Fill Out Your Michigan Tr 205 Form

The Michigan TR-205 form serves as a critical tool for those seeking to certify ownership of vehicles or watercraft in situations where conventional title documentation is unavailable. It is particularly applicable for vehicles that have been lost, stolen, or destroyed, and when the purchaser cannot establish contact with the prior owner for a duplicate title. The form requires applicants to affirm their rightful ownership and includes essential details such as the vehicle identification number (VIN), make, model, and year of manufacture. Additionally, individuals must check the appropriate box to identify the type of vehicle or watercraft. The form stipulates conditions for eligibility, including the age and value of the vehicle, which cannot exceed $2,500 with specific exceptions based on the type of vehicle involved. Notably, vehicle appraisals are mandatory for vehicle claims, while watercraft and non-titled vehicles do not require them. Furthermore, it incorporates a 6% use tax based on the purchase price or appraisal value. Finally, completed forms must be submitted to a Secretary of State office for verification against national databases, ensuring no outstanding claims or titles exist. This comprehensive process underscores the importance of the TR-205 form in helping resolve title issues while adhering to state regulations.

Michigan Tr 205 Example

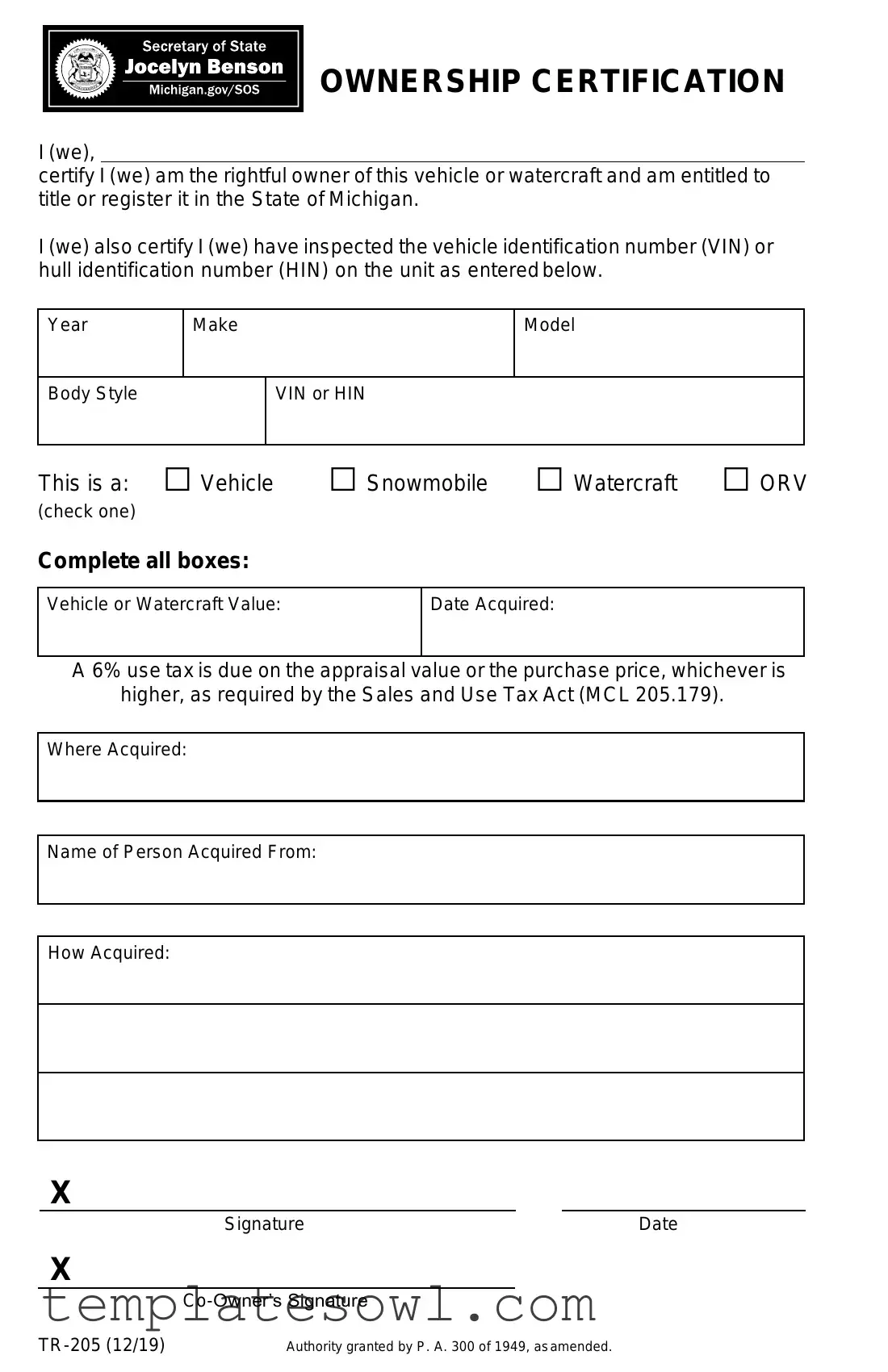

OWNERSHIP CERTIFICATION

I (we),

certify I (we) am the rightful owner of this vehicle or watercraft and am entitled to title or register it in the State of Michigan.

I (we) also certify I (we) have inspected the vehicle identification number (VIN) or hull identification number (HIN) on the unit as entered below.

Year

Make

Model

Body Style

VIN or HIN

This is a: □ Vehicle |

□ Snowmobile □ Watercraft □ ORV |

(check one) |

|

Complete all boxes: |

|

Vehicle or Watercraft Value:

Date Acquired:

A6% use tax is due on the appraisal value or the purchase price, whichever is higher, as required by the Sales and Use Tax Act (MCL 205.179).

Where Acquired:

Name of Person Acquired From:

How Acquired:

X

SignatureDate

X

|

|

Authority granted by P. A. 300 of 1949, as amended. |

Ownership Certification Instructions

Use of this form is limited as a last resort when a:

(a)Vehicle title, watercraft title or ORV title has been lost, destroyed, or stolen and the purchaser is unable to contact the previous owner for a duplicate title, or

(b)Snowmobile,

1.Eligibility for using this procedure:

●The vehicle must be 10 or more years old (6 or more years old for ORVs).

●The value of the vehicle can’t exceed $2,500 ($1,500 for ORVs).

●Can’t be used with mobile homes.

●Can’t be used for vehicles acquired out of state. The

●Can’t be used unless the applicant has exhausted all possibilities of contacting the titled or registered owner on record.

If the vehicle doesn’t meet the above criteria and you can’t obtain an assigned ownership document from the previous owner, a surety bond must be purchased.

2.For vehicles, applicants must submit a vehicle appraisal showing the value is $2,500 or less. This appraisal may be:

a)An appraisal completed by a licensed Michigan dealer, or

b)A page printed from an online appraisal service such as Kelly Blue Book, N.A.D.A. Guides, Edmunds etc. (kbb.com, nadaguides.com, edmunds.com)

An appraisal is not required for watercraft, snowmobiles, ORVs, and mopeds.

3.Complete the Ownership Certification (form

4.Submit the Ownership Certification and appraisal (for vehicles) at a Secretary of State office. Office staff will check national databases to ensure the vehicle is not reported stolen or titled in another state.

5.A 6% use tax is due on the appraisal value or the purchase price, whichever is higher, as required by the Sales and Use Tax Act (MCL 205.179).

6.A registration may be purchased as part of your transaction. For vehicles, proof of Michigan

Form Characteristics

| Fact Name | Description |

|---|---|

| Ownership Certification | The TR-205 form requires the owner to certify rightful ownership of the vehicle or watercraft and confirm it's eligible for registration in Michigan. |

| Governing Law | The use of this form is governed by P.A. 300 of 1949, as amended, and the Sales and Use Tax Act (MCL 205.179). |

| Eligibility Criteria | The vehicle must be at least 10 years old (or 6 years old for ORVs) and must not exceed a value of $2,500 ($1,500 for ORVs). |

| Usage Limitations | This form cannot be used for mobile homes or vehicles acquired out of state. |

| Owner Contact Requirement | Applicants must have tried to contact the titled or registered owner on record before using this form. |

| Appraisal Requirement | For vehicles over $2,500, an appraisal is necessary. Online appraisal services or a licensed dealer can provide this. |

| Secretary of State Submission | Applicants must submit the completed TR-205 form and appraisal at a Secretary of State office, where staff will check national databases. |

| Tax Due | A 6% use tax on the appraisal value or the purchase price must be paid upon registration. |

| Insurance Requirement | Proof of Michigan no-fault insurance is required for vehicle registration as part of the transaction. |

Guidelines on Utilizing Michigan Tr 205

Filling out the Michigan Tr 205 form involves providing accurate information about the vehicle or watercraft you own. This process enables you to certify your ownership and proceed with the necessary registration or title application.

- Ensure you meet the eligibility criteria for using the Tr 205 form. The vehicle must be at least 10 years old (6 years for ORVs) and valued at $2,500 or less.

- Gather the required information about your vehicle or watercraft, including the year, make, model, body style, and Vehicle Identification Number (VIN) or Hull Identification Number (HIN).

- Indicate the type of unit by checking one of the following options: Vehicle, Snowmobile, Watercraft, ORV.

- Complete all necessary fields, including the vehicle or watercraft’s value, the date acquired, where you acquired it, the name of the person you acquired it from, and how you acquired it.

- Sign where indicated. If there is a co-owner, they must also sign and date in the appropriate space.

- If applicable, obtain a vehicle appraisal if the unit is a vehicle, demonstrating the value of $2,500 or less. This can be from a licensed Michigan dealer or an online appraisal service.

- Submit the completed Tr 205 form along with the appraisal (if it is a vehicle) at a Secretary of State office.

- Be prepared to pay a 6% use tax on either the appraisal value or the purchase price, whichever amount is higher.

- If registering a vehicle, provide proof of Michigan no-fault insurance at the time of transaction.

What You Should Know About This Form

What is the Michigan TR 205 form and when should it be used?

The Michigan TR 205 form is a document used to certify ownership of a vehicle, watercraft, snowmobile, or off-road vehicle (ORV) when the original title or registration has been lost, destroyed, or stolen. This form is a last resort for individuals who have tried to contact the previous owner for a duplicate title but have been unsuccessful. It can be applied in specific situations outlined by Michigan law, which includes criteria regarding the age and value of the vehicle.

What are the eligibility requirements for using the TR 205 form?

To use the TR 205 form, the vehicle must be at least 10 years old (or 6 years for ORVs) and should not exceed a value of $2,500 (or $1,500 for ORVs). This form cannot be used for mobile homes or for vehicles acquired out of state without a valid out-of-state title. Additionally, the applicant must demonstrate that they have made all reasonable efforts to contact the titled or registered owner before resorting to this form.

Is an appraisal required for all vehicles when using the TR 205 form?

No, an appraisal is only required for vehicles. The appraisal must demonstrate that the vehicle's value is $2,500 or less. This can be an appraisal completed by a licensed Michigan dealer or a printout from a recognized online appraisal service like Kelley Blue Book or NADA Guides. For watercraft, snowmobiles, ORVs, and mopeds, an appraisal is not necessary.

After filling out the TR 205 form, what are the next steps?

Once you have completed the TR 205 form, you must submit it along with the vehicle appraisal (if applicable) at your local Secretary of State office. The office staff will check national databases to ensure that the vehicle you are attempting to certify is not reported stolen and is not titled in another state.

What taxes are associated with the TR 205 form?

A 6% use tax is applicable based on the appraisal value or the purchase price of the vehicle, whichever is higher. This tax must be paid as required by the Sales and Use Tax Act. Make sure to be prepared to cover this cost when you submit your TR 205 form at the Secretary of State office.

Can I register the vehicle at the same time as I submit the TR 205 form?

Yes, you can purchase a registration as part of your transaction when you submit the TR 205 form. However, for vehicles, you must present proof of Michigan no-fault insurance. Ensure that all necessary documents are gathered before your visit to expedite the process.

Common mistakes

When filling out the Michigan TR 205 form, many individuals encounter common hurdles that can lead to delays or complications in the process. One mistake often made is not confirming eligibility for using this form. Applicants should ensure that the vehicle is at least 10 years old or, for ORVs, 6 years old. If this condition is overlooked, it can result in the application being rejected.

Another frequent error involves missing the vehicle value limit. The vehicle's value must not exceed $2,500, while for ORVs, this limit is $1,500. Failing to provide an acceptable appraisal can cause setbacks. If your vehicle's value surpasses these thresholds, it will not qualify for the TR 205 process, necessitating a surety bond instead.

In addition, many submit the form without accurately completing all the required fields. Each section, including vehicle identification numbers (VIN or HIN), must be filled out correctly. An incomplete submission may lead to requests for additional information, unnecessarily prolonging the process.

It's also important to ensure the appropriate box is checked regarding the type of vehicle being registered. Whether it's a vehicle, snowmobile, watercraft, or ORV, marking the correct box is crucial for proper processing. Neglecting this can create confusion and delays.

An often overlooked aspect is the appraisal documentation requirement. Applicants typically must provide proof of the vehicle's value through an appraisal. This appraisal needs to come from a licensed Michigan dealer or an online appraisal service. Submitting an improper or unclear appraisal can lead to a rejection of the form.

People sometimes forget to sign the form. Every applicant must provide their signature, including any co-owners who may be involved. A missing signature will certainly stall progress, requiring the document to be resubmitted once properly signed.

Another issue arises when individuals neglect to prepare for any taxes due. The 6% use tax applies based on the higher of the appraisal value or the purchase price. Not accounting for this tax can lead to unexpected expenses and payment delays.

It’s vital to provide accurate acquisition details. Commonly, many applicants fail to specify where they acquired the vehicle or from whom. Lack of this information can result in additional inquiries from office staff.

Confusion about documentation is also prevalent. If a title cannot be provided because it was lost or destroyed, it's crucial that all prior efforts to contact the titled owner have been made. If this proof isn’t conveyed adequately, applicants may face significant hurdles.

Finally, remember that the TR 205 form should not be used if the vehicle's title was issued in another state. If that requirement is ignored, it may lead to complications that can derail the registration process altogether. Arm yourself with this knowledge as you prepare to fill out the TR 205 form.

Documents used along the form

The Michigan Tr 205 form, also known as the Ownership Certification, is utilized in specific situations when a vehicle or watercraft title is lost or cannot be obtained. Several additional forms and documents are often needed to complete the process of titling or registering a vehicle in Michigan. Below is a list of these forms, along with brief descriptions of their purpose.

- Vehicle Appraisal: This document provides an assessment of the vehicle's value, which is necessary if the vehicle is valued over a specific threshold. It can come from a licensed Michigan dealer or an online appraisal service.

- Bill of Sale: This document serves as proof of purchase and outlines the details of the transaction between the buyer and the seller, including price and vehicle information.

- Surety Bond: If the requirements for using the TR-205 form are not met, a surety bond may be necessary. This bond acts as insurance that protects against any potential claims on the vehicle's ownership.

- Application for Title (Form TR-11L): This application is used to formally request a title for a vehicle. It includes information about the vehicle and its new owner.

- Affidavit of Ownership: This document may be required to confirm the individual's ownership of the vehicle or watercraft. It can provide additional proof beyond the TR-205 form.

- Proof of Insurance: When registering a vehicle, applicants need to show proof of Michigan no-fault insurance to comply with state regulations.

- Identification Documents: A valid photo ID, such as a driver's license, is usually required to verify the identity of the applicant at the time of processing.

- Transfer Documents: If the vehicle was previously titled in another name, transfer documents might be needed to establish the chain of ownership clearly.

These additional forms and documents are essential for successfully completing the registration and titling process of a vehicle or watercraft in Michigan, especially in circumstances where the original title cannot be located.

Similar forms

The Michigan Tr 205 form serves a specific purpose in certifying ownership for vehicles, watercraft, and off-road vehicles in situations where traditional titles are unavailable. Several other documents share similarities in function, usage, or legal context. Below is a list of ten documents that have comparable attributes to the Michigan Tr 205 form:

- Form TR-200: This is an application for a new title when the original title has been lost. Like the Tr 205, it is used when the proper ownership documentation cannot be provided, but it is focused on titled vehicles.

- Form TR-180: This application is used for vehicle title transfers. Similar to the Tr 205, it may come into play when there is no physical title available due to various circumstances, such as the previous owner being unreachable.

- Bill of Sale: This document serves as proof of purchase and ownership transfer. Though not a government form, its purpose is aligned with the Tr 205 in establishing ownership, especially when official titles are lacking.

- Form TR-11: This form allows for the registration of a vehicle or watercraft, especially when there is no title. It shares the same intent as the Tr 205 regarding usage in specific circumstances where previous documentation cannot be acquired.

- Form TR-14: Often required for registering a snowmobile or watercraft without a title, this document is similar because it helps confirm ownership in absence of a traditional title.

- Surety Bond: If the vehicle does not meet the specific criteria to use the Tr 205, obtaining a surety bond can serve a function similar to that of the Tr 205, ensuring that there is a legal backing for ownership claims.

- Vehicle Registration Application: This application is essential for officially recording the ownership of a vehicle. It parallels the Tr 205 in that it provides a legal framework for ownership validation.

- Form TR-202: This form is used when a vehicle has been abandoned and a person wants to claim ownership. It relates closely to the Tr 205 by serving as a means to establish rightful ownership under unusual circumstances.

- Form TR-243: This document is for the transfer of a vehicle from a deceased owner's estate. It is similar to the Tr 205, as both forms help facilitate ownership claims when standard procedures may not apply.

- Form 690: Also known as the "Affidavit of Ownership," this form is used when individuals trust the seller's claim of ownership but lack conventional documentation. Thus, it serves a parallel role to the Tr 205 in verifying ownership legitimacy.

Each of these documents provides a means to address ownership verification and registration challenges, particularly when traditional titles are not available. This allows owners to navigate legal requirements and facilitate the proper documentation of their vehicles or watercraft effectively.

Dos and Don'ts

Filling out the Michigan TR-205 form can be a straightforward process if you know what to do and what to avoid. Here are some essential do's and don'ts to keep in mind:

- Do ensure that the vehicle meets eligibility requirements, such as being at least 10 years old (6 years for ORVs).

- Do provide a complete vehicle appraisal if the vehicle is valued over $2,500.

- Do check all boxes thoroughly on the form, including the type of vehicle.

- Do submit the completed form and appraisal at a Secretary of State office.

- Don't use this form if the vehicle's title was acquired out of state; a valid out-of-state title is required.

- Don't forget to include proof of Michigan no-fault insurance if you are registering a vehicle.

Misconceptions

Below is a list of common misconceptions about the Michigan TR 205 form along with explanations to clarify each point.

-

Only new vehicles qualify for the TR 205 form.

This is incorrect. The TR 205 form can be used for vehicles that are 10 or more years old or 6 or more years old for Off-Road Vehicles (ORVs).

-

The TR 205 form can be used for any type of vehicle.

This is misleading. The TR 205 form cannot be used for mobile homes or for vehicles obtained out of state without a title.

-

An appraisal is always required for all vehicles.

This is untrue. An appraisal is only required for vehicles valued at $2,500 or more, while no appraisal is needed for watercraft, snowmobiles, ORVs, and mopeds.

-

You can use the TR 205 form if you simply lost your title.

This is misleading. The TR 205 form is intended for situations where the title is lost, destroyed, or stolen, and the applicant cannot contact the previous owner.

-

It is not necessary to check for a previously titled vehicle.

This is incorrect. Before using the TR 205 form, applicants must ensure they have exhausted all possibilities to contact the titled or registered owner.

-

The use tax is not applicable to the TR 205 form.

This is false. A 6% use tax is required on the appraisal value or the purchase price, whichever is higher.

-

All vehicles, regardless of value, can be registered using the TR 205 form.

This is misleading. The vehicle's value cannot exceed $2,500 ($1,500 for ORVs) to use the TR 205 form.

-

Once the TR 205 form is submitted, registration is automatic.

This is untrue. The Secretary of State will check national databases for any reports of theft or existing titles before registration can be granted.

-

The TR 205 form allows for immediate vehicle ownership transfer.

This is incorrect. A surety bond must be purchased if you cannot obtain an assigned ownership document from the previous owner.

-

You cannot get a registration through the TR 205 process.

This is false. Applicants can purchase registration as part of their transaction, provided they present proof of Michigan no-fault insurance.

Key takeaways

When filling out and using the Michigan TR 205 form, consider these key takeaways:

- Eligibility Criteria: You can only use this form if the vehicle is at least 10 years old or 6 years old for ORVs. The vehicle’s value must not exceed $2,500, and certain types of vehicles are excluded.

- Appraisals Required: For vehicles, you need to submit an appraisal to show the value is $2,500 or less. This can be from a licensed dealer or an online appraisal service.

- Completing the Form: Fill out all sections of the Ownership Certification on the back of the form. Be sure to include details like the vehicle's VIN and your signature.

- Submission Process: Submit the completed TR 205 form and appraisal at a Secretary of State office. Staff will verify the vehicle's status in national databases before proceeding with your transaction.

Browse Other Templates

University of Richmond Transfer - The importance of following all outlined procedures in the form cannot be overstated.

Real Property Transfer Document,Property Transfer Declaration,Deed Transfer Report,Real Estate Transfer Form,Property Sale Statement,Transfer of Ownership Form,Deed Transaction Report,Property Transfer Notice,Ownership Change Certificate,Real Estate - This form serves to preserve transparency in the property transfer process.