Fill Out Your Merrill Lynch Trustee Certification Form

The Merrill Lynch Trustee Certification form serves as a critical legal and operational tool that assists trustees in managing trust accounts effectively. Designed for domestic revocable and irrevocable trusts, the form ensures that trustees meet specific requirements when establishing accounts with Merrill Lynch, Pierce, Fenner & Smith Incorporated. Key components of the form include declarations of the trust's legal standing, the identification of all current trustees, and details about the grantor or decedent, depending on how the trust was created. Additionally, the form outlines the responsibilities and authority granted to trustees, such as the ability to make distributions, manage investments, and delegate discretionary duties to investment advisors. It emphasizes the collective agreement needed among trustees to issue instructions regarding the trust's assets and provides mechanisms for addressing situations like trustee resignation or incapacity. The form also includes provisions that protect Merrill Lynch by limiting its liability related to trust activities, while requiring notarization of signatures to validate the certification. The comprehensive nature of the form underscores its importance in maintaining compliance and ensuring effective trust management.

Merrill Lynch Trustee Certification Example

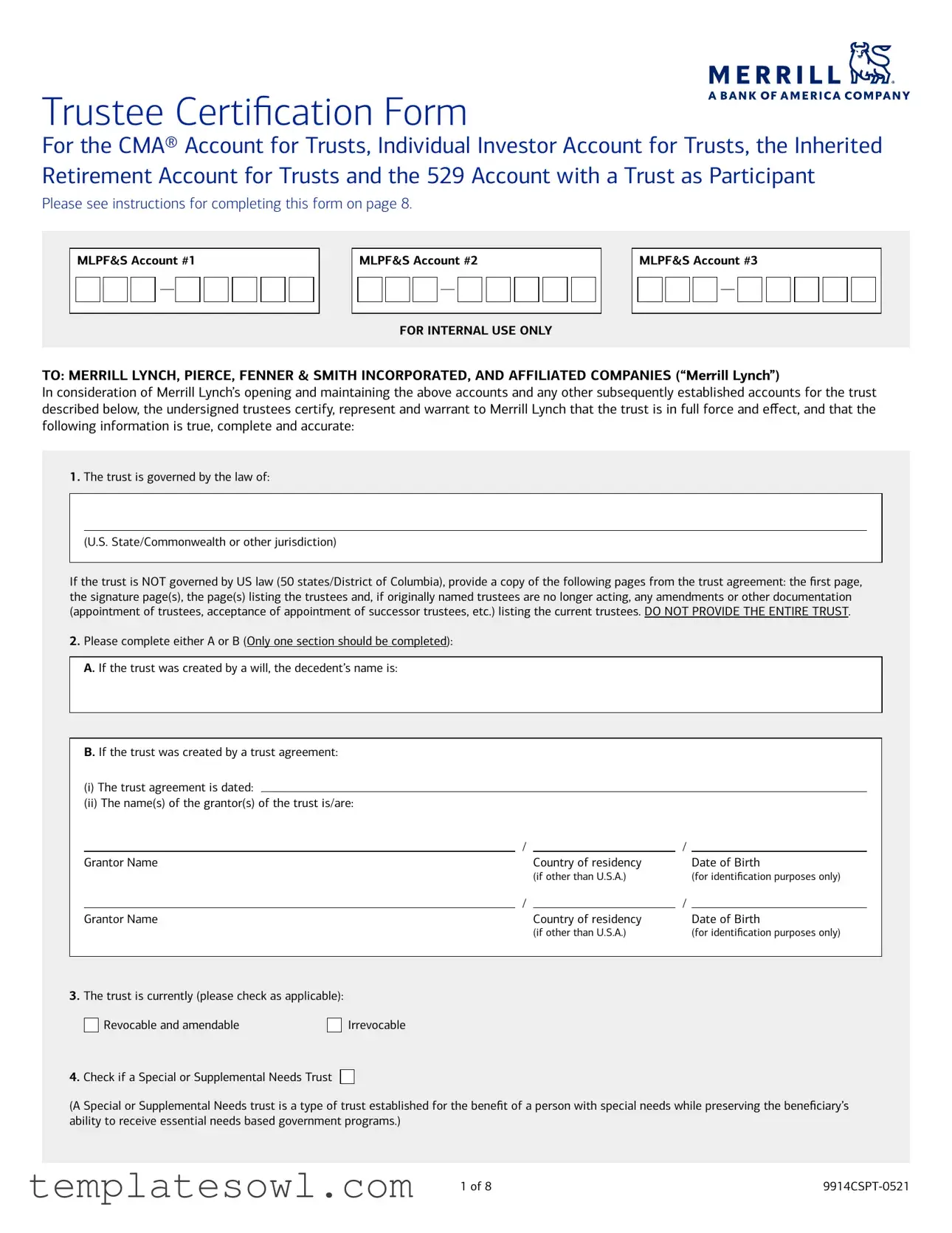

Trustee Certification Form

For the CMA® Account for Trusts, Individual Investor Account for Trusts, the Inherited Retirement Account for Trusts and the 529 Account with a Trust as Participant

Please see instructions for completing this form on page 8.

MLPF&S Account #1

MLPF&S Account #2

FOR INTERNAL USE ONLY

MLPF&S Account #3

TO: MERRILL LYNCH, PIERCE, FENNER & SMITH INCORPORATED, AND AFFILIATED COMPANIES (“Merrill Lynch”)

In consideration of Merrill Lynch’s opening and maintaining the above accounts and any other subsequently established accounts for the trust described below, the undersigned trustees certify, represent and warrant to Merrill Lynch that the trust is in full force and effect, and that the following information is true, complete and accurate:

1.The trust is governed by the law of:

(U.S. State/Commonwealth or other jurisdiction)

If the trust is NOT governed by US law (50 states/District of Columbia), provide a copy of the following pages from the trust agreement: the first page, the signature page(s), the page(s) listing the trustees and, if originally named trustees are no longer acting, any amendments or other documentation (appointment of trustees, acceptance of appointment of successor trustees, etc.) listing the current trustees. DO NOT PROVIDE THE ENTIRE TRUST.

2.Please complete either A or B (Only one section should be completed):

A.If the trust was created by a will, the decedent’s name is:

B.If the trust was created by a trust agreement:

(i)The trust agreement is dated:

(ii)The name(s) of the grantor(s) of the trust is/are:

|

/ |

|

/ |

|

Grantor Name |

|

Country of residency |

|

Date of Birth |

|

|

(if other than U.S.A.) |

|

(for identification purposes only) |

|

/ |

|

/ |

|

Grantor Name |

|

Country of residency |

|

Date of Birth |

|

|

(if other than U.S.A.) |

|

(for identification purposes only) |

3.The trust is currently (please check as applicable):

Revocable and amendable |

|

Irrevocable |

4.Check if a Special or Supplemental Needs Trust

(A Special or Supplemental Needs trust is a type of trust established for the benefit of a person with special needs while preserving the beneficiary’s ability to receive essential needs based government programs.)

1 of 8 |

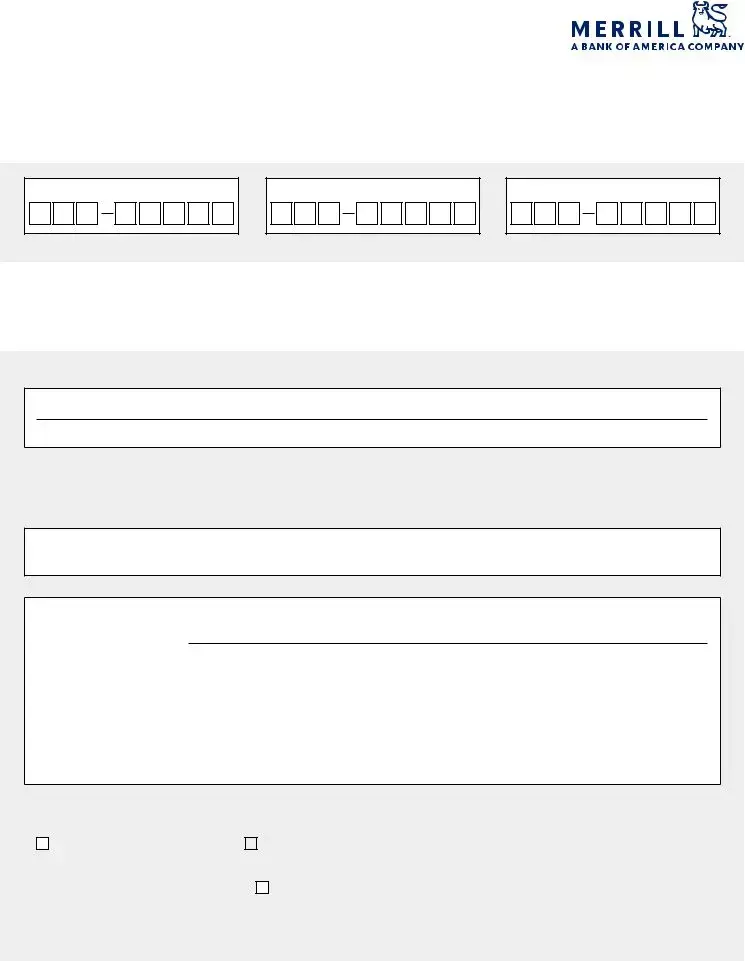

5.The names of all current trustees are: (If trustee is an entity, documentation indicating authorized individuals of entity, such as Corporate Resolution or Certificate of Incumbency, will be required)

A. |

|

/ |

|

|

|

|

Country of residency |

B. |

|

/ |

|

|

|

|

Country of residency |

C. |

|

/ |

|

|

|

|

Country of residency |

D. |

|

/ |

|

|

|

|

Country of residency |

Please print the name, address, and telephone number of an individual that Merrill Lynch may contact in the event a trustee resigns, becomes incapacitated or dies:

Name

Address |

Phone |

6.For trusts with more than one trustee only – All trustees initial this section if pursuant to the terms of the trust, when one or more of the

7.The trust or applicable law authorizes the trustees and any authorized agents to make distributions or transfers of trust funds, securities, or other assets by check, debit card, credit card, or other means (including

8.The trust or applicable law authorizes the trustees and any authorized agents (i) to enter into cash transactions for the purchase and sale of securities of all types (including buying and writing covered equity put/call options and buying index put/call options) and other investments available through Merrill Lynch, and (ii) (for trusts governed by U.S. law only) to purchase and own life insurance and annuity contracts and to exercise all rights associated with the ownership of life insurance and annuity contracts held in or linked to an account at Merrill Lynch, including but not limited

to, surrendering the contract, withdrawing available contract values, borrowing against contract values and otherwise encumbering the contract, assigning the contract and making designations of beneficiaries. The trustees understand and agree that it is the obligation of the trustees to ensure that any investment restrictions and/or requirements that govern the trust/trust assets are followed. The trustees further acknowledge and agree that Merrill Lynch and its employees or agents are not responsible for determining whether the trust is subject to any investment restrictions or requirements.

9.COMPLETE THIS SECTION ONLY IF THE TRUST IS REVOCABLE AND THE GRANTOR IS A CURRENT TRUSTEE. The trust also authorizes the following activities or, to the extent necessary, this paragraph 9 shall be deemed to amend the trust to allow such activities. All current trustees must initial those that apply in spaces provided:

A.Margin transactions including short sales

B.Margin transactions including short sales, uncovered put/call options, spreads, straddles and combinations, whether index or equity

2 of 8 |

10.If the trustee(s) executes an investment management contract or power of attorney delegating the performance of investment management or other duties and authorizes the compensation of such advisors or agents or payment of related fees, charges and expenses to be assessed or deducted from trust assets, the trustee(s) represents and warrants that such delegation and payments are authorized by the trust document and/or applicable law, the trustees have filed necessary statements or elections with governmental authorities, and have provided timely written notice to all beneficiaries eligible to receive income from the trust of this delegation. The consent of no party other than the trustees is required to vest investment discretion in investment advisors or other agents engaged by the trustees. If, at any time, an investment advisor or other agent not affiliated with Merrill Lynch’s programs or services, is granted discretionary authority over the trust, Merrill Lynch is authorized to act upon the instructions of such investment advisor or other agent to the extent authorized in a properly executed power of attorney. (Please submit power of attorney).

11.The trustees represent, warrant and agree that Merrill Lynch is authorized for all purposes regarding the trust’s accounts to follow the instructions of any one trustee. If there is more than one trustee, the trustees agree that it is their responsibility to agree among themselves before giving any instructions to Merrill Lynch for the trust’s accounts, if required by the trust instrument or applicable law, and that Merrill Lynch may conclusively presume that any one trustee who provides instructions to Merrill Lynch has obtained such agreement. Merrill Lynch shall be entitled to assume the existence of a trust power and the proper exercise of a trust power by any trustee without inquiry. Merrill Lynch, its employees or agents shall have no responsibility to assure the proper application of trust funds, securities or other assets by any trustee. In the event Merrill Lynch receives inconsistent instructions from two or more trustees, reasonably believes instructions received from one trustee are not mutually agreeable to all trustees, or receives a court order with respect to the account, Merrill Lynch may, but is not obligated to, restrict activity in the trust account, require that all instructions be in writing signed by all trustees, restrict/suspend activity in and from the trust account or terminate the account and/or file an interpleader action in an appropriate court at the expense of the trust.

The trustees are responsible for providing Merrill Lynch with the correct tax identification number for the trust and for contacting Merrill Lynch with any change to that number. A change in that number may result in the requirement that a new account be opened. Any purchase or sale in a trust account utilizing a Social Security number of a deceased person will be reported to the I.R.S under that Social Security number and the

12.The trustees represent and warrant that none of the beneficiaries of the trust are business organizations operating for profit such as corporations, partnerships, limited liability companies, associations or business trusts.

13.The trustees agree, jointly and severally, to indemnify Merrill Lynch, its employees, directors and agents to hold them harmless from any liabilities and expenses that arise from following the instructions of any trustee, or of any authorized investment advisors or agents, or that otherwise arise from Merrill Lynch’s reliance on the representations, warranties and agreements included in this Trustee Certification Form. This agreement to indemnify Merrill Lynch shall survive termination of the trust or of the accounts.

14.The trustees agree to provide a new Trustee Certification Form to Merrill Lynch in the event that any of these representations, warranties, agreements, or certifications change, or if they may no longer be relied upon by Merrill Lynch.

15.The trustees agree that Merrill Lynch may rely upon this Trustee Certification Form (and any copies thereof) until Merrill Lynch and any investment advisors or other agents receive a new Trustee Certification Form, executed by all

Merrill Lynch may, but need not, require current Letters of Trusteeship.

Except where it would be inconsistent to do so, words and phrases used in this document should be interpreted so the singular includes the plural and the plural includes the singular.

3 of 8 |

Signatures of Trustees (All Current trustees must sign and, for trusts governed by U.S. law (50 states/District of Columbia), all trustee signatures must be notarized.)

ACKNOWLEDGEMENT

Notary Page for use in all jurisdictions EXCEPT CA, CO, FL, IA, ID, MI, MN, MS, NE, NV, SD, TN and VT

(For CO, IA, ID, MI, MN, MS, NE, NV, SD, TN and VT notaries use pg. 5, for CA notaries use pg. 6, and for FL notaries use pg. 7)

A. Agreed and Certified to this ___________________________ day of ________________________________ year of ___________________________

Signature of Trustee: __________________________________________________________________________________________________________

Please Note That All Fields, Including The Boxes Below, Must Be Completed By The Notary (Or The Document Will Be Rejected).

This Acknowledgement May Not Be Used By California Notaries. California Notaries Are To Use The Attached Acknowledgement Or The Notarial Acknowledgment Available On The California Secretary Of State Website.

NOTARY ACKNOWLEDGEMENT:

State of ____________________________________________________ County of _________________________________________________________

The foregoing instrument was acknowledged before me, a Notary Public, this ________________ day of __________________________, 20_____, by

________________________________, the person whose name is subscribed to within this instrument and acknowledged to me that he/she executed

Insert Signer’s Name, NOT Notary’s Name

the same in his/her authorized capacity.

PLEASE CHECK ONE OF THE FOLLOWING (REQUIRED):

Personally known or |

|

Produced the following type of identification: ______________________________________________________ |

______________________________________________________________________________________________________________________________

WITNESS my hand and official seal

_______________________________________________________________ |

_____________________________________________________________ |

Signature of Notary Public |

Print Name of Notary Public |

My commission expires: ____________________________________________________________________________________________________ (Seal)

*All signatures must be acknowledged by a Notary Public. Copy this page as needed.

B. Agreed and Certified to this ___________________________ day of ________________________________ year of ___________________________

Signature of Trustee: __________________________________________________________________________________________________________

Please Note That All Fields, Including The Boxes Below, Must Be Completed By The Notary (Or The Document Will Be Rejected).

This Acknowledgement May Not Be Used By California Notaries. California Notaries Are To Use The Attached Acknowledgement Or The Notarial Acknowledgment Available On The California Secretary Of State Website.

NOTARY ACKNOWLEDGEMENT:

State of ____________________________________________________ County of _________________________________________________________

The foregoing instrument was acknowledged before me, a Notary Public, this ________________ day of __________________________, 20_____, by

________________________________, the person whose name is subscribed to within this instrument and acknowledged to me that he/she executed

Insert Signer’s Name, NOT Notary’s Name

the same in his/her authorized capacity.

PLEASE CHECK ONE OF THE FOLLOWING (REQUIRED):

Personally known or |

|

Produced the following type of identification: ______________________________________________________ |

______________________________________________________________________________________________________________________________

WITNESS my hand and official seal

_______________________________________________________________ |

_____________________________________________________________ |

Signature of Notary Public |

Print Name of Notary Public |

My commission expires: ____________________________________________________________________________________________________ (Seal)

*All signatures must be acknowledged by a Notary Public. Copy this page as needed.

MLPF&S Account #1

MLPF&S Account #2

MLPF&S Account #3

FOR INTERNAL USE ONLY

4 of 8 |

Signatures of Trustees (All Current trustees must sign and, for trusts governed by U.S. law (50 states/District of Columbia), all trustee signatures must be notarized.)

JURAT/AFFIDAVIT

Notary Page for use in CO, IA, ID, MI, MN, MS, NE, NV, SD, TN and VT

A. Agreed and Certified to this ___________________________ day of ________________________________ year of ___________________________

Signature of Trustee: __________________________________________________________________________________________________________

Please Note That All Fields, Including The Boxes Below, Must Be Completed By The Notary (Or The Document Will Be Rejected). Signature date and notary date must be the same.

NOTARY JURAT AND AFFIDAVIT FORM:

State of ____________________________________________________ County of ______________________________________________________

Signed and sworn to (or affirmed) before me this ___________________ day of ___________________________________, 20_____,

by ___________________________________, Trustee.

Insert Signer’s Name, NOT Notary’s Name

PLEASE CHECK ONE OF THE FOLLOWING (REQUIRED):

Personally known or |

|

Produced the following type of identification: ______________________________________________________ |

______________________________________________________________________________________________________________________________

WITNESS my hand and official seal

_______________________________________________________________ |

_____________________________________________________________ |

Signature of Notary Public |

Print Name of Notary Public |

My commission expires: _____________________________________________________________________________________________________(Seal)

*All signatures must be acknowledged by a Notary Public. Copy this page as needed.

B. Agreed and Certified to this ___________________________ day of ________________________________ year of ___________________________

Signature of Trustee: __________________________________________________________________________________________________________

Please Note That All Fields, Including The Boxes Below, Must Be Completed By The Notary (Or The Document Will Be Rejected). Signature date and notary date must be the same.

NOTARY JURAT AND AFFIDAVIT FORM:

State of ____________________________________________________ County of ______________________________________________________

Signed and sworn to (or affirmed) before me this ___________________ day of ___________________________________, 20_____,

by ___________________________________, Trustee.

Insert Signer’s Name, NOT Notary’s Name

PLEASE CHECK ONE OF THE FOLLOWING (REQUIRED):

Personally known or |

|

Produced the following type of identification: ______________________________________________________ |

______________________________________________________________________________________________________________________________

WITNESS my hand and official seal

_______________________________________________________________ |

_____________________________________________________________ |

Signature of Notary Public |

Print Name of Notary Public |

My commission expires: _____________________________________________________________________________________________________(Seal)

*All signatures must be acknowledged by a Notary Public. Copy this page as needed.

MLPF&S Account #1

MLPF&S Account #2

MLPF&S Account #3

FOR INTERNAL USE ONLY

5 of 8 |

Signatures of Trustees (All Current trustees must sign and, for trusts governed by U.S. law (50 states/District of Columbia), all trustee signatures must be notarized.)

NOTARY PAGE FOR CALIFORNIA

Please note that all fields, including the boxes below, must be completed by the Notary Public or the document will be returned. This acknowledgement must be used by notaries in California.

A. Agreed and Certified to thisday ofyear of

Signature of Trustee:

NOTARY PAGE FOR CALIFORNIA ACKNOWLEDGMENT

A notary public or other officer completing this certificate verifies only the identity of the individual who signed the document to which this certificate is attached, and not the truthfulness, accuracy, or validity of that document.

State of California, County of |

|

|

, |

|||

|

|

|

|

|

|

|

On |

|

before me, |

, |

|||

|

|

|

|

|

(Insert name and title of the officer) |

|

personally appeared |

|

|

|

, |

||

|

|

|

|

|

(Insert name of Trustee) |

|

who proved to me on the basis of satisfactory evidence to be the person(s) whose name(s) is/are subscribed to the within instrument and acknowledged to me that he/she/they executed the same in his/her/their authorized capacity(ies), and that by his/her/their signature(s) on the instrument the person(s), or the entity upon behalf of which the person(s) acted, executed the instrument.

I certify under PENALTY OF PERJURY under the laws of the State of California that the foregoing paragraph is true and correct. WITNESS my hand and official seal.

Signature |

|

|

|

|

(Seal) |

|||||

*All signatures must be acknowledged by a Notary Public. Copy this page as needed. |

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

B. Agreed and Certified to this |

|

day of |

|

year of |

||||||

Signature of Trustee: |

|

|

|

|

|

|

|

|

|

|

NOTARY PAGE FOR CALIFORNIA ACKNOWLEDGMENT

A notary public or other officer completing this certificate verifies only the identity of the individual who signed the document to which this certificate is attached, and not the truthfulness, accuracy, or validity of that document.

State of California, County of |

|

|

, |

|||

|

|

|

|

|

|

|

On |

|

before me, |

, |

|||

|

|

|

|

|

(Insert name and title of the officer) |

|

personally appeared |

|

|

|

, |

||

|

|

|

|

|

(Insert name of Trustee) |

|

who proved to me on the basis of satisfactory evidence to be the person(s) whose name(s) is/are subscribed to the within instrument and acknowledged to me that he/she/they executed the same in his/her/their authorized capacity(ies), and that by his/her/their signature(s) on the instrument the person(s), or the entity upon behalf of which the person(s) acted, executed the instrument.

I certify under PENALTY OF PERJURY under the laws of the State of California that the foregoing paragraph is true and correct. WITNESS my hand and official seal.

Signature |

|

(Seal) |

*All signatures must be acknowledged by a Notary Public. Copy this page as needed. |

|

|

MLPF&S Account #1

MLPF&S Account #2

MLPF&S Account #3

FOR INTERNAL USE ONLY

6 of 8 |

Signatures of Trustees (All Current trustees must sign and, for trusts governed by U.S. law (50 states/District of Columbia), all trustee signatures must be notarized.)

NOTARY PAGE FOR FLORIDA

Please note that all fields, including the boxes below, must be completed by the Notary Public or the document will be returned. This acknowledgement must be used by notaries in Florida.

A. Agreed and Certified to this ___________________________ day of ________________________________ year of ___________________________

Signature of Trustee: __________________________________________________________________________________________________________

Please Note That All Fields, Including The Boxes Below, Must Be Completed By The Notary (Or The Document Will Be Rejected). This Acknowledgement May Not Be Used By California Notaries. California Notaries Are To Use The Attached Acknowledgement Or The Notarial Acknowledgment Available On The California Secretary Of State Website.

NOTARY ACKNOWLEDGEMENT: |

|

|

State of Florida, County of __________________________________________________. |

|

|

The foregoing instrument was acknowledged before me, a Notary Public, by means of (check one) |

physical presence or |

online notarization, |

this ___________________ day of ___________________________________, 20_____, by ___________________________________, the person

Insert Signer’s Name, NOT Notary’s Name

whose name is subscribed to within this instrument and acknowledged to me that he/she executed the same in his/her authorized capacity.

PLEASE CHECK ONE OF THE FOLLOWING (REQUIRED):

Personally known or |

|

Produced the following type of identification: ______________________________________________________ |

______________________________________________________________________________________________________________________________

WITNESS my hand and official seal

_______________________________________________________________ |

_____________________________________________________________ |

Signature of Notary Public |

Print Name of Notary Public |

My commission expires: ____________________________________________________________________________________________________ (Seal)

*All signatures must be acknowledged by a Notary Public. Copy this page as needed.

B. Agreed and Certified to this ___________________________ day of ________________________________ year of ___________________________

Signature of Trustee: __________________________________________________________________________________________________________

Please Note That All Fields, Including The Boxes Below, Must Be Completed By The Notary (Or The Document Will Be Rejected). This Acknowledgement May Not Be Used By California Notaries. California Notaries Are To Use The Attached Acknowledgement Or The Notarial Acknowledgment Available On The California Secretary Of State Website.

NOTARY ACKNOWLEDGEMENT: |

|

|

State of Florida, County of __________________________________________________. |

|

|

The foregoing instrument was acknowledged before me, a Notary Public, by means of (check one) |

physical presence or |

online notarization, |

this ___________________ day of ___________________________________, 20_____, by ___________________________________, the person

Insert Signer’s Name, NOT Notary’s Name

whose name is subscribed to within this instrument and acknowledged to me that he/she executed the same in his/her authorized capacity.

PLEASE CHECK ONE OF THE FOLLOWING (REQUIRED):

Personally known or |

|

Produced the following type of identification: ______________________________________________________ |

______________________________________________________________________________________________________________________________

WITNESS my hand and official seal

_______________________________________________________________ |

_____________________________________________________________ |

Signature of Notary Public |

Print Name of Notary Public |

My commission expires: ____________________________________________________________________________________________________ (Seal)

*All signatures must be acknowledged by a Notary Public. Copy this page as needed.

MLPF&S Account #1

MLPF&S Account #2

MLPF&S Account #3

FOR INTERNAL USE ONLY

7 of 8 |

Instructions

This Trustee Certification Form is for use by trustees of any revocable trust or irrevocable trust to maintain one or more cash securities accounts and by trustees of any grantor revocable living trusts to maintain a margin account or engage in other investment activity. It is not to be used by employee benefit trusts, nominees or business trusts, nor for any trust for which the beneficiaries are business organizations operating for profit such as corporations, partnerships, limited liability companies, associations or business trusts. The Trustee Certification Form is also for use by trustees of revocable or irrevocable trusts for which the trustees delegate the performance of their discretionary duties to an investment advisor(s) or other agent(s).

NAMES OF TRUSTEES – If a change of trustees occurs by death or otherwise, a new Trustee Certification Form must be provided unless section 6 is completed and applicable.

POWER TO MAKE DISTRIBUTIONS/TRANSFERS – The authority of the trustees (and if applicable, the authority of any authorized agents) to make distributions/transfers shall (be understood to) include the power for the trustees and any authorized agents to draw upon the funds, securities or other assets in the account of the trust by check, debit card, credit card, or other means (including

INVESTMENT POWERS – The authority of the trustees of any trust to purchase and sell securities and other investments including options to the extent described in paragraph 8 shall be unrestricted. The authority of the grantor/trustee of a grantor revocable living trust to maintain a margin account and to engage in other activities described in paragraph 9 shall be understood to be unrestricted. Merrill Lynch shall be entitled to assume the existence of a trust power and the proper exercise of a trust power by any trustee (and by any investment advisor or agent appointed by the trustees for the trust) without inquiry. Merrill Lynch shall have no responsibility to assure the proper application of trust funds, securities or other assets by any trustee (or by an agent appointed by the trustees for the trust).

GRANTOR REVOCABLE LIVING TRUSTS – By signing this certification, the trustee of a grantor revocable living trust represents and warrants that he/she/it has full power and authority to direct the transfer of trust assets, and that the grantor has full power and authority to revoke and amend the trust.

SIGNATURES OF TRUSTEES – All trustees must sign this Trustee Certification Form. If there are more than two trustees, use an additional signature page. If only one trustee signs, it shall be a representation that the trust has a single trustee. All trustees are required to sign any account opening documents. This Trustee Certification Form may be signed in counterpart.

INVESTMENT ADVISORS AND AGENTS – If the trustees have designated an investment advisor(s) or other agent outside of Merrill Lynch’s programs or services with discretionary authority over the trust’s funds, securities or other assets, a power(s) of attorney signed by all of the trustees must also be provided (refer to paragraph 10).

NOTARIZATION – For trusts governed by U.S. law (50 states/Washington D.C.), notarization of all trustees’ signatures by a notary public is required. Notarization is not required for trusts governed by the law of other jurisdictions.

Please see applicable notary block pages. Use the notary form that corresponds to the respective jurisdiction as noted on the top of each page. Please note that all fields must be completed or the document will be rejected. California notaries are to use the acknowledgement on page 6 or the notarial acknowledgement available on the California Secretary of State website.

Merrill Lynch reserves the right to request a complete copy of the trust agreement or will at any time. Merrill Lynch may require written authorization of all

Merrill Lynch, Pierce, Fenner & Smith Incorporated (also referred to as “MLPF&S” or “Merrill”) makes available certain investment products sponsored, managed, distributed or provided by companies that are affiliates of Bank of American Corporation (BofA Corp.). MLP&S is a registered

Banking products are provided by Bank of America, N.A., and affiliated banks, Members FDIC and wholly owned subsidiary of BofA Corp. Investment products:

Are Not FDIC Insured

Are Not Bank Guaranteed

May Lose Value

Unless otherwise noted, all trademarks are the property of Bank of America Corporation. ©2021 Bank of America Corporation. All rights reserved.

8 of 8 |

Form Characteristics

| Fact Name | Description |

|---|---|

| Purpose of the Form | This Trustee Certification Form is used by trustees to manage cash and securities accounts for both revocable and irrevocable trusts. |

| Governing Law | The trust must be governed by the laws of a U.S. state or jurisdiction, ensuring compliance with local regulations. |

| Signature Requirement | All current trustees must sign the form and their signatures must be notarized for validation. |

| Investment Powers | The form allows trustees to buy and sell various securities and other investments, giving them significant investment authority. |

| Indemnification Agreement | Trustees agree to indemnify Merrill Lynch against any liabilities arising from following instructions provided by trustees or authorized agents. |

| Authority to Delegate | Trustees are allowed to delegate discretionary investment management duties to designated investment advisors, maintaining control over trust assets. |

Guidelines on Utilizing Merrill Lynch Trustee Certification

Completing the Merrill Lynch Trustee Certification form is essential for trustees managing trust accounts. This process confirms that the necessary details about the trust and trustees are accurately documented. By filling out this form correctly, you provide Merrill Lynch with the critical information they need to manage the trust accounts effectively.

- Begin by filling in the MLPF&S account numbers for the accounts associated with the trust.

- Specify the state or U.S. jurisdiction under which the trust is governed.

- Complete either section A or B:

- If the trust was created under a will, enter the decedent’s name.

- If the trust was created and funded during the grantor’s life:

- Write the date of the trust agreement.

- List the names and dates of birth for all grantors involved.

- Indicate whether the trust is revocable and amendable or irrevocable.

- List the names of all current trustees.

- Provide the contact details of a reliable individual who Merrill Lynch may reach out to if a trustee can no longer serve.

- Confirm that the trust or applicable law allows trustees to make distributions or transfers of trust funds.

- Verify that the trust permits trustees to engage in cash transactions for buying and selling securities.

- If applicable, complete the section about revocable trusts, noting any margin transactions your trustees may approve.

- Ensure that there is a provision for delegation of discretionary investment management duties to advisors or agents.

- Declare that no beneficiaries of the trust consist of for-profit business organizations.

- Agree to indemnify Merrill Lynch and its employees against liabilities resulting from instructions given by trustees.

- Commit to providing a new form if any representation or agreement changes.

- All trustees must sign and date the certification, ensuring notarization is completed for each signature.

What You Should Know About This Form

What is the purpose of the Merrill Lynch Trustee Certification Form?

The Merrill Lynch Trustee Certification Form is used by trustees of revocable or irrevocable trusts to manage accounts with Merrill Lynch. This form certifies the trust's validity and outlines the powers granted to trustees. It ensures that the trustees have the authority to handle investments and make distributions using the trust's assets. It also serves as a notification to Merrill Lynch about the trustees’ roles and responsibilities related to the trust.

Who needs to sign the form?

All current trustees must sign the Merrill Lynch Trustee Certification Form. If there are more than three trustees, additional forms are needed for those signatures. Each trustee's signature is essential as it represents that they are authorized to act on behalf of the trust. Additionally, a notarization of all signatures is required to validate the document and confirm the identities of the trustees.

What information is required to complete the form?

The form requires various details, including the name of the state governing the trust, the names and dates of birth of the grantors, and the current trustees’ names. You also need to indicate whether the trust is revocable or irrevocable. Specific sections require authorization for financial transactions and delegation of investment management duties. Complete and accurate information is crucial to avoid delays or issues with the account management process.

What happens if a trustee changes or if the trust's circumstances change?

If any trustee resigns, becomes incapacitated, or passes away, the trustees must provide an updated Trustee Certification Form to Merrill Lynch. This keeps the information current and ensures that Merrill Lynch has accurate records. It is crucial to notify Merrill Lynch of any changes involving the trust's structure or the trustees’ powers, as outdated information can lead to complications in managing the trust accounts.

Common mistakes

Completing the Merrill Lynch Trustee Certification Form can be a straightforward task, but many individuals stumble over common mistakes that can delay the process or lead to complications. One frequent error is failing to provide complete information about all current trustees. Each trustee's name must be listed clearly, along with their contact details. Omitting a trustee can cause unnecessary confusion and lead to delays in account setup.

Another common issue arises when indicating whether the trust is revocable or irrevocable. Some individuals overlook this step entirely or misidentify the trust's status. This classification is crucial because it impacts the authority of the trustees and the operations of the trust. Incorrect marking could lead to future problems with investment decisions or distributions.

Providing incorrect dates on the trust agreement is another frequent mistake. The form explicitly requires the trust agreement's date if the trust was created and funded during the grantor's life. Failure to accurately include the date may cause uncertainty about the trust's validity and may prompt additional inquiries from Merrill Lynch.

Not understanding the requirements around notarization can also lead to errors. Every trustee's signature must be notarized to authenticate the document. If even one signature is not properly notarized, it could render the entire form incomplete, requiring resubmission.

Omitting contact information for a designated individual in the event a trustee resigns or becomes incapacitated is another mistake often seen. This information ensures that Merrill Lynch has a reliable point of contact to manage trust activities seamlessly, thereby preventing any potential hold-ups.

Additionally, a misunderstanding of the powers granted under the trust can create complications. Some trustees may not adequately indicate their authority to make distributions or engage in investment management. This ambiguity can create legal and procedural issues as trust operations commence.

Trustees often neglect to update Merrill Lynch when changes occur, such as a change in trustee status or an alteration in the trust agreement. Failure to provide a new Trustee Certification Form upon these changes can lead to incorrect assumptions about the trust's operations and could expose the trustees to legal risks.

Inconsistencies in instructions can also lead to problems. If multiple trustees provide conflicting directions to Merrill Lynch without prior agreement, it complicates trust transactions. Each trustee must ensure they are on the same page before communicating with Merrill Lynch to avoid misunderstandings or operational delays.

Lastly, some individuals fail to recognize the importance of carefully reviewing the instructions provided on page 4 of the form. Ignoring these details can result in incomplete submissions or overlooked requirements, ultimately affecting the trust's functioning. Taking time to read and comprehend these guidelines can make completing the form a much smoother process.

Documents used along the form

The Merrill Lynch Trustee Certification form is a crucial document for trustees managing trusts. However, several other documents often accompany it to ensure comprehensive compliance and clarity in the management of trust accounts. Below is a list of documents typically used alongside the Trustee Certification Form.

- Trust Agreement: This foundational document outlines the terms and conditions of the trust. It specifies the roles, responsibilities, and powers of the trustees, as well as guidelines for asset management and distribution to beneficiaries.

- Power of Attorney: This document allows trustees to delegate authority to an individual, enabling them to manage the trust’s assets as per the terms of the trust agreement. A power of attorney is vital when a trustee cannot perform their duties due to incapacity or absence.

- Letter of Trusteeship: Often requested by financial institutions, this letter certifies the current trustees of the trust. It verifies their authority to manage trust assets and can also specify the duration of that authority.

- Beneficiary Designation Forms: These forms outline the beneficiaries entitled to receive distributions from the trust. They often accompany the account to ensure that all parties understand their rights to the trust’s assets.

- Tax Identification Number (TIN) Application: If the trust requires its own TIN for tax purposes, this application must be completed. Having a separate TIN is essential for filing tax returns associated with the trust's income and assets.

- Investment Management Agreement: If trustees hire external investment managers, this document details the terms of engagement, including the scope of authority, fees, and responsibilities of the investment advisor.

- Account Opening Documents: These include various forms and agreements that the trust must complete to establish a new account with Merrill Lynch. They often contain provisions regarding the management and access to the account.

- Notarized Signatures: All documents should have notarized signatures to affirm authenticity. This is especially critical for the Trustee Certification Form, ensuring that all signatures are valid and represent the true will of the trustees.

- Annual Trust Account Statements: These statements summarize the trust's activity over the previous year, including distributions, income, and expenses. They provide transparency and accountability to the beneficiaries.

Understanding these accompanying documents is essential for effective trust management. They collectively ensure that trustees fulfill their obligations while supporting the beneficial interests of the trust's beneficiaries.

Similar forms

- Power of Attorney Document: This document allows one person to act on behalf of another in legal or financial matters. Like the Trustee Certification, it requires the identity and authority of trustees to be established and may involve multiple parties working together.

- Trustee Appointment Certificate: This document certifies the appointment of trustees to manage a trust. Similar to the Trustee Certification Form, it affirms that trust responsibilities are understood and accepted by the appointed individuals.

- Living Trust Declaration: This is a document that creates a living trust, detailing the trust’s terms and the trustee’s powers. Both documents require clarity on the trust's structure and the authorities granted to trustees.

- Affidavit of Trustee Powers: This affidavit establishes a trustee’s authority to manage trust assets. It shares the necessity of verifying the legitimacy of actions taken on behalf of the trust, akin to the assurances made in the Trustee Certification Form.

- Revocable Trust Agreement: This document details the terms under which a revocable trust operates. Just like the Trustee Certification, it defines the powers of the trustees and addresses the revocation process if applicable.

- Memorandum of Trust: This is a summary of key provisions of a trust agreement. It provides necessary information to institutions, similar to what is done in the Trustee Certification Form for identifying trustees and their powers.

- Letter of Instruction for Trust Distribution: This letter guides the distribution of trust assets. It, like the Trustee Certification, outlines the authorities of the trustees in making distributions to beneficiaries.

- Trust Account Application: This document is used to open a financial account in the name of a trust. It requires similar verification of trustee authority and account management, echoing the requirements of the Trustee Certification Form.

- Investment Management Agreement: This agreement outlines the relationship between trustees and investment advisors. Similar to the Trustee Certification, it details the authority granted to third parties for managing trust assets.

Dos and Don'ts

When filling out the Merrill Lynch Trustee Certification form, there are several best practices to follow and common mistakes to avoid. Below are five key do's and don'ts:

- Do read the instructions carefully before you begin.

- Do ensure that all current trustees sign the form.

- Do provide complete and accurate information for each section.

- Do have all signatures notarized to validate the document.

- Do notify Merrill Lynch of any changes regarding trustees or the trust.

- Don't assume that one signature is sufficient if multiple trustees exist.

- Don't leave sections blank; incomplete forms may lead to delays.

- Don't forget to include the date of birth for grantors if required.

- Don't neglect to provide contact information for someone in case a trustee is unavailable.

- Don't wait until the last minute to submit the form; allow time for processing.

Misconceptions

Understanding the Merrill Lynch Trustee Certification form is essential for those managing a trust. However, many people have misconceptions about it that can lead to confusion. Here are five common misconceptions clarified:

- It's only for revocable trusts. Many believe the form is only applicable to revocable trusts. In reality, it is designed for both revocable and irrevocable trusts, allowing for comprehensive management regardless of the trust type.

- Not all trustees need to sign. Some individuals think that if one trustee signs the form, it's sufficient. This is not the case. All current trustees must sign, ensuring that everyone's agreement is obtained for the trust's actions.

- Merrill Lynch is responsible for verifying trustee actions. A misconception exists that Merrill Lynch will ensure trustees properly manage trust assets. However, the form states that Merrill Lynch is not responsible for monitoring the application of trust funds. It’s the trustees' duty to manage the trust responsibly.

- You can skip notarization if you have multiple trustees. Some may think notarization isn't necessary if there are multiple trustees involved. However, every trustee's signature must be notarized, regardless of the number of trustees, to validate the form.

- The form is only about establishing accounts. While the form does facilitate account establishment, it also serves other purposes. This includes granting investment powers and outlining the responsibilities and limitations of the trustees, making it a crucial document for ongoing trust management.

By clearing up these misconceptions, trustees can navigate the completion and submission of the Merrill Lynch Trustee Certification form with greater confidence and clarity.

Key takeaways

Ensure that all sections of the Trustee Certification Form are completed accurately. Incomplete forms may result in delays or complications in account setup.

Notarization is mandatory for the signatures of all current trustees. This adds an essential layer of authenticity to the document.

The form is specifically for trustees managing revocable and irrevocable trusts and should not be used for employee benefit trusts or trusts governed by foreign laws.

Provide contact information for an individual who can be reached if a trustee resigns, becomes incapacitated, or passes away. This step is crucial for ongoing account management.

Clearly indicate whether the trust is revocable or irrevocable, as this affects the authority granted to the trustees.

Trustees must agree that Merrill Lynch can act on the instructions of any single trustee. This underscores the importance of clear communication and agreement among all trustees.

Browse Other Templates

Spectrum Contract Buyout - Receiving funds through the Charter Contract Buyout Form is a straightforward and effective process.

Scac Code Trucking - SCAC codes help streamline operations within logistics and transportation networks.