Fill Out Your Mileage Log Form

Keeping an accurate record of your mileage is essential for various purposes, including tax deductions and reimbursement requests. The Mileage Log form serves as a crucial tool in this process, offering a structured way to document your vehicle use. It includes sections for your vehicle information, the date of travel, and the starting and ending odometer readings, which help you calculate total miles driven. Additionally, there’s space for noting parking expenses and other relevant details. This free printable mileage log ensures everything you need is at your fingertips, making it easier to stay organized and compliant with financial tracking requirements.

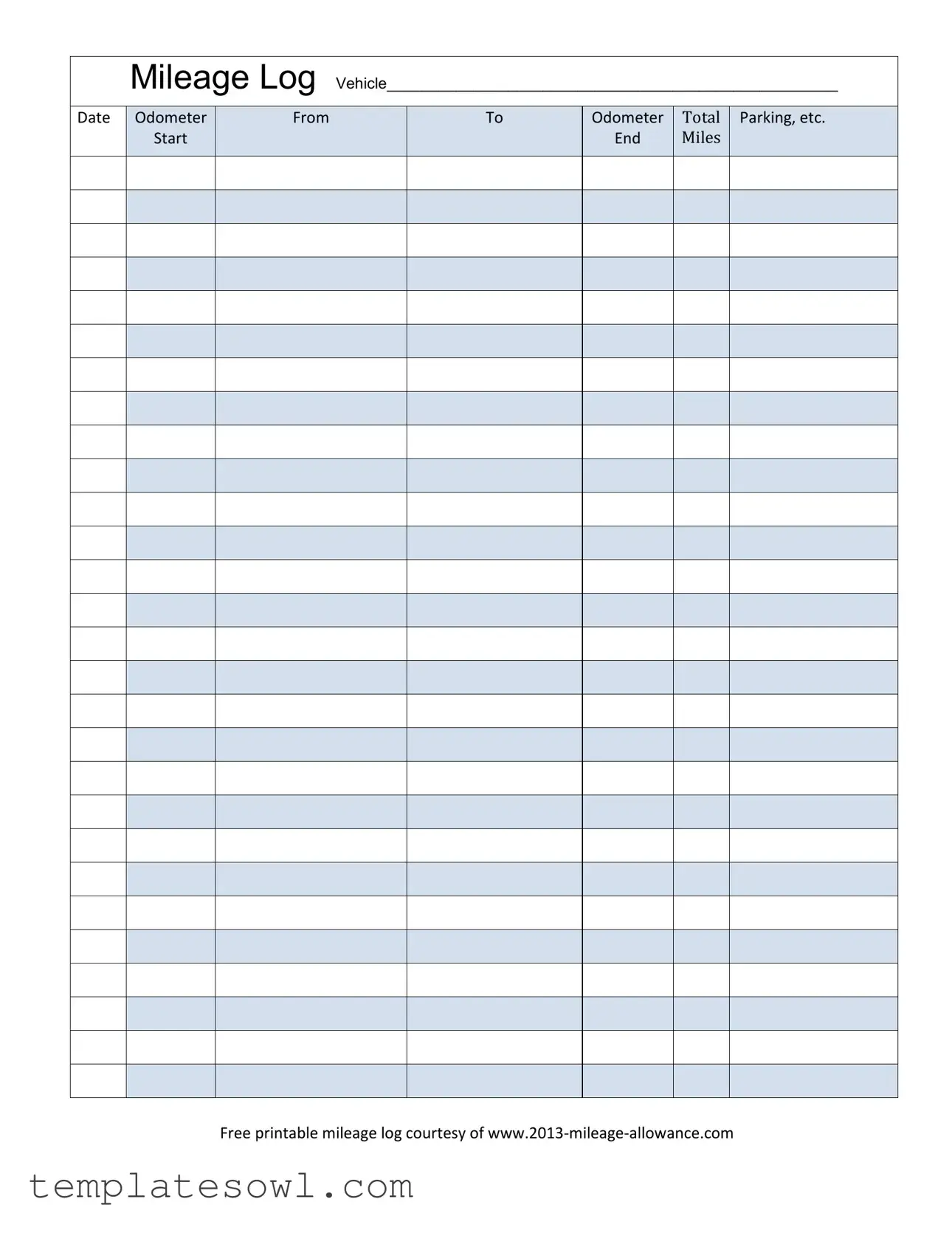

Mileage Log Example

Mileage Log Vehicle____________________________________________________

Date

Odometer |

Start |

From

To

Odometer |

End |

TOTAL  Parking, etc.

Parking, etc.

MILES

Free printable mileage log courtesy of

Form Characteristics

| Fact Name | Description |

|---|---|

| Purpose | The Mileage Log form is used to track and document the mileage driven for business or personal use. It helps in calculating deductions for tax purposes or reimbursements. |

| Structure | The form includes sections for vehicle details, date of travel, odometer readings, and total miles driven, making it straightforward to fill out. |

| Usage | Individuals and businesses can utilize this form to maintain accurate records of their vehicle usage, which is essential during tax filing or if requested by an employer. |

| State Requirements | Different states may have specific requirements related to mileage logs. In California, for example, taxpayers must maintain accurate records to substantiate their vehicle expenses as per the California Revenue and Taxation Code. |

| Free Availability | Many online resources offer free printable versions of the Mileage Log, making it accessible for anyone needing to document their travel effectively. |

Guidelines on Utilizing Mileage Log

Filling out the Mileage Log form effectively allows individuals to keep track of their driving for various purposes such as business reimbursements or tax deductions. Accurate records provide essential information regarding mileage, which can be vital when preparing financial statements or filing taxes.

- Gather Necessary Information: Collect all relevant data before starting, including details about your vehicle and the trips you plan to log.

- Enter Vehicle Information: Write the make and model of your vehicle in the designated section at the top of the form.

- Record the Date: Write the date for each trip in the appropriate field.

- Add Odometer Reading: For each trip, enter the starting odometer reading before you begin your journey.

- Indicate Start and Destination Locations: Clearly write where you started your trip (From) and where you ended (To).

- Document Ending Odometer Reading: After completing your trip, fill in the ending odometer reading.

- Calculate Total Miles: Subtract the starting odometer reading from the ending odometer reading to determine the total distance traveled for each trip.

- Include Additional Expenses (if necessary): If there are any parking fees or other expenses incurred during the trip, list them in the provided section.

- Review Entries: After filling out the form, double-check all entries for accuracy to ensure reliable records.

What You Should Know About This Form

What is a Mileage Log form?

A Mileage Log form is a document used to track the miles driven for business purposes or personal use. It captures important details like the date, starting and ending odometer readings, and the specific locations traveled. Many people use this form to provide proof of their mileage when filing taxes or requesting reimbursements from employers.

How should I fill out the Mileage Log?

To complete the Mileage Log, start by entering the details for each trip. Write down the date of the trip at the top. Then, fill in the vehicle details. Record the starting odometer reading before you begin your trip. When you arrive at your destination, note the ending odometer reading. Subtract the starting number from the ending number to calculate the total miles driven. Finally, make sure to include any parking fees or other related expenses for accurate record-keeping.

Is the Mileage Log form used for tax purposes?

Yes, the Mileage Log form can be essential for tax purposes. If you are self-employed or use your personal vehicle for business, you can deduct these miles from your taxable income. For this deduction, the IRS requires detailed records of your mileage, which is why having an accurate Mileage Log is so important.

Can I use a Mileage Log for personal trips?

While the primary purpose of a Mileage Log is often for business use, you can also use it to track personal trips if you want a clear record of your driving habits. However, keep in mind that personal mileage is usually not deductible for tax purposes. Thus, the main benefit of logging personal miles would be for your own information or if you plan to convert a personal vehicle to business use in the future.

Common mistakes

When filling out the Mileage Log form, many individuals inadvertently make errors that can affect the accuracy of their records. One common mistake is neglecting to include the vehicle information. Properly identifying the vehicle at the top of the form is crucial, as it provides context for the logged miles and ensures that the records are organized by vehicle.

Another frequent oversight is skipping the date section. This omission can lead to confusion when trying to recall when specific trips occurred. Accurate dating not only helps in tracking mileage but also assists in substantiating claims for tax deductions or reimbursements.

Additionally, some individuals fail to fill in the odometer readings correctly. Whether starting from an inaccurate number or forgetting to record the odometer reading at the end of the trip, these errors can skew the total miles calculated for each journey. It is essential to take these readings at both the beginning and the end of every trip.

Another common mistake involves not providing the starting and ending locations for each trip. Without this information, the log lacks context, which is necessary for understanding the purpose of travel and could be essential for future reference or audits.

Furthermore, many people neglect the total miles calculation, either forgetting to do the math or incorrectly adding the figures. This error can result in inaccurate mileage claims and potential financial repercussions if the data is used for expense reimbursement.

Some users also overlook including details about parking or other related expenses that may be reimbursable. These additional details often go hand-in-hand with mileage and should be documented to provide a comprehensive view of expenses incurred during travel.

Poor handwriting can also lead to confusion. If the entries on the Mileage Log are not legible, it can make it difficult to recall specific journey details later. Always ensure that the handwriting is clear and easy to read to prevent any issues down the line.

Another issue that arises is failing to regularly update the Mileage Log. Keeping the log up-to-date with timely entries ensures that nothing gets forgotten or miscalculated over time, making it easier to reference how many miles were traveled during any specific period.

Lastly, some people may not keep their logs secure or may forget to back them up. Losing track of a Mileage Log due to misplaced paperwork can create significant challenges down the road. It’s important to keep copies in a safe location, ensuring nothing is lost that could potentially be necessary for tax purposes or reimbursement requests.

Documents used along the form

The Mileage Log form is an essential document for tracking vehicle usage, especially for business purposes or tax deductions. However, it is often accompanied by other important forms and documents. Each of these documents serves a unique purpose in maintaining a comprehensive record of vehicle-related information and ensuring compliance with regulations.

- Expense Report: This document summarizes all business-related expenses, including fuel, maintenance, and other car-related costs. It helps in accounting and reimbursement processes.

- Vehicle Authorization Form: Before using a vehicle for work, employees may need to submit this form to obtain permission from their employer, confirming their authorization to use company vehicles.

- Fuel Receipts: These receipts provide proof of fuel purchases and can be attached to expense reports to claim reimbursement or verify travel expenses.

- Travel Authorization Form: Employees may be required to complete this form to formally request approval for travel that incurs expenses. It often includes details such as destination, purpose, and estimated costs.

- Business Use Agreement: This document outlines the terms and conditions of using a personal vehicle for business purposes, protecting both the employee and employer in case of disputes.

- Insurance Declaration Page: It is crucial to provide proof of insurance coverage for the vehicle being used for business purposes, ensuring compliance and protection in case of accidents.

- Accident Report Form: In the event of an accident, this form is used to document the details of the incident, which is essential for insurance claims and liability assessments.

- Service and Maintenance Records: Keeping detailed records of all vehicle maintenance helps demonstrate the vehicle's condition and history, which can be important for tax deductions and resale value.

- Carpool Agreement: If employees share rides, this document outlines the responsibilities and expectations of each participant in the carpool arrangement.

Each of these documents plays a crucial role in management, accountability, and compliance when it comes to vehicle use, especially in a business context. Understanding their purposes can enhance organization and protect interests related to vehicle travel and expenses.

Similar forms

- Expense Report: An expense report tracks business-related expenses, similar to how a Mileage Log records travel miles for reimbursement or tax purposes. Both documents require clear details about activities and totals.

- Travel Itinerary: A travel itinerary outlines planned travel routes and stops, much like a Mileage Log shows actual travel distances. Both documents help keep organized records of trips taken for business.

- Invoice: An invoice requests payment for goods or services rendered, paralleling the Mileage Log that can support requests for mileage reimbursement. Each document features specific details and figures that validate costs incurred.

- Time Sheet: A time sheet records hours worked and can include travel time. The Mileage Log, in contrast, focuses strictly on the miles traveled. Both documents are essential for accurate record-keeping in business for either hourly pay or reimbursements.

Dos and Don'ts

When it comes to filling out the Mileage Log form, attention to detail is crucial. Here’s a list of what to do and what to avoid to ensure your log is accurate and complete.

- Do: Record the date for each trip accurately. This helps in tracking your mileage over time.

- Do: Enter the starting and ending odometer readings clearly. This prevents any confusion about the distance traveled.

- Do: Keep a record of all trips, even short ones. Every mile counts!

- Do: Include any additional expenses, such as parking fees. This information may be necessary for expense reports.

- Do: Review the completed form for errors before submitting it. A quick check can save you from potential issues later.

- Don't: Forget to fill in the "From" and "To" sections. Leaving these blank may lead to questions about your travel.

- Don't: Use overly vague descriptions for your trips. Specificity is key in case of future audits.

- Don't: Mix personal and business mileage. This can create complications for tax purposes.

- Don't: Delay filling out the log. The longer you wait, the harder it can be to remember details.

- Don't: Ignore the importance of keeping a digital or physical copy of your completed logs. You may need them for your records.

Misconceptions

When it comes to keeping track of your mileage, the Mileage Log form can seem straightforward, but there are several misconceptions surrounding its use. Understanding the truth can help individuals and businesses make the most of this essential tool. Here are six common misconceptions:

- My Mileage Log Doesn't Need to Be Detailed: Some people believe that a simple note of miles driven is enough. In reality, the log should include specific details like the date, start and end odometer readings, and the purpose of each trip.

- Only Business Miles Count: Many think that only miles driven for business purposes can be logged. However, if you're self-employed or an independent contractor, you can also log mileage incurred while attending business meetings, even if they're not directly tied to a formal job.

- I Can Estimate My Mileage: Estimation may seem easier, but it's not advisable. Actual readings from your odometer provide a more accurate and defensible record in the event of an audit.

- I Don't Need to Keep My Mileage Log if Using a Personal Vehicle: Whether you drive a personal vehicle or a company car, maintaining a Mileage Log is crucial for tax purposes. Personal use can also be documented for potential deductions.

- It's Fine to Mix Business and Personal Mileage: While it's common to drive for both purposes, it's essential to keep these uses separate in your log. Accurate records enable you to claim deductions only for business-related miles.

- The Mileage Log Form is Complicated: Many people shy away from using the form because they think it's cumbersome. However, the Mileage Log is straightforward and designed to be user-friendly. Filling it out regularly can make record-keeping manageable.

By clearing up these misconceptions, you can better utilize the Mileage Log form to track your miles accurately. This is key for maximizing potential deductions and staying organized.

Key takeaways

Filling out a Mileage Log form correctly is essential for accurate record-keeping. Here are ten key takeaways to keep in mind:

- Begin by providing the vehicle information at the top of the form. Clearly state the make and model.

- Fill in the date of each trip to maintain an accurate timeline.

- Record the start and end odometer readings for each trip. This data is crucial for calculating total miles driven.

- Calculate the total miles driven by subtracting the starting odometer reading from the ending reading.

- Document any additional expenses incurred during the trip, such as parking fees, in the designated section.

- Be consistent. Use the same format for entering dates and distances to ensure clarity and ease of understanding.

- Review the form for any errors or omissions before finalizing it. Accuracy is key.

- Keep the log updated regularly to avoid missing important trips.

- Consider keeping digital records as a backup to your paper logs for ease of access.

- Regularly review your logged mileage for tax deductions or reimbursement opportunities.

Using the Mileage Log effectively helps in managing expenses and provides valuable documentation when needed.

Browse Other Templates

Vehicle Inspection Pdf - Securement devices are evaluated to confirm that loads are safely fastened for transportation.

Texas Sales Tax Id - Turnabouts are practiced for two hours in safe environments.