Fill Out Your Mi Tr 11L Application Title Form

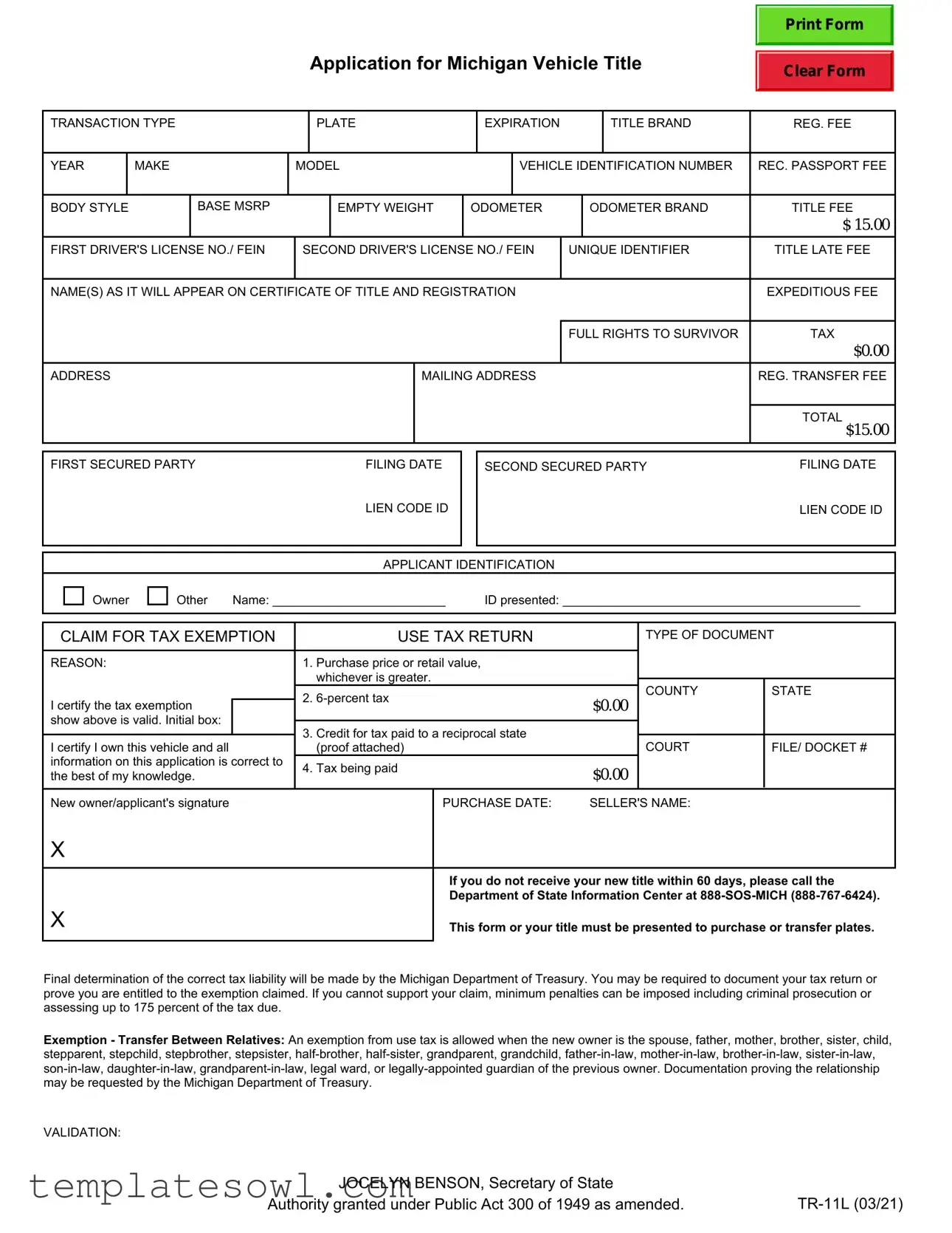

The Mi Tr 11L Application Title form is a crucial document used in Michigan for vehicle title transactions. This form facilitates the transfer of ownership, ensuring that all relevant information is accurately recorded and submitted to the state. Among its key components are sections for the transaction type, vehicle details, and applicant identification. For instance, the form requires the current license plate expiration, the vehicle's make and model, and its unique identification number. Additionally, it includes fees associated with the title application, such as the title fee and any applicable late fees. Understanding where to list the owner's name, as it will appear on the certificate of title and registration, is essential for a seamless process. Another important aspect is the claim for tax exemption, which outlines specific conditions under which an owner may be exempt from certain taxes, particularly in familial transfers. Moreover, the applicant must certify the accuracy of the information provided and acknowledge any potential penalties for inaccuracies or failure to support tax exemption claims. Finally, this form serves as a critical link between the vehicle owner and the Michigan Department of Treasury, highlighting the responsibilities of both parties in ensuring compliance with state laws regarding vehicle ownership and taxation.

Mi Tr 11L Application Title Example

Application for Michigan Vehicle Title

Print Form

Clear Form

TRANSACTION TYPE |

|

|

PLATE |

|

EXPIRATION |

|

|

TITLE BRAND |

REG. FEE |

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

YEAR |

|

MAKE |

|

MODEL |

|

|

VEHICLE IDENTIFICATION NUMBER |

REC. PASSPORT FEE |

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

BODY STYLE |

|

BASE MSRP |

|

|

|

EMPTY WEIGHT |

ODOMETER |

|

ODOMETER BRAND |

TITLE FEE |

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

$ 15.00 |

FIRST DRIVER'S LICENSE NO./ FEIN |

|

SECOND DRIVER'S LICENSE NO./ FEIN |

UNIQUE IDENTIFIER |

TITLE LATE FEE |

|||||||||||

|

|

|

|

|

|

|

|

|

|

||||||

NAME(S) AS IT WILL APPEAR ON CERTIFICATE OF TITLE AND REGISTRATION |

|

|

|

EXPEDITIOUS FEE |

|||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

FULL RIGHTS TO SURVIVOR |

TAX |

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

$0.00 |

ADDRESS |

|

|

|

|

|

|

MAILING ADDRESS |

|

|

|

REG. TRANSFER FEE |

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

TOTAL $15.00 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

FIRST SECURED PARTY |

FILING DATE |

|

LIEN CODE ID |

SECOND SECURED PARTY |

FILING DATE |

|

LIEN CODE ID |

APPLICANT IDENTIFICATION

Owner |

|

Other |

Name: _________________________ |

ID presented: ___________________________________________ |

CLAIM FOR TAX EXEMPTION |

|

USE TAX RETURN |

|

TYPE OF DOCUMENT |

||

|

|

|

|

|

|

|

REASON: |

1. |

Purchase price or retail value, |

|

|

|

|

|

|

|

whichever is greater. |

|

|

|

|

|

|

|

COUNTY |

STATE |

|

I certify the tax exemption |

|

2. |

$0.00 |

|||

|

|

|

||||

|

|

|

|

|

||

show above is valid. Initial box: |

|

|

|

|

|

|

3. |

Credit for tax paid to a reciprocal state |

|

|

|

||

|

|

|

|

|

||

I certify I own this vehicle and all |

|

COURT |

FILE/ DOCKET # |

|||

|

(proof attached) |

|

||||

information on this application is correct to |

4. |

Tax being paid |

$0.00 |

|

|

|

the best of my knowledge. |

|

|

||||

|

|

|

|

|||

|

|

|

|

|

|

|

New owner/applicant's signature |

|

PURCHASE DATE: |

SELLER'S NAME: |

|

||

X |

|

|

If you do not receive your new title within 60 days, please call the |

|

Department of State Information Center at |

X |

This form or your title must be presented to purchase or transfer plates. |

Final determination of the correct tax liability will be made by the Michigan Department of Treasury. You may be required to document your tax return or

prove you are entitled to the exemption claimed. If you cannot support your claim, minimum penalties can be imposed including criminal prosecution or assessing up to 175 percent of the tax due.

Exemption - Transfer Between Relatives: An exemption from use tax is allowed when the new owner is the spouse, father, mother, brother, sister, child, stepparent, stepchild, stepbrother, stepsister,

VALIDATION:

JOCELYN BENSON, Secretary of State |

|

Authority granted under Public Act 300 of 1949 as amended. |

Form Characteristics

| Fact Name | Fact Detail |

|---|---|

| Transaction Purpose | The Mi Tr 11L Application Title form is used to apply for a Michigan vehicle title. |

| Applicable Fee | The title fee is set at $15.00, which is required for processing the application. |

| Governing Law | This form is governed by Public Act 300 of 1949, as amended. |

| Exemption Criteria | There is an exemption from use tax for transfers between relatives, including immediate family members. |

| Validation Authority | The Secretary of State, Jocelyn Benson, validates the application. |

Guidelines on Utilizing Mi Tr 11L Application Title

Filling out the Mi Tr 11L Application Title form is a straightforward process. It involves providing important information about the vehicle as well as certain personal details. Once your form is complete, you can submit it to the appropriate department to begin the process of obtaining or transferring a vehicle title.

- Obtain the Form: Download the Mi Tr 11L Application Title form from the Michigan Department of State website or pick up a physical copy from a local office.

- Complete the Transaction Type: Indicate the transaction type at the top of the form.

- Enter Vehicle Information: Fill in the details regarding the vehicle, including the year, make, model, vehicle identification number (VIN), body style, and empty weight.

- Provide Odometer Information: Record the odometer reading and indicate whether the odometer brand is accurate or not.

- Identify the Owner: Write your name as it should appear on the title, including the driver's license number or Federal Employer Identification Number (FEIN).

- Complete Address Sections: Fill in both your residential address and mailing address.

- Add Details About Secured Parties: If there are any secured parties, list the first and second secured party names along with their filing dates and lien codes.

- Provide Purchase Information: Specify the purchase date, seller's name, and any applicable fees including title fees, tax exemptions, and total amounts due.

- Tax Exemption Claim: If applicable, complete the claim for tax exemption section. Initial the box for tax certification.

- Sign the Application: The new owner/applicant must sign and date the application, certifying the correctness of the information provided.

Once you have filled out all the necessary fields, double-check your form for accuracy. It’s essential to ensure that all information is correct and complete before submitting it. This can help avoid any delays in processing your application.

What You Should Know About This Form

What is the purpose of the Mi Tr 11L Application Title form?

The Mi Tr 11L Application Title form is used to apply for a Michigan vehicle title. This form is necessary when transferring ownership of a vehicle, registering a new vehicle, or changing details such as the owner's name. It gathers essential information about the vehicle, its owner, and the transaction type to ensure proper documentation and compliance with state regulations.

What fees are associated with submitting the Mi Tr 11L Application Title form?

There is a standard title fee of $15.00 when you submit the Mi Tr 11L Application Title form. Additional fees may apply, such as a late fee if your application is not submitted within the appropriate timelines or if you require expeditious processing. The total fees can vary depending on the specifics of the transaction and any applicable taxes or exemptions.

How do I know if I am eligible for a tax exemption when using this form?

You may be eligible for a tax exemption if the transfer of the vehicle occurs between certain family members, which includes spouses, parents, siblings, and children. To qualify, the relationship must fall within the legal definitions set forth by the Michigan Department of Treasury. It may be necessary to provide documentation proving your relationship to the previous owner to substantiate your claim for a tax exemption.

What should I do if I do not receive my title after submitting the form?

If you do not receive your new title within 60 days of submitting the Mi Tr 11L Application Title form, it is advisable to contact the Department of State Information Center at 888-SOS-MICH (888-767-6424). They can provide you with updates on the status of your application and assist with any issues that may arise during the processing of your title.

Common mistakes

When filling out the Mi Tr 11L Application Title form, many people make simple yet significant mistakes that can lead to delays in processing. One common error is not double-checking the vehicle identification number (VIN). The VIN is crucial for the identification of the vehicle. A single digit mistake can result in the application being rejected.

Another frequent mistake is failing to provide the correct address. It's essential that you provide your current and accurate mailing address. If the address does not match what’s on file, the state may send your title to the wrong location, causing additional delays and potential fees to rectify the issue.

Many applicants overlook the importance of signing the form. Without the new owner/applicant's signature, the application cannot be processed. This missing signature can lead to your application being delayed significantly. Make sure that all required signatures are provided before submitting.

Lastly, many people miscalculate the applicable fees. The total fees may include title fees, taxes, and possibly late fees. Review the fee section carefully to ensure you understand what you owe. If you submit the form with incorrect payment, it can prolong the title transfer process. Carefully review each section before submission to prevent these mistakes.

Documents used along the form

The Mi Tr 11L Application Title form is a crucial document for those seeking to register a vehicle in Michigan. However, several other forms and documents are often required to complete the application process. Each of these documents serves a specific purpose in ensuring that vehicle ownership and registration are properly recorded.

- Tax Exemption Claim Form: Used to claim an exemption from use tax when transferring ownership, this form outlines the relationship between the buyer and seller if applicable, ensuring no tax is assessed under certain circumstances.

- Vehicle Registration Application (Form TR-100): This document is used to apply for vehicle registration with the Michigan Department of State. It includes vehicle details and owner information necessary for processing the registration.

- Affidavit of Ownership: This form may be required when the applicant is unable to provide a previous title or bill of sale. It serves as a sworn statement asserting ownership of the vehicle.

- Bill of Sale: A record of the transaction between the buyer and seller, typically including the vehicle’s make, model, Vehicle Identification Number (VIN), and purchase price. This document helps verify ownership transfer.

- Liens and Security Interests Report: This report details any outstanding liens against the vehicle, ensuring that the new owner is aware of any claims on the title before the transfer is complete.

- Proof of Identity: Commonly a government-issued photo ID, this document validates the identity of the applicant, essential for the processing of the title application.

- Emissions Compliance Certificate: In some cases, this certificate is needed to prove that the vehicle meets Michigan’s emissions standards, which is important for registration purposes.

- VIN Verification Form: This form is used to confirm the Vehicle Identification Number. It is particularly necessary for vehicles that do not have a clear title or have been assembled from different parts.

Providing these documents can streamline the title application process and help ensure compliance with Michigan laws regarding vehicle ownership and registration. Each document plays an integral role in establishing legal ownership and tax compliance, ultimately facilitating a smooth transaction.

Similar forms

The Mi Tr 11L Application Title form serves as an essential document in the process of obtaining a vehicle title in Michigan. Other documents share similarities in purpose and function. Below are five such documents, each detailed for comparison:

- Vehicle Registration Application: Similar in its objective of officially recording a vehicle's ownership, this document provides information about the vehicle and its owner. Like the Mi Tr 11L, it may require details such as the vehicle identification number (VIN), make, and model.

- Bill of Sale: This document serves as proof of the transaction between the buyer and seller. It usually includes the purchase price, vehicle details, and signatures from both parties. The Bill of Sale can accompany the Mi Tr 11L form to demonstrate legal ownership and the transfer of rights.

- Application for Duplicate Title: If an original title is lost or destroyed, this application allows individuals to request a replacement. The information required mirrors that of the Mi Tr 11L, such as vehicle details and owner identification, ensuring continuity in vehicle ownership records.

- Statement of Vehicle Operation: For vehicles that were previously registered, this document may be needed to assert the claim of ownership and confirm usage history. It provides a narrative similar to what is included in the Mi Tr 11L regarding the vehicle's condition and previous title status.

- Affidavit of Ownership: In situations where an individual cannot provide a title or bill of sale (e.g., an inherited vehicle), this legal document acts as a sworn statement confirming ownership. It consolidates information akin to the Mi Tr 11L, ensuring that the new title application is substantiated.

Each of these documents plays a vital role in establishing and maintaining accurate records of vehicle ownership. They ensure that the rights of all parties involved are protected and that the transaction is legally validated.

Dos and Don'ts

When filling out the Mi Tr 11L Application Title form, it is essential to follow certain guidelines to ensure a smooth application process. Here’s a list of ten things you should and shouldn’t do:

- Do: Provide accurate vehicle identification numbers (VIN) and other vehicle details.

- Do: Double-check the spelling of all names as they will appear on the certificate of title.

- Do: Sign the application to certify that all provided information is correct.

- Do: Include the correct purchase price or retail value to determine the tax liability.

- Do: If applicable, document your claim for tax exemption thoroughly.

- Don’t: Leave any required fields blank; incomplete applications can delay processing.

- Don’t: Use abbreviations or nicknames for names or addresses on the form.

- Don’t: Forget to check for any applicable late fees that might apply to your application.

- Don’t: Ignore the instructions related to the documentation required for tax exemption.

- Don’t: Submit the form without reviewing it for any errors or omissions.

By adhering to these dos and don’ts, you will help ensure that your application is processed efficiently and correctly.

Misconceptions

Misconceptions about the Mi Tr 11L Application Title form can lead to confusion and delays in vehicle registration and title transfer. The following list clarifies some common misunderstandings:

- Only car dealerships can complete this form. This is incorrect. Individuals can fill out the form themselves to transfer a vehicle title.

- The form is only needed for new vehicles. In fact, this form is required for any vehicle title transfer, whether new, used, or transferred between relatives.

- Completing the form guarantees immediate title processing. While the form is essential, there is no guarantee of immediate processing. Allow for up to 60 days before following up with the Department of State.

- All title transfers incur a tax fee. Certain transfers, specifically between relatives, may be exempt from use tax. Proper documentation is required for any exemptions.

- The form does not require signatures. Signatures are mandatory. The new owner's signature certifies the information is accurate and affirms ownership.

- Once submitted, changes cannot be made. If there are mistakes, individuals can contact the Department of State for guidance on how to correct the information.

- Only residents of Michigan can fill out this form. While the form is specific to Michigan, individuals moving into the state can complete it to register their vehicles.

Key takeaways

Filling out and using the Mi Tr 11L Application Title form requires attention to detail and adherence to specific guidelines. Here are nine key takeaways for successful completion:

- Ensure all information regarding the vehicle, including year, make, model, and Vehicle Identification Number (VIN), is accurate. Inaccuracies may lead to delays.

- Clearly indicate the transaction type and relevant fees associated with the title application. The standard title fee is $15.00.

- Include the names of all owners as they will appear on the certificate of title and registration. Accuracy here is critical.

- Provide both mailing and physical addresses. This will ensure proper communication and delivery of the title.

- Understand tax exemptions that may apply. If you qualify, include documentation to support your claim.

- The application must be signed by the new owner or applicant, affirming the accuracy of the information provided.

- Be aware that you must present this form or your title when purchasing or transferring plates.

- If the new title is not received within 60 days, it is advisable to contact the Department of State Information Center.

- Failure to support tax exemption claims may result in penalties, so it is important to keep necessary documentation accessible.

Browse Other Templates

Public Information Report - Reviewing the form and its instructions carefully can prevent delays in processing requests.

What Is a Disclosure Statement - Homebuyers should thoroughly read this document as it holds crucial information about the property.