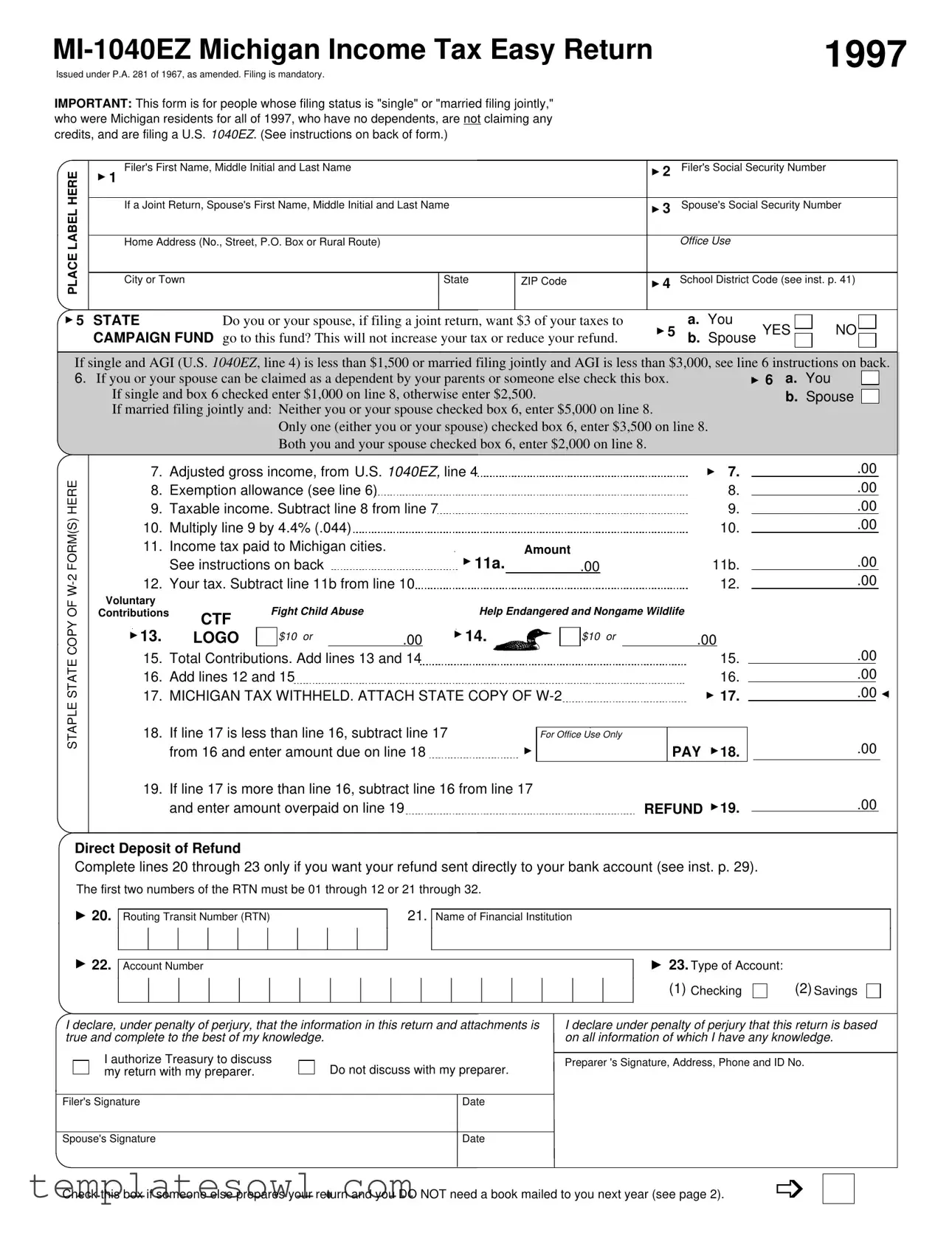

Fill Out Your Mi 1040Ez Form

The MI-1040EZ form is designed specifically for individuals and couples who meet certain criteria, simplifying the process of filing state income taxes in Michigan. This form is mandatory for residents who filed a U.S. 1040EZ and are either single or married filing jointly. Importantly, it caters to those without dependents, does not account for any tax credits, and requires the filer to have maintained residency in Michigan for the entire year. The form streamlines the reporting of income and taxes, offering a straightforward approach that prompts users to input their adjusted gross income, exemption allowances, and calculate their tax due based on a set percentage. In addition, it introduces voluntary contributions to specific causes, allowing filers the option to contribute a portion of their tax to selected charities without affecting their overall tax liability. The MI-1040EZ must be filed by April 15 annually, and it guides users with clear instructions on what information is necessary, such as Social Security numbers and W-2 forms. Filing correctly can help avoid penalties, ensuring a smoother tax season for those who qualify for this simplified return.

Mi 1040Ez Example

1997 |

Issued under P.A. 281 of 1967, as amended. Filing is mandatory.

IMPORTANT: This form is for people whose filing status is "single" or "married filing jointly," who were Michigan residents for all of 1997, who have no dependents, are not claiming any credits, and are filing a U.S. 1040EZ. (See instructions on back of form.)

PLACE LABEL HERE

Filer's First Name, Middle Initial and Last Name

▼ |

1 |

If a Joint Return, Spouse's First Name, Middle Initial and Last Name

Home Address (No., Street, P.O. Box or Rural Route) |

|

|

City or Town |

State |

ZIP Code |

▼ 2 |

Filer's Social Security Number |

|

|

▼ 3 |

Spouse's Social Security Number |

|

|

|

|

|

Office Use |

|

|

▼ 4 |

School District Code (see inst. p. 41) |

▼

5 STATEDo you or your spouse, if filing a joint return, want $3 of your taxes to CAMPAIGN FUND go to this fund? This will not increase your tax or reduce your refund.

▼

a. You

5 b. Spouse YES

NO

If single and AGI (U.S. 1040EZ, line 4) is less than $1,500 or married filing jointly and AGI is less than $3,000,

6.If you or your spouse can be claimed as a dependent by your parents or someone else check this box. If single and box 6 checked enter $1,000 on line 8, otherwise enter $2,500.

If married filing jointly and: Neither you or your spouse checked box 6, enter $5,000 on line 8.

Only one (either you or your spouse) checked box 6, enter $3,500 on line 8.

Both you and your spouse checked box 6, enter $2,000 on line 8.

see line 6 instructions on back. ▼ 6 a. You

b.Spouse

STAPLE STATE COPY OF

|

7. |

Adjusted gross income, from U.S. 1040EZ, line 4 |

|

|

▼ |

7. |

|||||||

|

8. |

Exemption allowance (see line 6) |

|

|

|

|

|

|

|

|

8. |

||

|

9. |

Taxable income. Subtract line 8 from line 7 |

|

|

|

|

|

|

|

9. |

|||

|

10. |

Multiply line 9 by 4.4% (.044) |

|

|

|

|

|

|

|

|

10. |

||

|

11. |

Income tax paid to Michigan cities. |

|

|

▼ |

Amount |

|

|

|

|

|||

|

|

See instructions on back |

|

|

11a. |

.00 |

|

11b. |

|||||

|

|

|

|

|

|

||||||||

|

12. |

Your tax. Subtract line 11b from line 10 |

|

|

|

|

|

|

|

12. |

|||

Voluntary |

|

|

|

|

|

|

|

|

|

|

|

|

|

Contributions |

CTF |

Fight Child Abuse |

|

|

|

Help Endangered and Nongame Wildlife |

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

▼ |

13. |

LOGO |

|

$10 or |

.00 |

▼ |

14. |

|

$10 or |

.00 |

|

||

|

15. |

|

|

|

|

|

|

|

|

|

|

15. |

|

|

Total Contributions. Add lines 13 and 14 |

|

|

|

|

|

|

|

|||||

|

16. |

Add lines 12 and 15 |

|

|

|

|

|

|

|

|

16. |

||

|

17. |

MICHIGAN TAX WITHHELD. ATTACH STATE COPY OF |

|

|

▼ |

17. |

|||||||

|

18. |

If line 17 is less than line 16, subtract line 17 |

|

|

|

|

|

|

|

||||

|

|

|

|

For Office Use Only |

PAY |

|

18. |

||||||

|

|

from 16 and enter amount due on line 18 |

|

|

▼ |

|

|

▼ |

|||||

|

19. |

|

|

|

|

|

|

|

|

||||

|

If line 17 is more than line 16, subtract line 16 from line 17 |

|

REFUND |

|

19. |

||||||||

|

|

and enter amount overpaid on line 19 |

|

|

|

|

|

▼ |

|||||

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

▼

Direct Deposit of Refund

Complete lines 20 through 23 only if you want your refund sent directly to your bank account (see inst. p. 29).

The first two numbers of the RTN must be 01 through 12 or 21 through 32.

▼ ▼

20. Routing Transit Number (RTN)

Routing Transit Number (RTN)

22. Account Number

Account Number

21. Name of Financial Institution

Name of Financial Institution

▼ |

23. Type of Account: |

|

||

|

(1) Checking |

|

|

(2) Savings |

|

|

|||

I declare, under penalty of perjury, that the information in this return and attachments is true and complete to the best of my knowledge.

|

|

I authorize Treasury to discuss |

|

Do not discuss with my preparer. |

|

|

my return with my preparer. |

|

|

|

|

|

||

Filer's Signature |

Date |

|||

I declare under penalty of perjury that this return is based on all information of which I have any knowledge.

Preparer 's Signature, Address, Phone and ID No.

Spouse's Signature |

Date |

Check this box if someone else prepares your return and you DO NOT need a book mailed to you next year (see page 2). |

➩ |

MICHIGAN EZ INCOME TAX INSTRUCTIONS

GENERAL INFORMATION

Who can file the EZ form

You can file an EZ form if ALL of the following are true:

•You filed a U.S. 1040EZ.

•Your filing status is single or married filing jointly.

Single. Your status is single if you are widowed, not married, or if you are legally divorced or separated under court order. Married filing jointly. You may use this filing status if you were married as of December 31, 1997, or your spouse died in 1997 and you did not remarry in 1997, or your spouse died in 1998 before filing a 1997 return.

•You do not have any dependents.

•You were a Michigan resident for all of 1997.

•You do not have any income from military pay, pensions, other states’ obligations or U.S. obligations.

•You are not age 65 or older, deaf, blind, hemiplegic, paraple- gic, quadriplegic or totally and permanently disabled.

•You did not make any estimated tax payments.

•You are not eligible for any of the tax credits listed in the next column.

Before you choose the EZ form, be sure you are not able to

claim a credit for any of the following:

•property taxes and/or rent paid

•farmland preservation

•college tuition and fees

•public contributions

•community foundations

•homeless shelter/food bank

•income tax paid to government units outside Michigan.

All these credits reduce the tax you owe. If you are eligible for any of these credits and you file an EZ form, you will pay more tax than you owe.

When to file

Your return must be postmarked no later than April 15, 1998. Late payments will be charged a monthly penalty of 5 percent of the tax due (minimum $10, maximum 50 percent of the tax), and monthly interest at 1 percent above the prime rate.

Lines not listed are explained on the form.

Lines 2 & 3: Write your Social Security number(s) here even if using your label.

Line 4: See instructions on pages 41 - 42.

Line 5: These funds are distributed among all candidates for governor who meet the campaign fund qualifications, regardless of political party. If you choose yes, it will not raise your tax or reduce your refund.

Line 6: If single and AGI is less than $1,500 or married filing jointly and AGI is less than $3,000 and Michigan tax is withheld, enter 0 on line 12 and complete lines 7, and 13 through 19. If Michigan tax is not withheld, you do not need to file this form.

Lines 11a and 11b: On line 11a, enter the total amount of city income tax withheld as shown on your

Lines 13 and 14: You may contribute any amount to one or both of these funds, whether you owe tax or are due a refund. For a full explanation of these funds, see page 9 of the income tax instruction book. Your donation will increase your tax or reduce your refund.

Step 1

Step 2

CITY INCOME TAX CREDIT WORKSHEET

To Determine Net City Income Tax

Add: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

• City income tax withheld from wages in 1997 |

|

|

|

|

|

|

|

|

|

|

||||||

(as shown in box 21 on your |

|

|

|

|

|

|

|

.00 |

|

|||||||

• Amount of tax paid with a Michigan city income tax return |

|

|

|

|

|

|||||||||||

filed in 1997 (do not include penalty and interest) |

+ |

|

.00 |

|

||||||||||||

...................................• Estimated city income tax payments paid in 1997 |

+ |

|

.00 |

|

||||||||||||

|

.00 |

|

||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

Subtotal |

|

|

||

Subtract: |

|

|

|

|

|

|

|

|

|

- |

|

|

|

|

||

• Any city income tax refunds received in 1997 |

|

|

|

|

|

|

.00 |

|

||||||||

|

|

|

|

|

|

|

|

|||||||||

.................................. |

= |

|

|

|

|

|||||||||||

Total net city income tax paid. Carry to line 11a |

|

.00 |

|

|||||||||||||

To Determine Your City Income Tax Credit |

|

|

|

|

|

|

|

|

|

|

||||||

If your Total Net City Income Tax Paid |

|

|

|

|

||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

$100 or less |

|

|

|

$101 through $150 |

|

|

|

|

$151 or more |

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net city income |

|

|

|

Net city income |

|

|

|

|

|

Net city income |

|

|

|

|

||

tax paid |

.00 |

|

tax paid |

|

.00 |

|

|

tax paid |

|

.00 |

|

|||||

|

|

x |

.20 |

|

Subtract |

- |

$100.00 |

|

|

|

Subtract |

- |

$150.00 |

|

||

|

|

|

|

|

|

|

|

|

|

|||||||

CREDIT. Carry |

|

|

|

|

|

.00 |

|

|

|

|

|

.00 |

|

|||

........to line 11b |

.00 |

|

Multiply |

x |

.10 |

|

|

|

Multiply |

x |

.05 |

|

||||

|

|

|

|

|

|

|

|

|

|

|||||||

|

|

|

|

|

|

|

|

.00 |

|

|

|

|

.00 |

|

||

|

Round all amounts to |

|

|

|

Add |

+ |

20.00 |

|

|

|

Add |

+ |

25.00 |

|

||

|

the nearest dollar. |

|

|

|

|

|

|

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

Credit cannot be more |

CREDIT. Carry |

|

|

|

|

|

CREDIT. Carry |

|

|

|

|

|||||

|

than $10,000.00 |

|

|

|

to line 11b |

|

.00 |

|

|

|

to line 11b |

|

.00 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

WHEN YOU HAVE FINISHED

Be sure to attach the state copy of your

Enclose your check if you owe $1.00 or more in tax. Make your check payable to "State of Michigan." Write your Social Security number and the words “1997 income tax” on the face of your check. Do not staple your check to your return.

Your return may be audited. Keep a copy of this form and all supporting documents for six years.

Mail Refunds to: Michigan Department of Treasury Lansing, MI 48956

Mail Payments to: Michigan Department of Treasury Lansing, MI 48929

www.treas.state.mi.us

Form Characteristics

| Fact Name | Description |

|---|---|

| Form Purpose | The MI-1040EZ is designed for individuals with basic tax situations, specifically for single filers or those married filing jointly. |

| Eligibility Criteria | Eligible individuals must be Michigan residents for all of 1997, have no dependents, and be filing a U.S. 1040EZ form. |

| Filing Status | This form can be used if the filing status is either single or married filing jointly. |

| Governing Law | Issued under P.A. 281 of 1967, as amended, the form adheres to state tax regulations. |

| Deadline for Filing | Tax returns must be postmarked no later than April 15, 1998. Late payments incur a monthly penalty. |

| Exemption Allowance | Exemption amounts vary depending on whether the taxpayer can be claimed as a dependent by another person. |

| Tax Rate | The tax due is calculated at a rate of 4.4% of taxable income derived from the return. |

| Refund Process | Direct deposit is available; filers must complete specific lines to receive refunds via bank account. |

Guidelines on Utilizing Mi 1040Ez

Completing the MI 1040EZ form is an essential step in filing your taxes as a Michigan resident. Please ensure you have all necessary documents ready, as accurate and timely filing can help you avoid penalties and expedite any refunds. Follow the steps outlined below for a smooth process.

- Gather your personal information, including your Social Security number and your spouse's, if applicable.

- Label the form with your first name, middle initial, and last name. If filing jointly, include your spouse's name.

- Provide your home address including city, state, and ZIP code.

- Enter the school district code as instructed on the form.

- Indicate whether you or your spouse wish to contribute $3 to the campaign fund by checking 'YES' or 'NO' for each.

- Check box 6 if you or your spouse can be claimed as a dependent by someone else.

- Staple your state copy of W-2 form(s) to the front of the MI 1040EZ.

- Fill in your adjusted gross income as taken from your U.S. 1040EZ.

- Input your exemption allowance based on your filing status.

- Calculate your taxable income by subtracting your exemption allowance from your adjusted gross income.

- Multiply your taxable income by 4.4% (0.044) to find your tax amount.

- List any income tax you paid to Michigan cities, and subtract that from your calculated tax amount.

- Complete the voluntary contribution section, if applicable, by entering amounts you wish to contribute.

- Add your tax amount and any total contributions.

- Enter the amount of Michigan tax withheld as shown on your W-2.

- If applicable, calculate the amount due or refund based on the difference between your taxes and withholdings.

- Decide if you want your refund direct-deposited by filling in the necessary banking information.

- Sign and date the form, ensuring all information is accurate and complete.

- Mail your completed form, along with payment if necessary, to the correct Michigan Department of Treasury address.

Once you submit your MI 1040EZ, you can keep a copy of the form and all documents for your records. This will be helpful in case of any audits down the line. Remember, the deadline for postmarking your return is April 15, so act swiftly to avoid penalties!

What You Should Know About This Form

What is the MI-1040EZ form?

The MI-1040EZ form is a simplified Michigan income tax return designed for specific individuals. It is for taxpayers whose filing status is either single or married filing jointly. Eligible filers must have been Michigan residents for the entire year, cannot claim dependents, and must not be eligible for certain tax credits. This form is intended to streamline the filing process for those whose tax situations meet these criteria.

Who is eligible to file the MI-1040EZ form?

Eligibility for the MI-1040EZ form requires that you file a U.S. 1040EZ. Additionally, you must be single or married filing jointly, have no dependents, and have been a Michigan resident for the entire tax year. Importantly, you should not receive income from military pay, pensions, or other types of income that could complicate your tax situation. Individuals age 65 or older and those with disabilities do not qualify for this form.

What is the deadline for filing the MI-1040EZ?

The deadline for filing the MI-1040EZ form is April 15 of the year following the tax year. For example, for the tax year 1997, the form needed to be postmarked by April 15, 1998. It is crucial to meet this deadline to avoid potential penalties, which could include a monthly charge of 5 percent of the tax due in addition to accruing interest.

What should I do if I owe taxes?

If the amount shown on your MI-1040EZ indicates that you owe taxes, you should include a check with your filing. Make the check payable to the "State of Michigan," and write your Social Security number and “1997 income tax” on the front of the check. Do not staple the check to the return. The payment should be mailed to the Michigan Department of Treasury at the appropriate address.

How do I report income from city taxes?

To report income from city taxes, you will need to enter the total amount of city income tax withheld from your wages on line 11a of the MI-1040EZ form. If you paid additional city taxes, those amounts should also be included. As part of this reporting, you may be eligible for a city income tax credit, which must be calculated separately and reported on line 11b.

Can I contribute to voluntary funds using the MI-1040EZ?

Yes, the MI-1040EZ form allows you to make voluntary contributions to specific funds, such as those aimed at fighting child abuse or supporting endangered wildlife. You may choose to contribute any amount to these funds, regardless of whether you owe taxes or are expecting a refund. Be aware that these contributions may affect your total tax owed or refund amount.

What should I attach to my MI-1040EZ when I file?

It is essential to attach a copy of your state W-2 forms to your MI-1040EZ submission. This documentation verifies your income and any taxes withheld. Additionally, make sure that you have signed and dated your return. Keeping a personal copy of your submitted forms and all supporting documents is advisable for your records, as the returns may be subject to audit.

What happens if I made a mistake on my MI-1040EZ form?

If you discover an error on your MI-1040EZ after submission, you can file an amended return. It is important to correct any inaccuracies promptly. A thorough review of your tax documents before filing can help minimize such errors. Additionally, consider consulting a tax professional if you are unsure how to proceed with an amendment.

Common mistakes

Filing the MI-1040EZ form can be straightforward, yet several common mistakes can complicate the process. One frequent error is failing to include the correct Social Security numbers for both the taxpayer and their spouse if filing jointly. This error can delay processing and potentially lead to issues with the return being accepted. It is crucial to write these numbers accurately, even if using a label.

Another mistake often observed is the incorrect exemption allowance calculation. Taxpayers may misinterpret line 6, which involves checking if they or their spouse can be claimed as dependents. If this situation applies, the amounts entered on line 8 must reflect this correctly, which varies based on filing status. Miscalculations here can lead to improper tax liabilities.

Additionally, many filers neglect to attach the state copy of their W-2 forms. This requirement is emphasized in the MI-1040EZ instructions. The absence of this crucial document can also result in processing delays or further inquiries from tax authorities. Ensuring that this form is properly stapled to the return is vital for complete submission.

Some individuals make the mistake of not claiming the city income tax credit correctly. Line 11a requires accurate reporting of city income taxes withheld and any paid during the tax year. Failing to calculate these amounts accurately can lead to an inflated tax liability, costing more than necessary.

Finally, there are instances where taxpayers mistakenly choose to donate to the campaign funds without understanding the implications. While contributions can be made, it is essential to acknowledge that these donations do not reduce tax owed or increase refunds but instead could affect the return outcome. Making an informed choice here is critical.

Documents used along the form

The MI-1040EZ form is intended for Michigan residents filing their state income tax return. It is a simplified version designed for individuals with relatively straightforward financial situations. However, when completing this form, you may also need to gather other documents and forms that support your filing. Below are several common forms and documents often used alongside the MI-1040EZ.

- W-2 Form: This form reports your annual wages and the taxes withheld by your employer. You need to attach your W-2 form to the MI-1040EZ to verify your income and the state tax you have already paid.

- U.S. 1040EZ Form: This federal tax return form must be completed before filing the MI-1040EZ. The adjusted gross income from the 1040EZ is used to determine your Michigan tax obligations.

- City Income Tax Credit Worksheet: If you paid city income taxes, this worksheet helps calculate the income tax credit available to you. It determines how much of your city tax paid can be credited against your Michigan income tax.

- Other State Tax Returns: If you earned income in another state during the tax year, you might need to include information from other state tax returns to determine tax liabilities or credits applicable to your filing.

- Form MI-1040CR: This form is for taxpayers who qualify for the homestead property tax credit. If you are eligible, this form must be filed simultaneously with the MI-1040EZ to claim the credit.

- Direct Deposit Form: If you want your refund directly deposited into your bank account, you must fill out this section at the end of the MI-1040EZ, providing your bank’s routing number and your account number.

Being aware of these documents can facilitate a smoother filing process. Ensure that you have all required forms ready when submitting your MI-1040EZ to avoid delays or issues with your return.

Similar forms

The MI-1040EZ form is a simplified tax return used by residents of Michigan who meet specific criteria. Some other tax documents share similarities with this form, often targeting specific taxpayer situations. Below is a list of five forms that are similar to the MI-1040EZ:

- IRS Form 1040EZ: The federal cousin of the MI-1040EZ, it is also for those with simple tax situations, such as individuals or couples filing jointly without dependents. Like the MI-1040EZ, it is designed for straightforward reporting, limiting complications with deductions and credits.

- MI-1040: This form serves as a more comprehensive tax return for Michigan residents. It accommodates those with dependents and various credits, similar to how the MI-1040EZ is tailored for simpler cases. Both forms require information on income, exemptions, and tax withheld.

- MI-1040A: This is another version of Michigan's tax return options, meant for individuals who may have more deductions or credits than the EZ allows. Similar to the MI-1040EZ, it is designed to simplify the process, though with added depth for slightly more complex situations.

- IRS Form 1040A: Like the MI-1040A, this federal form is for those with more diverse income sources or eligible for certain credits and deductions but who do not require the full detail of a 1040 form. Both forms enable filers to report income and claim exemptions in a more straightforward manner than the full-form versions.

- MI-1040CR: This form is specifically for Michigan's homestead property tax credit, intended for residents who qualify for property tax relief. While its purpose differs, it aligns with the MI-1040EZ's overarching goal of facilitating easier tax processes for eligible individuals.

Dos and Don'ts

When filling out the MI 1040EZ form, careful attention to detail can significantly impact your tax experience. To navigate the process effectively, here are several do’s and don’ts.

- Do ensure you are eligible to use the MI 1040EZ form by meeting all specified criteria.

- Do include your Social Security numbers in the appropriate sections, even if you are using a label. Accurate identification is essential.

- Do review the instructions carefully on the back of the form. Understanding each section can prevent costly mistakes.

- Do attach your W-2 forms to your return. This documentation is crucial to verify your income and withholding.

- Do double-check all calculations before submitting. Errors in arithmetic can lead to underpayment or overpayment of taxes.

- Don’t choose the EZ form if you qualify for any credits that can reduce your tax liability. Filing the EZ may result in a higher tax than you owe.

- Don’t forget to sign your return before mailing it. A missing signature can delay processing.

- Don’t staple your check to the return if you owe taxes. Instead, include it in an envelope to facilitate processing.

- Don’t submit the form late without understanding the penalties involved. Timeliness is critical to avoid additional costs.

By adhering to these guidelines, you can simplify the filing process and ensure that your MI 1040EZ form is completed correctly. This attention to detail helps safeguard against unnecessary complications down the line.

Misconceptions

Misconceptions about the MI-1040EZ form can lead to confusion during tax season. Here are seven common misconceptions:

- Misconception 1: The MI-1040EZ can be filed by anyone regardless of income.

- Misconception 2: You can claim dependents on this form.

- Misconception 3: All residents of Michigan can file the MI-1040EZ.

- Misconception 4: If you file the MI-1040EZ, you don't need to attach any documents.

- Misconception 5: Filing the MI-1040EZ is optional.

- Misconception 6: You can claim various credits with the MI-1040EZ.

- Misconception 7: The MI-1040EZ is the same as the U.S. 1040EZ.

This form is only for those with simple tax situations. You must meet specific income criteria to use it.

The MI-1040EZ is strictly for individuals without dependents. If you have dependents, you need to file a different form.

This form is only for those who were Michigan residents for the entire tax year in question.

You must attach your W-2 form. This is crucial for your tax return to be processed accurately.

Filing is mandatory if you meet the requirements. Failing to file may result in penalties and interest charges.

Many tax credits are not available when using this form. You will end up paying more tax if you're eligible for those credits but still file the MI-1040EZ.

While they share a name, the MI-1040EZ has different rules and requirements specific to Michigan taxes.

Key takeaways

When filling out and using the MI 1040EZ form, there are several key points to keep in mind:

- Eligibility Criteria: The MI 1040EZ form is designed for individuals who are either single or married filing jointly. You must have been a Michigan resident for the entire tax year and cannot have any dependents. If you earn certain types of income, such as military pay or pensions, you will need to use a different form.

- Filing Deadlines: Submitting your MI 1040EZ form is crucial before the deadline. For the 1997 tax year, your return must be postmarked by April 15, 1998. Failing to file on time can lead to penalties and interest on any unpaid taxes.

- Contributions and Credits: The form allows you to contribute to campaign funds, which does not affect your tax bill. However, be aware that if you qualify for certain tax credits—such as those for property taxes or college tuition—you should consider using a different form, as filing the EZ form may result in a higher tax liability.

- Documentation Requirements: It's essential to attach a copy of your W-2 form when submitting the MI 1040EZ. Always keep a copy of your completed return and any supporting documents for at least six years in case of an audit.

Browse Other Templates

Complaint Letter to Council - Identifying key issues regarding current drinking water safety policies.

How Do I Get My 1095 From Unitedhealthcare - The signed consent allows for a seamless process in sharing essential health screening results.

Mn State Tax Payment - Make sure to follow all instructions for printing and mailing the payment.