Fill Out Your Auto Insurance Card Form

When navigating the responsibilities of car ownership, one essential document stands out: the Auto Insurance Card. This card, issued by your insurance agency, is critical because it provides necessary proof of your vehicle's insurance coverage. It prominently displays key details such as the company name, policy number, and effective and expiration dates. Furthermore, it includes your vehicle's make, model, and identification number, ensuring that law enforcement and others can identify the specific car covered under the policy. Importantly, this card must be kept in the vehicle at all times and must be presented upon request, especially in the event of an accident. In such situations, it is vital to promptly report the incident to your insurance agent or company while collecting information from all parties involved. Remember to take note of all names, addresses, and insurance details related to each driver, passenger, and witness. The front of this card is also designed with an artificial watermark for added security, which can be viewed by holding it at an angle. Understanding these components of the Auto Insurance Card is crucial for responsible vehicle ownership and insurance compliance.

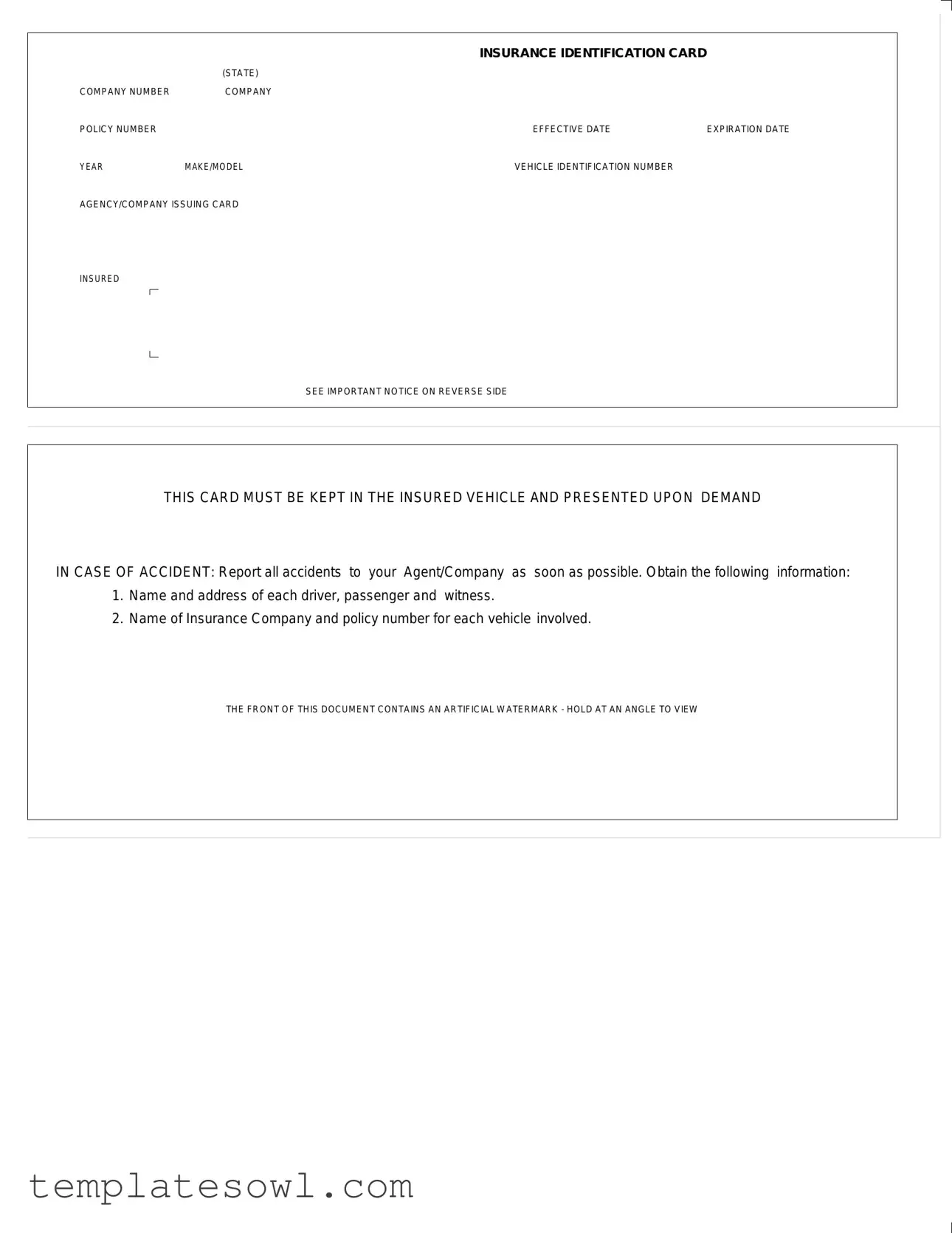

Auto Insurance Card Example

|

|

INSURANCE IDENTIFICATION CARD |

|

|

(STATE) |

|

|

COMPANY NUMBER |

COMPANY |

|

|

POLICY NUMBER |

|

EFFECTIVE DATE |

EXPIRATION DATE |

YEAR |

MAKE/MODEL |

VEHICLE IDENTIFICATION NUMBER |

|

AGENCY/COMPANY ISSUING CARD

INSURED

SEE IMPORTANT NOTICE ON REVERSE SIDE

THIS CARD MUST BE KEPT IN THE INSURED VEHICLE AND PRESENTED UPON DEMAND

IN CASE OF ACCIDENT: Report all accidents to your Agent/Company as soon as possible. Obtain the following information:

1.Name and address of each driver, passenger and witness.

2.Name of Insurance Company and policy number for each vehicle involved.

THE FRONT OF THIS DOCUMENT CONTAINS AN ARTIFICIAL WATERMARK - HOLD AT AN ANGLE TO VIEW

Form Characteristics

| Fact Name | Details |

|---|---|

| Form Purpose | This Auto Insurance Card serves as proof of insurance coverage for the vehicle listed on the card. |

| Essential Information | It includes key details such as the company number, policy number, effective date, and expiration date. |

| Vehicle Details | The card specifies the year, make, model of the vehicle, and the vehicle identification number (VIN). |

| Insurance Company | It identifies the agency or company that issued the card, ensuring clarity on the responsible insurer. |

| State-Specific Requirements | The form must comply with relevant state laws, which may include specific documentation and display regulations. |

| Accident Reporting | Upon an accident, the cardholder is required to report the incident to their agent or company promptly. |

| Display Requirement | Insurance regulations typically mandate that this card be kept in the insured vehicle and presented upon demand during an accident. |

Guidelines on Utilizing Auto Insurance Card

Completing the Auto Insurance Card form requires careful attention to detail to ensure all necessary information is correctly documented. After filling out the form, it will be essential to keep it in your vehicle at all times. You may need to show it in case of an accident or if you are pulled over by law enforcement. Following the right steps will help you accomplish this efficiently.

- Locate the Auto Insurance Card form document.

- Fill in the Company Name of your auto insurance provider in the "Company" field.

- Enter the Company Number given by your insurance provider in the corresponding field.

- Write your Policy Number in the designated area.

- Select the Effective Date of your policy, indicating when coverage begins.

- Fill in the Expiration Date, which shows when your coverage ends.

- Provide details about your vehicle by filling in the Year, Make/Model, and Vehicle Identification Number (VIN) in the appropriate fields.

- Identify the Agency or Company Issuing the Card in the respective section.

- Read and follow the important notice on the reverse side for any additional requirements.

What You Should Know About This Form

What is the purpose of the Auto Insurance Card?

The Auto Insurance Card serves as proof of insurance for your vehicle. It must be kept in the vehicle at all times and presented upon request during traffic stops or when involved in an accident.

What information is included on the Auto Insurance Card?

The card displays critical details, including the insurance company number, policy number, effective and expiration dates, the year, make and model of the vehicle, the vehicle identification number (VIN), and the agency or company issuing the card.

Can I use a digital version of the Auto Insurance Card?

Many states accept digital versions of auto insurance cards, provided they can be easily accessed and presented when necessary. However, it's advisable to check your state's specific regulations regarding digital insurance proofs.

What should I do if I lose my Auto Insurance Card?

If you lose your card, contact your insurance agent or company immediately. They can issue a replacement card, which you can use until you receive the new one.

What actions should I take after an accident?

After an accident, report it to your insurance agent or company as soon as possible. Gather information from all parties involved, including names, addresses, and insurance details. Document the accident scene by noting details from witnesses, passengers, and drivers.

What is the significance of the artificial watermark on the card?

The artificial watermark on the front of the card is a security feature. It can be viewed clearly by holding the card at an angle. This watermark helps to prevent fraud and ensures that the card is legitimate.

Common mistakes

Filling out the Auto Insurance Card form should be straightforward, but many people make common mistakes. These errors can lead to confusion during an accident or when trying to validate your coverage. Here are seven mistakes that should be avoided when completing this essential document.

First, some individuals forget to include the effective date. This date marks when the insurance coverage begins. Without it, you may find it challenging to prove that your policy is active, potentially leading to fines or liability issues.

Another common error is leaving out the expiration date. Like the effective date, this information is crucial. An outdated card can suggest that your insurance is no longer in effect. Always double-check that these dates are clearly filled in.

Some people also neglect to write down the company policy number. This number is unique to your policy and helps identify your coverage. If there's an incident, lacking this information could cause delays as you attempt to contact your insurance company.

Many don’t pay attention to the vehicle identification number (VIN). This number is specific to your vehicle and essential for verifying coverage. Missing this detail may cause complications down the line, especially if you need to submit a claim.

A frequent mistake involves miswriting the make/model of the vehicle. An accurate description is important for your insurer and for legal documentation. If there’s a mix-up, your insurance company may question the validity of your coverage.

Some individuals fail to keep the card in the vehicle, which is a requirement. It must be presented upon demand during an accident or to law enforcement. Forgetting this step means you may not be able to prove you have valid insurance at a critical moment.

Lastly, people often skip reading the important notice on the back of the card. This section contains valuable information regarding what to do in case of an accident. Ignoring it can lead to uncertainty and unnecessary stress when you need to act quickly.

Being aware of these common mistakes can make a difference. Filling out your Auto Insurance Card accurately helps ensure that you are protected as you navigate the complexities of driving and insurance coverage.

Documents used along the form

When handling auto insurance matters, several forms and documents are essential in addition to the Auto Insurance Card. These documents help streamline communication and ensure compliance with legal and insurance requirements. They provide necessary information about the insured vehicle and the coverage in place.

- Declarations Page: This document summarizes the coverage, limits, and any endorsements of the insurance policy. It provides a snapshot of what the policyholder is entitled to under their insurance agreement.

- Claim Form: If an accident occurs, filing a claim form is crucial. This document officially initiates the claims process and requires detailed information about the incident, including dates, times, and the parties involved.

- Policy Document: The full insurance policy outlines the terms and conditions of coverage. It includes details on what is covered, any exclusions, and the procedures for filing claims. Understanding this document is vital for policyholders.

- SR-22 Form: This is a certificate of insurance that may be required if someone has had their driver's license suspended. It proves that the driver carries the state’s minimum required insurance coverage.

- Accident Report Form: This form gathers original details about the accident for the insurance company and law enforcement. It often includes descriptions of the accident, damage assessments, and witness statements.

Being familiar with these forms and their purposes will help ensure all necessary information is readily available should an accident occur. Keeping this documentation organized and accessible is essential for efficient handling of any auto insurance issues that may arise.

Similar forms

The Auto Insurance Card serves as an important document for drivers, but it’s not the only paper you might need in various situations. Below are seven documents similar to the Auto Insurance Card and an explanation of how each one relates:

- Vehicle Registration Document: This document provides proof that a vehicle is legally registered with the state. Like the Auto Insurance Card, it must often be kept in the vehicle and shown during traffic stops or accidents.

- Driver's License: This card verifies that a person is legally allowed to operate a vehicle. It includes personal information and should be presented along with the Auto Insurance Card if requested by law enforcement.

- Title Certificate: This document establishes legal ownership of a vehicle. While the Auto Insurance Card proves you have coverage, the title proves you own the vehicle being insured.

- Accident Report Form: In the event of a collision, this form is often filled out by law enforcement to document the incident. It serves as an official record, similar to how the Auto Insurance Card serves as proof of coverage.

- Inspection Certificate: This document shows that a vehicle has passed a state inspection, ensuring it meets safety standards. Like the Auto Insurance Card, it may be required for legal compliance.

- Policy Declarations Page: This document outlines the details of the insurance policy, including coverage limits and terms. It complements the Auto Insurance Card by providing additional information about your insurance coverage.

- Claims Document: This form is submitted in case of an accident to request compensation from the insurance company. While the Auto Insurance Card helps establish coverage, the claims document seeks to utilize that coverage.

Dos and Don'ts

When filling out the Auto Insurance Card form, there are important dos and don'ts to keep in mind to ensure accuracy and compliance.

- Do use clear and legible handwriting or type the information.

- Do double-check your policy number and the effective dates before submission.

- Do ensure your vehicle identification number (VIN) is accurate.

- Do keep the card in your vehicle at all times.

- Don't leave any required fields blank.

- Don't alter the form in any way, such as crossing out information.

- Don't forget to sign the form if required.

- Don't ignore the instructions provided in the important notice on the reverse side.

Misconceptions

There are several misconceptions about the Auto Insurance Card form that can lead to confusion. Here’s a breakdown of eight common myths and the truth behind them.

- It’s just a piece of paper. Many think the card is merely a placeholder. However, it serves as proof of your insurance coverage and must be kept in the vehicle at all times.

- It’s unnecessary to carry the card if you have digital insurance proof. Some believe that a digital version is enough. While many states accept digital proof, having a physical card on hand is still advisable.

- All insurance cards look the same. People might assume any card is sufficient without realizing that formats can vary by state or insurance provider.

- You don’t need to report minor accidents. Some individuals think minor accidents don't need to be reported. In fact, it’s essential to inform your insurance agent about any accident, regardless of size.

- The effective and expiration dates aren’t important. It’s a common misconception that these dates don’t matter. Keeping track of these dates ensures your coverage doesn’t lapse.

- A watermark makes it invalid. Some might assume the watermark invalidates the card. In reality, it’s a security feature to prevent fraud.

- You can ignore the back of the card. Many overlook the important notice on the reverse side. It contains crucial guidelines on what to do in case of an accident.

- If my card is lost, I don't need to replace it immediately. People may think it’s okay to wait. Promptly replacing a lost card is vital to ensure you have proof of insurance available at all times.

Understanding these misconceptions can help you navigate auto insurance responsibilities more effectively. Always stay informed, and don’t hesitate to consult your insurance provider for any questions or clarification.

Key takeaways

When filling out the Auto Insurance Card form, consider the following key takeaways:

- The form contains essential information including your insurance identification card, company number, and policy number.

- Make sure to fill in the effective date and expiration date accurately.

- Provide details about your vehicle, including its year, make/model, and vehicle identification number.

- The agency or company issuing the card needs to be clearly listed.

- This card must be kept in your vehicle at all times.

- In case of an accident, report it to your agent or company as soon as possible.

- Remember to gather all necessary information from involved parties after an accident, including names and insurance details.

Always keep this card easily accessible and ensure that it's properly completed to avoid complications in case of an accident.

Browse Other Templates

Indiana Oversize Permits Online - Transportation companies must have a valid Federal Motor Carrier number for certain operations.

Public Title Portal - The form requires owner and lienholder information to be accurately listed.

Beckett Submission Form - Select the appropriate grading service level for your submission.