Fill Out Your Metlife Ownership Form

The MetLife Ownership form plays a crucial role in ensuring that the ownership of a life insurance policy accurately reflects the wishes of the policyholder, particularly in circumstances such as inheritance or change of beneficiaries. This form comes into play when a change of policy owner is requested, and it is essential that the legal and administrative processes associated with this change are followed correctly. Throughout the form, policyholders and their legal heirs must provide detailed information, including the existing policy owner's details, the new owner’s personal information, and relevant identification. Notably, the form mandates certain documentation, such as a death certificate for the deceased policy owner and identity proof for the new owner, underscoring the importance of verifying ownership and entitlement. The request should be initiated by the rightful legal heirs to ensure compliance with regulations. It also highlights the need for an indemnity bond and correctly filled sections to affirm that all parties understand the implications of transferring ownership. Communication channels, such as customer service contacts, are readily available, emphasizing the company's commitment to assisting clients through this often sensitive process. Understanding these elements is vital for anyone looking to navigate the potentially complex landscape of life insurance ownership changes.

Metlife Ownership Example

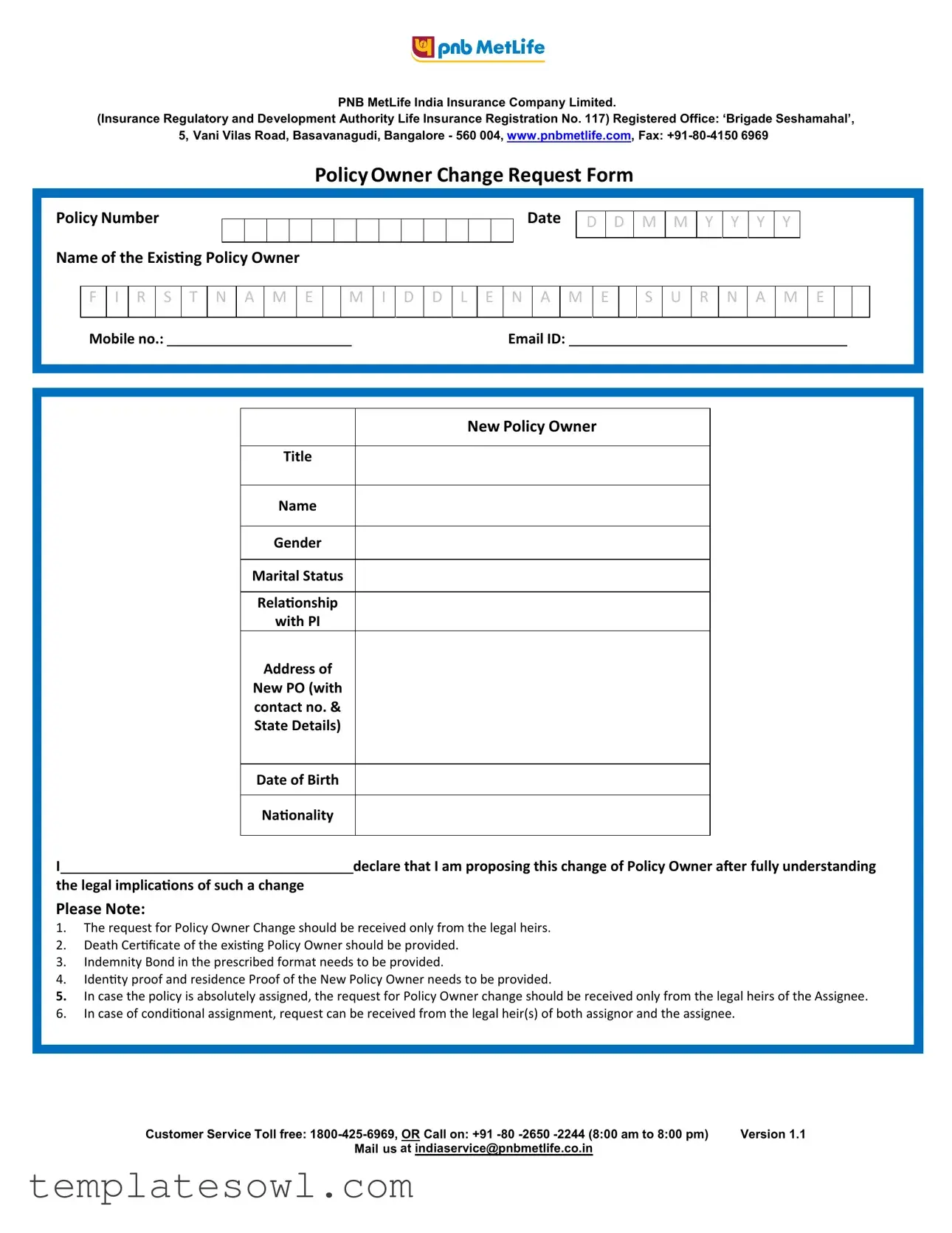

PNB MetLife India Insurance Company Limited.

(Insurance Regulatory and Development Authority Life Insurance Registration No. 117) Registered Office: ‘Brigade Seshamahal’, 5, Vani Vilas Road, Basavanagudi, Bangalore - 560 004, www.pnbmetlife.com, Fax:

Policy Owner Change Request Form

Policy Number

Name of the Exising Policy Owner

Date

D D

M M Y Y Y

Y

F I R S T N A M

E

M I D D L E

N A M

E

S U R

N

A M E

Mobile no.: |

|

Email ID: |

New Policy Owner

Title

Name

Gender

Marital Status

Relaionship

with PI

Address of

New PO (with

contact no. &

State Details)

Date of Birth

Naionality

I |

|

declare that I am proposing this change of Policy Owner ater fully understanding |

the legal implicaions of such a change |

|

|

Please Note:

1.The request for Policy Owner Change should be received only from the legal heirs.

2.Death Cerificate of the exising Policy Owner should be provided.

3.Indemnity Bond in the prescribed format needs to be provided.

4.Idenity proof and residence Proof of the New Policy Owner needs to be provided.

5.In case the policy is absolutely assigned, the request for Policy Owner change should be received only from the legal heirs of the Assignee.

6.In case of condiional assignment, request can be received from the legal heir(s) of both assignor and the assignee.

Customer Service Toll free: |

Version 1.1 |

Mail us at indiaservice@pnbmetlife.co.in |

|

PNB MetLife India Insurance Company Limited.

(Insurance Regulatory and Development Authority Life Insurance Registration No. 117) Registered Office: ‘Brigade Seshamahal’, 5, Vani Vilas Road, Basavanagudi, Bangalore - 560 004, www.pnbmetlife.com, Fax:

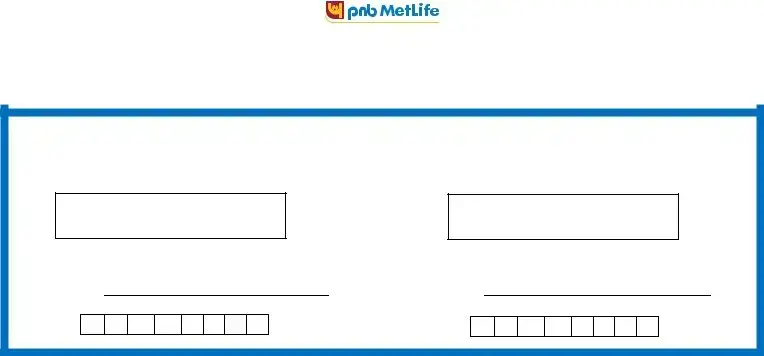

I hereby confirm having read and understood all the policy terms and condiions including those applicable to this request. I understand and accept that my request shall be processed in accordance with the terms and condiions of the policy and that I shall be solely responsible for all the consequences arising out of this request including any incorrect or incomplete informaion contained herein

Signature of Legal Heir

Place:

Date: |

D D M M Y Y Y Y |

|

(Signature of Legal Heir of Assignee), only in case of Assignment

Place:

Date: D D M M Y Y Y Y

Customer Service Toll free: |

Version 1.1 |

Mail us at indiaservice@pnbmetlife.co.in |

|

PNB MetLife India Insurance Company Limited.

(Insurance Regulatory and Development Authority Life Insurance Registration No. 117) Registered Office: ‘Brigade Seshamahal’, 5, Vani Vilas Road, Basavanagudi, Bangalore - 560 004, www.pnbmetlife.com, Fax:

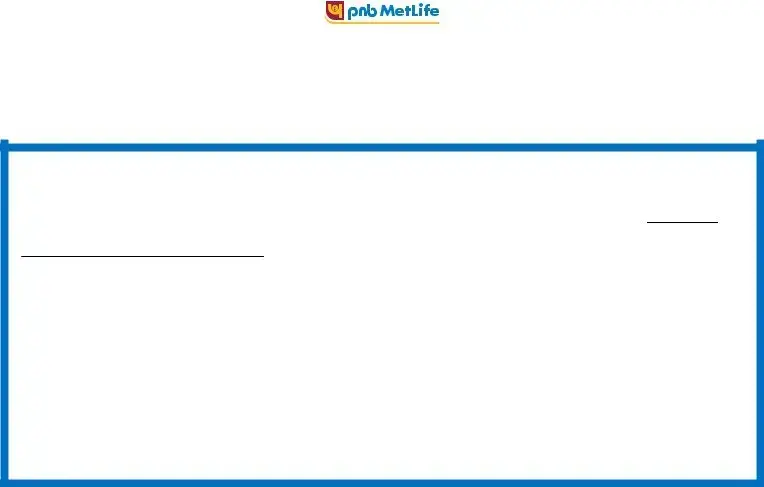

Acknowledgement Slip

Received a request for |

|

against Policy Number |

On |

|

at |

|

|

|

am/pm |

||

Received By: |

|

|

|

|

|

|||

Employee Name |

|

|

|

|

|

|

||

Employee Code |

|

|

|

|

Date and ime Stamp / Seal of Branch |

|||

|

|

|

|

|

|

|

|

|

Customer Service Toll free: |

Version 1.1 |

Mail us at indiaservice@pnbmetlife.co.in |

|

Form Characteristics

| Fact Name | Details |

|---|---|

| Insurance Company | PNB MetLife India Insurance Company Limited |

| Regulatory Authority | Insurance Regulatory and Development Authority (IRDA) |

| Registration Number | Life Insurance Registration No. 117 |

| Request Initiated By | Legal heirs must submit the Policy Owner Change Request |

| Documentation Required | Death Certificate, Indemnity Bond, Identity and Residence Proof of New Policy Owner |

| Contact Information | Toll free: 1800-425-6969, or +91 -80 -2650 -2244 (8:00 am to 8:00 pm) |

Guidelines on Utilizing Metlife Ownership

Understanding the steps involved in filling out the Metlife Ownership form is crucial for ensuring that the process goes smoothly. Each individual must carefully complete their part to avoid any delays. Following the instructions will help ensure that your request is submitted correctly.

- Begin by locating the Policy Number and fill it in at the top of the form.

- Enter the Name of the Existing Policy Owner, including their First Name, Middle Name, and Surname.

- Provide the Date using the format of day, month, and year.

- List the Mobile Number and Email ID for further contact.

- In the section for the New Policy Owner, fill in the Title, Name, Gender, Marital Status, and Relationship with the previous owner.

- Fill in the New Policy Owner's Address along with a contact number and state details.

- Add the Date of Birth and indicate the Nationality of the new owner.

- Read and understand the declaration statement about fully understanding the legal implications of the policy owner change.

- Provide all necessary supplementary documents as mentioned, including the death certificate of the existing policy owner, indemnity bond, identity proof, and residence proof of the new policy owner.

- If the request concerns an assignee, ensure that the legal heir of the assignee also signs where indicated.

- Finally, sign the form. Include the Place and Date of signing.

What You Should Know About This Form

What is the purpose of the MetLife Ownership form?

The MetLife Ownership form is used to request a change in the ownership of a life insurance policy from one individual to another. This may be necessary due to various circumstances, such as a change in financial planning, family dynamics, or the unfortunate passing of the original policy owner. Completing this form is essential to ensure that the correct individual is recognized as the new policy holder.

Who is eligible to submit the Ownership Change Request?

Only legal heirs of the existing policy owner are permitted to submit the Ownership Change Request. This restriction ensures that the transition of ownership is managed appropriately and legally. In cases involving absolute assignments, the request must originate from the heirs of the assignee as well. If conditional assignments are involved, requests may be made by the legal heirs of both the assignor and the assignee.

What documents are required to complete the Ownership Change Request?

To successfully process the Ownership Change Request, several documents must be submitted. These include the death certificate of the current policy owner, an indemnity bond in the prescribed format, and identity and residence proof of the new policy owner. Providing these documents helps establish legitimacy and protects the interests of all parties involved.

Can I change the policy ownership if there is an absolute assignment?

No, if the policy is absolutely assigned, only the legal heirs of the assignee can request a change in ownership. It is crucial to understand these stipulations to avoid delays in processing. Proper verification of relationships and statuses is needed to maintain compliance with legal requirements.

What happens if the information provided in the form is incorrect or incomplete?

If any information in the Ownership Change Request form is incorrect or incomplete, it can result in delays or complications in processing the request. It is the responsibility of the person submitting the request to ensure that all details are accurate and complete. Review all information carefully before submission to mitigate any potential issues.

How can I contact customer service for assistance with my policy?

If you have questions or need assistance with your policy or the Ownership Change Request, you can reach the customer service team at PNB MetLife India Insurance Company. They can be contacted toll-free at 1800-425-6969 or at +91-80-2650-2244 from 8:00 am to 8:00 pm. Alternatively, you can email them at indiaservice@pnbmetlife.co.in for support.

Common mistakes

Filling out the Metlife Ownership form can be straightforward; however, many individuals make common mistakes that can delay the process. One of the most frequent errors occurs when people forget to include crucial personal details. Omitting information, such as the correct policy number or contact information, can lead to increased processing times and unnecessary complications.

Another common mistake is failing to provide the necessary documentation. The form specifically requests a death certificate of the existing policy owner. Individuals often overlook this requirement, assuming it is unnecessary. Not submitting this document can result in the rejection of the request.

Inaccurate information is frequently reported. Filling out the form requires attention to detail. Errors, such as misspelled names or incorrect dates of birth, can create significant issues later in the process. It is essential to double-check all entries before submitting the form.

Some individuals neglect to indicate their relationship with the policy owner. This detail is crucial, as only legal heirs can apply for changes in ownership. Leaving this field blank may raise questions during the processing of the request.

Another mistake involves ignoring the requirement for proof of identity and residence for the new policy owner. Submitting this information is essential. Applications without proper identification may be delayed or denied entirely.

In cases where the policy has been assigned, individuals often do not clarify the type of assignment. Understanding the distinction between absolute and conditional assignments is important. This knowledge affects who is authorized to submit a request for ownership change.

Individuals sometimes submit the form without their signature. It is vital to confirm that all required signatures are present. Without them, processing cannot proceed, resulting in unnecessary delays.

Lastly, individuals may fail to read and understand all terms and conditions associated with the ownership change. This oversight can lead to misunderstandings about responsibilities and consequences. It is important to fully grasp the implications of the changes being requested.

Documents used along the form

The PNB MetLife Ownership form is an important document for changing the ownership of an insurance policy. However, there are several other documents that accompany this form to ensure a smooth transition of ownership and compliance with legal requirements. Below is a list of other forms and documents typically used in conjunction with the MetLife Ownership form, explained succinctly.

- Death Certificate: This is necessary to confirm the passing of the existing policy owner. It serves as proof for initiating the ownership change request.

- Indemnity Bond: A legal document that the new owner signs to protect the insurance company from any future claims or disputes regarding ownership. It outlines the responsibilities and liabilities of the new policy owner.

- Identity Proof: New policy owners must provide a government-issued ID to verify their identity. This could be a passport, driver's license, or any other acceptable form of identification.

- Residence Proof: This document confirms the new owner's address. Utility bills, lease agreements, or bank statements are commonly accepted as proof of residence.

- Assignment Agreement: If the policy was assigned to someone else before the ownership change, this agreement outlines the terms under which the rights to the policy were transferred. It is necessary in conditional assignment cases.

When submitting a request for a policy owner change, ensure that all required documents are completed and accurate. This meticulous approach will facilitate the process and help prevent delays or complications.

Similar forms

- Change of Beneficiary Form: Similar to the Ownership form, this document allows policyholders to update the designated beneficiaries. Both forms require identification and confirmation of intent to avoid legal conflicts.

- Policy Assignment Form: This document transfers ownership rights of a policy to another party. Like the Ownership form, it requires legal heir documentation and proof of ownership, ensuring that the transfer is legitimate.

- Beneficiary Designation Change Request: This request enables a policy owner to change beneficiaries, requiring signatures and possibly identification, much like the Ownership form.

- Insurance Application Form: This form is filled out when applying for a new policy. It requires personal and contact information, similar in structure to the Ownership form, which also collects detailed personal information.

- Claim Form: This document is used to request benefits after a policyholder's death. It also requires similar documents, such as death certificates and identification, mimicking the requirements in the Ownership form.

- Policy Termination Request Form: This document is submitted to cancel a policy and includes reasons for cancellation. It shares the formal verification process similar to the Ownership change process.

- Medical History Declaration Form: Policyholders use this document to disclose medical information. Its detailed information requirement is comparable to the thorough personal information needed for the Ownership form.

- Survivorship Agreement: This legal document outlines the distribution of assets upon death. It parallels the Ownership form in the need for legal heirs to provide documentation and signatures.

Dos and Don'ts

Filling out the Metlife Ownership form can be a straightforward process if you take care with the details. Here are ten important do's and don'ts to consider:

- Do ensure that you provide complete and accurate information in all fields of the form.

- Do include the death certificate of the existing policy owner if applicable.

- Do submit a signed indemnity bond in the specified format.

- Do provide identity proof and residence proof for the new policy owner.

- Do double-check the policy number and personal details before submission.

- Don't forget to declare your relationship with the policy owner in the appropriate section.

- Don't submit the form if it has corrections; use a fresh form instead.

- Don't neglect to sign the form, as an unsigned document may be deemed invalid.

- Don't attempt to change the policy owner without being a legal heir if the policy requires it.

- Don't leave any required documents out of your submission, as this may lead to delays.

Following these guidelines can help ensure a smoother process when requesting a change in policy ownership. Always remember to reach out to customer service if you have questions or need further assistance.

Misconceptions

There are several misconceptions surrounding the MetLife Ownership form that can lead to confusion. Here are five common misconceptions explained for clarity:

- Only the existing policy owner can change the ownership: Many people believe that only the current owner of the policy can initiate a change in ownership. However, requests for ownership changes can be made by legal heirs under specific conditions, especially if the existing policy owner has passed away.

- A death certificate is optional: Some individuals think that a death certificate is not necessary when changing the policy owner. In reality, providing the death certificate of the existing policy owner is a crucial requirement in order to process the request.

- Proof of identity is not needed for the new owner: Another misconception is that the new policy owner does not need to provide any identity proof. In fact, both identity proof and residence proof are mandatory for the new policy owner to ensure accurate processing.

- Indemnity bonds are not required: It's commonly believed that an indemnity bond is an optional document. However, this bond must be provided in the prescribed format as a part of the ownership change process.

- Legal heirs can change ownership without restrictions: Some individuals think that all legal heirs have the same rights when it comes to changing the policy ownership. However, if the policy is assigned, only the legal heirs of the assignee can request the change, and in the case of conditional assignments, heirs from both parties must be involved.

Understanding these misconceptions can help ensure smoother processing of your requests concerning the MetLife Ownership form. Always check the requirements thoroughly to avoid any delays.

Key takeaways

When filling out and using the Metlife Ownership form, be aware of the following key takeaways:

- Legal Heirs Only: The request for a Policy Owner Change must originate from legal heirs. Ensure that you possess the necessary legal standing to make this request.

- Important Documentation: Submit the Death Certificate of the existing Policy Owner along with the Indemnity Bond, Identity proof, and residence proof of the new Policy Owner.

- Assignor and Assignee Provisions: If the policy is absolutely assigned, ensure that only the legal heirs of the Assignee make the request. For conditional assignments, requests can come from legal heirs of both the assignor and the assignee.

- Understand Your Responsibilities: By signing the form, you confirm understanding of the policy terms and conditions and take full responsibility for any consequences due to incorrect or incomplete information.

Taking these points into consideration will help facilitate a smoother experience when navigating the Policy Owner Change process.

Browse Other Templates

Sky Zone Donation Request - Empowering local causes is at the heart of what we do.

De 2525xx - Be mindful of any additional instructions specific to your request.

8804 - It is a critical component in compliance with Section 1446 of the Internal Revenue Code.