Fill Out Your Metlife Annuity Loan Application Form

The MetLife Annuity Loan Application form is designed for individuals seeking to obtain a loan against their annuity contracts, allowing access to funds based on specific terms and conditions. It collects essential account information, including the borrower's details, loan amount request, repayment duration, and intended use of loan proceeds. Borrowers can select between using proceeds for purchasing a principal residence or other purposes, with distinct repayment periods applicable to each scenario. The form also ensures compliance with IRS regulations, emphasizing that only one loan may be maintained at a time and that outstanding loans under related employer plans could affect eligibility. Additionally, the application requires a thorough disclosure of prior loans, underscoring the need for strategic financial planning and management to avoid complications such as defaults. Spousal consent is necessary for borrowers under ERISA plans, highlighting the importance of ensuring that any loan taken does not compromise the rights to retirement benefits. This comprehensive application process serves as a safeguard for both the borrower and MetLife, establishing clear expectations and responsibilities regarding the loan borrowed against the annuity. The contents detailed in this form form the cornerstone of an informed lending process, facilitating a transparent and structured approach to accessing funds while managing the implications of borrowing against retirement assets.

Metlife Annuity Loan Application Example

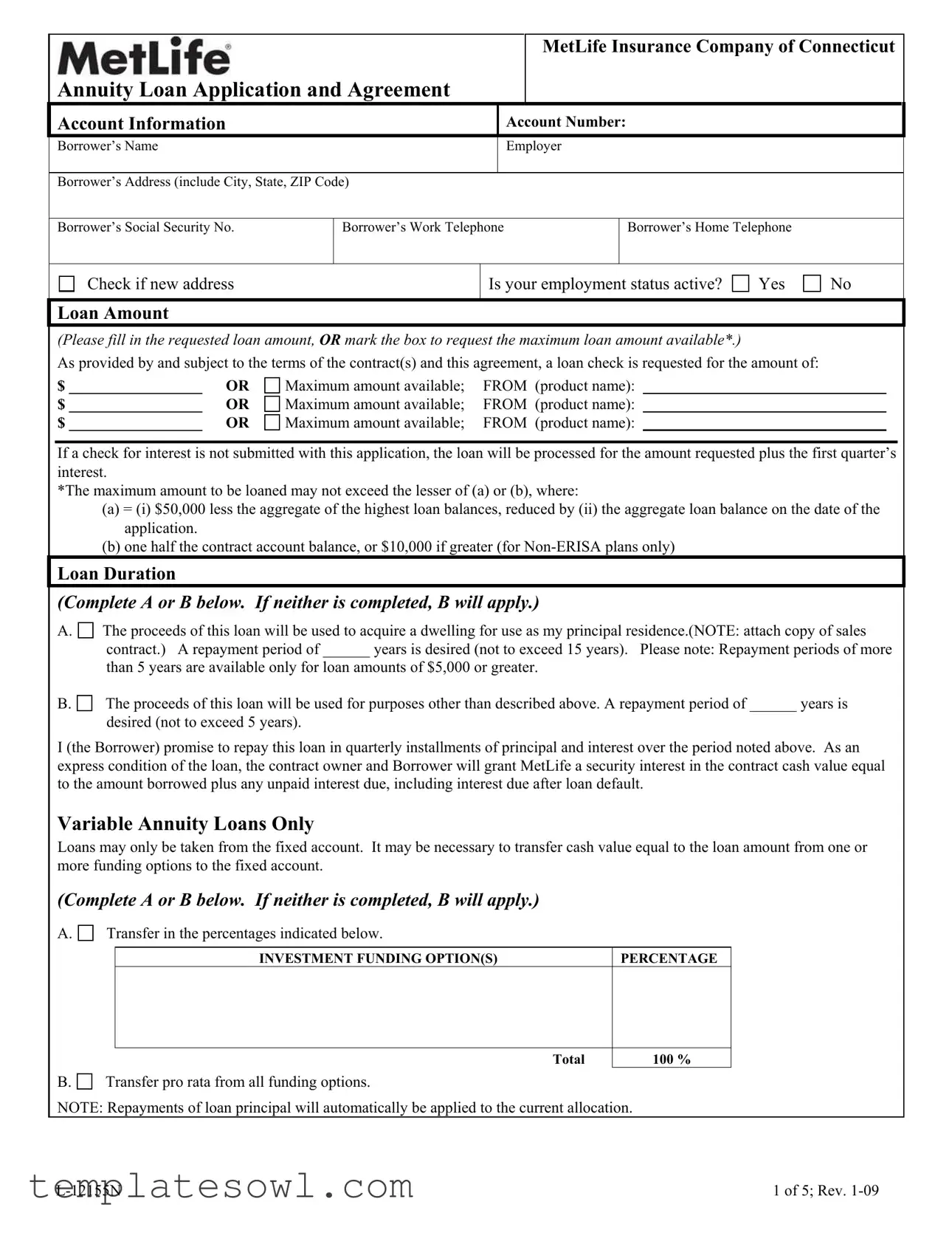

MetLife Insurance Company of Connecticut

Annuity Loan Application and Agreement

Account Information |

|

|

|

Account Number: |

|

|

|

Borrower’s Name |

|

|

|

Employer |

|

|

|

|

|

|

|

|

|

|

|

Borrower’s Address (include City, State, ZIP Code) |

|

|

|

|

|||

|

|

|

|

|

|

||

Borrower’s Social Security No. |

Borrower’s Work Telephone |

|

Borrower’s Home Telephone |

|

|||

|

|

|

|

|

|

||

Check if new address |

|

Is your employment status active? |

Yes |

No |

|||

|

|

|

|

|

|

|

|

Loan Amount

(Please fill in the requested loan amount, OR mark the box to request the maximum loan amount available*.)

As provided by and subject to the terms of the contract(s) and this agreement, a loan check is requested for the amount of:

$ _________________ |

OR |

Maximum amount available; |

FROM (product name): |

|

$ _________________ |

OR |

Maximum amount available; |

FROM |

(product name): |

$ _________________ |

OR |

Maximum amount available; |

FROM |

(product name): |

If a check for interest is not submitted with this application, the loan will be processed for the amount requested plus the first quarter’s interest.

*The maximum amount to be loaned may not exceed the lesser of (a) or (b), where:

(a) = (i) $50,000 less the aggregate of the highest loan balances, reduced by (ii) the aggregate loan balance on the date of the application.

(b) one half the contract account balance, or $10,000 if greater (for

Loan Duration

(Complete A or B below. If neither is completed, B will apply.)

A.

The proceeds of this loan will be used to acquire a dwelling for use as my principal residence.(NOTE: attach copy of sales

contract.) A repayment period of ______ years is desired (not to exceed 15 years). Please note: Repayment periods of more

than 5 years are available only for loan amounts of $5,000 or greater.

B.

The proceeds of this loan will be used for purposes other than described above. A repayment period of ______ years is

desired (not to exceed 5 years).

I (the Borrower) promise to repay this loan in quarterly installments of principal and interest over the period noted above. As an express condition of the loan, the contract owner and Borrower will grant MetLife a security interest in the contract cash value equal to the amount borrowed plus any unpaid interest due, including interest due after loan default.

Variable Annuity Loans Only

Loans may only be taken from the fixed account. It may be necessary to transfer cash value equal to the loan amount from one or more funding options to the fixed account.

(Complete A or B below. If neither is completed, B will apply.)

A.

Transfer in the percentages indicated below.

INVESTMENT FUNDING OPTION(S)

PERCENTAGE

Total

100 %

B. |

Transfer pro rata from all funding options. |

NOTE: Repayments of loan principal will automatically be applied to the current allocation.

1 of 5; Rev. |

Group Plans Only

(Check A or B below. If neither is completed, B will apply.)

A.

B.

Cash Value attributable to employer contributions (other than contributions derived from salary reduction) may be used to secure this loan.

Cash Value attributable to employer contributions (other than contributions derived from salary reduction) may not be used to secure this loan.

Loan Request Information

List all outstanding loans from any retirement plan of the employer (or related employer) during the previous 12 months, including defaulted loans which have not been repaid or offset.* A loan will not be processed if the participant has an outstanding loan

under any retirement plan of the employer (or related employer) which has defaulted, but not been repaid or offset.

Company Name

Certificate or

Contract Number

Current Vested

Account Balance

Current Loan

Balance

Highest Loan Balance

During Past 12

Months

In Default But Not Yet Offset?

Acknowledgement and Signatures

I authorize the loan check and bills to be sent to this billing address:

Street |

City, State, Zip Code |

I (the borrower) understand that federal income tax loan regulations will be enforced to the extent necessary to keep the annuity contract qualified under applicable Internal Revenue Code provisions and under other applicable tax and benefits plan laws and regulations. I understand that I may have only one loan at a time from this contract or certificate. I may not have another loan from this contract or certificate until the outstanding loan and interest are repaid in full.

I understand that a loan is not permitted if I have a loan from 1) any of my employer’s retirement plans or 2) from retirement plans of a related employer, that is in default and is still outstanding due to tax law restrictions on offset; and I certify that I do not have any such previously defaulted loans.

I understand that I am responsible for ensuring that I do not borrow an amount in excess of the loan amount permitted under section 72(p) of the Internal Revenue Code of 1986, as amended ( the “Code”); and that adverse tax consequences, including treatment of such excess amounts as deemed distributions, will result in such case.

I (borrower and/or contract owner) understand and accept the terms and conditions applicable to this loan, including the special terms and conditions described in the "Contract Loan Terms and Conditions" section of this agreement, and accept full responsibility for compliance with these requirements. I/we also understand that MetLife accepts no responsibility concerning adherence to these requirements and that contract values are assigned to MetLife as sole security of the loan.

I acknowledge that I have read and understood the terms and conditions of this loan agreement:

I certify this withdrawal is permissible under the terms of the Plan.

Signature of Plan Administrator/Authorized Representative |

Date |

|

|

Borrower’s Signature

Date

*A loan offset occurs when your accrued plan benefit is reduced (offset) in order to repay the loan (including the enforcement of our security interest in your accrued benefit).

2 of 5; Rev. |

Spousal Consent – ERISA Plans Only

I hereby consent to the loan request by the contract owner as set forth above. I understand that if I am married, I must obtain my spouse's consent to this loan. I understand that a spouse is guaranteed certain rights to assets in this retirement account by federal law and these rights include the right to a preretirement survivor's annuity and the right to a joint and survivor annuity and these rights could be diminished by an annuity loan which is not repaid. This consent cannot be revoked once given.

__ I certify that I am not married and therefore spousal consent to this loan is not required __ I am married and my spouse's consent to this loan is provided below

__ I am married and certify my spouse's consent cannot be obtained or is not required because: (Check only one box below) __ My spouse cannot be found

__ My spouse is legally incompetent to give consent (spouse's legal guardian may give consent)

__ I am legally separated from or have been abandoned by my spouse (within the meaning of local law) and have a court order to such effect and no qualified domestic relations order exists that requires spousal consent to this loan.

Borrower’s Signature

Date

Spouse’s Name (Please print)

Spouse’s Signature

Date

I certify that the

Notary Public’s Signature

Date

Plan Administrator’s Signature

Date

|

Mailing Instructions |

|

Mail this form to: |

Overnight mail only: |

Fax to: |

MetLife |

MetLife |

|

P.O. Box 572 |

4700 Westown Parkway, Ste. 200 |

|

Des Moines, IA |

West Des Moines, IA 50266 |

|

SEE NEXT TWO PAGES FOR LOAN TERMS AND CONDITIONS

3 of 5; Rev. |

MetLife Insurance Company of Connecticut

Annuity Contract

Loan Terms and Conditions

Minimum and Maximum Loan Amounts

•Minimum: $1,000*

•Maximum:

The maximum amount that can be borrowed is an amount which when added to the other outstanding loan balances under plans of the same or related employer ( the “Plan”) does not exceed the lesser of:

1.$50,000 reduced by the excess ( if any) of :(a) the highest total amount of the Plan loans outstanding during the twelve

month period ending on the day before this loan over (b) the outstanding plan loan amount on the date of this loan.

2.

In addition to the above limits, in no event may the loan amount under this Contract exceed :

Vested Contract Cash Value |

Additional loan limitation under this Contract |

$1,250 - $12,500 |

80 % of vested Contract cash value for |

|

50% of vested Contract cash value for ERISA Plan |

Over $12,500 - $20,000 |

$10,000 for |

|

50%of vested Contract cash value for ERISA Plan |

Over $20,000 |

Lesser of |

|

(a)50% of the vested contract cash value or (b) $50,000.reduced by the highest Plan loan balance |

|

during the previous 12 nmonths |

|

|

*For the following contract holders in the state of New Jersey, the minimum loan amount is $500.00 - PrimElite II; Portfolio Architect 3; Universal Annuity (Individual); Vintage; Vintage II; Vintage II Series II; Vintage 3

Loan Duration

Repayments of principal and interest must be made in quarterly installments from one to five years. If the proceeds of the loan are used to acquire the Borrower’s principal residence, the loan repayment period may be extended to fifteen (15) years. Repayment periods of more than five (5) years are available only for loan amounts of $5,000 or greater.

The Borrower may have only one outstanding loan per contract.

Loan Billing and Repayment

Loan proceeds and bills will be mailed to the billing address noted in this agreement. If no address is specified, the check and all correspondence will be mailed to the most current address on our records for the Borrower.

A bill in the amount of the quarterly repayment due (to include principal and interest) will be mailed 45 days prior to the repayment due date. Repayments will be applied first to unpaid interest due, then to loan principal. If the repayment amount exceeds the total amount billed, the excess money will be applied towards the outstanding loan principal, not to future quarterly repayments.

Acceptable methods for repayment are personal checks or bank checks.

Interest Charged

Quarterly loan interest must be paid in advance. Interest charged will be at the rate in effect at the time the request is received in good order at MetLife Home Office. The loan’s first quarter interest may be paid from the loan proceeds, or by check at the time the loan is made.

If the original loan check is returned within twenty (20) days of the date of the loan check, loan interest will be waived.

The loan interest rate is determined by whether the plan or contract is subject to ERISA.

4 of 5; Rev. |

ERISA Loans:

The interest rate charged at the inception of the loan will remain in effect for one year from the loan effective date. The interest rate may change annually. Notification of any change in the interest rate charged will be made at least thirty (30) days prior to its taking effect. If the interest rate changes, required quarterly repayments will change.

The interest rate charged at the loan’s effective date will remain in effect for the duration of the loan.

Current loan interest rates can be obtained by contacting your MetLife representative directly or by calling our Annuity Customer Service Center.

Loan Default and Taxation

You may repay amounts after a loan default. Such repayments will prevent any additional interest from accruing on the repaid amounts and will reduce the amount of your outstanding loan balance for purposes of determining the amount of any additional loans you may have under retirement plans of your employer. However, such repayments after the administrative grace period will not reverse the default or the deemed distribution of the unpaid loan balance that is reportable for federal income tax purposes. (See below.)

If a quarterly repayment has not been received

If a repayment is not received within ninety (90) days of its due date and the billed amount has not been paid as described in the previous paragraph, the entire loan will be placed in default. A tax report will be produced for the calendar year the loan was placed in default, reporting to the IRS as a deemed distribution the outstanding loan amount. Interest will be charged on the defaulted loan amount until it is repaid. The defaulted loan can be repaid at any time to avoid the interest charge accrual. At the time the contract cash value becomes available for loan repayment under federal tax law or regulation, and to the extent permissible under applicable state regulations, the cash value will be reduced by the amount of the loan outstanding and any unpaid interest due. Any applicable deferred sales charges or surrender penalties will be taken. The loan will no longer be outstanding.

The loan plus any unpaid interest due must be repaid in full at the time of an allowable full surrender, including a direct rollover or transfer. Amounts available for partial surrender , including a direct rollover or transfer, will be limited to the cash surrender value of the contract minus the loan amount outstanding, including amounts in default, minus unpaid interest due.

In the event the Borrower files a bankruptcy petition while the loan remains in effect, an exemption will be elected for the annuity contract, including but not limited to its cash value, pursuant to Section 522 of Federal Bankruptcy Code or under a state law exemption at least as broad in scope as Section 522.

PLEASE RETAIN THIS COPY FOR YOUR RECORDS

5 of 5; Rev. |

Form Characteristics

| Fact Name | Description |

|---|---|

| Loan Amount Limitations | The maximum loan amount that can be borrowed is determined by two criteria. First, it cannot exceed $50,000 reduced by any outstanding loan balances. Second, it must also not exceed one half of the contract account balance or $10,000 for Non-ERISA plans only. |

| Loan Duration | Loan repayment can range from one to five years, with possible extensions up to 15 years if the loan is used to acquire a principal residence. Repayment periods longer than five years require loan amounts of $5,000 or greater. |

| Address Verification | Borrowers must provide their current mailing address on the form. If no address is specified, communication will be sent to the address on record with MetLife. |

| Spousal Consent Requirement | For ERISA plans, spouses must consent to the loan request. Federal law secures certain rights for spouses regarding retirement account assets, which could be affected by an unpaid loan. |

Guidelines on Utilizing Metlife Annuity Loan Application

Filling out the Metlife Annuity Loan Application form requires attention to detail and accurate information. Following these steps will help ensure that the application is completed correctly, which will facilitate the processing of your loan request.

- Enter your Account Number in the designated field.

- Provide your Borrower’s Name, Employer, and Borrower’s Address (including City, State, and ZIP Code) in the respective sections.

- Fill in your Borrower’s Social Security Number, Borrower’s Work Telephone, and Borrower’s Home Telephone.

- If applicable, check the box to indicate if you have a new address.

- Indicate your employment status by checking either Yes or No for active employment.

- Specify the Loan Amount by either entering the requested loan amount or marking the box for the maximum loan amount available.

- Select the Loan Duration by completing either section A or B on the form.

- If borrowing for a dwelling purchase, attach a copy of the sales contract.

- For variable annuity loans, complete either A or B, detailing the transfer of cash value as needed.

- Indicate your cash value status by checking either A or B for Group Plans.

- List all outstanding loans from any retirement plans of your employer or related employers over the past 12 months, providing details such as Company Name, Certificate or Contract Number, etc.

- Complete the Acknowledgement and Signatures section, ensuring you authorize the loan check and bills to be sent to the specified billing address.

- Sign and date the application as the borrower.

- If applicable, complete the Spousal Consent section, including signatures and details as required.

- Mail or fax the completed form to the addresses provided in the instructions.

Once the application is submitted, it will be processed based on the completed information, allowing for the necessary evaluations and approvals required for your loan request.

What You Should Know About This Form

1. What information do I need to provide on the Metlife Annuity Loan Application form?

You need to fill out information such as your account number, name, address, Social Security number, and contact numbers for both work and home. It's crucial to indicate whether your employment is active and to specify the loan amount you are requesting. Additionally, you must complete sections regarding the duration of the loan and the purpose of the loan, whether it's for a principal residence or other purposes.

2. What are the maximum and minimum amounts I can borrow with this loan?

The minimum loan amount is typically $1,000, though for certain contracts in New Jersey, the minimum may be $500. The maximum amount you can borrow depends on factors like your highest loan balances in the past year and your account balance. Generally, it cannot exceed either $50,000 (subject to your other outstanding loans) or half the total account balance. Specific limits apply based on your contract's details, so make sure to review those thoroughly.

3. How do I determine the loan duration and repayment terms?

You can select between two sections when specifying your loan duration. If the loan is for acquiring a principal residence, you can request a repayment period of up to 15 years. For all other purposes, the period cannot exceed five years. You will be expected to make quarterly installment payments comprised of principal and interest throughout the repayment period selected.

4. What happens if I default on the loan?

If you miss a payment, you have 31 days to make it up. If you fail to do so, a portion of your cash value may be surrendered to cover the unpaid amount, which will be reported as a distribution. Default may lead to your entire loan being reported as a deemed distribution to the IRS, meaning you could face tax consequences. You can repay the defaulted amount at any time to avoid additional penalties.

5. Is spousal consent required, and how does it apply?

If you are married and taking a loan against an ERISA plan, your spouse must provide consent. This is to ensure that their rights to the retirement account assets are recognized under federal law. You will need to indicate your marital status on the application and include your spouse’s consent as necessary. If you cannot obtain consent due to specific circumstances, this must be documented in the application.

Common mistakes

Filling out the Metlife Annuity Loan Application can be complex, and errors may lead to delays or denial of the loan. One common mistake occurs when individuals forget to provide their correct account number. This number is essential for processing the application. Without it, the application may be rejected, causing frustration and the need to resubmit.

Another frequent error involves the loan amount section. Applicants often either leave this blank or request an amount that exceeds the maximum allowed. It's crucial to follow the guidelines regarding the maximum loan limits, which can be confusing. Not indicating whether the requested amount is the exact loan or the maximum available can complicate matters further.

In addition, people frequently overlook the importance of the employment status question. Many fail to mark whether their employment status is “active.” If this question is not answered accurately, it can raise red flags during the review process. Such oversights may lead to unnecessary inquiries, delaying loan approval.

Lastly, many applicants overlook the notary and spousal consent sections if applicable. Those who are married must acquire their spouse's consent, and failure to provide this can halt the entire loan process. Even if a borrower believes spousal consent is not necessary, they must still complete this section correctly or risk delays in funds receipt.

Documents used along the form

When applying for a MetLife Annuity Loan, several other forms and documents may be required or recommended to accompany the application. These documents help provide additional information or meet specific legal obligations and are essential for a smooth application process.

- Loan Repayment Schedule: This document outlines the proposed repayment terms including the schedule of payments, interest rates, and duration of the loan, ensuring that borrowers understand their obligations.

- Spousal Consent Form: Required for ERISA plans, this document confirms that the spouse agrees to the terms of the loan. It ensures compliance with federal laws protecting spousal rights in retirement accounts.

- Proof of Employment: A letter from the borrower’s employer verifying employment status and position, which helps substantiate the applicant's financial stability and eligibility for the loan.

- Sales Contract (if applicable): If the loan is being used to purchase a principal residence, this document verifies the purchase agreement, assuring that the loan proceeds adhere to the intended use.

- Current Account Statements: Recent statements from the annuity account provide a clearer picture of the borrower's financial standing and cash value, demonstrating their ability to manage the loan.

- Loan Request Disclosure: This document outlines the potential risks and responsibilities associated with taking out a loan against an annuity, ensuring that borrowers are fully informed before proceeding.

- Tax Implications Statement: A summary of the taxation rules related to annuity loans. This helps borrowers understand the potential tax consequences of defaulting on the loan or taking out an amount in excess of the regulated limits.

- Notarized Signature: Depending on the specific requirements, a notarized signature on certain documents may be necessary to authenticate the borrower's identity and consent.

- Financial Need Statement: A brief document explaining the reasons for the loan, which may help lenders assess the borrower's financial situation and need for funds.

Each of these documents plays a vital role in the integrity of the loan application process. Preparing them in advance can facilitate a smoother interaction with MetLife and ensure compliance with relevant guidelines and regulations.

Similar forms

- Loan Application Form: Similar to the MetLife Annuity Loan Application form, other loan application forms typically require personal information such as name, address, and social security number. They also detail the requested loan amount and repayment terms, ensuring both the lender and borrower are aligned on the expectations.

- Mortgage Application Form: This form shares similarities with the MetLife form as it requires information about the borrower’s employment status, income, and assets. It typically includes sections for specifying the loan amount and describing the purpose of the loan, which could be for purchasing a property or refinancing.

- Retirement Account Withdrawal Form: Like the MetLife form, this document covers details about the account holder’s retirement account and necessitates disclosure of previous loans or withdrawals. Both aim to maintain compliance with specific regulations regarding the amount that can be withdrawn or borrowed.

- Personal Loan Agreement: The personal loan agreement, created between a lender and individual, parallels the MetLife form because it outlines the terms of the loan, including the interest rate, repayment schedule, and borrower’s responsibilities in repaying the loan. It also mandates signatures to accept terms.

- Small Business Loan Application: Similar to the MetLife application, this form seeks detailed business and personal information to assess risk and loan eligibility, including purpose and amount of the loan request, along with acknowledgment of financial responsibilities linked to the loan.

- Credit Card Application: This application shares common elements with the MetLife form, mainly requiring personal identification and financial details, along with an understanding of the terms related to borrowing and repayment responsibilities. Both are designed to gauge creditworthiness and set terms for the use of borrowed funds.

Dos and Don'ts

When filling out the MetLife Annuity Loan Application form, consider the following guidelines:

- Ensure all personal information is accurate, including your Social Security Number and address.

- Clearly indicate your employment status as either "active" or "inactive."

- Provide a valid loan amount request and ensure it complies with maximum borrowing rules.

- Complete the loan duration section, selecting either A or B as applicable.

- Attach necessary documentation, such as a sales contract, if using the loan for a principal residence.

- Disclose any outstanding loans from retirement plans to avoid processing delays.

- Read the terms and conditions carefully to understand your responsibilities.

- Sign the application and obtain any required spousal consent, if married, to ensure legitimacy.

Avoid the following common mistakes:

- Do not leave any fields blank; all required information must be filled out.

- Refrain from submitting the application without verifying your financial information first.

- Do not request an amount exceeding the allowed limits set forth in the agreement.

- Do not ignore repayment terms as failure to adhere can lead to loan default and tax complications.

- Never falsify any information, as doing so may lead to serious penalties or loan denial.

- Avoid submitting the application without proper documentation attached.

- Do not forget to check the submission method to ensure timely processing.

- Do not overlook signing the application; an unsigned application will not be processed.

Misconceptions

Misconceptions about the MetLife Annuity Loan Application form can lead to confusion and misunderstandings. Below are six common misconceptions and explanations to clarify them.

- Misconception 1: I can take out multiple loans at the same time.

- Misconception 2: The loan amount can be any amount I desire.

- Misconception 3: I do not need to repay the loan until I choose to.

- Misconception 4: I can just ignore the loan terms and conditions.

- Misconception 5: I can use any portion of my annuity for the loan.

- Misconception 6: My spouse’s consent is not necessary for taking out the loan.

The truth is, the application states that a borrower may only have one active loan at a time from a particular contract or certificate. Only after paying the outstanding loan and interest can a new loan be requested.

Loan amounts are subject to maximum limits based on specific calculations derived from your contract and other outstanding loans. The borrower must adhere to outlined limits that ensure the total borrowed does not exceed allowable amounts according to federal regulations.

Repayment is required through scheduled quarterly installments. If repayments are not made within a specified period after the due date, there can be serious consequences, including default and tax implications.

This misconception can create problems, as the borrower is responsible for understanding and accepting the terms when applying. Ignoring these obligations may lead to unintended financial consequences.

The application specifies that only vested cash value may be used for securing a loan. Certain restrictions apply, particularly regarding cash value derived from employer contributions versus employee contributions.

If the borrower is married, obtaining spousal consent is often a legal requirement under ERISA plans. Without this consent, the loan cannot be processed, as the spouse has rights to certain benefits protected by federal law.

Key takeaways

Here are some key takeaways about filling out and using the MetLife Annuity Loan Application form:

- Provide Complete Account Information: Ensure you fill in your account number, name, address, and Social Security number accurately. This information is essential for processing your loan.

- Specify the Loan Amount: Clearly state the amount you wish to borrow or check the box for the maximum loan amount available. Remember, the maximum amount depends on your contract and outstanding loans.

- Indicate Loan Duration: Specify your desired repayment period. Use the correct section based on whether the loan is for purchasing a principal residence or for other purposes. Note that repayment periods differ based on the purpose.

- Understand Security Interest: MetLife will hold a security interest in your contract’s cash value. This means if you default on the loan, they may use the cash value to recover the amount owed.

- Be Aware of Eligibility Requirements: You must disclose any outstanding loans from your employer's retirement plans. If there’s an existing default, the application will not be processed.

- Signature and Consent: Don’t forget to sign the application. If married, spousal consent may be necessary under federal law. Ensure all required signatures are gathered before submission.

Filling out this application correctly helps streamline the loan process and avoid potential delays. Take your time to review each section thoroughly.

Browse Other Templates

Informed Refusal Form - You can change your mind about seeking treatment at any time.

Arizona University - Timely submission of the waiver request can enhance the chances of a successful application experience.