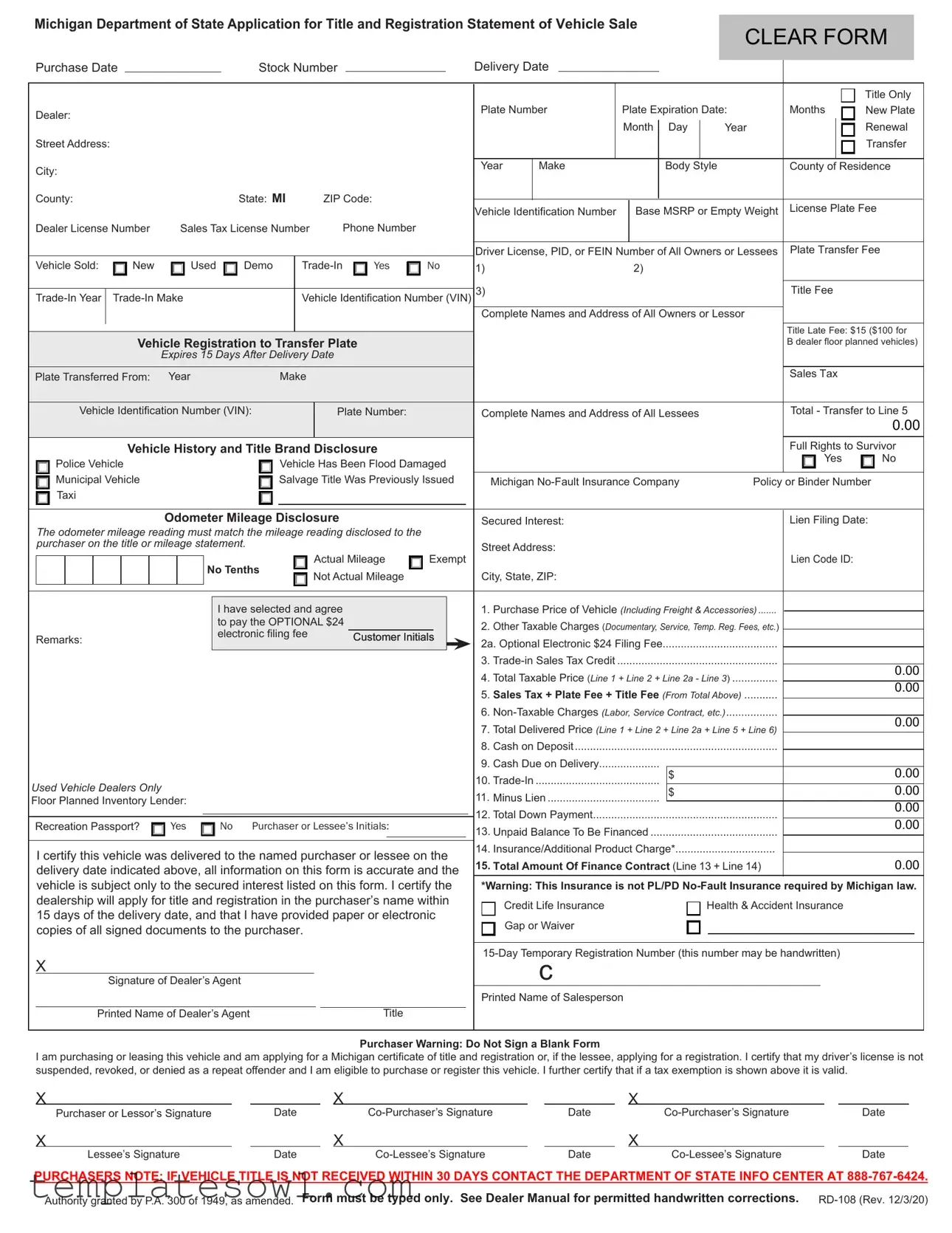

Fill Out Your Michigan Category Weight Form

The Michigan Category Weight form plays a vital role in the vehicle title and registration process. It streamlines the information required for both new and used vehicle transactions. Essential details, such as the purchase date, vehicle identification number, and buyer information, need to be filled out accurately. This form includes sections to document whether the vehicle is new, used, or a demo, along with specifics about trade-ins. Through clear sections, it requests information about fees, taxes, and any necessary disclosures, such as the vehicle's history and condition. It is crucial for the transaction process, as buyers must indicate the purchase price and any associated charges, including sales tax and registration fees. Additionally, the form reflects compliance with Michigan's legal requirements, ensuring that every pertinent detail is addressed and signed by both the purchaser and the dealer. Filing this document correctly helps in obtaining a Michigan certificate of title and registration promptly, allowing buyers to enjoy their new vehicles without undue delays.

Michigan Category Weight Example

Michigan Department of State Application for Title and Registration Statement of Vehicle Sale

CLEAR FORM

Purchase Date |

|

|

|

|

|

|

|

Stock Number |

|

|

|

|

|

|

|

|

|

Delivery Date |

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Title Only |

|

Dealer: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Plate Number |

|

Plate Expiration Date: |

Months |

New Plate |

||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Month |

|

Day |

|

Year |

|

|

|

Renewal |

||

Street Address: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Transfer |

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

City: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Year |

|

Make |

|

|

Body Style |

County of |

Residence |

|||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

County: |

|

|

|

|

|

|

|

|

|

|

State: MI |

|

ZIP Code: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Vehicle Identification Number |

|

Base MSRP or Empty Weight |

License Plate Fee |

||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

Dealer License Number |

|

Sales Tax License Number |

|

Phone Number |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Driver License, PID, or FEIN Number of All Owners or Lessees |

Plate Transfer Fee |

||||||||||||||

|

Vehicle Sold: |

|

|

New |

|

|

Used |

Demo |

|

Yes |

No |

1) |

|

|

|

|

2) |

|

|

|

|

|

|

|

|

|

|||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

3) |

|

|

|

|

|

|

|

|

|

|

Title Fee |

|

|

||

|

|

|

|

|

|

|

Vehicle Identification Number (VIN) |

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Complete Names and Address of All Owners or Lessor |

|

|

|

|

|

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Title Late Fee: $15 ($100 for |

||||

|

|

|

|

|

|

Vehicle Registration to Transfer Plate |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

B dealer floor planned vehicles) |

||||||||||||||||||

|

|

|

|

|

|

|

|

Expires 15 Days After Delivery Date |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||

Plate Transferred From: |

Year |

|

|

|

|

|

Make |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Sales Tax |

|

|

|||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

|

|

Vehicle Identification Number (VIN): |

|

|

|

Plate Number: |

|

|

|

|

|

Complete Names and Address of All Lessees |

|

|

Total - Transfer to Line 5 |

||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

0.00 |

|

|

|

|

|

|

|

Vehicle History and Title Brand Disclosure |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Full Rights to Survivor |

||||||||||||||||||||

|

Police Vehicle |

|

|

|

|

|

|

|

Vehicle Has Been Flood Damaged |

|

|

|

|

|

|

|

|

|

|

|

|

Yes |

No |

||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||

|

Municipal Vehicle |

|

|

|

|

|

|

|

Salvage Title Was Previously Issued |

Michigan |

|

Policy or Binder Number |

|||||||||||||||||||||||||||||||

|

Taxi |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||

|

|

|

|

|

|

|

|

Odometer Mileage Disclosure |

|

|

|

|

|

|

|

Secured Interest: |

|

|

|

|

|

|

Lien Filing Date: |

||||||||||||||||||||

|

The odometer mileage reading must match the mileage reading disclosed to the |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||

|

purchaser on the title or mileage statement. |

|

|

|

|

|

|

|

|

|

|

|

|

|

Street Address: |

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Actual Mileage |

Exempt |

|

|

|

|

|

|

Lien Code ID: |

|

|

||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

No Tenths |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

Not Actual Mileage |

|

|

|

|

|

City, State, ZIP: |

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

I have selected and agree |

|

|

|

|

|

|

|

1. Purchase Price of Vehicle (Including Freight & Accessories) |

|

|

|

|

|

||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

to pay the OPTIONAL $24 |

|

|

|

|

|

|

|

|

2. Other Taxable Charges (Documentary, Service, Temp. Reg. Fees, etc.) |

|

|

|

|

|

|||||||||||||||||

|

Remarks: |

|

|

|

|

|

|

|

|

electronic filing fee |

|

|

|

Customer Initials |

|

|

|

|

|

|

|

|

|||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2a. Optional Electronic $24 Filing Fee |

|

|

|

|

|

|

|

|||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

......................................................3. |

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

0.00 |

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

4. Total Taxable Price (Line 1 + Line 2 + Line 2a - Line 3) |

|

|

|

||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

0.00 |

||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

5. Sales Tax + Plate Fee + Title Fee (From Total Above) |

|

|

|

||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

6. |

|

|

|

|

|

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

0.00 |

||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

7. Total Delivered Price (Line 1 + Line 2 + Line 2a + Line 5 + Line 6). |

|

|

|

||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

8. Cash on Deposit |

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

9. Cash Due on Delivery |

|

|

|

|

|

|

|

|

|

|

|||||

Used Vehicle Dealers Only |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

10. |

|

|

|

$ |

|

|

|

|

|

0.00 |

||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

$ |

|

|

|

|

|

0.00 |

||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

11. Minus Lien |

|

|

|

|

|

|

|

|

|||||||||||||||||

Floor Planned Inventory Lender: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

0.00 |

||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

12. Total Down Payment |

|

|

|

|

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

Recreation Passport? |

Yes |

|

|

No |

Purchaser or Lessee’s Initials: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

0.00 |

|||||||||||||||||||||||

|

|

|

|

|

|

|

13. Unpaid Balance To Be Financed |

|

|

|

|

|

|||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

14. Insurance/Additional Product Charge* |

|

|

|

|

|

|

|

||||||||

|

I certify this vehicle was delivered to the named purchaser or lessee on the |

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

0.00 |

|||||||||||||||||||||||||||||||||||||

|

15. Total Amount Of Finance Contract (Line 13 + Line 14) |

|

|

|

|||||||||||||||||||||||||||||||||||||||

|

delivery date indicated above, all information on this form is accurate and the |

|

|

|

|||||||||||||||||||||||||||||||||||||||

|

vehicle is subject only to the secured interest listed on this form. I certify the |

*Warning: This Insurance is not PL/PD |

|||||||||||||||||||||||||||||||||||||||||

|

dealership will apply for title and registration in the purchaser’s name within |

|

Credit Life Insurance |

|

|

|

|

Health & Accident Insurance |

|

|

|||||||||||||||||||||||||||||||||

|

15 days of the delivery date, and that I have provided paper or electronic |

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||||||||

|

|

Gap or Waiver |

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||||

|

copies of all signed documents to the purchaser. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

X |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

c |

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

Signature of Dealer’s Agent |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Printed Name of Salesperson |

|

|

|

|

|

|

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

|

|

|

Printed Name of Dealer’s Agent |

|

|

|

|

|

|

Title |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Purchaser Warning: Do Not Sign a Blank Form

I am purchasing or leasing this vehicle and am applying for a Michigan certificate of title and registration or, if the lessee, applying for a registration. I certify that my driver’s license is not suspended, revoked, or denied as a repeat offender and I am eligible to purchase or register this vehicle. I further certify that if a tax exemption is shown above it is valid.

X |

|

|

|

X |

|

|

|

X |

|

|

Purchaser or Lessor’s Signature |

Date |

|

Date |

|

|

Date |

||||

X |

|

|

|

X |

|

|

|

X |

|

|

Lessee’s Signature |

Date |

|

Date |

|

|

Date |

||||

PURCHASERS NOTE: IF VEHICLE TITLE IS NOT RECEIVED WITHIN 30 DAYS CONTACT THE DEPARTMENT OF STATE INFO CENTER AT

Authority granted by P.A. 300 of 1949, as amended. Form must be typed only. See Dealer Manual for permitted handwritten corrections.

Form Characteristics

| Fact Name | Description |

|---|---|

| Governing Law | This form is governed by Public Act 300 of 1949, as amended. |

| Purpose | The Michigan Category Weight form is used to register a vehicle and apply for its title. |

| Application Validity | The dealership must apply for title and registration within 15 days from the delivery date. |

| Fees | Various fees are applicable, including title fees, sales tax, and plate transfer fees. |

| Transfer of Plates | Plate transfer is allowed under certain conditions stated on the form. |

| Trade-In Information | Trade-in vehicles must be listed with their year, make, and vehicle identification number. |

| Odometer Disclosure | The mileage reading must match the title or mileage statement provided to the purchaser. |

| Insurance Requirement | This form does not provide the no-fault insurance required by Michigan law. |

| Signatures Required | All purchasers and lessees must sign the form, affirming eligibility to register the vehicle. |

| Notification of Title | Purchasers should contact the Department of State Info Center if the vehicle title is not received within 30 days. |

Guidelines on Utilizing Michigan Category Weight

Filling out the Michigan Category Weight form is an essential task when buying or leasing a vehicle. Proper completion will ensure a smooth transition to receiving your vehicle’s title and registration. Follow these steps carefully to fill out the form accurately.

- Begin with the Purchase Date, entering the day, month, and year of the transaction.

- Fill in the Stock Number provided by the dealer.

- Document the Delivery Date, which is the date you received the vehicle.

- If applicable, enter the Plate Number and Plate Expiration Date.

- Provide the Street Address, City, County, and ZIP Code of your residence.

- Enter the Vehicle Identification Number (VIN) in the designated area.

- Specify whether the vehicle sold is New, Used, Demo, or Trade-In.

- Complete the Base MSRP or Empty Weight as required.

- Indicate the Trade-In Year and Trade-In Make if applicable.

- List the complete names and addresses of all owners or lessees on the form.

- Fill in the Sales Tax information and any Plate Transfer Fee.

- If necessary, indicate any fees related to Title Late Fee.

- Complete the sections for the Odometer Mileage Disclosure, ensuring it matches the title.

- Provide the Purchase Price of Vehicle and any Other Taxable Charges.

- Calculate the Total Taxable Price and document it in the corresponding line.

- Fill in the Cash on Deposit and Cash Due on Delivery amounts.

- Complete the sections for Outstanding Balance and any additional finance charges.

- Sign and date the form as the Purchaser or Lessee and have any co-purchasers or lessees sign as required.

After completing these steps, review the form to ensure all information is accurate. Submit the form as instructed to finalize your application for title and registration. Keep in mind the importance of accuracy in each section to avoid delays in processing.

What You Should Know About This Form

1. What is the Michigan Category Weight form?

The Michigan Category Weight form is an application used for title and registration of vehicles in Michigan. This form is necessary when transferring vehicle ownership or registering a vehicle for the first time. It collects important information about the vehicle, the purchaser, and the transaction details.

2. Who needs to fill out this form?

Both buyers and dealers need to complete the Michigan Category Weight form. Buyers typically fill this out when purchasing a vehicle, while dealers assist in filling it out to facilitate the title and registration process.

3. What information do I need to provide on the form?

You'll need to provide details about the vehicle, such as its make, model, and Vehicle Identification Number (VIN). Additionally, personal information like names, addresses, and driver’s license numbers of all owners or lessees needs to be included. The form also requires the vehicle's purchase price and other applicable fees or taxes.

4. What are the fees associated with this form?

Fees may include title fees, license plate fees, and sales tax. An optional electronic filing fee of $24 is also available. It's important to calculate these fees accurately and ensure they are reflected on the form for a smooth transaction.

5. What is the ‘Trade-In Sales Tax Credit’ section?

This section allows you to note any trade-in vehicle you are offering as part of the purchase. You can receive a sales tax credit for the value of the trade-in, which can lower the overall sales tax you owe on your new vehicle.

6. How do I know if my odometer reading is valid?

You'll need to disclose whether the mileage is actual, exempt, or not actual. The odometer reading must match what is stated on the title or any mileage statement provided. Inaccurate readings could lead to legal issues down the line.

7. What should I do if I don’t receive my vehicle title within 30 days?

If you have not received your vehicle title within 30 days of purchase, you should contact the Michigan Department of State Information Center at 888-767-6424. They can provide guidance on how to address any delays or issues.

8. Can I use this form for both new and used vehicles?

Yes, the Michigan Category Weight form can be used for both new and used vehicles. The form captures necessary details for any type of vehicle sale, ensuring consistency in the registration process regardless of the vehicle's age.

9. What if there is an error on the form?

If you notice an error after submitting the form, it is best to contact your dealer or the Department of State immediately. While minor corrections can sometimes be handwritten on the form, significant errors may require you to complete a new form.

10. Are there any exemptions to the fees on this form?

Some exemptions may apply depending on specific circumstances, such as if you are a tax-exempt organization. It's crucial to have valid documentation ready to provide proof of exemption. Ensure you understand the exemptions available to avoid overpaying.

Common mistakes

Filling out the Michigan Category Weight form correctly is crucial for ensuring a smooth vehicle registration and title process. However, many people make common mistakes that can lead to delays or complications. Understanding these errors can help simplify the experience. Here are six mistakes that often occur when completing the form.

One frequent error is neglecting to provide accurate vehicle identification numbers (VIN). The VIN is a unique identifier for your vehicle, and it must be entered correctly. A typo can lead to significant issues, including complications with title transfers and potential legal disputes. Always double-check the VIN against the vehicle’s documentation.

Another mistake arises when people fail to include all necessary personal information. Fields requesting the complete names and addresses of all owners or lessees should not be overlooked. Incomplete or incorrect information can result in delays or even rejection of the title application.

Some individuals mistakenly fill out the sales tax and fees section without verifying the amounts. The total taxable price must be calculated accurately to ensure the correct amount is paid. Using an incorrect figure can lead to issues with the Michigan Department of State and may require subsequent adjustments or payments.

Additionally, many applicants forget to indicate whether the vehicle is new, used, or a demo. This classification can affect sales tax rates and registration fees. It is essential to choose the correct option, as this can help avoid unnecessary complications during the application process.

Another common oversight involves neglecting the optional electronic filing fee. While it is categorized as optional, many applicants fail to include these fees in their total calculations. Failure to address this aspect can lead to incorrect payment totals and delays in processing.

Lastly, signature requirements often trip up applicants. It is vital to ensure all necessary individuals sign the form where indicated. Incomplete signatures can halt the registration process entirely. Double-check that every required individual has provided their signature before submitting the form.

By being aware of these common mistakes, applicants can navigate the Michigan Category Weight form process with greater ease and efficiency. Proper diligence at the outset can save time and effort later on.

Documents used along the form

The Michigan Category Weight form plays a critical role in the process of vehicle title and registration. When completing this form, several other documents can accompany it to ensure a smooth transaction. The following list describes these additional forms and documents that you may need to prepare or submit in conjunction with the Michigan Category Weight form.

- Michigan Application for Title (Form RD-108): This form is essential for applying for a Michigan title. It captures the vehicle's information and the owner's details, serving as the official request for title issuance.

- Statement of Vehicle Sale: This document provides verification of the sale between the seller and the purchaser. It includes crucial details such as the sale date, purchase price, and vehicle particulars.

- Bill of Sale: The bill of sale is a legal document that outlines the sale terms. It acts as proof of the transaction and validates the change of ownership for the vehicle.

- Odometer Disclosure Statement: Required by federal law, this statement discloses the vehicle's mileage at the time of sale. It ensures transparency regarding the vehicle's usage history.

- Insurance Verification Form: This document confirms that the vehicle is insured at the time of registration. Proof of insurance is mandatory for obtaining a Michigan title.

- Power of Attorney (if applicable): If someone is acting on behalf of the owner to complete the paperwork, a power of attorney form is necessary. It grants legal authorization for the representative to perform specific tasks related to the title transfer.

- Sales Tax Payment Form: This form is used to document the payment of sales tax on the vehicle purchase. It ensures that the correct amount of tax is collected and recorded.

- Vehicle History Report: This report provides a comprehensive view of the vehicle's background, including previous ownership, accidents, and any title issues. It aids in assessing the vehicle's condition before purchase.

These additional forms and documents work together with the Michigan Category Weight form to facilitate a successful and legally compliant vehicle title and registration process. Ensuring you have all necessary paperwork will help streamline the transaction and reduce potential delays.

Similar forms

- Vehicle Registration Application: This document is used to register a vehicle with the state, detailing important information such as ownership and vehicle specifications. Similar to the Michigan Category Weight form, it collects data necessary for titling and registration.

- Title Application: A title application is submitted by individuals seeking to establish ownership of a vehicle. It contains similar sections regarding vehicle details and ownership information, akin to the Michigan form.

- Bill of Sale: A bill of sale is often required during a vehicle transaction and formally documents the sale. Like the Michigan Category Weight form, it includes relevant information about the vehicle and the parties involved in the transaction.

- Odometer Disclosure Statement: This statement is mandated to document the vehicle’s mileage at the point of sale. It overlaps with the Michigan form by ensuring accurate mileage reporting during ownership transfer.

- Sales Tax Certificate: A sales tax certificate may be required to confirm that applicable taxes have been collected during a vehicle transaction. Much like the Michigan form, it plays a crucial role in financial documentation related to vehicle purchases.

- Affidavit of Ownership: When ownership issues arise, an affidavit can be submitted to assert ownership of a vehicle. This document parallels the Michigan Category Weight form in its aim to verify vehicle ownership details.

Dos and Don'ts

Filling out the Michigan Category Weight form can be straightforward as long as you keep some important tips in mind. Here’s a list of things you should and shouldn’t do to ensure everything goes smoothly.

- Do provide accurate information for each field, especially the Vehicle Identification Number (VIN).

- Do double-check the purchase date and delivery date for accuracy.

- Do read all instructions carefully before filling out the form.

- Do ensure all signatures are obtained before submission to avoid delays.

- Do keep a copy of the completed form for your records.

- Don't leave any mandatory fields blank; it might cause processing issues.

- Don't sign a blank form; always verify that all sections are completed.

- Don't use correction fluid or erase any mistakes; rather, draw a line through an error and write the correct information.

- Don't forget to include the optional electronic filing fee if you choose to use it.

- Don't ignore the list of required documents needed for submission.

By following these guidelines, you can help ensure that your form is processed without any unnecessary delays. Taking your time and being thorough makes a difference.

Misconceptions

Understanding the Michigan Category Weight form can be confusing, and there are several misconceptions associated with it. Below is a list that addresses ten common misunderstandings.

- This form is only for new vehicles. The Michigan Category Weight form applies to both new and used vehicles. It is required for the registration and titling process of any motor vehicle.

- Only dealerships can fill out this form. While dealerships often deal with this form, private sellers can also complete and submit it when selling a vehicle.

- The form is not necessary for a vehicle title transfer. A properly filled form is essential for transferring a vehicle title in Michigan. Without it, the transfer may be delayed or rejected.

- Every field must be completed for the form to be valid. Some fields are optional. However, to avoid complications, it is advisable to fill out all applicable sections.

- The purchase date does not matter. The purchase date is critical as it impacts the legal ownership of the vehicle and any associated fees or taxes.

- Submitting the form is the same as registering the vehicle. Submission of the form initiates the process, but registration is complete only after processing by the Michigan Department of State.

- The electronic filing fee is mandatory. The $24 optional electronic filing fee can be avoided if preferred, but it may expedite the process.

- There is no penalty for late submission of forms. There is a 15-day window for submitting the form. After that, a late fee may apply.

- Only one owner’s signature is required. The signatures of all owners or lessors are necessary on the form. This ensures that all parties agree to the transaction.

- All tax credits and fees are automatically calculated. While the form includes space for calculating fees, individuals must ensure that they are correctly entered. Double-checking these numbers is advisable to avoid surprises.

It is important to have a clear understanding of the requirements and details included in the Michigan Category Weight form to facilitate a smooth vehicle purchase or transfer experience.

Key takeaways

The Michigan Category Weight form is crucial for properly registering a vehicle in the state. Following the guidelines provided in this form will help ensure compliance with state regulations.

- Complete Information: Fill out all sections accurately. Missing or incorrect information can lead to delays in processing.

- Purchaser’s Responsibility: The purchaser or lessee must ensure their driver’s license is valid and that all signatures are obtained before submission.

- Timeliness Matters: The dealership is required to apply for title and registration within 15 days of the vehicle's delivery date. It's essential to adhere to this timeline to avoid penalties.

- Sales Tax Calculations: Understand how to calculate taxable amounts. This includes the purchase price and any additional charges, minus any applicable trade-in credits.

- Lien Disclosure: Accurately disclose any lien information. This ensures that all secured interests are properly recorded.

- Document Retention: Retain copies of all signed documents. Both parties should have access to these records in case of discrepancies.

- Urgent Follow-Up: If the vehicle title is not received within 30 days, contact the Department of State Info Center immediately for assistance.

Taking these steps seriously will facilitate a smoother transaction process and help avoid unnecessary complications. Ensuring accuracy now will save time and effort later.

Browse Other Templates

Bmw Application - The form ensures every applicant reviews and certifies the accuracy of the information provided.

Dl-90b - The instructor certifies the completion of 14 hours of observation and in-car instruction.