Fill Out Your Met Life Stock Transfer Form

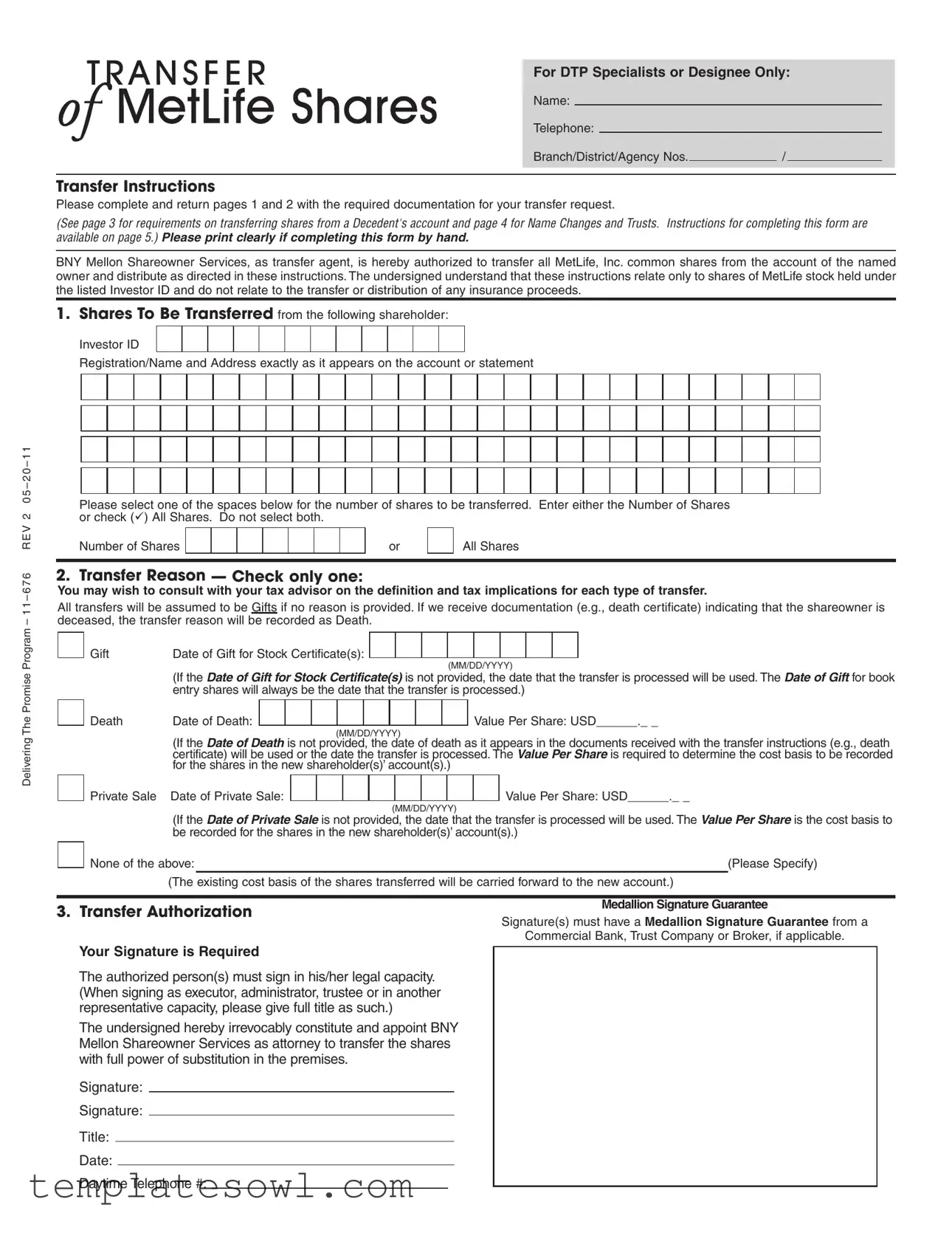

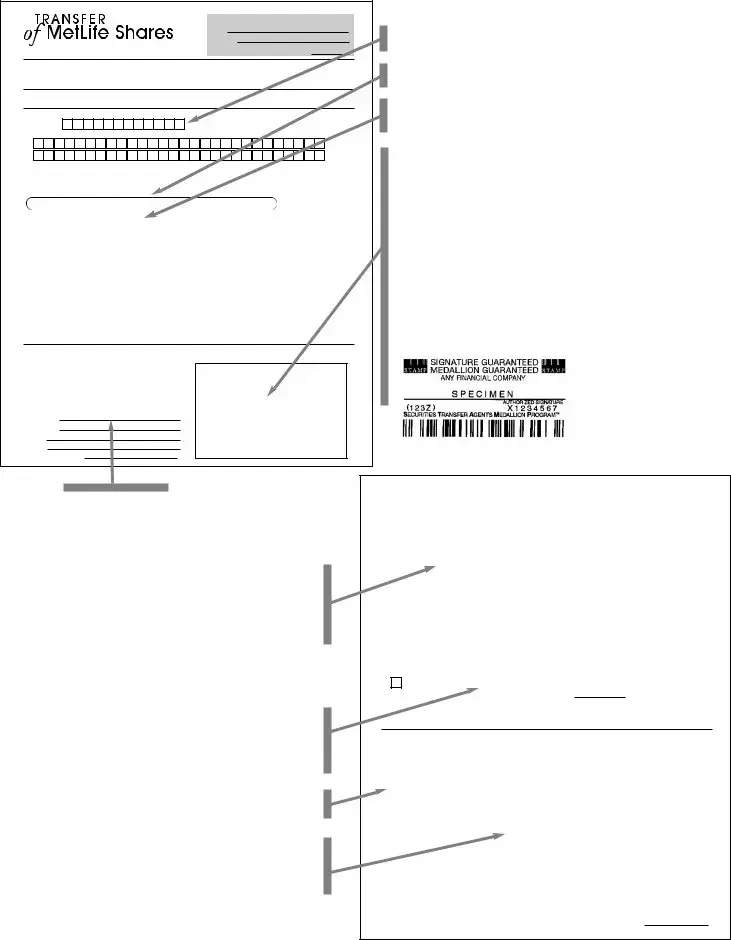

When it comes to transferring shares of MetLife, the Met Life Stock Transfer form is an essential document that guides shareholders through the process. This form is specifically designed to facilitate the transfer of MetLife, Inc. common shares and requires careful attention to detail. It starts with basic information about the transferring shareholder, including their Investor ID, name, and address, ensuring that all details align with existing account records. The form further prompts users to indicate whether they want to transfer a specific number of shares or all shares, emphasizing the importance of clarity in the request. Transfer reasons must also be selected, with options ranging from gifts to private sales, and in instances of death, appropriate documentation is necessary. Signature requirements are stringent, necessitating authorized signatures along with Medallion Signature Guarantees from recognized financial institutions. Additionally, the second page of the form captures nuances like new shareholder information and taxpayer ID certification, which are crucial for tax reporting purposes. For those managing estates or trusts, specific instructions and additional documentation may be required, reflecting the potential complexities involved in the transfer of shares. In summary, the Met Life Stock Transfer form is a comprehensive tool that helps navigate the intricacies of transferring MetLife shares while ensuring compliance with regulatory standards.

Met Life Stock Transfer Example

Delivering The Promise Program – 1 1 – 6 7 6 R E V 2 0 5 – 2 0 – 1 1

For DTP Specialists or Designee Only:

Name:

Telephone:

Branch/District/Agency Nos. |

|

/ |

|

Transfer Instructions

Please complete and return pages 1 and 2 with the required documentation for your transfer request.

(See page 3 for requirements on transferring shares from a Decedent's account and page 4 for Name Changes and Trusts. Instructions for completing this form are

available on page 5.) Please print clearly if completing this form by hand.

BNY Mellon Shareowner Services, as transfer agent, is hereby authorized to transfer all MetLife, Inc. common shares from the account of the named owner and distribute as directed in these instructions. The undersigned understand that these instructions relate only to shares of MetLife stock held under the listed Investor ID and do not relate to the transfer or distribution of any insurance proceeds.

1.Shares To Be Transferred from the following shareholder:

Investor ID

Registration/Name and Address exactly as it appears on the account or statement

Please select one of the spaces below for the number of shares to be transferred. Enter either the Number of Shares or check () All Shares. Do not select both.

Number of Shares |

|

|

|

|

|

|

|

or |

|

All Shares |

|

|

|

|

|

|

|

|

|

|

|

2. Transfer Reason — Check only one:

You may wish to consult with your tax advisor on the definition and tax implications for each type of transfer.

All transfers will be assumed to be Gifts if no reason is provided. If we receive documentation (e.g., death certificate) indicating that the shareowner is deceased, the transfer reason will be recorded as Death.

Gift |

Date of Gift for Stock Certificate(s): |

(MM/DD/YYYY)

(If the Date of Gift for Stock Certificate(s) is not provided, the date that the transfer is processed will be used. The Date of Gift for book entry shares will always be the date that the transfer is processed.)

Death |

Date of Death: |

|

|

|

|

|

|

|

|

Value Per Share: USD______._ _ |

|

|

|

|

|

|

|

|

(MM/DD/YYYY)

(If the Date of Death is not provided, the date of death as it appears in the documents received with the transfer instructions (e.g., death certificate) will be used or the date the transfer is processed. The Value Per Share is required to determine the cost basis to be recorded for the shares in the new shareholder(s)’ account(s).)

Private Sale Date of Private Sale: |

|

|

|

|

|

|

|

|

Value Per Share: USD______._ _ |

|

|

|

|

|

|

|

|

(MM/DD/YYYY)

(If the Date of Private Sale is not provided, the date that the transfer is processed will be used. The Value Per Share is the cost basis to be recorded for the shares in the new shareholder(s)’ account(s).)

None of the above: |

|

(Please Specify) |

(The existing cost basis of the shares transferred will be carried forward to the new account.) |

|

|

3.Transfer Authorization

Your Signature is Required

The authorized person(s) must sign in his/her legal capacity. (When signing as executor, administrator, trustee or in another representative capacity, please give full title as such.)

The undersigned hereby irrevocably constitute and appoint BNY Mellon Shareowner Services as attorney to transfer the shares with full power of substitution in the premises.

Signature:

Signature:

Title:

Date:

Daytime Telephone #:

Medallion Signature Guarantee

Signature(s) must have a Medallion Signature Guarantee from a

Commercial Bank, Trust Company or Broker, if applicable.

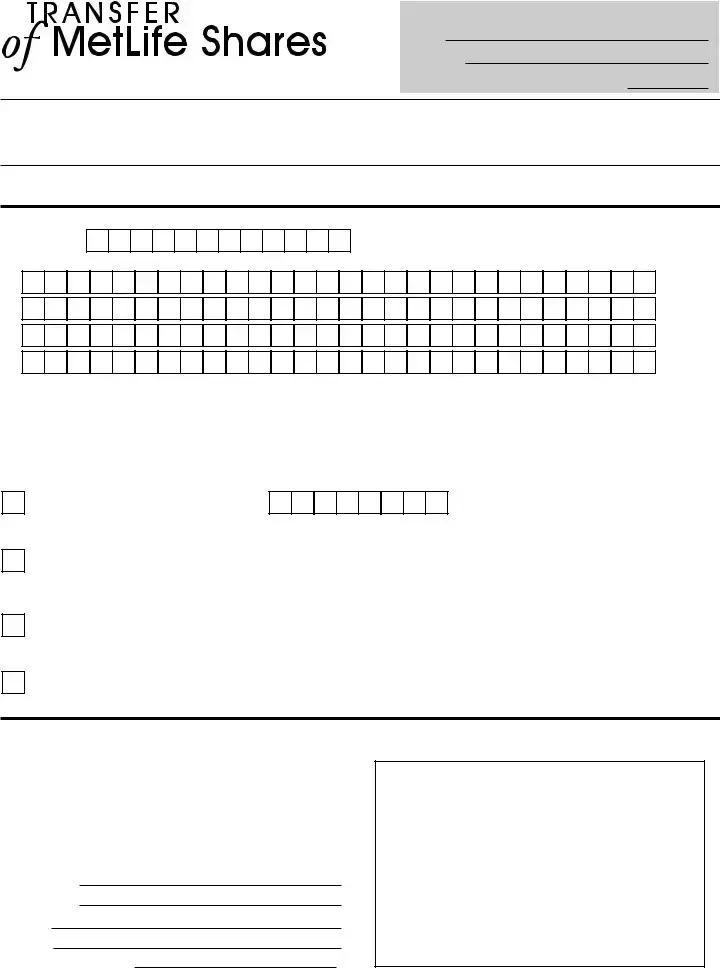

New MetLife Shareholder Account Information

4. New Shareholder’s Account Information

Page 2

(If you wish to divide the shares between two or more owners individually, please use additional copies of this page specifying the total shares per account. Please note that all shares will be held electronically in Book Entry form.)

|

|

|

|

|

|

|

|

|

New Shareholder’s |

|

|

|

|

Shares To Be |

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

Taxpayer ID Number |

|

|

Transferred to This Account |

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

All Shares |

|

||||

Name of New Shareholder (Please refer to the Name Guidelines on Page 4 for Further Information) |

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Name of Joint Owner/Second Trustee/Minor/Other (if applicable) |

Minor’s State of Residence |

|

||||||||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Name of Trust/Estate (if applicable) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Date of Trust |

|

|||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Address of New Shareholder |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(MM/DD/YYYY) |

|

|||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

City |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

State |

|

|

|

Zip Code |

|

||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

5. New Shareholder’s Sale Instructions

(The new shareholder must sign on the signature line in order to sell shares. If this section is left blank or sale instructions unsigned, your MetLife shares will not be sold and will remain in Book Entry form in the new account.)

Sell only the shares received from this transfer

Signature:

Sell all shares currently held in my existing account along with the shares received from this transfer

Date:

All sale transactions will be subject to the terms and conditions described in the Sale Disclosure attached on page 6 and made part of this form. If your shares are held outside the Policyholder Trust in Book Entry form, through the Direct Registration System (DRS), they will be enrolled in the DRS Sales Program, to be sold. Please acknowledge your agree- ment with the foregoing by signing in the space above.

6.Taxpayer ID Certification (Based on Form

YOUR ACCOUNT MAY BE SUBJECT TO BACKUP WITHHOLDING AT THE APPLICABLE RATE IF YOU DO NOT COMPLETE THIS SUBSTITUTE FORM

All new security holders are required to sign and return this certification. If the requested information is not known at the time of the transfer or the new owner is not available to sign, a

Check appropriate box:

Individual/

Sole proprietor

C Corporation

S Corporation

Partnership |

|

Trust/Estate |

Limited liability company. Enter the tax classification (C=C corporation, S=S corporation, P=partnership) ____

Other |

|

|

|

|

|

|

|

(Please Specify) |

||||

New Shareholder’s |

|

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Taxpayer ID Number |

|

|

|

|

|

|

|

|

|

|

|

Under penalties of perjury, I certify that:

1.The number shown on this form is my correct taxpayer identification number (or I am waiting for a number to be issued to me), and

2.I am not subject to backup withholding because: (a) I am exempt from backup withholding, or (b) I have not been notified by the Internal Revenue Service (IRS) that I am subject to backup withholding as a result of a failure to report all interest or dividends, or (c) the IRS has notified me that I am no longer subject to backup withholding, and

3.I am a U.S. citizen or other U.S. person (defined in the instructions).

Certification instructions. You must cross out item 2 above if you have been notified by the IRS that you are currently subject to backup withholding because you have failed to report all interest and dividends on your tax return. For real estate transactions, item 2 does not apply. For mortgage interest paid, acquisition or abandonment of secured property, cancellation of debt, contributions to an individual retirement arrangement (IRA), and generally, payments other than interest and dividends, you are not required to sign the Certification, but you must provide your correct TIN.

Signature of U.S. person: |

|

Date: |

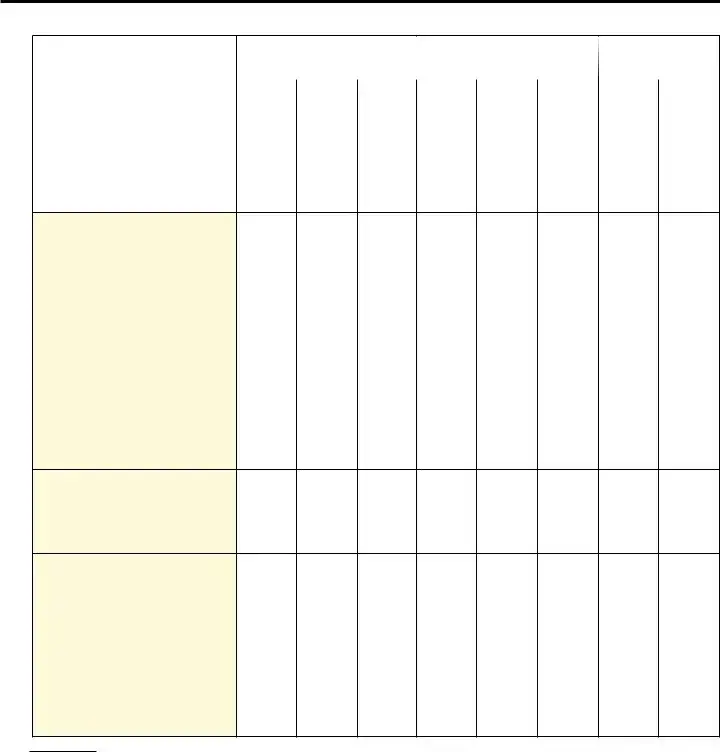

BNY Mellon Shareowner Services Requirements for Transferring MetLife Shares |

Page 3 |

|

|

From a Decedent’s Account

A.Requirements for transferring MetLife shares where the following situations apply:

|

Probated Estates |

Joint Accounts |

|||||||

TRANSFER REQUIREMENTS |

|

|

|

|

|

|

|

|

|

|

MORE |

MORE |

|

MORE |

MORE |

|

|

||

|

50 shares |

than |

50 shares |

than |

250 shares |

MORE |

|||

|

than 250 |

than 250 |

|||||||

|

or Less |

50 up to |

or Less |

50 up to |

or Less |

than 250 |

|||

|

shares |

shares |

|||||||

|

|

250 shares |

|

250 shares |

|

|

|||

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

1. The completed Transfer of |

|

|

|

|

|

|

|

|

|

MetLife Shares form signed by |

● |

● |

● |

▲ |

▲ |

▲ |

■ |

■ |

|

the Executor(s) or the |

|||||||||

|

|

|

|

|

|

|

|

||

Authorized Representative(s). |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2.A certified copy, with original signature and seal affixed, of the

Certificate of Appointment of |

|

▲ or (6) |

▲ |

|

|

Executor(s) dated within one |

|

|

|

|

|

year of the transfer |

|

|

|

|

|

|

|

|

|

|

|

3. A photocopy of the death |

● |

● |

■ |

■ |

|

certificate |

|||||

|

|

|

|

||

|

|

|

|

|

|

4. A completed waiver of |

|

|

|

|

|

Probate or a Small Estate |

|

|

|

|

|

Affidavit with signatures of the |

|

|

|

|

|

surviving tenant(s)/heir(s) |

● or (6) |

● |

|

|

|

notarized. You may contact that |

|

|

|||

|

|

|

|

||

state’s local probate office for |

|

|

|

|

|

applicable small estate |

|

|

|

|

|

procedures.1 |

|

|

|

|

5.In some states an inheritance tax waiver is required. The

waiver can be requested from |

● |

● |

● |

▲ |

▲ |

▲ |

■ |

■ |

the state in which the deceased |

|

|

|

|

|

|

|

|

shareholder lived. |

|

|

|

|

|

|

|

|

6.The completed Transfer of MetLife Shares form must have a

Medallion Signature Guaranteed by a participating commercial bank, trust

company, securities |

● or (4) |

● |

▲ or (2) |

▲ |

■ |

broker/dealer, credit union or |

|

|

|

|

|

savings association |

|

|

|

|

|

participating in a Medallion |

|

|

|

|

|

Program approved by the |

|

|

|

|

|

Securities Transfer Association. |

|

|

|

|

|

1If the deceased shareholder lived in Illinois or California, the following is also required: A completed, notarized Small Estate Affidavit (if estate is valued at less than $100,000).

The new owner will need to call BNY Mellon at

● =

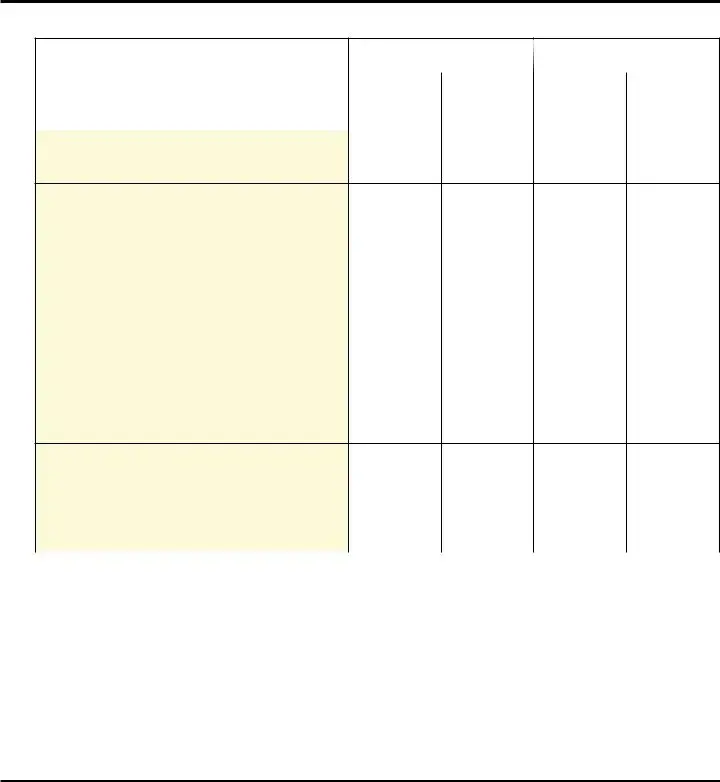

BNY Mellon Shareowner Services Requirements for Transferring MetLife Shares |

Page 4 |

|

|

For Name Changes and Trusts

B.Requirements for transferring MetLife shares where the following situations apply:

|

Name Change |

Trust Account |

|||

|

|

|

|

|

|

TRANSFER REQUIREMENTS |

250 shares |

MORE than |

250 shares |

MORE than |

|

|

|||||

|

or Less |

250 shares |

or Less |

250 shares |

|

|

|

|

|

|

|

1. The completed Transfer of MetLife Shares form |

▲ |

▲ |

● |

● |

|

signed by the registered owner(s). |

|||||

|

|

|

|

||

2.For name changes due to: Include a copy of:

Birth |

Birth Certificate |

▲ |

▲ |

|

Marriage |

Marriage Certificate |

|

|

|

Divorce |

Divorce Decree |

|

|

|

|

|

|

|

|

3. The completed Transfer of MetLife Shares form |

|

|

|

|

must have a Medallion Signature Guaranteed by a |

|

|

|

|

participating commercial bank, trust company, |

|

▲ |

● |

|

securities broker/dealer, credit union or savings |

|

|||

|

|

|

||

association participating in a Medallion Program |

|

|

|

|

approved by the Securities Transfer Association. |

|

|

|

|

|

4. A copy of the first and last page of the Trust |

|

|

|

Agreement specifying the name(s) of the |

● |

● |

|

trustee(s), the date the trust was established and |

||

|

|

|

|

|

the complete title of the trust. |

|

|

|

|

|

|

▲ = Name Change; ● = Trust Account |

|

|

|

|

|

|

|

C.Name Guidelines

•Multiple Ownership – registration types are: Joint Tenancy with Rights of Survivorship (Jt Ten), Tenants in Common (Ten Com), or Tenants by the Entireties (Ten Ent). Use “and” between owners names.

•Trust – name identical to the Trust Agreement, must give Trust Title, Trust Date, and Trustee(s).

•Custodian – name followed by “custodian”, the minor’s name, either UGMA or UTMA and the state of minor's residency.

•Transfer On Death – registration types are “John Doe TOD Jane Smith Subject to STA TOD Rules” or “William Brown and Robert Jones JT TEN TOD James Walker Subject to STA TOD RULES.” Please be advised that not all states allow transfer on death registration.

You should consult with tax/legal counsel to determine which form of ownership is applicable to you.

D. First Class/Registered/Certified Mail |

Overnight/Express Mail (ONLY) |

MetLife |

BNY Mellon Shareowner Services |

c/o BNY Mellon Shareowner Services |

Securities Transfer Services |

P.O. Box 358447 |

500 Ross St., Room |

Pittsburgh, PA 15252 |

Pittsburgh, PA 15262 |

Instructions for completing the MetLife Stock Transfer Form |

Page 5 |

|

|

For DTP Specialists or Designee Only:

Name:

Telephone:

Branch/District/Agency Nos. |

|

/ |

Transfer Instructions

Please complete and return pages 1 and 2 with the required documentation for your transfer request.

(See page 3 for requirements on transferring shares from a Decedent's account and page 4 for Name Changes and Trusts. Instructions for completing this form are

available on page 5.) Please print clearly if completing this form by hand.

BNY Mellon Shareowner Services, as transfer agent, is hereby authorized to transfer all MetLife, Inc. common shares from the account of the named owner and distribute as directed in these instructions. The undersigned understand that these instructions relate only to shares of MetLife stock held under the listed Investor ID and do not relate to the transfer or distribution of any insurance proceeds.

1. Shares To Be Transferred from the following shareholder:

Investor ID

Registration/Name and Address exactly as it appears on the account or statement

0 5 – 2 0 – 1 1 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

Please select one of the spaces below for the number of shares to be transferred. Enter either the Number of Shares |

|||||||||||||||||||||||||||||||||||||

2 |

|||||||||||||||||||||||||||||||||||||

or check () All Shares. Do not select both. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||

R E V |

Number of Shares |

|

|

|

|

|

|

|

|

|

|

|

or |

|

|

All Shares |

|||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

6 |

2. Transfer Reason — Check only one: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||

6 7 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||

You may wish to consult with your tax advisor on the definition and tax implications for each type of transfer. |

|||||||||||||||||||||||||||||||||||||

1– |

All transfers will be assumed to be Gifts if no reason is provided. If we receive documentation (e.g., death certificate) indicating that the shareowner is |

||||||||||||||||||||||||||||||||||||

– 1 |

|||||||||||||||||||||||||||||||||||||

deceased, the transfer reason will be recorded as Death. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||

Program |

|

Gift |

Date of Gift for Stock Certificate(s): |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

|

|

|

|

|

|

(MM/DD/YYYY) |

|||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||

Promise |

|

|

|

|

(If the Date of Gift for Stock Certificate(s) is not provided, the date that the transfer is processed will be used. The Date of Gift for book |

||||||||||||||||||||||||||||||||

|

|

|

|

entry shares will always be the date that the transfer is processed.) |

|||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

The |

|

Death |

Date of Death: |

|

|

|

|

|

|

|

|

|

|

|

|

Value Per Share: USD______._ _ |

|||||||||||||||||||||

|

|

|

|

|

(MM/DD/YYYY) |

|

|||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||

Delivering |

|

|

|

|

(If the Date of Death is not provided, the date of death as it appears in the documents received with the transfer instructions (e.g., death |

||||||||||||||||||||||||||||||||

|

|

|

|

certificate) will be used or the date the transfer is processed. The Value Per Share is required to determine the cost basis to be recorded |

|||||||||||||||||||||||||||||||||

|

|

|

|

for the shares in the new shareholder(s)’ account(s).) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||

|

Private Sale |

Date of Private Sale: |

|

|

|

|

|

|

|

|

|

|

|

Value Per Share: USD______._ _ |

|||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(MM/DD/YYYY) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

(If the Date of Private Sale is not provided, the date that the transfer is processed will be used. The Value Per Share is the cost basis to |

||||||||||||||||||||||||||||||||

|

|

|

|

|

be recorded for the shares in the new shareholder(s)’ account(s).) |

||||||||||||||||||||||||||||||||

|

|

None of the above: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(Please Specify) |

|||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||

|

|

|

|

|

(The existing cost basis of the shares transferred will be carried forward to the new account.) |

||||||||||||||||||||||||||||||||

To avoid delays in processing your request, enter the Investor ID and the complete name and address of the original shareholder.

Write the number of shares you wish to transfer in these blocks or check () the All Shares box. Do not select both.

Mark the reason associated with your Transfer request. You may wish to consult with your tax advisor on the definition and tax implications for each type of transfer.

1. Question: What is a Medallion Signature Guarantee?

Medallion Signature Guarantee Program - a program approved by the Securities Transfer Association that enables participating financial institutions to guarantee signatures. The Medallion program ensures that the individual signing the stock certificate or stock power is in fact the registered owner as it appears on the stock certificate or stock power.

2.Question: Where can I obtain a Medallion Signature Guarantee? Any U.S. financial institution that belongs to the Medallion Signature Guarantee program can provide Medallion Guarantees. Such institutions include banks, savings and loans, credit unions and U.S. brokerages. (Also known as Medallion Stamp Program.)

Example of a Medallion Signature Guarantee

(The limits are determined by the alpha prefix of the imprint number that is located just below the signature.)

3.Transfer Authorization

Your Signature is Required

The authorized person(s) must sign in his/her legal capacity. (When signing as executor, administrator, trustee or in another representative capacity, please give full title as such.)

The undersigned hereby irrevocably constitute and appoint BNY Mellon Shareowner Services as attorney to transfer the shares with full power of substitution in the premises.

Signature:

Signature:

Title:

Date:

Daytime Telephone #:

Medallion Signature Guarantee

Signature(s) must have a Medallion Signature Guarantee from a

Commercial Bank, Trust Company or Broker, if applicable.

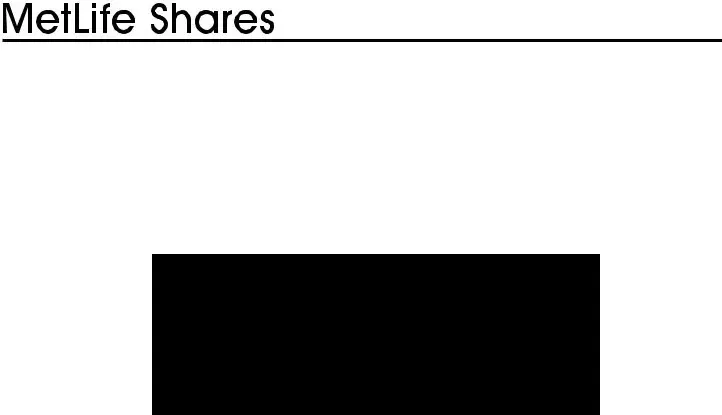

The person(s) |

|

legally authorized |

|

to effect this |

|

transfer must |

|

sign here and |

You are legally required to |

indicate title of |

|

legal capacity. |

submit a Taxpayer ID |

|

Certification (Substitute |

|

Form |

|

Enter your Taxpayer ID |

|

number here. |

Please complete and sign only if you would like us to sell the transferred shares.

Check the box that applies to you.

Please enter your Social Security Number here and sign and date below.

New MetLife Shareholder Account Information |

PAGE 2 |

4. New Shareholder’s Account Information

(If you wish to divide the shares between two or more owners individually, please use additional copies of this page specifying the total shares per account. Please note that all shares will be held electronically in Book Entry form.)

|

|

|

|

|

|

|

|

|

New Shareholder’s |

|

|

|

|

Shares To Be |

|

|

|

|

|

|

|

|

||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

Taxpayer ID Number |

|

|

Transferred to This Account |

|

|

|

|

|

|

|

|

||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

All Shares |

|

||||

|

Name of New Shareholder (Please refer to the Name Guidelines on Page 4 for Further Information) |

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Name of Joint Owner/Second Trustee/Minor/Other (if applicable) |

Minor’s State of Residence |

|

|||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Name of Trust/Estate (if applicable) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Date of Trust |

|

||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Address of New Shareholder |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(MM/DD/YYYY) |

|

||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

City |

|

|

|

|

|

|

|

|

|

|

|

|

State |

|

|

|

Zip Code |

|

|||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

5. New Shareholder’s Sale Instructions

(The new shareholder must sign on the signature line in order to sell shares. If this section is left blank or sale instructions unsigned, your MetLife shares will not be sold and will remain in Book Entry form in the new account.)

Sell only the shares received from this transfer |

|

Sell all shares currently held in my existing account |

|

along with the shares received from this transfer |

|

|

|

Signature: |

|

Date: |

All sale transactions will be subject to the terms and conditions described in the Sale Disclosure attached on page 6 and made part of this form. If your shares are held outside the Policyholder Trust in Book Entry form, through the Direct Registration System (DRS), they will be enrolled in the DRS Sales Program, to be sold. Please acknowledge your agree- ment with the foregoing by signing in the space above.

6.Taxpayer ID Certification (Based on Form

YOUR ACCOUNT MAY BE SUBJECT TO BACKUP WITHHOLDING AT THE APPLICABLE RATE IF YOU DO NOT COMPLETE THIS SUBSTITUTE FORM

All new security holders are required to sign and return this certification. If the requested information is not known at the time of the transfer or the new owner is not available to sign, a

|

|

|

|

|

Individual/ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

Check appropriate box: |

|

Sole proprietor |

|

|

C Corporation |

|

S Corporation |

|

Partnership |

|

Trust/Estate |

|||||||||||

|

|

Limited liability company. Enter the tax classification (C=C corporation, S=S corporation, P=partnership) ____ |

||||||||||||||||||||

|

|

|||||||||||||||||||||

|

|

Other |

|

|

|

|

|

|

|

|

|

|

|

(Please Specify) |

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

New Shareholder’s |

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

Taxpayer ID Number |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

Under penalties of perjury, I certify that:

1.The number shown on this form is my correct taxpayer identification number (or I am waiting for a number to be issued to me), and

2.I am not subject to backup withholding because: (a) I am exempt from backup withholding, or (b) I have not been notified by the Internal Revenue Service (IRS) that I am subject to backup withholding as a result of a failure to report all interest or dividends, or (c) the IRS has notified me that I am no longer subject to backup withholding, and

3.I am a U.S. citizen or other U.S. person (defined in the instructions).

Certification instructions. You must cross out item 2 above if you have been notified by the IRS that you are currently subject to backup withholding because you have failed to report all interest and dividends on your tax return. For real estate transactions, item 2 does not apply. For mortgage interest paid, acquisition or abandonment of secured property, cancellation of debt, contributions to an individual retirement arrangement (IRA), and generally, payments other than interest and dividends, you are not required to sign the Certification, but you must provide your correct TIN.

Signature of U.S. person: |

|

Date: |

Page 6

Sale Disclosure

MetLife Policyholder Trust Accounts

All sale transactions in the MetLife Policyholder Trust are subject to the terms and conditions set forth in the Purchase & Sale Program and the Program Procedures. Under the terms of the Program, once a sale instruction is delivered to the Program Agent, it cannot be revoked.

Under the MetLife Purchase & Sale Program, as amended, you may sell shares of MetLife, Inc. common stock through the MetLife Policyholder Trust (the “Trust”) free of any commissions or other fees. A copy of the brochure describing the program is available on the Internet at www.metlife.com under Investors Relations on the Shareholder Services Information page or by calling our Customer Service Center at

Selling all shares will terminate your participation in the Trust and your right to participate in the Purchase & Sale Program.

Partial sale are only permitted if you have more than 199 shares. Partial sales can only be made in lots of 100.

Effective December 14, 2001, you are permitted to sell all, but not less than all of the Trust Interests transferred to you (as permitted under the Program) by a deceased Trust Beneficiary without regard to the share limitations described above related to partial sales.

MetLife shares held in Book Entry in the Direct Registration System (DRS), held in

The Administrator will combine the shares you want to sell through the program with other shares that are also being sold by other program participants. Shares are then periodically submitted in bulk to the broker/dealer for sale. Shares will be sold promptly after the Administrator receives your instructions, usually within one business day, but in no event more than five business days (except where deferral is necessary under State or Federal regulations).

The price per share for any shares sold through the program will equal the market price that the broker/dealer receives for your shares (or the weighted average of the market prices of each sale if more than one broker trade is necessary to sell all the combined shares). On the settlement date, which is three business days after the date your shares have been sold, the Administrator will mail your proceeds by check to your address of record.

All sale requests are final, and once received cannot be cancelled or changed. All sales are subject to market conditions and other factors. Under the program, directions to sell shares on a specific day or at a specific price cannot be accepted. The actual sale date or price received for any share sold through the program cannot be guaranteed.

Participants must perform their own research and must make their own investment decisions. Neither the Administrator nor any of its affiliates will provide any investment recommendations or investment advice with respect to transactions made through the program.

Form Characteristics

| Fact Name | Details |

|---|---|

| Form Purpose | This form is used to transfer ownership of MetLife, Inc. common shares. |

| Transfer Agent | BNY Mellon Shareowner Services acts as the transfer agent for processing these requests. |

| Documentation Required | Proper documentation, including a Medallion Signature Guarantee, is necessary to process transfers. |

| Transfer Reasons | Common reasons for transfer include gifts, death, or private sales. No reason defaults to a gift. |

| Date for Tax Purposes | The value per share and the gift or death dates are crucial for tax documentation. |

| Medallion Signature Guarantee | A Medallion Signature Guarantee is needed to verify the identity of the signer and can be obtained from various U.S. financial institutions. |

| New Shareholder Accounts | New shareholders' accounts will be held electronically in Book Entry form, with necessary information required. |

| Taxpayer ID Certification | All new holders must complete a Taxpayer ID Certification to avoid backup withholding. |

| State-Specific Requirements | Certain states may have specific requirements, including inheritance tax waivers; it’s essential to check local laws. |

| Governing Laws | The applicable state laws will govern transfers, especially in cases of decedent accounts. |

Guidelines on Utilizing Met Life Stock Transfer

Once you've gathered the necessary information and documentation, you’re ready to fill out the Met Life Stock Transfer form. This process ensures that your shares are securely and accurately transferred according to your instructions.

- Identify the Shareholder: Begin by entering the "Investor ID" and "Name and Address" exactly as they appear on the account or statement.

- Select Shares to Transfer: Choose either a specific number of shares or the option for "All Shares." Do not select both options.

- Indicate Transfer Reason: Check only one reason for the transfer. Options include Gift, Death, Private Sale, or None of the Above. Provide relevant dates and values where required.

- Authorize the Transfer: The person authorized to effect the transfer must sign and indicate their title. Ensure that you include the date and daytime telephone number.

- Obtain Medallion Signature Guarantee: If necessary, get a Medallion Signature Guarantee from an authorized institution. This is crucial for the verification of signatures.

- Complete New Shareholder Information: On page 2, fill out the new shareholder's name, Taxpayer ID number, and address. If shares are to be divided among several owners, make copies and specify the allocation of shares per account.

- Provide Sale Instructions: Indicate if the new shareholder wishes to sell the shares received from this transfer or all shares held in the existing account. Include a signature and date here.

- Complete Taxpayer ID Certification: Fill out the appropriate tax classification and provide the Taxpayer ID number. Ensure you understand the implications of backup withholding.

Once the form is complete, double-check it for accuracy before submission. Attach any required documentation, such as a death certificate or marriage certificate if applicable, and send it to the address provided in the form. This sequence will help ensure that your transfer request is processed smoothly and without delays.

What You Should Know About This Form

What is a Medallion Signature Guarantee?

A Medallion Signature Guarantee is a program approved by the Securities Transfer Association. It ensures that the signature on a stock certificate or stock power belongs to the registered owner, as it appears on the document. This guarantee provides an extra layer of security in transferring shares, protecting both the transferor and the transferee from potential fraud.

Where can I obtain a Medallion Signature Guarantee?

You can obtain a Medallion Signature Guarantee at any U.S. financial institution that participates in the Medallion Signature Guarantee program. This includes banks, credit unions, savings and loans, and U.S. brokerages. Just bring the necessary documents and a valid ID, and the institution can help you with the process.

Why do I need to provide a Taxpayer ID Certification?

The Taxpayer ID Certification, commonly known as Substitute Form W-9, ensures that the correct taxpayer information is used. This is important for tax reporting purposes. If the certification is not completed, your account may face backup withholding, which could lead to more taxes being deducted from your transactions.

What documents are required to transfer shares from a deceased shareholder's account?

To successfully transfer shares from a deceased shareholder's account, several documents are needed. These include a completed Transfer of MetLife Shares form signed by the executor or authorized representative, a certified copy of the death certificate, and a Medallion Signature Guarantee. Depending on the situation, additional documents, like an inheritance tax waiver, may also be required.

Can I specify the number of shares I want to transfer?

Yes, when completing the MetLife Stock Transfer form, you can specify the exact number of shares you wish to transfer. Alternatively, there is an option to transfer all shares associated with the account. Just ensure you don’t select both options on the form to avoid confusion.

What happens if I leave the sale instructions section blank?

If you leave the sale instructions section blank, it means your MetLife shares will not be sold. Instead, they will remain in Book Entry form in the new account. Make sure to fill out this section if you intend to sell any shares after the transfer.

How can I ensure my transfer request is processed without delays?

To avoid delays, ensure that you complete the form clearly and legibly, including the Investor ID and the complete name and address of the original shareholder. Be specific in selecting the number of shares and provide any required documentation for the type of transfer you’re requesting.

What should I do if I am transferring shares held in a trust?

If you are transferring shares held in a trust, complete the Transfer of MetLife Shares form as usual, making sure to include the name of the trust, the trustee(s), and the date the trust was established. You may also need to provide a copy of the trust agreement and ensure that the form has a Medallion Signature Guarantee.

What if the new shareholder's information is not available at the time of transfer?

If the new shareholder's information is not available when submitting the transfer, a W-9 Form will be mailed to them once the shares are transferred. Alternatively, the new shareholder can certify their Taxpayer Identification Number online at the BNY Mellon website once the transfer is complete.

Common mistakes

Filling out the Met Life Stock Transfer form can be a straightforward process but some common mistakes can lead to delays in processing. One frequent error is entering incorrect or incomplete personal information. This includes the Investor ID and the name and address that appear on the account. Each entry should match exactly with the records to avoid confusion.

Another common mistake occurs when individuals fail to select the correct number of shares. The form provides options for entering either a specific number of shares or selecting “All Shares,” but checking both options is not permitted. This can lead to processing delays as the request may be deemed invalid.

Choosing the transfer reason incorrectly is another frequent misstep. The form requires individuals to check only one reason for the transfer. If no reason is selected, the default assumption will be that the transfer is a gift. Clarity in this section helps prevent misunderstandings about the transfer's purpose.

Missing signatures and Medallion Signature Guarantees are also common issues. Each authorized person must sign the form in their legal capacity, and if applicable, a Medallion Signature Guarantee must be included. Without these, the transfer cannot be processed, causing significant delays.

Lastly, many people overlook the Taxpayer ID Certification section. This must be completed to avoid backup withholding penalties. Failing to provide a correct Taxpayer ID or omitting the certification altogether can lead to automatic withholding, which may not be desirable for the new shareholder.

Overall, careful attention to detail when filling out the Met Life Stock Transfer form can help ensure a smooth and timely transfer process.

Documents used along the form

When transferring shares using the Met Life Stock Transfer form, several additional documents may be required. These documents help facilitate the transfer process and ensure that all necessary information is correctly submitted. Each document has its own purpose and requirements. Below is a list of some common forms that might be needed.

- Death Certificate: Required when transferring shares due to the death of the shareholder. It verifies the death and is essential for processing the transfer.

- Medallion Signature Guarantee: This certification from a financial institution confirms that the signature on the transfer form is valid. It protects against unauthorized transfers.

- W-9 Form: A Taxpayer Identification Number Certification, needed to certify that the new owner is not subject to backup withholding. This form provides necessary tax information for the new shareholder.

- Trust Agreement Document: If the shares are being transferred to a trust, the first and last pages of the trust agreement are needed. It outlines the trust's terms and verifies the identity of trustees.

- Small Estate Affidavit: This document may be required for the transfer of shares if the estate of the deceased shareholder is small and avoids probate. It simplifies the process for transferring assets.

- Certificate of Appointment of Executor: In probated estates, this certified document is necessary, showing who has the legal authority to administer the estate and manage the transfer.

- Marriage Certificate or Divorce Decree: Needed if shares are being transferred due to a name change from marriage or divorce. These documents demonstrate the legal name change.

- Inheritances Tax Waiver: Some states require a waiver indicating taxes have been settled before allowing the transfer. This ensures compliance with state laws.

Submitting all required documents helps avoid delays and ensures a smooth transfer process. If you have questions about any specific documents needed for your situation, seeking guidance can be beneficial.

Similar forms

- Stock Power Form: Similar to the Met Life Stock Transfer form, a Stock Power Form allows for the transfer of ownership of stock shares. This document must be signed by the current owner and typically requires a medallion signature guarantee to validate the transfer.

- Transfer on Death (TOD) Registration: This document designates a beneficiary for shares in the event of an owner's death. Like the Stock Transfer form, it provides clear instructions for transferring shares without the need for probate.

- Gift Tax Return (Form 709): When transferring stock as a gift, this IRS form is necessary to report the gift for tax purposes. It parallels the Met Life form’s requirement for documenting the reason for the transfer, specifically gifts.

- Stock Certificate: A physical representation of stock ownership, this document can be accompanied by a stock transfer form to facilitate ownership transfer, similar to the way ownership is transferred in the Met Life form.

- Executor or Administrator Authorization: In cases where an estate is involved, this legal document authorizes the named executor or administrator to transfer assets. It is akin to the vocational signatures required by the Met Life Stock Transfer form for legitimizing the transfer request.

- Beneficiary Change Form: This form allows account holders to specify new beneficiaries for their accounts. The requirement for clear identification and authorization mirrors the instructions outlined in the Met Life form.

- Trust Transfer Form: When shares are held in a trust, a specific transfer form must be completed to move shares to a new beneficiary. This is comparable to the Met Life form in its handling of transfers involving trusts and estate matters.

- Shareholder Agreement: This legal document outlines the rights and responsibilities of shareholders within a company. It serves a similar purpose of governing the transfer of ownership as illustrated in the detailed instructions within the Met Life Stock Transfer form.

Dos and Don'ts

When completing the Met Life Stock Transfer form, attention to detail is paramount. Below are some crucial dos and don'ts to ensure your submission goes smoothly.

- Do print clearly if filling out the form by hand to avoid any misunderstandings.

- Do select only one option for the number of shares to be transferred—either specify the number of shares or check the "All Shares" box, but not both.

- Do provide all required signatures, including a Medallion Signature Guarantee if applicable, to validate the transfer.

- Do indicate the transfer reason accurately and consult a tax advisor for implications; otherwise, all transfers will be assumed as gifts.

- Don't leave sections blank, especially regarding sale instructions; otherwise, shares will not be sold.

- Don't forget to provide the new shareholder's Taxpayer ID number, as failure to do so might subject the account to backup withholding.

Misconceptions

- Misconception 1: The Met Life Stock Transfer form is only for transferring stock ownership after someone dies.

- Misconception 2: All shares must be transferred at once.

- Misconception 3: A Medallion Signature Guarantee is not necessary.

- Misconception 4: The form does not require a reason for the transfer.

- Misconception 5: There are no tax implications associated with transferring stocks.

- Misconception 6: Anyone can complete the form and submit it.

- Misconception 7: The value of the shares is irrelevant.

- Misconception 8: Transfers can take place without proper documentation.

- Misconception 9: Joint account holders automatically have equal rights to the shares.

- Misconception 10: The form does not require additional pages.

This form can be used for various types of transfers, including gifts and private sales, not just those related to decedents.

You can choose to transfer either a specific number of shares or all shares from the account, depending on your needs.

This guarantee is often required for valid execution, ensuring that the signature on the form matches the registered owner’s identity.

Providing a transfer reason is crucial. If no reason is supplied, the transfer will automatically be considered a gift.

It is advisable to consult a tax advisor, as different types of transfers may have different tax treatments.

This form must be completed and signed by authorized individuals only, such as executors or trustees.

The value per share is important and must be indicated for tax basis purposes to assist in accurate record-keeping for the new owner.

It is essential to provide all required documentation to avoid delays in processing the transfer.

Transfer rights depend on the type of account setup (e.g., Joint Tenancy vs. Tenants in Common), which can affect how shares are managed upon transfer.

If multiple owners or accounts are involved, it may be necessary to use additional copies of the form to specify the total shares being transferred per owner.

Key takeaways

When filling out and using the Met Life Stock Transfer form, it is essential to adhere to specific guidelines and requirements. Here are eight key takeaways that will help facilitate the process.

- Complete Required Sections: Ensure that all necessary parts of the form are filled out. Specifically, provide information on the number of shares being transferred and the reason for the transfer.

- Signatures Matter: The form requires signatures from authorized individuals. Signatures must be in a legal capacity, such as executor or trustee, and include a Medallion Signature Guarantee where applicable.

- Identify Shareholder Correctly: Enter the name and address of the current shareholder exactly as it appears on the account or statement. This precision helps avoid processing delays.

- Choose Transfer Reason: It is critical to select the reason for the transfer. If none is provided, it will be assumed to be a gift, which may have tax implications.

- Medallion Signature Guarantee: Obtain this guarantee from any participating U.S. financial institution. This step is crucial to verify the identity of the individual signing the form.

- Taxpayer Identification Number (TIN): Include a TIN to avoid backup withholding issues. All new shareholders need to complete this certification accurately.

- New Shareholder Information: Provide complete details about the new shareholder on the second page of the form, including their taxpayer ID and address.

- Keep a Copy: Before submitting the form, make a copy for your records. Having documentation of your submission can be beneficial for future reference.

By following these steps closely, individuals can ensure a smooth process when handling the Met Life Stock Transfer form, minimizing potential errors and complications.

Browse Other Templates

Spouse Open Work Permit Document Checklist Outside Canada - Check for the latest version of the IMM 1295 form before submission.

New Hire Form - A signature does not necessarily indicate agreement with the evaluation.

How to Transfer Title in Nevada - This affidavit is part of a larger framework to regulate vehicle lien processes in Nevada.