Fill Out Your Mineral Deed Form

The Mineral Deed form serves as a crucial instrument in the transfer of mineral rights between parties, specifically from a seller, referred to as the Grantor, to a buyer, known as the Grantee. This legally binding document outlines the terms of the transfer, which typically includes the consideration amount—often as minimal as ten dollars—while establishing the rights and privileges granted to the Grantee. Essential elements of the deed encompass the delineation of the undivided interest in various minerals, such as oil and gas, and the rights associated with drilling, mining, exploring, and transporting these resources. Furthermore, it clarifies the Grantee’s entitlement to benefits like bonuses and royalties stemming from existing leases. The Grantor also agrees to grant additional assurances and addresses potential obligations related to unpaid liens or taxes on the property. Importantly, this deed does not require the Grantee to undertake any drilling operations unless they choose to do so. The document ensures that all rights and interests, past and future, are explicitly conveyed and remain binding on heirs and assigns, providing clarity and security in mineral rights transactions. With the increasing interest in mineral resources, understanding the implications and details of the Mineral Deed form is vital for both parties involved in such agreements.

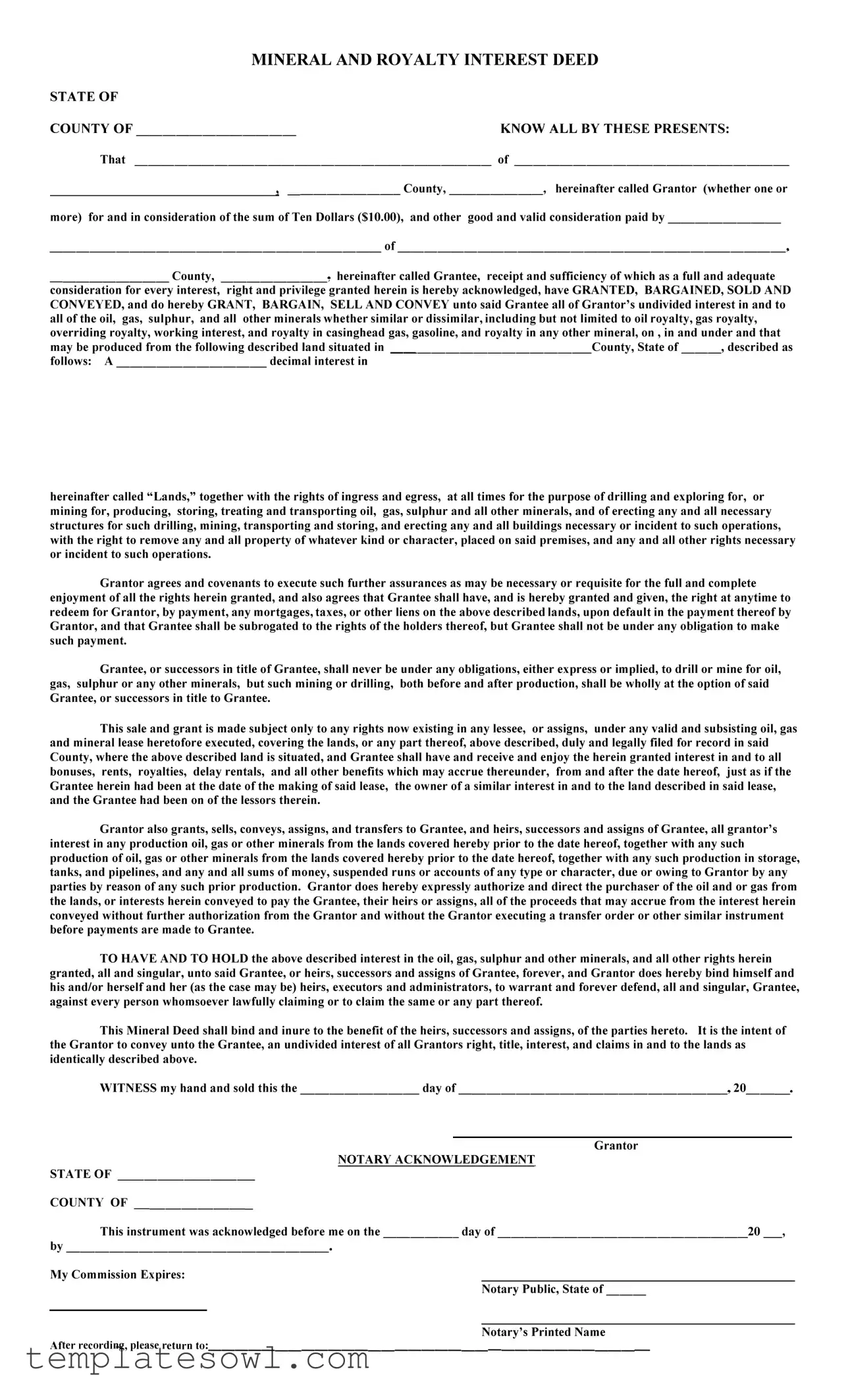

Mineral Deed Example

MINERAL AND ROYALTY INTEREST DEED

STATE OF |

|

COUNTY OF |

KNOW ALL BY THESE PRESENTS: |

That |

of |

_________ County, _______, hereinafter called Grantor (whether one or

more) for and in consideration of the sum of Ten Dollars ($10.00), and other good and valid consideration paid by ________

_________ County,

consideration for every interest, right and privilege granted herein is hereby acknowledged, have GRANTED, BARGAINED, SOLD AND CONVEYED, and do hereby GRANT, BARGAIN, SELL AND CONVEY unto said Grantee all of Grantor's undivided interest in and to all of the oil, gas, sulphur, and all other minerals whether similar or dissimilar, including but not limited to oil royalty, gas royalty, overriding royalty, working interest, and royalty in casinghead gas, gasoline, and royalty in any other mineral, on , in and under and that may be produced from the following described land situated in ______________County, State of ___, described as

follows: A ___________ decimal interest in

hereinafter called "Lands," together with the rights of ingress and egress, at all times for the purpose of drilling and exploring for, or mining for, producing, storing, treating and transporting oil, gas, sulphur and all other minerals, and of erecting any and all necessary structures for such drilling, mining, transporting and storing, and erecting any and all buildings necessary or incident to such operations, with the right to remove any and all property of whatever kind or character, placed on said premises, and any and all other rights necessary or incident to such operations.

Grantor agrees and covenants to execute such further assurances as may be necessary or requisite for the full and complete enjoyment of all the rights herein granted, and also agrees that Grantee shall have, and is hereby granted and given, the right at anytime to redeem for Grantor, by payment, any mortgages, taxes, or other liens on the above described lands, upon default in the payment thereof by Grantor, and that Grantee shall be subrogated to the rights of the holders thereof, but Grantee shall not be under any obligation to make such payment.

Grantee, or successors in title of Grantee, shall never be under any obligations, either express or implied, to drill or mine for oil, gas, sulphur or any other minerals, but such mining or drilling, both before and after production, shall be wholly at the option of said Grantee, or successors in title to Grantee.

This sale and grant is made subject only to any rights now existing in any lessee, or assigns, under any valid and subsisting oil, gas and mineral lease heretofore executed, covering the lands, or any part thereof, above described, duly and legally filed for record in said County, where the above described land is situated, and Grantee shall have and receive and enjoy the herein granted interest in and to all bonuses, rents, royalties, delay rentals, and all other benefits which may accrue thereunder, from and after the date hereof, just as if the Grantee herein had been at the date of the making of said lease, the owner of a similar interest in and to the land described in said lease, and the Grantee had been on of the lessors therein.

Grantor also grants, sells, conveys, assigns, and transfers to Grantee, and heirs, successors and assigns of Grantee, all grantor's interest in any production oil, gas or other minerals from the lands covered hereby prior to the date hereof, together with any such production of oil, gas or other minerals from the lands covered hereby prior to the date hereof, together with any such production in storage, tanks, and pipelines, and any and all sums of money, suspended runs or accounts of any type or character, due or owing to Grantor by any parties by reason of any such prior production. Grantor does hereby expressly authorize and direct the purchaser of the oil and or gas from the lands, or interests herein conveyed to pay the Grantee, their heirs or assigns, all of the proceeds that may accrue from the interest herein conveyed without further authorization from the Grantor and without the Grantor executing a transfer order or other similar instrument before payments are made to Grantee.

TO HAVE AND TO HOLD the above described interest in the oil, gas, sulphur and other minerals, and all other rights herein granted, all and singular, unto said Grantee, or heirs, successors and assigns of Grantee, forever, and Grantor does hereby bind himself and his and/or herself and her (as the case may be) heirs, executors and administrators, to warrant and forever defend, all and singular, Grantee, against every person whomsoever lawfully claiming or to claim the same or any part thereof.

This Mineral Deed shall bind and inure to the benefit of the heirs, successors and assigns, of the parties hereto. It is the intent of the Grantor to convey unto the Grantee, an undivided interest of all Grantors right, title, interest, and claims in and to the lands as identically described above.

WITNESS my hand and sold this the ________ day of __________________� 20___

STATE OF

COUNTY OF ________

Grantor

NOTARY ACKNOWLEDGEMENT

This instrument was acknowledged before me on the ______ day of ___________________20 _,

by __________________

My Commission Expires:

Notary Public, State of ___

After recording,

please

Notary's Printed Name

return to:_________________________________

Form Characteristics

| Fact Title | Description |

|---|---|

| Name | The document is officially titled the Mineral and Royalty Interest Deed. |

| Purpose | This deed is used to transfer ownership of mineral rights, including oil, gas, and other minerals, from one party (the Grantor) to another (the Grantee). |

| Consideration | The Grantor acknowledges receipt of consideration, typically a specified sum, in exchange for the mineral rights. |

| Mineral Rights | The deed covers rights related to all minerals, which include but are not limited to oil and gas royalties. |

| Rights Granted | The Grantee receives rights for ingress and egress to conduct operations related to drilling, mining, and transporting minerals. |

| State-Specific Law | In the U.S., mineral deeds are governed by specific state laws, which vary by state. It is important to check the local laws applicable to mineral rights transfers. |

| Notarization | The deed typically requires notarization to verify the identities of the parties involved and to confirm the legitimacy of the transaction. |

Guidelines on Utilizing Mineral Deed

Filling out a Mineral Deed form is an important step in transferring mineral rights. Properly completing this form ensures that the transaction is legally recognized and protects the interests of both the Grantor and the Grantee. Below are the steps to accurately fill out the Mineral Deed form.

- Start by entering the state name and county where the property is located at the top of the form.

- In the "Grantor" section, write the full name of the person or entity transferring the mineral rights, along with their county and state.

- In the "Grantee" section, enter the full name of the person or entity receiving the mineral rights, along with their county and state.

- Indicate the consideration amount, typically Ten Dollars ($10.00), in the designated space.

- Describe the lands involved in the transaction. This includes any relevant specifics about the location and size of the land, ensuring that the description is clear and precise.

- Specify the decimal interest being transferred, typically expressed as a fraction or percentage.

- Provide the rights related to drilling, mining, and transporting minerals as outlined in the form. Ensure that all rights granted are listed accurately.

- Include any obligations of the Grantor that might affect the Grantee’s rights, such as any existing mortgages or liens on the property.

- Sign and date the form at the bottom where indicated. The date should reflect the day of signing.

- Next, assure that the Notary Acknowledgment section is filled out. This is essential for legal validation.

- After signing, either provide the name of the Notary Public along with their commission expiration date or leave space for them to fill that in.

- Make sure to indicate where the form should be returned upon recording, by providing the appropriate address.

What You Should Know About This Form

What is a Mineral Deed form?

A Mineral Deed form is a legal document that allows one party (known as the Grantor) to transfer their interest in minerals, such as oil, gas, and sulfur, to another party (known as the Grantee). This deed outlines the specific rights being transferred, along with any conditions or obligations. The deed also clarifies the geographic area involved and ensures that the Grantee can access and utilize the mineral rights as specified.

Why should I use a Mineral Deed form?

Using a Mineral Deed form is essential for legally transferring mineral rights. It protects the interests of both parties involved in the transaction. By documenting the transfer, the Grantor ensures that they are not liable for future obligations related to the minerals, while the Grantee secures legal rights to explore and extract those minerals. Proper documentation helps avoid disputes and clarifies ownership.

What information do I need to complete a Mineral Deed?

To complete a Mineral Deed, you need to provide several key pieces of information. This includes the full names and addresses of both the Grantor and Grantee, a precise description of the land where the minerals are located, and the specifics of the interest being transferred. Additionally, the deed should state the consideration paid for the transfer, typically summarized as a monetary amount, such as ten dollars.

Are there any obligations for the Grantee after the transfer?

No, the Grantee is not required to drill or mine for the minerals. The deed states that any exploration or extraction is entirely at the Grantee's discretion. This means the Grantee has the option to act but is not compelled to do so. However, the Grantee does benefit from any revenues generated from the mineral rights once the deed is executed.

What happens if there are existing leases on the land?

The Mineral Deed is subject to any existing leases related to the mineral rights. This means that if there are valid leases already in place, the Grantee must respect those agreements. Nevertheless, the Grantee will receive benefits such as bonuses, rents, and royalties from existing leases, as if they had been the original lessor. Therefore, it's crucial to review any current leases before executing the Mineral Deed.

Common mistakes

Filling out a Mineral Deed form can be straightforward, but many people make common mistakes that can lead to problems down the line. One of the most frequent errors is failing to clearly identify the Grantor and Grantee. Without accurate names and details, the transfer of mineral rights can become complicated or even contested.

Another mistake involves improperly noting the consideration given for the transfer. The form requires the specification of the sum paid, typically stated as "Ten Dollars ($10.00) and other good and valid consideration." Forgetting to mention this can create ambiguity about the validity of the deed.

Leaving out the legal description of the property is a significant oversight. This section must clearly outline the lands involved in the transaction. Any ambiguity here could lead to disputes over what rights have been conveyed.

People sometimes forget to include a statement about any existing leases on the property. This information is crucial because it dictates what rights the Grantee has concerning existing agreements. Omitting this can mislead the Grantee about their rights and responsibilities.

A critical element often neglected is the specific interest being conveyed. The deed should state whether it includes a working interest, royalty interest, or another type of mineral interest. Vague language here could lead to misunderstandings later.

Inadequate attention to the notary acknowledgment can also cause issues. The deed must be properly notarized to be legally binding. If this step is skipped or not done correctly, the deed may not hold up in court.

Another common mistake is failing to clarify the rights of ingress and egress. This section allows the Grantee access to the property for the purpose of drilling and extraction. Omitting this can restrict the Grantee's ability to utilize their rights fully.

Many people overlook the importance of spelling out the right of redemption concerning unpaid mortgages or taxes. Clarifying this not only protects the Grantee's interests but also minimizes potential legal conflicts.

Finally, ensuring that the document is signed and dated both by the Grantor and the notary can’t be ignored. An unsigned or undated document can complicate enforcement and may lead to the deed being deemed invalid in a legal context.

Being mindful of these common mistakes can help ensure that the Mineral Deed is completed correctly and that the transfer of rights proceeds smoothly.

Documents used along the form

The Mineral Deed is a crucial document for transferring rights related to minerals from one party to another. However, several other forms and documents are commonly associated with the Mineral Deed to ensure a smooth and legally compliant transaction. Here is a brief overview of those documents:

- Title Abstract: This document provides a comprehensive summary of ownership history and any encumbrances on the property, helping to establish the grantor's clear title to the mineral rights being conveyed.

- Lease Agreement: Often executed simultaneously, this agreement outlines the terms under which the mineral properties can be developed, including payment structures like bonuses and royalties.

- Affidavit of Consideration: This affidavit verifies the consideration provided for the mineral transfer, which aids in clarifying any potential tax implications related to the transfer.

- Right of Way Agreement: This document grants permission for access across the land to transport minerals, ensuring that the grantee can develop their rights without obstruction.

- Joint Operating Agreement: In cases where multiple parties have rights to a mineral lease, this agreement defines how operations will be managed and profits distributed among joint owners.

- Production Sharing Agreement: This document specifies how the benefits from the extracted minerals will be divided among the parties involved, outlining the terms of production sharing.

- Quitclaim Deed: If there are uncertainties regarding title, a quitclaim deed may be used to transfer any interest the grantor may have in the minerals without warranties.

- Notarized Consent Statements: These statements may be required from co-owners or interested parties to confirm that they are aware of and agree to the transaction being undertaken.

Familiarizing yourself with these documents can help facilitate a successful mineral rights transaction. Each plays a vital role in clarifying ownership, responsibilities, and financial arrangements, ensuring everyone involved understands their rights and obligations.

Similar forms

The Mineral Deed form has some similarities with other documents in real estate and mineral rights law. Here is a list of nine documents that share characteristics with a Mineral Deed:

- Lease Agreement: Like a Mineral Deed, a lease agreement provides rights to explore, extract, and produce minerals. However, it typically grants temporary rights, while a Mineral Deed transfers permanent ownership of those rights.

- Royalty Agreement: This document details the payment structure for mineral extraction, outlining the percentage of revenue owed to the landowner. Similar to a Mineral Deed, it reflects ownership interests in mineral rights but is specifically focused on financial compensation.

- Quitclaim Deed: A Quitclaim Deed transfers whatever interest the grantor has in a property, without guarantees about the quality of that interest. This is similar to a Mineral Deed in that both involve the transfer of property rights, but the quitclaim offers less legal assurance.

- Deed of Trust: This document is often used to secure loans with real estate as collateral, and while it differs from a Mineral Deed in purpose, both involve property interests and can influence mineral rights by encumbering the land.

- Easement Agreement: An easement allows access to a property for specific purposes, such as drilling. It is related to a Mineral Deed, as both deal with access to land and resources, but easements typically do not transfer ownership of the mineral rights.

- Mining Lease: This is a specific lease for mining operations, granting rights to extract minerals. Like a Mineral Deed, it establishes who has the rights to minerals, but generally, a mining lease is for a defined period and subject to renewal.

- Assignment of Interest: This document allows one party to transfer their rights in a property to another party. Similar to a Mineral Deed, it involves the transfer of ownership but may not necessarily convey the underlying mineral rights specifically.

- License Agreement: A license agreement permits another party to use the land for specific activities, like exploration. Similar to a Mineral Deed, it may relate to mineral rights but does not transfer any ownership of those rights.

- Certificate of Title: This document certifies the ownership of a property, including mineral rights. While a Mineral Deed actually conveys the rights, a certificate of title simply proves who owns the rights.

Understanding these documents can help clarify the nature of mineral rights and their transfer, providing insight into the various ways individuals and entities can engage with land and resources.

Dos and Don'ts

- Do review all instructions carefully before filling out the Mineral Deed form.

- Do ensure all names, including Grantor and Grantee, are spelled correctly.

- Do clearly state the consideration amount as Ten Dollars ($10.00).

- Do provide accurate descriptions of the lands involved, including the county and state.

- Do specify the decimal interest in the lands.

- Don't leave any blank spaces; fill in all required information completely.

- Don't use abbreviations or shorthand that could confuse the details.

- Don't forget to sign and date the form; ensure the signature is legible.

- Don't neglect to have your signature notarized to validate the document.

- Don't overlook the instruction to return the document after recording.

Misconceptions

Understanding the Mineral Deed form is essential for anyone involved in the transfer of mineral rights. However, misconceptions often cloud the true function and implications of this important document. Here are some common misconceptions about the Mineral Deed form, along with clarifications:

- All mineral rights are the same. Many believe that mineral rights are uniform across all properties. In reality, mineral entitlements can vary significantly, depending on prior agreements, leases, and state laws.

- A low price indicates low value. The Mineral Deed often mentions a nominal consideration amount, such as $10. This does not reflect the true value of the mineral rights; it is a legal requirement rather than an indicator of worth.

- Grantees must drill or extract immediately. Some assume that once they obtain mineral rights, they are obligated to start drilling. In fact, the Grantee has the option to drill or not, with no obligation to do so immediately.

- All mineral rights convey with the sale. A common belief is that selling land automatically includes all mineral rights. However, this depends on how the sale is structured and any previous leases or contracts in place.

- Only oil and gas are included. People often think that a Mineral Deed only covers oil and gas. However, it typically includes other minerals like sulfur and any similar or dissimilar minerals, broadening its scope.

- The Grantor retains some rights after transfer. It is a misconception that the Grantor holds any rights post-transfer. A properly executed Mineral Deed should fully transfer those rights to the Grantee.

- Notarization is unimportant. Some may think notarization is merely a formality. In reality, it provides legal validation that can protect all parties involved from disputes.

- Mineral rights can’t be transferred separately. Many believe that mineral rights must always be sold with the land. In truth, mineral rights can be separately transferred or leased from the surface property.

In summary, being informed about the intricacies of Mineral Deeds can pave the way for better decisions in property and mineral transactions. Understanding the facts can help individuals navigate these often-complex matters effectively.

Key takeaways

Ensure you provide all required information accurately. This includes the names of the Grantor and Grantee, the description of the land, and the exact interest being conveyed.

Clearly state the consideration for the deed. The form mentions a minimum amount (Ten Dollars), but you can include any valid consideration that both parties agree upon.

The deed must indicate the specific mineral rights being transferred. This can include oil, gas, sulphur, and other minerals, so be specific about what is included.

Grantors must acknowledge their obligation to assist in further assurances if needed. This commitment helps ensure that the Grantee can fully enjoy the rights granted.

The Grantee has the right, but not the obligation, to undertake drilling or mining activities. This provides flexibility for the Grantee based on their needs or plans.

Include any existing rights under current leases in the deed. This detail prevents future disputes concerning the use of the land and assures clarity between current and future interests.

After execution, a Notary acknowledgment is required, enhancing the legitimacy of the deed. This step is essential for record-keeping and protecting against fraud.

Browse Other Templates

Chase Dreamaker - Missing payments may impact your credit report negatively.

Receipt Format - This rental receipt can aid in financial planning and record-keeping for tenants.

Mortgage Payment Deferral - It is important to follow up with all necessary documentation as requested.