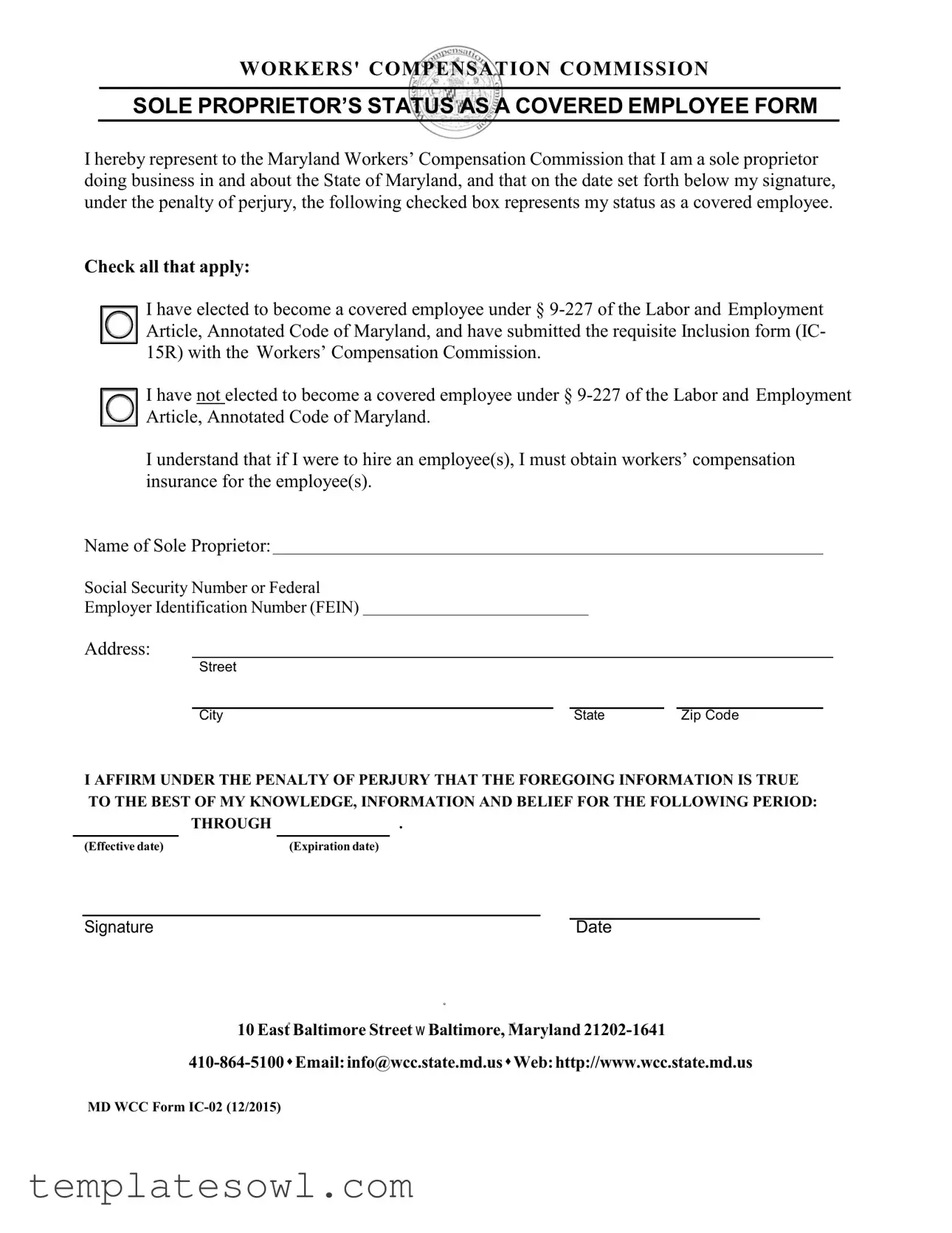

WORKERS' COMPENSATION COMMISSION

SOLE PROPRIETOR’S STATUS AS A COVERED EMPLOYEE FORM

I hereby represent to the Maryland Workers’ Compensation Commission that I am a sole proprietor doing business in and about the State of Maryland, and that on the date set forth below my signature, under the penalty of perjury, the following checked box represents my status as a covered employee.

Check all that apply:

I have elected to become a covered employee under §

15R) with the Workers’ Compensation Commission.

I have not elected to become a covered employee under §

I understand that if I were to hire an employee(s), I must obtain workers’ compensation insurance for the employee(s).

Name of Sole Proprietor:

Social Security Number or Federal

Employer Identification Number (FEIN)

Address:

Street |

|

|

City |

State |

Zip Code |

I AFFIRM UNDER THE PENALTY OF PERJURY THAT THE FOREGOING INFORMATION IS TRUE

TO THE BEST OF MY KNOWLEDGE, INFORMATION AND BELIEF FOR THE FOLLOWING PERIOD:

|

THROUGH |

. |

|

|

|

|

|

(Effective date) |

(Expiration date) |

||

Signature |

Date |

10 East Baltimore Street w Baltimore, Maryland

MD WCC Form

Form Characteristics

| Fact Name | Details |

|---|---|

| Form Purpose | This form verifies a sole proprietor’s status regarding coverage under workers' compensation in Maryland. |

| Governing Law | The Maryland Workers’ Compensation Commission operates under § 9-227 of the Labor and Employment Article, Annotated Code of Maryland. |

| Coverage Election | Sole proprietors may elect to become covered employees by submitting this form along with the Inclusion form (IC-15R). |

| Non-Coverage Option | The form allows sole proprietors to indicate if they have not elected to become covered employees. |

| Insurance Requirement | If a sole proprietor hires employees, obtaining workers’ compensation insurance is mandatory. |

| Affirmation Statement | By signing the form, the sole proprietor affirms that the information provided is accurate under penalty of perjury. |

| Contact Information | For inquiries, individuals can contact the Maryland Workers’ Compensation Commission at 410-864-5100. |

Guidelines on Utilizing Md Wcc Ic 02

Completing the Md Wcc Ic 02 form is an important step in establishing your status as a covered employee in Maryland. Ensure that you have all required information before you begin filling out the form. Follow the steps outlined below for a smooth process.

- Obtain the Md Wcc Ic 02 form from the Maryland Workers' Compensation Commission website or any official source.

- Read the introductory section on the form carefully to understand your obligations and the implications of your choices.

- Check the appropriate box that represents your status as a covered employee. You have two options:

- I have elected to become a covered employee under § 9-227.

- I have not elected to become a covered employee under § 9-227.

- If you selected to become a covered employee, ensure you have submitted the requisite Inclusion form (IC-15R).

- Fill in your name in the "Name of Sole Proprietor" field.

- Provide your Social Security Number or Federal Employer Identification Number (FEIN).

- Complete your address by entering the street, city, state, and zip code.

- Affirm the accuracy of the information provided by writing the effective date and expiration date of your coverage.

- Sign and date the form to certify that the information is true to the best of your knowledge.

- Review the entire form for accuracy and completeness.

- Submit the signed form to the Maryland Workers' Compensation Commission through the provided options (mail or email).

Once submitted, the Maryland Workers' Compensation Commission will review your form and the information you provided may influence your workers' compensation status and obligations, especially if you later hire employees. Keep a copy for your records.

What You Should Know About This Form

What is the Md Wcc Ic 02 form?

The Md Wcc Ic 02 form is a declaration submitted to the Maryland Workers' Compensation Commission by sole proprietors. It identifies their status as covered employees under Maryland law. This form also requires the individual to affirm their status concerning workers' compensation coverage and to provide their personal information, including their social security number or federal employer identification number.

Who needs to complete the Md Wcc Ic 02 form?

Any sole proprietor conducting business in Maryland must complete the Md Wcc Ic 02 form if they wish to declare their status as a covered employee under § 9-227 of the Labor and Employment Article, Annotated Code of Maryland. This form is specifically for those sole proprietors who need to affirm their coverage status for workers' compensation.

What are the options available when completing the form?

When filling out the Md Wcc Ic 02 form, a sole proprietor must check one of two boxes. The first option indicates that the sole proprietor has elected to become a covered employee and has submitted the requisite Inclusion form (IC-15R). The second option states that the proprietor has not elected to become a covered employee. It's essential to choose accurately to avoid legal repercussions.

What is the significance of the effective and expiration dates on the form?

The effective and expiration dates on the Md Wcc Ic 02 form serve to establish the period during which the declaration is valid. Sole proprietors must indicate the specific time frame for which the information is true. This ensures clarity regarding coverage status and accountability for any potential audits or claims.

What happens if a sole proprietor hires employees?

If a sole proprietor decides to hire employees, they must obtain workers' compensation insurance for those employees, even if they have chosen not to elect coverage for themselves. This requirement serves to protect employees and ensure that the proprietor complies with Maryland workers' compensation laws.

How should the form be submitted?

The completed Md Wcc Ic 02 form can be submitted to the Maryland Workers' Compensation Commission either by mail or in person at their office. It is crucial to ensure that all required information is accurately filled out and that it is submitted within the necessary timeframe to avoid delays in coverage status processing.

Where can I get more information about the Md Wcc Ic 02 form?

For additional information or assistance regarding the Md Wcc Ic 02 form, you may contact the Maryland Workers' Compensation Commission directly via phone or email. Their contact details are listed on their official website, where further resources are also available for sole proprietors regarding workers' compensation coverage.

Common mistakes

Filling out the Maryland Workers' Compensation Commission Sole Proprietor’s Status as a Covered Employee form is an important step for sole proprietors in ensuring they have the necessary workers' compensation coverage. However, mistakes can happen during this process, and it is essential to recognize and avoid them. One common error is neglecting to check the appropriate box regarding coverage election. This form requires you to clearly indicate whether or not you have chosen to become a covered employee. Failing to make this selection can lead to confusion and may delay your application.

Another frequent mistake is incorrect personal information. Ensure that the name you provide matches exactly with your registration documents. If you use an abbreviation or misspell your name, it could create issues with your record-keeping with the Workers' Compensation Commission. Moreover, be vigilant about your Social Security Number or Federal Employer Identification Number (FEIN). Any inaccuracies here may cause your application to be processed incorrectly or rejected.

Additionally, many individuals forget to fill in their address completely. Including the street, city, state, and zip code in the specified fields is crucial. Omitting any part of your address not only makes it difficult for the Commission to reach you, but it can also impede effective communications regarding your application status or any changes that may arise.

Another often-overlooked detail is the effective and expiration dates. It is important to accurately state the effective date when your coverage will begin, as well as the expiration date if known. Failing to provide these dates may lead to complications in validating the covered status of your business and could potentially leave gaps in your insurance coverage.

Completing the signature section also requires care. It is vital that you sign the form yourself. A common misunderstanding is that another person can sign on your behalf. This is not acceptable and can result in the form being rejected. Each signature must come from the sole proprietor to validate the information presented under penalty of perjury.

Lastly, remember to submit the form to the correct address. Ensuring that you send the form to the Maryland Workers' Compensation Commission and checking for any specific submission requirements is key. Sending the form to an incorrect address or failing to adhere to submission guidelines can cause significant delays in your application process.

By being attentive to these common mistakes, you can help ensure a smoother experience with the application process for workers' compensation coverage. Taking the time to carefully review your completed form will benefit you and your business in the long run.

Documents used along the form

When dealing with the Md WCC IC 02 form, several other documents often accompany it to ensure compliance with workers' compensation regulations in Maryland. Each of these forms serves a specific purpose that helps clarify the status of the business owner and their obligations under the law.

- IC-15R Inclusion Form: This form is necessary for sole proprietors who choose to elect coverage under Maryland's workers' compensation laws. It outlines the decision to become a covered employee and is a critical companion to the IC 02.

- WC-01 Application for Benefits: If a business owner or employee experiences a work-related injury, this form is used to apply for workers' compensation benefits. It details the nature of the injury and the circumstances surrounding it.

- WC-02 Employee's Claim for Compensation: This document is similar to the WC-01 but is specifically for employees. It allows them to claim benefits and outlines the particulars of their situation.

- WC-03 Employer's Report of Injury: Employers use this form to report employee injuries to the Workers' Compensation Commission. It enables timely processing of claims and helps ensure compliance with reporting requirements.

- WC-04 Medical Report Form: When an employee files a claim, this form provides medical documentation related to the injury or occupational disease. It supports the employee's claim and outlines the necessary treatment.

- WC-05 Wage Statement: This form is vital for calculating the benefits owed to an injured employee. It includes the employee's earnings and provides necessary details for determining compensation amounts.

- WC-06 Notice of Temporary Absence: Employers must submit this form if an employee is expected to be absent for more than a specific duration due to injury. It helps track injuries and manage workers’ compensation claims efficiently.

Each of these documents plays an essential role in the workers' compensation process, ensuring proper communication and adherence to legal requirements. Working with these forms correctly can make a significant difference in both the claims process and overall compliance.

Similar forms

- IC-15R Inclusion Form: This document is submitted alongside the IC-02 form. It includes an election by the sole proprietor to become a covered employee under Maryland law, providing confirmation of their insurance status.

- IC-20 Notice of Claim: This form serves as a notification that a claim has been filed for workers’ compensation benefits. Similar to IC-02, it requires specific information about the business and the employee’s status.

- IC-3 Report of Injury: Filed by employers, this report details injuries or conditions that occur at the workplace. It parallels the IC-02 in its emphasis on accurate information and compliance with workers’ compensation laws.

- WC-1 Claim for Workers’ Compensation Benefits: This is the initial claim form for benefits, focusing on claims made by employees. Like the IC-02, it aims for understanding the relationship between the worker and the employer.

- WC-2 Wage Statement: Similar to the IC-02, the WC-2 verifies employees’ earnings while seeking compensation. It ensures accurate wage assessments tied to workers’ compensation claims.

- WC-3 Employer's Report of Injury: This document must be submitted by employers following an employee’s injury. It parallels the IC-02 by detailing employment status and incident specifics.

- IC-31 Termination of Coverage Form: This form notifies the commission when a business no longer wishes to maintain workers’ compensation coverage. It shares similarities with the IC-02 regarding coverage status and legal implications.

Dos and Don'ts

When filling out the Md Wcc Ic 02 form, it's important to ensure accuracy and compliance with state regulations. Below is a list of things you should and shouldn't do:

- Do: Read the entire form carefully before starting.

- Do: Provide accurate personal information, including your name and Social Security Number or FEIN.

- Do: Check the appropriate boxes that accurately represent your status as a covered employee.

- Do: Sign and date the form to affirm the information is true.

- Do: Review the form for completeness before submission.

- Don't: Skip any sections without providing the necessary information.

- Don't: Use outdated versions of the form; always ensure you have the most current version.

- Don't: Leave the signature and date sections blank.

- Don't: Submit the form without a thorough check for errors or omissions.

Misconceptions

Here are some common misconceptions about the Md Wcc Ic 02 form, along with clarifications to enhance understanding:

- Misconception 1: Only employees need to file this form.

- Misconception 2: Anyone can check the coverage box.

- Misconception 3: Submitting this form means I automatically have insurance.

- Misconception 4: This form is not legally binding.

- Misconception 5: This form must be filed every year.

- Misconception 6: I can still operate without insurance if I don’t file this form.

- Misconception 7: The form does not require personal information.

- Misconception 8: Filing this form guarantees benefits.

This form is specifically for sole proprietors. It allows them to declare their status and choose whether or not they want coverage under workers' compensation.

Only sole proprietors who have elected coverage under § 9-227 of the Labor and Employment Article can check the box indicating their status as a covered employee.

Filing the Md Wcc Ic 02 form does not initiate coverage. Sole proprietors must also submit the Inclusion form (IC-15R) to ensure they are covered.

The data provided is affirmed under the penalty of perjury. This means that submitting false information could lead to legal consequences.

The form has an effective and expiration date. It only needs to be filed again if a new election is made or if the coverage status changes.

If a sole proprietor hires employees, obtaining workers' compensation insurance is mandatory, even if they choose not to cover themselves.

The form requires the sole proprietor’s name, Social Security Number or FEIN, and address. This information is necessary for proper identification.

Filing the form does not guarantee that claims will be paid. Benefits are subject to the terms of the policy and applicable law.

Key takeaways

Here are key takeaways regarding the filling out and using the Md Wcc Ic 02 form:

- Purpose: This form is used to indicate whether a sole proprietor wishes to be considered a covered employee under Maryland's Workers' Compensation laws.

- Eligibility: Only sole proprietors doing business in Maryland need to fill out this form.

- Check Options: You must check the appropriate box that represents your status regarding workers' compensation coverage.

- Elections: If you choose to become a covered employee, ensure you have submitted the requisite Inclusion form (IC-15R).

- Hiring Employees: If you hire employees in the future, obtaining workers' compensation insurance for them is mandatory.

- Identification: Include your name and either your Social Security Number or Federal Employer Identification Number (FEIN) when completing the form.

- Address Details: Ensure your address is complete and accurate. This includes the street, city, state, and zip code.

- Affirmation: By signing the form, you affirm under penalty of perjury that the information you provided is true.

- Effective Dates: Specify the effective and expiration dates for which the information is relevant.

- Submission: After filling out the form, submit it to the Maryland Workers’ Compensation Commission for processing.

Completing this form accurately is crucial for compliance with state regulations. You can seek assistance if you have any questions about the process or content.

Browse Other Templates

Incident Report - Any treatments given right after the incident should be noted.

Louisiana Overweight Permit Cost - Payment options make it flexible for applicants to submit fees as required.