Fill Out Your Midland National Form

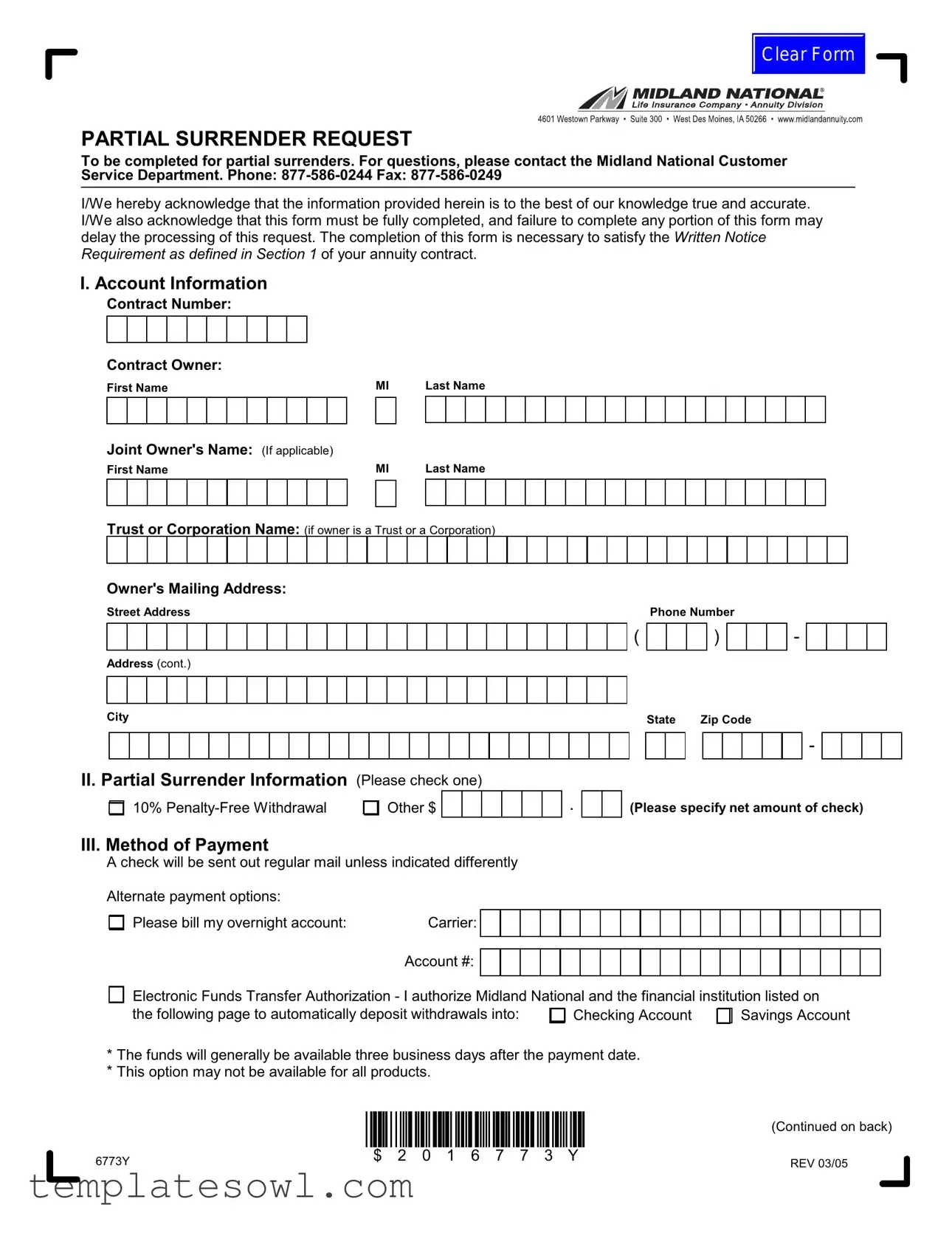

The Midland National form is an important document designed for individuals seeking to request a partial surrender of funds from their annuity contracts. This form requires the contract owner to provide essential account information, such as the contract number and the owner's name, and may also include details about joint ownership or corporate ownership if applicable. Additionally, individuals will select the type of withdrawal they intend to make, whether it be a 10% penalty-free withdrawal or another specified amount. Alongside the request for funds, the form outlines various payment methods, including options for check delivery and electronic funds transfer. This ensures that those withdrawing funds can receive their money in the most convenient manner possible. Furthermore, the form includes provisions for tax withholding, enabling the contract owner to specify whether federal or state taxes should be deducted from their payment. Notably, signatures from the contract owner and potentially a notary are required, especially for larger withdrawal amounts. By carefully completing this form, participants ensure compliance with their annuity contract's written notice requirements and avoid any delays in the processing of their requests.

Midland National Example

Clear Form

PARTIAL SURRENDER REQUEST

To be completed for partial surrenders. For questions, please contact the Midland National Customer Service Department. Phone:

I/We hereby acknowledge that the information provided herein is to the best of our knowledge true and accurate. I/We also acknowledge that this form must be fully completed, and failure to complete any portion of this form may delay the processing of this request. The completion of this form is necessary to satisfy the Written Notice Requirement as defined in Section 1 of your annuity contract.

I. Account Information

Contract Number:

Contract Owner:

First NameMI Last Name

Joint Owner's Name: (If applicable)

First Name |

|

MI |

|

Last Name |

||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Trust or Corporation Name: (if owner is a Trust or a Corporation)

Owner's Mailing Address:

Street Address |

Phone Number |

(

Address (cont.)

)

-

City |

State |

Zip Code |

|

II. Partial Surrender Information (Please check one)

10% |

Other $ |

III. Method of Payment

A check will be sent out regular mail unless indicated differently

.

-

(Please specify net amount of check)

Alternate payment options: |

|

Please bill my overnight account: |

Carrier: |

Account #:

Electronic Funds Transfer Authorization - I authorize Midland National and the financial institution listed on the following page to automatically deposit withdrawals into:

*The funds will generally be available three business days after the payment date.

*This option may not be available for all products.

(Continued on back)

6773Y |

$ |

2 |

0 |

1 |

6 |

7 |

7 |

3 |

Y |

REV 03/05 |

|

|

|

|

|

|

|

|

|

III. Method of Payment (Continued)

Should an inappropriate deposit be made, the financial institution is authorized to make a debit entry to my account and return to Midland National the corrected amount. This authorization will remain in effect until I have cancelled it in writing.

Financial Institution's Name

Street Address

Address (cont.)

City |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

State |

|

Zip Code |

||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

- |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Account Number at Financial Institution |

Routing Number (ABA#) |

|

|

|

|

|

|

|

||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

A voided check is required for verification of all financial institution information.

IV. Election of Withholding

You must indicate if Federal/State income taxes should be withheld from your payment by signing and dating this election form and returning it to Midland National. State taxes will be withheld only if required by your state. Even if you elect not to have Federal/State income taxes withheld, you are liable for Federal/State income taxes on the taxable portion of your benefits. You may also be subject to tax penalties under the Estimated Tax Payment rules if your payments of estimated tax and withholding, if any, are not adequate. If no election is made, 10% Federal

income tax will be withheld.

Check One:

I do not want Federal/State income taxes withheld from my payment.

I do want Federal/State income taxes withheld from my payment. |

Federal |

%State

%

TAXPAYER IDENTIFICATION NUMBER (TIN):

Social Security Number |

|

|

|

|

|

|

|

Employer Identification Number |

|

|||||||||||||||||||

|

|

|

- |

|

|

- |

|

|

|

|

|

|

|

|

|

- |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

JOINT TAXPAYER IDENTIFICATION NUMBER (TIN): |

|

|||||||||||||||||||||||||||

Social Security Number |

|

|

|

|

|

|

|

Employer Identification Number |

|

|||||||||||||||||||

|

|

|

- |

|

|

- |

|

|

|

|

|

|

|

- |

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

6773Y

2 0 2 6 7 7 3 Y

REV 03/05

Form Characteristics

| Fact Name | Description |

|---|---|

| Form Purpose | This form is designed for requesting a partial surrender of funds from an account. |

| Contact Information | If assistance is needed, individuals can contact Midland National Customer Service at 877-586-0244 or send a fax to 877-586-0249. |

| Account Information | To complete the form, users must provide their contract number, owner's details, and mailing address. |

| Withdrawal Options | The form allows for a penalty-free withdrawal of up to 10% or a different specified amount. |

| Payment Method | Checks will be mailed by default, but alternative payment options include electronic funds transfer or overnight delivery. |

| Tax Withholding | Participants must decide if they want federal or state income taxes withheld; otherwise, a default of 10% federal withholding applies. |

Guidelines on Utilizing Midland National

Completing the Midland National form requires accurate information to ensure your request is processed without delay. Follow these steps carefully to fill out the form correctly.

- Start with the Account Information section. Enter the following:

- Contract Number

- Contract Owner's First Name, Middle Initial, and Last Name

- Joint Owner's First Name, Middle Initial, and Last Name (if applicable)

- Trust or Corporation Name (if applicable)

- Owner's Mailing Address: Street Address, City, State, and Zip Code

- Phone Number

- Move to the Partial Surrender Information section. Check one option:

- 10% Penalty-Free Withdrawal

- Other (enter amount)

- Fill out the Method of Payment section. Choose how you want to receive your funds:

- Standard mail (indicate net amount)

- Overnight account (specify carrier and account number)

- Electronic Funds Transfer (fill in financial institution details)

- Include a Notary Signature if the surrender charge exceeds $10,000.

- If applicable, have a Spousal Signature for contracts issued in specific states.

- Obtain necessary signatures:

- Joint Owner Signature/Assignee

- Contract Owner Signature/Assignee

- Complete the Certification section confirming your taxpayer identification information.

- In the Election of Withholding section, indicate whether you want taxes withheld. Provide your TIN information as necessary.

Ensure all sections are completed accurately. Incomplete forms may result in delays. Once filled out, submit the form as directed on the document.

What You Should Know About This Form

What is the purpose of the Midland National form?

The Midland National form is primarily used for requesting a partial surrender from your annuity account. This means you can access a portion of your funds while keeping the rest in your account. It's essential to have this form filled out correctly to ensure a smooth process.

What information do I need to provide on the form?

You will need to provide several details, including your contract number, account owner's name, mailing address, and amount of the partial surrender. If applicable, include joint owner's information or the name of the trust or corporation. Make sure to complete all sections to avoid delays in processing.

How will I receive my funds from a partial surrender?

Typically, a check will be sent out via regular mail unless you specify a different method. Options include requesting an overnight delivery or utilizing an electronic funds transfer. If you choose the latter, ensure that you fill in the necessary information about your financial institution on the form.

Will I face any penalties for taking a partial surrender?

If you are requesting a withdrawal that exceeds the penalty-free limit, you may incur a 10% surrender charge. It’s crucial to check your contract details to understand any penalties that may apply to your specific account situation.

Do I need to consider tax implications when withdrawing funds?

Yes, you should think about taxes when making a withdrawal. By default, 10% federal income tax will be withheld unless you indicate otherwise on the form. You are still responsible for any taxes owed, even if you opt out of withholding, so it’s wise to consult with a tax professional for advice tailored to your circumstances.

Common mistakes

Completing the Midland National form requires careful attention to detail. One common mistake is not filling in all required fields. Omitting information can lead to delays in processing the request.

Another frequent error is failing to provide an accurate contract number. This number is essential for identifying the account and processing the surrender. Ensure it matches the information on your contract.

People often skip the notary signature, especially when surrender charges exceed $10,000. Without this signature, the request may be invalid and could cause unnecessary complications.

Inaccurate taxpayer identification numbers are another issue. Providing the wrong number can have tax implications and may complicate future transactions. Make sure to double-check this information.

Some individuals neglect to indicate their payment method clearly. Stating "regular mail" without checking other options could mean a delay in receiving funds. Always specify if you prefer expedited payment methods.

It's also important to address the withholding election correctly. Choosing not to withhold taxes when required can lead to tax penalties. Review your preferences carefully and ensure they are accurately marked.

When listing a financial institution, people often forget to include all necessary details, such as the routing number. Missing this information can prevent the proper transfer of funds, causing frustration and delays.

For joint accounts, failing to secure the necessary signatures can be another oversight. Ensuring that all parties involved provide their consent is vital for processing the request smoothly.

The use of a voided check is sometimes misunderstood. Some applicants think it’s optional, but it is required for verification of financial information. Always include a voided check along with your submission.

Lastly, not reading the instructions thoroughly can lead to several mistakes. Understanding the requirements for completing the form can prevent unnecessary delays and complications. Always take the time to review the entire document before submitting.

Documents used along the form

When managing financial transactions or benefits related to an annuity contract, several documents frequently accompany the Midland National form to ensure compliance and proper processing of requests. Each of these documents serves a specific purpose, contributing to the overall clarity and legality of the transaction.

- Authorization for Electronic Funds Transfer (EFT): This document allows the contract owner to authorize automatic withdrawals or deposits to their bank account. It is essential for those who prefer faster access to their funds via electronic means.

- W-4P Form: As a taxpayer, if you choose to have taxes withheld from your payments, this form will provide the necessary information regarding your withholding preferences. Completing it ensures that the right amount of federal income tax is deducted from your benefits.

- Notarization Form: For partial surrenders exceeding a certain amount (such as $10,000), this document requires a notary's signature. It's used to verify the identity of the signer and to provide an additional layer of security against fraud.

- Spousal Consent Form: In certain states, this form is required when the contract owner is married. It serves as proof that the spouse acknowledges and consents to the partial surrender of funds from the annuity.

- Account Information Verification: This document helps confirm the accuracy of the financial institution's details, including account and routing numbers. Typically, a voided check is attached to verify this information.

- Withdrawal Request Letter: A simple letter may be necessary to formally request a withdrawal. This written request typically outlines the specifics of the surrender, such as the amount and the reason for the withdrawal, ensuring all parties have a record of the request.

- State Tax Withholding Notice: Required in many jurisdictions, this document informs you about any state taxes that will be withheld from your payment, allowing you to understand the financial implications of your withdrawal.

In summary, the Midland National form is often complemented by these various documents. They promote a seamless process for handling requests related to annuity contracts, ensuring compliance with legal requirements and providing protection for all parties involved. Proper attention to each document’s purpose and requirements is essential for successful transactions.

Similar forms

-

Withdrawal Request Form: Similar to the Midland National form, this document facilitates the request for funds from various types of accounts. Both forms require detailed account information and specify the amount to be withdrawn.

-

Transfer Request Form: This document allows for the transfer of funds between accounts. Like the Midland National form, it necessitates the identification of the account holders and the authorization for the movement of funds.

-

Direct Deposit Authorization Form: This form is used to set up direct deposits to bank accounts. Both forms require similar banking information, ensuring smooth transactions for withdrawals or deposits.

-

Partial Withdrawal Request Form: This document is aimed specifically at requesting partial withdrawals from investment accounts. It shares a similar purpose with the Midland National form, focusing on the withdrawal amount and applicable penalties.

-

Tax Withholding Election Form: This form allows individuals to elect how much tax to withhold from their payments. Both documents inform users of the implications of their withholding choices.

-

Account Closure Request Form: Used to formally close an account, this form requires account holder details and directives for final fund transfer, mirroring the identification process in the Midland National form.

-

Beneficiary Designation Form: This document names beneficiaries for different types of accounts. Like the Midland National form, it ensures the accuracy of account holder information and any associated legal requirements.

-

Account Change Request Form: This form is utilized to request changes, such as updating personal information. The process outlined is akin to that in the Midland National form, emphasizing the importance of accurate information.

-

Annuity Surrender Form: Used to cashed out annuities, similar to the Midland National form, it requires thorough completion and typically features a penalty warning for early withdrawals.

-

Loan Request Form: This document is used to apply for loans against various financial accounts. Both forms necessitate similar personal information and signatures for processing requests.

Dos and Don'ts

Filling out the Midland National form can be straightforward if you follow some key guidelines. Here are seven do's and don'ts to keep in mind while completing the form:

- Do double-check your personal information, such as your name and contact details, before submitting the form to avoid delays.

- Don't skip any sections. Each part of the form is important, and incomplete submissions may hinder your request.

- Do ensure that the contract number is correct. This helps to accurately identify your account.

- Don't forget to sign and date the form where required. Signatures are necessary for processing your request.

- Do read the payment method options carefully. Choose the method that best fits your needs to avoid complications.

- Don't neglect to provide any required documentation, such as a voided check for financial verification.

- Do contact customer service if you have questions. They are available to assist you with any uncertainties you may have.

Misconceptions

- Misconception 1: The Midland National form is only for full withdrawals.

This form is specifically designed for partial surrenders, allowing account holders to withdraw a portion of their investment while maintaining the account.

- Misconception 2: A notary signature is required for all partial surrenders.

Notary signatures are only needed for surrender charges greater than $10,000. For smaller amounts, this is not a requirement.

- Misconception 3: All accounts must have both a contract owner and a joint owner listed.

While a joint owner can be included, it is not mandatory. A contract can be held by a single individual.

- Misconception 4: Tax withholding is optional regardless of the amount withdrawn.

The form requires account holders to select their tax withholding preference. If no election is made, 10% will automatically be withheld.

- Misconception 5: The method of payment cannot be changed once indicated.

Account holders can specify different payment options, such as electronic funds transfer or overnight mail, at the time of completing the form.

- Misconception 6: Information provided on the form does not need to be complete for submission.

It is crucial to complete the entire form. Any inaccuracies or omissions may lead to delays in processing.

- Misconception 7: Partial surrenders always incur penalties.

Some withdrawals can be made penalty-free, especially those that fall under the 10% penalty-free withdrawal option. It is essential to check the terms of the contract.

- Misconception 8: The form only applies to individual account holders.

Trusts and corporations can also utilize this form if they are the account owners, ensuring that they follow the necessary requirements.

Key takeaways

When using the Midland National form for a partial surrender request, consider the following key takeaways:

- Complete Required Sections: Ensure all sections of the form are filled out completely. Incomplete forms may lead to delays in processing your request.

- Choose Payment Method: Specify how you would like to receive your funds. Options include regular mail or electronic funds transfer, but you will need to provide specific account information if choosing the latter.

- Tax Withholding Election: If you want federal or state income taxes withheld, you must indicate your preference on the form. If you do not make an election, 10% federal tax will automatically be withheld.

- Notary and Spousal Signatures: If your surrender charge exceeds $10,000, a notary signature is required. Additionally, spousal approval is necessary in certain states if the contract was issued there.

- Provide Accurate Taxpayer Identification: Ensure your taxpayer identification number is correctly entered. This information is crucial for tax reporting purposes and avoiding potential penalties.

Browse Other Templates

Business License Renewal California - Retain copies of previous licenses for reference.

Eservices for Business - Grand totals must be calculated at the end of the reporting period.

Ga Lottery Retailer - Retailers must maintain fiduciary duties regarding the funds collected from lottery ticket sales.