Fill Out Your Minnesota New Hire Reporting Form

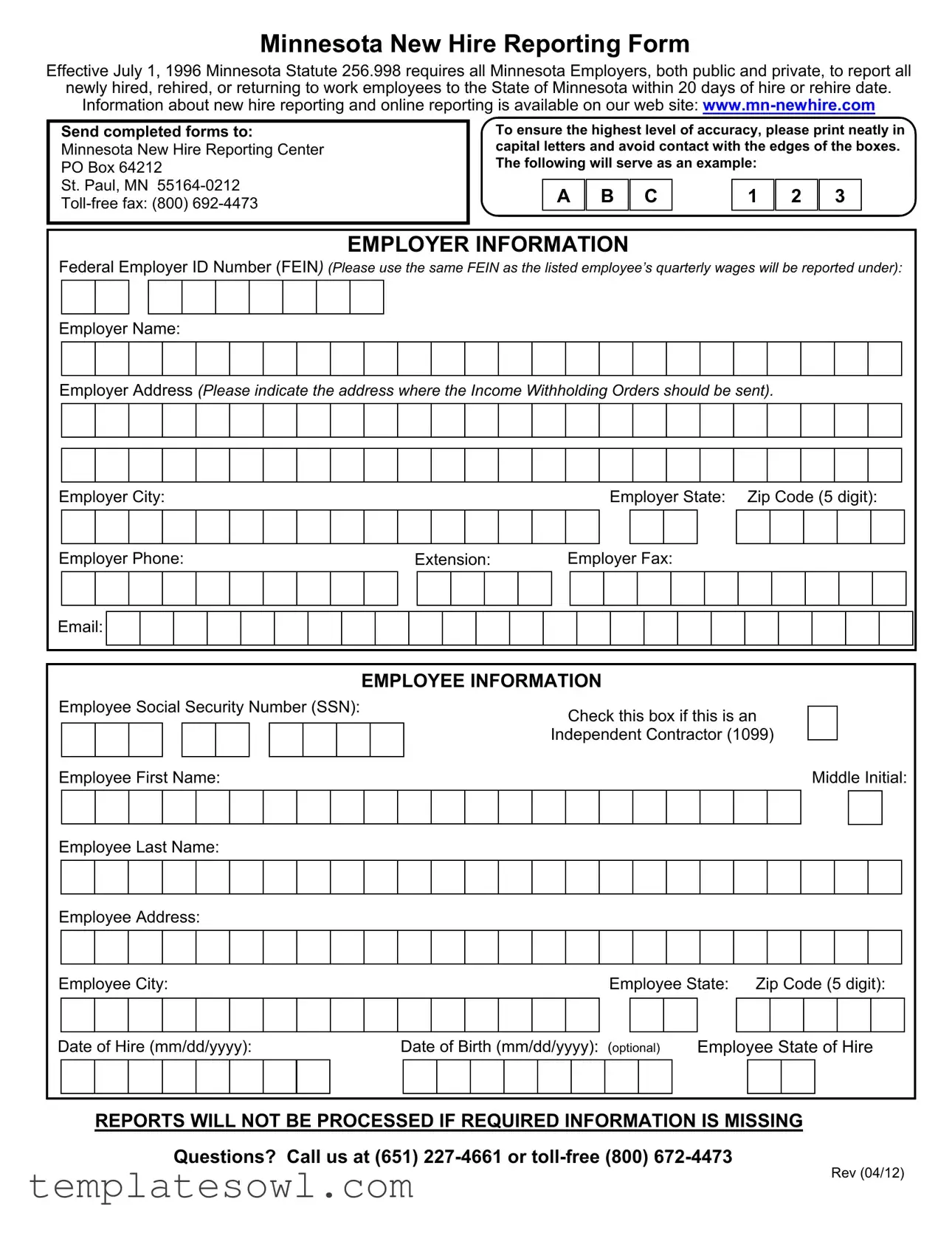

In Minnesota, employers play a crucial role in the timely reporting of new hires, a responsibility mandated by law to support state and federal efforts in tracking employment and ensuring compliance with various regulations. Effective since July 1, 1996, a statute requires every public and private employer in the state to report newly hired employees, those who have been rehired, or returning workers within 20 days of their employment start date. The Minnesota New Hire Reporting Form serves as the primary document for this process, capturing essential information that includes employer details like the Federal Employer Identification Number (FEIN), name, address, and contact information, as well as employee specifics such as Social Security Number (SSN), hiring date, and, optionally, date of birth. To promote accuracy in the reporting, the form should be completed using capital letters and by avoiding contact with the edges of designated fillable boxes. Employers can send the completed forms to the Minnesota New Hire Reporting Center and access online reporting information through the designated website. Missing required information may lead to processing delays, highlighting the importance of diligent and precise completion of the form.

Minnesota New Hire Reporting Example

Minnesota New Hire Reporting Form

Effective July 1, 1996 Minnesota Statute 256.998 requires all Minnesota Employers, both public and private, to report all newly hired, rehired, or returning to work employees to the State of Minnesota within 20 days of hire or rehire date.

Information about new hire reporting and online reporting is available on our web site:

Send completed forms to:

Minnesota New Hire Reporting Center PO Box 64212

St. Paul, MN

To ensure the highest level of accuracy, please print neatly in capital letters and avoid contact with the edges of the boxes. The following will serve as an example:

A |

B |

C |

|

1 |

2 |

3 |

|

|

|

|

|

|

|

EMPLOYER INFORMATION

Federal Employer ID Number (FEIN) (Please use the same FEIN as the listed employee’s quarterly wages will be reported under):

Employer Name:

Employer Address (Please indicate the address where the Income Withholding Orders should be sent).

Employer City: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Employer State: |

|

Zip Code (5 digit): |

|||||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Employer Phone: |

|

|

|

|

|

|

Extension: |

|

|

|

|

|

|

|

|

Employer Fax: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

Email: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

EMPLOYEE INFORMATION |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||||||||

Employee Social Security Number (SSN): |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Check this box if this is an |

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Independent Contractor (1099) |

|

|

|

|

|

|||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Employee First Name: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Middle Initial: |

|||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Employee Last Name: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Employee Address: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

Employee City: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Employee State: |

|

Zip Code (5 digit): |

|||||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Date of Hire (mm/dd/yyyy): |

|

|

|

|

Date of Birth (mm/dd/yyyy): (optional) |

Employee State of Hire |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

REPORTS WILL NOT BE PROCESSED IF REQUIRED INFORMATION IS MISSING

Questions? Call us at (651)

Rev (04/12)

Form Characteristics

| Fact | Description |

|---|---|

| Requirement for Reporting | All employers in Minnesota must report newly hired and rehired employees under Minnesota Statute 256.998. |

| Reporting Deadline | Employers are required to complete their reporting within 20 days of the hire or rehire date. |

| Applicable Employers | Both public and private sector employers have the obligation to report new hires. |

| Submission Method | Completed forms must be sent to the Minnesota New Hire Reporting Center via mail or fax. |

| Mailing Address | The mailing address for submissions is PO Box 64212, St. Paul, MN 55164-0212. |

| Online Reporting | Employers can access information and online reporting options at www.mn-newhire.com. |

| Accuracy in Submission | Employers are encouraged to print neatly in capital letters to ensure accuracy. |

| Required Employee Information | Employers must provide the employee's Social Security Number and other necessary details on the form. |

| Contact Information for Queries | Questions can be directed to the Minnesota New Hire Reporting Center at (651) 227-4661 or toll-free (800) 672-4473. |

Guidelines on Utilizing Minnesota New Hire Reporting

Completing the Minnesota New Hire Reporting form is a straightforward process that ensures compliance with state regulations. Everything needed to accurately report new hires, including rehired or returning employees, is included in the form. Make sure to fill it out carefully and send it within the specified timeframe. Below are the detailed steps for filling out the form correctly.

- Begin by gathering all necessary information. You will need the employer's details, such as the Federal Employer ID Number (FEIN), name, address, and contact information.

- In the first section labeled EMPLOYER INFORMATION, input the following details:

- Federal Employer ID Number (FEIN)

- Employer Name

- Employer Address

- Employer City

- Employer State

- Zip Code (5-digit)

- Employer Phone Number (with Extension if applicable)

- Employer Fax Number

- Email Address

- Proceed to the next section labeled EMPLOYEE INFORMATION. Input the following employee details:

- Employee Social Security Number (SSN)

- Indicate if the employee is an Independent Contractor by checking the appropriate box

- Employee First Name

- Middle Initial

- Employee Last Name

- Employee Address

- Employee City

- Employee State

- Zip Code (5-digit)

- Date of Hire (format: mm/dd/yyyy)

- Date of Birth (format: mm/dd/yyyy; optional)

- Employee State of Hire

- Review the form thoroughly to ensure all required fields are completed accurately. Incomplete forms may delay processing.

- Once verified, send the completed form to the Minnesota New Hire Reporting Center at:

- Minnesota New Hire Reporting Center

- PO Box 64212

- St. Paul, MN 55164-0212

- Toll-free fax: (800) 692-4473

Make sure to meet the deadline of submitting the form within 20 days of the hire or rehire date. For any questions, the reporting center can be reached at their toll-free numbers.

What You Should Know About This Form

What is the Minnesota New Hire Reporting form?

The Minnesota New Hire Reporting form is a document required by law that employers must complete when they hire, rehire, or return an employee to work in Minnesota. This form collects essential information about the new employee to help the state track employment and support child support enforcement efforts.

Who needs to fill out the form?

All employers in Minnesota, whether public or private, need to fill out the New Hire Reporting form for every new hire, rehire, or employee returning from a break in service. This requirement applies regardless of the employee's job status or pay type.

When is the form due?

The completed form must be submitted to the state within 20 days of the new hire or rehire date. Timely reporting is crucial to ensure compliance with Minnesota laws and to assist in tracking employment for child support purposes.

Where should the completed form be sent?

After filling out the form, you should send it to the Minnesota New Hire Reporting Center. The mailing address is PO Box 64212, St. Paul, MN 55164-0212. You can also fax the completed form to the toll-free number (800) 692-4473.

What information is required on the form?

The form requires basic information about both the employer and the employee. For the employer, you will need to provide the Federal Employer ID Number, name, address, phone number, and fax number. For the employee, you must include the Social Security Number, name, address, and date of hire, among other details. Be sure to fill out the form completely to avoid processing delays.

What happens if I don’t submit the form?

Failing to submit the Minnesota New Hire Reporting form can lead to penalties for the employer. The state may impose fines or other enforcement actions if the reporting is not done in a timely manner. It is important to comply with this requirement to avoid potential legal issues.

What should I do if I have questions about the form?

If you have any questions about completing the form or the reporting process, you can contact the Minnesota New Hire Reporting Center at (651) 227-4661 or toll-free at (800) 672-4473. They are available to assist you with any concerns you may have.

Common mistakes

When filling out the Minnesota New Hire Reporting form, errors can lead to processing delays or complications. One common mistake is failing to complete the form within the required timeframe. Employers must report newly hired or rehired employees within 20 days of their start date. Neglecting this requirement can result in penalties or missed opportunities for assistance from state services.

A second frequent error involves inaccurate employer information. It is essential that employers provide their correct Federal Employer ID Number (FEIN) and other contact details. If the FEIN does not match what is reported on the employee's quarterly wages, this inconsistency can cause issues in processing the report. Double-checking this information can prevent unnecessary obstacles.

Omitting essential employee details represents a third mistake. Required fields include the employee’s Social Security Number and full name. If these fields are left blank or incorrectly filled out, the report will not be processed. This situation can delay necessary state services or benefits that the employee might need.

A fourth error relates to the use of capital letters. The form explicitly states that information should be printed neatly in capital letters. Employers who ignore this guideline may make it difficult for officials to read the handwritten entries. Poor legibility can lead to misunderstandings and mistakes in processing the report.

Finally, many submitters overlook the consequences of not checking the Independent Contractor box when applicable. If a worker qualifies as an independent contractor but is reported as a regular employee, it may create issues for tax reporting. This distinction is critical and should be made clear to avoid unnecessary complications down the line.

Documents used along the form

The Minnesota New Hire Reporting Form is a vital document for employers in Minnesota to report new or returning employees to the state. Along with this form, there are several other documents that employers may need to consider during the hiring process or for ongoing employment compliance. Here are five common forms and documents that often accompany the Minnesota New Hire Reporting Form.

- W-4 Form: The W-4 form is used by employees to indicate their tax withholding preferences. This form allows employees to choose how much federal income tax should be withheld from their paychecks based on their personal circumstances, such as marital status and number of dependents. Employers need this document to ensure proper compliance with tax regulations.

- I-9 Form: The I-9 form, or Employment Eligibility Verification form, is used to verify an employee's identity and eligibility to work in the United States. Employees must provide documentation to support their identity and employment authorization within three days of being hired. This form is essential for compliance with federal immigration laws.

- State Withholding Form: A Minnesota State Withholding form is similar to the W-4 but is specifically tailored for state income tax withholding. Employees complete this form to inform the employer of their state tax withholding preferences. This enables accurate tax withholding at the state level.

- Employee Handbook Acknowledgment: Many employers provide an employee handbook that outlines company policies, procedures, and employee rights. An acknowledgment form is often signed by employees to confirm they have received and understand the handbook. This helps ensure that employees are informed about workplace expectations and company culture.

- Direct Deposit Authorization Form: When employees prefer to have their paychecks deposited directly into their bank accounts, they complete a direct deposit authorization form. This document collects necessary banking information, allowing employers to process payroll efficiently and securely.

These documents enhance the hiring process, ensure legal compliance, and protect both the employer and employee. Proper management of these forms contributes to a smoother employment experience and helps maintain organizational standards.

Similar forms

The Minnesota New Hire Reporting Form shares similarities with several other documents used for employment and tax purposes. Below is a list of nine related forms, along with an explanation of each.

- W-4 Form: This form is used by employees to indicate their tax situation to their employer. Like the New Hire Reporting Form, it collects essential information needed for payroll processing, including personal details and Taxpayer Identification Numbers.

- I-9 Form: The Employment Eligibility Verification form confirms the identity and employment authorization of individuals hired for employment in the United States. It is similar in that it must be completed by new hires and submitted by the employer, ensuring compliance with federal regulations.

- 1099-MISC Form: Independent contractors use this form to report earnings to the IRS. It covers some of the same information as the New Hire Reporting Form, such as the contractor's name and social security number, especially when the new hire is marked as an independent contractor.

- State New Hire Reporting Forms: Many states have their own new hire reporting requirements. These forms collect relevant employee information to assist in child support enforcement, mirroring the purpose of the Minnesota New Hire Reporting Form.

- Employer’s Quarterly Federal Tax Return (Form 941): This form is used to report income taxes, social security tax, and Medicare tax withheld from employee's paychecks. It also requires employer identification information, making it similar in function to the New Hire Reporting Form.

- UI Reporting Forms: Unemployment insurance reporting forms require information about employees and wages paid, aligning them closely with new hire reporting needs to track employment for unemployment benefits.

- State Wage Reports: These reports detail employee wage information for state taxation purposes. Similar to the New Hire Reporting Form, they gather essential data about employees for state compliance.

- Form 4852: This form serves as a substitute for the W-2 or 1099 when those documents are not available. Both forms collect key personal information and earnings data, helping accurately report employee income to the IRS.

- Health Insurance Marketplace Notice: Employers must provide this notice to inform employees about health insurance options. While differing in purpose, it still requires the collection of employee information at the time of hiring, similar to the New Hire Reporting Form.

Dos and Don'ts

When completing the Minnesota New Hire Reporting form, it's essential to adhere to best practices to ensure a smooth process. Here are five recommended actions and five things to avoid.

- Print clearly in capital letters to maintain legibility.

- Submit the form within 20 days of the hire or rehire date to comply with state requirements.

- Provide complete information to avoid delays in processing.

- Double-check all entries for accuracy before submitting.

- Use the correct FEIN for the employer to ensure proper wage reporting.

- Avoid overcrowding the fields; do not contact the edges of the boxes.

- Do not leave any required fields blank, as this may result in form rejection.

- Refrain from using pencil or cursive writing, which may hinder legibility.

- Do not fail to specify if the employee is an Independent Contractor by checking the appropriate box.

- Do not send the form to an incorrect address, as this will cause unnecessary delays.

Misconceptions

Here are nine common misconceptions about the Minnesota New Hire Reporting form:

- Only private employers need to report new hires. This is incorrect. Both public and private employers in Minnesota are required to submit information about newly hired or rehired employees.

- New hires must be reported only if they are full-time. This is not true. Employers must report all newly hired employees, regardless of their work schedule, whether full-time, part-time, or temporary.

- The reporting deadline is flexible. In reality, employers must submit reports within 20 days of the hire or rehire date. Late submissions can lead to penalties.

- Employees can opt out of new hire reporting. This misunderstanding is false. Employers are legally required to report new hires, and employees do not have the option to decline this reporting.

- Only employees, not independent contractors, need to be reported. This is incorrect. Employers must report independent contractors as well, if applicable. Indicate that status on the form.

- All information on the form is optional. Many fields are required. Critical information must be included, or the reports will not be processed.

- The form can be submitted at any address. This is misleading. Completed forms must be sent to the Minnesota New Hire Reporting Center at the designated address provided.

- Fax submissions are not accepted. This is incorrect. There is a toll-free fax number available for employers to submit completed forms.

- The form does not require a Federal Employer ID Number (FEIN). This is false. Employers must use the same FEIN that is reported on the employee's quarterly wages.

Understanding these misconceptions can help ensure proper compliance with Minnesota's New Hire Reporting requirements.

Key takeaways

When filling out the Minnesota New Hire Reporting form, keep these important points in mind:

- Timely Submission: You must report all newly hired, rehired, or returning employees within 20 days of their hire date. Failing to meet this deadline could lead to regulatory issues.

- Accurate Completion: Ensure that every section of the form is filled out completely. Reports will not be processed if required information is missing.

- Clear Writing: Print neatly in capital letters. Avoid contact with the edges of the boxes to enhance readability and ensure all information is clear.

- Employer Information: Specify the correct Federal Employer ID Number (FEIN) and ensure it matches the quarterly wage reports. This connection is crucial for proper reporting.

- Contact Details: Provide your employer address and contact information accurately, particularly where income withholding orders should be sent. This prevents delays in communication.

- Independent Contractors: If hiring an independent contractor, check the specified box on the form. This designation impacts tax reporting and filing procedures.

Remember, improperly completed forms can lead to processing delays, so take the time to ensure everything is correct before submission.

Browse Other Templates

Letter of Instruction Example - Different stipulations apply based on your relationship to the account holder.

Maryland Form 202 - A complete street address including city and ZIP code must be provided.

Hud 92006 - Builders must indicate if they sold five or more houses within the last year.