Fill Out Your Metlife Life Insurance Claim Form

Dealing with the loss of a loved one is undoubtedly one of the most challenging experiences one can face. During this difficult time, beneficiaries of MetLife life insurance policies can turn to the comprehensive Life Insurance Claim form for guidance and support. This form facilitates the claims process, allowing individuals to submit the necessary information about themselves and the deceased. Key sections of the form include personal details about the claimant, such as their name, address, social security number, and their relationship to the deceased. Additionally, beneficiaries will be required to provide similar information about the deceased, along with a certified copy of the death certificate to avoid delays. One of the significant features of the claims process is the Total Control Account, which allows beneficiaries to manage proceeds securely while deciding how to best utilize their funds. Other settlement options may exist depending on the policy, and the form outlines the specifics of each option. Contact information for MetLife's representatives is readily available, offering beneficiaries reassurance and assistance throughout the claims journey. Completing this form accurately is crucial, as it lays the foundation for receiving the benefits intended to provide financial support during a profoundly challenging time.

Metlife Life Insurance Claim Example

Dear Beneficiary:

We at MetLife are sorry for your loss. To help you through what can be a very difficult, emotional, and confusing time, we created a settlement option, the Total Control Account¨ Money Market Option, to give you the time you need to best decide how to use your insurance or annuity proceeds.

The insurance or annuity contract may have provided other settlement options for payment of the proceeds. Unless the contract owner or insured preselected a specific method of settlement, your right to choose any of these other settlement options is preserved while your money is in a Total Control Account. If a settlement option was preselected for you, more information will be provided as your claim is processed.

If the amount of proceeds payable to you is $7,500 or more, a Total Control Account will be opened in your name once your claim is approved, unless a different settlement option was selected. You will receive a personalized ÒcheckbookÓ and a Customer Agreement, which gives you additional information regarding your Account in an easy to read question and answer format. By using one of your personalized Òchecks,Ó you can draw a draft on your Total Control Account for the entire amount at any time. Information regarding the other settlement options available will also be provided.

While your money is in a Total Control Account, it is guaranteed by MetLife. You can access all or part of the insurance proceeds at any time, simply by writing one of your checks. You are not charged for checks, there are no transaction or monthly fees and there are no penalties for withdrawing all or part of your money.

We hope that the Total Control Account will help you rest a little easier knowing that your money is safe, earning a competitive rate, and accessible to you when you need it, giving you time to make financial decisions that are right for you. Please read the additional information regarding the Total Control Account provided on this form.

If you have further questions about the Account, MetLifeÕs Investment and Fiduciary Services Department is available every business day at (908)

Once again, we extend our condolences and assure you that we will make every effort to help you in every way we can.

Please complete the Beneficiary Life Insurance Claim Statement section of this form. Then ask your employer to complete the EmployerÕs Statement section and mail this form to:

MetLife

SBC Life Claims

P.O. Box 6122

Utica, NY

The TOTAL CONTROL ACCOUNT¨ Money Market Option

Designed to Put YOU in Complete Control of Your Life Insurance Proceeds

The Total Control Account provides É

SAFETY

¥The entire amount of your Account, including all interest earned, is fully guaranteed by MetLife.

COMPETITIVE RATES

¥The Account earns interest at money market rates that are responsive to current market conditions.

¥Interest is compounded daily and credited monthly. (Generally, the interest earned will be subject to income tax.)

FREE CHECKING

¥You can write checks from a minimum amount of $250 up to the full amount in the Account at any time.

¥There are no monthly service or transaction charges. There is no charge for printing or reordering checks.

CONVENIENCE

¥A personalized checkbook provides you with easy and immediate access to the funds.

¥You will receive a monthly statement, showing all transactions, interest earned and the balance in the Account.

FLEXIBILITY

¥You can withdraw all or part of your money at any time, without penalty or loss of interest.

¥There are no limits on the number of checks you can write each month.

¥You can name a beneficiary to receive money held in the Account, in case something happens to you.

FULL SERVICE

¥Beneficiary Service Representatives are within easy reach to answer any questions you may have about your Account. YouÕll be able to call them,

TIME TO DECIDE

¥Your rights to elect all other available MetLife settlement options* are preserved. You may, at any time, place some or all of the money in your Account in any other available option.

¥MetLife has a range of settlement options for you to choose from, including Guaranteed Interest Certificates. You will receive complete information on all settlement options which are available to you along with the Total Control Account checkbook.

*If the insured designated an alternative settlement option, that designation will be carried out. In this case, more information will be provided to you as your claim is processed.

The Total Control Account gives you:

Safety ¥ Security ¥ Convenience ¥ Flexibility

Free Checking ¥ Competitive Interest

If the proceeds payable to you are less than $7,500 Ñ and the insured did not designate a settlement option, payment is usually made by a single,

Completing Your Claim Statement

Every effort has been made to make completing your claim form as simple as possible. The following examples should make it even simpler. Each beneficiary must submit his or her own claim form.

SECTION A

Here you are asked for information about you and your relationship to the deceased. Your completed form might look like this:

A. Information about you: |

|

|

|

|

|

|

||

|

|

|

|

______________________________________________________________________________ |

||||

1. |

Your Name (please print or type) |

|

|

JOAN |

R. |

SMITH |

||

|

|

|

|

|

|

First |

Middle Initial |

Last |

2. |

Your Social Security No. |

|

|

|||||

3. |

Your Date of Birth |

6 |

|

28 |

37 |

Your Sex ⬛ Male |

⬛ Female |

|

|

|

|

Mo. |

|

Day |

Year |

|

X |

4. |

Your Phone Number (in case we need to contact you) |

Day (305) |

||||||

5. |

Your Address |

|

|

|

Area Code |

Area Code |

||

|

|

|

MARTIN STREET |

3B |

||||

|

|

_____________________________________________________________________________________________ |

||||||

|

|

|

House Number |

|

|

Street Name |

Apt./Box No. (if any) |

|

|

|

MIAMI |

|

|

|

FLORIDA |

33400 |

|

|

_______________________________________________________________________________________________________ |

|||||||

|

|

|

City |

|

|

|

State |

Zip |

6. |

Your relationship to the deceased. You are the |

⬛ Husband or Wife ⬛ Child ⬛ Parent ⬛ Other _________________________ |

||||||

|

|

|

|

|

|

X |

|

Explain |

SECTION B

In Section B we ask you to tell us about the deceased. Please be sure that you use the deceasedÕs legal residence address prior to the death. Your completed form might look like this:

B. Information about the deceased: |

|

|

|

|

|

|

|||

1. |

His/Her Name |

GEORGE |

|

H. |

|

|

SMITH |

|

|

|

|

|

First |

|

Middle Initial |

|

|

Last |

|

|

|

__________________________________________________________________________________ |

|||||||

2. |

His/Her Residence Address |

|

|

MARTIN STREET |

3B |

|

|||

|

|

|

House Number |

Street Name |

|

Apt./Box No. (if any) |

|

||

|

_______________________________________________________________________________________________________ |

||||||||

|

|

|

MIAMI |

|

FLORIDA |

|

33400 |

|

|

|

|

|

City |

|

State |

|

|

Zip |

|

3. |

His/Her Marital Status |

|

⬛ Single |

⬛ Married ⬛ Widow/Widower |

⬛ Separated ⬛ Divorced |

||||

4. |

His/Her Date of Birth |

6 |

28 |

37 |

|

|

|

|

|

|

|

Mo. |

Day |

Year |

|

______________________________________________ |

|||

5. |

His/Her Social Security No. 123/ 45/ 6789 |

6. |

His/Her Employer |

|

ABC COMPANY |

|

|||

7. |

We need an officially certified copy of death certificate. Is a copy attached? |

|

⬛ Yes |

⬛ No |

|||||

|

|

|

|

|

|

|

|

X |

|

If not, state why ___________________________________________________________________________________________

Please make every effort to include with your form an officially certified copy of the death certificate. The absence of the death certificate can cause substantial delays. If your name has changed since the original beneficiary designation please provide supporting documentation.

Once you have completed the form, sign (just as you sign checks) and date it.

The information I have given is, to the best of my knowledge, true and accurate. Under penalties of perjury, I certify that the number shown on this form is my correct taxpayer identification number, and that: (please check one)

⬛The Internal Revenue Service (IRS) has notified me that I am subject to backup withholding as a result of a failure to report all interest or dividends, or

⬛I am not subject (or no longer subject) to backup withholding.

The IRS does not require your consent to any provision of this document other than the certifications to avoid backup withholding.

If the insured was covered under a policy issued in one of the states listed below or if you reside in one of the states listed below, one of the following state warnings may apply to you:

New Jersey: Any person who knowingly files a statement of claim containing any false or misleading information is subject to criminal and civil penalties.

Florida: Any person who knowingly and with intent to injure, defraud or deceive any insurer files a statement of claim containing any false, incomplete or misleading information is guilty of a felony of the third degree.

Virginia: It is a crime to knowingly provide false, incomplete or misleading information to an insurance company for the purpose of defrauding the company. Penalties include imprisonment, fines and denial of insurance benefits.

If the insured was covered under a policy issued in any state other than those listed above, or if you reside in any state other than those listed above, then the following warning may apply to you:

Any person who knowingly and with intent to defraud any insurance company or other person files a statement of claim containing any materially false information or conceals, for the purpose of misleading, information concerning any fact material thereto commits a fraudulent insurance act, which is a crime and subjects such person to criminal and civil penalties.

Please sign below as you would sign on checks. If you are receiving a Total Control Account, this signature will be placed with your Account.

Joan Rose Smith |

January 20, 1992 |

Beneficiary Signature |

Date |

Return this completed Claim Statement to the EmployerÕs appropriate Benefit Office. Be sure to include an officially certified copy of the death certificate.

Metropolitan Life Insurance Company

One Madison Avenue, New York, NY

BeneficiaryÕs Life Insurance Claim Statement

In order to process your claim as quickly as possible we need some information about you and about the deceased. Each beneficiary must submit his or her own claim statement.

A. Information about you:

1.Your Name (please print or type) _______________________________________________________________________________

First |

Middle Initial |

Last |

2.Your Social Security No. _________________________

3. |

Your Date of Birth ________________________________ |

Your Sex ☐ Male ☐ Female |

|

||||

|

Mo. |

Day |

Year |

|

|

|

|

4. |

Your Phone Number (in case we need to contact you) |

Day ( |

)_____________ |

Evening ( |

)_____________ |

||

|

|

|

|

Area Code |

Area Code |

||

5.Your Address ______________________________________________________________________________________________

House NumberStreet NameApt./Box No. (if any)

________________________________________________________________________________________________________

CityStateZip

6. Your relationship to the deceased. You are the ☐ Husband or Wife ☐ Child ☐ Parent ☐ Other __________________________

Explain

B. Information about the deceased:

1.His/Her Name______________________________________________________________________________________________

First |

Middle Initial |

Last |

2.His/Her Residence Address____________________________________________________________________________________

House NumberStreet NameApt./Box No. (if any)

________________________________________________________________________________________________________

|

City |

|

State |

|

Zip |

3. His/Her Marital Status |

☐ Single |

☐ Married |

☐ Widow/Widower |

☐ Separated |

☐ Divorced |

4.His/Her Date of Birth ______________________________

|

Mo. |

Day |

Year |

|

|

5. |

His/Her Social Security No. ____ / ___ / ______ |

6. His/Her Employer ________________________________________________ |

|||

7. |

We need an officially certified copy of death certificate. Is a copy attached? |

☐ Yes |

☐ No |

||

|

If not, please state why_______________________________________________________________________________________ |

||||

The information I have given is, to the best of my knowledge, true and accurate. Under penalties of perjury, I certify that the number shown on this form is my correct taxpayer identification number, and that: (please check one)

⬛The Internal Revenue Service (IRS) has notified me that I am subject to backup withholding as a result of a failure to report all interest or dividends, or

⬛I am not subject (or no longer subject) to backup withholding.

The IRS does not require your consent to any provision of this document other than the certifications to avoid backup withholding.

If the insured was covered under a policy issued in one of the states listed below or if you reside in one of the states listed below, one of the following state warnings may apply to you:

New Jersey: Any person who knowingly files a statement of claim containing any false or misleading information is subject to criminal and civil penalties.

Florida: Any person who knowingly and with intent to injure, defraud or deceive any insurer files a statement of claim containing any false, incomplete or misleading information is guilty of a felony of the third degree.

Virginia: It is a crime to knowingly provide false, incomplete or misleading information to an insurance company for the purpose of defrauding the company. Penalties include imprisonment, fines and denial of insurance benefits.

If the insured was covered under a policy issued in any state other than those listed above, or if you reside in any state other than those listed above, then the following warning may apply to you:

Any person who knowingly and with intent to defraud any insurance company or other person files a statement of claim containing any materially false information or conceals, for the purpose of misleading, information concerning any fact material thereto commits a fraudulent insurance act, which is a crime and subjects such person to criminal and civil penalties.

Please sign below as you would sign on checks. If you are receiving a Total Control Account, this signature will be placed with your Account.

_______________________________________________________ _____________________________________________

Beneficiary Signature |

Date |

EMPLOYERÕS STATEMENT Ñ To Be Completed by an Authorized Company Representative. Please Type.

Certificate

Number

Date of Death

Mo. Day Yr.

Date of Birth

Mo. Day Yr.

|

Name of Insured Employee |

|

Sex |

Last |

First |

Middle |

M or F |

|

|

|

|

Name of

Employer ______________________________________________

Division or

Subsidiary ______________________________________________

and Location

Social Sec. Number

If Different from Cert. No.

This Line Across for Dependent Claims Only

Date of Birth

Mo. Day Yr.

Sex |

Amount of |

|

Name of Deceased Dependent |

|

M or F |

Dependent Life Insurance |

Last |

First |

Middle |

|

|

|

|

|

Relationship

Spouse______________

Child _______________

Notice: Be sure to consider any reduction formula applicable to each type of Life benefit |

Complete the following if Applicable: |

|

|

☐ Hourly Employee |

or |

☐ Salaried Employee |

|

|

|||

|

☐ Union Employee |

or |

☐ |

Group |

Sub |

Claim |

Type of Life Benefits |

Amount |

(Report Number) |

Code |

Pay Point |

Check applicable box(es) |

|

|

|

(Branch) |

|

|

|

|

|

☐ Basic Life |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

☐ Optional Life* |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

☐ Group Life Plus |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

☐ Group Universal Life** |

|

|

|

|

|

|

|

|

|

|

|

*Optional Life includes Supplemental Life, Additional Life, and Voluntary Life Benefits

**For more information concerning Group Universal Life coverage, please call

☐ Exempt Employee or ☐

Occupation ___________________________________________________

Is there any transaction pending which will affect the payee or the amount payable? If yes, give particulars:

____________________________________________________________

____________________________________________________________

On what date did the employee last work? ________________Reason for stopping ___________________________________________

Was employee ☐ active or |

☐ retired? Date retired _______________Annual base pay_____________________ |

|

If active, enter the effective date of the amount of insurance being claimed. ______________________ |

||

If retired, enter the amount of insurance prior to reduction, if any. ________________________ |

||

Was the |

Date ____________Reason _____________________ |

|

Was life insurance cancelled? |

☐ No ☐ Yes Date ____________Was conversion applied for? ☐ No ☐ Yes ☐ Unknown |

|

Was a Total and Permanent Disability claim ever filed with MetLife for this employee? |

☐ No ☐ Yes |

|

If yes, please provide the approval number. _____________________________________________________________________________

Annuity Death Benefit |

|

|

Accidental Death Benefit |

|

Survivor Income Benefit |

|

|

|

|

|

|

|

|

If an Annuity Death Benefit is claimed, and |

For groups operated on the ÒAnnual |

|

|

If an Accidental Death Benefit is |

If the deceased employee qualified for |

|

such benefit is covered by MetLife, enter |

ExhibitÓ method of billing or if employee |

|

claimed, and such benefit is covered |

Survivor Income Benefits, and such |

||

Group Annuity |

contributions are reported annually: |

|

|

by MetLife, enter amount of such |

benefits are covered by MetLife, specify if |

|

|

Employee contributions |

|

|

benefit only. |

the claim |

☐ is attached, or |

|

|

|

|

|

☐ will follow |

|

|

for prior exhibit year $______________ |

|

$_____________________________ |

|

||

Contract No. ________________________ |

|

|

|

|||

Employee contributions |

|

|

Amount of Regular Life Insurance |

|

|

|

|

|

|

|

|

||

and Cert. No. ________________________ |

for current |

|

|

should be entered above. |

|

|

exhibit year $_____________________ |

|

|

|

|

||

|

|

|

|

|

||

|

Total employee |

|

|

|

|

|

|

contributions $ ___________________ |

|

|

|

|

|

_______________________________________________________________ |

__________________________________ |

__________________________________ |

||||

Signature of EmployerÕs Authorized Representative |

Date |

|

Telephone No. |

|||

Send check or Total Control Account Package:

☐Directly to Beneficiary(ies)

☐Other: ___________________________________________

___________________________________________

___________________________________________

___________________________________________

Please attach any enrollment forms and beneficiary designations you retained. If a beneficiary is deceased, a copy of his or her death certificate is required. If you have any questions, please contact the MetLife administrator responsible for your group.

© 1988 Metropolitan Life Insurance Company Total Control Account¨ is a registered service mark of Metropolitan Life Insurance Company |

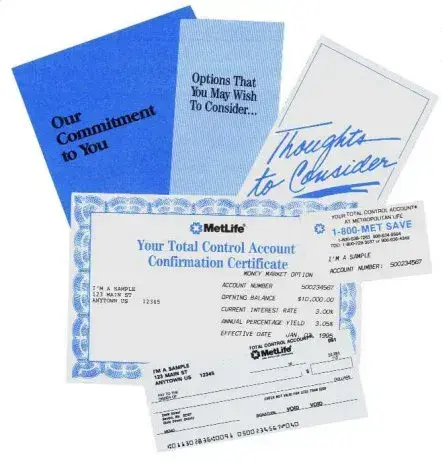

As soon as your claim has been processed and approved (and the amount payable to you exceeds $7,500), a Total Control Account will be automatically opened, and you will receive:

¥A booklet which includes your Customer Agreement spelling out the exact terms of your Account in an

¥A brochure describing other Settlement Options available, at no cost to you, including Guaranteed Interest Certificates.

¥A Total Control Account card is included for your convenience when calling your Beneficiary Service Representative on our

¥A Confirmation Certificate, showing the amount of life insurance proceeds placed in your Account, your Account number, the current interest rate, effective annual yield, and a Beneficiary Designation form.

¥Personalized checks give you immediate access to your money. You may write checks, payable to anyone, for any amount of $250 or more, to cover immediate expenses or for any other purpose. Meanwhile, the funds you donÕt use right away are safe at MetLife

and continuing to earn competitive money market interest.

© 1988 Metropolitan Life Insurance Company Total Control Account¨ is a registered service mark of Metropolitan Life Insurance Company |

|

18000208126 (0399) |

|

Form Characteristics

| Fact Name | Description |

|---|---|

| Condolences Expressed | MetLife offers condolences for the loss of a loved one to support beneficiaries during a difficult time. |

| Settlement Option | The Total Control Account offers beneficiaries control over how to use their insurance or annuity proceeds. |

| Approval Amount | If proceeds are $7,500 or more, a Total Control Account opens for the beneficiary upon claim approval. |

| Free Checkwriting | Beneficiaries can withdraw any amount from the Total Control Account anytime without charges or penalties. |

| Interest Rates | The Total Control Account earns competitive interest that compounds daily and is credited monthly. |

| State-Specific Laws | In New Jersey, Florida, and Virginia, false claims can lead to criminal and civil penalties. |

| Information Required | Each beneficiary must submit individual claim forms along with the death certificate for processing. |

| Beneficiary Support | Beneficiary Service Representatives are accessible to answer questions regarding the Total Control Account. |

| Withdrawal Flexibility | Beneficiaries can withdraw full or partial amounts from their Total Control Account without restrictions. |

| Multiple Settlement Options | MetLife provides various other settlement options that beneficiaries can choose from, preserving their rights. |

Guidelines on Utilizing Metlife Life Insurance Claim

Completing the MetLife Life Insurance Claim form can seem daunting, especially during a challenging time. However, following these straightforward steps will facilitate the process and ensure that you provide all necessary information for your claim. It is vital to collect all required documents as you fill out the form to avoid delays.

- Begin by filling out Section A: Information About You. Provide your name, Social Security number, date of birth, sex, phone number, and address. Be clear and accurate, checking for any typos.

- Indicate your relationship to the deceased. Choose from the options provided, such as husband, wife, child, parent, or other.

- Next, complete Section B: Information About the Deceased. Enter the deceased's full name, residence address prior to death, marital status, date of birth, Social Security number, and employer.

- Answer whether an officially certified copy of the death certificate is attached. If it is not, briefly explain why.

- Sign and date the form at the bottom of the page, ensuring that your signature matches your usual signature style for checks.

- Once you have filled out your portion of the form, ask your employer to complete the Employer's Statement section, as this must also be filled out for the claim to proceed.

- After both sections are complete, mail the form along with the certified death certificate to:

MetLife

SBC Life Claims

P.O. Box 6122

Utica, NY 13501-6122. - Keep a copy of the completed form and any attached documents for your records.

By following these steps diligently, you will enhance the chances of a smooth and prompt processing of your life insurance claim.

What You Should Know About This Form

What is the Total Control Account option mentioned in the Metlife Life Insurance Claim form?

The Total Control Account is a settlement option provided by MetLife for insurance proceeds of $7,500 or more. It allows beneficiaries to have immediate access to their funds while ensuring that the money is safe and earning interest. This account gives you the flexibility to withdraw money by writing checks without incurring any fees or penalties. You will also receive a monthly statement detailing your transactions, interest earned, and the balance in your account, allowing for easy management of your funds.

How do I complete the Beneficiary Life Insurance Claim Statement?

Filling out the Beneficiary Life Insurance Claim Statement involves providing personal information about yourself as the beneficiary, including your name, Social Security number, contact details, and your relationship to the deceased. You will also need to detail similar information about the deceased, including their Social Security number and date of birth. Be sure to attach a certified copy of the death certificate. Each beneficiary must submit their own claim form.

What happens if my claim amount is less than $7,500?

If the insurance proceeds payable to you are less than $7,500 and no specific settlement option was designated by the insured, you typically will receive a single lump-sum check. This straightforward approach ensures that you receive your funds without the additional steps required for accounts with higher payouts. It’s important to follow the instructions carefully to avoid delays in processing your claim.

Who should I contact if I have questions regarding my Total Control Account?

If you have further inquiries about your Total Control Account or need assistance, MetLife's Investment and Fiduciary Services Department is available to help. You can reach them every business day at (908) 634-9594 or via the toll-free number 800-MET-SAVE (800-638-7283). For hearing-impaired callers, TDD services are also available at (908) 636-4349 or 800-229-3037. They are there to ensure that you have all the information you need during this challenging time.

Common mistakes

Filing a life insurance claim can be emotionally challenging, and mistakes on the MetLife Life Insurance Claim form can create additional stress. Here are four common errors that people make when completing this important document.

Firstly, providing incorrect or incomplete information in Section A about yourself is a frequent mistake. It’s essential to accurately fill in your name, address, social security number, and relationship to the deceased. If you accidentally misspell a name or provide the wrong social security number, it could delay the processing of your claim. Moreover, ensure that the relationship you specify correlates with what is documented in the insurance policy. Missing this crucial detail could lead to further complications.

Another common error involves the details related to the deceased in Section B. Beneficiaries sometimes provide outdated address information or fail to use the deceased's legal name as listed on their legal documents. It is vital to use the correct and up-to-date address that the deceased resided in prior to death. A simple mistake here can cause the claim to be held up while MetLife verifies the information.

Additionally, beneficiaries often overlook the requirement for an officially certified copy of the death certificate. Failing to attach this document is a significant mistake that can substantially delay the claim process. It is crucial to ensure that the death certificate is included alongside the claim form, as MetLife specifically requests it in order to proceed.

Lastly, many confusion arises from the signature section. Beneficiaries may forget to sign the form entirely or may not sign it in the manner that matches their identification. The signature should be the same as it appears on checks and official documents. Always double-check that you have included your signature and the date. A missing or mismatched signature can result in processing delays or even rejection of the claim.

By paying careful attention to these details, individuals can help streamline the claims process during what is often a difficult time. Making sure to provide accurate information, attaching necessary documents, and signing properly are critical steps in ensuring that claims are processed efficiently.

Documents used along the form

When submitting a MetLife Life Insurance Claim, several additional documents may be needed to support the claim process. Here is a list of commonly required documents, along with a brief description of each.

- Death Certificate: An officially certified copy of the death certificate is essential. It verifies the death of the insured and must be submitted with the claim form.

- Beneficiary Designation Form: This form confirms the designated beneficiaries of the insurance policy. It is necessary if the beneficiary's name has changed since the original designation.

- Employer’s Statement: Completed by an authorized representative of the employer, this document provides information on the insured's employment status, including dates of service and type of coverage.

- Claim Supporting Documentation: Any additional documents such as divorce decrees, marriage certificates, or court orders may be necessary to establish the beneficiary's relationship with the deceased.

- Tax Identification Number Form: This form ensures that the claimant's correct taxpayer identification number is on file to avoid backup withholding. It is critical for processing tax-related information.

- Authorization Release Form: This form authorizes MetLife to obtain any additional information necessary to process the claim, helping to speed up the review and payment process.

Collecting and submitting these documents along with the MetLife Life Insurance Claim form will help ensure a smooth and efficient claims process. If there are questions or clarifications needed, reaching out to MetLife's customer service can provide the necessary assistance.

Similar forms

- Life Insurance Policy Application: Like the MetLife Life Insurance Claim form, this document collects personal details of the applicant, including their relationship to the insured, and requires necessary identification numbers such as Social Security numbers.

- Beneficiary Designation Form: This document specifies who receives the benefits from a life insurance policy. Similar to the claim form, it requires details about the beneficiary’s personal information and their relationship to the insured.

- Death Certificate: This official document is often required to claim insurance benefits. Both the claim form and the death certificate establish legal authorization for benefits to be paid to the beneficiary.

- Insurance Policy Summary: This summary outlines the coverage details, associated rights, and options for beneficiaries, akin to the settlement options provided in the MetLife form.

- Power of Attorney Document: This legal document allows an individual to act on behalf of another. It can be necessary when claiming benefits as it may provide authority to handle insurance matters similar to how the claim form authorizes the beneficiary to receive funds.

- Claim Appeal Form: When a claim is denied, this form is used to appeal the decision. Like the MetLife claim form, it gathers pertinent information regarding the claimant and the insured to reassess the claim.

- Insurance Settlement Agreement: This document outlines the agreement between the insurer and the beneficiary on how the benefits will be paid. It has similarities to the Total Control Account section of the claim form, which offers settlement options and flexibility in accessing funds.

Dos and Don'ts

Things You Should Do

- Fill out the form completely and accurately to avoid processing delays.

- Ensure you provide your relationship to the deceased clearly in the form.

- Attach an officially certified copy of the death certificate.

- Contact MetLife for any questions regarding the process or if you need clarification.

Things You Shouldn't Do

- Do not leave any mandatory sections of the form blank.

- Avoid providing false information, as it can lead to serious penalties.

- Do not forget to check the accuracy of your personal information.

- Don’t rush the process; take the time to gather all required documents before submitting.

Misconceptions

1. All claims must be submitted immediately. Many beneficiaries believe they need to file the claim right away, but there is often a grace period in which to submit the necessary forms and documentation.

2. You can only choose the Total Control Account if your proceeds are over $10,000. The claim form indicates that if the amount of proceeds is $7,500 or more, a Total Control Account will be established, debunking this misconception.

3. All beneficiaries must submit the same claim form. Each beneficiary must submit their own claim form, which ensures that all information is collected accurately and efficiently.

4. You cannot access your funds until the claim is fully processed. While the claim is in process, beneficiaries can access their funds through the Total Control Account at any time by writing a check.

5. The Total Control Account has fees associated with it. There are no service charges, transaction fees, or penalties for withdrawing money from the Total Control Account, making it a cost-effective option.

6. A death certificate is not crucial for the claim process. The absence of a certified death certificate can lead to delays. It is essential to include this document with the claim form to ensure prompt processing.

7. You lose settlement options if you choose the Total Control Account. Beneficiaries have the right to select any available settlement option while their funds are in the Total Control Account, preserving their flexibility.

8. You cannot name another beneficiary for the Total Control Account. It is possible to designate a new beneficiary for the Total Control Account, providing security and peace of mind for your financial matters.

9. The funds in the Total Control Account are not earning interest. The account earns interest at competitive money market rates, compounded daily and credited monthly, ensuring that funds grow over time.

10. You must remain in the Total Control Account indefinitely. At any time, beneficiaries may move their funds into any other available MetLife settlement options, allowing for financial planning according to personal needs.

Key takeaways

Filling out the MetLife Life Insurance Claim form can seem daunting, especially during a challenging time. Here are some key takeaways to help you navigate the process effectively:

- Personalization of Claims: Each beneficiary must submit their own claim form. This means it's critical to ensure that all information regarding both the beneficiary and the deceased is accurately recorded.

- Death Certificate Requirement: Always include an officially certified copy of the deceased's death certificate. Without it, processing the claim may experience significant delays.

- Total Control Account: If your claim amount is $7,500 or more, a Total Control Account will be opened in your name once the claim is approved. This provides you with flexibility and easy access to your funds.

- Section Completion: Pay close attention to completing the Beneficiary Life Insurance Claim Statement. Each section should be filled out thoroughly, including your relationship to the deceased and accurate contact information.

- Contacting MetLife: If you have questions or need assistance, MetLife's Investment and Fiduciary Services Department is readily available. You can reach them during business hours at their toll-free number.

Browse Other Templates

How to Fight a Ticket in Michigan - If this is your first offense, be sure to indicate that on the form.

Shutterfly Donation Request - Community engagement is a core component of our mission.

Free Printable Child Custody Forms California - This form can be used in conjunction with other custody and visitation documents.