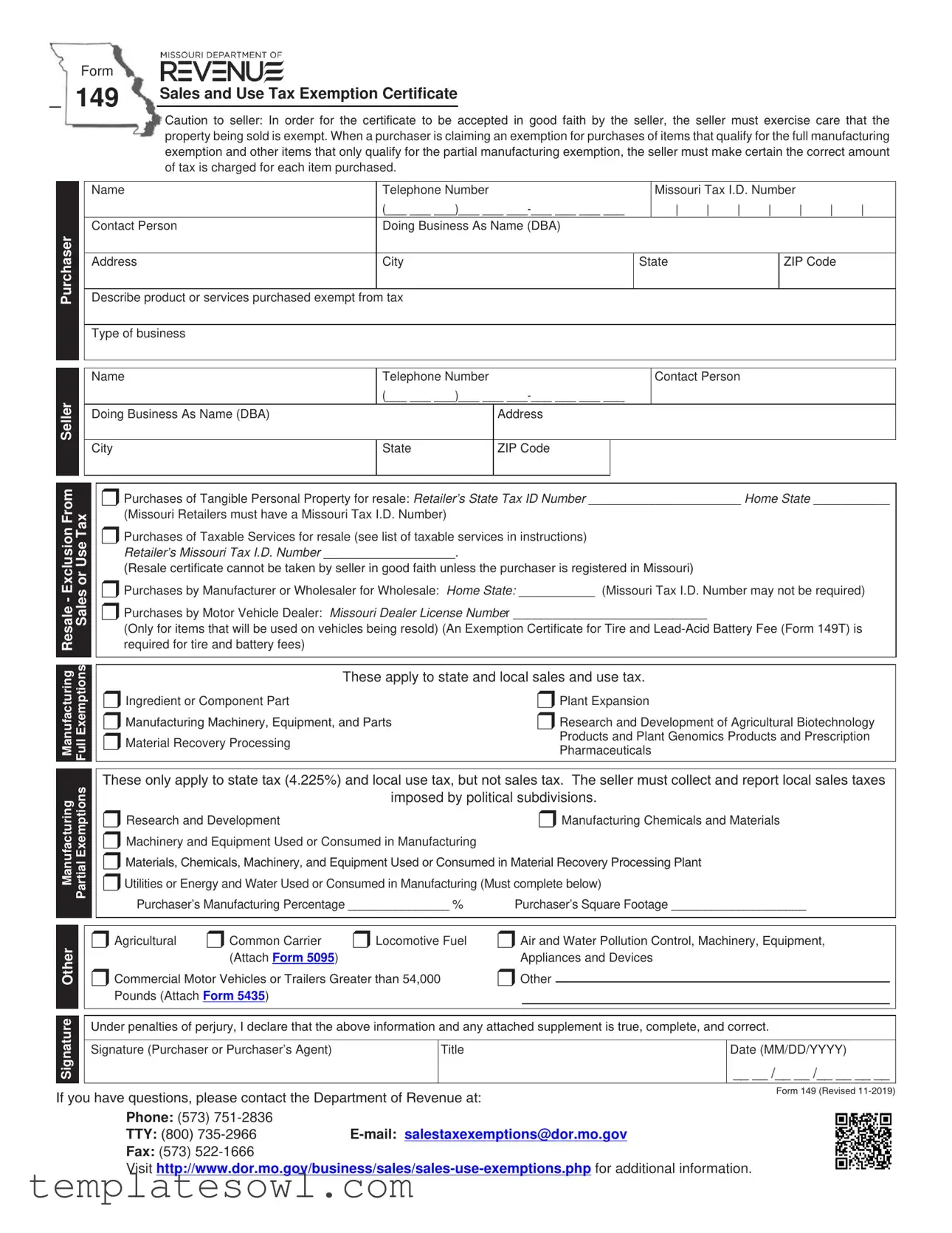

Fill Out Your Missouri 149 Form

When navigating the complexities of sales and use tax exemptions in Missouri, the Missouri 149 form emerges as a crucial tool for both purchasers and sellers alike. This form serves as a Sales and Use Tax Exemption Certificate, facilitating legitimate claims for exemptions from various types of sales tax. Whether a business is looking to purchase tangible personal property for resale or seeking exemption based on manufacturing needs, Form 149 allows for a streamlined process. Designed to ensure compliance with Missouri tax law, it outlines specific categories for exemption, which include full and partial exemptions for manufacturing and the resale of goods. Importantly, the form requires critical details such as the purchaser's and seller’s contact information, the nature of the transaction, and the appropriate documentation to substantiate the claim. Moreover, it emphasizes the responsibility of sellers to verify the accuracy of exemptions being claimed to avoid penalties. By understanding the key sections and requirements of this form, businesses can navigate their tax obligations with greater confidence.

Missouri 149 Example

Form

149 |

Sales and Use Tax Exemption Certificate |

|

Caution to seller: In order for the certificate to be accepted in good faith by the seller, the seller must exercise care that the

property being sold is exempt. When a purchaser is claiming an exemption for purchases of items that qualify for the full manufacturing exemption and other items that only qualify for the partial manufacturing exemption, the seller must make certain the correct amount

|

|

|

|

|

|

of tax is charged for each item purchased. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

Name |

|

|

Telephone Number |

|

|

|

|

|

|

Missouri Tax I.D. Number |

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

(___ ___ ___)___ ___ |

|

|

| |

| |

| |

| |

|

| |

| |

| |

|

|||||

|

|

|

|

|

Contact Person |

|

|

Doing Business As Name (DBA) |

|

|

|

|

|

|

|

|

|

||||||||

|

Purchaser |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

Address |

|

|

City |

|

|

|

|

State |

|

|

|

|

ZIP Code |

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

Describe product or services purchased exempt from tax |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Type of business |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Name |

|

|

Telephone Number |

|

|

|

|

|

|

Contact Person |

|

|

|

|

|

|

||||

|

Seller |

|

|

|

|

|

|

|

(___ ___ ___)___ ___ |

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

Doing Business As Name (DBA) |

|

|

|

Address |

|

|

|

|

|

|

|

|

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

City |

|

|

State |

ZIP Code |

|

|

|

|

|

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Resale - Exclusion From |

|

|

|

|

r Purchases of Tangible Personal Property for resale: RETAILER’S STATE TAX ID NUMBER ______________________ HOME STATE ___________ |

|||||||||||||||||||

|

Sales or Use Tax |

|

(Missouri Retailers must have a Missouri Tax I.D. Number) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

|

|

r Purchases of Taxable Services for resale (see list of taxable services in instructions) |

|

|

|

|

|

|

|

|

|

||||||||||||||

|

|

RETAILER’S MISSOURI TAX I.D. NUMBER ___________________. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

|

|

(Resale certificate cannot be taken by seller in good faith unless the purchaser is registered in Missouri) |

|

|

|

|

|

|

|

|

|||||||||||||||

|

|

r Purchases by Manufacturer or Wholesaler for Wholesale: HOME STATE: ___________ (Missouri Tax I.D. Number may not be required) |

|||||||||||||||||||||||

|

|

r Purchases by Motor Vehicle Dealer: MISSOURI DEALER LICENSE NUMBEr ____________________________ |

|

|

|

|

|

|

|

||||||||||||||||

|

|

(Only for items that will be used on vehicles being resold) (An Exemption Certificate for Tire and |

|||||||||||||||||||||||

|

|

required for tire and battery fees) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Manufacturing |

Full Exemptions |

|

|

|

These apply to state and local sales and use tax. |

|

|

|

|

|

|

|

|

|

||||||||||

|

|

r Ingredient or Component Part |

|

|

|

|

r Plant Expansion |

|

|

|

|

|

|

|

|

|

|||||||||

|

|

r Manufacturing Machinery, Equipment, and Parts |

|

r Research and Development of Agricultural Biotechnology |

|||||||||||||||||||||

|

|

r Material Recovery Processing |

|

|

|

|

|

Products and Plant Genomics Products and Prescription |

|||||||||||||||||

|

|

|

|

|

|

|

Pharmaceuticals |

|

|

|

|

|

|

|

|

|

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||

|

|

Partial Exemptions |

|

These only apply to state tax (4.225%) and local use tax, but not sales tax. The seller must collect and report local sales taxes |

|||||||||||||||||||||

|

Manufacturing |

|

|

|

|

imposed by political subdivisions. |

|

|

|

|

|

|

|

|

|

||||||||||

|

|

r Research and Development |

|

|

|

|

r Manufacturing Chemicals and Materials |

|

|

|

|

||||||||||||||

|

|

r Machinery and Equipment Used or Consumed in Manufacturing |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

|

|

r Materials, Chemicals, Machinery, and Equipment Used or Consumed in Material Recovery Processing Plant |

|

|

|

|

|

|

|

|

|||||||||||||||

|

|

rUtilities or Energy and Water Used or Consumed in Manufacturing (Must complete below) |

|

|

|

|

|

|

|

|

|

||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

Purchaser’s Manufacturing Percentage _______________ % |

Purchaser’s Square Footage ____________________ |

|

|

|

|||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

|

Other |

|

|

|

r Agricultural |

r Common Carrier |

r Locomotive Fuel |

r Air and Water Pollution Control, Machinery, Equipment, |

|

|

|

||||||||||||||

|

|

|

|

|

|

(Attach Form 5095) |

|

|

|

Appliances and Devices |

|

|

|

|

|

|

|

|

|

||||||

|

|

|

|

r Commercial Motor Vehicles or Trailers Greater than 54,000 |

r Other |

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||

|

|

|

|

|

|

Pounds (Attach Form 5435) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||

|

Signature |

|

|

|

Under penalties of perjury, I declare that the above information and any attached supplement is true, complete, and correct. |

|

|

|

|

||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

|

|

|

|

Signature (Purchaser or Purchaser’s Agent) |

|

|

Title |

|

|

|

|

|

|

|

|

Date (MM/DD/YYYY) |

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

__ __ /__ __ /__ __ __ __ |

|

||||||

If you have questions, please contact the Department of Revenue at: |

Form 149 (Revised |

|

Phone: (573)

TTY: (800)

Fax: (573)

Visit

Sales or Use Tax

Manufacturing - Full Exemptions

Resale - Exclusion From

Manufacturing - Partial Exemptions

Other

Sales or Use Tax Exemption Certificate (Form 149) Instructions

Select the appropriate box for the type of exemption to be claimed and complete any additional information requested.

•Purchases of Tangible Personal Property for resale: Retailers that are purchasing tangible personal property for resale purposes are exempt from sales or use tax.

The purchaser’s state tax ID number can be found on the Missouri Retail License or out of state registration for retail sales.

•Purchases of Taxable Services for resale: Purchasers for resale must have a Missouri retail license in order to claim resale of taxable services in Missouri. A taxable service includes sales of restaurants, hotels, motels, places of amusement, recreation, entertainment, games and athletic events not at arms length, and sales of telecommunications and utilities (see Section 144.018, RSMo).

•Purchases by Manufacturer or Wholesaler for Wholesale: A Missouri Tax I.D. Number is not required to claim this exclusion.

•Purchaser’s Home State: Provide the state in which purchaser is located and registered.

•Purchases by Motor Vehicle Dealer: A motor vehicle dealer who is purchasing items for the repair of a vehicle being resold is exempt from sales or use tax. The dealer’s license is issued by the Missouri Motor Vehicle Bureau or by the out of state registration authority that issues such licenses.

Check the appropriate box for the type of exemption to be claimed. All items selected in this section are exempt from state and local sales and use

tax under Section 144.030, RSMo.

•Ingredient or Component Parts: This exemption includes materials, manufactured goods, machinery, and parts that become a part of the final product. To qualify, the product must ultimately be subject to sales or use tax, or its equivalent, in Missouri or other states.

•Manufacturing Machinery, Equipment and Parts: This exemption includes only machinery and equipment and their parts that are used directly in manufacturing a product. To qualify, the product must ultimately be subject to sales or use tax, or its equivalent, in Missouri or other states.

•Material Recovery Processing: This exemption includes machinery and equipment used to establish new or to replace existing material recovery processing plants. See Sections 144.030.2(5) and (32), RSMo, for a definition of, and exemptions for, material recovery processing.

•Plant Expansion: This exemption includes machinery, equipment, and parts and the materials and supplies solely required for installing or constructing the machinery and equipment, used to establish new or to expand existing Missouri manufacturing, mining, or fabricating plants. To qualify, the machinery must be used directly in manufacturing, mining or fabricating a product that is ultimately subject to sales or use tax, or its equivalent, in Missouri or other states.

•Research and Development of Agricultural Biotechnology Products and Plant Genomics Products and Prescription Pharmaceuticals: This exemption is specifically authorized in Section 144.030.2(34), RSMo, and exempts any tangible personal property used or consumed directly or exclusively in research and development of agricultural, biotechnology, and plant genomics products and prescription pharmaceuticals consumed by humans or animals.

Check the appropriate box for the type of exemption to be claimed according to Section 144.054, RSMo. All items in this section are exempt from state sales and use tax and local use tax, but are still subject to local sales tax. Section 144.054, RSMo, exempts electrical energy and gas (natural, artificial and propane), water, coal, energy sources, chemicals, machinery, equipment and materials used or consumed in manufacturing, processing, compounding, mining or producing any product. These same items are exempt if used or consumed in processing recovered materials. To qualify for this exemption, the item must be used or consumed and does not have the same requirement of direct use that is required in Section 144.030, RSMo. Additionally, the manufactured product is not required to be ultimately subject to tax.

•Research and Development: Check this box if the exemption is for the research and development related to manufacturing, processing, compounding or producing a product.

•Manufacturing Chemicals and Materials: Check this box if the exemption is for chemicals or materials used or consumed in manufacturing, processing, compounding or producing a product.

•Machinery and Equipment Used or Consumed in Manufacturing: Check this box if the exemption is for machinery or equipment used or consumed in manufacturing, processing, compounding or producing a product.

•Materials, Chemicals, Machinery, and Equipment Used or Consumed in Material Recovery Processing Plant: Check this box if the exemption is for material recovery processing.

•Utilities or Energy and Water Used or Consumed in Manufacturing: If claiming utilities (electrical energy, gas or water), record account numbers, meter numbers, or other information as required by the vendor. All purchasers who are claiming an exemption for energy use must provide the amount of energy use which is related to manufacturing in the space provided and also select the method by which this percentage was obtained.

•Agricultural: Farm machinery and equipment are exempt from tax if used exclusively for agricultural purposes, used on land owned or leased for the purpose of producing farm products, and used directly in the production of farm products to be ultimately sold at retail. The sale of grains to be converted into foodstuffs or seed, and limestone, fertilizer, and herbicides used in connection with the growth or production of crops, livestock or poultry is exempt from tax. The sale of livestock, animals or poultry used for breeding or feeding purposes, feed for livestock or poultry, feed additives, medications or vaccines administered to livestock or poultry in the production of food or fiber, and sales of pesticides and herbicides used in the production of aquaculture, livestock or poultry are exempt from tax. All sales of fencing materials used for agricultural purposes and the purchase of motor fuel are exempt from tax.

•Common Carrier: Materials, replacement parts and equipment purchased for use directly upon, and for the repair and maintenance or manufacture of, motor vehicles, watercraft, railroad rolling stock or aircraft engaged as common carriers of persons or property. See Section 144.030.2(3), RSMo. Attach completed Form 5095.

•Locomotive Fuel: Fuel purchased for use in a locomotive that is a common carrier is exempt from sales and use tax.

•Air and Water Pollution Control Machinery, Equipment, Appliances and Devices: Machinery, equipment, appliances and devices purchased or leased and used solely for the purpose of preventing, abating or monitoring water and air pollution, and materials and supplies solely required for the installation, construction or reconstruction of such machinery, equipment, appliances and devices. See Sections 144.030.2(15) and (16), RSMo.

•Commercial Motor Vehicles or Trailers Greater Than 54,000 Pounds: Motor vehicles registered for and capable of pulling in excess of 54,000

pounds and their trailers actually used in the normal course of business to haul property on the public highways of the state are exempt from tax. The purchase of materials, replacement parts, and equipment used directly on, for the repair of and maintenance or manufacture of these vehicles is also exempt. See Section 144.030.2(4), RSMo.

•Other: Exemptions not listed on this sheet, but are provided by statute. Provide explanation of exemption being claimed. See Chapter 144 of the Missouri Revised Statutes for exemption http://www.moga.mo.gov/mostatutes/statutesAna.html#T10.

Form 149 (Revised

Form Characteristics

| Fact Name | Details |

|---|---|

| Name of the Form | Form 149 - Sales and Use Tax Exemption Certificate |

| Governing Law | Section 144.030, RSMo, governs the exemptions provided by Form 149. |

| Usage | The form is used to certify sales and use tax exemptions for various purchases such as manufacturing equipment and resale items. |

| Contact Information | For inquiries, contact the Missouri Department of Revenue at (573) 751-2836 or email salestaxexemptions@dor.mo.gov. |

Guidelines on Utilizing Missouri 149

Completing the Missouri 149 form is an important step for those who are requesting a sales and use tax exemption. It requires accurate and honest information about your qualifications for an exemption. The next steps will guide you through the process of filling out the form effectively.

- Begin by entering your Name and Telephone Number at the top of the form.

- Provide your Missouri Tax I.D. Number in the designated space.

- Identify the Contact Person for your business.

- List your Doing Business As Name (DBA) if applicable.

- Fill in your Purchaser Address, including City, State, and ZIP Code.

- Describe the product or services purchased that you are claiming as exempt.

- Indicate the Type of Business and provide the Name and Telephone Number of the contact person for the seller.

- Complete the seller's Doing Business As Name (DBA) field.

- Fill out the seller's Address, City, State, and ZIP Code.

- Check the appropriate box to indicate the type of exemption you are claiming. Be thorough in selecting the correct exemption category.

- If claiming for resale, provide the Retailer’s State Tax ID Number and the Home State.

- For other exemptions, provide any necessary details as prompted on the form.

- Section for the Signature: The form must be signed by the Purchaser or the Purchaser’s Agent. Include your Title and the Date of signing.

After completing the form, ensure that all information is correct and clear. Double-check the exemptions you have selected to make sure they align with your purchases. A copy of this completed form should be retained for your records. If any questions arise during this process, the Department of Revenue is available to assist you.

What You Should Know About This Form

What is the Missouri 149 Form?

The Missouri 149 Form, officially known as the Sales and Use Tax Exemption Certificate, is a document that allows qualified purchasers to claim exemption from sales or use tax on specific purchases. This form is especially relevant for organizations that engage in manufacturing, reselling, or specific types of operations that are legally exempt from taxation. Proper use of this form can significantly reduce tax liabilities if used correctly and in accordance with Missouri tax law.

Who can use the Missouri 149 Form?

The form can be utilized by various entities, including retailers, manufacturers, wholesalers, and service providers, who are eligible for specific exemptions under Missouri law. For instance, if you are a retailer purchasing tangible personal property for resale, or a manufacturer acquiring machinery used in production, you may use this form to ensure your purchase does not incur sales tax. However, to claim a resale exemption, you must have a Missouri Tax I.D. Number, which proves your registration in the state.

What types of exemptions are available on the Missouri 149 Form?

The form provides for several exemptions, which fall into two major categories: full and partial exemptions. Full exemptions include items like manufacturing machinery and equipment, while partial exemptions may include utilities consumed in a manufacturing process. It is essential to select the correct exemption box that matches your purchase type, as failing to do so could result in tax liabilities or penalties.

How do I complete the Missouri 149 Form?

To complete the Missouri 149 Form, begin by identifying the correct exemption for your purchase type. Fill out your information, including your name, address, and Missouri Tax ID number, alongside the seller's details. Specify the product or service you are purchasing and the exemption type you are claiming. After ensuring all parts of the form are filled out accurately, sign it under the penalties of perjury to affirm the truthfulness of your declarations. Double-check for any required attachments, especially for specific exemptions like pollution control machinery.

What should sellers know when accepting the Missouri 149 Form?

Sellers must exercise due diligence when accepting the Missouri 149 Form. It is crucial to ensure that the purchaser is legally entitled to an exemption. Care must be taken to identify if the purchased items qualify for a full or partial exemption, as this can influence the tax owed. If there is doubt about a purchase’s tax-exempt status, sellers should not accept the form in good faith. Documentation and verification of tax-exempt status help protect sellers from potential tax liabilities.

What are the consequences of misusing the Missouri 149 Form?

Misuse of the Missouri 149 Form could lead to severe consequences, including fines, penalties, and a tax audit. If a seller accepts the form incorrectly, they could be held liable for unpaid taxes. For purchasers, claiming an exemption when not entitled can lead to criminal penalties, including charges of tax evasion. It is crucial for both parties to understand the responsibilities involved in using this form.

Where can I find additional assistance or information about the Missouri 149 Form?

If you have further questions or need assistance regarding the Missouri 149 Form, you can contact the Missouri Department of Revenue. They provide resources and guidance to help you navigate the complexities of tax exemptions. You can reach them by phone at (573) 751-2836, or via email at salestaxexemptions@dor.mo.gov. Additional information is available on their website, which hosts details about various tax exemptions applicable in Missouri.

Common mistakes

When completing the Missouri Form 149, many individuals make common mistakes that can result in delays or denials of tax exemptions. One significant error involves failing to include the correct tax identification number. The state tax identification number is crucial for identifying the purchaser and ensuring they are recognized as a legitimate entity entitled to the exemption. Omitting this information or providing an incorrect number can lead to complications with the transaction.

Another frequent oversight is not specifying the type of exemption being claimed. The form requires individuals to check the appropriate box that corresponds to their exemption claim—whether for resale, manufacturing, or other categories. Neglecting to identify the type of exemption clearly can confuse sellers and may result in the inability to process the exemption properly.

Individuals also sometimes omit necessary descriptions of the products or services being purchased. It is essential to provide clear and specific details for what the exemption applies to, as broad or vague descriptions may warrant additional scrutiny from the seller or the state.

In addition, there are instances where people forget to sign the form. A valid signature is legally necessary to authenticate the claim for exemption. Without it, the form does not hold weight, resulting in potential rejection by the seller.

Failure to include contact details for the seller is another mistake commonly seen. This information is important not only for verification but also for tracking the transaction should any issues arise later.

Another area of concern is that individuals may not provide the purchaser’s home state when required, especially when claiming exemptions that pertain to items sold out-of-state. Properly filling in this information helps clarify eligibility and compliance with tax laws.

Finally, many seem to forget to keep records or documents that support their claims. It's vital to maintain copies of the completed form as well as any receipts or invoices associated with the transactions. This documentation ensures that if questions arise later, individuals can provide evidence of their claims.

Documents used along the form

When navigating the sales and use tax landscape in Missouri, it's essential to understand the various forms and documents that work in tandem with the Missouri 149 form, also known as the Sales and Use Tax Exemption Certificate. Each document serves a unique purpose and can help streamline the exemption process. Below is a brief overview of additional forms commonly associated with the Missouri 149 form.

- Form 149T: This is the Exemption Certificate for Tire and Lead-Acid Battery Fee. Specific to the purchase of tires and batteries, this form is required to exempt these fees when applicable.

- Form 5095: This form is used for Air and Water Pollution Control Machinery, Equipment, Appliances, and Devices. It certifies that the purchased items are intended for preventing or monitoring environmental pollution.

- Form 5435: This document is required for claiming exemptions related to commercial motor vehicles or trailers weighing over 54,000 pounds. It confirms that these vehicles and related equipment are used for business purposes.

- Missouri Retail License: This essential document allows retailers to collect sales tax. Retailers must possess a valid license to claim exemptions on tangible goods purchased for resale.

- Purchaser Affidavit: Often necessary when claiming an exemption, this affidavit confirms the intent and purpose for which items are being purchased, ensuring transparency in transactions.

- Manufacturer's Exemption Certificate: This certificate is utilized by manufacturers claiming tax exemptions on items used directly in manufacturing processes, enhancing clarity on eligible purchases.

Utilizing the correct forms and understanding their significance can help ease the complexities associated with sales and use tax exemptions. Ensuring all required documentation is properly completed and submitted will not only facilitate a smoother experience but also contribute to compliance with Missouri tax regulations.

Similar forms

When navigating the landscape of tax exemptions in Missouri, understanding the various forms that serve a similar purpose to the Missouri 149 form can be incredibly helpful. Here's a look at six documents that share similarities with the Missouri 149 form and how they align in function or intent:

- Sales Tax Resale Certificate (Form ST-3): This certificate is used by retailers when purchasing products for resale. Like the Missouri 149, it exempts purchases from sales tax, ensuring that the tax is only paid when the product is sold to the final consumer.

- Sales and Use Tax Exemption Certificate (Form ST-4): Used by nonprofit organizations in Missouri, Form ST-4 allows these entities to make purchases without paying sales or use tax. Both forms serve to protect certain purchases from taxation, although they target different user groups.

- Manufacturing Exemption Certificate (Form 149M): Specific to manufacturing operations, this form is used to claim exemptions on certain machinery and equipment used in manufacturing processes. It parallels the Missouri 149 by allowing businesses in the manufacturing sector to secure tax exemptions on relevant items.

- 501(c)(3) Exemption Certificate: This document is issued to qualified nonprofit organizations. Similar to Form 149, it allows eligible entities to purchase goods and services without incurring sales tax, thereby promoting their charitable missions.

- Utility Exemption Form: This form is aimed at businesses that utilize significant amounts of electrical energy or water in their operations. Like the Missouri 149, it helps reduce operational costs by allowing certain utilities to be exempt from taxation.

- Farm Exemption Certificate: Farmers use this certificate when purchasing products related to their agricultural operations. It aligns with the Missouri 149 in that it provides a tax exemption for specific purchases, reflecting the agricultural industry's unique needs.

Each of these forms serves to facilitate fair tax practices while supporting the needs of specific sectors within Missouri’s economy. Understanding the nuances between them can empower businesses and organizations to make informed purchasing decisions and maximize their tax benefits.

Dos and Don'ts

Filling out the Missouri 149 form correctly is essential for ensuring that exemptions are properly claimed. Here are some things you should and shouldn’t do when completing this form:

- Do check all applicable boxes clearly to indicate the type of exemption you are claiming.

- Don’t leave any required fields blank; providing incomplete information may result in denial of your exemption.

- Do verify that your Missouri Tax I.D. Number is correct and matches your business registration details.

- Don’t use the form to claim exemptions if you don’t possess a valid Missouri Tax I.D. if one is required.

- Do sign and date the form; your signature acknowledges the truthfulness of the information provided.

- Don’t forget to provide your contact information in case officials need to reach you for further clarification.

- Do specify the exact nature of the products or services for which you are claiming an exemption.

- Don’t attempt to manipulate the exemptions; only claim those that apply to your purchases.

- Do maintain a copy of the completed form for your records.

Completing the Missouri 149 form accurately can save time and prevent issues with tax authorities. Following these guidelines will help you navigate the process more smoothly.

Misconceptions

Understanding the Missouri 149 form can be challenging, and several misconceptions surround its use. Here are seven common misunderstandings:

- All Purchases Qualify for Exemption: Many people believe that simply filling out the Missouri 149 form exempts all purchases. In reality, exemptions are specific to certain categories and must meet qualifying criteria.

- Sellers Can Ignore Exemption Details: Some sellers might think they can accept the form without verifying the details. However, it’s essential for sellers to ensure that the purchased items genuinely qualify for the exemption to avoid potential penalties.

- Out-of-State Purchasers Cannot Use the Form: A common misconception is that out-of-state buyers cannot use the Missouri 149 form. In fact, out-of-state businesses can take advantage of the exemptions, provided they are registered appropriately.

- Form 149 is Only for Manufacturers: While this form primarily serves manufacturers, it also applies to wholesalers, retailers, and even certain service providers. Its uses extend beyond just the manufacturing sector.

- Exemption Categories are Always Clear-Cut: Many individuals assume that each exemption category is straightforward. However, several exemptions have specific conditions that can lead to confusion, particularly around partial versus full exemptions.

- Filling Out the Form Guarantees Exemption: Just submitting the form does not guarantee that a claim for exemption will be honored. Buyers must provide accurate information and meet the specific requirements for the exemption type.

- Local Sales Taxes Are Always Excluded: Some may believe that all items listed in the exemptions are free from local sales tax. However, even with a Missouri 149 form, local jurisdictions might impose their sales taxes on certain items.

Key takeaways

Filling out and using the Missouri 149 form requires careful attention to ensure compliance with state tax regulations. Here are key takeaways to keep in mind:

- Understand the purpose of the Missouri 149 form, which is to claim exemptions from sales and use tax for specific purchases.

- Clearly indicate the type of exemption being claimed by selecting the appropriate box on the form.

- The seller must verify that the property being sold meets the criteria for exemption.

- Make sure to provide accurate contact information, including the name, phone number, and tax identification number.

- Specify the product or service purchased, including details about its purpose and intended use.

- Be aware that not all exemptions are applicable to both state and local taxes; read each exemption's eligibility rules carefully.

- For resale claims, retailers must hold a valid Missouri retail license.

- Detailed records, including account numbers and energy usage, may be necessary when claiming exemptions for utilities.

- Filing the form does not guarantee exemption; sellers may still need to collect and report appropriate taxes based on the items sold.

- Submit the completed form to the seller at the time of purchase to ensure that the exemption is honored.

Contact the Missouri Department of Revenue for any questions regarding the form or its completion. Clear communication can help avoid misunderstandings and ensure a smoother process.

Browse Other Templates

Dmv Form Dl 44 - The DSD 10 provides essential data for the Virginia Motor Vehicle Dealer Board's review.

Fl 191 Form - Confidentiality is emphasized; the information on the form is not placed in the court file.

Safeline Customer Service - Documentation should be sent to the address provided in the letter.