Fill Out Your Michigan No Fault Insurance Form

The Michigan No Fault Insurance form serves a critical role in vehicle insurance regulation within the state. This certificate verifies that a motor vehicle is insured in accordance with Michigan's No-Fault Insurance Act, specifically Act 294, P.A. 1972. The form is available in both a vehicle copy and a Secretary of State’s copy, each detailing essential information such as the policy number, effective and expiration dates, vehicle make and model, and identification number. It is imperative for vehicle owners to keep this certificate in their vehicles at all times, as failing to provide it upon request by law enforcement can lead to a civil infraction. Compliance with Michigan law requires that vehicle owners maintain sufficient insurance or approved security, ensuring coverage for no-fault benefits. Violations of this regulation can result in misdemeanor charges and significant penalties, including fines and possible imprisonment. Moreover, the form must accompany applications for vehicle registration, reinforcing its importance in lawful vehicle operation. Specific warnings highlight the consequences when individuals excluded from coverage drive the vehicle, effectively voiding all liability coverage and placing accountability squarely on the vehicle owner. Thus, understanding the components and responsibilities outlined in the Michigan No Fault Insurance form is essential for both vehicle owners and insurers in the state.

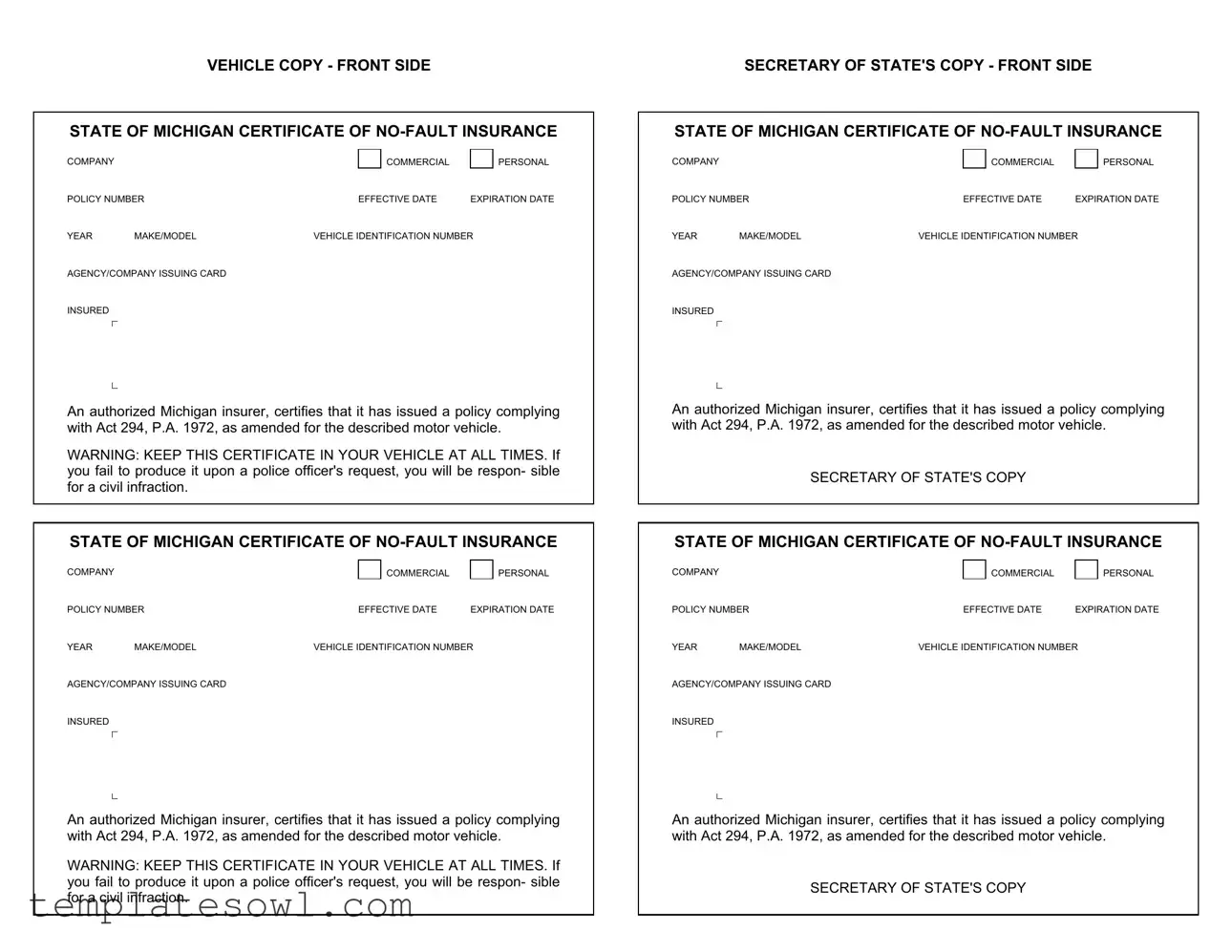

Michigan No Fault Insurance Example

VEHICLE COPY - FRONT SIDE

STATE OF MICHIGAN CERTIFICATE OF

COMPANY |

|

|

|

COMMERCIAL |

|

PERSONAL |

POLICY NUMBER |

|

EFFECTIVE DATE |

EXPIRATION DATE |

|||

YEAR |

MAKE/MODEL |

VEHICLE IDENTIFICATION NUMBER |

||||

AGENCY/COMPANY ISSUING CARD

INSURED

An authorized Michigan insurer, certifies that it has issued a policy complying with Act 294, P.A. 1972, as amended for the described motor vehicle.

WARNING: KEEP THIS CERTIFICATE IN YOUR VEHICLE AT ALL TIMES. If you fail to produce it upon a police officer's request, you will be respon- sible for a civil infraction.

STATE OF MICHIGAN CERTIFICATE OF

COMPANY |

|

|

|

COMMERCIAL |

|

PERSONAL |

POLICY NUMBER |

|

EFFECTIVE DATE |

EXPIRATION DATE |

|||

YEAR |

MAKE/MODEL |

VEHICLE IDENTIFICATION NUMBER |

||||

AGENCY/COMPANY ISSUING CARD

INSURED

An authorized Michigan insurer, certifies that it has issued a policy complying with Act 294, P.A. 1972, as amended for the described motor vehicle.

WARNING: KEEP THIS CERTIFICATE IN YOUR VEHICLE AT ALL TIMES. If you fail to produce it upon a police officer's request, you will be respon- sible for a civil infraction.

SECRETARY OF STATE'S COPY - FRONT SIDE

STATE OF MICHIGAN CERTIFICATE OF

COMPANY |

|

|

|

COMMERCIAL |

|

PERSONAL |

POLICY NUMBER |

|

EFFECTIVE DATE |

EXPIRATION DATE |

|||

YEAR |

MAKE/MODEL |

VEHICLE IDENTIFICATION NUMBER |

||||

AGENCY/COMPANY ISSUING CARD

INSURED

An authorized Michigan insurer, certifies that it has issued a policy complying with Act 294, P.A. 1972, as amended for the described motor vehicle.

SECRETARY OF STATE'S COPY

STATE OF MICHIGAN CERTIFICATE OF

COMPANY |

|

|

|

COMMERCIAL |

|

PERSONAL |

POLICY NUMBER |

|

EFFECTIVE DATE |

EXPIRATION DATE |

|||

YEAR |

MAKE/MODEL |

VEHICLE IDENTIFICATION NUMBER |

||||

AGENCY/COMPANY ISSUING CARD

INSURED

An authorized Michigan insurer, certifies that it has issued a policy complying with Act 294, P.A. 1972, as amended for the described motor vehicle.

SECRETARY OF STATE'S COPY

SECRETARY OF STATE'S COPY - REVERSE SIDE |

VEHICLE COPY - REVERSE SIDE |

Michigan Law (MCLA 500.3101) requires that the owner or registrant of a motor vehicle regis- tered in this state must have insurance or other approved security for the payment of

An owner or registrant convicted of such a misdemeanor shall be fined not less than $200.00 nor more than $500.00, or imprisoned for not more than 1 year, or both.

THIS FORM MUST BE PRESENTED AS EVIDENCE OF INSURANCE WITH YOUR APPLICA- TION FOR LICENSE PLATES, EITHER BY MAIL OR AT ANY SECRETARY OF STATE LICENSE PLATE BRANCH OFFICE. A PERSON WHO ISSUES OR WHO SUPPLIES FALSE INFORMA- TION TO THE SECRETARY OF STATE OR USES AN INVALID CERTIFICATE OF INSURANCE IS GUILTY OF A MISDEMEANOR PUNISHABLE BY IMPRISONMENT FOR NOT MORE THAN 1 YEAR, OR A FINE OF NOT MORE THAN $1,000.00, OR BOTH.

If this vehicle is driven by the person(s) named below, residual liability insurance does not apply and the vehicle will be considered uninsured:

WARNING - when a named excluded person operates a vehicle, all liability coverage is void - no one is insured. Owners of the vehicle and others legally responsible for the acts of the named excluded person remain fully responsible.

ACORD 50 MI (2007/12) |

© 1993, 2007 ACORD CORPORATION. All rights reserved. |

Michigan Law (MCLA 500.3101) requires that the owner or registrant of a motor vehicle regis- tered in this state must have insurance or other approved security for the payment of

An owner or registrant convicted of such a misdemeanor shall be fined not less than $200.00 nor more than $500.00, or imprisoned for not more than 1 year, or both.

THIS FORM MUST BE PRESENTED AS EVIDENCE OF INSURANCE WITH YOUR APPLICA- TION FOR LICENSE PLATES, EITHER BY MAIL OR AT ANY SECRETARY OF STATE LICENSE PLATE BRANCH OFFICE. A PERSON WHO ISSUES OR WHO SUPPLIES FALSE INFORMA- TION TO THE SECRETARY OF STATE OR USES AN INVALID CERTIFICATE OF INSURANCE IS GUILTY OF A MISDEMEANOR PUNISHABLE BY IMPRISONMENT FOR NOT MORE THAN 1 YEAR, OR A FINE OF NOT MORE THAN $1,000.00, OR BOTH.

If this vehicle is driven by the person(s) named below, residual liability insurance does not apply and the vehicle will be considered uninsured:

WARNING - when a named excluded person operates a vehicle, all liability coverage is void - no one is insured. Owners of the vehicle and others legally responsible for the acts of the named excluded person remain fully responsible.

ACORD 50 MI (2007/12) |

© 1993, 2007 ACORD CORPORATION. All rights reserved. |

Michigan Law (MCLA 500.3101) requires that the owner or registrant of a motor vehicle regis- tered in this state must have insurance or other approved security for the payment of

An owner or registrant convicted of such a misdemeanor shall be fined not less than $200.00 nor more than $500.00, or imprisoned for not more than 1 year, or both.

A PERSON WHO SUPPLIES FALSE INFORMATION TO THE SECRETARY OF STATE OR WHO ISSUES OR USES AN INVALID CERTIFICATE OF INSURANCE IS GUILTY OF A MISDEMEAN- OR PUNISHABLE BY IMPRISONMENT FOR NOT MORE THAN 1 YEAR, OR A FINE OF NOT MORE THAN $1,000.00, OR BOTH.

If this vehicle is driven by the person(s) named below, residual liability insurance does not apply and the vehicle will be considered uninsured:

WARNING - when a named excluded person operates a vehicle, all liability coverage is void - no one is insured. Owners of the vehicle and others legally responsible for the acts of the named excluded person remain fully responsible.

ACORD 50 MI (2007/12) |

© 1993, 2007 ACORD CORPORATION. All rights reserved. |

Michigan Law (MCLA 500.3101) requires that the owner or registrant of a motor vehicle regis- tered in this state must have insurance or other approved security for the payment of

An owner or registrant convicted of such a misdemeanor shall be fined not less than $200.00 nor more than $500.00, or imprisoned for not more than 1 year, or both.

A PERSON WHO SUPPLIES FALSE INFORMATION TO THE SECRETARY OF STATE OR WHO ISSUES OR USES AN INVALID CERTIFICATE OF INSURANCE IS GUILTY OF A MISDEMEAN- OR PUNISHABLE BY IMPRISONMENT FOR NOT MORE THAN 1 YEAR, OR A FINE OF NOT MORE THAN $1,000.00, OR BOTH.

If this vehicle is driven by the person(s) named below, residual liability insurance does not apply and the vehicle will be considered uninsured:

WARNING - when a named excluded person operates a vehicle, all liability coverage is void - no one is insured. Owners of the vehicle and others legally responsible for the acts of the named excluded person remain fully responsible.

ACORD 50 MI (2007/12) |

© 1993, 2007 ACORD CORPORATION. All rights reserved. |

Form Characteristics

| Fact Name | Detail |

|---|---|

| Purpose of the Form | This certificate serves as proof of no-fault insurance coverage for a motor vehicle registered in Michigan. |

| Governing Law | The requirement for no-fault insurance in Michigan is governed by Act 294, P.A. 1972, as amended, specifically stated in MCLA 500.3101. |

| Legal Requirements | Motor vehicle owners must maintain insurance or other approved security to cover no-fault benefits at all times. |

| Civil Penalties | Failure to produce this certificate upon request can lead to a civil infraction. |

| Misdemeanor Penalties | Driving without proper insurance could result in fines ranging from $200 to $500 or imprisonment for up to one year. |

| False Information Consequences | Providing false information or using an invalid certificate can lead to penalties including imprisonment for up to one year and a fine of up to $1,000. |

Guidelines on Utilizing Michigan No Fault Insurance

Preparing to fill out the Michigan No Fault Insurance form is an important step in ensuring compliance with state insurance laws for vehicle ownership. After completing this form, you will present it as evidence of insurance in conjunction with your application for license plates. Here are the steps to successfully fill out the form.

- Locate the form. Make sure you have the correct version of the Michigan No Fault Insurance form.

- Fill in the Policy Number. Enter your insurance policy number clearly in the designated space.

- Provide the Effective Date. Input the date when your insurance coverage begins.

- Include the Expiration Date. Write the date your insurance coverage will end.

- Indicate the Year of the vehicle. Fill in the year of the vehicle you are insuring.

- Fill out the Make/Model. Clearly state the manufacturer and model of the vehicle.

- Enter the Vehicle Identification Number (VIN). The VIN is a unique alphanumeric code assigned to the vehicle, and it is typically found on the dashboard or inside the driver's side door.

- Provide information about the Agency/Company Issuing the Card. Write the name of the insurance agency or company that is providing your coverage.

- Identify the Insured. Enter the name of the person who is insured on the policy.

- After completing all fields, review your entries for accuracy. Ensure that all information is clear and legible.

Make sure to keep the completed form in your vehicle at all times, as it is necessary if a police officer requests proof of insurance. This is crucial to avoid any civil infractions related to insurance verification.

What You Should Know About This Form

What is the Michigan No Fault Insurance form?

The Michigan No Fault Insurance form is a document that certifies a vehicle owner's compliance with the state's no-fault insurance law. This form is issued by authorized insurers and must include essential information such as the policy number, effective date, expiration date, vehicle make and model, and the insurer's details. It serves as proof that a motor vehicle is insured under the no-fault insurance system, which is mandated by Michigan law.

Why is it important to keep the No Fault Insurance form in my vehicle?

This certificate must be kept in your vehicle at all times. If requested by a police officer, failure to present it can result in a civil infraction. This means you might have to pay a fine and could face other repercussions. Keeping the form handy ensures that you can demonstrate compliance with Michigan's insurance requirements during any traffic stop or accident investigation.

What happens if I do not have the No Fault Insurance form in my vehicle?

If you fail to produce the No Fault Insurance form when requested by law enforcement, you will be liable for a civil infraction. This could lead to fines and complications regarding your vehicle's insurance status. It’s crucial to avoid this by ensuring the form is always accessible in your vehicle.

What information is included on the No Fault Insurance form?

The form contains several key pieces of information, including the vehicle's identification number (VIN), the year, make, and model of the vehicle, the policy number, and the coverage effective and expiration dates. Additionally, it indicates the name of the issuing insurance agency, ensuring that all the necessary details are readily available and verifiable.

Can I use my No Fault Insurance form for other vehicles?

No, the No Fault Insurance form is specific to the vehicle it describes. Each form is tied to a particular policy and vehicle identification number. If you own multiple vehicles, you will need separate forms for each one to adhere to Michigan's no-fault insurance laws.

What penalties exist for driving without proper insurance in Michigan?

Driving without the required no-fault insurance is considered a misdemeanor in Michigan. Penalties can include a fine ranging from $200 to $500, and even potential imprisonment for up to one year. The law is strict, emphasizing the importance of maintaining valid insurance at all times.

What should I do if I lose my No Fault Insurance form?

If you misplace your No Fault Insurance form, it’s crucial to contact your insurance provider immediately. They can provide you with a replacement certificate. Ensure you have the new form with you in your vehicle as soon as possible to avoid potential legal issues.

Is it possible to face legal trouble for providing false information on the No Fault Insurance form?

Yes, providing false information on the No Fault Insurance form is a serious offense. It can lead to being charged with a misdemeanor, punishable by imprisonment of up to one year or a fine of up to $1,000. It is essential to provide accurate information when obtaining this form to avoid these legal consequences.

Common mistakes

Filling out the Michigan No Fault Insurance form can be an essential task for vehicle owners, but it often comes with a set of common mistakes that can lead to legal complications. One of the most frequently encountered issues is the omission of necessary information. Many people forget to include critical details such as the vehicle identification number (VIN) or the policy number. This information is vital for establishing a valid insurance policy. Without these specifics, the form may be deemed incomplete, potentially leading to delays in processing or even fines.

Another common error lies in not keeping the certificate in the vehicle as required by law. The warning prominently featured on the form states that keeping the certificate within the vehicle is mandatory. Failure to do so can result in being held responsible for a civil infraction, which could carry penalties. Forgetting to actually carry the certificate can happen easily, especially in a hectic lifestyle, yet the consequences can be significant.

Moreover, individuals often mistakenly neglect to update their insurance information. The expiration date of the policy is a crucial detail. If this date lapses and the form is completed with outdated information, the vehicle may be considered uninsured. Updating this information promptly upon renewal is critical to maintaining compliance with Michigan's no-fault insurance requirements.

Error also occurs when individuals provide incorrect information about themselves or the vehicle. Incorrectly entering the make or model of the vehicle, for instance, can lead to potential conflicts in coverage. If the information supplied does not match the insurance company’s records, the policy might be considered invalid. It is important to double-check all details before submitting the form to ensure accuracy.

Another mistake people make involves misunderstanding the consequences of naming excluded drivers. When an excluded driver operates a vehicle, the liability coverage can become void, leaving the vehicle uninsured. Some individuals may overlook this significant warning and, in doing so, might unknowingly expose themselves to greater financial liability in the event of an accident.

Failing to seek clarification from the insurance provider can also be problematic. Navigating insurance forms and legal requirements can be complex. Individuals often do not take the time to consult with their insurance agent prior to filling out the form. This can lead to misunderstandings about what coverage is necessary or the implications of certain policy features.

Lastly, submitting the form without ensuring it meets all legal requirements can result in disqualification of the application for license plates. The Michigan law mandates that this form be presented as evidence of insurance when applying for registration. Without proper adherence to this requirement, individuals may face additional legal consequences, which can be both frustrating and costly. Understanding these common pitfalls can help individuals navigate the Michigan No Fault Insurance process more effectively, ensuring compliance and peace of mind.

Documents used along the form

Michigan's No Fault Insurance forms are just part of the paperwork involved in ensuring compliance with auto insurance laws in the state. Along with the primary form, several other documents typically accompany it. Each serves a specific purpose, so understanding their roles can simplify the process of securing and maintaining the required insurance. Here is a list of related documents you may encounter:

- Vehicle Registration Application: This form is necessary when registering a vehicle in Michigan. It collects information about the vehicle and its owner, ensuring that the car meets state requirements.

- Certificate of Insurance: This document, often provided as proof of coverage, outlines the details of the insurance policy, including the insured parties, coverage amounts, and effective dates.

- Policy Declarations Page: Part of the insurance policy, this page summarizes the coverage, limits, and deductibles of the policyholder's auto insurance. It is helpful for quick reference.

- Proof of Payment: This document serves as confirmation that the insurance premium has been paid. It is often required to validate the insurance policy.

- Liability Waiver Form: In some cases, this form is needed if the vehicle owner wants to waive certain liability damages. This document specifies the boundaries of that waiver.

- Accident Report Form: If an accident occurs, this form helps document the details. It may be submitted to both the insurance company and local authorities.

- Named Excluded Driver Form: This form indicates individuals who are excluded from coverage under the policy. Driving the vehicle while excluded can void any insurance coverage.

Understanding these forms can greatly enhance the experience of managing auto insurance in Michigan. Each document plays a crucial role in ensuring compliance with state regulations and protecting drivers on the road. Keeping them organized and easily accessible can save time and prevent headaches later on.

Similar forms

The Michigan No Fault Insurance form is important for vehicle owners in Michigan. It serves various purposes, much like several other documents that relate to insurance and vehicle registration. Here are eight documents that are similar to the Michigan No Fault Insurance form:

- Certificate of Liability Insurance - This document shows proof of liability coverage, essential for all vehicle owners. It helps confirm that the driver meets the state's minimum insurance requirements.

- Registration Certificate - This certifies that a vehicle is registered with the state's motor vehicle department. It provides important details about the vehicle, such as make, model, and ownership information.

- Verification of Insurance Form - Often used in cases when a police officer requests proof of insurance coverage, this form is similar in purpose and function to the No Fault Insurance form.

- State ID Card - While primarily used for identification, a state ID card can also verify that the cardholder is a responsible driver. It sometimes requires proof of insurance to be issued.

- ACORD Form - An ACORD form is a standard format used in the insurance industry to provide evidence of insurance. It can include details similar to those found on the No Fault Insurance form.

- Motor Vehicle Title - A title acts as proof of ownership and can also indicate whether a vehicle is insured. Insured vehicles are typically more valuable and have fewer issues when selling or trading in.

- Proof of Financial Responsibility Statement - Required by some states, this statement confirms that a driver has the financial means to cover potential damages in the event of an accident.

- SR-22 Form - This form is filed by insurance companies with the state to prove a driver maintains the required liability coverage after certain violations. It is akin to the assurance provided by the No Fault Insurance form.

Each of these documents plays a role in ensuring that drivers remain compliant with state laws and that they have necessary coverage in case of an incident on the road.

Dos and Don'ts

When filling out the Michigan No Fault Insurance form, it’s crucial to do so accurately to avoid complications. Here are 8 important tips:

- Do: Ensure that all information is complete and correct.

- Do: Use the correct policy number provided by your insurer.

- Do: Keep a copy of the completed form in your vehicle at all times.

- Do: Review the dates of your insurance policy, including the effective and expiration dates.

- Don't: Provide false or misleading information. This is a serious offense.

- Don't: Forget to sign and date the form before submission.

- Don't: Leave any fields blank; incomplete forms may be rejected.

- Don't: Assume your insurance covers all situations without checking the details.

Misconceptions

-

Everyone automatically has coverage. Many people believe that purchasing a no-fault insurance policy guarantees comprehensive coverage. However, no-fault insurance only covers specific benefits, such as medical expenses and lost wages, for the policyholder and their passengers. It does not cover property damage claims against other drivers.

-

I don’t need no-fault insurance if I don’t drive often. This is inaccurate. Michigan law mandates that all registered vehicles must have no-fault insurance, regardless of how often they are driven. Owning a vehicle requires maintaining proper insurance coverage at all times.

-

It protects against all liability claims. Some believe that no-fault insurance covers all liability claims after an accident. Instead, it only protects you from personal injury claims. For damages to another vehicle or property, drivers should carry additional liability insurance.

-

All no-fault policies are the same. There is a misconception that all no-fault insurance policies offer identical benefits and coverage limits. In reality, the specifics of coverage can vary widely between insurance providers and the policies they offer, making it vital to review details before purchasing.

-

I can ignore the insurance certificate requirement. Some drivers think they can bypass the regulations regarding the insurance certificate. However, failing to keep the certificate in your vehicle can lead to a civil infraction if you cannot provide it to law enforcement when requested.

-

Exclusions do not affect my coverage. It is a common misunderstanding that excluded persons do not impact liability coverage. When a named excluded driver operates the vehicle, all liability coverage becomes void, exposing the vehicle owner to potential financial responsibility for any incidents that occur.

-

Filing a claim is the same as personal injury cases. Many believe that filing a claim under no-fault insurance operates in the same manner as traditional personal injury claims. However, no-fault claims are generally processed differently, focusing on the benefits outlined in the policy rather than proving negligence.

Key takeaways

- The Michigan No Fault Insurance form is essential for proving insurance coverage.

- Always keep a copy of the certificate in your vehicle; having it readily available is vital.

- If you cannot produce the form when requested by law enforcement, it could result in a civil infraction.

- Ensure that the form is filled out completely, including the policy number and effective dates.

- This certificate is necessary for applying for license plates, either by mail or at any Secretary of State office.

- Driving without proper insurance can lead to serious legal consequences, including fines and potential imprisonment.

- Providing false information or using an invalid certificate is considered a misdemeanor.

- Be aware that if a named excluded driver operates the vehicle, it will be seen as uninsured.

- Failure to comply with insurance requirements may leave you liable for damages in the event of an accident.

- Understanding the requirements of the Michigan No Fault Insurance Act is crucial for compliance.

Browse Other Templates

How to Create a Fax Cover Sheet - Building a framework for effective communication through faxes.

University of Richmond Transfer - Transfers cannot be requested under the No Child Left Behind Act using this form.

Veronica Montelongo John Morales Wedding - The mention of a notable past event enhances the legacy of the Montelongo name in public discourse.