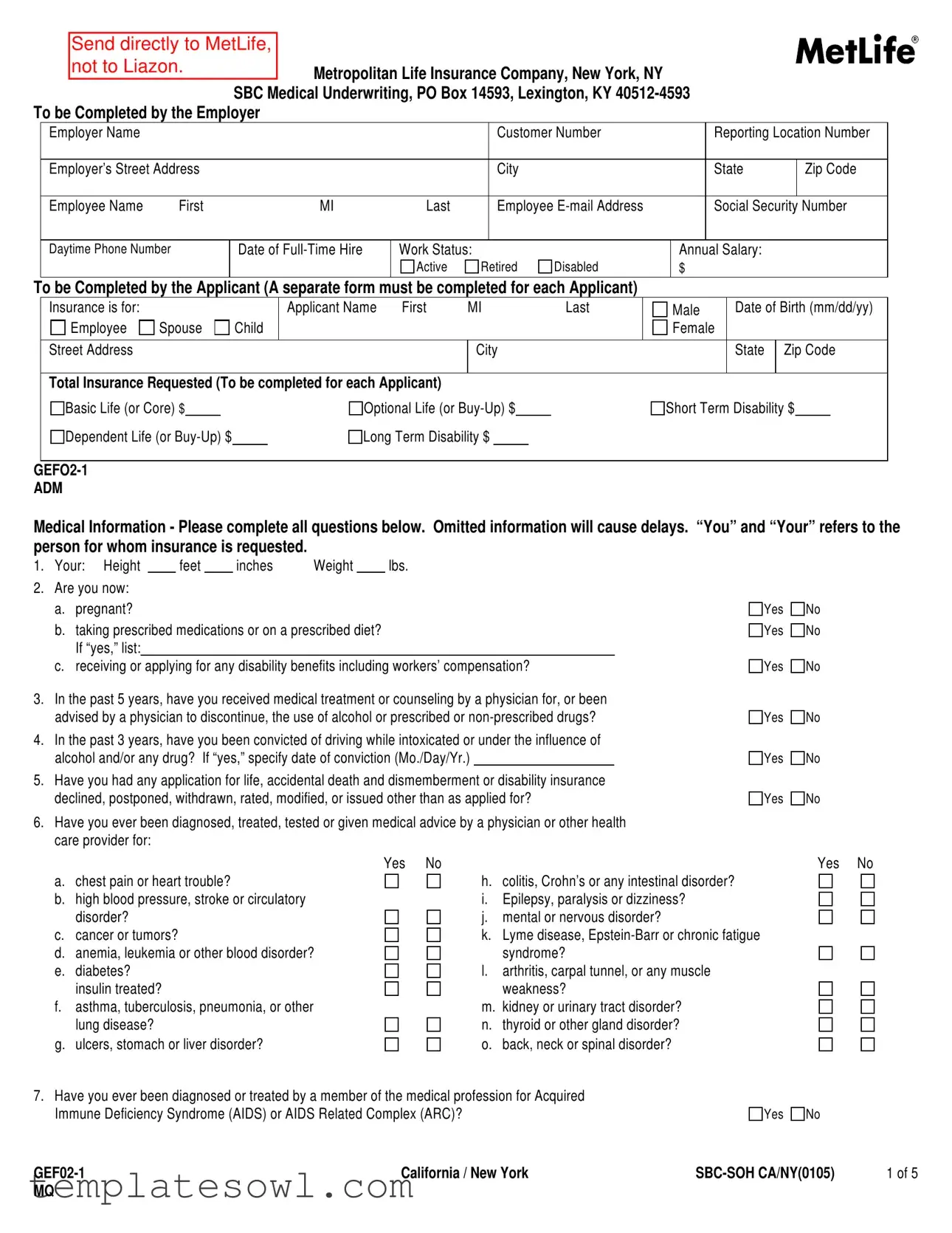

Fill Out Your Metlife Statement Of Health Form

The Metlife Statement of Health form plays a critical role in the insurance application process. This form is essential for employees who are applying for various types of insurance through their employer, including basic life, optional life, short-term and long-term disability coverage, and dependent life insurance. It requires detailed information from both the employer and the applicant, ensuring that all relevant data is collected for underwriting purposes. Key aspects of the form include the applicant's personal details, such as name, date of birth, and contact information, as well as specific medical history inquiries that assess overall health and any pre-existing conditions. Employers must provide essential identifiers, including the customer number and address, which help streamline the processing of applications. Additionally, the form outlines the medical information section, which consists of a series of questions addressing past medical treatments, medications, and lifestyle factors that may influence insurability. This comprehensive documentation ensures that MetLife can evaluate the applicant's eligibility accurately and efficiently, helping both the insurer and the insured make informed decisions regarding coverage options.

Metlife Statement Of Health Example

Send directly to MetLife,

not to Liazon.Metropolitan Life Insurance Company, New York, NY

SBC Medical Underwriting, PO Box 14593, Lexington, KY

Employer Name |

|

|

|

Customer Number |

Reporting Location Number |

|

|

|

|

|

|

|

|

Employer’s Street Address |

|

|

City |

State |

Zip Code |

|

|

|

|

|

|

|

|

Employee Name |

First |

MI |

Last |

Employee |

Social Security Number |

|

|

|

|

|

|

|

|

Daytime Phone Number

Date of

Work Status:

Active

Retired

Disabled

Annual Salary:

$

To be Completed by the Applicant (A separate form must be completed for each Applicant)

Insurance is for: |

|

|

Applicant Name |

First |

MI |

Last |

Male |

Date of Birth (mm/dd/yy) |

|

Employee |

Spouse |

Child |

|

|

|

|

Female |

|

|

|

|

|

|

|

|

|

|

|

|

Street Address |

|

|

|

|

City |

|

|

State |

Zip Code |

|

|

|

|

|

|

|

|

|

|

Total Insurance Requested (To be completed for each Applicant)

Basic Life (or Core) $ |

|

|

|

Optional Life (or |

|

|

Short Term Disability $ |

|

Dependent Life (or |

|

Long Term Disability $ |

|

|

|

|

||

ADM

Medical Information - Please complete all questions below. Omitted information will cause delays. “You” and “Your” refers to the person for whom insurance is requested.

1. Your: Height |

|

feet |

|

inches |

Weight |

|

lbs. |

2.Are you now:

a.pregnant?

b.taking prescribed medications or on a prescribed diet? If “yes,” list:

c.receiving or applying for any disability benefits including workers’ compensation?

3.In the past 5 years, have you received medical treatment or counseling by a physician for, or been advised by a physician to discontinue, the use of alcohol or prescribed or

4.In the past 3 years, have you been convicted of driving while intoxicated or under the influence of alcohol and/or any drug? If “yes,” specify date of conviction (Mo./Day/Yr.)

5.Have you had any application for life, accidental death and dismemberment or disability insurance declined, postponed, withdrawn, rated, modified, or issued other than as applied for?

6.Have you ever been diagnosed, treated, tested or given medical advice by a physician or other health care provider for:

Yes Yes

Yes

Yes

Yes

Yes

No No

No

No

No

No

a.chest pain or heart trouble?

b.high blood pressure, stroke or circulatory disorder?

c.cancer or tumors?

d.anemia, leukemia or other blood disorder?

e.diabetes? insulin treated?

f.asthma, tuberculosis, pneumonia, or other lung disease?

g.ulcers, stomach or liver disorder?

Yes No |

Yes No |

h. |

colitis, Crohn’s or any intestinal disorder? |

i. |

Epilepsy, paralysis or dizziness? |

j. |

mental or nervous disorder? |

k. |

Lyme disease, |

|

syndrome? |

l. |

arthritis, carpal tunnel, or any muscle |

|

weakness? |

m. kidney or urinary tract disorder? |

|

n. |

thyroid or other gland disorder? |

o. |

back, neck or spinal disorder? |

7. Have you ever been diagnosed or treated by a member of the medical profession for Acquired |

|

|

Immune Deficiency Syndrome (AIDS) or AIDS Related Complex (ARC)? |

Yes |

No |

California / New York |

1 of 5 |

||

MQ |

|

|

|

8.Have you ever had persistent cough, pneumonia, chest discomfort, muscle weakness, unexplained weight loss

of 10 pounds or more, swollen glands, patches in the mouth, visual disturbance, or recurring diarrhea, fever or infection?

9. Personal Physician: |

|

Date and reason for last visit: |

Yes

No

Address: |

|

Phone Number: |

Give full details for “Yes” answers. If more space is needed for full details, attach a separate sheet, sign and date it.

Question |

Dates of |

|

|

Name of Physician or Name of Clinic or Hospital |

|

Number |

Treatment |

Diagnosis/Condition |

Duration |

and Complete Address, Including Zip Code |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

CA/NY |

MQ

Declaration — I have read this Statement of Health and declare that all information given above is true and complete to the best of my knowledge and belief. I understand that this information will be used by MetLife to determine my insurability.

Fraud Warning:

If you reside in or are applying for insurance under a policy issued in one of the following states, please read the applicable warning.

New York [only applies to Accident and Health Benefits (AD&D/Disability/Dental)]: Any person who knowingly and with intent to defraud any insurance company or other person files an application for insurance containing any materially false information, or conceals for the purpose of misleading, information concerning any fact material thereto, commits a fraudulent insurance act, which is a crime, and shall also be subject to a civil penalty not to exceed five thousand dollars and the stated value of the claim for each such violation.

Florida: Any person who knowingly and with intent to injure, defraud, or deceive any insurer files a statement of claim or an application containing any false, incomplete, or misleading information is guilty of a felony of the third degree.

Massachusetts: Any person who knowingly and with intent to defraud any insurance company or other person files an application for insurance containing any materially false information or conceals, for the purpose of misleading, information concerning any fact material thereto commits a fraudulent insurance act, and may subject such person to criminal and civil penalties.

New Jersey: Any person who includes any false or misleading information on an application for an insurance policy is subject to criminal and civil penalties.

Oklahoma: Any person who knowingly, and with intent to injure, defraud or deceive any insurer, makes any claim for the proceeds of an insurance policy containing any false, incomplete or misleading information is guilty of a felony.

Kansas and Oregon: Any person who knowingly and with intent to defraud any insurance company or other person files an application for insurance containing any materially false information or conceals, for the purpose of misleading, information concerning any fact material thereto may be guilty of insurance fraud, and may be subject to criminal and civil penalties.

Virginia: Any person who, with the intent to defraud or knowing that he is facilitating a fraud against an insurer, submits an application containing a false or deceptive statement may have violated state law.

In any other case, read the following warning.

Any person who knowingly and with intent to defraud any insurance company or other person files an application for insurance or a statement of claim containing any materially false information or conceals, for the purpose of misleading, information concerning any fact material thereto commits a fraudulent insurance act, which is a crime and subjects such person to criminal and civil penalties.

|

|

|

|

|

Sign & Date |

|

|

|

|

|

Here |

Applicant |

Signature |

|

Date (Mo./Day/Yr.) |

|

|

|

|

|

|||

|

Medical Information Form Will Not Be Processed Without Accompanying Authorization Form. |

|

|||

|

|

California / New York |

2 of 5 |

||

DEC |

|

|

|

|

|

AUTHORIZATION

In connection with an enrollment for group insurance, for underwriting and claim purposes regarding the proposed insureds (the proposed insureds are the employee, spouse, and any other person(s) named below), notwithstanding any prior restriction placed on information, records or data by a proposed insured, each proposed insured authorizes:

•Any medical practitioner, facility or related entity; any insurer; the Medical Information Bureau, Inc. (MIB); any employer; any group policyholder, contract holder or benefit plan administrator; or any government agency to give Metropolitan Life Insurance Company (“MetLife”) or any third party acting on MetLife's behalf in this regard:

•personal information and data about the proposed insured;

•medical information, records and data about the proposed insured including information, records and data about drugs prescribed, medical test results and sexually transmitted diseases;

•information, records and data about the proposed insured related to alcohol and drug abuse and treatment, including information and data records and data related to alcohol and drug abuse protected by Federal Regulations 42 CFR part 2;

•information, records and data about the proposed insured relating to Acquired Immune Deficiency Syndrome (AIDS) or AIDS related conditions including, where permitted by applicable law, Human Immune deficiency Virus (HIV) test results; and

•information, records and data about the proposed insured relating to mental illness, except psychotherapy notes.

Expiration, Revocation and Refusal to Sign: This authorization will expire 24 months from the date on this form or sooner if prescribed by

law. Unless permitted by applicable law, the proposed insured cannot revoke this authorization: (1) to the extent that MetLife has taken action relying on the authorization; or (2) if MetLife obtained the authorization as a condition to the proposed insured obtaining insurance coverage. In all other cases, the proposed insured may revoke this authorization at any time. To revoke the authorization, the proposed insured must write to MetLife at SBC Administration, P.O. Box 14593, Lexington, KY

By signing below, each proposed insured acknowledges his or her understanding that:

•All or part of the information, records and data that MetLife receives pursuant to this authorization may be disclosed to MIB. Such information may also be disclosed to and used by any reinsurer, employee, affiliate or independent contractor who performs a business service for MetLife on the insurance applied for or on existing insurance with MetLife, or disclosed as otherwise required or permitted by applicable laws.

•Medical information, records and data that may have been subject to federal and state laws or regulations, including federal rules issued by Health and Human Services, setting forth standards for the use, maintenance and disclosure of such information by health care providers and health plans and records and data related to alcohol and drug abuse protected by Federal Regulations 42 CFR part 2, once disclosed to MetLife or upon redisclosure by MetLife, may no longer be covered by those laws or regulations.

•Information relating to HIV test results will only be disclosed as permitted by applicable law.

•Information obtained pursuant to this authorization about a proposed insured may be used, to the extent permitted by applicable law, to determine the insurability of other family members.

•Each proposed insured has a right to receive a copy of this form.

A photocopy of this form is as valid as the original form.

Signature of Proposed Insured or |

Print Name of Proposed Insured |

Date (Mo./Day/Yr.) |

Signature & Relationship of Personal Representative* |

|

|

*If a child proposed for insurance is age 18 or over, the child must sign this Authorization. If the child is under age 18, a Personal Representative for the child must sign, and indicate the legal relationship between the Personal Representative and the proposed insured. A Personal Representative for the child is a person who has the right to control the child’s health care, usually a parent, legal guardian, or a person appointed by a court.

Sign, Date & Return

AUTH |

3 of 5 |

NW |

|

Privacy Notice

If you submit a request for insurance (Statement of Health form) we will evaluate it. We will review the information you give to us and we may confirm it or add to it in the ways explained below.

This Privacy Notice is given to you on behalf of METROPOLITAN LIFE INSURANCE COMPANY.

Please read this Privacy Notice carefully. It describes in broad terms how we learn about you and how we treat the information we get about you. (If anyone else is to be insured, what we say here also applies to information about him or her.) We are required by law to give you this notice.

Why We Need to Know about You: We need to know about you (and anyone else to be insured) so that we can provide the insurance and other products and services you’ve asked for. We may also need information from you and others to help us verify identities in order to prevent money laundering and terrorism.

What we need to know includes address, age and other basic information. But we may need more information, including finances, employment, health, hobbies or business conducted with us, with other MetLife companies (our “affiliates”) or with other companies.

How We Learn about You: What we know about you (and anyone else to be insured) we get mostly from you. But we may also have to find out more from other sources in order to make sure that what we know is correct and complete. Those sources may include adult relatives, employers, consumer reporting agencies, health care providers and others. Some of our sources may give us reports and may disclose what they know to others. We may ask for medical information about you from these sources. The Authorization that you sign when you request insurance permits these sources to tell us about you. So we may, for instance:

•Ask for a medical exam

•Ask for blood and urine tests

•Ask health care providers to give us health data, including information about alcohol or drug abuse

We may also ask a consumer reporting agency for a “consumer report” about you (or anyone else to be insured). Consumer reports may tell us about a lot of things, including information about your finances, employment, hobbies, mode of living, work history, and driving record.

The information may be kept by the consumer reporting agency and later given to others as permitted by law. The agency will give you a copy of the report it provides to us, if you ask the agency and can provide adequate identification. If you write to us and we have asked for a consumer report about you, we will tell you so and give you the name, address and phone number of the consumer reporting agency.

Another source of information is MIB Group, Inc. (“MIB”). It is a

How We Protect What We Know About You: Because you entrust us with your personal information, we treat what we know about you confidentially. Our employees are told to take care in handling your information. They may get information about you only when there is a good reason to do so. We take steps to make our computer data bases secure and to safeguard the information we have.

How We Use and Disclose What We Know About You: We may use anything we know about you to help us serve you better. We may use it, and disclose it to our affiliates and others, for any purpose allowed by law. For instance, we may use your information, and disclose it to others, in order to:

4 of 5 |

• Help us evaluate your request for a product or service |

• |

Help us comply with the law |

• Help us process claims and other transactions |

• |

Help us run our business |

• Confirm or correct what we know about you |

• |

Process data for us |

• Help us prevent fraud, money laundering, terrorism and |

• |

Perform research for us |

other crimes by verifying what we know about you |

|

|

|

• |

Audit our business |

Other reasons we may disclose what we know about you include:

•Doing what a court or government agency requires us to do; for example, complying with a search warrant or subpoena

•Telling another company what we know about you, if we are or may be selling all or any part of our business or merging with another company

•Giving information to the government so that it can decide whether you may get benefits that it will have to pay for

•Telling a group customer about its members’ claims or cooperating in a group customer’s audit of our service

•Telling your health care provider about a medical problem that you have but may not be aware of

•Giving your information to a peer review organization if you have health insurance with us

•Giving your information to someone who has a legal interest in your insurance, such as someone who lent you money and holds a lien on your insurance or benefits

Generally, we will disclose only the information we consider reasonably necessary to disclose.

We may use what we know about you in order to offer you our other products and services. We may share your information with other companies to help us. Here are our other rules on using your information to market products and services:

•We will not share information about you with any of our affiliates for use in marketing its products to you, unless we first notify you. You will then have an opportunity to tell us not to share your information by “opting out.”

•Before we share what we know about you with another financial services company to offer you products or services through a joint marketing arrangement, we will let you

•We will not disclose information to unaffiliated companies for use in selling their products to you, except through such joint marketing arrangements.

•We will not share your health information with any other company, even one of our affiliates, to permit it to market its products and services to you.

How You Can See and Correct Your Information: Generally, we will let you review what we know about you if you ask us in writing. (Because of its legal sensitivity, we will not show you anything that we learned in connection with a claim or lawsuit.) If you tell us that what we know about you is incorrect, we will review it. If we agree with you, we will correct our records. If we do not agree with your, you may tell us in writing, and we will include your statement when we give your information to anyone outside MetLife.

You Can Get Other Material from Us: In addition to any other privacy notice we may give you, we must give you a summary of our privacy policy once each year. You may have other rights under the law. If you want to know more about our privacy policy, please contact us at our website, www.metlife.com, or write to your MetLife Insurance Company, c/o MetLife Privacy Office - Inst, P.O. Box 489, Warwick, RI

5 of 5 |

Form Characteristics

| Fact Name | Fact Detail |

|---|---|

| Submission Address | The completed MetLife Statement of Health form must be sent directly to MetLife at the address: SBC Medical Underwriting, PO Box 14593, Lexington, KY 40512-4593. |

| Required Information | Personal information, including the applicant's height, weight, and medical history, must be completed accurately to avoid processing delays. |

| Multiple Applicants | A separate Statement of Health form is necessary for each individual applying for coverage, such as the employee, spouse, or child. |

| Fraud Warning | The form includes a notice about potential penalties for providing false information, particularly in states like New York and Florida, where it's considered a felony. |

| California and New York Specifics | This form is governed by state laws in California and New York, referenced as GEF02-1 CA/NY. Specific legal warnings apply to these states regarding fraudulent acts in insurance applications. |

| Privacy Authorization | Applicants must authorize MetLife to access relevant medical and personal information necessary for processing the application and determining insurability. |

| Processing Requirements | The MetLife Statement of Health form will not be processed unless an accompanying authorization form is submitted. |

Guidelines on Utilizing Metlife Statement Of Health

Filling out the MetLife Statement of Health form is an important step in the insurance application process. It gathers essential details about your health and lifestyle, which will be reviewed by MetLife to determine eligibility for coverage. Ensure you complete it carefully and truthfully to avoid any delays in processing.

- Download the Form: Obtain the MetLife Statement of Health form from your employer or directly from MetLife's website.

- Complete Employer Information: Fill in the required details such as the employer's name, customer number, reporting location number, and the employer's address.

- Fill Out Employee Information: Provide the employee's name, email address, Social Security number, daytime phone number, and date of full-time hire. Indicate the work status and annual salary.

- Complete Applicant Information: Specify who the insurance is for: employee, spouse, or child. Fill in the applicant's name, gender, and date of birth.

- Provide Address Details: Enter the applicant's street address, city, state, and zip code.

- Insurance Coverage Amounts: Enter the total insurance requested for various categories such as Basic Life, Optional Life, Short Term Disability, and so on, detailing specific amounts for each.

- Answer Medical Questions: Answer all medical questions truthfully. This includes height, weight, any current medications or conditions, previous treatments, and healthcare provider details.

- Declaration: Read the declaration statement carefully and ensure that you understand its implications. Sign and date the form to confirm the accuracy of the information provided.

- Authorization Section: Review the authorization section, which allows MetLife to access your medical information. Sign and date this part as well.

- Submit the Form: Send the completed form to MetLife at the address specified on the document, not to Liazon.

After submitting the form, it will be processed by MetLife for review. Keep an eye on your email for any communication regarding your application status. The next steps will typically involve waiting for a decision based on the provided information.

What You Should Know About This Form

What is the purpose of the MetLife Statement of Health form?

The MetLife Statement of Health form is a document that collects medical information necessary for underwriting purposes. This form assesses the insurability of individuals applying for insurance coverage, such as life, disability, and dependent coverage. It ensures that all pertinent health information is captured to avoid coverage delays or issues.

Who needs to fill out this form?

Both the employer and the applicant must complete sections of the form. The employer fills out their information, including the company name and employee details, while the applicant—who can be the employee, spouse, or child—must answer questions regarding their health history and insurance requests. Each applicant requires a separate form.

Where should I send the completed form?

The completed MetLife Statement of Health form should be sent directly to MetLife at the following address: Metropolitan Life Insurance Company, New York, NY, SBC Medical Underwriting, PO Box 14593, Lexington, KY 40512-4593. Do not send the form to Liazon.

What kind of medical information is required?

The form requests detailed medical information, including height, weight, and a series of yes/no questions regarding past and current health issues. Applicants must disclose any prescribed medications, prior medical treatments, and specific conditions such as heart trouble, cancer, or mental health disorders. Failing to provide complete information can result in delays in processing the application.

What happens if I do not provide all requested information?

If the form is missing information, it may cause processing delays. Incomplete or inaccurate responses can also lead to the denial of coverage. Therefore, it is crucial for applicants to provide thorough and accurate information in order to ensure a smooth underwriting process.

Why is an authorization form needed?

An authorization form must accompany the Statement of Health form to allow MetLife to obtain necessary medical information from healthcare providers and other sources. Without this authorization, the medical information cannot be processed, which could delay or prevent the issuance of insurance coverage.

How is my privacy protected when I submit this form?

MetLife is committed to protecting personal information. Data submitted is treated confidentially, and employees are trained to handle sensitive information carefully. MetLife will not disclose health information to unauthorized parties and utilizes secure methods to store and manage personal data.

Common mistakes

Completing the MetLife Statement of Health form requires attention to detail. Mistakes can lead to delays in processing or even denial of coverage. One common error occurs when applicants omit important information. Each question on the form is designed to gather critical details about health history. Failing to answer completely can raise red flags and complicate the underwriting process.

Another common mistake is providing inaccurate personal information. This includes misspelling names, incorrect social security numbers, or inaccuracies in the contact address. Such errors can hinder communication and prompt inquiries that could have been avoided if the information was precise from the outset.

Many applicants neglect to carefully read the questions. This often results in misunderstanding what is being asked, leading to incomplete or incorrect answers. For instance, questions regarding medical history ask for specific details. Providing vague responses instead of full disclosures can result in further investigations or delays in the application process.

Some individuals may attempt to be overly concise in their responses. While brevity is valued, in this context, it can mean omitting critical details necessary for MetLife’s evaluation. It’s crucial to provide thorough but relevant explanations, especially for "yes" responses where additional details are required.

Applicants often fail to attach necessary documents when additional space is needed for explanations. If an applicant checks “yes” for certain medical conditions, they must provide comprehensive additional information. Not supplying this could delay the underwriting process as the reviewer may have to seek clarification later.

Another urgent mistake made is not signing and dating the form appropriately. An unsigned application is considered incomplete and cannot be processed until all required signatures are present. This simple oversight can significantly delay any potential coverage benefits.

Lastly, disregarding the submission instructions can cause unnecessary delays. The form must be sent directly to MetLife and not to intermediary parties. Ensuring it is properly addressed and sent to the correct location is essential for timely processing.

Documents used along the form

The MetLife Statement of Health form is an important document for individuals looking to enroll in group insurance. Alongside this form, several other documents often accompany the application process. Below is a list of these key documents and a brief description of each one.

- Authorization Form: This form allows MetLife to request certain medical information from doctors, hospitals, and insurance companies. It is crucial for ensuring accurate assessments of an applicant's health status.

- Privacy Notice: This notice explains how MetLife collects, uses, and safeguards personal information. It serves to inform applicants about their rights regarding their medical and personal data.

- Medical Information Form: This form captures detailed health history, including any treatments or diagnoses. Providing complete and accurate information helps in the decision-making process for insurance coverage.

- Employer Verification Form: Employers must complete this document to verify the employee's details, job status, and salary. It ensures that the information provided matches the company's records.

- Dependent Information Form: When a policy includes coverage for dependents, this form is necessary to include their details, such as name and relationship to the employee. It organizes information for additional insured individuals.

- Claim Submission Forms: If a claim arises post-coverage, these forms detail the process for filing a claim, including required documentation. They streamline the communication for obtaining benefits.

Using these documents together with the MetLife Statement of Health form ensures a smoother application process and helps in accurately determining eligibility for the insurance coverage being requested.

Similar forms

- Insurance Application Form: Similar to the Metlife Statement Of Health, an insurance application form collects important personal and health-related information from the applicant. It serves to assess the applicant's eligibility for insurance coverage and typically asks for details regarding medical history, lifestyle habits, and existing health conditions, just like the Metlife form.

- Medical Release Form: A medical release form and the Metlife Statement Of Health both require the applicant to give permission for insurance companies to access their medical records. This document often specifies which health care providers can disclose information and what kind of medical information can be retrieved.

- Health Questionnaire: A health questionnaire is very similar in purpose and structure to the Metlife Statement Of Health. It gathers comprehensive details about the applicant's health, previous treatments, and medications, ensuring that the insurer can make informed decisions about coverage based on the individual's health status.

- Dependent Enrollment Form: When enrolling dependents in a health insurance plan, a dependent enrollment form collects similar information as the Metlife Statement Of Health. It typically requires details about the dependent's health history and any current medical conditions to determine eligibility for coverage.

- Supplemental Health Insurance Application: Much like the Metlife form, a supplemental health insurance application requires potential policy holders to disclose their health information. It focuses on specific health needs to tailor additional coverage options, ensuring that both the insurer and insured have a clear understanding of any health risks involved.

Dos and Don'ts

When filling out the MetLife Statement Of Health form, there are certain dos and don'ts to ensure the process goes smoothly. Follow these guidelines:

- Do send the completed form directly to MetLife at the address provided.

- Don't send the form to Liazon or any other intermediary.

- Do provide your employer's name, address, and customer number accurately.

- Don't leave any sections blank; missing information can cause delays.

- Do include a daytime phone number where you can be reached for questions.

- Don't provide incomplete or inaccurate answers to medical questions.

- Do sign and date the application to confirm the accuracy of your information.

- Don't ignore the fraud warning; providing false information is a serious offense.

- Do attach a separate sheet if you need more space to explain any "Yes" answers.

- Don't forget to keep a copy of the completed form for your records.

Misconceptions

- Misconception 1: The form is optional.

- Misconception 2: You can submit it to any office.

- Misconception 3: It only needs to be completed by employees.

- Misconception 4: Height and weight details don’t matter.

- Misconception 5: Only serious medical conditions need to be reported.

- Misconception 6: Past denials won't impact current applications.

- Misconception 7: You can leave questions blank.

- Misconception 8: You do not need to provide a medical authorization.

- Misconception 9: Someone else can fill it out for you.

- Misconception 10: It won’t affect my premiums.

This form must be completed for certain types of insurance coverage. Skipping it can delay the approval of your insurance.

Always send your completed form directly to MetLife at the specified address, not to any intermediary like Liazon.

While it starts with employer information, the applicant (which can also include spouses and dependents) must fill out their section.

These physical metrics are crucial for determining eligibility and risk. Provide accurate information.

Even minor issues can affect coverage. Be thorough and transparent in your medical history.

Previous applications that were declined or modified can affect your current request, so be honest about your history.

All questions must be answered fully to avoid delays in processing. Omitted information is a common pitfall.

Along with the Statement of Health, an accompanying authorization form is required for processing to comply with privacy laws.

While a representative can assist, the applicant needs to provide their personal details to ensure accuracy and legality.

The information provided can influence rates. Incomplete or misleading information may result in higher costs or declined coverage.

Key takeaways

Ensure that you send the completed Metlife Statement Of Health form directly to MetLife at the specified address: Metropolitan Life Insurance Company, SBC Medical Underwriting, PO Box 14593, Lexington, KY 40512-4593. Do not send it to Liazon.

Both the employer and the applicant sections must be filled out completely. Missing information can lead to delays in processing your application.

Fill out health-related questions with transparency. MetLife uses this information to assess insurability, so accurate disclosures are crucial.

Applications involving multiple applicants require a separate form for each individual. This applies to spouses and children as well as employees.

Remember to include necessary authorization forms. The Medical Information Form will not be processed without them, as they provide consent to obtain relevant medical information.

Browse Other Templates

Illinois Llc Involuntary Dissolution Reinstatement - The form must be dated to validate the request for termination.

Cms-1490s Printable Form - Patients must include a copy of the itemized bill with their claim submission.